Bitcoin Stuck: Here Are 2 Things That Must Happen For BTC To Break $72,000

13 Junio 2024 - 3:00PM

NEWSBTC

At spot rates, Bitcoin is firm, but traders doubt the uptrend

following the unexpected dump on June 11. Currently, Bitcoin is

stable, trending above $67,000 and down despite gains on June 12.

Still, even at this level, there are concerns because the coin,

despite all the confidence across the board, remains below $72,000.

This reaction line is emerging as a key liquidation area. If

broken, BTC could unleash a wave of short liquidation, accelerating

the lift-off to $74,000 and beyond. Will Bitcoin Demand Soar In

Spot Markets? Taking to X, one on-chain analyst said that Bitcoin

is stagnating at spot levels below $72,000 because hedge funds are

short on futures. Related Reading: Solana On-Chain Indicators

Suggests A Return Of Bullish Sentiment, Is It Time To Buy SOL?

Though this has been a known development for a while, hedge funds

have stacked their BTC shorts via the Chicago Mercantile Exchange

(CME) by over $1 billion in the last week alone. Therefore, the

analyst says two things must happen to reverse this effect and

support prices. Although the BTC shorting on CME is not necessarily

a bearish signal, hedge funds are hedging by playing a

sophisticated arbitrate strategy, and coin holders must look at

fundamentals. Hedge funds are simultaneously shorting BTC futures

on CME and buying on the spot market. Therefore, for the coin to

break $72,000 and pierce $74,000, the analyst said users must buy

at least 2X the amount of BTC futures shorted in the spot market.

BTC Prices Must Fall For Short Sellers To Exit If there is no

incentive to lift spot prices higher, then Bitcoin prices must

fall. Falling prices will encourage short sellers, in this case,

the hedge funds, to exit their positions lest they continue paying

funding rates. In a bearish market, and when futures prices begin

to fall, short sellers must pay longs for the index not to deviate.

Whether there will be a spike in demand in the spot market remains

to be seen. However, what’s evident is that institutional interest

in Bitcoin is there, only that hedge funds, as seen from their

arbitrage trade using CME, want to profit, regardless of price

movements. Related Reading: Dogecoin Under Pressure And ‘Going To

Zero’, Analyst Says – Here’s Why The analyst also shared another

chart to solidify the bullish outlook. The trader used the “Growth

Rate” metric to compare changes in Bitcoin’s market and realized

cap. Currently, the metric is at around 0.001, way below 0.002,

meaning the market is highly likely overheated. Bulls might be

preparing to make a comeback. Feature image from DALLE, chart from

TradingView

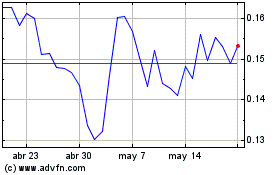

Dogecoin (COIN:DOGEUSD)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Dogecoin (COIN:DOGEUSD)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024