TIDMDKL

RNS Number : 4222F

Dekel Agri-Vision PLC

15 July 2021

The following corrects the announcement released at 07:00 on

9(th) July 2021 under RNS No. 6876E in which, under Issue of Equity

paragraph, the number of new shares should be 335,864 (not 333,864

as previously stated), with admission expected on or around 21 July

2021 . All other details remain unchanged and the full corrected

announcement is reproduced below.

Dekel Agri-Vision Plc / Index: AIM / Epic: DKL / Sector: Food

Producers

Dekel Agri-Vision Plc ('Dekel' or the 'Company')

Half Year Production Update

Dekel Agri-Vision Plc (AIM: DKL) , the West African agriculture

company focused on building a portfolio of sustainable and

diversified projects, is pleased to provide its half year

production update for the period ending 30 June 2021 on the

100%-owned Ayenouan palm oil project in Côte d'Ivoire ('Ayenouan'

or the 'Project').

Highlight s

-- 12.6% increase in June CPO production to 2,638 tonnes in June 2021 compared to June 2020

o Brings cumulative CPO production for H1 2021 to 26,515 tonnes,

a 11.0% increase on production compared to H1 2020

-- 4,822 tonnes of CPO sold in June 2021, a 97.3% increase on June 2020 sales

o Brings cumulative CPO sales for H1 2021 to 24,784 tonnes, 3.7%

increase compared to H1 2020

-- 82.3% increase in average realised CPO prices to EUR915 per

tonne in June compared to June 2020

o June monthly CPO sales price of EUR915 per tonne a record

monthly price for the Company

o Brings average realised CPO prices for H1 2021 to EUR817 per

tonne, 35.7% higher than the EUR602 per tonne achieved in H1

2020

-- H1 2021 financial results expected to significantly surpass

H1 2020's EUR15.4m revenues; EUR1.9m EBITDA; and EUR0.4m net

profits

Lincoln Moore, Dekel 's Executive Director , said: "The overall

Company performance in H1 2021 is arguably our strongest since

joining the London AIM Market. The strong palm oil high season,

significant advance of the cashew processing plant towards first

production and substantial strengthening of our Balance Sheet via

the capital injections have put the Company in an excellent

position moving forward. In particular, credit should be given to

the operations team for delivering a strong palm oil high season to

ensure the Company capitalised on the current multi-year high CPO

prices. We look forward to the next 6-12 months with great optimism

for a further step up in the Company operational and financial

growth."

Jun-21 Jun-20 Change H1 2021 H1 2020 Change

FFB processed (tonnes) 11,839 9,616 23.1% 123,684 106,188 16.5%

CPO production (tonnes) 2,638 2,343 12.6% 26,515 23,882 11.0%

CPO Sales (tonnes) 4,822 2,444 97.3% 24,784 23,906 3.7%

Average CPO price

per tonne EUR915 EUR502 82.3% EUR817 EUR602 35.7%

PKO production (tonnes) 195 214 -8.9% 1,554 1,715 -9.4%

PKO Sales (tonnes) Nil 158 n/a 1,223 1,002 22.1%

Average PKO price

per tonne n/a EUR595 n/a EUR792 EUR628 26.1%

PKC production (tonnes) 326 476 -31.5% 2,428 2,683 -9.5%

PKC Sales (tonnes) 228 565 -59.6% 1,707 2,690 -36.5%

Average PKC price

per tonne EUR80 EUR59 35.6% EUR77 EUR60 28.3%

* Numbers subject to half year interim audit including final audit cut-offs

Crude Palm Oil

-- Production: 12.6% increase in CPO produced to 2,638 tonnes in

June 2021 compared to June 2020's 2,343 tonnes

o Brings total CPO produced for H1 2021 to 26,515 tonnes, 11.0%

higher than the 23,882 tonnes of CPO produced in H1 2020

o 11.0% increase in CPO produced in June less than 16.5%

increase in June fresh fruit bunch ('FFB') deliveries due to lower

oil content of the fruit and exceptional comparatives

-- June 2021 CPO extraction rate increased from the previous

month to 22.3%, however, remained lower than the exceptionally high

24.4% in June 2020

-- Sales: 97.3% increase in CPO sales volumes in June reflect

higher monthly CPO production and material quantities of sales

agreed in May which were delivered in June

o Brings total CPO sold in H1 2021 to 24,784 tonnes compared to

23,906 tonnes sold in H1 2020

o CPO stock on hand at end of H1 2021 is over 1,900 tonnes

compared to 215 tonnes in H1 2020 which will be supportive of H2

2021 results

-- Prices: 82.3% increase in average realised CPO prices to

EUR915 per tonne in June 2021, a record monthly price for the

Company (May 2020: EUR502)

o Brings H1 2021 realised prices to EUR817, a 35.7% increase on

H1 2020

o International CPO prices have softened slightly but continue

to trade at multi-year highs of approximately EUR800 per tonne

o The local 4-6 week price lag mechanic in Cote d'Ivoire means

we are currently achieving CPO prices higher than the international

price

Palm Kernel Oil ('PKO')

-- Production: H1 PKO production 9.4% lower than H1 2020

-- Whilst PKO sales for H1 2021 are 22.1% higher than H1 2020 we

continue to take a patient sales strategy approach to capitalise on

rising local PKO price levels - Dekel currently holds over 800

tonnes of stock at the end of H1 2021 which we expect to sell

gradually during H2 2021

-- PKO Prices achieved in H1 2021 26.1% higher than H1 2021

Palm Kernel Cake ('PKC')

-- Similarly to PKO, we are also taking a patient approach to

sales prices to capitalise on rising local PKC price levels

-- Dekel currently holds approximately 850 tonnes of stock at

the end of H1 2021 which we expect to sell gradually in H2 2021

-- Prices: 28.3% increase in average realised PKC prices to

EUR77 per tonne in H1 2021 compared to EUR60 per tonne in H1

2020

Production Updates

The Company will continue issuing CPO production figures on a

monthly basis to provide shareholders with visibility on operations

and trading during the global COVID-19 pandemic.

Issue of Equity

In addition, application has been made to the London Stock

Exchange for the admission of a total of 335,864 ordinary shares of

EUR0.0003367 each ("Ordinary Shares") issued to certain advisers in

settlement of fees for services provided ("Admission"). It is

expected that Admission will become effective on or around 21 July

2021. Following Admission, the Company's issued share capital will

consist of 535,863,569 Ordinary Shares.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ("MAR"). Upon the

publication of this announcement via a Regulatory Information

Service ("RIS"), this inside information is now considered to be in

the public domain.

** ENDS **

For further information please visit the Company's website

www.dekelagrivision.com or contact:

Dekel Agri-Vision Plc

Youval Rasin

Shai Kol

Lincoln Moore +44 (0) 207 236 1177

Arden Partners Plc (Nomad and Joint Broker)

Paul Shackleton / Ruari McGirr / Akhil

Shah +44 (0) 207 614 5900

Optiva Securities Limited (Joint Broker)

Christian Dennis

Jeremy King +44 (0) 203 137 1903

Notes:

Dekel Agri-Vision Plc is a multi-project, multi-commodity

agriculture company focused on West Africa. It has a portfolio of

projects in Côte d'Ivoire at various stages of development: a fully

operational palm oil project in Ayenouan where fruit produced by

local smallholders is processed at the Company's 60,000tpa crude

palm oil mill; a cashew processing project in Tiebissou, which is

due to commence production in Q3 2021.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDMZGMNKKNGMZM

(END) Dow Jones Newswires

July 15, 2021 11:23 ET (15:23 GMT)

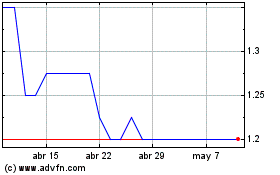

Dekel Agri-vision (LSE:DKL)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Dekel Agri-vision (LSE:DKL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024