Draper Esprit PLC Announcement of admission to the Official Lists (1794G)

22 Julio 2021 - 8:16AM

UK Regulatory

TIDMGROW

RNS Number : 1794G

Draper Esprit PLC

22 July 2021

Draper Esprit plc: Announcement of admission to the Official

Lists and cancellation of AIM and Euronext Growth listing

Draper Esprit plc (dual listed, AIM: GROW, Euronext Growth: GRW)

("Draper" or the "Company"), a leading venture capital firm

investing in and developing high growth digital technology

businesses, is pleased to announce that its ordinary shares (the

"Ordinary Shares") will be admitted tomorrow to the premium listing

segment of the Official List of the Financial Conduct Authority and

the secondary listing segment of the Official List of the Irish

Stock Exchange plc, trading as Euronext Dublin ("Euronext Dublin")

(the "Official Lists") and to trading on the London Stock Exchange

plc's (the "London Stock Exchange") main market for listed

securities and the regulated market of Euronext Dublin (the "Main

Markets") (together "Admission"). Dealings in the Ordinary Shares

will commence on the Main Markets at 8.00 a.m. on 23 July 2021 and

trading in the Ordinary Shares on the AIM market of the London

Stock Exchange ("AIM") and the Euronext Growth market will be

cancelled simultaneously therewith.

Admission will be through an introduction of the existing

Ordinary Shares. The Company is not offering any new Ordinary

Shares nor any other securities in connection with the proposed

Admission or the publication of the Prospectus. Following

Admission, the Company's Ordinary Shares will continue to be

registered with their existing ISIN number GB00BY7QYJ50. The

Company's ticker symbol will continue to be GROW in the UK and GRW

in Ireland. On Admission, there will be 152,999,853 Ordinary Shares

in issue.

The Prospectus has been approved by the Financial Conduct

Authority and the Central Bank of Ireland and is available for

inspection on the Company's website at www.draperesprit.com. Copies

of the Prospectus are also available, on request, in printed form

at the Company's registered office, 20 Garrick Street, London,

United Kingdom, WC2E 9BT.

The Company's existing shareholders should consult their own tax

advisers as to the tax implications of the Company's proposed move

to the Main Markets.

Enquiries

Draper Esprit plc

Martin Davis (Chief Executive

Officer)

Ben Wilkinson (Chief Financial

Officer) +44 (0)20 7931 8800

Numis Securities

Nominated Adviser & Joint Broker

Simon Willis

Richard Thomas

Jamie Loughborough +44 (0)20 7260 1000

Goodbody Stockbrokers

Euronext Growth Adviser & Joint

Broker

Don Harrington

Charlotte Craigie

Linda Clarke +44 (0) 20 3841 6202

Powerscourt

Public relations

Elly Williamson +44 (0)7970 246 725 /

Jane Glover +44 (0)7961 628 862

About Draper Esprit

Draper Esprit is one of the most active venture capital firms in

Europe, investing in disruptive, high growth technology companies.

We believe the best entrepreneurs in Europe are capable of building

the global businesses of the future. We fuel their growth with

long-term capital, access to international networks and decades of

experience building businesses.

Currently, Draper Esprit is a shareholder in a diverse portfolio

of 71 companies with 17 of those part of our core portfolio which

accounts for over 60% of our holdings. Our core companies include

UiPath, Aircall, Graphcore and Revolut. We invest across four

sectors: Consumer Technology, Enterprise Technology, Hardware and

Deeptech, and Digital Health and Wellness, with highly experienced

partners constantly looking for new opportunities in each. We look

for high-growth companies operating in new markets, with a serious

potential for global expansion, strong IP, powerful technology, and

management teams to deliver success. We also look for businesses

with the potential to generate strong margins to ensure rapid,

sustainable growth in substantial addressable markets.

Draper Esprit provides an opportunity for public market

investors to access these fast-growing tech businesses, without

having to commit to long term investments with limited liquidity.

Since IPO to the AIM market of the London Stock Exchange plc in

June 2016, we have deployed circa GBP550m+ capital into fast

growing tech companies and have realised over GBP300m. In June

2021, we raised gross proceeds of circa GBP111m to help us

capitalise on the transition to a digital future in a European VC

market which is expanding rapidly but is still less than one

quarter of the combined size of the US and European market by

value.

For more information, go to https://draperesprit.com/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFLFLVDVIFFIL

(END) Dow Jones Newswires

July 22, 2021 09:16 ET (13:16 GMT)

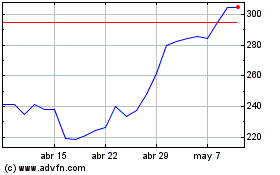

Molten Ventures (LSE:GROW)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

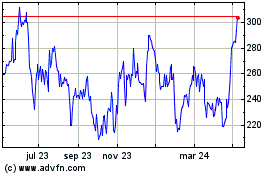

Molten Ventures (LSE:GROW)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024