TIDMAJIT

RNS Number : 7045B

abrdn Japan Investment Trust plc

06 June 2023

ABRDN JAPAN INVESTMENT TRUST PLC

ANNUAL FINANCIAL REPORT ANNOUNCEMENT

FOR THE YEARED 31 MARCH 2023

Performance Highlights

Net asset value total return(A) Topix Index total return

Figures to 31 March 2023 Figures to 31 March 2023

-4.4% +2.8%

Figures to 31 March 2022 -10.0% Figures to 31 March 2022 -2.7%

Return since 8 October 2013 Return since 8 October 2013

(change of mandate) +100.4% (change of mandate) +105.1%

Share price total return(A) Ongoing charges ratio(A)

Figures to 31 March 2023 Year to 31 March 2023

-10.0% 1.17%

Figures to 31 March 2022 -10.9% Year to 31 March 2022 1.00%

Return since 8 October 2013

(change of mandate) +85.8%

Discount to net asset value(A) Dividend per share

As at 31 March 2023 Year to 31 March 2023

16.4% 12.00p

As at 31 March 2022 11.0% Year to 31 March 2022 15.00p

(A) Alternative Performance Measure (see pages 86 to 88 of the 2023

Annual Report). Comparatives for the corresponding period can be also

be found on these pages.

Financial Calendar, Dividends and Highlights

Payment dates of dividends July 2023

December 2023

======================================== ===================================

Annual General Meeting (London) To be confirmed by separate notice

======================================== ===================================

Half year end 30 September 2023

======================================== ===================================

Expected announcement of results November 2023

for the six months ending 30 September

2023

======================================== ===================================

Financial year end 31 March 2024

======================================== ===================================

Expected announcement of results June 2024

for the year ending 31 March 2024

======================================== ===================================

Dividends

Rate Ex-dividend Record date Payment date

date

======================== ====== ============ ============ ============

Proposed second interim 7.00p 22 June 2023 23 June 2023 21 July 2023

dividend 2023

======================== ====== ============ ============ ============

Interim dividend 2023 5.00p 1 December 2 December 29 December

2022 2022 2022

======================== ====== ============ ============ ============

Total dividends 2023 12.00p

------------------------ ------ ------------ ------------ ------------

Final dividend 2022 9.00p 23 June 2022 24 June 2022 22 July 2022

======================== ====== ============ ============ ============

Interim dividend 2022 6.00p 2 December 3 December 30 December

2021 2021 2021

======================== ====== ============ ============ ============

Total dividends 2022 15.00p

------------------------ ------ ------------ ------------ ------------

Highlights

31 March 2023 31 March 2022 % change

====================================== ============= ============== ========

Total assets (as defined on page

101 of the 2023 Annual Report) GBP93,273,000 GBP100,564,000 -7.3

====================================== ============= ============== ========

Total equity shareholders' funds

(net assets) GBP82,954,000 GBP89,930,000 -7.8

====================================== ============= ============== ========

Market capitalisation GBP69,309,000 GBP80,043,000 -13.4

====================================== ============= ============== ========

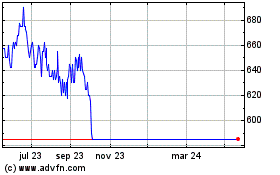

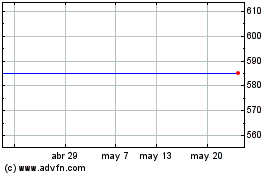

Share price (mid market) 557.50p 635.00p -12.2

====================================== ============= ============== ========

Net asset value per Ordinary share 667.26p 713.43p -6.5

====================================== ============= ============== ========

Discount to net asset value(A) 16.4% 11.0%

====================================== ============= ============== ========

Net gearing(A) 12.3% 11.4%

====================================== ============= ============== ========

Operating costs

====================================== ============= ============== ========

Ongoing charges ratio(A) 1.17% 1.00%

====================================== ============= ============== ========

Earnings

====================================== ============= ============== ========

Total return per Ordinary share (33.72p) (81.70p)

====================================== ============= ============== ========

Revenue return per Ordinary share 7.11p 8.54p

====================================== ============= ============== ========

Dividends per Ordinary share(B) 12.00p 15.00p

====================================== ============= ============== ========

Revenue reserves (prior to payment GBP1,456,000 GBP1,631,000

of proposed second interim dividend)

-------------------------------------- ------------- -------------- --------

(A) Considered to be an Alternative Performance Measure. See pages

86 and 87 of the 2023 Annual Report for more information.

(B) The figure for dividends reflects the years in which they were

earned.

Chairman's Statement

Performance Record

The last year to 31 March 2023 was a difficult period for stock

markets globally, in particular for better quality growth stocks,

as well as the broader global economy. Japanese equities faced an

uphill struggle for much of the period with investors seemingly

overly focused on the macro at the expense of company fundamentals

which, for the most part, remain strong.

The Company's net asset value (NAV) total return for the year to

31 March 2023 was -4.4%, in sterling terms underperforming the

TOPIX Index, the Company's benchmark's gain of 2.8%. The Company's

Ordinary share price ended the year at 557.5p, down from 635.0p at

the start of the period, and the discount to NAV per Ordinary share

widened from 11.0% to 16.4%. Over one, three and five years to 31

March 2023 the Company's NAV total return has lagged the TOPIX

Index (in sterling terms) by 7.2% and 9.9% and 13.1% respectively;

and, since the change of mandate in October 2013, the Company's NAV

total return has lagged the TOPIX Index by 0.4% per annum in

sterling terms.

Every year the Company has a defined discount monitoring period,

being 90 days up to 31 March 2023 (the "Discount Monitoring

Period"). The average discount for this year's monitoring period

was 14.0%, above the target of 10.0% requiring a continuation vote

to be put to shareholders at the next Annual General Meeting

("AGM") or a general meeting held before the AGM.

The Board, while an enthusiastic supporter of the attractions of

Japan's equity markets for investment opportunities, has long been

mindful of the need for the Company to deliver consistent

competitive investment performance, increased scale, greater

liquidity and a more modest discount. Increased investment

resources, an enhanced dividend policy, more focused marketing and

a change of corporate broker are some of the strategies the Board

has employed in an attempt to address the challenges relating to

performance, scale, liquidity and the discount.

Strategic Review

Following consultation with a number of the Company's major

shareholders, the Board undertook a rigorous strategic review of

the opportunities in the Japan fund sector, to consider which

investment strategy would be best for shareholders while remaining

invested in the Japanese market. The Board considered solutions

among closed-end investment trusts, where greater liquidity and a

lower discount can reasonably be expected and where there is a

clear, focused and differentiated investment strategy which has

delivered strong performance.

The Board believes the strategic review demonstrated that the

case for taking advantage of the corporate governance changes in

Japan is more compelling than ever. Over recent decades, many

Japanese companies have accumulated significant cash reserves and

have reduced their reliance on debt financing. This has resulted in

many companies having excess capital and, consequently, generating

lower returns for equity investors. The Japanese authorities are

seeking to address this by implementing regulations to improve

governance and deliver improved returns to shareholders. The Board

is of the view that this provides a highly favourable background

for an active investment approach, particularly in smaller quoted

companies.

Proposed rollover into Nippon Active Value Fund plc ("NAVF")

As announced on 18 May 2023, the Board has agreed terms for a

proposed combination of the assets of the Company with the assets

of NAVF (the "Proposal"). NAVF is a top-performing UK investment

trust which targets attractive capital growth for its shareholders

through active engagement with a focused portfolio of small and

mid-cap quoted companies which have the majority of their

operations in, or revenue derived from, Japan and that have been

identified as being undervalued.

The proposed combination with NAVF is expected to improve the

enlarged fund's liquidity as well as spreading the fixed costs of

NAVF over a larger pool of assets. Following completion of the

Proposal, it is expected that a director of the Company will join

the Board of NAVF, taking the total number of directors of NAVF to

six. The Company has consulted with a number of its major

shareholders, together holding around 30% of the Company's issued

share capital, who have indicated support for the Proposal.

Implementation of the Proposal is subject to the approval, inter

alia, of the Company's shareholders as well as regulatory and tax

approvals and approval by the shareholders of NAVF. A circular

providing further details of the Proposal and convening general

meetings to seek the necessary shareholder approvals will be

published by the Company as soon as practicable. It is anticipated

that the Proposal, if approved, will be implemented in Q3 2023.

The Board believes that implementation of the Proposal is in the

best interest of shareholders as a whole and many shareholders will

wish to continue to be invested in the enlarged fund. The Board

would encourage them to roll over their interest into NAVF, as Sir

David Warren and I, being the members of the Board with shares in

the Company, intend to do with our holdings. Nevertheless, given

the proposed change of investment strategy represented by the

Proposal, the Board believes it is appropriate to offer

shareholders the opportunity to realise part, or potentially all,

of their investment in the Company via a cash exit for up to 25% of

the Company's shares in issue, at 2% discount to fair value ("FAV")

per share of the Company.

Japan Economic Background

One of the most significant developments domestically over the

year to 31 March 2023 was regarding the Bank of Japan (BoJ) and

monetary policy. Despite inflation creeping up to its highest level

in more than 30 years (albeit much lower than elsewhere), BoJ

Governor Haruhiko Kuroda stuck to his no-intervention policy for

much of the year, even in the face of an increasingly weak

currency; the yen fell to its lowest point against the US dollar in

more than 20 years. At the same time, the BoJ remained committed to

its policy of yield-curve control and restricting sales of 10-year

Japanese Government Bonds to ensure that yields stayed around

zero.

Towards the end of 2022, the BoJ relaxed its rules. And, with

Kuroda's retirement in April 2023, there are expectations that new

governor Kazuo Ueda will start to unpick some of the policies that

have been pushed through in previous years. If this happens, the

banking sector could start to become more profitable. Notably,

despite some profit-taking and news from the US regarding the

failure and subsequent buyout of Silicon Valley Bank, financials

were the best performing sector over the review period.

Prevailing global concerns - the ongoing Ukraine war, rising

inflation and disruption to supply chains - combined with domestic

worries, not least the weaker yen, weighed on the market. While

companies considered to be more sensitive to rising interest rates,

and the more 'defensive' sectors fared well, most other sectors

lost ground. The weaker yen was particularly damaging for the

margins of the better quality companies favoured by the Investment

Manager. Within the portfolio, this translated into weaker

performance for sectors including consumer discretionary,

communication services and real estate. The best relative

performance came from consumer staples and materials holdings. For

more detail on company-specific performance, see the Investment

Manager's Review on pages 12 to 13 of the 2023 Annual Report.

There are already signs of improving macroeconomic conditions.

The yen has bounced back from its October lows, there is general

consensus that interest rate rises that have hurt the global

economy should slow from here, while soaring inflation should

slowly start to moderate. Meanwhile, China's reopening is proving

to be a positive for the supply-chain issues that have beset many

Japanese businesses, where shortages of essential components, such

as semiconductors, have delayed production.

Dividend

The Company's revenue return per Ordinary share for the

financial year was 7.1p (2022 - 8.5p). An interim dividend of 5.0p

has already been declared and was paid to shareholders on 29

December 2022. The Board proposes a second interim dividend of

7.0p, making a total dividend of 12.0p (2022 - 15.0p) for the year

ended 31 March 2023. The dividend comprises 7.1p from revenue

return, 10.1p from revenue reserves and 1.9p from capital

reserves.

Gearing

The Company continued to make use of its capacity to gear

through its loan facilities provided by ING Bank. Earlier in the

year these were renewed with the Yen 1.3 billion fixed term loan

now expiring in January 2024 and the Yen 1.0 billion floating rate

facility now extended to expire in December 2024.

Environmental, Social & Corporate Governance ("ESG")

Corporate governance remains highly topical in Japan and this is

key to the Board's decision to recommend the Proposal given NAVF's

active investment strategy is well aligned with these trends. There

are signs of real progress in how Japanese companies seek to

improve shareholder returns. There is a strong focus on making

responsible use of capital, evident in the share buybacks that have

reached their highest level in 16 years. The Tokyo Stock Exchange

is also encouraging companies trading below book value to work to

raise valuations and has detailed how it wants listed companies to

become more aware of their cost of capital and stock price, to

encourage more sustainable growth and promote longer-term increases

in shareholder value.

External Service Providers

As usual, the Board has been monitoring costs generally and

service providers during the year, considering the best interests

of shareholders. This year, there have been some changes to service

providers as a result of these discussions.

As mentioned in the last Half Yearly Report, KPMG resigned as

the Company's external audit firm on 15 November 2022 following

discussions regarding increasing fees and the Board's completion of

a successful audit tender, which resulted in the appointment of

Johnston Carmichael LLP ("Johnston Carmichael") to undertake the

Company's audit for the year ended 31 March 2023. The appointment

of Johnston Carmichael as auditor is recommended by the Board to

shareholders at the Company's forthcoming Annual General Meeting

("AGM"). More information can be found in the Audit Committee

Report on pages 50 to 52 of the 2023 Annual Report.

The Board also undertook a review of the terms of the Registrar

during the year and, following careful consideration, determined

that it was in the best interests of the Company to change

Registrar. The transfer of services to Computershare was undertaken

successfully in February 2023. Contact details are on page 106 of

the 2023 Annual Report.

Annual General Meeting ("AGM")

Normally, the notice of the Company's AGM would accompany this

Annual Report and the AGM would take place in early July. As a

result of the average discount at which the Company's shares traded

throughout the discount monitoring period to 31 March 2023, the

Company is required to put a continuation resolution to

shareholders at or before the forthcoming AGM. The outcome of the

strategic review also requires that general meetings are convened

to seek necessary shareholder approvals for the Proposal. The Board

anticipates the continuation vote will be subsumed into the

business of these meetings, and the Company's AGM is likely to be

delayed accordingly. The Board will update shareholders on the

timings of all shareholder meetings once these are confirmed by

notice of meeting as usual and by RNS announcement.

Investment Manager's Review

Overview

Japanese shares fell initially but rebounded to finish the year

4.4% higher in Yen terms. Initial selling pressure came from fears

over high inflation and concerns that central bank overreactions,

particularly from the US Federal Reserve, would push economies into

recession. As the period progressed, investors became more

optimistic about the prospects for a recovery in global growth.

While the Bank of Japan ("BoJ") held interest rates unchanged, it

took steps to relax its market yield controls, a potential sign of

tightening to come now that Kazuo Ueda has taken over from Haruhiko

Kuroda as governor in April 2023.

There was a notable factor rotation within Japanese equities,

which impacted our investment style and also led to our stock

selection underperforming. This rotation also produced investment

opportunities, as we capitalised on pockets of mispricing to

identify new ideas and add to holdings which we deemed to be

oversold given their strong fundamentals. As long-term investors in

Japanese equities, we maintain our conviction that quality

companies will outperform over the long term. This is particularly

the case where there is inflation; price rises have been less

extreme in Japan than in many other developed economies, but we

have looked to invest in quality companies which have the ability

to pass cost increases on to their customers.

The technology sector also saw testing times. Many global

manufacturers struggled with high shipping costs and supply chain

issues, particularly through China's intense lockdowns. The

shortages were particularly acute in semiconductors, which in turn

limited output for many companies in the technology sector. Signs

of weakening end-demand also emerged amid a slowing global economy.

At this stage, however, there are good reasons for optimism. After

a difficult period at the end of 2022, China has now relaxed its

harsh Covid-19 restrictions; logistical bottlenecks are moving and

component shortages are easing: this bodes well for a consumer

recovery.

Environmental, social and governance

Within corporate Japan, one key theme of ESG engagement has been

the push to improve investor returns. In particular, the Tokyo

Stock Exchange is encouraging companies that trade at low

valuations to improve their capital efficiency, as it seeks to

create a more vibrant stock market.

This has been an ongoing point of engagement with many of our

portfolio companies; for instance, automotive lamp maker Koito

Manufacturing has been growing its business continuously and with

it, the amount of cash held on its balance sheet. As of December

2022, Koito held cash and cash equivalents that made up nearly 60%

of its book value. We have petitioned the company to move towards a

more independent board and improve its capital efficiency.

We have also been suggesting to the management of Japan Exchange

Group that they make a clear statement on what they consider to be

excess capital, and how they intend to use these funds. The company

has announced a share buyback, which we see as a positive step, but

we still see room for further improvement.

Across other areas, we reached out to endoscope maker Olympus to

discuss its disclosure on responsible marketing. We were encouraged

to learn that the company intends to set specific key performance

indicators and action plans for the issues that have been

identified internally and we will continue to track its progress in

this area. We also engaged with Seven & i regarding the

restructuring of its domestic businesses, a governance factor as it

concerns good use of capital on its balance sheet.

You can read more about our engagement efforts in our case study

on Keyence on page 34 of the 2023 Annual Report.

Portfolio Review

The Company's NAV fell by 4.4% in sterling total return terms

during the year to 31 March 2023, underperforming the benchmark's

(TOPIX Index) rise of 2.8%.

The Company's underperformance was primarily due to currency and

stock selection effects. Within the portfolio, industrial,

financial and healthcare stocks have generally detracted. However,

information technology, communication services and consumer staples

sectors have been positive for performance.

In terms of individual holdings, Ajinomoto performed well. The

seasonings manufacturer delivered consistently good results as it

grew its sales despite price increases. Semiconductor tester maker

Advantest also contributed to returns, owing to growing confidence

in the prospects for artificial intelligence ("AI"). Investors

expect increased use of AI will boost demand for high-performance

computing chips. AI marketing solution provider Appier Group was

another key contributor on the back of good results.

The biggest detractor from performance was ValueCommerce , which

was sold during the period. Its share price lagged on concerns that

its parent company was introducing competing online marketing

solutions . Electronic component maker Kohoku Kogyo reported weaker

earnings due to a rapid rise in metal prices, but the company

expects to pass this cost inflation on through price increases with

a time lag of a few months. In our view, Kohoku's pricing power

stems from a lack of competitors that can match its product quality

and cost leadership.

Portfolio Activity

Over the year we added stocks to the portfolio which we believe

offer good potential for upside in the current economic

environment. In the first six months, the initiations were across

various sectors. We invested in Seven & i , the convenience

shop chain which benefits from economies of scale and a strong

logistical advantage. The market is discounting the potential for

meaningful restructuring of its domestic businesses which we see as

an opportunity to add value. We also bought Olympus , the leader in

gastrointestinal endoscopes, which has grown market share by

investing in service centres and customer training. Another new

holding was system integrator Nomura Research Institute ("NRI"). We

believe Japanese corporate technology spend will remain firm, given

rising digitisation and digitalisation, and NRI has a track record

of providing high value-added solutions. We also introduced Katitas

, which buys properties at appealing discounts, then re-models them

into good quality homes for sale at affordable prices.

In the second half of the year, we initiated positions in

Suntory Beverage & Food , MUFJ , Hitachi and Internet

Initiative Japan . Suntory Beverage & Food owns many leading

soft drinks brands across the globe. The company offers attractive

exposure to resilient consumption trends in the soft-drinks market.

Its focus on the low-sugar, energy and health-conscious segments

has enabled the company to grow at a faster pace than the industry

generally. Under its current management, geographic expansion into

Vietnam and Thailand has proved successful and we see this as key

to its further growth. In its home market of Japan and in Europe,

price increases, product revamps and operational restructuring

support further growth in sales and margins.

MUFJ is the largest of the three mega-banks in Japan with

significant overseas operations that contribute a third of the

group's profits. Under the current management led by CEO, Hironori

Kamezawa, we believe that the company has become committed to a

more disciplined and shareholder friendly approach to capital

management. Its efforts to improve capital efficiency include the

sale of US-based Union Bank last year. At the same time, MUFJ

assesses new acquisitions based on stringent criteria. As the

company uses excess capital to maintain attractive shareholder

returns or fund growth initiatives, we believe that its share price

discount will gradually narrow.

At the broader industry level, we have previously been concerned

about the impact of the BoJ's policy. However, the recent

adjustment to the trading band for 10-year Japanese government

bonds showed the potential for policy changes to positively impact

the banking sector.

Hitachi is Japan's major industrial and engineering

conglomerate, covering a broad range of manufacturing and services

in power generation, defence systems, electronics, construction and

infrastructure, digital and other products. Over the past decade,

its restructuring has led to an expansion in margins and a

portfolio that is more resilient over differing business cycles. We

expect its profitability and growth to improve further, led by the

power-grid business that has world-leading technology for

power-loss reduction during transmission. Hitachi stands to benefit

from greater demand for renewable energy, as well as Lumada, an

Internet of Things ("IoT") platform, and digital product

engineering company GlobalLogic, which will capture rising

digitalisation demand for factories and infrastructure.

Internet Initiative Japan is one of two business-to-business

internet service providers remaining in Japan. The company is

uniquely positioned to capture the rising corporate demand for

bandwidth on the back of digital transformation needs. It can also

leverage on its network know-how to cross-sell other services such

as IoT, network security and system integration.

To fund these more attractive opportunities, we sold our

positions in electronics components supplier Murata Manufacturing

on concerns over an inventory correction affecting its earnings,

semiconductor maker Sanken Electric, and laboratory operator BML .

As we mentioned in the Half Yearly Report, this was a small holding

which had benefited from the rise in testing over the Covid-19

pandemic. With the impact of the pandemic waning, we saw more

limited potential for upside.

More recently, we sold Workman , over concerns that the

company's unwillingness to raise prices in spite of cost inflation

will lead to a deterioration in profitability and Heiwa Real Estate

, in view of limited further upside to shareholder returns.

ValueCommerce was another disposal. This company generates a large

portion of its profits from providing advertising solutions to

tenants on the e-commerce platforms of Z Holdings, which recently

introduced competing advertising solutions. Other sales included

Fukui Computer , which we sold due to concerns over a reduction in

government subsidies affecting demand, and Renesas Electronics ,

Nippon Sanso and Daifuku , in view of better opportunities

elsewhere.

Outlook

Looking ahead, there is cause for optimism. The macroeconomic

conditions that have hurt some of our holdings in the recent past

appear to be reversing: the yen has strengthened, inflationary

pressures are easing, and interest rate rises are moderating. While

there are still concerns that the market may be underestimating the

persistence of inflation, and that geopolitics could still lead to

sudden changes in the economic outlook, we believe that the

prospects for better run businesses in Japan should improve and,

over time, see them outperform. We remain true to our investment

philosophy: that investing in a group of well-run companies,

alongside increasing active engagement, will lead to better

outcomes for shareholders.

Kwok Chern-Yeh,

abrdn Japan Limited

5 June 2023

Overview of Strategy

Business Model

This report provides shareholders with details of the Company's

current business model and strategy as well as the principal risks

and challenges it faces.

The Company is an investment trust which seeks to deliver a

competitive return to its shareholders through the investment of

its funds in accordance with the investment policy as approved by

shareholders.

The Board appoints and oversees an investment manager, decides

the appropriate financial policies to manage the assets and

liabilities of the Company, ensures compliance with legal and

regulatory requirements and reports objectively to shareholders on

performance.

Investment Objective and Purpose

To achieve long-term capital growth principally through

investment in listed Japanese companies which are believed by the

Investment Manager to have above average prospects for growth.

The Board's strategy is represented by its investment policy,

financial policies, and risk management policies.

Investment Policy

The Company primarily invests in the shares of companies which

are listed in Japan. The portfolio is constructed through the

identification of individual companies of any market capitalisation

and in any business sector, which offer long-term growth

potential.

The portfolio is selected from the 3,800 listed stocks in Japan

and is actively managed to contain between 30 and 70 stocks which,

in the Manager's opinion, represent the best basis for producing

higher returns than those of the market as a whole in the long

term. There will therefore inevitably be periods in which the

Company's portfolio either outperforms or underperforms the market

as represented by the Company's benchmark.

The Board does not impose any restrictions on these shorter term

performance variations from the benchmark, nor any limits on the

concentration of stock or sector weightings within the portfolio,

except that no individual shareholding shall exceed 10% of the

Company's portfolio at the time of purchase, although market

movements may subsequently increase

this percentage.

The full text of the Company's investment policy is provided on

page 91 of the 2023 Annual Report.

Benchmark Index

Tokyo Stock Price Index, TOPIX (in Sterling terms)

Investment Approach

The Investment Manager's investment philosophy is that markets

are not always efficient. The Investment Manager's approach is

therefore that superior investment returns are attainable by

investing in companies with good fundamentals and above average

growth prospects that in the Investment Manager's opinion drive

share prices over the long-term. The Investment Manager follows a

bottom-up investment process based on a disciplined evaluation of

companies through active engagement, at least twice a year, with

management on performance including environmental, social and

governance issues by its fund managers who are based in Japan and

supported by the Manager's Asian investment team in Singapore. The

Manager estimates a company's worth in two stages; quality, defined

by reference to management, business focus, the balance sheet and

corporate governance; and then price, calculated by reference to

key financial ratios, the market, the peer group and business

prospects. Understanding a company's management and gauging its

experience is essential and no stock is bought without the fund

managers having first met management.

Stock selection is key in constructing a diversified portfolio

of companies with macroeconomic, political factors and benchmark

weightings being secondary.

Given the long-term fundamental investment philosophy, the

Manager expects to hold most companies in which the Company invests

for extended periods of time.

Financial Policies

The Board's main financial policies cover the management of

shareholder capital, risk management of the Company's assets and

liabilities, including currency risk, the use of gearing and the

reporting to shareholders of the Company's performance and

financial position.

Management of shareholder Capital

The Board's policy for the management of shareholder capital is

primarily to ensure its long term growth. This growth will reflect

both the Manager's investment performance and from time to time the

issue of shares, when sufficient demand exists to do this, without

diluting the value of existing shareholder capital.

The Board's dividend policy is to make distributions on a

semi-annual basis and currently consists of the Company's earnings

for the year, 3.0p per share released from the revenue reserves and

an amount from the distributable capital reserves.

The Board may authorise the buyback of shares in order to avoid

excessive variability in the discount and if, despite this, the

average discount exceeds 10% during the 90 day period preceding its

financial year end, the Board will offer shareholders the

opportunity to vote on the continuation of the Company at a general

meeting. The average discount for this year's monitoring period was

above the target, requiring a continuation vote to be put to

shareholders at the next Annual General Meeting ("AGM") or a

general meeting held before the AGM, to be confirmed in due

course.

Risk Management

The policy for risk management is primarily focused on the

investment risk in the portfolio using the Manager's risk

management systems and risk parameters, overseen by the Board.

Derivatives

The Company may use derivatives from time to time for the

purpose of mitigating risk in its investments. The performance of

the Company is subject to fluctuations in the Yen/GBP exchange

rate. The Company's exposure to Yen fluctuations is partially

offset by the natural hedge provided by any borrowing in Yen as

well as by investments in Japanese companies which have significant

sources of income from exports of goods or from non-Japanese

operations.

The wider corporate risks, including those arising from the

increasingly regulated and competitive marketplace, are managed

directly by the Board. The principal risks are more fully described

under the paragraph 'Principal Risks and Uncertainties'.

Use of Gearing

Gearing is the amount of borrowing used to increase the

Company's portfolio of investments in order to enhance returns when

and to the extent it is considered appropriate to do so or to

finance share buybacks when necessary. The level of borrowing under

the Company's investment policy is subject to a maximum of 25% of

net assets but will normally be set at a stable and lower level

than the maximum. The Board has currently established a gearing

level of around 10% of net assets although, with stock market

fluctuations, this may range between 5% and 15%.

Principal Risks and Uncertainties

There are a number of risks which, if realised, could have a

material adverse effect on the Company and its business model,

financial position, performance and prospects.

The Board has in place a robust process to identify, assess and

monitor the principal risks and uncertainties facing the Company

and to identify and evaluate newly emerging risks, such as

geopolitical risk and cyber risk referenced in the table below. The

Company's risks are regularly assessed by the Audit Committee and

managed by the Board through the adoption of a risk matrix which

identifies the key risks for the Company, including emerging risks,

and covers strategy, investment management, operations,

shareholders, regulatory and financial obligations and third party

service providers. The principal risks and uncertainties facing the

Company, which have been identified by the Board, are described in

the table below, together with the mitigating actions.

Description Mitigating Action

======================================= =================================================

Market, Economic and Political An explanation of these risks and

Risk the management of them is included

The Company's assets consist in Note 16 to the Financial Statements

mainly of listed securities on pages 81 to 83 of the 2023 Annual

and the principal risks are Report. The risk is considered to

therefore market-related. have increased due to increased interest

This includes concerns about rates and inflation. The Board considers

stock market volatility caused the composition and diversification

by geopolitical instability, of the portfolio by industry, size

political change, economic and growth rates, as well as purchases

growth, interest rates, currency, and sales, at each meeting, and in

and other price risks, as monthly papers. Individual holdings

well as national or global are discussed with the Manager, as

crises that are harder to well as views by sector and industry.

predict and may cause major

market shocks

======================================= =================================================

Investment Strategy Risk The Board regularly reviews and monitors:

The Company and its investment the Company's investment objective,

objective may become unattractive policy and strategy; the portfolio

to investors, leading to reduced and its performance; longer term trends

returns for shareholders, in investor demand; and the performance

decreased demand for the Company's of the Manager in operating the investment

shares, reduced value of shareholder policy against the long-term objectives

funds and possible widening of the Company. If appropriate, the

of the share price discount Board can propose changes in the investment

to NAV. objective or undertake a strategic

review as it has done this year. The

risk increased during the year due

to the widening discount of the share

price to NAV.

======================================= =================================================

Investment Management Risk The Board relies on the Investment

Investment risk arises from Manager's skills and judgment to make

the Company's exposure to investment decisions based on research

variations of share prices and analysis of stocks and sectors.

within its portfolio in response The Board regularly monitors the investment

to individual company and performance of the portfolio and reviews

to wider Japanese or international holdings, purchases and sales on a

factors. Investment in a focussed monthly basis, as well as with the

portfolio of shares can lead Manager at Board meetings. The Board

to greater short-term changes regularly reviews performance data

in the portfolio's value than and attribution analysis and other

in a larger portfolio of stocks relevant factors and, were any underperformance

and these variations will seen as likely to be sustained, would

be amplified by the use of be able to take remedial measures,

gearing. Inappropriate investment such as a strategic review.

decisions may result in the

Company's underperformance

against the benchmark index

and peer group and a widening

of the

Company's discount.

======================================= =================================================

Operational Risk The Manager has extensive business

The Company relies on a number continuity procedures and contingency

of third-party service providers, arrangements to ensure that they are

principally the Manager, Registrar, able to continue to service their

Custodian and Depositary. clients. Third parties are subject

Major events or market developments, to risk-based reviews by the Manager.

including significant corporate The Board reviews reports on the operation

transactions, geopolitical and efficacy of the risk management

developments or global pandemic and control systems of the Manager

may impact the operations and other key third- party service

and services provided by third-party providers, including those relating

suppliers. to cyber security and cybercrime.

======================================= =================================================

Regulatory Risk The Board is active in ensuring that

The Company operates under it fully complies with all applicable

a complex regulatory environment. laws and regulation and is assisted

Serious breaches of regulations, by the Manager and other advisers

such as Section 1158 of the in doing this. The Board believes

Corporation Tax Act 2010, that, while the consequences of non-compliance

the UKLA Listing Rules, Companies can be severe, the control arrangements

Act 2006 and the Alternative it has put in place reduce the likelihood

Investment Fund Managers Directive of

could lead to a number of this happening.

detrimental outcomes and reputational

damage.

======================================= =================================================

Share Price and Discount Risk The price of the Company's shares

The principal risks described and its discount to NAV are not wholly

above can affect the movement within the Company's control, as both

of the Company's share price are subject to market volatility.

and in some cases have the The discount has widened during the

potential to increase the year. The Board has limited influence

discount in the market value over the discount, when deemed to

of the Company compared with be in the best interests of shareholders,

the NAV. through its ability to authorise the

buyback of existing shares up to a

limit agreed by shareholder resolution.

The share price, NAV and discount

are monitored daily by the Manager

and regularly reviewed by the Board.

If the average discount exceeds 10%

during the 90 day monitoring period

preceding the Company's financial

year end, the Board will offer shareholders

the opportunity to vote on the continuation

of the Company at a general meeting.

A continuation vote has been triggered

by the widening discount and, accordingly,

will be put to shareholders at the

forthcoming AGM.

======================================= =================================================

Leverage The maximum level of borrowing permitted

The Company may borrow money by the Company's investment policy

for investment purposes. If is 25% of net assets. All borrowing

investments fall in value, requires prior approval of the Board.

gearing has the effect of In order to manage the level of gearing,

magnifying the extent of this the Board has established a gearing

fall. level of around 10% of net assets

although, with stock market fluctuations,

this may range between 5% and 15%.

The Board regularly reviews the Company's

gearing levels and its compliance

with bank covenants.

======================================= =================================================

ESG Risks The Board supports the Manager's approach

There is a risk that the Manager's to integration of ESG in Equity investing,

integration of ESG in the including its active engagement with

investment process is not companies and analysis of ESG and

optimised, potentially leading risks associated with climate change.

to loss of value to the Company's The Board reviews ESG engagement by

portfolio. The Manager also the Manager on a quarterly basis,

monitors and responds to ESG and company research notes in the

and sustainability risks at board papers address and rate ESG

portfolio companies as they risks for all new investments.

evolve over time. This may

have a positive or negative

impact on performance.

======================================= =================================================

Promoting the Success of the Company

The Board is required to report on how it has discharged its

duties and responsibilities under section 172 of the Companies Act

2006 (the "s172 Statement"). Under section 172, the Directors have

a duty to promote the success of the Company for the benefit of its

members as a whole, taking into account the likely long term

consequences of decisions, the need to foster relationships with

the Company's stakeholders and the impact of the Company's

operations on the environment.

The Board comprises four independent non-executive Directors and

has no employees or customers in the traditional sense. As the

Company has no employees, the culture of the Company is embodied in

the Board of Directors. The Board seeks to promote a culture of

strong governance and to challenge, in a constructive and

respectful way, the Company's advisers and other stakeholders.

The Board's principal concern has been, and continues to be, the

interests of the Company's shareholders and potential

investors.

The Manager undertakes an annual programme of meetings with the

largest shareholders and investors and reports back to the Board on

issues raised at these meetings. The Investment Manager, who is

based in the Manager's Tokyo office, will attend such meetings. The

Board encourages all shareholders to attend and participate in the

Company's AGM and shareholders can contact the Directors via the

Company Secretary. Shareholders and investors can obtain up-to-date

information on the Company through its website and the Manager's

information services and have direct access to the Company through

the Manager's customer services team or the Company Secretary.

As an investment trust, a number of the Company's functions are

outsourced to third parties. The key outsourced function is the

provision of investment management services to the Manager and

other stakeholders support the Company by providing secretarial,

administration, depositary, custodial, banking and audit

services.

The Board undertakes a robust evaluation of the Manager,

including investment performance and responsible ownership, to

ensure that the Company's objective of providing sustainable income

and capital growth for its investors is met. The Board typically

visits the Manager's offices in Tokyo annually and last visited in

November 2022. This enables the Board to conduct face to face

meetings with the fund management and research teams. The portfolio

activities undertaken by the Manager on behalf of the Company can

be found in the Manager's Review and details of the Board's

relationship with the Manager and other third party providers,

including oversight, is provided in the Statement of Corporate

Governance (pages 44 to 49 of the 2023 Annual Report).

Whilst the Company's direct operations are limited, the Board

recognises the importance of considering the impact of the

Company's investment strategy and policy on the wider community and

the environment. The Board believes that its oversight of

environmental, social and governance ("ESG") matters is an

important part of its responsibility to stakeholders, and its

proper consideration aligns with the Company's objective to achieve

long-term capital growth. The Board's review of the Manager

includes an assessment of their approach to ESG integration in the

investment process. Further information can be found on pages 92 to

94 of the 2023 Annual Report.

During the year, the Board focused on the performance of the

Manager in achieving the Company's investment objective within an

appropriate risk framework. In addition to ensuring that the

Company's investment objective was being pursued, key decisions and

actions undertaken by the Directors during the financial year and

up to the date of this report have included:

- conducting an extensive review of investment strategies in the

Japan fund sector following the ongoing evaluation of the

performance of the Manager, and in view of the requirement to hold

a continuation vote under the articles of association. As a result

of this process, the Board has announced the agreement of heads of

terms for a proposed combination of the assets of the Company with

the assets of Nippon Active Value Fund plc.

- renewal of the Company's fixed-term loan facility which

matured in January 2023, in order to continue to take advantage of

the Company's investment structure to allow the use of gearing,

where appropriate, to enhance long-term total returns to

shareholders.

- the appointment of Johnston Carmichael LLP as the Company's

external auditor, following an early audit tender (more details can

be found on page 10 of the 2023 Annual Report).

- change of the Company's registrar following review of contract

provisions, specifically around data protection, and fees (new

contact details can be found on page 106 of the 2023 Annual

Report).

- the decision to pay an interim dividend of 5.0p per share and

a second interim dividend of 7.0p.

In summary, the Directors are cognisant of their duties under

section 172 and decisions made by the Board take into account the

interests of all of the Company's key stakeholders and reflect the

Board's belief that the long-term sustainable success of the

Company is linked directly to its key stakeholders.

Key Performance Indicators ("KPIs")

Performance is compared against the Company's benchmark, the

TOPIX Index in sterling terms, and its Peer Group. In view of the

Manager's style of investing, there can be, in the short-term,

considerable divergence from both comparators. The Board uses a

three year rolling performance for the following KPIs: total NAV

return against the benchmark index and share price total return

compared with the Peer Group. The KPI for the discount comparison

to its Peer Group is over one year. The Company's Ongoing Charges

Ratio ("OCR") is compared with the Peer Group, taking into account

its size, to ensure that total running costs remain

competitive.

Achievement

KPI of KPI

============================ ===========

NAV (total return) relative No

to the Company's benchmark

index (3 years) (A)

============================ ===========

Share price (total return) No

vs Peer Group (3 years) (A)

============================ ===========

Discount or premium of the No

share price to NAV vs Peer

Group on an annual average

(1 year) (A)

============================ ===========

OCR vs Peer Group (B) No

============================ ===========

(A) See page 22 of the 2023 Annual Report for details of key

performance indicator results.

(B) See page 87 of the 2023 Annual Report for details of the OCR

calculation.

Over the three year period to 31 March 2023, the Company

underperformed against all of the KPI's monitored by the Board.

Duration

The Company does not have a fixed life. However, under the

articles of association (the "Articles"), if, in the 90 days

preceding the Company's financial year-end (31 March), the Ordinary

shares have been trading, on average, at a discount in excess of

10% to the underlying NAV over the same period, notice will be

given of an ordinary resolution to be proposed at the following AGM

to approve the continuation of the Company. In the 90 days to 31

March 2023, the Ordinary shares traded at an average discount of

14.0% to the underlying NAV and therefore exceeded the 10% limit

defined in the Articles. A continuation vote is therefore required.

A notice confirming the date of the AGM will be sent in due course

together with details of General Meetings where resolutions will be

recommended relating to the Proposal.

Board Diversity

The Board recognises the importance of having a diverse group of

Directors with the appropriate mix of competencies and expertise to

allow the Board to fulfil its obligations. At 31 March 2023 there

were two male Directors and two female Directors, all of whom bring

a variety of knowledge, experience and skills and contribute

individually to the Board's performance. Further detail, including

the Board's first formal Diversity Statement, is provided on pages

45 to 46 of the 2023 Annual Report.

Employee, Environmental, Social & Human Rights Issues

The Company has no employees as it has delegated operational

management to the Manager. There are therefore no disclosures to be

made in respect of employees. Further information on the Manager's

approach to socially responsible investment can be found on pages

92 to 94 of the 2023 Annual Report.

Global Greenhouse Gas Emissions and Streamlined Energy and

Carbon

Reporting ("SECR")

All of the Company's activities are outsourced to third parties.

The Company therefore has no greenhouse gas emissions to report

from the operations of its business other than Directors' travel,

nor does it have responsibility for any other emissions producing

sources under the Companies Act 2006 (Strategic Report and

Directors' Reports) Regulations 2013. For the same reason as set

out above, the Company considers itself to be a low energy user

under the SECR regulations and therefore is not required to

disclose energy and carbon information.

Modern Slavery Act

Due to the nature of the Company's business, being a company

that does not offer goods and services to customers, the Board

considers that it is not within the scope of the Modern Slavery Act

2015 because it has no turnover. The Company is therefore not

required to make a slavery and human trafficking statement. In any

event, the Board considers the Company's supply chains, dealing

predominantly with professional advisers and service providers in

the financial services industry, to be low risk in relation to this

matter.

Viability Statement

The Company's business model is designed to deliver long term

capital growth to its shareholders through investment in readily

realisable stocks in the Japanese equity markets. Its plans are

therefore based on having no fixed or limited life provided the

global equity markets continue to operate normally.

The Board has assessed the Company's prospects over a three year

period, notwithstanding its announcement on 18 May 2023 of the

proposed combination with NAVF and the material uncertainty

identified in relation to this matter. The Board considers that

this period reflects a balance between looking out over a long-term

horizon and the inherent uncertainties of looking out further than

three years. In assessing the viability of the Company over the

review period the Directors have focused upon the following

factors:

- The requirement under the articles of association to hold a

continuation vote at the next AGM;

- The ongoing relevance of the Company's investment objective in

the current economic environment, considered via an extensive

strategic review;

- The Proposal arising from the strategic review, to combine the

assets of the Company with those of NAVF by means of a section 110

scheme of reconstruction, which is subject to shareholder and

regulatory approvals at the date of this Annual Report;

- The principal risks detailed in the strategic report on pages

16 to 17 of the 2023 Annual Report and the steps taken to mitigate

these risks;

- The liquidity of the Company's underlying portfolio, which is

invested in liquid and readily realisable securities;

- Recent stress testing has confirmed that shares can be easily

liquidated, despite continued uncertainty and a volatile economic

environment;

- The level of forecast revenue surplus generated by the Company

and its ability to achieve the dividend policy;

- The level of gearing is closely monitored by the Board.

Covenants are actively monitored and there is adequate headroom in

place; and

- The Company has a fixed term loan facility of JPY 1.3 billion

in place until January 2024 and a revolving loan facility of JPY

1.0 billion in place until December 2024. The Company has the

ability to renew or repay its gearing through proceeds from equity

sales.

Following the strategic review, the Board believes that the

Proposal will benefit shareholders and expects that the required

approvals will be received at a general meeting of the Company.

Should the Proposal not receive the necessary approval, or the

Continuation vote not be passed, the Board believes from the work

carried out during their review, that other attractive options

remain available for shareholders in the Japan sector which can be

pursued.

Accordingly, taking into account the Company's current position

and its prospects, and the potential impact of its principal risks

and uncertainties, the Directors have a reasonable expectation that

the Company will be able to continue in operation and meet its

liabilities as they fall due for a period of three years from the

date of this Report.

In making this assessment, the Board has considered that matters

such as significant economic or stock market volatility (including

the possibility of a greater than anticipated economic impact of

geopolitical developments), a substantial reduction in the

liquidity of the portfolio, or changes in investor sentiment, and

the outcome of the general meeting(s), could have an impact on its

assessment of the Company's prospects and viability in the

future.

The Strategic Report was approved by the Board of Directors and

signed on its behalf for abrdn Japan Investment Trust plc (formerly

named Aberdeen Japan Investment Trust plc) by:

Karen Brade,

Chairman

5 June 2023

Results

Key Performance Indicators

Return since

1 year 3 year 5 year 8 October

2013

return return return (change of

mandate)

================================== ======== ========= ======== ==============

Net asset value total

return(A) -4.4% +14.9% +6.5% +100.4%

================================== ======== ========= ======== ==============

Topix Index total return +2.8% +24.8% +19.5% +105.1%

================================== ======== ========= ======== ==============

Share price total return(A) -10.0% +8.5% +5.3% +85.8%

================================== ======== ========= ======== ==============

Peer Group share price

total return -6.4% +29.3% +6.5% +118.5%

---------------------------------- -------- --------- -------- --------------

Over period

since

Over Over Over 8 October

2013

1 year 3 years 5 years (change of

mandate)

================================== ======== ========= ======== ==============

Average discount - Company -14.5% -12.5% -12.1% -10.8%

================================== ======== ========= ======== ==============

Average discount - Peer

Group -9.6% -8.6% -7.5% -6.7%

---------------------------------- -------- --------- -------- --------------

(A) Considered to be an Alternative Performance Measure. See page

88 of the 2023 Annual Report for further details.

Source: abrdn plc, Lipper & Morningstar.

Peer group is the average of Baillie Gifford Japan, CC Japan Income

& Growth, Fidelity Japan, JP Morgan Japanese and Schroder Japan Growth.

Ten Year Financial Record

Year to 31 March 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

======================== ======= ====== ======= ====== ======= ======= ====== ======= ======= =======

Total revenue (GBP'000) 1,710 1,222 1,681 2,015 1,879 1,839 1,981 1,815 1,996 1,804

------------------------ ------- ------ ------- ------ ------- ------- ------ ------- ------- -------

Per share (p)

======================== ======= ====== ======= ====== ======= ======= ====== ======= ======= =======

Net revenue return 6.00 3.70 5.67 7.25 6.59 6.83 8.08 6.57 8.54 7.11

======================== ======= ====== ======= ====== ======= ======= ====== ======= ======= =======

Total return (30.91) 174.47 (36.18) 102.69 75.83 (70.63) 19.03 203.49 (81.70) (33.72)

======================== ======= ====== ======= ====== ======= ======= ====== ======= ======= =======

Dividends paid from

revenue reserves 4.50 2.60 4.20 6.00 5.20 5.40 11.00 9.50 11.50 10.10

======================== ======= ====== ======= ====== ======= ======= ====== ======= ======= =======

Dividends paid from

capital reserves - - - - - - 4.00 5.50 3.50 1.90

======================== ======= ====== ======= ====== ======= ======= ====== ======= ======= =======

Net asset value 377.94 547.91 511.29 611.41 682.31 607.89 617.09 807.66 713.43 667.26

------------------------ ------- ------ ------- ------ ------- ------- ------ ------- ------- -------

shareholders' funds

(GBP'000) 55,148 79,949 79,723 92,168 100,472 88,025 85,206 107,438 89,930 82,954

------------------------ ------- ------ ------- ------ ------- ------- ------ ------- ------- -------

Ten Largest Investments

As at 31 March 2023

4.6% Sony Corporation 4.0% Tokio Marine Holdings,

Total assets The electronics giant Total assets Inc.

has a dominant market Tokio Marine is the

share in image sensors most progressive of

and video games. The the three largest local

company has been able property and casualty

to leverage on these insurers. Of note is

and its other distinct its positive view on

businesses - particularly shareholder returns,

in music, TV and motion which we expect will

pictures - to collectively grow gradually as it

create greater value. makes further inroads

abroad that add value

to its business.

3.7% Keyence Corporation 3.2% Shin-Etsu Chemical Company

Total assets Keyence runs an efficient Total assets The Japanese maker of

direct sales organisation specialty chemicals

that develops and manufactures remains a global leader

sensors, vision systems, in the majority of its

barcode readers, and businesses: PVC, silicon

laser markers, amongst wafers, and silicones,

other factory automation amongst others. Over

equipment, across the the long term, the company

world. The company has been very prudent

has a cash generative in its use of capital.

business and is backed

by a strong balance

sheet and technological

expertise.

2.9% Advantest Corporation 2.9% Asahi Group Holdings

Total assets Advantest operates Total assets Japan's largest brewer

in a duopolistic market is well positioned to

of semiconductor testing achieve growth through

equipment. Demand is premiumisation, cost

expected to rise from synergies and cross-selling

increasingly complex across different brands

components and from and geographies. In

a wider range of applications, addition to its leading

including 5G networks. market share in Japan,

the company has a strong

presence in Europe and

Australia, a result

of acquisitions in recent

years.

2.8% Hitachi 2.8% Misumi Group

Total assets Hitachi is Japan's Total assets Misumi produces and

major industrial and distributes precision

engineering conglomerate. machinery parts and

Hitachi has gone through other automation equipment,

a restructuring over and it has successfully

the last decade, which extended its business

has led to an expansion model abroad in recent

in margins and a business years. We see its growth

portfolio that is more prospects underpinned

resilient to business by China and expansion

cycles. to new areas such as

logistics automation.

2.7% Nippon Paint Holdings 2.4% Toyota Motor Corporation

Total assets Company Total assets The automaker has continued

Nippon Paint is among to gain market share

the world's leading and post strong profitability,

paint companies. It despite a challenging

has a strong presence operating environment.

in decorative paints In the medium to longer

in Asia and Oceania, term, the company's

holding the top spot focus on research and

in both China and Australia. technology places it

It derives most of ahead of many peers

its earnings from the in the areas of autonomous

decorative paint market driving, connectivity,

in China. sharing and subscription

services, and electrification.

Investment Portfolio

As at 31 March 2023

========================== ================================== ========= ===========

Valuation Total

2023 investments

Company Sector GBP'000 %

========================== ================================== ========= ===========

Sony Corporation Leisure Goods 4,279 4.6

========================== ================================== ========= ===========

Tokio Marine Holdings,

Inc. Non-life Insurance 3,699 4.0

========================== ================================== ========= ===========

Electronic and Electrical

Keyence Corporation Equipment 3,484 3.8

========================== ================================== ========= ===========

Shin-Etsu Chemical

Company Chemicals 2,994 3.2

========================== ================================== ========= ===========

Technology Hardware and

Advantest Corporation Equipment 2,754 3.0

========================== ================================== ========= ===========

Asahi Group Holdings Beverages 2,734 2.9

========================== ================================== ========= ===========

Hitachi General Industrials 2,613 2.8

========================== ================================== ========= ===========

Misumi Group Industrial Engineering 2,589 2.8

========================== ================================== ========= ===========

Nippon Paint Holdings

Company General Industrials 2,511 2.7

========================== ================================== ========= ===========

Toyota Motor Corporation Automobiles and Parts 2,252 2.4

-------------------------- ---------------------------------- --------- -----------

Top ten investments 29,909 32.2

-------------------------------------------------------------- --------- -----------

Resorttrust Travel and Leisure 1,931 2.1

========================== ================================== ========= ===========

Technology Hardware and

Tokyo Electron Equipment 1,900 2.1

========================== ================================== ========= ===========

Telecommunications Service

KDDI Corporation Providers 1,862 2.0

========================== ================================== ========= ===========

Technology Hardware and

Ibiden Equipment 1,835 2.0

========================== ================================== ========= ===========

AGC General Industrials 1,801 1.9

========================== ================================== ========= ===========

Real Estate Investment

Tokyu Fudosan Holdings and Services 1,792 1.9

========================== ================================== ========= ===========

Mitsubishi UFJ Financial

Group Banks 1,781 1.9

========================== ================================== ========= ===========

Seven & I Holdings Retailers 1,757 1.9

========================== ================================== ========= ===========

Ajinomoto Food Producers 1,695 1.8

========================== ================================== ========= ===========

Welcia Holdings Personal Care, Drug and

Company Grocery Stores 1,673 1.8

-------------------------- ---------------------------------- --------- -----------

Top twenty investments 47,936 51.6

-------------------------------------------------------------- --------- -----------

Daiichi Sankyo Pharmaceuticals and Biotechnology 1,657 1.8

========================== ================================== ========= ===========

Medical Equipment and

Olympus Corporation Services 1,639 1.8

========================== ================================== ========= ===========

Daikin Industries Construction and Materials 1,623 1.7

========================== ================================== ========= ===========

Nomura Research Software and Computer

Institute Services 1,584 1.7

========================== ================================== ========= ===========

Sho-Bond Holdings

Company Construction and Materials 1,549 1.7

========================== ================================== ========= ===========

Denso Corporation Automobiles and Parts 1,519 1.6

========================== ================================== ========= ===========

Household Goods and Home

Shoei Co Construction 1,497 1.6

========================== ================================== ========= ===========

Suntory Beverage

& Food Beverages 1,478 1.6

========================== ================================== ========= ===========

Medical Equipment and

Hoya Corporation Services 1,451 1.6

========================== ================================== ========= ===========

Zenkoku Hosho Company Finance and Credit Services 1,419 1.5

-------------------------- ---------------------------------- --------- -----------

Top thirty investments 63,352 68.2

-------------------------------------------------------------- --------- -----------

Software and Computer

TechnoPro Holdings Services 1,411 1.5

========================== ================================== ========= ===========

Astellas Pharma Pharmaceuticals and Biotechnology 1,396 1.5

========================== ================================== ========= ===========

Tokyo Century Corporation Consumer Services 1,282 1.4

========================== ================================== ========= ===========

Electronic and Electrical

Jeol Equipment 1,219 1.3

========================== ================================== ========= ===========

Technology Hardware and

Kaga Electronics Equipment 1,191 1.3

========================== ================================== ========= ===========

Amada Company Industrial Engineering 1,187 1.3

========================== ================================== ========= ===========

Fanuc Corporation Industrial Engineering 1,186 1.3

========================== ================================== ========= ===========

Milbon Company Personal Goods 1,176 1.3

========================== ================================== ========= ===========

Kansai Paint Company General Industrials 1,152 1.2

========================== ================================== ========= ===========

Shiseido Company Personal Goods 1,122 1.2

-------------------------- ---------------------------------- --------- -----------

Top forty investments 75,674 81.5

-------------------------------------------------------------- --------- -----------

Nabtesco Corporation Industrial Engineering 1,097 1.2

========================== ================================== ========= ===========

Software and Computer

Otsuka Corporation Services 1,062 1.1

========================== ================================== ========= ===========

Internet Initiative Telecommunications Service

Japan Providers 1,043 1.1

========================== ================================== ========= ===========

Household Goods and Home

Makita Corporation Construction 1,029 1.1

========================== ================================== ========= ===========

Nitori Holdings Retailers 1,024 1.1

========================== ================================== ========= ===========

Chugai Pharmaceutical

Company Pharmaceuticals and Biotechnology 965 1.0

========================== ================================== ========= ===========

Software and Computer

Zuken Services 887 1.0

========================== ================================== ========= ===========

Software and Computer

Appier Group Services 823 0.9

========================== ================================== ========= ===========

Daiseki Company Waste and Disposal Services 735 0.8

========================== ================================== ========= ===========

Technology Hardware and

Elecom Company Equipment 725 0.8

-------------------------- ---------------------------------- --------- -----------

Top fifty investments 85,064 91.6

-------------------------------------------------------------- --------- -----------

Household Goods and Home

Katitas Construction 686 0.7

========================== ================================== ========= ===========

Software and Computer

Sansan Services 678 0.7

========================== ================================== ========= ===========

Medical Equipment and

As One Corporation Services 636 0.7

========================== ================================== ========= ===========

Recruit Holdings

Corporation Industrial Support Services 630 0.7

========================== ================================== ========= ===========

Electronic and Electrical

Kohoku Kogyo Equipment 616 0.7

========================== ================================== ========= ===========

Technology Hardware and

NEC Corporation Equipment 608 0.7

========================== ================================== ========= ===========

Medical Equipment and

Menicon Company Services 567 0.6

========================== ================================== ========= ===========

Medical Equipment and

Asahi Intecc Company Services 517 0.6

========================== ================================== ========= ===========

Takuma Construction and Materials 463 0.5

========================== ================================== ========= ===========

Yamaha Corporation Leisure Goods 444 0.5

-------------------------- ---------------------------------- --------- -----------

Top sixty investments 90,909 98.0

-------------------------------------------------------------- --------- -----------

Investment Banking and

WealthNavi Brokerage Services 400 0.4

========================== ================================== ========= ===========