Invesco Select Trust Plc Restructuring Proposals

14 Diciembre 2023 - 1:00AM

UK Regulatory

TIDMIVPU TIDMIVPM TIDMIVPG TIDMIVPB

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED IN IT ARE NOT FOR RELEASE,

PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR

INTO, THE UNITED STATES, AUSTRALIA, CANADA, JAPAN OR THE REPUBLIC OF SOUTH

AFRICA OR ANY JURISDICTION FOR WHICH THE SAME COULD BE UNLAWFUL.

The information communicated in this announcement is deemed to constitute inside

information as stipulated under the Market Abuse Regulations (EU) No. 596/2014

which is part of UK law by virtue of the European Union (Withdrawal) Act 2018,

as amended (the Market Abuse Regulation). The person responsible for arranging

for the release of this announcement on behalf of the Company is Invesco Asset

Management Limited acting as company secretary. Upon the publication of this

announcement, this information is considered to be in the public domain.

Legal Entity Identifier: 549300JZQ39WJPD7U596

14 December 2023

Invesco Select Trust Plc

Restructuring Proposals

The Board of Invesco Select Trust Plc (the "Company") has undertaken a review of

the Company and its strategy, with the objective of broadening the appeal of the

Company as well as improving liquidity and narrowing the discount at which the

Company's shares trade. Consequently, the Board intends to put forward proposals

to the Company's shareholders ("Shareholders") to simplify the Company's

corporate structure and to introduce certain features that it believes will

appeal to a broad investor base (the "Proposals").

Background

The Company was launched in 2006 with a multi-share class structure to enable

Shareholders to invest in a wide array of asset classes and to rebalance their

portfolio by allowing them to convert, tax-efficiently between share classes.

However, in recent years, the Company has seen a limited take-up of the

conversion opportunities between the existing four share classes: Global Equity

Income ("Global Share Class"); UK Equity Income ("UK Share Class"); Balanced

Risk Allocation ("Balanced Risk Class"); and Managed Liquidity ("Managed

Liquidity Class"). The Balanced Risk Class and the Managed Liquidity Class

(together, the "Smaller Share Classes") now amount to, in aggregate, only circa

3.6 per cent. of the net assets of the Company as at 12 December 2023. Further,

with demand from investors for larger, more liquid investment vehicles, the

Board believes it could be increasingly challenging to market separately the

Global Share Class and the UK Share Class in their current form, with the

structure potentially presenting an additional hurdle for those looking to

invest.

The Proposals

The Board believes that the Global universe offers the broadest set of

investment opportunities for equity investors whilst also providing

diversification benefits for UK investors. Additionally, the Board has

confidence in its award-winning Global Equity Income fund manager, Stephen

Anness, to continue to seek out investment opportunities for the ongoing benefit

of shareholders. The Board believes his approach to be rigorous, differentiated

and balanced. Under Stephen's stewardship the Global Equity Income portfolio has

delivered strong, sector-leading NAV total return performance:

+--------+---------------+-----------------+--------------+------------------+

| |Global Share |MSCI World Index |Outperformance|AIC Global Equity |

| |Class NAV Total|£GBP Total Return| |Income Sector rank|

| |Return | | | |

+--------+---------------+-----------------+--------------+------------------+

|One year|16.8% |6.3% |10.5% |1st |

|to 30 | | | | |

|November| | | | |

|2023 | | | | |

+--------+---------------+-----------------+--------------+------------------+

|Three |52.2% |29.3% |22.9% |1st |

|years to| | | | |

|30 | | | | |

|November| | | | |

|2023 | | | | |

+--------+---------------+-----------------+--------------+------------------+

Source: LSEG Data Analytics / AIC

Accordingly, the Board has concluded that it would be in the best interests of

shareholders as a whole to consolidate the UK Share Class and the Smaller Share

Classes into the Global Share Class (the "Consolidation"). As part of the

Consolidation the Board will undertake a 15 per cent. tender offer on the UK

Share Class. Additionally, given the Smaller Share Classes offer significantly

differentiated risk profiles and asset exposures to the Global Share Class, the

Board will provide the Smaller Share Classes with the opportunity for a full

cash exit through a tender offer. The tender offer prices will be based on the

NAVs of the respective share class less the costs of the Proposals less a 2 per

cent. discount.

The Consolidation would result in the Company having net assets of approximately

£182 million[1]. As compared with any of the Company's current share classes

individually, the Board believes this should increase the appeal to investors

and would be expected to have a beneficial impact on liquidity, and potentially

on the discount of the enlarged Global Share Class.

The investment objective and investment policy of the Global Share Class will be

retained, reflecting the Board's confidence in Stephen's investment process as

well as the strength and depth of his team.

Dividend enhancement

In recognition of the increasing importance of dividends to Shareholders in the

current economic environment, the Board intends, subject to shareholder approval

of the Proposals, to enhance the current dividend policy of the Global Share

Class which consists of three equal interim dividends and a `wrap-up' fourth

interim dividend. The new policy will involve paying at least 1 per cent. of cum

-income net asset value ("NAV"), paid quarterly, calculated on the unaudited

year end NAV. The intention would be that these dividends would be paid from the

Company's revenues and capital reserves as required. The Board believes that

this should provide both an enhanced dividend compared to current levels on the

Global Share Class and, once the relevant NAV is known, a smoother, predictable

income stream to Shareholders.

Continuation votes and discount management

If the Proposals are approved, the Board intends to put forward a vote at the

Company's AGM in 2026 for the continuation of the Company (the "2026

Continuation Vote"). If the 2026 Continuation Vote is passed the Board will put

forward a continuation vote at the AGM in 2031 and, if passed, at each fifth AGM

thereafter.

The Board also intends to introduce a discount control policy in the enlarged

Global Share Class which will seek to maintain the discount at less than 10 per

cent., in normal market conditions.

Next steps

The Proposals will require the approval of Shareholders. The Board has received

indications of support for the Proposals from those Shareholders it was able to

consult through market soundings. The Company currently anticipates being able

to publish a circular and notice of meeting(s) in connection with the Proposals

in Q1 2024.

In order to facilitate the Proposals, the Board has determined to postpone the

conversion that would have taken place in February 2024.

For further information please contact:

Chair +44 (0)20 7543 3559

Victoria Muir (via James Poole, Invesco

Asset Management Limited, company

secretary)

Invesco Fund Managers Limited +44 (0)20 7543 3500

Will Ellis

John Armstrong-Denby

Winterflood Securities Limited +44 (0) 20 3100 0000

Neil Morgan

Darren Willis

[1] Based on the NAV as at 12 December 2023 and an assumption that both of the

Smaller Share Classes and the UK Share Class take up their respective tender

offers in full.

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

December 14, 2023 02:00 ET (07:00 GMT)

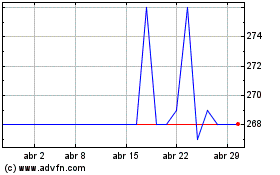

Invesco Select (LSE:IVPG)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

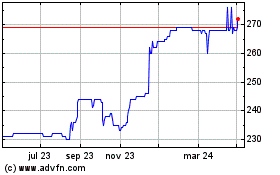

Invesco Select (LSE:IVPG)

Gráfica de Acción Histórica

De May 2023 a May 2024