TIDMLND

RNS Number : 9152C

Landore Resources Limited

24 June 2021

24 June 2021

Landore Resources Limited

("Landore Resources" or the "Company")

Final Results and Notice of AGM

The Board of Landore Resources (AIM: LND) is pleased to announce

its audited results for the year to 31 December 2020.

For more information, please contact:

Landore Resources Limited

Bill Humphries, Chief Executive Tel: 07734 681262

Officer

Glenn Featherby, Finance Director Tel: 07730 420318

Cenkos Securities (Nominated Advisor

and Broker)

Derrick Lee / Peter Lynch Tel: 0131 220 9100

Chief Executive Officer's statement

I am pleased to present the 2020 Annual Report for Landore

Resources Limited ("Landore Resources" or the "Group").

2020 was a challenging year for the globe due to the onset of a

novel strain of coronavirus ("COVID-19") causing significant

disruption to the commencement of the Group's Canadian operations.

However, by mid-2020 Landore successfully resumed operations as per

Government COVID-19 guidelines.

During 2020 all of Landore Resources' exploration efforts were

focussed on the Junior Lake property with a 23,000 metre drilling

programme aimed at further expansion of the highly prospective BAM

Gold resource of 1,015,000 ounces of gold (reported by the Company

on 7th January 2020). In addition, Landore completed an extensive

exploration campaign westwards along strike for approximately 7

kilometres from the existing BAM Gold Project successfully

identifying widespread anomalous gold and multiple gold trends.

Financial Results

In the year ended 31 December 2020, the Group incurred a loss,

after tax, of GBP2,553,556 (2019: GBP2,145,920).

Operating expenses were in line with our budgets and

expectations. Details of funds generated during the year are set

out below.

In January 2020, the Group raised GBP225,000 by the issuance of

shares at a price of 0.7p per share.

In April 2020, the Group raised GBP260,000 by the issuance of

shares at a price of 0.675p per share.

In July 2020, the Group raised a further GBP2.8 million by the

issuance of shares at a price of 0.675p per share. Investors in

both the April 2020 and July 2020 issues received one warrant per

share purchased, as described in Note 16.

Share Consolidation

In August 2020, the Company announced a Consolidation of the

Company's shares with the number of issued ordinary shares of no

par value each in the Company ("Ordinary Shares") being reduced by

a factor of 20.

Post-year end events

In February 2021, the Group raised a further GBP3.5 million by

the issuance of shares at a price of 30p. The fundraising received

good support from new and existing investors. This will allow the

continued development of the identified BAM Gold Resource, the

completion of a further exploration programme

along strike to other known gold prospects and the commission of

a refreshed Preliminary Economic Assessment ("PEA") and Resource

Report.

The Group is funded for the current exploration programme and

has no debt. The Company will continue to raise further equity as

needed to carry out its development plans. Shareholders have been

very supportive of the Group's financing needs and the Directors

are confident of raising further funds as required.

The Junior Lake Property:

The Junior Lake property, 100 per cent. owned by Landore, is

located in the province of Ontario, Canada, approximately 235

kilometres north-northeast of Thunder Bay and is host to the BAM

Gold Deposit, the B4-7 Nickel-Copper-Cobalt-PGEs Deposit and

numerous other highly prospective mineral occurrences.

The Junior Lake property together with the adjacent 90.2% owned

Lamaune Lake property extends for 31 kilometres across highly

prospective Archean greenstone belt and covers an area of 30,507

hectares.

BAM Gold Deposit: In October 2020, Landore commenced a 23,000

metre drilling programme aimed at further infilling and extending

the defined resource. To June 2021, a total of 17,070 metres had

been completed. Drilling has successfully intersected gold

mineralisation of similar widths and grade to the existing BAM Gold

Deposit with several instances of visible gold ("VG").

Intersections included bonanza grade gold mineralisation in drill

hole 0421-785 reporting 0.32 metres at 432.0 grams/tonne gold

(g/t). Further drilling is underway to establish strike extensions

to the east and west of the defined deposit.

The BAM Gold Deposit now extends over 3.5 kilometres from local

grid line 400E to 4100E remaining open to the east and west and

down dip.

The continued rapid growth of the BAM Gold Deposit together with

the possible future development of the other known gold prospects

along this highly prospective 31 kilometre long Archean greenstone

belt bodes well for the future of the Junior Lake Property hosting

a multi-million ounce gold deposit.

B4-7 Nickel-copper-cobalt-PGEs deposit: The burgeoning demand

for electric cars has increased demand for battery metals such as

nickel, cobalt and lithium. The Company is encouraged by the growth

in this sector and thus has initiated an in-house economic analysis

of its B4-7 deposit with the aim of its potential development. The

B4-7 deposit and Alpha Zone contains 3,292,000 tonnes at 1.20%

Nickel Equivalent (NiEq) in the Indicated category and 568,000

tonnes at 1.26% NiEq in the Inferred category for a total of 46,661

tonnes of contained metal.

Planned works for 2021 : At the conclusion of the 2020-2021

drilling programme the Company is planning to commission an updated

Mineral Resource Estimate ("MRE") and Preliminary Economic

Assessment ("PEA") on the BAM Gold Deposit.

Social and Environmental Responsibility : The Group continues to

enjoy solid working relationships with the local First Nations on

whose traditional lands our Junior Lake Property is located.

Landore believes that a successful project is best achieved through

maintaining close working relationships with First Nations and

other local communities.

On behalf of my fellow directors I wish to thank our

shareholders for their continued support together with Landore's

Management and Exploration team for their dedication and

perseverance in advancing the highly prospective Junior Lake

Property though this particularly challenging year.

William Humphries

Chief Executive Officer

23 June 2021

Operations report

INTRODUCTION:

Landore Resources Limited, through its 100 per cent owned

subsidiary Landore Resources Canada Inc. ("Landore"), is actively

engaged in mineral exploration in Eastern Canada. Landore owns or

has the mineral rights to three properties in Eastern Canada

including its highly prospective Junior Lake Property.

In December 2020, Landore sold its 30 per cent interest in the

West Graham property located in the Sudbury Nickel Belt and has

retained a 1% net smelter returns royalty ("NSR") from the

Property. After the balance sheet date, the Miminiska / Keezhik

Lake property, was optioned to purchase subject to certain terms

and conditions. Landore will be entitled to receive a 2% NSR from

the Property subject to a buyback clause.

Landore through its 100 per cent owned subsidiary Brancote US,

owns or has the mineral rights to a further eight properties for 99

claims in the State of Nevada.

During 2020 all of Landore Resources' exploration efforts were

focussed on the Junior Lake property. Drilling was conducted to

further infill, extend and deepen the BAM Gold resource of

1,015,000 ounces of gold (reported by the Company on 7 January

2020), as well as soil sampling two kilometres east and west of the

defined deposit which has indicated widespread anomalous gold and

multiple gold trends.

Full details of the Group's projects, including maps, Canadian

National Instrument 43-101 (NI 43-101) resource reports,

geophysical and soil geochemistry surveys etc. can be viewed on the

Group's website, www.landore.com .

JUNIOR LAKE PROPERTY:

The Junior Lake property, 100 per cent. owned by Landore, is

located in the province of Ontario, Canada, approximately 235

kilometres north-northeast of Thunder Bay and is host to the BAM

Gold Deposit, the B4-7 Nickel-Copper-Cobalt-PGEs Deposit and the

adjacent Alpha PGEs zone. Junior Lake also contains the VW Nickel

Deposit and numerous other highly prospective mineral

occurrences.

The Junior Lake property is comprised of the Junior Lake claim

group and the immediately adjacent claim group of Lamaune Iron Inc.

("Lamaune Iron"). In October 2017, Landore acquired a 90.2%

ownership of Lamaune Iron, which has become a subsidiary company of

Landore.

Landore's Junior Lake property including the Lamaune claim group

now consist of 1,158 staked mineral claims and six mining leases,

all together totalling approximately 30,507 ha. The property

extends for 31 kilometres across highly prospective Archean

greenstone belt.

BAM GOLD DEPOSIT:

The BAM Gold Deposit (formerly BAM East Gold Deposit) is located

approximately 2 kilometres to the east of the B4-7 Deposit and 1

kilometre north of the VW Deposit and is situated midway along an

east-southeast to west-northwest trending MaxMin geophysical

anomaly (MM-7).

The latest BAM Gold resource estimate and report, completed by

Cube Consulting Pty Ltd ("Cube") of Perth, Western Australia and

reported by Landore 7(th) January 2020, increased the resource

to:

31,083,000 tonnes (t) at 1.02 grams/tonne (g/t) for 1,015,000

ounces of gold including 21,930,000t at 1.06g/t for 747,000 ounces

gold in the Indicated Category ( compliant with National Instrument

43-101 Standards of Disclosure for Mineral Projects (NI

43-101)).

Table 0 -- 1 BAM Gold Project In-Situ Mineral Resources In-situ

Mineral Resource - All Indicated and Inferred Resources (as at 30

December 2019)

Resource Material Au g/t Tonnes Grade Contained

Category Type cut off (kT) (g/t Metal

Au) (Oz Au)

Measured ALL >0.3 0 0 0

---------- ---------- ------- ------ ----------

Indicated ALL >0.3 21,930 1.06 747,000

---------- ---------- ------- ------ ----------

Inferred ALL >0.3 9,153 0.91 268,000

---------- ---------- ------- ------ ----------

Notes:

1 Effective date of 30 December 2019 .

2 Mineral Resources are estimated at a block cut-off

grade of 0.3 g/t Au.

3 Mineral Resources are estimated using a long-term gold

price of US$1,500 per ounce.

4 A minimum mining width of two metres was used.

5 Bulk densities for the main host rocks are 2.82 t/m(3)

, 2.84 t/m(3) , and 2.90 t/m(3) .

6 Mineral Resources that are not Mineral Reserves do

not have demonstrated economic viability.

7 Figures may not add up due to rounding

The BAM Gold Deposit was discovered in December 2015 while

drilling to test the geophysical target, MaxMin anomaly MM-7.

Mineralisation consisted of near-surface low grade gold with

periodic intervals of higher grade gold. Subsequent drilling has

grown the resource considerably, now extending over 3.5 kilometres

from local grid line 400E to 4100E remaining open to the east and

west and down dip. In addition, soil sampling conducted in 2019 and

2020 has identified widespread gold mineralisation along strike to

the west for a further 7 kilometres and 2 kilometres to the

east.

The BAM Gold Deposit is interpreted as an Archean-aged

mesothermal gold deposit. Findings from drilling to-date on the BAM

Gold Deposit have revealed a lithological sequence consisting of

leucogabbro and gabbro of the Grassy Pond Sill to the south,

metasedimentary rocks of the BAM

Sequence in the central portion, to mafic volcanics to the

north. All lithological units have been subjected to variable

shearing and deformation, markedly the metasedimentary unit.

The deposit consists of gold mineralisation that is hosted by

sheared and altered rocks of the Grassy Pond Sill and the BAM

Sequence. The gold mineralisation is commonly observed in drill

core to exist as visible gold that is hosted by very thin,

foliation-parallel quartz-rich veinlets, hosted by highly fissile

ultramafic sediments of the BAM Sequence, or by foliated rocks of

the Grassy Pond Sill.

The BAM Gold Deposit has the potential to be initially developed

as a low cost, bulk tonnage, open pit operation.

Fall Drill Campaign: In October 2020, Landore re-commenced

drilling aimed at further infilling and extending the defined

resource of 1,015,000 ounces of gold and to test the depth

potential of the previously delineated mineralisation.

The 2020/2021 drill campaign, currently in-progress, consists of

15,903 metres for 68 HQ diamond drill holes (0420-725 to 0421-792)

as at April 30 2021. Drilling successfully intersected gold

mineralisation of similar widths and grade to the existing BAM Gold

Deposit with several instances of visible gold ("VG").

Intersections included bonanza grade gold mineralisation in drill

hole 0421-785 reporting 0.32 metres at 432.0 grams/tonne gold (g/t)

and drill-hole 0420-733 reporting 14.18 metres at 1.52g/t gold.

Results received in the 2020/2021 drilling campaign

included:

Easting Northing Drill-hole From Interval* Au

No Metres Metres g/t

--------- ----------- ------- ---------- -------

00E 470N 0421-768 346.15 2.20 2.51

--------- ----------- ------- ---------- -------

00E 570N 0420-732 193.26 1.02 1.67

--------- ----------- ------- ---------- -------

600E 420N 0421-763 237.05 2.33 0.79

--------- ----------- ------- ---------- -------

including 238.04 0.98 1.40

--------- ----------- ------- ---------- -------

800E 400N 0421-757 164.50 1.04 3.71

--------- ----------- ------- ---------- -------

and 188.50 1.00 8.14

--------- ----------- ------- ---------- -------

900E 385N 0421-754 162.82 12.60 0.33

--------- ----------- ------- ---------- -------

950E 350N 0420-755 118.15 5.30 1.13

--------- ----------- ------- ---------- -------

and 256.80 4.20 1.69

--------- ----------- ------- ---------- -------

1000E 295N 0420-752 235.15 3.07 4.02

--------- ----------- ------- ---------- -------

and 247.08 10.61 1.19

--------- ----------- ------- ---------- -------

1050E 295N 0420-733 78.43 0.67 3.45

--------- ----------- ------- ---------- -------

and 232.82 14.18 1.52

--------- ----------- ------- ---------- -------

including 239.51 3.24 4.48

--------- ----------- ------- ---------- -------

1150E 270N 0420-734 103.50 1.00 4.32

--------- ----------- ------- ---------- -------

and 285.37 9.81 1.34

--------- ----------- ------- ---------- -------

1450E 195N 0420-736 258.88 14.70 1.33

--------- ----------- ------- ---------- -------

including 272.53 1.05 8.50

--------- ----------- ------- ---------- -------

1500E 185N 0420-737 268.26 9.33 1.21

--------- ----------- ------- ---------- -------

Including 268.26 1.08 6.34

--------- ----------- ------- ---------- -------

1550E 190N 0420-739 259.46 6.85 1.76

--------- ----------- ------- ---------- -------

1550E 360N 0420-743 34.35 8.25 0.89

--------- ----------- ------- ---------- -------

and 55.22 0.98 6.04

--------- ----------- ------- ---------- -------

1700E 350N 0420-744 36.73 5.15 0.74

--------- ----------- ------- ---------- -------

1800E 260N 0420-747 131.41 3.71 1.88

--------- ----------- ------- ---------- -------

1900E 100N 0420-740 239.00 12.83 0.85

--------- ----------- ------- ---------- -------

2350E 85S 0420-738 324.38 9.90 1.09

--------- ----------- ------- ---------- -------

2850E 125S 0421-785 191.50 0.32 432.00

--------- ----------- ------- ---------- -------

and 192.30 0.55 3.59

--------- ----------- ------- ---------- -------

2950E 150S 0421-784 92.64 1.81 1.65

--------- ----------- ------- ---------- -------

and 183.76 1.98 2.06

--------- ----------- ------- ---------- -------

3000E 200S 0421-783 226.90 0.84 7.34

--------- ----------- ------- ---------- -------

3200E 260S 0421-780 187.90 7.70 0.41

--------- ----------- ------- ---------- -------

3500E 320S 0421-777 153.90 12.15 0.33

--------- ----------- ------- ---------- -------

and 171.05 3.00 0.45

--------- ----------- ------- ---------- -------

and 184.00 4.00 0.70

--------- ----------- ------- ---------- -------

3600E 370S 0421-776 166.62 1.00 1.38

--------- ----------- ------- ---------- -------

and 177.00 1.00 2.04

--------- ----------- ------- ---------- -------

and 220.90 1.00 4.20

--------- ----------- ------- ---------- -------

3700E 270S 0421-773 8.16 9.44 0.33

--------- ----------- ------- ---------- -------

including 17.00 0.60 2.25

--------- ----------- ------- ---------- -------

3900E 380S 0421-765 117.68 0.67 3.49

--------- ----------- ------- ---------- -------

* The above drill holes were drilled north at 45-52 degrees into

a lithological package dipping approximately sub-vertical to 80

degrees to the south. The actual true thickness of mineralisation

is estimated to represent 65% to 80% of the intervals shown in the

above table.

The 2020/2021 drilling campaign has successfully delineated

further gold mineralisation along strike from the BAM Gold Deposit

and at depth. Drilling below the BAM East defined pit has

consistently intersected the deposit's typical lithology and

mineralisation including frequent sighting of visible gold. Step

out drilling from the defined deposit, to the east for 1,100 metres

and to the west for 1,200 metres at 100 metre spacing, has

intersected lithology and mineralisation similar to the BAM Gold

deposit. Modelling work is underway to determine the next round of

drilling in these areas. The BAM Gold Deposit remains open to the

east and west and down dip.

The BAM Gold Deposit is located along a highly prospective

archean greenstone belt which traverses the Junior Lake Property

from east to west for approximately 31 kilometres, and has great

potential for further significant gold mineralisation. This

favourable greenstone belt ranges from 0.5 to 1.5 kilometres wide

and hosts multiple known gold occurrences including the Lamaune

Gold Prospect.

It is Landore's opinion that the Junior Lake property has

definite potential to host a multi-million ounce gold deposit.

2020 Ground Exploration: An extensive exploration campaign was

completed during the summer of 2020 which included the

establishment of a cut grid and soil sampling westwards along

strike for 2.1 kilometres and eastwards along strike for 2

kilometres from the existing BAM Gold Project. Soil sampling

successfully established the presence of widespread anomalous gold

and multiple gold trends, recording the highest soil-till assay

results to date in both of the 2019/2020 soil till campaigns

completed on the Junior Lake property.

The results identified numerous gold anomalies and trends, which

together with the encouraging geology and geophysics results have

generated numerous new drill targets with the potential of being

advanced into additional resources.

A map of the identified soil gold anomalies showing the regional

growth potential is available in the full version of the Annual

Report available on the Company's website at www.landore.com

A drilling programme is underway to further test for depth

extension of the east defined and extend the known BAM Gold Zone to

the east and west.

B4-7 NICKEL-COPPER-COBALT-PGEs DEPOSIT:

No material work has been completed on the B4-7 since the

discovery of the BAM Gold Deposit in December 2015 as the Company

has focussed on the rapid progression of the gold project.

The B4-7 resource estimate and report, completed by RPA Inc.

(RPA) independent engineers of Toronto, Canada in January 2018, is

compliant with the requirements of NI 43-101. The resource , so far

delineated over 900 metres of strike and a depth of 550 metres,

remains open down plunge at depth and along strike to the west.

Table 1-2 Mineral Resources for the B4-7 Nickel-Copper-Cobalt-PGE

Deposit and Alpha Zone - December 1, 2017

Landore Resources Canada Inc. - Junior Lake Project

Deposit Tonnes Ni Cu Co Pt Pd Au NiEq

(%) (%) (%) (g/t) (g/t) (g/t) (%)

--------------- ----------- ------------ ------ ------ ----- -------- -------- -------- -----

Open Pit

Indicated Alpha 132,000 0.23 0.09 0.02 0.18 0.99 0.01 0.63

B4-7 1,640,000 0.62 0.41 0.05 0.14 0.55 0.03 1.20

Inferred - - - - - - - -

Underground

Indicated B4-7 1,520,000 0.65 0.45 0.06 0.12 0.48 0.03 1.25

Inferred B4-7 568,000 0.61 0.52 0.05 0.08 0.50 0.03 1.26

Total

Indicated 3,292,000 0.62 0.42 0.05 0.13 0.53 0.03 1.20

Inferred 568,000 0.61 0.52 0.05 0.08 0.5 0.03 1.26

Notes:

1. CIM (2014) definitions were followed for Mineral Resource estimation and classification.

2. Mineral Resources are estimated using average long-term metal

prices (US$) of $8.00/lb nickel, $3.50/lb copper, $19.00/lb cobalt,

$1,400/oz platinum, $1,000/oz palladium, and $1,400/oz gold and an

exchange rate (C$/US$) of 1.25, and the NSR factors stated in the

body of this report.

3. Open Pit Mineral Resources are reported within a resource pit

shell at an NSR cut-off value of $22/t. Underground Mineral

Resources are reported at an NSR cut-off value of $62/t.

4. Tonnage figures are rounded to three significant figures.

Totals may not add correctly due to rounding.

5. The Mineral Resource estimate uses drill hole data available as of December 16 2015.

6. The Mineral Resource estimate for the B4-7 Deposit is

reported using densities calculated from estimated nickel + cobalt

grades. The Mineral Resource estimate for the Alpha Zone is

reported using densities calculated from estimated nickel

grades.

The report also identified a new Exploration Target located

immediately west of the B4-7 Deposit containing a potential 1.5 Mt

to 2.0 Mt of sulphide mineralisation of similar grade range to that

which has been outlined to-date (potential 18,000 to 24,000 tonnes

of contained metal).

There is significant value in the B4-7 Deposit in its credit

commodities, in particular cobalt and palladium. The B4-7 2018

resource upgrade reported a significant cobalt content credit of

+4.6 million pounds for the deposit to date together with + 66,000

ounces of Palladium. However the adjacent Alpha Zone, which has

only partially been included in the B4-7 resource, is

palladium/platinum rich with drilling reporting intersections of

1.5 metres at 10.15g/t Pd in drill hole 0415-507 and 20.15 metres

at 1.54 g/t Pd. in drill-hole 0414-503 including 0.72 metres at

12.85 g/t Pd.

Infrastructure: The city of Thunder Bay is located on the

northern shore of Lake Superior and is the main supply hub for the

mining centres of northern Ontario including Red Lake, Pickle Lake,

and the Musselwhite gold mine. It has extensive port facilities and

an airport providing daily flights to major provincial cities, as

well as a rail line that provides access to both eastern and

western North American markets.

Access to Junior Lake from Thunder Bay is via a sealed highway

for 235 kilometres to the town of Armstrong and then via a

well-maintained forest products unsealed road for 105 kilometres

that runs to the property.

The Canadian National Railway runs parallel to the Junior Lake

property 13 kilometres to the south providing direct transport

access to both the nickel smelting centre of Sudbury and the port

facilities at Thunder Bay. In addition, Junior Lake has abundant

water resources nearby.

Environmental Baseline Studies: Golder Associates of Sudbury,

Ontario, have continued with the Environmental Baseline Studies

programme initiated on the mining leases containing the B4-7 and VW

Deposits in the winter of 2007. Water surface monitoring of lakes

and drainage tributaries within the vicinity of the deposits has

continued on at least a bi-annual basis since 2011. The area of

influence has recently been expanded to include lakes and drainage

further out from the leases. The environmental and baseline studies

are all pre-requisite for permitting requirements for the

development of the BAM, B4-7 and VW Deposits.

Mining Leases: A pre-requisite for the development of the BAM,

B4-7 and VW Deposits is to secure tenure over an area of land

sufficiently large to provide for development, mining, processing,

infrastructure and buffer zones around the mining areas and for

future expansion. Landore has been granted three mining leases

("Mining Leases"), which include mining and surface rights, over an

area encompassing the BAM, B4-7 and VW Deposits. The mining leases

cover 23 existing exploration claims for a total area of 3,676

hectares and have been granted for 21 years renewable for further

terms of 21 years. Additionally, in late 2019 Ontario's Ministry of

Energy, Northern Development and Mines granted the Company Mining

Leases 109856 and 109857 encompassing all of Lamaune Iron Inc.'s

exploration claims over an area totalling approximately 4,133

hectares.

The combined Landore and Lamaune Mining Leases cover a total of

approximately 7,862 hectares and extend for 22 kilometres,

encompassing all of Landore's established mineral deposits and

prospects. These include: the BAM Gold Deposit; B4-7

Nickel-Copper-Cobalt-PGEs Deposit; VW Nickel-Copper Deposit (all

NI43-101 compliant); the Lamaune Gold Exploration Target; and the

Lamaune Iron Deposit.

Within the Mining Leases, Landore has the right, subject to

provisions of certain Acts and reservations, to:

-- Sink shafts, excavations etc., for mining purposes.

-- Construct dams, reservoirs, railways, etc., as needed.

-- Erect buildings, machinery, furnaces, etc., as required and

to treat ores.

OTHER PROPERTIES:

Landore has other non-core exploration properties which include

grass roots exploration and defined drill targets.

SOCIAL AND ENVIRONMENTAL RESPONSIBILITY:

Landore believes that a successful project is best achieved

through maintaining close working relationships with First Nations

and other local communities. This social ideology is at the

forefront of all of Landore's exploration initiatives by

establishing and maintaining co-operative relationships with First

Nations communities, hiring local personnel and using local

contractors and suppliers.

Careful attention is given to ensure that all exploration

activity is performed in an environmentally responsible manner and

abides by all relevant mining and environmental acts. Landore takes

a conscientious role in all of its operations, and is aware of its

social responsibility and its environmental duty.

COVID-19:

The spread of COVID-19 and measures taken to contain the spread

of the virus caused significant disruption to Landore's exploration

activities during the first half of 2020. By mid-2020 the Company

resumed Canadian operations, and since then has successfully

operated in accordance with Government COVID-19 guidelines.

Michele Tuomi, P.Geo.

Director/VP Exploration, Landore Resources Canada Inc.

23 June 2021

Consolidated Statement of Comprehensive Income

For the year ended 31 December 2020

Group Group

31 December 31 December

2020 2019

Notes GBP GBP

Exploration costs 9 (1,345,454) (1,241,647)

Administrative expenses 25 (1,363,949) (904,424)

---------------------------------------------- ----- ----------- -----------

Operating loss (2,709,403) (2,146,071)

Other income 27 155,834 -

Finance income 5 13 151

---------------------------------------------- ----- ----------- -----------

Loss before income tax (2,553,556) (2,145,920)

Income tax 8 - -

---------------------------------------------- ----- ----------- -----------

Loss for the year (2,553,556) (2,145,920)

---------------------------------------------- ----- ----------- -----------

Other comprehensive (loss)/income

Items that will subsequently be reclassified

to profit or loss:

Exchange differences on translating foreign

operations 18 (4,594) (30,884)

---------------------------------------------- ----- ----------- -----------

Other comprehensive (loss)/income for

the year net of tax (4,594) (30,884)

---------------------------------------------- ----- ----------- -----------

Total comprehensive loss for year (2,558,150) (2,176,804)

---------------------------------------------- ----- ----------- -----------

Loss attributable to:

Equity holders of the Company (2,552,455) (2,144,998)

Non-controlling interests (1,101) (922)

---------------------------------------------- ----- ----------- -----------

Total comprehensive loss attributable

to:

Equity holders of the Company (2,557,049) (2,175,882)

Non-controlling interests (1,101) (922)

---------------------------------------------- ----- ----------- -----------

Loss per share for losses attributable

to the equity holders

of the Company during the year

- basic 10 (0.03) (0.04)

---------------------------------------------- ----- ----------- -----------

- diluted 10 (0.03) (0.04)

---------------------------------------------- ----- ----------- -----------

The Group's operating loss relates to continuing operations.

Company Statement of Comprehensive Income

For the year ended 31 December 2020

Company Company

31 December 31 December

2020 2019

Notes GBP GBP

Administrative expenses 25 (1,127,692) (629,645)

-------------------------------------- ----- ----------- -----------

Operating loss (1,127,692) (629,645)

Interest receivable 13 151

Foreign exchange (loss)/gain (359,559) 223,960

-------------------------------------- ----- ----------- -----------

Loss before income tax (1,487,238) (405,534)

Income tax expense - -

-------------------------------------- ----- ----------- -----------

Total comprehensive loss for the year (1,487,238) (405,534)

-------------------------------------- ----- ----------- -----------

The Company's operating loss relates to continuing

operations.

Consolidated statement of financial position

As at 31 December 2020

Group Group

At At

31 December 31 December

2020 2019

Notes GBP GBP

Assets

Non-current assets

Property, plant and equipment 11 23,416 32,323

---------------------------------- ----- ------------ ------------

23,416 32,323

Current assets

Trade and other receivables 13 139,524 19,965

Cash and cash equivalents 26 1,052,623 107,668

---------------------------------- ----- ------------ ------------

1,192,147 127,633

---------------------------------- ----- ------------ ------------

Total assets 1,215,563 159,956

---------------------------------- ----- ------------ ------------

Equity

Capital and reserves attributable

to the Company's

equity holders

Share capital - nil par value 15 46,108,934 42,915,903

Share-based payment reserve 16 921,133 640,347

Accumulated deficit 17 (45,905,940) (43,353,485)

Translation reserve 18 (348,111) (343,517)

Total equity shareholders' funds 776,016 (140,752)

---------------------------------- ----- ------------ ------------

Non-controlling interests 22 (4,328) (3,227)

Total equity 771,688 (143,979)

---------------------------------- ----- ------------ ------------

Liabilities

Current liabilities

Trade and other payables 14 409,410 269,058

Current income tax liabilities 14 34,465 34,877

---------------------------------- ----- ------------ ------------

443,875 303,935

---------------------------------- ----- ------------ ------------

Total liabilities 443,875 303,935

---------------------------------- ----- ------------ ------------

Total equity and liabilities 1,215,563 159,956

---------------------------------- ----- ------------ ------------

These consolidated financial statements were approved and

authorised for issue by the Board of Directors on 23 June 2021.

William Humphries Glenn Featherby

Director Director

Company statement of financial position

As at 31 December 2020

Company Company

At At

31 December 31 December

2020 2019

Notes GBP GBP

Assets

Non- current assets

Investment in subsidiaries 12 94,888 94,888

---------------------------------- ----- ------------ ------------

94,888 94,888

---------------------------------- ----- ------------ ------------

Current assets

Trade and other receivables 13 32,983,474 31,505,051

Cash and cash equivalents 26 549,559 57,101

---------------------------------- ----- ------------ ------------

33,533,033 31,562,152

---------------------------------- ----- ------------ ------------

Total assets 33,627,921 31,657,040

---------------------------------- ----- ------------ ------------

Equity

Capital and reserves attributable

to the Company's

equity holders

Share capital - nil par value 15 46,108,934 42,915,903

Share-based payment reserve 16 921,133 640,347

Accumulated deficit 17 (13,471,794) (11,984,556)

---------------------------------- ----- ------------ ------------

Total equity shareholders' funds 33,558,273 31,571,694

---------------------------------- ----- ------------ ------------

Liabilities

Current liabilities

Trade and other payables 14 69,648 85,346

---------------------------------- ----- ------------ ------------

Total liabilities 69,648 85,346

---------------------------------- ----- ------------ ------------

Total equity and liabilities 33,627,921 31,657,040

---------------------------------- ----- ------------ ------------

These financial statements were approved and authorised for

issue by the Board of Directors on 23 June 2021.

William Humphries Glenn Featherby

Director Director

Consolidated statement of changes in equity

For the year ended 31 December 2020

Equity shareholders' funds

-------------------------------------------- -----------

Share capital Share-based Accumulated Translation Non-controlling

nil par value payment deficit reserve interest Total

GBP GBP GBP GBP GBP GBP

Balance as at 1 January 2019 41,247,016 726,453 (41,432,637) (312,633) (2,305) 225,894

--------------- ----------- ------------ ----------- ----------------- -----------

Share option reserve

adjustment for

lapsed options (note 16) - (224,150) 224,150 - - -

Issue of options (note 16) - 128,243 - - - 128,243

Issue of warrants (note 16) - 9,801 - - - 9,801

Issue of ordinary share

capital - nil par (note 15) 1,820,000 - - - - 1,820,000

Issue costs (note 15) (151,113) - - - - (151,113)

Total transactions with

owners 1,668,887 (86,106) 224,150 - - 1,806,931

----------------------------- --------------- ----------- ------------ ----------- ----------------- -----------

Loss for the year - - (2,144,998) - (922) (2,145,920)

Exchange difference from

translating

foreign operations - - - (30,884) - (30,884)

----------------------------- --------------- ----------- ------------ ----------- ----------------- -----------

Total comprehensive loss for

the year - - (2,144,998) (30,884) (922) (2,176,804)

----------------------------- --------------- ----------- ------------ ----------- ----------------- -----------

Balance as at 31 December

2019 42,915,903 640,347 (43,353,485) (343,517) (3,227) (143,979)

----------------------------- --------------- ----------- ------------ ----------- ----------------- -----------

Balance as at 1 January

2020 42,915,903 640,347 (43,353,485) (343,517) (3,227) (143,979)

--------------- ----------- ------------ ----------- ----------------- -----------

Issue of options (note 16) - 220,435 - - - 220,435

Issue of warrants (note 16) - 60,351 - - - 60,351

Issue of ordinary share

capital - nil par (note 15) 3,503,539 - - - - 3,503,539

Issue costs (note 15) (310,508) - - - - (310,508)

Total transactions with

owners 3,193,031 280,786 - - - 3,473,817

----------------------------- --------------- ----------- ------------ ----------- ----------------- -----------

Loss for the year - - (2,552,455) - (1,101) (2,553,556)

Exchange difference from

translating

foreign operations - - - (4,594) - (4,594)

----------------------------- --------------- ----------- ------------ ----------- ----------------- -----------

Total comprehensive loss for

the year - - (2,552,455) (4,594) (1,101) (2,558,150)

----------------------------- --------------- ----------- ------------ ----------- ----------------- -----------

Balance as at 31 December

2020 46,108,934 921,133 (45,905,940) (348,111) (4,328) (771,688)

----------------------------- --------------- ----------- ------------ ----------- ----------------- -----------

The accounting policies and notes on pages 46 to 76 form an

integral part of these consolidated financial statements.

Company statement of changes in equity

For the year ended 31 December 2020

Share capital Share-based Accumulated

nil par value payment deficit Total

GBP GBP GBP GBP

Balance as at 1 January 2019 41,247,016 726,453 (11,803,172) 30,170,297

------------- ----------- ------------ -----------

Lapsed options (note 16) - (224,150) 224,150 -

Issue of options (note 16) - 128,243 - 128,243

Issue of warrants (note 16) - 9,801 - 9,801

Issue of ordinary share capital - nil par (note 15) 1,820,000 - - 1,820,000

Issue costs (note 15) (151,113) - - (151,113)

Total transactions with owners 1,668,887 (86,106) 224,150 1,806,931

---------------------------------------------------- ------------- ----------- ------------ -----------

Loss for the year - - (405,534) (405,534)

---------------------------------------------------- ------------- ----------- ------------ -----------

Total comprehensive loss for the year - - (405,534) (405,534)

---------------------------------------------------- ------------- ----------- ------------ -----------

Balance as at 31 December 2019 42,915,903 640,347 (11,984,556) 31,571,694

---------------------------------------------------- ------------- ----------- ------------ -----------

Balance as at 1 January 2020 42,915,903 640,347 (11,984,556) 31,571,694

------------- ----------- ------------ -----------

Issue of options (note 16) - 220,435 - 220,435

Issue of warrants (note 16) - 60,351 - 60,351

Issue of ordinary share capital - nil par (note 15) 3,503,539 - - 3,503,539

Issue costs (note 15) (310,508) - - (310,508)

Total transactions with owners 3,193,031 280,786 - 3,473,817

---------------------------------------------------- ------------- ----------- ------------ -----------

Loss for the year - - (1,487,238) (1,487,238)

---------------------------------------------------- ------------- ----------- ------------ -----------

Total comprehensive loss for the year - - (1,487,238) (1,487,238)

---------------------------------------------------- ------------- ----------- ------------ -----------

Balance as at 31 December 2020 46,108,934 921,133 (13,471,794) 33,558,273

---------------------------------------------------- ------------- ----------- ------------ -----------

Consolidated statement of cash flows

For the year ended 31 December 2020

Group Group

31 December 31 December

2020 2019

Notes GBP GBP

Cash flows from operating activities

Operating loss (2,709,403) (2,146,071)

Other income 27 155,834 -

Finance income 5 13 151

Depreciation of tangible fixed assets 11 8,629 12,121

Share options issued 16 220,435 128,244

Foreign exchange loss on non-cash items (44,961) (33,620)

Non-cash director remuneration 7 68,000 -

Non-cash exploration and evaluation expenditures 43,582 -

(Increase)/decrease in trade and other

receivables (77,073) 23,622

Increase in trade and other payables 144,437 266,979

Net cash used in operating activities (2,190,507) (1,748,574)

Cash flows from financing activities

Proceeds from issue of ordinary shares 15 3,391,701 1,720,000

Issue costs 15 (250,157) (141,312)

Net cash generated by financing activities 3,141,544 1,578,688

Net increase/(decrease) in cash and cash

equivalents 951,037 (169,886)

Cash and cash equivalents at beginning

of the year 107,668 277,458

Exchange (loss)/gain on cash and cash

equivalents (6,082) 96

------------------------------------------------- ----- ----------- -----------

Cash and cash equivalents at end of the

year 1,052,623 107,668

------------------------------------------------- ----- ----------- -----------

Company statement of cash flows

For the year ended 31 December 2020

Company Company

31 December 31 December

2020 2019

Notes GBP GBP

Cash flows from operating activities

Operating loss (1,127,692) (629,645)

Finance income 13 151

Foreign exchange (loss)/gain on non-cash

items (359,559) 223,961

Non-cash director remuneration 7 68,000 -

Share options issued 16 220,435 128,243

Increase in trade and other receivables (1,434,585) (1,611,012)

Increase in trade and other payables (15,698) 121,043

-------------------------------------------- ----- ----------- -----------

Net cash used in operating activities (2,649,086) (1,767,259)

Cash flows from financing activities

Proceeds from issue of ordinary shares 15 3,391,701 1,720,000

Issue costs (250,157) (141,312)

Net cash generated by financing activity 3,141,544 1,578,688

Net decrease in cash and cash equivalents 492,458 (188,571)

Cash and cash equivalents at beginning

of year 57,101 245,672

-------------------------------------------- ----- ----------- -----------

Cash and cash equivalents at end of year 549,559 57,101

-------------------------------------------- ----- ----------- -----------

Notes

1. Publication of non-statutory accounts

The financial information, for the year ended 31 December 2020,

set out in this announcement does not constitute statutory

accounts.

This information has been extracted from the Group's financial

statements to that date upon which the auditors' opinion is

unmodified but contains material uncertainty on going concern.

2. Basis of preparation

The financial information, for the year ended 31 December 2020,

set out in this announcement, has been:

-- computed in accordance with EU-Adopted International

Financial Reporting Standards ("EU IFRSs"), however this

preliminary announcement does not contain sufficient information to

comply with IFRSs. The EU IFRSs compliant Consolidated Financial

Statements will be published in the Annual Report for the year

ended 31 December 2020; and

-- prepared on the basis of the accounting policies as stated in

the Annual Report for the year ended 31 December 2020.

3. Going concern

The consolidated financial statements are prepared on a going

concern basis with a reasonable expectation that the Group has

adequate resources to continue in operational existence for the

foreseeable future. The Group's comprehensive loss after tax for

the year as at 31 December 2020 amounted to GBP2.6m.

The Group raised GBP3.5m on 16 February 2021 with the intention

of providing sufficient funds to meet the planned operational

expenditure and working capital up to 31 December 2021. With the

addition of GBP646,672 raised from the exercise of warrants and

share options post year end the Board are satisfied the Group has

sufficient cash to meet its requirements for a period of at least

12 months from the date of approval of these financial

statements.

Due to the location of the Group's principal assets, it is well

protected from the effects of any potential COVID-19 resurgence on

its operations. Whilst the Group is exposed to any wider economic

implications from further restrictions, the Board believe that its

interests in a range of precious metals combined with the drilling

progress achieved in 2020 provide a significant hedge to the

potential exposure of further Covid-19 impacts. The Group's

operations during 2020 were unaffected by the pandemic.

The Board also note the significant degree to which future

expenditure is uncommitted. Whilst the Board is pursuing maximum

progress at Junior Lake, in a downside scenario the Board has

significant scope to control costs and its cash management

flexibility has been demonstrated over a number of years.

The Group will continue to consider all options to maximise

shareholder value and the Directors are confident of raising

further equity should the need arise.

4. Annual Report

The Annual Report for the year ended 31 December 2020, Notice of

the Annual General Meeting and Form of Proxy will shortly be

available on the Company's website at www.landore.com

The Annual General Meeting of Landore Resources Limited will be

held at La Tonnelle House, Les Banques, St Sampson, Guernsey, GY1

3HS on 20 July 2021 at 11.30 am.

Effect of COVID-19 regulations on the Annual General Meeting

In light of the requirement for persons arriving in the

Bailiwick of Guernsey to potentially self-isolate for up to 21 days

on arrival pursuant to restrictions imposed by the Medical Officer

of Health in Guernsey under the Emergency Powers (Coronavirus)

(General Provision) (Bailiwick of Guernsey) (No.6) Regulations 2021

(as supplemented, amended or replaced from time to time) (the

"Guernsey Quarantine Restrictions"), the Company strongly

encourages all Shareholders to submit their Form of Proxy,

appointing the Chairman of the Annual General Meeting as proxy.

Only the formal business of the Resolutions will be carried out at

the meeting and no update will be provided. At the date of

publication of this Notice of Annual General Meeting the Company

notes that the Guernsey Civil Contingency Authority has announced

that from 1 July 2021, there will be no isolation or testing

requirements in respect of persons who (i) have been fully

vaccinated (provided 14 days have elapsed from the date of

receiving their second dose of the vaccine prior to arrival in

Guernsey) and (ii) are travelling into Guernsey from jurisdictions

within the Common Travel Area (CTA) (and who have not been in a

jurisdiction outside the CTA within the prior 14 days) (such

persons being "Excepted Category Persons"). The CTA includes the

United Kingdom, the Bailiwick of Guernsey, the Bailiwick of Jersey,

the Isle of Man and the Republic of Ireland. The States of Guernsey

have confirmed however that Public Health may apply overrides to

the categorisation of any country or region if it has concerns,

including countries or regions of countries, within the CTA.

Persons who are travelling into Guernsey and who are not Excepted

Category Persons will be subject to the isolation and testing

requirements applicable to the jurisdiction from which they are

travelling and should consult

https://covid19.gov.gg/guidance/travel/countries for more

information. The Annual General Meeting has been arranged on the

assumption that the Guernsey Quarantine Restrictions as at the date

of publication of this Notice of Annual General Meeting will

continue to apply at the date of the Annual General Meeting. Unless

notified otherwise after publication of the Notice of Annual

General Meeting, no Shareholder, proxy or corporate representative

who has not complied fully with the relevant travel restrictions

and/or other requirements of the Guernsey Quarantine Restrictions

should attend the Annual General Meeting in person. The Chairman of

the Annual General Meeting may exercise his powers to exclude any

person who has arrived in Guernsey and who is not in compliance

with the relevant travel restrictions in force at such time (or is

otherwise in breach of the Guernsey Quarantine Restrictions) and

who attempts to attend the Annual General Meeting, and they may not

be permitted entry to the location of the Annual General Meeting.

The situation regarding COVID-19 is constantly evolving, and the

Government of Guernsey may change current restrictions or implement

further measures relating to the holding of general meetings during

the affected period. Any changes to the Annual General Meeting

(including any change to the location of the Annual General

Meeting) will be communicated to Shareholders before the meeting

through our website at https://www.landore.com/index.php and, where

appropriate, by announcement made by the Company to a Regulatory

Information Service. It is suggested that Shareholders consult

https://covid19.gov.gg/guidance/travel for updates closer to the

date of the meeting.

Shareholders will find accompanying the Notice of AGM, a Form of

Proxy, for use in connection with the Annual General Meeting. The

Form of Proxy should be completed and returned in accordance with

the instructions thereon so as to be received by the Company's

Registrar Agents, Computershare Investor Services (Guernsey)

Limited, as soon as possible and in any event not later 11.30am on

16 July 2021.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UOSBRANUNUAR

(END) Dow Jones Newswires

June 24, 2021 02:00 ET (06:00 GMT)

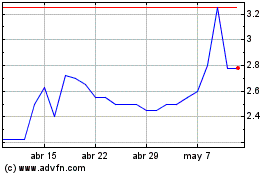

Landore Resources (LSE:LND)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Landore Resources (LSE:LND)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024