TIDMDIVI

THE DIVERSE INCOME TRUST PLC

ANNUAL FINANCIAL REPORT FOR THE YEARED 31 MAY 2021

The Directors present the Annual Financial Report of The Diverse Income Trust

plc (the "Company", "Diverse" or the "Trust") for the year ended 31 May 2021.

The full Annual Report and Accounts can be accessed via the Company's website,

www.diverseincometrust.com, or by contacting the Company Secretary on 01392

477500.

STRATEGIC REPORT

RESULTS FOR THE YEAR TO 31 MAY 2021

* NAV total return* to shareholders of 38.4% This includes the increase in

NAV, plus the dividends paid during the year and compares with an increase

in the FTSE All-Share Index of 23.1% on a total return basis over the year

to 31 May 2021.

* Over the year to 31 May 2021, the movement in the Company's NAV* was +33.2%

This compares with the FTSE All-Share Index that increased 19.4%.

* 3.75p of ordinary dividends for the year The three interim dividends and

the proposed final dividend for the year amount to 3.75p, compared with

3.70p in the previous year, an increase of 1.4%.

* Share price total return* to shareholders of 47.6% The share price total

return was 47.6%, boosted by the share price re-rating from a discount to a

premium to NAV.

* Revenue reserves were £15.2m (2020: £15.0m) The Company's revenue return

after taxation was £13.4m, which compares with dividends distributed to

shareholders during the year of £14.8m. At the year end £15.2m of revenue

reserves remain available to smooth forthcoming dividend distributions to

shareholders.

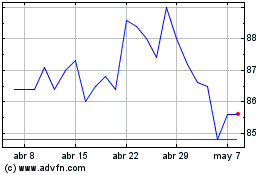

31 May 2021 31 May 2020 Change

NAV per ordinary share 118.31p 88.82p 33.2%

Ordinary share price (mid) 119.00p 84.00p 41.7%

Premium/(discount) to NAV* 0.58% (5.43%)

Revenue return per ordinary share 3.73p 3.27p

Dividends per ordinary share paid 3.75p 3.70p 1.4%

/declared

Ongoing charges (further details 1.06% 1.09%

below)*

Ordinary shares in issue 378,289,047

361,445,105

* Alternative performance measure. Details provided in the Glossary below.

Key Performance Indicators

The Board has the following Key Performance Indicators (KPIs) that are used to

gauge the success of the Company's strategy and its outcome to shareholders.

* NAV total return* - Over the year, the NAV total return of the Trust was

38.4% (2020: -2.5%), which compares to 38.3% for the peer group and 23.1%

for the FTSE All-Share Index. Since the listing of Diverse in April 2011,

the NAV total return was 239.7% to 31 May 2021, which compares to 135.8%

for the peer group and 83.0% for the FTSE All-Share Index.

* Growth of ordinary dividends to shareholders - Over the year, the four

dividends to shareholders have increased from 3.70p to 3.75p. The Trust's

revenue per share for the year to 31 May 2021 has recovered strongly from

the prior year. The Trust has retained an unbroken dividend record without

distributing capital, but we have drawn very modestly on retained revenue

reserves.

* Discount* - Over the year to 31 May 2021, the share price discount averaged

4.7%, moving from a larger discount at the start of the year to a premium

to NAV after Brexit occurred. Over the ten years since listing, the

Company's share price has largely matched its NAV.

* Ongoing Charges* - The ongoing charges for the year to 31 May 2021 are

1.06% of NAV (2020: 1.09%), which compares with 0.92% for the peer group**.

The Board pays careful attention to expenses and believes that the Trust's

overall costs are justifiable in the context of its specialist investment

universe, and premium returns it has delivered since issue. More detail of

the ongoing charges are provided below.

* Alternative performance measure. Details provided in the Glossary below.

** The peer group is as defined in the glossary. One outlier (British &

American Investment Trust) has been excluded from the calculation of the peer

group's ongoing charges ratio, in order to provide a figure which is comparable

and not skewed by one exceptionally high ratio.

CHAIRMAN'S STATEMENT

"The Company's NAV total return was 38.4%, well ahead of the FTSE All Share

Index's total return of 23.1%"

Andrew Bell

Chairman

This report covers the results for the year ended 31 May 2021, the tenth year

since the Diverse Income Trust listed on the stock market in 2011. It was a

turbulent year in both economic and social terms, as governments responded to

the pressures to preserve lives and livelihoods in the face of the COVID-19

pandemic. The rapid deployment of vaccines (developed in record time) and

improvements in therapeutic care for those infected meant that the year ended

with the UK and other developed economies reopening, a much more hopeful

environment for corporate and personal wellbeing than prevailed for most of the

period.

Returns during the year

Over the year to May 2021, the Company's Net Asset Value (NAV) increased by

33.2%. When the four quarterly dividends paid to shareholders within the year

to May 2021 are included, the Company's NAV total return was 38.4%. The share

price total return (boosted by a move from a 5.4% discount at the start of the

period to a premium of 0.6% at the end) was 47.6%. These figures were all well

ahead of the FTSE All Share Index's total return of 23.1%.

Over the period, in total return terms, the FTSE SmallCap Index (excluding

Investment Companies) appreciated by 69.3% and the FTSE AIM All Share Index was

up 44.6%. Although the Company's returns lagged the recovery in these areas,

the Company's portfolio was well-represented in AIM and other smallcap stocks,

which helped drive our outperformance of the overall UK market.

The Company's revenue earnings grew from 3.27p to 3.73p, recovering much of the

ground lost in the previous year, when the onset of the pandemic led to

widespread dividend cuts in the UK market. The Board is recommending a final

dividend of 1.10p (2020: 1.05p). This makes the total dividend for the year

3.75p, which represents a 1.4% increase on the prior year. As in 2020, this has

involved drawing upon retained revenue reserves, although to a much reduced

extent. The Board's expectation is that the Company's revenue earnings will

continue to recover, restoring the normal position where annual revenue

earnings fully fund the year's dividends and dividend growth.

Returns since the Company was first listed in April 2011

Over the ten years (and one month) since the Company was first listed in April

2011, the Company's NAV total return including dividends paid to shareholders

was 239.7%. The share price total return was 227.1%. Both measures are well

ahead of the main measures of UK equity performance over the same period. The

total return on the FTSE All Share Index was 83.0%, while that of the FTSE

SmallCap Index (excluding Investment Trusts) was 202.2% and that of the FTSE

AIM All Share Index was 52.9%. Please refer to page 6 of the full Annual Report

for a graph of the Company's NAV Total Return since launch on 28 April 2011 in

comparison with the FTSE All-Share Index Total Return over the same period.

Share Issuance and Redemptions

Over the year to May 2021, the Company's share price discount to its daily NAV

averaged 4.8%. This masks an underlying improvement, from discounts of 5-12% in

the early part of the period when COVID-19 uncertainty was at its peak, to a

premium of over 2% shortly before the period end. Sentiment towards UK equities

improved following the Brexit agreement reached in December and as the recovery

prospects for the domestic economy improved following the successful

vaccination programme. The rerating towards the end of the period enabled the

Company to issue new shares at a premium to the prevailing NAV. This is

modestly accretive to shareholders' NAV, spreads the fixed costs of the Company

over a larger number of shares and should contribute to increased dealing

liquidity of the Company's shares in the market.

The Company offers all shareholders the option to redeem their shares each

year. At the end of April, 347,580 shares were offered for redemption, which

were sold on the redeeming shareholders' behalf to new investors at the

redemption point NAV at the end of May 2021. During the year, the Company also

issued 3,400,000 new ordinary shares at a premium to the NAV, utilising the

block listing facility. Following the year end, block listing of a further

26,104,001 shares was applied for and granted.

Board succession

Although referred to at the interim stage, it is only right to reiterate the

Board's thanks to Michael Wrobel, my predecessor as Chairman, who stood down at

last year's AGM. Under his leadership, the Company had a highly successful

first nine years as a quoted company, with our Manager's skill taking advantage

of many of the opportunities presented and avoiding many of the pitfalls. Paul

Craig, who has been a director since 2011 will (along with the rest of the

Board) be standing for re-election this year, but will stand down once a

successor has been appointed.

Prospects

UK equities have in recent years been widely shunned by investors, for a

combination of Brexit related reasons and the domination of the FTSE 100 index

by companies in sectors with low growth prospects. As the economy reopens from

the COVID related lockdowns, amid record low interest rates and fiscal

stimulus, the prospects for the domestic economy (to which many smaller

companies are exposed) have brightened considerably.

Internationally, the decades-long trend of falling bond yields appears to have

reached a turning point. A combination of accelerating global economic recovery

from the pandemic, allied to higher long bond yields would favour performance

from a wider range of sectors than the rapidly-growing (in some cases

non-profit-making) technology stocks which have dominated the league tables in

recent years. There is a related risk that governments and central banks overdo

the stimulus, prompting a rise in inflation which would ultimately need to be

countered by tighter policy, but at present this appears a potential worry for

future years rather than an imminent concern.

Global stock markets have continued to rise this year, with strong performance

from many UK quoted smallcaps, which are benefiting from improved earnings

prospects as well as some reversal of the fund outflows during the years of

Brexit uncertainty.

The Diverse Income Trust pursues an investment approach covering the whole UK

quoted universe, which enables the stock picking skills and experience of our

Manager to construct a portfolio which is both distinct from the relatively

concentrated nature of the market index and has more diverse sources of income,

avoiding overdependence on what proved to be unreliable dividend payers in the

FTSE 100 index.

Andrew Bell

Chairman

9 August 2021

MANAGER'S REPORT

Who are the fund managers of the Company?

Premier Miton Group plc is an independent, listed fund management company,

formed from the merger of Premier Asset Management and Miton Group in November

2019, with a well-established reputation for successfully managing UK-quoted

smaller company portfolios over the longer term. The Company's Board appointed

Miton Group (now Premier Miton Group) as Manager when it was listed in April

2011.

The day-to-day management of the Company's portfolio continues to be carried

out by Gervais Williams and Martin Turner, who came together as a team in April

2011.

Gervais Williams

Gervais joined Miton in March 2011 and is now Head of Equities in Premier

Miton. He has been an equity fund manager since 1985, including 17 years at

Gartmore. He was named Fund Manager of the Year by What Investment? in 2014.

Gervais is also a board member of the Quoted Companies Alliance and a member of

the AIM Advisory Council.

Martin Turner

Martin joined Miton in May 2011. Martin and Gervais have had a close working

relationship since 2004, with complementary expertise that led them to back a

series of successful companies. Martin qualified as a Chartered Accountant with

Arthur Anderson and had senior roles and extensive experience at Merrill Lynch

and Collins Stewart.

What were the main influences on the Company's performance over the year?

The year to May 2021 was a period when share prices around the world continued

to recover after the pandemic setback, often moving towards new highs. Whilst

the FTSE All Share Index total return was 23.1%, the share prices of UK quoted

smallcaps delivered even stronger returns, in part due to reassurance about the

domestic prospects of the UK after the Brexit agreement, and in part because

smallcaps are often immature businesses with prospects that are less reliant on

global growth. The total return of the FTSE SmallCap Index (excluding

investment companies) index was 69.3% and the FTSE AIM All Share Index was

44.6%.

Whilst economic conditions were challenging for many companies during the

global pandemic, for some the relatively abrupt changes in customer behaviour

enhanced their prospects. CMC Markets, the Contract for Differences trading

business for example, enjoyed very strong trading conditions over the year to

May 2021, and greatly increased its profits and dividend payments. CMC Markets

was the largest contributor over the year under review, adding 3.5% to the

return of the Company.

The second best contributor was K3 Capital, a multi-disciplinary group of

professional services businesses advising small to medium enterprises on

matters such as Mergers and Acquisitions. Although volumes were weak at this

time last year, K3 Capital scaled up its operations via two complementary

acquisitions at a time when corporate valuations were low. Subsequently, as SME

transactions have recovered, the combined business has gone on to generate much

greater cash surpluses than previously anticipated. K3 Capital enhanced the

return of the Company by 1.9%.

The holdings in 888 Holdings, Kenmare Resources and Strix Group contributed

over 1.0% each to the Company's returns in the period under review.

The portfolio holding that most detracted from the Company's return during the

year was Manolete. Its share price had performed strongly in previous years, as

it helped insolvent businesses fund past legal cases. This business has found

it more difficult over the pandemic as there have been fewer court sittings.

Much of the holding was sold early in the period, and it was sold entirely by

the year end. Another disappointing holding was Centamin, a gold miner which

was obliged to mine some lesser grade ore due to safety concerns on its planned

operations. In our view, Centamin will mine the higher grade ore in future

years so the holding has been increased during a time when the share price was

weak, in anticipation of future dividend growth. Together these holdings

detracted 1.7% from returns in the year.

Overall, the Company's NAV total return over the year was 38.4%, which compares

favourably with the return of the FTSE All Share Index.

Why has the Company paid shareholders a dividend that exceeds the revenue per

share again this year?

Last year, the Company's revenue per share fell 17% as numerous UK quoted

companies cut or ceased to pay their dividends at the onset of the global

pandemic. Whilst some companies that passed their dividends in the previous

year have resumed dividend payments this year, the overall dividend income from

the UK stock market is still very much lower than it was previously.

In contrast, this year the Company's revenue per share has almost matched that

of the year to May 2019. In part this reflects superior stock selection where

many portfolio holdings have now resumed dividends after they cut them last

year. Alongside, some portfolio companies such as CMC Markets and K3 Capital

have paid much larger dividends than in previous years. In addition, the

Company took a major cash profit on a FTSE 100 Put option during the stock

market setback in March 2020, and hence at the start of the year under review,

it had new capital to invest in additional income shares at a time when their

share prices were weak.

Last year, the Board underlined its confidence in the prospect for an

improvement in the Company's revenue per share this year, by recommending a

slight increase in the final dividend, even though the distribution needed to

use a part of the past revenue reserves. This year, the revenue per share

almost covers the Company's current dividend, and the Trust does not need to

draw upon capital to fund the dividend shortfall. Whilst there may not be such

a marked improvement in the revenue per share in the coming year, the Board has

concluded that the present dividend to shareholders is sustainable. On that

basis they have indicated their confidence again by recommending a slight

increase in the final dividend, using a modest sum from the past revenue

reserves.

What are the main factors that have driven the Company's returns since it first

listed in April 2011?

Over the ten years and one month since the Company was first listed in April

2011, central banks have injected plentiful economic stimulus, often via

Quantitative Easing. Over time, this has driven up the valuation of all assets,

with the price of UK 10-year government bonds rising so that they now yield

just 0.6% per annum compared with 3.5% ten years ago. Hence, global stock

markets have generally delivered good returns over the last 10 years, despite

the impact of the global pandemic.

Even with the uncertainties regarding the UK's negotiation of its exit from the

EU after the Brexit referendum, the total return on the FTSE All Share Index

since April 2011 was 83.0%. The UK stock market has greater potential to add

value than many others, as it has such a large universe of smallcap quoted

companies, which have greater scope to grow and are less efficiently valued.

Over the period since the Company's issue, the FTSE SmallCap Index (excluding

Investment Companies) has delivered a total return of 202.2%.

Even so, not all quoted smallcap share prices have performed as strongly, as

the total return on the FTSE AIM All Share Index was 52.9%, which is actually

rather less than the return of the FTSE All Share Index. All this underlines

why a multicap approach as used by the Company, needs to be actively managed.

This offers scope for the investment managers to participate in many of the

equity income smallcaps that outperform, and hopefully avoid, many of those

that do not. The Company's strategy of seeking quoted companies that are

well-positioned to generate abnormal cash surpluses has delivered significant

added value due to superior stock selection over the period. The NAV total

return on the Diverse Income Trust was 239.7% over the period, well ahead of

the comparatives.

Total Returns since inception %

The Diverse Income Trust Plc - Ordinary 239.75

Shares

FTSE All-Share 83.03

FTSE Small Cap Ex Investment Trusts 202.19

FTSE AIM All-Share 52.92

How is the climate change agenda reflected in the Company's portfolio?

Whilst some fund strategies are dedicated to investing solely in low-carbon

companies that are already close to meeting the climate change agenda, the

interconnected nature of the corporate world means that many of these still

have a reliance on others that are less well aligned. Specifically, we believe

that the financial markets have a major role in actively engaging with the

less-aligned companies. Each needs to make an assessment of its current carbon

footprint and then plan to steadily reduce it in future. Evolving a business

towards a zero carbon future, will involve very substantial investment, so

access to capital will be an important component of these plans.

As managers of The Diverse Income Trust we have a long history of actively

highlighting areas of potential hazard with the management teams of quoted

companies, so that they can be considered, and the risks moderated. In that

regard, we actively quiz management teams as to how they are planning to

address the climate change agenda, and often give best practice examples of

others' actions. This strategy does involve engaging with some that currently

have poor metrics, on the basis that reductions in the carbon footprints of

these kinds of companies are needed for the UK economy as a whole to meet its

zero carbon commitment.

The way we see it, many of the current activities of businesses will either

become unviable as the costs of carbon emissions becomes prohibitive, or

customer preferences will change and lead to a major decline in demand. Thus,

all companies will need to embrace change and step up investment, so they

remain sustainable in all senses of the word. For some, moving ahead of others

may offer commercial advantage, and hence enhanced returns. Conversely, some

may misjudge how quickly others respond, and carry additional downside risks.

The bottom line is that the Company's portfolio does have shareholdings in all

sorts of businesses that need to change to meet the climate change agenda. In

our view, their willingness to invest, and shareholders' willingness to fund

that investment, will help them succeed in addressing the climate change

agenda. This progress will not only actively assist the UK to become a

low-carbon economy, but also, ultimately, to deliver ongoing returns to

investors.

What impact would a sustained pick up in global inflation have on the Company?

After the surge of economic stimulus following the global pandemic, all sorts

of industry bottlenecks have occurred and there are renewed inflationary

pressures. At this stage, it is unknown whether the rise in inflation will

prove to be temporary or persistent in nature.

If inflation did prove to be more persistent, then the yields of long-dated

bonds might rise, and weigh on the valuations of all assets, including stock

markets. This would make it harder for all investment strategies to deliver

capital gains, and investor returns might become more reliant on assets that

delivered a part of their return via income, like that of the Diverse Income

Trust.

Furthermore, if inflation were sustained, then it might greatly reduce the

scope for central banks or governments to inject economic stimulus in future

and, ultimately, put more companies at risk of insolvency. Listed stocks, with

their access to external capital, tend to be much more resilient than private

companies because their capital structures tend to be principally financed by

risk capital rather than debt. Furthermore, if insolvencies were to rise,

quoted companies can acquire previously over-borrowed, but otherwise viable,

businesses from the receiver. These kinds of acquisitions often bring

additional skilled staff and the prospect of generating additional cash

returns, which further boosts the returns of the acquirers at a time when most

other assets are not delivering much return. This pattern of enhanced returns

can be even more dramatic for quoted smallcaps, as sometimes low-cost

acquisitions from the receivers can be transformative to their prospects.

Overall, a sustained increase in inflation would make it harder for nearly all

assets to deliver returns as good as those of recent decades. Although The

Diverse Income Trust might not deliver returns as strong as those of the last

ten years if market trends were to change, it is anticipated that the Company's

multicap, equity income strategy could outperform a wider range of strategies

than previously.

How unusual is the multicap investment universe of the UK stock markets?

Prior to the long period of globalisation, returns on mainstream stock markets

were often not much higher than that of underlying inflation. At that time,

institutions actively allocated capital to quoted smallcaps because they needed

access to the premium returns they offered.

During the period of globalisation, asset returns of all kinds have been

unusually plentiful, so institutional interest in quoted smallcap strategies

has been crowded out by larger weightings in long-duration assets such as the

US technology stocks. Meanwhile, many quoted smallcap exchanges around the

world have closed over recent decades, for lack of institutional interest.

In contrast to others, the UK stock market has retained a vibrant smallcap

exchange due to dedicated tax exemptions, because the UK Government favours the

fact that these businesses generate additional skilled employment and increased

productivity compared with the mainstream companies, and ultimately that they

pay much tax take locally. Hence, the UK stock market differs from others in

still retaining a genuine multicap investment universe, not only including

numerous quoted mainstream stocks, but also a plentiful universe of quoted

smallcaps, with business operating across a very wide range of industry

sectors.

In summary, whilst the prospects for the UK economy may not differ much from

others, the multicap investment universe of UK stock exchanges is almost

unique. If market trends were to change, and if investors were to seek

diversification away from strategies that perform well when bond valuations are

rising, then the UK stock market would be well-placed to attract much greater

institutional allocations.

What are the prospects for the Company?

As the yield on government debt has progressively fallen over recent decades,

it has been a tailwind for asset prices of all kinds. Long-dated bonds have

outperformed, with the longest dated often outperforming the most. Within

equities, US technology stocks, whose valuation is significantly boosted by

higher bond prices, have tended to appreciate quicker than most others.

Whilst numerous business are reporting excellent order books at present, many

are also juggling these with all sorts of supply bottlenecks. Importantly in

our view, many investors assume that the current industry bottlenecks are

transitory. This comfortable position was reinforced over the first half of the

year by the ongoing appreciation of global assets. The significant degree to

which the stock market appreciation was fuelled by the running down the US

Government's cash surplus, and the ongoing Quantitative Easing policy is

largely overlooked.

We are concerned that market liquidity could narrow in future, and new risks

might emerge such as the US Senate starting to game the forthcoming budget

ceiling negotiations. Alongside, the global recovery in the first half was

smoothed by the running down of global inventories. Unfortunately, we are

worried that the component and staffing problems will persist, and the global

economy could struggle to even sustain the output of the first half of 2021.

When this is set in the context of a stock market where corporate valuations

are already standing at very elevated levels, even a slight reduction in market

liquidity could lead to a pullback in stock market valuations. In recent weeks,

a FTSE100 Put with an exercise level of 6,200 and a term to December 2022 has

been purchased, covering 38% of the current portfolio value.

The bottom line is that after some decades of importing deflation, the current

bottlenecks have changed the dynamic. If this pattern persists, as we fear it

might, then investors will start to reweight their holdings away from popular

US technology stocks to reallocate toward equity holdings with reliable surplus

cash generation, albeit that they might have lesser growth prospects. In this

regard, the UK stock market with its multicap universe including major

companies paying good and growing dividends, along with younger smallcaps that

often serve immature industry sectors, is well placed to participate.

Overall, whatever the outcome regarding these near-term worries, we believe the

Diverse Income Trust strategy will continue to be better placed than most

others. Should the past market trends return, then the Diverse Income Trust may

continue to be one of the better performing strategies in its peer group, as it

has been over the last ten years. Conversely, if market trends are changing,

then a UK multicap income investment universe might outperform others,

including other stock markets such as the US.

Gervais Williams and Martin Turner

9 August 2021

PORTFOLIO INFORMATION

AS AT 31 MAY 2021

Sector & Valuation % of Yield1

Rank Company main activity £000 net assets %

1 CMC Markets Financials 15,820 3.7 4.4

2 K3 Capital2 Financials 10,390 2.4 1.8

3 Kenmare Basic Materials 8,881 2.1 1.7

Resources

4 888 Consumer 8,300 1.9 3.2

Discretionary

5 Strix2 Industrials 7,556 1.8 2.6

6 Legal & General Financials 6,025 1.4 6.2

7 Just Financials 5,977 1.4 -

8 National Grid Utilities 5,544 1.3 5.0

9 Intermediate Financials 5,529 1.3 2.5

Capital

10 MAN Financials 5,421 1.3 3.1

Top 10 investments 79,443 18.6

11 Randall & Financials 5,371 1.3 5.0

Quilter2

12 Amino Telecommunications 5,342 1.2 1.3

Technologies2

13 Sainsbury (J) Consumer Staples 5,234 1.2 4.0

14 DRAX Utilities 5,213 1.2 3.9

15 Morrison (WM) Consumer Staples 5,205 1.2 3.9

Supermarkets

16 Diversified Energy 5,173 1.2 10.7

Energy2

17 FRP Advisory2 Industrials 5,142 1.2 2.2

18 Direct Line Financials 5,066 1.2 7.4

Insurance

19 Inspiration Health Care 5,065 1.2 0.4

Healthcare2

20 Phoenix Financials 5,056 1.2 6.5

Top 20 investments 131,310 30.7

21 Blackbird2 Technology 5,055 1.2 -

22 Admiral Financials 5,053 1.2 4.0

23 Smurfit Kappa Industrials 4,914 1.1 2.7

24 DWF Industrials 4,786 1.1 2.1

25 AVIVA Financials 4,712 1.1 5.1

26 Sabre Insurance Financials 4,704 1.1 4.2

27 iEnergizer2 Industrials 4,605 1.1 4.6

28 AO World Consumer 4,594 1.1 -

Discretionary

29 BT Telecommunications 4,585 1.1 -

30 Pan African Basic Materials 4,515 1.0 3.0

Resources2

Top 30 investments 178,833 41.8

31 Centamin Basic Materials 4,350 1.0 6.8

32 Rio Tinto Basic Materials 4,333 1.0 4.9

33 Bloomsbury Consumer 4,320 1.0 2.5

Publishing Discretionary

34 XPS Pensions Financials 4,301 1.0 5.0

35 Persimmon Consumer 4,290 1.0 3.5

Discretionary

36 Jadestone Energy Energy 4,213 1.0 -

37 Polymetal Basic Materials 4,179 1.0 5.4

International

38 Forterra Industrials 4,134 1.0 1.0

39 M&G Financials 4,114 1.0 7.5

40 Concurrent Technology 4,088 0.9 2.8

Technologies2

Top 40 investments 221,155 51.7

Balance held in 88 equity 191,413 44.8

investments

Total equity investments 412,568 96.5

600 Group 8% Convertible Loan Notes 14/02/20223 2,255 0.5

Fixed interest investments 2,255 0.5

Total investment portfolio 414,823 97.0

Other net current assets 12,819 3.0

Net assets 427,642 100.0

A copy of the latest month end top 20 holdings may be found on the Company's

website, www.diverseincometrust.com.

1 Source: Refinitiv. Dividend yield based upon historic dividends and therefore

not representative of future yield and includes special dividends where known.

2 AIM/NEX listed.

3 Bermuda Stock Exchange listed

Portfolio exposure by sector £414.8 million

%

Financials 31.3

Industrials 15.8

Basic Materials 11.4

Consumer Discretionary 9.6

Energy 7.6

Consumer Staples 5.8

Telecomms 3.9

Health Care 3.4

Technology 3.2

Real Estate 3.2

Utilities

2.7

Oil & Gas 1.6

Fixed interest 0.5

100.0

Actual income by sector £15.5 million

%

Financials 40.0

Industrials 14.5

Basic Materials 12.4

Consumer Discretionary 6.2

Energy 5.8

Consumer Staples 5.3

Utilities 3.5

Oil & Gas 2.9

Telecomms 2.5

Fixed Interest 2.5

Real Estate 2.3

Health Care 1.1

Technology 1.0

100.0

Portfolio by asset allocation £414.8

million

%

AIM/NEX Exchanges 35.3

FTSE 100 Index 23.5

FTSE 250 Index 21.8

FTSE SmallCap Index 14.0

Other 2.9

FTSE Fledgling Index 1.3

International Equities 0.7

Fixed Interest 0.5

100.0

Portfolio by spread of investment £15.5 million

income

%

FTSE 100 Index 32.7

FTSE 250 Index 30.4

AIM/NEX Exchanges 19.7

FTSE SmallCap Index 6.3

Other 3.9

International Equities 2.9

Fixed Interest 2.5

FTSE Fledgling Index 1.6

100.0

Source: Thomson Reuters.

The London Stock Exchange ("LSE") assigns all UK-quoted companies to an

industrial sector and frequently to a stock market index. The LSE also assigns

industrial sectors to many international quoted equities as well, and those

that have not been classified by the LSE have been assigned as though they had.

The portfolio as at 31 May 2021 is set out in some detail above, in line with

that included in the Balance Sheet. The income from investments above comprises

all of the income from the portfolio as included in the Income Statement for

the year ended 31 May 2021. The AIM and NEX markets are both UK exchanges

specifically set up to meet the requirements of smaller listed companies.

The first two bars above determine the overall sector weightings of the

Company's capital at the end of the year and with regard to the income received

by the Company over the year. The second pair of bars illustrates the LSE stock

market index within which portfolio companies sit and the source of the income

received by the Company over the year.

Investments for the Company's portfolio are principally selected on their

individual merits. As the portfolio evolves, the Investment Manager

continuously reviews the portfolio's overall sector and index balance to ensure

that it remains in line with the underlying conviction of the Investment

Manager. The Investment Policy is set out below and details regarding risk

diversification and other policies are set out each year in the Annual Report.

A Summary of the Total Costs Involved in Managing Diverse

Investment trusts differ from some other forms of collective funds in that they

are set up as independent corporations with their operations overseen by a

board that is separate from and independent of the fund management group that

manages the capital. In addition, they are listed, with their shares traded on

an approved exchange - which, in our case, is the LSE.

Running costs are deducted from the total assets of the Group on a pro-forma

basis so the NAV published each day is expressed after costs. The figures below

are the costs paid by the Group over the year under review and are expressed as

a percentage of the average asset value of the Group over the year to 31 May

2021 of £359,991,000 (year to 31 May 2020: £346,694,000).

2021 2020

% %

Fund management fees1 0.85 0.86

Administration costs, including Company Secretarial 0.04 0.04

fees

Directors/Auditor/Depositary/Registrar/Custodian and 0.10 0.12

Stockbroker fees

All other direct costs, including VAT on the fees 0.07 0.07

above, plus marketing, legal, printing, insurance and

bank charges

Ongoing charges 1.06 1.09

In addition, the Company also pays transaction charges that are levied when

shares are bought or sold in the portfolio. These are dealing commissions paid

to stockbrokers and stamp duty, a Government tax paid on transactions (which is

zero when dealing on the AIM/NEX exchanges).

2021 2020

% %

Costs paid in dealing commissions 0.03 0.05

Stamp duty, a Government tax on transactions 0.10 0.14

Overall costs including charges on transactions2 1.19 1.28

The overall costs of the Company for the period were 1.19%. This compares with

the Company's average NAV total return since issue of 12.9% per annum (after

the deduction of costs).

1 Fund management fees are tiered and calculated based on the share price, so

may vary in each year. With effect from 1 August 2019, the Manager received a

management fee of 0.9% per annum on the adjusted market capitalisation of the

Company up to £300m, 0.8% per annum on the average market capitalisation

between £300m and £500m and 0.7% per annum on the average market capitalisation

above £500m.

2 Transactions conducted by the Company also involve some loss of value due to

the dealing spread in stock exchange prices. Spreads range from less than 1% in

the most actively traded large cap stocks to more than 3% in the smallest, most

infrequently traded stocks. The exact loss of value is difficult to determine

precisely, but is normally less than half of the dealing spread at the time of

the transaction. In a large percentage of the transactions, especially in the

smallest stocks, the stock is passed through from sizeable seller to sizeable

buyer on a 'put through' basis with potentially no loss of value through the

spread. During the year under review, this cost is believed to be very modest

in comparison to the NAV.

BUSINESS MODEL

Diverse was launched on 28 April 2011. It is registered in England as a public

limited company and is an investment company in accordance with the provisions

of Sections 832 and 833 of the Companies Act 2006.

The principal activity of the Company is to carry on business as an investment

trust. The Company intends at all times to conduct its affairs so as to enable

it to qualify as an investment trust for the purposes of Sections 1158/1159 of

the Corporation Tax Act 2010 ("S1158/1159"). The Directors do not envisage any

change in this activity in the foreseeable future.

The Company has been granted approval from HM Revenue & Customs ("HMRC") as an

investment trust under S1158/1159 and will continue to be treated as an

investment trust company, subject to there being no serious breaches of the

conditions for approval.

The principal conditions that must be met for continuing approval by HMRC as an

investment trust are that the Company's business should consist of "investing

in shares, land or other assets with the aim of spreading investment risk and

giving members of the company the benefit of the results" and the Company may

only retain 15% of its investment income without distributing it as dividend

payments. The Company must also not be a close company. The Directors are of

the opinion that the Company has conducted its affairs for the year ended 31

May 2021 so as to be able to continue to qualify as an investment trust.

The Company's status as an investment trust allows it to obtain an exemption

from paying taxes on the profits made from the sale of its investments and all

other net capital gains.

The Company has a wholly-owned subsidiary, DIT Income Services Limited. The

purpose of the subsidiary is to invest in shorter-term holdings, where the

gains after corporation tax can be passed up to the parent company by way of

dividends, thus improving the position of the Company's revenue account.

Investment Objective

The Company's investment objective is to provide shareholders with an

attractive and growing level of dividends coupled with capital growth over the

long term.

Investment Policy

The Company invests primarily in UK-quoted or traded companies with a wide

range of market capitalisations, but a long-term bias toward small and mid cap

equities. The Company may also invest in large cap companies, including FTSE

100 constituents, where it is believed that this may increase shareholder

value.

The Manager adopts a stock-specific approach in managing the Company's

portfolio and therefore sector weightings will be of secondary consideration.

As a result of this approach, the Company's portfolio will not track any

benchmark index.

The Company may utilise derivative instruments including index-linked notes,

contracts for differences, covered options and other equity-related derivative

instruments for efficient portfolio management, gearing and investment

purposes. Any use of derivatives for investment purposes will be made on the

basis of the same principles of risk spreading and diversification that apply

to the Company's direct investments, as described below. The Company will not

enter into uncovered short positions.

Risk Diversification

Portfolio risk is mitigated by investing in a diversified spread of

investments. Investments in any one company shall not, at the time of

acquisition, exceed 15% of the value of the Company's investment portfolio.

Typically it is expected that the Company will hold a portfolio of between 100

and 180 securities, most of which will represent no more than 1.5% of the value

of the Company's investment portfolio as at the time of acquisition.

The Company will not invest more than 10% of its gross assets, at the time of

acquisition, in other listed closed-ended investment funds, whether managed by

the Manager or not, except that this restriction shall not apply to investments

in listed closed-ended investment funds which themselves have stated investment

policies to invest no more than 15% of their gross assets in other listed

closed-ended investment funds. In addition to this restriction, the Directors

have further determined that no more than 15% of the Company's gross assets

will, at the time of acquisition, be invested in other listed closed-ended

investment funds (including investment trusts) whether or not such funds have

stated policies to invest no more than 15% of their gross assets in other

listed closed-ended investment funds.

Unquoted Investments

The Company may invest in unquoted companies from time to time subject to prior

Board approval. Investments in unquoted companies in aggregate will not exceed

5% of the value of the Company's investment portfolio as at the time of

investment.

Borrowing and Gearing Policy

The Board considers that long-term capital growth can be enhanced by the use of

gearing which may be through bank borrowings and the use of derivative

instruments such as contracts for differences. The Company may borrow (through

bank facilities and derivative instruments) up to 15% of NAV (calculated at the

time of borrowing).

The Board oversees the level of gearing in the Company, and reviews the

position with the Manager on a regular basis.

In the event of a breach of the investment policy set out above and the

investment and gearing restrictions set out therein, the Manager shall inform

the Board upon becoming aware of the same and if the Board considers the breach

to be material, notification will be made to the LSE.

No material change will be made to the investment policy without the approval

of shareholders by ordinary resolution.

Principal Risks and Uncertainties

The Company is exposed to a variety of risks and uncertainties that could cause

its asset price or the income from the investment portfolio to reduce, possibly

by a sizeable percentage in the most adverse circumstances. The Board, through

delegation to the Audit Committee, has undertaken a robust assessment and

review of the emerging and principal risks facing the Company, together with a

review of any new risks which may have arisen during the year, including those

that would threaten its business model, future performance, solvency or

liquidity. These risks are formalised within the Company's risk matrix.

Information regarding the Company's internal control and risk management

procedures can be found in the Corporate Governance Statement in the full

Annual Report. Whilst reviewing the principal risks and uncertainties, the

Board was cognisant of the continued risks posed by the COVID-19 pandemic.

The principal financial risks and the Company's policies for managing these

risks, and the policy and practice with regard to financial instruments are

summarised in note 19 to the financial statements.

The Board has also identified the following principal risks and uncertainties:

Investment and strategy

Risk: There can be no guarantee that the investment objective of the Company

will be achieved.

The Company does not follow any benchmark. Accordingly, the portfolio of

investments held by the Company will not mirror the stocks and weightings that

constitute any particular index or indices, which may lead to the Company's

shares failing to follow either the direction or extent of any moves in the

financial markets generally (which may or may not be to the advantage of

shareholders).

Mitigation: The Manager has in place a dedicated investment management process

which is designed to maximise the chances of the investment objective being

achieved. The Board reviews regular investment and financial reports from the

Manager to monitor this.

Smaller companies

Risk: The Company will invest primarily in quoted UK companies with a wide

range of market capitalisations but a long-term bias toward small and mid cap

equities. Smaller companies can be expected, in comparison to larger companies,

to operate over a narrower range of products, have more restricted depth of

management and a higher risk profile. In addition, the relatively small market

capitalisation of such companies can make the market in their shares less

liquid. Prices of individual smaller capitalisation stocks could be more

volatile than prices of larger capitalisation stocks and the risk of insolvency

of many smaller companies (with the attendant losses to investors) is higher.

Mitigation: The Board looks to mitigate this risk by ensuring the Company holds

a spread of investments, achieved through limiting the size of new holdings at

the time of investment to typically between 1% and 1.5% of the portfolio. All

potential investee companies are researched by the Manager prior to investment.

Sectoral diversification

Risk: The Company is not constrained from weighting to any sector. This may

lead to the Company having significant exposure to portfolio companies from

certain business sectors from time to time. Greater concentration of

investments in any one sector may result in greater volatility in the value of

the Company's investments and consequently its NAV.

Mitigation: The Company seeks to achieve attractive returns by investing in

weightings that are different from the overall market, yet also seeks to ensure

that individual variances are not so extreme as to leave shareholders at risk

of portfolio volatility that is unreasonably poor. Even though there may be

significant exposures to a single sector, this will be achieved by holding a

number of different stocks in the portfolio.

Dividends

Risk: The Company's investment objective includes the aim of providing

shareholders with an attractive and growing dividend. There is no guarantee

that any dividends will be paid in respect of any financial year or period. The

ability to pay dividends is dependent on a number of factors, including the

level of dividends earned from the portfolio and the net revenue profits

available for that purpose.

The redemption of shares pursuant to the redemption facility may also reduce

distributable reserves to the extent that the Company is unable to pay

dividends.

Mitigation: The Company maintains accounting records and produces forecasts

that are designed to reduce the likelihood that the Company will not have

sufficient distributable resources to meet its dividend objective.

The pandemic has caused the Trust's dividend income to drop but there remain

sufficient reserves for the Trust to maintain its dividend policy.

Share price volatility and liquidity/marketability risk

Risk: The market price of the Company's shares, like shares in all investment

companies, may fluctuate independently of the NAV and thus may not reflect the

underlying NAV of the shares. The shares could trade at a discount or premium

to NAV at different times, depending on factors such as supply and demand for

the shares, market conditions and general investor sentiment.

Mitigation: The Company has in place an annual redemption facility whereby

shareholders can voluntarily tender their shares. The Board monitors the

relationship between the share price and the NAV. The Company has taken powers

to re-purchase shares should there be a sustained imbalance in the supply and

demand leading to a discount. The Company has powers to issue shares (only at a

premium to NAV) should there be good investment opportunities and the size of

the Company has not become too large to continue to meet its objectives.

Gearing

Risk: The Company's investment strategy may involve the use of gearing to

enhance investment returns, which exposes the Company to risks associated with

borrowings. Gearing may be generated through the use of options, futures,

options on futures, swaps and other synthetic or derivative financial

instruments. Such financial instruments inherently contain much greater

leverage than a non-margined purchase of the underlying security or instrument.

While the use of borrowings should enhance the total return on the shares where

the return on the Company's underlying assets is rising and exceeds the cost of

borrowing, it will have the opposite effect where the return on the Company's

underlying assets is rising at a lower rate than the cost of borrowing or

falling, further reducing the total return on the shares.

As a result, the use of borrowings by the Company may increase the volatility

of the NAV per share.

Mitigation: The Company has a revolving loan facility in place, as detailed in

note 5 to the financial statements. The facility has been put in place to offer

the Company the opportunity to enhance its performance through the use of

borrowings, when appropriate. However, the facility remained undrawn as at 31

May 2021 and, subsequently, to the date of this report.

The Company is limited to a maximum gearing of 15% of the net assets. There was

no gearing as at 31 May 2021 (2020: nil).

Key man risk

Risk: The Company depends on the diligence, skill, judgement and business

contacts of the Manager's investment professionals and its future success could

depend on the continued service of these individuals, in particular Gervais

Williams.

Mitigation: The Company is managed by a team of two at Premier Miton, Gervais

Williams and Martin Turner, and this moderates the key man risk were one or the

other to leave Premier Miton's employment. Furthermore, the Company may

terminate the Management Agreement should Gervais Williams cease to be an

employee of the Manager's group and is not replaced by a person whom the

Company considers to be of equal or satisfactory standing within three months

of his departure.

Engagement of third party service providers

Risk: The Company has no employees and the Directors have all been appointed on

a non-executive basis. Whilst the Company has taken all reasonable steps to

establish and maintain adequate procedures, systems and controls to enable it

to comply with its obligations, the Company is reliant upon the performance of

third party service providers for its executive function.

Mitigation: The Company operates through a series of contractual relationships

with its service providers. These contracts, supported by service level

agreements where appropriate, set out the terms on which a service is to be

provided to the Company. The Board reviews performance of all the service

providers both in the Board meetings and in the Management Engagement Committee

meetings, where the terms on which the service providers are engaged are also

reviewed. The Board also receives assurance or internal controls reports from

key service providers. In addition, the contracts provide the Company with

protection in the event of failure to perform by a service provider.

The Board considered the impact of the pandemic on each of the service

providers, including the Manager, and found them all to be operating

effectively.

SHARE CAPITAL

The Company's share capital consists of redeemable ordinary shares of 0.1p each

with one vote per share and non-voting management shares of £1 each. From time

to time, the Company may issue C ordinary shares of 1p each with one vote per

share.

The Company's shares have the following rights:

Voting: the ordinary and C shares have equal voting rights. At shareholder

meetings, members present in person or by proxy have one vote on a show of

hands and on a poll have one vote for each share held. Management shares are

non-voting.

Dividends: the assets of the ordinary and C shares are separate and each class

is entitled to dividends declared on their respective asset pool. The

management shares are entitled to receive, in priority to the holders of any

other class of shares, a fixed cumulative dividend equal to 0.00001p per annum.

Capital: if there are any C shares in issue, the surplus capital and assets of

the Company shall, on a winding-up or on a return of capital, be applied

amongst the existing ordinary shareholders and the management shareholders pro

rata according to the nominal capital paid up on their holdings after having

deducted therefrom an amount equivalent to the assets and liabilities relating

to the C shares, which amount shall be applied amongst the C shareholders pro

rata according to the nominal capital paid up on their holdings of C shares.

When there are no C shares in issue, any surplus shall be divided amongst the

ordinary shareholders and management shareholders pro rata according to the

nominal capital paid up on their holdings of ordinary shares and management

shares.

In each instance, the holders of the management shares shall only receive an

amount up to the capital paid up on such management shares and the management

shares shall not confer the right to participate in any surplus remaining

following payment of such amount.

As at the date of this Report, there were 361,445,105 ordinary shares in issue,

none of which were held in treasury, and 50,000 management shares. The Company

has a redemption facility through which shareholders are entitled to request

the redemption of all or part of their holding of ordinary shares on an annual

basis on 31 May in each year.

The Board may, at its absolute discretion, elect not to operate the annual

redemption facility in whole or in part, although it has indicated that it is

minded to approve all requests.

Further details of the capital structure can be found in note 9 to the

financial statements.

Share Issues

At the AGM held on 14 October 2020, the Directors were granted authority to

allot ordinary shares up to an aggregate nominal amount of £35,804 (being

approximately 10% of the issued ordinary share capital). This authority is due

to expire at the Company's AGM on 20 October 2021.

The Company has a block listing of ordinary shares to be listed to the premium

segment of the Official List of the FCA and admitted to trading on the premium

segment of the LSE's main market. During the year ended 31 May 2021, 3,400,000

ordinary shares were issued utilising the block listing, details of which are

provided in the schedule below.

Date Number of shares Price paid per Mid-market price

share

15/04/2021 150,000 1.1675 1.1650

16/04/2021 100,000 1.1725 1.1800

27/04/2021 800,000 1.1775 1.1775

05/05/2021 1,950,000 1.1875 1.1800

12/05/2021 400,000 1.1850 1.1800

Total 3,400,000

Following the period end, on 2 June 2021, the Company applied for and was

granted block listing of a further 26,104,001 shares. As at the year end,

6,299,999 shares remained under the block listing, and as at the date of this

Report the balance was 32,404,000 shares.

A resolution for renewal of the Directors' authority to issue shares will be

proposed at the next AGM.

There are no restrictions concerning the transfer of securities in the Company

or on voting rights; no special rights with regard to control attached to

securities; no agreements between holders of securities regarding their

transfer known to the Company; and no agreements which the Company is party to

that might affect its control following a successful takeover bid.

Purchase of Own Shares

At the AGM held on 14 October 2020, the Directors were granted the authority to

buy back up to 53,670,961 ordinary shares. No ordinary shares have been bought

back under this authority during the year, nor in prior years. The authority

will expire at the next AGM when a resolution for its renewal will be proposed.

Any shares bought back under this authority will not be sold from treasury at a

price lower than the prevailing NAV at that time.

Treasury Shares

Shares bought back by the Company may be held in treasury, from where they

could be re-issued at a premium to NAV quickly and cost effectively. This

provides the Company with additional flexibility in the management of its

capital base. No shares were purchased for, or held in, treasury during the

year or since the year end.

Share Redemptions

Valid redemption requests were received under the Company's redemption facility

for the 28 May 2021 Redemption Point in relation to 347,580 ordinary shares,

representing 0.096% of the issued share capital. All of these shares were

matched with buyers and sold at a Redemption Price of 118.08p per share.

Current Share Capital

As at the year end, there were 361,445,105 ordinary shares and 50,000

management shares (see note 9 to the financial statements) in issue,

representing 99.986% and 0.014% of the total share capital respectively.

SECTION 172 STATEMENT

A discussion of the Company's Stakeholders and how the Directors discharge

their duties to Stakeholders under section 172 of the Companies Act 2006, is

included on pages 22 and 23 of the Annual Report.

MANAGEMENT, SOCIAL, ENVIRONMENTAL AND DIVERSITY MATTERS

Management Arrangements

The Company appointed Premier Portfolio Managers Limited ("PPM" or the

"Manager") as its Alternative Investment Fund Manager ("AIFM") and its Manager,

following the novation of the Appointment of Manager agreement on 24 April

2020. PPM has been approved as an AIFM by the UK's FCA.

The Manager receives a management fee of 0.9% per annum on the average market

capitalisation of the Company up to £300m and 0.8% per annum on the average

market capitalisation between £300m and £500m and 0.7% per annum on the average

market capitalisation above £500m.

In addition to the basic management fee, and for so long as a Redemption Pool

(see note 9 for details) is in existence, the Manager is entitled to receive

from the Company a fee calculated at the rate of one-twelfth of 1.0% per

calendar month of the NAV of the Redemption Pool on the last business day of

the relevant calendar month.

In accordance with the Directors' policy on the allocation of expenses between

income and capital, in each financial year, 75% of the management fee payable

is charged to capital and the remaining 25% to revenue.

The Management Agreement is terminable by either the Manager or the Company

giving to the other not less than 12 months' written notice. The Management

Agreement may be terminated earlier by the Company with immediate effect on the

occurrence of certain events, including the liquidation of the Manager or

appointment of a receiver or administrative receiver over the whole or any

substantial part of the assets or undertaking of the Manager or a material

breach by the Manager of the Management Agreement which is not remedied. The

Company may also terminate the Management Agreement should Gervais Williams

cease to be an employee of the Manager's group and is not replaced by a person

whom the Company considers to be of equal or satisfactory standing within three

months of his departure.

The Company has given certain market standard indemnities in favour of the

Manager in respect of the Manager's potential losses in carrying on its

responsibilities under the Management Agreement.

The Board appointed Bank of New York Mellon as its Depositary and Custodian

under an agreement dated 22 July 2014. The annual fee for depositary services

due to Bank of New York Mellon is 0.02% of gross assets, subject to a minimum

fee of £15,000 per annum. The Company and the Depositary may terminate the

Depositary Agreement with three months' written notice.

Company secretarial and administrative services are provided by Link

Alternative Fund Administrators Limited, under an agreement dated 7 April 2011.

This agreement may be terminated by 12 months' written notice subject to

provisions for earlier termination as provided therein.

Continuing Appointment of the Manager

The Board keeps the performance of the Manager under continual review, and the

Management Engagement Committee conducts an annual appraisal of the Manager's

performance, and makes a recommendation to the Board about the continuing

appointment of the Manager. It is the opinion of the Directors that the

continuing appointment of the Manager is in the interests of shareholders as a

whole. The reasons for this view are that the Manager has executed the

investment strategy according to the Board's expectations and has demonstrated

superior risk-adjusted returns relative to the broader market and the peer

group.

The Directors also believe that by paying the management fee calculated on a

market capitalisation basis, rather than a percentage of assets basis, the

interests of the Manager are more closely aligned with those of shareholders.

Environmental, Human Rights, Employee, Social and Community Issues

Since the Company does not have any employees, the day-to-day management of

these areas is delegated to the Manager. As an investment trust, the Company

has no direct impact on the community or the environment, and as such has no

environmental, human rights, social or community policies.

Environmental, Social and Governance ("ESG") factors are central to the

investment process as misjudgements on these matters can incur major additional

costs to the portfolio holdings, as well as undermining their equity return

through reputational damage. In company meetings, the Manager routinely

questions the corporate management on a variety of topics, such as safety

records and the make-up of their board papers, to ensure companies are adhering

to best practice. These questions can be quite wide ranging. For example, the

Manager has raised issues ranging from the use of antibiotics in livestock, to

how individual companies monitor the working conditions in the overseas plants

of their suppliers.

Diversity

The Board of Directors of the Company comprises two female and three male

Directors.

The Company's Diversity Policy acknowledges the benefits of greater diversity,

including gender diversity, and the Board remains committed to ensuring that

the Company's Directors bring a wide range of skills, knowledge, experience,

backgrounds and perspectives. Details of the Company's Diversity Policy are set

out in the Annual Report.

The Strategic Report has been approved by the Board of Directors.

On behalf of the Board

Andrew Bell

Chairman

9 August 2021

DIRECTORS (ALL NON-EXECUTIVE)

Andrew Bell - Chairman of the Board

Paul Craig

Caroline Kemsley-Pein - Chair of the Management Engagement and Nomination

Committees

Michelle Mcgrade

Calum Thomson - Chairman of the Audit Committee and Senior Independent Director

All Directors are non-executive and are independent of the Manager.

EXTRACTS FROM THE REPORT OF THE DIRECTORS

Results and Dividends

A final dividend of 1.10p is recommended. Subject to shareholder approval at

the forthcoming AGM, this dividend will be payable on 30 November 2021 to

shareholders on the register at close of business on 24 September 2021. The

ex-dividend date will be 23 September 2021. The dividends paid or payable in

respect of the year ended 31 May 2021 are set out in note 8 below.

Going Concern

The Directors consider that it is appropriate to adopt the going concern basis

in preparing the financial statements. After making enquiries, and bearing in

mind the nature of the business and assets of the Company and its subsidiary

("the Group"), the Directors consider that the Group has adequate resources to

continue in operational existence for the foreseeable future. In arriving at

this conclusion, the Directors have considered the liquidity of the portfolio

and the Group's ability to meet obligations as they fall due for a period of at

least 12 months from the date that these financial statements were approved.

In making the assessment, the Directors have considered the likely impacts of

the ongoing COVID-19 pandemic on the Company, operations and portfolio.

Cash flow projections have been reviewed and show that the Group has sufficient

funds to meet both its contracted expenditure and its discretionary cash

outflows in the form of the dividend policy.

Viability Statement

The Directors have assessed the viability of the Company over a three-year

period, taking account of the Company's position and the risks as set out in

the Strategic Report. The period assessed balances the long-term aims of the

Company, the Board's view that the success of the Company is best assessed over

a longer time period and the inherent uncertainty of looking out for too long a

period. The present pandemic has demonstrated the short term volatility of the

stock markets and as a result the board consider it appropriate to continue to

review the viability of the Company over a three year time period which

balances the long term nature of investing against the short term liquidity of

the investments.

As part of its assessment of the viability of the Company, the Board has

considered the emerging and principal risks and uncertainties and the impact on

the Company's portfolio of a significant fall in UK markets. The Directors do

not expect there to be any significant change in the current principal risks

and adequacy of the mitigating controls in place over the period of this

assessment.

To provide this assessment, the Board has considered the Company's financial

position and its ability to liquidate its portfolio to meet its expenses or

other liabilities as they fall due:

* The Company invests largely in companies listed and traded on stock

exchanges. These are actively traded, and whilst perhaps less liquid than

larger quoted companies, the portfolio is well diversified by both number

of holdings and industry sector.

* The expenses of the Company are predictable and modest in comparison with

the assets in the portfolio. There are no commitments that would change

that position.

* ?The Company has an annual redemption facility whereby shareholders may

request that their shares are redeemed at NAV. The Board has considered the

possibility that shareholders holding a significant percentage of the

Company's shares request redemption. Firstly, the Board has flexibility

over the method of redemption so as to avoid disruption to the overall

operation of the Company in this situation. Secondly, the Company's

investments comprise readily realisable securities which can be sold to

meet funding requirements if necessary. The most significant of the

Company's expenses vary in proportion to the size of the Company.

In addition to considering the emerging and principal risks set out above and

the financial position of the Company as described above, the Board has also

considered the following factors:

* the continuing relevance of the Company's investment objective in the

current environment;

* the level of demand for the Company's shares and that since launch, the

Company has been able to issue further shares;

* the gearing policy of the Company; and

* that regulation will not increase to such an extent that the costs of

running the Company become uneconomical.

The Board has reviewed the influence of the COVID-19 pandemic on its service

providers and is satisfied with the ongoing services provided to the Company.

During the year, the Board periodically reviews key stress tests, which are

provided by the Investment Manager and are based on correlations from defined

historical periods to review key sensitivities to pre-determined shocks. The

Investment Manager's Funds Risk Committee and Investment Oversight Committee

review similar sensitivities or stress tests on a quarterly and monthly basis

respectively. Both committees have been satisfied when they last convened that

there were no undue risks or sensitivities of concern for the Trust.

Accordingly, the Directors have formed the reasonable expectation that the

Company will be able to continue in operation and meet its liabilities as they

fall due over the next three years.

Company Culture

The Company's defined purpose is to deliver our investment objective: to pay

shareholders a good and growing dividend income. The Directors believe that

this will be facilitated by establishing and maintaining a healthy corporate

culture among the Board and in its interaction with the Investment Manager,

shareholders and other stakeholders.

The Board strives for its culture to be in line with the Company's purpose,

values and strategy. Whilst ensuring that it does not conflict with the

investment objective, the Board aims to structure the Company's operations in

such a manner that it takes all its stakeholders and the impact of the

Company's operations on the environment and community into account.

In addition, the Board promotes and monitors the effective management or

mitigation of the risks faced by the Company.

As the Company has no employees and acts through its Board and service

providers, its culture is represented by the values and behaviour of those

parties. Accordingly, the Board assesses and takes account of the

organisational effectiveness of its service providers (including "soft" factors

such as openness and teamwork) as well as their regulatory compliance. The

Board is responsible for ensuring that the Company's culture is embedded in its

day to day operations and it has adopted a number of policies and practices to

facilitate this. In recognition of the Company's corporate and social

responsibilities and to safeguard the Company's interests, the Board engages

with the Company's service providers and other stakeholders. As part of this

ongoing monitoring, the board receives reports from its service providers with

respect to their anti-bribery and corruption policies; Modern Slavery Act 2015

statements; equal opportunities and diversity policies; and greenhouse gas and

energy use reporting.

STATEMENT OF DIRECTORS' RESPONSIBILITIES

The Directors are responsible for preparing the Annual Report and the financial

statements in accordance with international accounting standards in conformity

with the requirements of the Companies Act 2006 and applicable law and

regulations.

Company law requires the Directors to prepare financial statements for each

financial year. Under that law the Directors are required to prepare the Group

financial statements in accordance with international accounting standards in

conformity with the requirements of the Companies Act 2006. Under company law

the Directors must not approve the financial statements unless they are

satisfied that they give a true and fair view of the state of affairs of the

Group and Company and of the profit or loss for the Group for that period. The

Directors are also required to prepare financial statements in accordance with

international financial reporting standards adopted pursuant to Regulation (EC)

No 1606/2002 as it applies in the European Union.

In preparing these financial statements, the Directors are required to:

* select suitable accounting policies and then apply them consistently;

* make judgements and accounting estimates that are reasonable and prudent;

* state whether they have been prepared in accordance with international

accounting standards in conformity with the requirements of the Companies

Act 2006, subject to any material departures disclosed and explained in the

financial statements

* state whether they have been prepared in accordance with international

financial reporting standards adopted pursuant to Regulation (EC) No 1606/

2002 as it applies in the European Union, subject to any material

departures disclosed and explained in the financial statements;

* prepare the financial statements on the going concern basis unless it is

inappropriate to presume that the Company will continue in business;

* prepare a directors' report, a strategic report and directors' remuneration

report which comply with the requirements of the Companies Act 2006.

The Directors are responsible for keeping adequate accounting records that are

sufficient to show and explain the Company's transactions and disclose with

reasonable accuracy at any time the financial position of the Company and

enable them to ensure that the financial statements comply with the Companies

Act 2006 and, as regards the Group financial statements, Article 4 of the IAS

Regulation.

They are also responsible for safeguarding the assets of the Company and hence

for taking reasonable steps for the prevention and detection of fraud and other

irregularities. The Directors are responsible for ensuring that the Annual

Report and accounts, taken as a whole, are fair, balanced, and understandable

and provides the information necessary for shareholders to assess the Group's

performance, business model and strategy.

Website publication

The Directors are responsible for ensuring the Annual Report and the financial

statements are made available on a website. Financial statements are published

on the Company's website in accordance with legislation in the United Kingdom

governing the preparation and dissemination of financial statements, which may

vary from legislation in other jurisdictions. The maintenance and integrity of

the Company's website has been delegated to the Manager, but the Directors'

responsibility extends to the ongoing integrity of the financial statements

contained therein.

Directors' responsibilities pursuant to DTR4