Euro Higher As European Shares Rise Amid Uptick In Treasury Yields

09 Julio 2021 - 4:06AM

RTTF2

The euro advanced its most major counterparts in the European

session on Friday amid risk appetite, as U.S. treasury yields

climbed and China's central bank slashed the reserve requirement

ratio for banks by 50 basis points.

The recovery in treasury yields helped ease some of the concerns

about the pace of the economic recovery from crisis.

The yield on the benchmark 10-year treasury note rose 5 basis

points to 1.336 percent.

The RRR cut will inject 1 trillion yuan into the banking

system.

The PBOC said that it will maintain a prudent monetary policy

and keep liquidity reasonably stable.

European Central Bank policy makers broadly agreed that economic

activity could accelerate in the second half of the year after

lifting of more containment measures, according to the account of

the monetary policy meeting the governing council held on June 9

and 10.

"In view of the better outlook for growth and inflation and the

associated upside risks, it was, however, also argued that, to

provide the same degree of accommodation, asset purchases should be

scaled back somewhat," minutes showed.

Policymakers indicated that the broad parameters for PEPP

purchases would continue to be decided on the basis of a quarterly

joint assessment of financing conditions and the inflation

outlook.

The euro edged up to 1.0855 against the franc and 1.1864 against

the greenback, up from Thursday's closing values of 1.0833 and

1.1842, respectively. The euro is seen locating resistance around

1.10 against the franc and 1.20 versus the greenback.

The euro climbed to a 2-day high of 130.59 against the yen,

compared to Thursday's close of 129.93. Next key resistance for the

euro is likely seen around the 134 level.

In contrast, the euro weakened to 1.5859 against the aussie and

1.4794 versus the loonie, from yesterday's closing values of 1.5933

and 1.4837, respectively. On the downside, 1.56 and 1.46 are

possibly seen as its next support levels against the aussie and the

loonie, respectively.

The euro pulled back from an early more than 2-week high of

1.7099 against the kiwi, with the pair worth 1.6971. At yesterday's

trading close, the pair was quoted at 1.7036. Immediate support for

the currency is likely seen around the 1.68 level.

The European currency was trading lower at 0.8570 against the

pound. The euro-pound pair had ended yesterday's trading session at

0.8588. The euro may face support around the 0.84 region.

Data from the Office for National Statistics showed that the UK

economy expanded for the fourth consecutive month in May, albeit at

a slower pace and remained below the pre-pandemic levels.

Gross domestic product grew 0.8 percent month-on-month in May,

but slower than the revised 2 percent growth posted in April and

the economists' forecast of +1.5 percent. Nonetheless, GDP rose for

the fourth straight month.

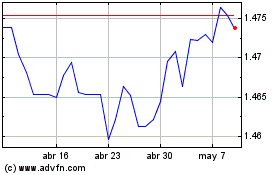

Euro vs CAD (FX:EURCAD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Euro vs CAD (FX:EURCAD)

Gráfica de Divisa

De Abr 2023 a Abr 2024