TIDMMTRO

RNS Number : 0531P

Metro Bank Holdings PLC

09 October 2023

NOT FOR PUBLICATION, RELEASE OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART IN, OR INTO THE UNITED STATES,

AUSTRALIA, CANADA, JAPAN OR SOUTH AFRICA OR ANY OTHER JURISDICTION

IN WHICH SUCH PUBLICATION, RELEASE OR DISTRIBUTION WOULD BE

UNLAWFUL.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

CONSTITUTE OR CONTAIN ANY INVITATION, SOLICITATION, RECOMMATION,

OFFER OR ADVICE TO ANY PERSON TO SUBSCRIBE FOR, OTHERWISE ACQUIRE

OR DISPOSE OF ANY SECURITIES IN METRO BANK HOLDINGS PLC OR ANY

OTHER ENTITY IN ANY JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE UK VERSION OF REGULATION (EU) NO. 596/2014 ON

MARKET ABUSE, AS IT FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE

EUROPEAN UNION (WITHDRAWAL) ACT 2018.

Metro Bank Holdings PLC (LSE: MTRO LN)

8 October 2023

Metro Bank Holdings PLC ("Metro Bank") (the "Company")

Legal Entity Identifier: 984500CDDEAD6C2EDQ64

Metro Bank Announces Successful Capital Package: GBP325m Capital

Raise and GBP600m Debt Refinancing

Highlights

-- Secured GBP325m capital raise , comprising GBP150m of new

equity and GBP175m of new MREL issuance, alongside GBP600m of debt

refinancing, enhancing balance sheet strength and accelerating

earnings potential.

-- Capital Package significantly strengthens CET1 ratio, takes

Metro Bank out of the CRD IV Combined Buffer and is expected to

support Metro Bank's delivery of RoTE in excess of 9% in 2025 and

low double-digit to mid-teens thereafter over the medium term.

-- Delivers a pro forma 30 June 2023 CET1 ratio in excess of 13%

and MREL ratio in excess of 21.5%.

-- Provides opportunity to grow assets significantly over the

coming years , via a gradual shift in asset side growth towards

specialist mortgages and commercial lending to optimise risk

adjusted returns; supported by continued success in raising

deposits and driving current account growth.

-- Equity raise led by Spaldy Investments Limited , Metro Bank's

largest shareholder, which is contributing GBP102m. Spaldy

Investments Limited will become the controlling shareholder of

Metro Bank upon completion of the Transaction with a c.53%

shareholding.

-- Refinancing extends the call date of the existing MREL Senior Instrument to 2028 .

-- In discussions regarding an asset sale of up to GBP3bn of

residential mortgages which are expected to reduce RWAs by c.GBP1bn

(assuming a c.GBP3bn Asset Sale), increase Metro Bank's CET1 ratio

and be earnings accretive in 2024, subject to pricing.

-- Continued positive trading in Q3 2023 , made a statutory

profit after tax and continued momentum in Personal and Business

Current Account growth and customer acquisition.

-- The Capital Package also allows Metro Bank to continue to

evolve its products and services to meet the banking needs of its

customers both digitally and in-store.

-- The Capital Package is subject to certain customary conditions and regulatory approvals.

Daniel Frumkin, Chief Executive Officer at Metro Bank, said:

"Today's announcement marks a new chapter for Metro Bank,

facilitating the delivery of continued profitable growth over the

coming years. Metro Bank made a statutory profit after tax in Q3

2023, and continues to demonstrate ongoing momentum as we strive

towards our ambition to be the UK's number one community bank.

Our strong franchise is underpinned by our loyal customer base

and engaged colleagues and we will continue to develop the Metro

Bank offer to provide the digital and physical banking services our

customers expect. We thank our shareholders and noteholders for

their continuing support of Metro Bank and our customers."

Jaime Gilinski Bacal, founder of Spaldy Investments Limited,

said:

"I have been an active investor in Metro Bank since 2019. The

opportunity to become the Bank's major shareholder is driven by my

belief in the need for physical and digital banking underpinned by

a focus on exceptional customer service. I believe that the package

announced today enables the Bank to pursue growth and build on the

foundational work undertaken over the past three years."

Update on Recent Trading

Metro Bank made a statutory profit after tax in Q3 2023 with

continued momentum in Personal and Business Current Account growth

and customer acquisition, in line with expectations. The Company's

Q3 2023 trading update will be published in early November

2023.

Agreed Capital Package

Metro Bank announces that it has secured a GBP325m capital raise

and GBP600m debt refinancing package (the "Transaction" or the

"Capital Package"), provided primarily by existing shareholders and

noteholders, and new investors, which underpins the financial

stability of the Company with growth capital to support Metro

Bank's continued progress. The Transaction (before the benefit of

the Asset Sale (see below)) will increase the Bank's CET1 capital

by approximately GBP200m, resulting in a pro forma CET1 ratio as of

30 June 2023 in excess of 13%, and extends the maturity profile of

the Company's debt securities to April 2029 (for the new MREL

Senior Instrument referred to below) and April 2034 (for the new

Tier 2 instrument referred to below). The pro forma MREL ratio

would have been at least 21.5% as at 30 June 2023 and remains above

Metro Bank's minimum regulatory capital requirements (including the

CRD IV Combined Buffer).

As part of the Transaction, a number of existing shareholders

have given commitments to provide GBP150m of new equity (the

"Equity Raise"), and a number of existing noteholders have

committed to subscribe for GBP175m at par value in a new MREL

senior instrument maturing April 2029 (call date April 2028) to be

issued by Metro Bank Holdings PLC (the "new MREL Senior

Instrument") (the "new MREL Raise").

The liability management exercise via consent solicitation has

secured 100% support from noteholders identified and is expected to

reach 75% voting thresholds required for 100% noteholder

participation involving the GBP250m fixed rate reset callable

subordinated notes due June 2028 issued by Metro Bank plc (the

"Tier 2 Instrument") and the GBP350m fixed rate senior notes due

October 2025 issued by the Company (the "MREL Senior Instrument")

(the "Debt Refinancing").

The Debt Refinancing involves:

-- a 40% haircut on the notional amount of the Tier 2

Instrument, rising to 45% if 75% (by value) of noteholders of the

Tier 2 Instrument do not enter into lock-up agreements supporting

the Debt Refinancing by 13 October 2023, resulting in an increase

to Metro Bank's CET1 capital of up to GBP100m (assuming the 40%

haircut);

-- the exchange of the balance of the notional amount of the

Tier 2 Instrument on a par for par basis for a new subordinated

10NC5 Tier 2 instrument to be issued by Metro Bank Holdings PLC

with a coupon of 14%, a call date of April 2029 and a maturity date

of April 2034; and

-- the 100% (falling to 95% % if 75% (by value) of noteholders

of the MREL Senior Instrument do not enter into lock-up agreements

supporting the Debt Refinancing by 13 October 2023) exchange of the

existing MREL Senior Instrument on a par for par basis into the New

MREL Senior Instrument.

Metro Bank expects the Transaction to complete in Q4 2023.

Separate to the Transaction, the Company is in discussions

regarding an asset sale of up to GBP3bn of residential mortgages

(the "Asset Sale") consistent with the successful similar

transaction executed in December 2020. The Asset Sale is expected

to be CET1 ratio and MREL ratio accretive, reducing RWAs by

c.GBP1bn (assuming a c.GBP3bn Asset Sale) and allowing Metro Bank

to reinvest proceeds into cash at a higher yield, subject to

pricing.

The Transaction and Asset Sale will put Metro Bank in a strong

position to accelerate earnings growth. Metro Bank is expected to

deliver a RoTE in excess of 9% in 2025 and low double-digit to

mid-teens thereafter over the medium term.

Details of the Capital Package

The Capital Package comprises three key elements: the Equity

Raise, the new MREL Raise and the Debt Refinancing.

1) Equity Raise

-- GBP150m firm placing at 30p per share, underpinned by equity

commitments from a number of existing shareholders and new

investors.

-- To complete in Q4 2023, subject to shareholder approval.

-- The Equity Raise has been led by Spaldy Investments Limited,

Metro Bank's largest shareholder, which is contributing GBP102m.

Spaldy Investments Limited will become the controlling shareholder

of Metro Bank upon completion of the Transaction with a c.53%

shareholding. Spaldy Investments Limited, a shareholder in Metro

Bank since 2019, is run by Jaime Gilinski Bacal. As part of its

investment, Spaldy Investments Limited will enter into a

relationship agreement with Metro Bank governing its ongoing

relationship in accordance with the Listing Rules.

-- The Equity Raise includes a subscription by Daniel Frumkin,

Chief Executive Officer at Metro Bank, of up to GBP2m. Under

Listing Rule 11.1.10R, the participation in the Equity Raise by

Daniel Frumkin constitutes a smaller related party transaction and

as such does not require the approval of independent ordinary

shareholders of the Company.

-- The Equity Raise includes a subscription by James Hopkinson,

Chief Financial Officer at Metro Bank, of up to GBP60,000.

-- The shares will be issued at a price of 30 pence per share,

which represents a discount to the current market price of the

shares. This will result in the issued ordinary share capital of

the Company increasing. Consequently, a holder of the shares will

experience material dilution with respect to its relative ownership

interest in the Company.

2) Debt Refinancing and Maturity Extension

-- Liability management exercise via consent solicitation

securing 100% support from bondholders identified and expected to

reach 75% voting thresholds required for 100% noteholder

participation in:

o A 40% haircut, rising to 45% if 75% (by value) of noteholders

of the Tier 2 Instrument do not enter into lock-up agreements

supporting the Debt Refinancing by 13 October 2023, on the existing

GBP250m Metro Bank Tier 2 Instrument, combined with a 60% notional

exchange into a new Holdings 10NC5 Tier 2 Instrument at a 14%

coupon; and

o A 100% (falling to 95% % if 75% (by value) of noteholders of

the MREL Senior Instrument do not enter into lock-up agreements

supporting the Debt Refinancing by 13 October 2023) notional

exchange on the existing GBP350m MREL Senior Instrument for a new

MREL Senior Instrument at a 12% coupon.

-- To complete in Q4 2023 subject to noteholder approval.

3) New MREL Raise

-- GBP175m of new fixed-rate senior non-preferred notes in 6NC5

format with a coupon of 12% upsizing the senior MREL Instrument

exchange and raised with the support of existing investors.

-- To complete in Q4 2023, subject to noteholder approval.

The Equity Raise, new MREL Raise and Debt Refinancing are

inter-conditional and are subject to shareholder, noteholder

approval as well as a number of additional conditions. Shareholder

approvals will include special and ordinary resolutions, together

with an ordinary resolution of the independent shareholders (being

those not participating in the Equity Raise) to approve a waiver of

Rule 9 of the City Code on Takeovers and Mergers.

Asset Sale

In addition, Metro Bank is in discussions to execute the Asset

Sale, which will further enhance its capital ratios.

-- Metro Bank is in discussions regarding the sale of up to

GBP3bn of residential mortgages in Q4 2023.

-- The sale is expected to be CET1 ratio and MREL ratio

accretive, reducing RWAs by c.GBP1bn (assuming a c.GBP3bn Asset

Sale) and allowing Metro Bank to reinvest proceeds into cash at a

higher yield, subject to pricing.

Morgan Stanley is acting as Lead Financial Adviser, Debt

Financial Adviser and Asset Sale Adviser. RBC Capital Markets is

acting as Financial Adviser, Sponsor and Sole Bookrunner on the

Equity Raise. Moelis is acting as Debt Financial Adviser.

Linklaters LLP is acting as Legal Adviser.

Background to and rationale for the Capital Package

Metro Bank was founded in 2010 as the first full-service,

independent, new high street bank to open in the UK in more than

150 years. The Company seeks to become the number one community

bank in the UK and uses a disruptive, service-led, deposit-driven

funding model and a customer service proposition that emphasises

simple, straightforward banking in order to turn its customers into

"FANS" (customers who recommend someone to bank with the

Company).

Metro Bank has built a platform with scalable and robust

infrastructure, while staying true to the Company's community

banking model. However, current capital levels constrain the

Company's ability to grow lending balances significantly in the

near term.

Metro Bank's existing GBP350m MREL Senior Instrument has a first

call date of October 2024. After this date this instrument is no

longer MREL eligible, at which point absent the Transaction, or

another form of capital solution, Metro Bank would expect to fall

below MREL minima. The new MREL Senior Instrument to be issued to

the holders of the existing GBP350m MREL Senior Instrument and the

investors participating in the GBP175m MREL Raise as part of the

Transaction will have a later call date of April 2028. The existing

GBP250m Tier 2 Instrument, which is issued by Metro Bank plc, will

be replaced by a new Tier 2 instrument issued by Metro Bank

Holdings PLC with a later call date of April 2029.

The Board of Metro Bank believes that subject to easing of

capital constraints, there is opportunity for the Company to grow

assets significantly over the coming years. The envisioned growth

strategy includes a gradual shift in asset side growth towards

specialist mortgages and commercial lending to maximise risk

adjusted returns and would be supported by continued success in

raising deposits and driving current account growth, with planned

store openings in the North of England further supporting expansion

of Metro Bank's customer base.

The Company expects to deliver [1] :

-- Asset rotation towards specialist mortgages (with average

LTVs assumed to be in-line or below current profile) and commercial

lending

o Loan book contraction in 2023E owing to the portfolio sale;

double digit CAGR from 2024E to 2028E driven by shift towards

specialist mortgages and commercial lending

-- Overall deposit balances are expected to experience low to

mid-single digit growth in 2025E and 2026E

o An increase in share of Instant Access and cash ISA products

is expected over time. Current account balances are still expected

to grow notwithstanding the recent increase in deposit outflow

rates in advance of the announcement of the Capital Package

-- NIM step up approaching 3% in 2026E

o Steady growth in 2024E NIM supported by the loan portfolio

sale whereby additional cash is redeployed into treasury portfolio

at higher yields

-- Cost reduction plan launched in Q4 2023, cost savings of

GBP30M assumed per year (75% phasing in 2024E and 100% phasing from

2025E onwards) with a 40% restructuring cost expensed in 2023E. Low

single digit operating cost growth y-o-y after the cost reduction

plan as the bank benefits from significant economies of scale

o Cost:income ratio will continue to reduce y-o-y but expected

to remain above 60% until 2027E

-- RoTE in excess of 9% in 2025 and low double-digit to

mid-teens thereafter over the medium term

-- 40% blended risk weight

-- Transaction results in an illustrative pro forma 30 June 2023

CET1 ratio in excess of 13% and MREL Ratio in excess of 21.5%

Spaldy Investments Limited

Spaldy Investments Limited, which currently has a 9.2%

shareholding in Metro Bank, is owned and controlled by Mr Jaime

Gilinski Bacal, who has had long-term investments in the banking

sector including in Latin America, Spain and the UK.

Timetable

-- Publication of a prospectus and shareholder circular in the coming weeks.

-- Launch of consent solicitation process in respect of the Debt

Refinancing and documentation of the new MREL Raise in the coming

weeks.

-- Expected completion of the Capital Package in Q4 2023.

-- Further announcements will be made in due course.

Conditions of the Capital Package

The Capital Package is subject to a number of conditions, which

include:

-- Interconditionality between the Equity Raise, new MREL Raise

and the Debt Refinancing. Metro Bank has received commitments from

shareholders for the Equity Raise and commitments from investors

for the GBP175m MREL issuance; and expects to receive over 75%

approval from debtholders for the debt refinancing (enabling 100%

take-up of the debt refinancing);

-- Shareholder approval of the Equity Raise (special and

ordinary resolutions), including independent shareholder approval

(ordinary resolution of independent shareholders) of a Rule 9

waiver for the purposes of the City Code on Takeovers and

Mergers;

-- Approval of the consent solicitations for the Debt

Refinancing by the requisite majorities of the holders of the

existing MREL Senior Instrument and Tier 2 Instrument. Note Metro

Bank has received 100% support from noteholders identified and

expects to achieve the 75% voting thresholds required for 100%

noteholder participation (enabling 100% take-up of the debt

refinancing);

-- Formal PRA Change of Control approval for Spaldy Investments

Limited having been received; and

-- Formal PRA notifications and permissions having been made and granted, as applicable.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 (which forms part of

UK law pursuant to the European Union (Withdrawal) Act 2018) and

was authorised for release by Clare Gilligan, Company

Secretary.

For more information, please contact:

Metro Bank Investor Relations

Jo Roberts

+44 (0) 20 3402 8900

IR@metrobank.plc.uk

Metro Bank Media Relations

Tina Coates / Mona Patel

+44 (0)7811 246016 / +44 (0) 7815 506845

pressoffice@metrobank.plc.uk

Teneo

Charles Armitstead / Haya Herbert Burns

+44 (0)7703 330269 / +44 (0) 7342 031051

Metrobank@teneo.com

Morgan Stanley

Lead Financial Adviser

Paul Miller / Colm Donlon / Nishil Bhagani / Matthew Jarman

Debt Financial Adviser

Alex Menounos / Matteo Benedetto / Charles-Antoine Dozin

Asset Sale Adviser

Noreen Whyte / Tristan Collier

+44 (0)20 7425 8000

RBC Capital Markets

Financial Adviser, Sponsor, Bookrunner and Corporate Broker

Oliver Hearsey / Elliot Thomas / Kathryn Deegan

+44 (0)20 7653 4000

Moelis & Company

Debt Financial Adviser

Matthew Prest

+44 (0)207 634 3567

IMPORTANT NOTICES

This announcement has been issued by and is the sole

responsibility of the Company. The information contained in this

announcement is for background purposes only and does not purport

to be full or complete. No reliance may or should be placed by any

person for any purpose whatsoever on the information contained in

this announcement or on its accuracy or completeness. The

information in this announcement is subject to change.

A copy of the Prospectus and Circular, once published, will be

available on the Company's website at

https://www.metrobankonline.co.uk. Neither the content of the

Company's website nor any website accessible by hyperlinks on the

Company's website is incorporated in, or forms part of, this

announcement. The Prospectus and Circular will provide further

details of the Transaction, including securities being issued

pursuant to the Equity Raise and the Debt Refinancing.

This announcement is not for publication or distribution,

directly or indirectly, in or into the United States of America.

This announcement does not contain or constitute an offer for sale

or the solicitation of an offer to purchase securities in the

United States. No securities referred to herein have been or will

be registered under the US Securities Act of 1933 (the "Securities

Act") or under any securities laws of any state or other

jurisdiction of the United States and such securities may not be

offered, sold, taken up, exercised, resold, renounced, transferred

or delivered, directly or indirectly, within the United States

except pursuant to an applicable exemption from or in a transaction

not subject to the registration requirements of the Securities Act

and in compliance with any applicable securities laws of any state

or other jurisdiction of the United States. No public offering of

securities is being made in the United States. No securities

referred to herein, nor this announcement nor any other document

connected with the proposed transactions referred to herein has

been or will be approved or disapproved by the United States

Securities and Exchange Commission or by the securities commissions

of any state or other jurisdiction of the United States or any

other regulatory authority, and none of the foregoing authorities

or any securities commission has passed upon or endorsed the merits

of the proposed transactions or the securities referred to herein

or the adequacy of this announcement or any other document

connected with the proposed transactions referred to herein. Any

representation to the contrary is a criminal offence in the United

States.

This announcement is for information purposes only and is not

intended to and does not constitute or form part of any offer or

invitation to purchase or subscribe for, or any solicitation to

purchase or

subscribe for any securities in any jurisdiction. No offer or

invitation to purchase or subscribe for, or any solicitation to

purchase or subscribe for, any securities will be made in any

jurisdiction in which such an offer or solicitation is unlawful.

The information contained in this announcement is not for release,

publication or distribution to persons in the United States or

Australia, Canada, Japan, the People's Republic of China or South

Africa, and should not be distributed, forwarded to or transmitted

in or into any jurisdiction, where to do so might constitute a

violation of local securities laws or regulations.

No representations or warranties, express or implied, are made

as to, and no reliance should be placed

on, the accuracy, fairness or completeness of the information

presented or contained in this release.

This release contains certain forward-looking statements, which

are based on current assumptions and estimates by the management of

the Company. Past performance cannot be relied upon as a guide to

future performance and should not be taken as a representation that

trends or activities underlying past performance will continue in

the future. Such statements are subject to numerous risks and

uncertainties that could cause actual results to differ materially

from any expected future results in forward-looking statements.

These risks may include, for example, changes in the global

economic situation, and changes affecting individual markets and

exchange rates.

The Company provides no guarantee that future development and

future results achieved will correspond to the forward-looking

statements included here and accepts no liability if they should

fail to do so. Neither the Company nor any of its advisers

undertakes any obligation to update these forward-looking

statements or to publicly release any revisions that may be made to

these forward-looking statements, which may result from events or

circumstances arising after the date of this release.

This release is for informational purposes only and does not

constitute or form part of any invitation or inducement to engage

in investment activity, nor does it constitute an offer or

invitation to buy any

securities, in any jurisdiction including the United States, or

a recommendation in respect of buying,

holding or selling any securities.

This announcement is an advertisement for the purposes of the

Prospectus Regulation Rules of the

Financial Conduct Authority ("FCA") and not a prospectus and not

an offer to sell, or a solicitation of an offer to subscribe for or

to acquire securities. Neither this announcement nor anything

contained herein shall form the basis of, or be relied upon in

connection with, any offer or commitment whatsoever in any

jurisdiction. Investors should not purchase or subscribe for any

transferable securities referred to in this announcement except on

the basis of information contained in the Prospectus to be

published by the Company in due course.

RBC Europe Limited (trading as "RBC Capital Markets"), which is

authorised by the Prudential Regulatory Authority (the "PRA") and

regulated by the FCA and the PRA in the United Kingdom, is acting

exclusively for Metro Bank Holdings PLC and for no one else in

connection with the subject matter of this announcement and will

not be responsible to anyone other than Metro Bank Holdings PLC for

providing the protections afforded to its clients or for providing

advice in connection with the subject matter of this announcement.

Neither RBC Capital Markets nor any of its subsidiaries, branches

or affiliates owes or accepts any duty, liability or responsibility

whatsoever (whether direct or indirect, whether in contract, in

tort, under statute or otherwise) to any person who is not a client

in connection with the subject matter of this announcement, any

statement contained herein or otherwise.

Morgan Stanley & Co. International plc ("Morgan Stanley"),

which is authorised by the PRA and regulated by the FCA and the PRA

in the United Kingdom, is acting exclusively for Metro Bank

Holdings PLC and for no one else in connection with the subject

matter of this announcement. Morgan Stanley, its affiliates and

their respective directors, officers, employees and agents will not

regard any other person as their client, nor will they be

responsible to anyone other than Metro Bank Holdings PLC for

providing the protections afforded to clients of Morgan Stanley nor

for providing advice in connection with the contents of this

announcement or any matter referred to herein or otherwise.

Moelis & Company UK LLP ("Moelis & Company"), which is

authorised and regulated by the FCA in the UK, is acting as

exclusive financial adviser to Metro Bank Holdings PLC and no one

else in connection with the matters described in this announcement

and will not be responsible to anyone other than Metro Bank

Holdings PLC for providing the protections afforded to clients of

Moelis & Company nor for providing advice in connection with

the matters referred to herein. Neither Moelis & Company nor

any of its affiliates owes or accepts any duty, liability or

responsibility whatsoever (whether direct or indirect, whether in

contract, in tort, under statute or otherwise) to any person who is

not a client of Moelis & Company in connection with this

announcement, any statement contained herein or otherwise.

Cautionary statement regarding forward-looking statements

This announcement contains forward-looking statements, including

with respect to financial information, that are based on current

expectations or beliefs, as well as assumptions about future

events. These forward-looking statements can be identified by the

fact that they do not relate only to historical or current facts.

Forward-looking statements often use words such as "anticipate",

"target", "expect", "estimate", "intend", "plan", "goal",

"believe", "will", "may", "should", "would", "could", "is

confident", or other words of similar meaning. Undue reliance

should not be placed on any such statements because they speak only

as at the date of this announcement and, by their very nature, they

are subject to known and unknown risks and uncertainties and can be

affected by other factors that could cause actual results, and the

Company's plans and objectives, to differ materially from those

expressed or implied in the forward-looking statements. No

representation or warranty is made that any forward-looking

statement will come to pass.

You are advised to read the Prospectus and Circular in their

entirety, and, in particular, the section of the Prospectus headed

"Risk Factors", for a further discussion of the factors that could

affect the Company's future performance and the industry in which

it operates. In light of these risks, uncertainties and

assumptions, the events described in the forward-looking

statements, including statements regarding prospective financial

information, in this announcement may not occur. These statements

are not fact and should not be relied upon as being necessarily

indicative of future results, and readers of this announcement are

cautioned not to place undue reliance on the forward-looking

statements, including those regarding prospective financial

information.

No statement in this announcement is intended as a profit

forecast, and no statement in this announcement should be

interpreted to mean that underlying operating profit for the

current or future financial years would necessarily be above a

minimum level, or match or exceed the historical published

operating profit or set a minimum level of operating profit.

Neither the Company nor any of its advisers is under any

obligation to update or revise publicly any

forward-looking statement contained within this announcement,

whether as a result of new information, future events or otherwise,

other than in accordance with their legal or regulatory obligations

(including, for the avoidance of doubt, the Prospectus Regulation

Rules, the Listing Rules and Disclosure Guidance and Transparency

Rules).

[1] Note: Including the benefit of the Asset Sale.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DOCDGBDGSSGDGXI

(END) Dow Jones Newswires

October 09, 2023 02:00 ET (06:00 GMT)

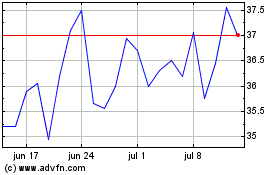

Metro Bank (LSE:MTRO)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Metro Bank (LSE:MTRO)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024