Distribution Finance Cap. Hldgs PLC Progressive publishes new research

09 Julio 2021 - 1:51AM

RNS Non-Regulatory

TIDMDFCH

Distribution Finance Cap. Hldgs PLC

09 July 2021

Significant loan origination to continue

DF Capital's (DFC) recent Q2 trading update reported that the Group saw very strong new business

originations over the quarter while arrears levels remained favourable. Dealer loan facilities

were also at a robust level. Market dynamics which reflected record sales for many of DFC's

customers also included an accelerated stock turn and subsequent delays to stock replenishment.

The nub of this environment is that DFC's loan book reduced to GBP166m by the end of Q2 from

GBP193m at the end of Q1. As manufacturers work through delivery delays, DFC expects to see

'significant' loan origination during H2. Management also reiterates its expectation of achieving

monthly run-rate profitability during Q4 of FY 2021E. We adjust estimates to reflect the pattern

of growth in the loan book which mainly affects FY 2021E and FY 2022E through lower anticipated

average loan books during those years. Our FY 2023E numbers are substantially unchanged. Meanwhile,

the outlook is one based on a supportive market backdrop with significant lending opportunities

for DFC.

Click here for full analysis

Subscribe to Progressive's research, which is freely available

to every type of investor, and be kept informed about our regular

programme of investor engagement.

About Progressive:

Progressive helps you make informed investment decisions. FCA

authorised and regulated, and with a 15-strong team of highly

experienced analysts, we provide freely available institutional

grade equity research and access to company management teams across

every sector of the market.

www.progressive-research.com

Broad coverage Analyst calibre

across 12 sectors

Business Services Oil & Gas 15 with average 20

analysts years

Financials Property experience

of

Healthcare Retail

Industrials Technology 30+ techMARK

Investment Trusts Telecoms industry based Extel

Mining Utilities awards StarMine

For further information please contact:

Emily Ritchie

+44 (0) 20 7781 5311

eritchie@progressive-research.com

This information is provided by Reach, the non-regulatory press

release distribution service of RNS, part of the London Stock

Exchange. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

Reach is a non-regulatory news service. By using this service an

issuer is confirming that the information contained within this

announcement is of a non-regulatory nature. Reach announcements are

identified with an orange label and the word "Reach" in the source

column of the News Explorer pages of London Stock Exchange's

website so that they are distinguished from the RNS UK regulatory

service. Other vendors subscribing for Reach press releases may use

a different method to distinguish Reach announcements from UK

regulatory news.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NRAFIFSRDAIAIIL

(END) Dow Jones Newswires

July 09, 2021 02:51 ET (06:51 GMT)

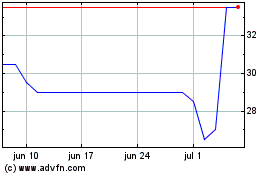

Distribution Finance Cap... (LSE:DFCH)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Distribution Finance Cap... (LSE:DFCH)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024