TIDMRRR

RNS Number : 2197I

Red Rock Resources plc

10 August 2021

Red Rock Resources PLC

Kenya Exploration Update

Drill Programme Begins at Central KKM Gold Prospect

10 August 2021

Red Rock Resources Plc ("Red Rock" or "the Company"), the

natural resource development company with interests in gold,

manganese and copper announces that following the recent receipt of

all permits the Company is now beginning the reverse circulation

("RC") drill programme at the Central KKM Gold Prospect, the

central part of the Mikei Gold Project ("MGP" or the "Project") in

Kenya announced on 30 June 2021.

Elsewhere in the MGP Red Rock continues its exploration, with 54

line KM of the planned 115 line KM of IP survey covered in the

Masurura area of the Eastern license. In addition, a 300 line km

magnetic survey has started at Kurutyange, also part of the Eastern

License, following completion of an 11 Line km survey at the MK

Prospect north of Central KKM.

HIGHLIGHTS:

-- 2,000m RC drill programme begins at central KKM prospect

-- Hole depths planned to be between 60m and 220m

-- Possibility of extending drill programme

-- 54 line km of IP covered in Masurura area of the Eastern license.

-- 300 line km of Magnetics survey started in the Eastern License.

This programme follows up some of the recommendations

accompanying the announcement of a revised Mineral Resource

Estimate ("MRE") on 22 February 2021, covering the five prospects

which together currently make up the MGP.

The object of the programme is to improve the confidence and

classification of future MREs at the MGP through infill drilling,

and by targeted step-out drilling to potentially increase the size

of the Mineral Resource.

Red Rock Project Manager Joseph Komu comments: "I am extremely

excited that we finally have the necessary permits for the drilling

contractor to mobilize to site and start drilling. We have 19 drill

pads ready for the rig and the laboratory is ready to receive the

first shipment of samples for assay in the coming weeks. We are

optimistic that this initial programme will spur an extended drill

programme that will advance the Resource to the next stages of

development".

Further Details and Background

The MGP (100% owned by Red Rock) comprises two prospecting

licences which cover approximately 245 km2, namely PL/2018/0202 and

PL/2018/0203, over the Migori Greenstone Belt, and are located

along the northern margin of the Tanzanian Craton. The licences

extend 63 km along strike of the belt, which also hosts the

Kilimapesa Gold treatment plant. The North Mara Gold Mine, which is

operated by Barrick Gold, is located 30 km to the south of the MGP

in Tanzania.

Regional exploration in the project area began in the early

1930s and culminated in the identification and subsequent mining of

the Macalder volcanogenic massive sulphide (VMS) base metal

mine.

In 2010, Red Rock began the extensive task of file organisation,

data digitisation and compilation of available historical data,

following which CSA Global (UK) Ltd performed cross-checks and

validation steps prior to loading it into a Structured Query

Language (SQL) database using Datashed. During 2011 and 2012, Red

Rock undertook an infill drilling programme at all five of the lode

gold prospects; MK, Kakula-Kalange-Munyu (KKM),

Kakula-Kalange-Munyu West (KW), Nyanza (NZ), and Gori Maria (GM)

within PL/2018/0202.The Report published earlier this year

documented the results of Mineral Resource estimation work

initially conducted in 2011 and 2012 and revised in 2021 in order

to report the Mineral Resources according to JORC (2012)

guidelines.

JORC (2012) differs from earlier editions of the JORC Code in

that for a Mineral Resource to be estimated it requires the

application of "reasonable prospects of eventual economic

extraction" ("RPEEE") principles. This has resulted in the case of

the Mikei MRE in the calculation of pit shells supported by

conceptual cost and gold price forecast parameters. Any material

outside or below the reporting pit shell was updated as "Not

Classified" since it did not meet the criteria to be reported as a

Mineral Resource.

The total Mineral Resource Estimate, at both Inferred and

Indicated levels, was estimated at:

15.13 Mt @ 1.49 g/t Au with contained metal content of 723 KOz

Au

This compares with the Mineral Resource Estimate reported and

announced in 2012 under an earlier edition of the JORC Code of

29.36 Mt at 1.26 g/t Au with contained metal content of 1,192.1 KOz

Au.

Key Points of the Report:

-- MRE covered the five prospect areas covered by the 2012 MRE

-- Application of RPEEE principles required by JORC (2012) led

to the exclusion of some previously estimated Resource areas and a

consequent 39% reduction in Resource ounces of gold

-- Gold grade of the MRE for the same reason increased by 18% to 1.49 g/t

-- Some material previously stated as Indicated in the oxidised

zone was downgraded to Inferred reflecting uncertainties relating

to the terrain model and the extent of artisanal activity since

2012

-- Recommendations for a first stage step-out drilling programme

were made to potentially increase the size of the MRE

All prospects, except GM, were classified as Indicated and

Inferred Mineral Resources. GM was classified as Inferred only,

mainly due to the relatively low average RC drill recovery of

62%.

Due to the uncertain lateral extent and depth of artisanal

mining at the Mikei prospects, and the lack of topographic data to

accurately deplete the Mineral Resource, all oxidised material was

classified as Inferred Mineral Resources.

The term "reasonable prospects for eventual economic extraction"

(RPEEE) implies a realistic inventory of mineralisation which,

under assumed and justifiable technical, economic and development

conditions, might, in whole or in part, become economically

extractable. The assumption is that the Mikei prospects will be

extracted by open pit mining. The MGP block models were assessed

for RPEEE by applying conceptual benchmarked costs to calculate

reporting pit shells. The following conceptual parameters were

applied for open pit mining:

-- Mining cost: US$3/tonne

-- Processing cost: US$22/tonne ore

-- Pit slope angle: 52deg

-- Recovery: 90%

-- Royalty: 7%

-- Gold price: US$ 1,800/troy ounce.

The Mineral Resource was reported as that material within the

RPEEE pit shells, and above a cut-off grade of 0.5 g/t Au. The

Mineral Resource was reported as of 18 January 2021 (Table 1).

Table 1: Mineral Resource for the Mikei prospects reported at a

cut-off of 0.5 g/t Au, as of 18 January 2021

Area Indicated Inferred Total

Tonnage Grade Content Tonnage Grade Content Tonnage Grade Content

(Mt) (g/t (koz (Mt) (g/t (koz (Mt) (g/t (koz

Au) Au) Au) Au) Au) Au)

-------- ------ -------- -------- ------ -------- -------- ------ --------

KKM 7.88 1.10 277.8 2.63 1.11 93.5 10.51 1.10 371.3

KW 0.61 1.10 21.6 0.32 1.42 14.7 0.93 1.21 36.3

NZ 1.04 3.96 132.0 0.32 3.17 32.2 1.35 3.78 164.1

GM - - - 1.91 1.37 84.0 1.91 1.37 84.0

MK 0.28 5.48 49.0 0.15 3.83 18.2 0.43 4.91 67.1

------- -------- ------ -------- -------- ------ -------- -------- ------ --------

Total 9.81 1.52 480.4 5.32 1.42 242.6 15.13 1.49 723.0

------- -------- ------ -------- -------- ------ -------- -------- ------ --------

Note:

-- Computational errors may exist due to rounding.

-- Under JORC (2012)

-- Red Rock owns 100% and therefore figures both gross and net to Red Rock

The technical information in this release has been reviewed by

Mr Joseph Komu, a member of AusIMM and the Project Manager of the

Project. He is a member of a recognised professional organisation

and has sufficient relevant experience to qualify as a qualified

person as defined in the Guidance Note for Mining, Oil and Gas

Companies published by AIM .

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

For further information, please contact:

Andrew Bell 0207 747 9990 Chairman Red Rock Resources Plc

Roland Cornish/ Rosalind Hill Abrahams 0207 628 3396 NOMAD

Beaumont Cornish Limited

Mark Treharne 0203 700 2500 Broker Pello Capital Limited

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDDKKBBOBKDKFD

(END) Dow Jones Newswires

August 10, 2021 13:23 ET (17:23 GMT)

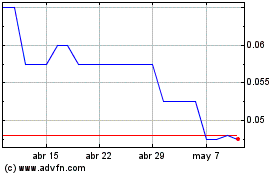

Red Rock Resources (LSE:RRR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Red Rock Resources (LSE:RRR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024