NB Distressed Debt Invest. Fd. Ltd Portfolio Update - Global Shares (5679O)

29 Mayo 2015 - 1:00AM

UK Regulatory

TIDMNBDD TIDMNBDX TIDMNBDG

RNS Number : 5679O

NB Distressed Debt Invest. Fd. Ltd

29 May 2015

NB Distressed Debt Investment Fund Limited

Portfolio Update - Global Shares

NB Distressed Debt Investment Fund Limited ("NBDDIF") is a

Guernsey-incorporated closed-ended investment company that launched

in June 2010. NBDDIF's primary objective is to provide investors

with attractive risk-adjusted returns through long-biased,

opportunistic stressed, distressed and special situation

credit-related investments while seeking to limit downside

risk.

NBDDIF owns holdings diversified across distressed, stressed and

special situations investments, with a focus on senior debt backed

by hard assets. The portfolio is managed by the Distressed Debt

team at Neuberger Berman, which sits within what we believe is one

of the largest and most experienced non-investment grade credit

teams in the industry.

The New Global Share Class ("NBDG") was created in March 2014

and aims to capture the growing opportunity in distressed debt

globally. NBDG is subject to an investment period ending on 31

March 2017, following which the assets will be placed into

run-off.

The New Global Shares are one of three classes of shares in

NBDDIF. The other classes are the Ordinary Share Class and the

Extended Life Share Class. The Ordinary Share Class is subject to

an investment period which ended on 10 June 2013 and the Extended

Life Share Class is subject to an investment period which ended on

31 March 2015. Separate factsheets are produced for those

classes.

Summary

In the first quarter of 2015, we continued to deploy capital in

new and existing positions. We exited three positions which

contributed positively to NAV. We see significant upside potential

in the existing portfolio, which we expect to realise as we

restructure and exit investments.

Portfolio

As at 31 March 2015, we had deployed approximately 78.4% of

NBDG's capital. NBDG had investments in 27 names across 12

industries. The largest sector concentrations were in lodging &

casinos, utilities, shipping and surface transportation. In the

first quarter we added new positions in the oil & gas and air

transportation sectors. We also added incremental exposure to

existing names in the shipping, oil & gas, power, casino and

metals sectors.

NBDG's NAV per share decreased 1.1% in the first quarter of

2015, to GBP 87.66 from GBP 88.60 per share. The primary drivers of

NBDG's NAV decrease were secondary market price declines of

existing positions. We believe that performance comparison versus

other distressed managers is indicated by the HFRI

Distressed/Restructuring Index(1) which returned 0.8% in the

quarter. During the first quarter of 2015 we saw three exits, which

all added positively to NAV and are described in detail below. We

are working towards key restructuring milestones on our existing

investments, which we anticipate can ultimately result in

profitable exits.

.

Market Update(2)

We continue to believe the pipeline of distressed debt

opportunities in real estate, transportation and energy debt is

compelling. EU banks in particular increased their disposal of

European and U.S. loans and assets to EUR91 billion in 2014, versus

EUR64 billion in 2013, EUR46 billion in 2012, EUR36 billion in 2011

and EUR11 billion in 2010. However, over EUR1 trillion of

non-performing loans remain on EU banks' balance sheets. We believe

that the European regulatory environment may continue to facilitate

further recognition and disposal of distressed loans. Additionally,

the recent volatility in energy markets has presented new

opportunities in the U.S.

Exits

In the first quarter we saw three exits in NBDG, our 3(rd) ,

4(th) and 5(th) exits since inception. These exits generated

approximately GBP0.8 million of total return and gains for

NBDG.

Investment 3: We purchased a GBP4.0 million portion of a first

lien debt facility at 87.75% of par, which was secured by the

operating assets of a British ferry company. We expected that the

company would either restructure its debt or would refinance its

existing debt structure. In the case of a debt restructuring and

conversion into post-reorganization securities, we believed that

our cost basis represented a significant valuation discount versus

comparable assets. Ultimately, the company was sold and our debt

paid off at par plus accrued interest. Total return from this

investment was GBP0.6 million generating an IRR of 24%.

Investment 4: We purchased $1.0 million face value of senior

notes at 87.60% of par of a company with oil & gas assets. We

believed that the company would be able to refinance its capital

structure through a combination of asset sales and capital markets

activities. Subsequent to our purchase, the secondary price of the

senior notes increased significantly and we exited via the

secondary market. Total return from this investment was GBP0.1

million generating an IRR of 112%.

Investment 5: We purchased $0.6 million face value of senior

notes at 90.25% of par of a company with oil & gas assets. We

believed that the company would be able to refinance its capital

structure through a combination of asset sales and capital markets

activities. Subsequent to our purchase, the secondary price of the

senior notes increased significantly and we exited via the

secondary market. Total return from this investment was GBP41,000

generating an IRR of 90%.

Data as at March 31, 2015 unless otherwise noted. Past

performance is not indicative of future returns. All comments

unless otherwise stated relate to NBDG.

1. The HFRI Distressed/Restructuring Index reflects distressed

restructuring strategies which employ an investment process focused

on corporate fixed income instruments, primarily on corporate

credit instruments of companies trading at significant discounts to

their value at issuance or obliged (par value) at maturity as a

result of either formal bankruptcy proceeding or financial market

perception of near term proceedings (provided by Hedge Fund

Research, Inc.).

2. Source: Data from PWC dated January 2015.

-ENDS-

For further information please contact:

Neuberger Berman Europe Limited +44 (0)20 3214 9000

Damian Holland

Financial Dynamics +44 (0)20 7269 7297

Neil Doyle

Ed Berry

Laura Ewart

An accompanying factsheet on the information provided above can

be found on the Company's website www.nbddif.com. Neither the

contents of the Company's website nor the contents of any website

accessible from hyperlinks on the Company's website (or any other

website) is incorporated into, or forms part of, this

announcement.

This information is provided by RNS

The company news service from the London Stock Exchange

END

PFUAPMFTMBJTBIA

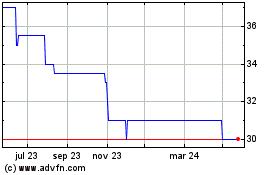

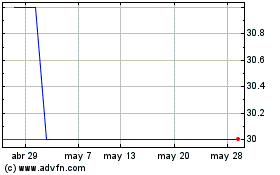

Nb Distressed Debt Inves... (LSE:NBDG)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Nb Distressed Debt Inves... (LSE:NBDG)

Gráfica de Acción Histórica

De May 2023 a May 2024