TIDMDUKE

RNS Number : 7443D

Duke Royalty Limited

01 July 2021

1 July 2021

Duke Royalty Limited

("Duke Royalty", "Duke" or the "Company")

New Royalty Agreement with Fairmed Healthcare AG

Duke Royalty, a provider of alternative capital solutions to a

diversified range of profitable and long-established businesses in

Europe and abroad, is pleased to announce that it has further

diversified and increased its revenue base by entering into a EUR10

million royalty financing agreement (the "Financing") with Fairmed

Healthcare AG ("Fairmed"). Formed in 2012 and based in Zug,

Switzerland, Fairmed provides high quality generic prescription

medicines, over-the-counter pharmaceuticals, dermocosmetics and

dietary supplements in various EU countries.

Highlights:

-- Duke was selected as Fairmed's capital partner because of the

long-term nature of its capital and because it was able to

structure a non-dilutive solution for management while maintaining

its required internal rate of return.

-- Fairmed is majority owned by Strides Pharma Global Pte Ltd

("Strides Pharma Global") which is in turn a wholly-owned step-down

subsidiary of Strides Pharma Science Limited ("Strides"), a listed

public company.

-- Incorporated in 1990, Strides is a global pharmaceutical

company with more than 3,000 employees, headquartered in Bangalore,

India. Strides has a global manufacturing footprint with eight

manufacturing facilities spread across three continents with a

strong footprint across 100 countries.

-- Strides Pharma Global acquired its interest in Fairmed in

2019 to provide it with a platform for distribution of its

pharmaceutical products in the EU, post-Brexit.

-- The EUR10 million royalty is a 30-year senior secured

financing, with monthly payments commencing immediately in July

2021 on Duke's typical investment terms.

-- Duke has negotiated a comprehensive security package as the senior lender to Fairmed.

Neil Johnson, CEO of Duke Royalty, said:

"Fairmed's long history of operating in the EU

generic/over-the-counter pharmaceutical sector and the

well-established underlying demographic growth characteristics of

the market in which it operates, makes this an ideal investment

opportunity for Duke. Fairmed has reached an inflection point in

the evolution of its business plan that allowed Duke to propose its

alternative financing solution to support the business without

diluting management's equity stake.

"The business has an established track record of effectively

delivering growth, providing Duke with confidence in the team's

ability to continue this trend in the months and years ahead.

Strides' vision and strong backing of Fairmed in the post-Brexit EU

medical regulatory environment has given us additional confidence

in completing the opportunity.

"Duke is well positioned to make more investments in due course

as we focus on further deploying capital and diversifying the

portfolio to create value for shareholders."

Oren Weininger, CEO of Fairmed, said:

"Duke's investment solution has been a great fit for our group

of companies. Using the proceeds from this investment, we are

excited to take Fairmed's business plan to the next level and build

on the excellent reputation of the firm in the EU."

Further information regarding Fairmed

https://www.fair-med.com/

Formed in 2012 and based in Zug, Switzerland, Fairmed provides

high quality generic prescription medicines, over-the counter

pharmaceuticals, dermocosmetics and dietary supplements in c. 15

core markets. The combination of Strides' vast international

product portfolio and Fairmed's market access, particularly in the

Germany/Austria/Switzerland region, provides a strong growth

platform in continental Europe.

About Strides

Incorporated in 1990, Strides Pharma Science Limited is a global

pharmaceutical company with over 3,000 employees, headquartered in

Bangalore, India. The company has a global manufacturing footprint

with eight manufacturing facilities spread across three continents

with a strong footprint across 100 countries.

About the Financing

Duke has committed EUR10 million of capital to enable the

current management team to maintain its minority equity interest

and shape the future growth of the business with support from

Strides Global in the form of supply of products and strategic

alignment.

The terms of the Financing are in line with Duke's typical

royalty investment criteria whereby Duke will be entitled to

monthly distributions (the "Distribution") beginning in July 2021.

The Financing is provided as a senior secured loan with appropriate

covenants and rights.

Duke Royalty Portfolio

A full list of Duke's current Royalty Partners are now included

for reference on our Partners page of our website:

www.dukeroyalty.com/partners

This announcement contains inside information.

***ENDS***

For further information, please visit www.dukeroyalty.com or contact:

Neil Johnson / Charlie

Cannon Brookes / Hugo

Duke Royalty Limited Evans +44 (0) 1481 730 613

Cenkos Securities

plc Stephen Keys / Callum

(Nominated Adviser Davidson / Julian Morse

and Joint Broker) / Michael Johnson +44 (0) 207 397 8900

Canaccord Genuity Adam James / Georgina

(Joint Broker) McCooke +44 (0) 207 523 8000

SEC Newgate (PR) Elisabeth Cowell/ Richard + +44 (0) 20 3757 6880

Bicknell/ Megan Kovach dukeroyalty@secnewgate.co.uk

About Duke Royalty

Duke Royalty Limited provides alternative capital solutions to a

diversified range of profitable and long-established businesses in

Europe and abroad. Duke Royalty's experienced team provide

financing solutions to private companies that are in need of

capital but whose owners wish to maintain equity control of their

business. Duke Royalty's royalty investments are intended to

provide robust, stable, long term returns to its shareholders. Duke

Royalty is listed on the AIM market under the ticker DUKE and is

headquartered in Guernsey.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

AGRWPUMWQUPGGMU

(END) Dow Jones Newswires

July 01, 2021 02:00 ET (06:00 GMT)

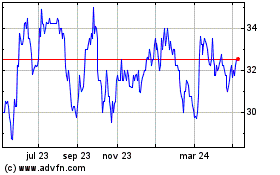

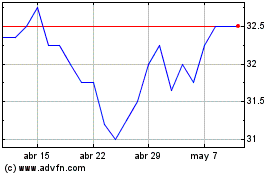

Duke Capital (LSE:DUKE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Duke Capital (LSE:DUKE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024