Weiss Korea Opp Second Compulsory Redemption of Realisation Shares

07 Septiembre 2021 - 7:18AM

UK Regulatory

TIDMWKOF

NOT FOR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO

THE UNITED STATES, CANADA, AUSTRALIA, JAPAN, THE REPUBLIC OF IRELAND OR SOUTH

AFRICA OR TO US PERSONS.

Weiss Korea Opportunity Fund Ltd.

("the Company")

(a closed-ended investment scheme incorporated with limited liability

under the laws of Guernsey with registered number 56535)

LEI 213800GXKGJVWN3BF511

Second Compulsory Redemption of Realisation Shares

Further to the announcements of 23 June 2021 and 9 June 2021, the Company has

made good progress with the sale of assets in the Realisation Pool and is

pleased to announce the second compulsory redemption of Realisation Shares

representing approximately 90 per cent. of Realisation Shares in issue (the

"Second Redemption").

The Second Redemption will be effected pro-rata to holdings of Realisation

Shares on the register at the close of business on 06 September 2021 ("Second

Redemption Date"). The Second Redemption price will be 275.55 pence per

Realisation Share (the "Second Redemption Price"), equivalent to the unaudited

Net Asset Value per Realisation Share as at 31 August 2021.

Fractions of Realisation Shares will not be redeemed and the number of

Realisation Shares to be redeemed for each Realisation shareholder will be

rounded down to the nearest whole number of Realisation Shares. Accordingly,

2,457,780 Realisation Shares will be compulsorily redeemed at the Second

Redemption Price. The Second Redemption proceeds due in respect of the Second

Redemption will be paid by cheque and sent to Realisation Shareholders during

the week commencing 20 September 2021. At the same time, Realisation

Shareholders will be advised of the balance of their Realisation Shares which

have not been compulsorily redeemed.

All Realisation Shares that are redeemed will be re-designated as Ordinary

Shares and held in Treasury, with effect from the Second Redemption Date.

The total number of Realisation Shares in issue following completion of the

Second Redemption will be 273,085 Realisation Shares.

Total Voting Rights

Following the Second Redemption, pursuant to the FCA's Disclosure Guidance and

Transparency Rules, the Company will have 80,744,743 Ordinary Shares in issue.

The Company will hold 11,437,665 Ordinary Shares in treasury. Therefore, the

total number of voting rights in the Company is 69,307,078.

The above figure of 69,307,078 may be used by shareholders as the denominator

for the calculations by which they will determine if they are required to

notify their interest in, or a change to their interest in, the Company under

the FCA's Disclosure and Transparency Rules.

Terms used and not defined in this announcement shall have the meanings given

to them in the circular dated 15 March 2021.

This announcement contains inside information for the purposes of Article 7 of

Regulation 596/2014.

For further information please contact:

Singer Capital Markets +44 20 7496 3000

James Maxwell/ Alaina Wong/ James Fischer - Nominated

Adviser

James Waterlow - Sales

Northern Trust International Fund +44 1481 745 385

Administration Services (Guernsey) Limited

Andy Le Page

Website

www.weisskoreaopportunityfund.com

END

(END) Dow Jones Newswires

September 07, 2021 08:18 ET (12:18 GMT)

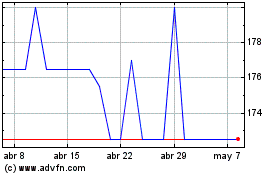

Weiss Korea Opportunity (LSE:WKOF)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

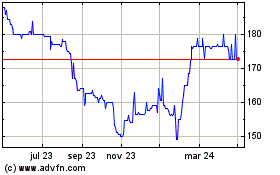

Weiss Korea Opportunity (LSE:WKOF)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024