TIDMRST

RNS Number : 4160J

Restore PLC

16 August 2023

16 August 2023

Restore plc

("Restore" or the "Group" or "Company")

Half Year Results 2023

Restore plc (AIM: RST), the UK's leading provider of digital and

information management and secure lifecycle services, today

announces its unaudited results for the six months ended 30 June

2023 ("H1", or "the period").

OVERVIEW

During the half, the Group delivered solid revenues with good

performances in Records Management, Digital's recurring income

streams and Harrow Green. As previously announced, this has been

offset by a weaker performance in Technology due to reduced volumes

of quality IT assets for resale, and a lower level of non-recurring

contracts in Digital (particularly in bulk scanning).

Overall, revenue was broadly unchanged at GBP139.6m (H1 2022:

GBP140.3m) for the period, with adjusted EBITDA(1) down 5% against

H1 2022 at GBP38.3m as a result of the net effect of trading

factors noted above. Adjusted profit before tax(1) reduced to

GBP15.1m after the additional impact of higher interest rates on

borrowing costs.

As a result of increases to the Group's cost of capital, reduced

expectations on service activity, paper volumes and recycled paper

pricing, a non-cash write-down of GBP32.5m against the legacy

investment in Datashred has been applied. This write-down results

in a statutory loss before tax for the Group of GBP25.9m.

The Group remained highly cash generative, with net debt(2)

reducing to GBP97.9m and a leverage(3) ratio of 1.8x which remains

well within the Group's target range and covenant levels.

The Group has also announced today the appointment of Mike

Killick as interim CFO who will take over day-to-day finance

responsibility with effect from 21 August 2023 from Neil Ritchie

who previously announced his decision to step down as CFO on 14

June 2023. Neil Ritchie will oversee an orderly transition and be

available until the end of his contractual notice period on 13

December 2023. Good progress is being made with the Group's

management succession planning and further updates on the ongoing

search processes for a new CEO and the permanent CFO roles will be

made in due course.

Current trading remains in line with the Board's revised

expectations to achieve an adjusted profit before tax of GBP31m for

the full year.

FINANCIAL SUMMARY H1 2023 H1 2022(4) Change

-------------------------------------- ---------- ----------- -------

Revenue GBP139.6m GBP140.3m -0%

Adjusted EBITDA GBP38.3m GBP40.3m -5%

Adjusted profit before tax GBP15.1m GBP20.9m -28%

Statutory (loss)/profit before

tax -GBP25.9m GBP14.1m -284%

Net debt(4) GBP97.9m GBP103.5m -5%

Adjusted basic earnings per share(1) 8.4p 12.4p -32%

Statutory basic (loss)/earnings

per share -20.5p 7.5p -373%

Dividend per share 1.85p 2.6p -29%

--------------------------------------- ---------- ----------- -------

OPERATING PERFORMANCE

-- Records Management, which represents over 70% of Group

profits, delivered revenue growth of 6% and net box growth of 0.4%

in the period. Price increases have been successfully implemented

and costs have been well controlled. The new BBC and Department for

Work and Pensions contracts continue to progress well

-- In the Digital business, income from recurring outsourcing,

storage and data support services was in line with expectations,

although a reduction in bulk scanning has impacted performance,

with the comparative period also benefiting from a large

non-recurring public sector contract of GBP5.3m delivered in H1

2022

-- Revenue in Technology declined, as recycled asset sales

continued to show weak volume and quality, although secure

destruction and end user device services remained on track. The

latest hardware market data indicates that subdued volumes will

continue into H2 2023

-- Datashred delivered increased service activity levels and a

continued focus on operational efficiency, however a significant

reduction in recycled paper prices since the period end is expected

to impact H2 profitability

-- Harrow Green continues to perform well and in line with management's expectations

-- Cost reduction plan on track to save c.GBP5m in 2023,

primarily through organisation and property changes, whilst

preserving capability and capacity. Other cost mitigation actions

include a fixing of a proportion of energy costs to replace the

Group's previous fixed energy deal and an extension of fixed rate

interest instruments.

FINANCIAL PERFORMANCE

-- Revenue was broadly unchanged at GBP139.6m (H1 2022:

GBP140.3m), with adjusted EBITDA down 5% at GBP38.3m reflecting a

robust performance in Records Management but weakness in Technology

trading and non-recurring contracts in Digital

-- Across the Group, total storage revenue was up 11%, long term

contracts and recurring income was up 3%, relocations revenue was

up 7% but other service income, IT asset and paper trading was down

13%

-- In the Digital and Information Management division revenue

was GBP85.1m (H1 2022: GBP87.1m) and adjusted operating profit was

GBP20.9m (H1 2022: GBP24.6m)

-- In the Secure Lifecycle Services division revenue was

GBP54.5m (H1 2022: GBP53.2m) and adjusted operating profit was

GBP3.3m (H1 2022: GBP5.6m)

-- Adjusted profit before tax was lower at GBP15.1m (H1 2022:

GBP20.9m) due to the net impact of different trading conditions

across the Group and the impact of higher interest rates on

financing costs with the resulting adjusted basic earnings per

share down 32% to 8.4p (H1 2022: 12.4p)

-- A non-cash impairment of GBP32.5m has been made to the

carrying value of the Datashred acquisition investment and results

from an increase in the weighted average cost of capital used in

the valuation of future cashflows and reduced expectations on

service activity, paper volumes and recycled paper pricing.

Although a large write down, this does not impact the Group's

ability to pay dividends

-- Statutory loss before tax for the period was GBP25.9m (H1

2022: GBP14.1m profit before tax) and is reflective of the

significant non-cash impairment of the Datashred investment, with a

resulting statutory basic loss per share of 20.5p (H1 2022: 7.5p

earnings per share). Excluding this impairment, the statutory

profit before tax for the period would be GBP6.6m

-- Good cash generation, resulted in net debt reducing to

GBP97.9m and a leverage ratio of 1.8x, well within the Group's

target range and covenant levels (H1 2022: 1.7x)

-- Interim dividend of 1.85p (H1 2022: 2.6p) declared, but

reduced proportionately to reflect the lower earnings in the

period.

OUTLOOK

The Board anticipates that the Group will achieve a solid

revenue performance for the year underpinned by the core storage

and highly contracted income streams that are a central feature of

the Group's strength. As previously announced, the specific

challenges in Technology, Digital and Datashred will impact the

full year performance. However, actions are being taken to mitigate

these headwinds, including plans to reduce costs by approximately

GBP5m in 2023 whilst preserving the Group's capabilities and

capacity. Current trading remains in line with the Board's revised

expectations for an adjusted profit before tax of GBP31m for the

full year.

Cash generation is expected to remain good and net debt is

expected to continue to reduce in the second half.

Whilst the near-term economic outlook remains uncertain, the

fundamentals of the business remain strong, with the core long-term

contracted and storage revenue underpinning the profitability and

cash generation of the Group.

Jamie Hopkins, Interim CEO, commented:

"Whilst the first half has been a difficult period, the Group

remains profitable and cash generative on an adjusted basis and

continues to deliver excellent service for our customers. The

fundamentals of the business remain highly attractive and our core

storage business and recurring service income across the Group

provide a strong base from which to navigate the current economic

challenges and rebuild profitability and shareholder value. Good

progress is being made with the Group's management succession

planning and we are delighted to welcome Mike Killick, who will be

joining as interim CFO on 21 August 2023."

For further information please contact:

Restore plc www.restoreplc.com

Jamie Hopkins, Interim CEO

Chris Fussell, Company Secretary +44 (0) 207 409 2420

Investec (Nominated Adviser and Joint www.investec.com

Broker)

Carlton Nelson

James Rudd +44 (0) 207 597 5970

Canaccord Genuity (Joint Broker, Corporate www.canaccordgenuity.com

Advisor)

Max Hartley

Chris Robinson +44 (0) 207 523 8000

Citi (Joint Broker) www.citigroup.com

Stuart Field

Luke Spells +44 (0) 207 986 4074

Buchanan Communications (PR enquiries) www.buchanan.uk.com

Charles Ryland

Simon Compton +44 (0) 207 466 5000

Notes

1. Adjusted profit and earnings are stated before adjusting

items, amortisation and impairment, with adjusted EPS calculated

using a standard tax charge

2. Net debt defined as external borrowings less cash, excluding

the effects of lease obligations under IFRS16

3. Leverage calculated using pre-IFRS16 EBITDA adjusted for

share-based payments, including a pro-forma adjustment for

acquisitions in line with financial debt covenants

4. GBP0.3m of bank refinancing charges were treated as adjusting

items in deriving adjusted PBT and adjusted EPS at H1 2022 but have

been restated to not exclude these charges consistent with

treatment at FY22

BUSINESS PERFORMANCE

The core business of the Group in storage and recurring services

continued to grow during the period. However, the Group experienced

reduced levels of activity across some business lines in Q2 with

customers deferring or reducing activity to reduce their costs as a

result of broader macro-economic uncertainty.

These effects, together with continued soft trading in recycled

IT assets and a large non-recurring public sector contract in

Digital benefitting H1 2022 resulted in a flat revenue performance

of GBP139.6m (H1 2022: GBP140.3m). The Group remains profitable on

an adjusted basis, albeit at a lower level than that achieved in H1

2022, with price increases offsetting inflationary pressures. The

lower adjusted profit before tax for the period of GBP15.1m (H1

2022: GBP20.9m) reflects these different trading effects and also

the impact of interest costs on financing expenses.

The statutory loss before tax for the period of GBP25.9m (H1

2022: GBP14.1m profit before tax) reflects a non-cash impairment of

GBP32.5m on the carrying value of the historic acquisition

investment in Restore Datashred.

The Group remains highly cash generative, with net debt reducing

during the period to GBP97.9m and leverage operating well within

the Group's target at 1.8x (H1 2022: 1.7x).

Digital and Information Management

Our Digital and Information Management division comprises

Restore Records Management and Restore Digital.

For the period, the division achieved revenue of GBP85.1m (H1

2022: GBP87.1m) and an adjusted operating profit of GBP20.9m (H1

2022: GBP24.6m). Within this, the business successfully implemented

a programme of price increases that offset inflationary pressures

during the period. The prior half year also included the benefit of

large non-recurring contracts within Digital with associated

revenues of GBP5.3m.

Restore Records Management - Revenue GBP59.3m up 6% (H1 2022:

GBP55.9m)

Records Management is the largest business unit in the Group and

represents over 40% of Group revenue and 70% of operating

profits.

Storage income, representing 71% of revenue, saw boxes under

management increase by 0.4% during the period, primarily as a

result of intake on the previously announced BBC archive contract

that commenced in April following completion of a bespoke,

environment-controlled vault.

Price increases were successfully implemented through Q1 and

into Q2 and have offset inflationary pressures from people costs,

leases, rates and energy.

Cost management is a continued focus and targeted changes to

organisation structures and the property estate are returning

savings and a more efficient operating model. As a result, capacity

utilisation eased as planned from 97% to 95% and is more in line

with our long-term utilisation target.

With the BBC contract underway, the focus for sales has now

returned to new business wins and there is a strong pipeline of

opportunities for H2. However, offsetting net box growth has been

an increased level of customer destructions.

Restore Digital - Revenue GBP25.8m down 17% (H1 2022:

GBP31.2m)

Digital has successfully developed a broader portfolio of income

streams since the acquisition of EDM in 2021, with revenue from

outsourced digital mailrooms, cloud hosted storage and management

services, records preservation and software provision performing

predictably and in line with management expectations.

However, a high proportion of the business remains in bulk

document scanning and data capture services which, whilst providing

future potential to develop into more complex, recurring revenue,

can be more cyclical in the current macro environment.

In 2022, the Digital business benefitted from substantial

non-recurring contracts of GBP5.3m and during the later stages of

H1 2023 the level of non-recurring customer project activity

reduced and led us to reduce our expectations for the year.

In line with this change, a number of strategic operational

initiatives have been accelerated, including the consolidation of

one of the eleven sites into the rest of the estate, which will

improve flexibility and reduce costs.

In sales, the team continues to lead the market with 233 new

deals won in the period, extension of long-term contracts with ten

key customers and a stable pipeline of further opportunities

although customer decision making has slowed in 2023.

Secure Lifecycle Services

Our Secure Lifecycle Services division comprises Restore

Technology, the market leader in IT Lifecycle Services, Restore

Datashred, a national shredding business, and Restore Harrow Green,

the UK's market leader in office and commercial relocations.

For the period the division achieved revenue of GBP54.5m (H1

2022: GBP53.2m) and an adjusted operating profit of GBP3.3m (H1

2022: GBP5.6m).

Whilst the recycling arm of Technology faced laptop and desktop

availability headwinds resulting in reduced recycling income,

Datashred and Harrow Green performed well through H1, although

caution should be applied to the outlook for Datashred where

recycled paper bale prices fell significantly at the end of Q2 and

are anticipated to continue to be weak in H2.

Restore Technology - Revenue GBP16.3m down 5% (H1 2022:

GBP17.2m)

Revenue associated with 'in life' end user device services and

secure, on site, destruction improved compared to H1 2022.

However, income from IT asset recycling and resale fell by 16%

with asset quality also reduced. With a much lower grade of laptop

and desktop assets received by the business for processing, this

has resulted in an impact on profitability. This trend is

consistent with the most recent IDC Global PC shipments data

reporting that sales are down 13.4% in Q2 2023 against the

equivalent period in the prior year.

The sector continues to be highly fragmented and we experienced

increasing customer and sales channel demand for highly trusted

partners to support new asset installation and services for mid and

end of life asset and data management and recycling services. The

current slowdown in hardware sales is anticipated to reverse,

although the timeframe is uncertain, and we believe reflects

customers slowing investment due to economic uncertainty and the

life of assets procured to support ways of working during the

pandemic.

In response, we are preserving our core capabilities but

reducing capacity through consolidation of the Dunsfold site into

the remaining six sites and reducing shift patterns elsewhere in

the business.

Restore Datashred - Revenue GBP18.6m up 2% (H1 2022:

GBP18.3m)

Datashred performed well in H1, with increased service activity

levels despite high customer churn as customers looked to

consolidate and reduce site count. The business implemented price

increases in H1 and these are offsetting inflation pressures in

people and fleet costs.

The team continued to improve the operational effectiveness of

the business with visits per day at record highs of more than 11

per day and its net promoter score improving further to 76 in the

period illustrating continued strong customer satisfaction.

With c.70% of revenue attributable to service revenues, the

business has a solid base of contracted income although, as noted,

customer churn through customer action and sector competition was

higher in H1.

The balance of revenue from recycled paper bales has a history

of volatility with pricing since the end of the pandemic (assuming

H2 2021) at over GBP200/tonne compared with an average price of

c.GBP160/tonne for the three years leading up to the pandemic, and

a range of GBP130 to GBP180. As such, the predictability of profits

can be difficult to determine and in H1 paper pricing of

c.GBP210/tonne supported a good profit result. However, pricing

since June has fallen to below GBP180/tonne and, as such, the

business is cautious on its H2 outlook.

Restore Harrow Green - Revenue GBP19.6m up 11% (H1 2022:

GBP17.7m)

Revenue in H1 was good at +11% against H1 2022, particularly

when considering the equivalent period in the prior year benefitted

from a large MoD contract that ended in Q2 2022.

The business has seen good expansion of relocation activity in

London with total relocations up 7%. The decision to expand storage

capacity is proving to be sound with storage revenue growing 36%,

and now represents 15% of total income in H1.

We are also pleased with the development of the Life Sciences

business following the opening of the Cambridge site in 2021 with

73% revenue growth achieved in H1 and major contracts planned for

H2.

Further strategic development of the business is continuing with

potential for regional expansion and commercial storage

capabilities.

FINANCIAL PERFORMANCE

Financial overview

The Group has delivered a profitable and cash generative result

for H1 on an adjusted basis although profits are lower than

anticipated at the commencement of the year with the statutory loss

for the period also reflecting the impact of a non-cash impairment

of GBP32.5m on the holding value of the Datashred intangible asset

arising on historic acquisition.

Pricing is negating inflation pressures and cost management

plans are being actioned although activity levels are varied across

the business units with weak market conditions in technology

recycling, indications of customers reducing spend on some of the

Group's more discretionary service lines and the headwind of

increased interest rates.

Cashflows continue to be strong with 84% cash conversion(5) with

a corresponding reduction in net debt and leverage in line with

expectations at 1.8x. A proportion of interest rates were fixed in

H1 through conversion of GBP25m of the Group's floating debt

facility into a fixed term / fixed rate USPP with interest rate

hedges undertaken post period end on a further GBP25m of the

floating debt facility.

Adjusted basic earnings per share for the period were 8.4p (H1

2022: 12.4p) and reflect lower operating profit, higher interest

costs and a higher tax rate. The statutory loss per share of 20.5p

(H1 2022: 7.5p earnings per share) reflects the impairment of the

Datashred intangible asset and would be 3.2p before the effects of

the impairment.

An interim dividend of 1.85p (H1 2022: 2.6p) will be paid on 20

October 2023 to shareholders on the register on 22 September 2023,

maintaining the approximate ratio of dividend to adjusted earnings

per share.

Income Statement

Revenue was broadly flat for the period at GBP139.6m (H1 2022:

GBP140.3m), with storage revenues up 11%, long term contracts and

recurring income up 3%, relocations revenue up 7% but other service

income, IT asset and paper trading down 13%.

The table below summarises the effects of pricing, activity

levels and prior year acquisitions on H1 revenues and indicates

that the positive pricing effect of GBP5.8m across the businesses

are offset by the weakness of revenues in Technology (-GBP0.9m) and

the effect of a reduction in non-recurring contracts

(-GBP5.3m).

H1 H1 Price Activity Non-repeats Acq'n

2023 2022 change change change change Change

Revenue GBPm GBPm % % % % %

----------------------------- ------ ------ -------- --------- ------------ -------- -------

Restore Records Management 59.3 55.9 +6% - - - +6%

Restore Digital 25.8 31.2 +5% -5% -17% - -17%

Digital & Information

Management 85.1 87.1 +6% -2% -6% - -2%

Restore Technology 16.3 17.2 +1% -16% - +10% -5%

Restore Datashred 18.6 18.3 +2% - - - +2%

Restore Harrow Green 19.6 17.7 +1% +4% - +6% +11%

Secure Lifecycle Services 54.5 53.2 +1% -4% - +5% +2%

----------------------------- ------ ------ -------- --------- ------------ -------- -------

Total 139.6 140.3 +4% -2% -4% +2% -0%

----------------------------- ------ ------ -------- --------- ------------ -------- -------

Within the Digital and Information management division, Records

Management performed well with price and activity driven revenue

growth offsetting inflationary pressures. In Digital, the business

is lapping a strong comparative with GBP5.3m of revenue in the

comparable period attributable to a large non-recurring scanning

contracts. Other Digital revenues from cloud storage and recurring

services, such as digital mailrooms, have performed in line with

expectations.

Records Management is exiting the period in strong shape with

Digital experiencing a slow-down in bulk scanning projects as a

result of customers managing their budgets although the increasing

proportion of recurring revenues, largely due to the acquisition of

EDM in 2021 and its subsequent development, is in line with the

strategy to develop a more rounded digital services business of

scale.

In Secure Lifecycle Services, Harrow Green and Datashred have

grown revenues as a result of increased activity levels and pricing

actions.

However, the Technology business continued to experience low

volumes of quality IT assets for recycling during H1 with recent

IDC data on Q2 indicating a further period of reduced new laptop

sales of -13% suggesting that this trend is likely to continue

through H2.

Although this is believed to be a largely cyclical effect caused

by pandemic demand patterns, the current lack of volume has

significantly reduced profit expectation from this business unit

for the year although we are encouraged by the expansion and scale

of the other Technology lifecycle income streams including secure

onsite data destruction, pre and mid-life services and server

recovery and resale.

The profitability for the period was lower primarily due to

quality of assets in Technology and the effect of the non-repeat

contracts in Digital with adjusted EBITDA down 5% to GBP38.3m and

adjusted PBT down 28% to GBP15.1m after the additional effect of

higher interest costs. The statutory loss before tax was GBP25.9m

and is stated after a non-cash impairment charge of GBP32.5m that

primarily relates to the intangible assets arising on the 2016

acquisition of Datashred. Before impairment, the statutory profit

before tax would be GBP6.6m.

The table below summarises the key aspects to performance in the

period with the positive price effect of GBP5.8m offsetting cost

inflation of GBP5.0m, whilst reduced activity levels in Digital

(non-repeat contracts) and Technology (asset quality) impact

operating profit by GBP6.0m, and interest costs increased by

GBP1.9m against H1 2022. Other non-cash effects benefiting adjusted

profit were GBP1.3m and are primarily due to the net effect of

non-cash charges relating to long term incentive provisions and

IFRS16 charges.

GBPm

-------------------------------- --------

H1 2022 Adjusted profit before

tax 20.9

Price increases 5.8

Cost inflation (5.0)

Technology/Digital activity (6.0)

Bank interest (1.9)

Other 1.3

--------------------------------- --------

H1 2023 Adjusted profit before

tax 15.1

--------------------------------- --------

Adjusted profit items

Management believe that presentation of an adjusted profit

before tax assists readers of the accounts to better understand the

performance of the business. The adjusting items during the period

are described below.

H1 2023 H1 2022

GBPm GBPm Change

------------------------------------------- -------- -------- -------

Impairment of intangible assets 32.5 - n/a

Amortisation of intangible assets 6.3 5.9 +7%

Acquisition related transaction/advisory

costs 0.2 0.8 -75%

Restructuring and redundancy 1.0 0.1 +900%

Strategic IT reorganisation 1.0 - n/a

Total adjusting items 41.0 6.8 +503%

------------------------------------------- -------- -------- -------

The GBP32.5m non-cash impairment of intangible assets relates to

the historic acquisition of Datashred. Amortisation of intangible

assets increased versus H1 2022 as a result of prior year

acquisitions. Acquisition related transaction / advisory costs are

lower due to low levels of acquisition with restructuring costs

primarily relating to redundancy on the strategic organisation

restructure and site closure of Dunsfold. IT reorganisation costs

relate to specific strategic programmes to consolidate finance and

other operational systems.

Balance Sheet and Cashflow

The Balance Sheet as at 30 June 2023 remains strong, with key

ratios across working capital and trade debt consistent with prior

periods.

Cashflows were also strong with a reduction in net debt to

GBP97.9m and leverage of 1.8x.

The net debt was further diversified during H1 by the

introduction of GBP25m of fixed term USPP, building on the

improvement of the floating rate bank facility in 2022. Together

with the introduction of interest hedging on the floating facility,

interest cost certainty is substantially increased with a policy to

hedge or fix rate on 50-70% of debt.

On review of the Datashred business following recent paper price

reductions and a period of relative stability in working patterns,

management have reduced their medium-term expectation of tonnages

that the business unit will collect for processing and the pricing

of recycled paper bales. This, together with an increase in the

cost of capital resulting from recent interest rate rises, has led

to a reduction in expectation of the value of future cashflows. As

such, management have reviewed the carrying value of the Datashred

investment, that largely arose on the acquisition of the PHS paper

shredding business in 2016, and have applied an impairment of

GBP32.5 on the carrying value of the investment leaving a remaining

value of GBP27.5m.

Notes

5. Calculated as free cashflows (reconciled in statement of

cashflows), divided by adjusted operating profit after tax (using a

standard tax rate)

FINANCIAL STATEMENTS

Condensed Consolidated Statement of Comprehensive Income

For the six months ended 30 June 2023

Unaudited Unaudited

six months six months Audited

ended ended year ended

30 June 30 June 31 December

Note 2023 2022 2022

GBP'm GBP'm GBP'm

-------------------------------------------- ------- ------------ ------------ --------------

Revenue - continuing operations 2 139.6 140.3 279.0

Cost of sales (80.1) (78.7) (155.4)

Gross profit 59.5 61.6 123.6

Administrative expenses (46.3) (42.6) (89.2)

Movement in trade receivables loss

allowances - - (0.2)

Impairment of intangible assets (32.5) - -

Operating (loss)/profit (19.3) 19.0 34.2

-------------------------------------------- ------- ------------ ------------ --------------

Finance costs (6.6) (4.9) (10.9)

(Loss)/profit before tax (25.9) 14.1 23.3

-------------------------------------------- ------- ------------ ------------ --------------

Taxation 4 (2.2) (3.8) (6.5)

-------------------------------------------- ------- ------------ ------------ --------------

(Loss)/profit after tax (28.1) 10.3 16.8

Other comprehensive income - - -

-------------------------------------------- ------- ------------ ------------ --------------

(Loss)/profit and total comprehensive

(loss)/income for the period attributable

to owners of the parent (28.1) 10.3 16.8

-------------------------------------------- ------- ------------ ------------ --------------

(Loss)/earnings per share attributable

to owner of the parent (pence)

Total

- Basic 6 (20.5p) 7.5p 12.3p

- Diluted 6 (20.5p) 7.3p 12.2p

-------------------------------------------- ------- ------------ ------------ --------------

The reconciliation between the statutory results shown above and

the non-GAAP alternative performance measures are shown below:

Operating (loss)/profit (19.3) 19.0 34.2

----------------------------------------- --- --------- ------- -------

Adjustments for:

Adjusting items - Amortisation

of intangible assets 3 6.3 5.9 12.1

Adjusting items - Administrative

expenses 3 2.2 0.9 5.6

Adjusting items - Impairment 3 32.5 - -

Adjustments* 41.0 6.8 17.7

----------------------------------------- --- --------- ------- -------

Adjusted operating profit 21.7 25.8 51.9

----------------------------------------- --- --------- ------- -------

Depreciation of property, plant

and equipment and right-of-use

assets 16.6 14.5 29.6

----------------------------------------- --- --------- ------- -------

Earnings before interest,

taxation, depreciation, amortisation,

impairment and adjusting items

(adjusted EBITDA) 38.3 40.3 81.5

----------------------------------------- --- --------- ------- -------

(Loss)/profit before tax (25.9) 14.1 23.3

Adjustments* (as stated above) 41.0 6.8 17.7

Adjusted profit before tax 15.1 20.9 41.0

----------------------------------------- --- --------- ------- -------

*GBP0.3m of bank refinancing charges were treated as adjusting

items in deriving the Group's alternative performance measures at

H1 22 but have been restated consistent with the presentation at

FY22.

Condensed Consolidated Statement of Financial Position

As at 30 June 2023

Unaudited Audited

30 June Unaudited 31 December

2023 30 June 2022 2022

Note GBP'm GBP'm GBP'm

--------- ------------- ------------

ASSETS

Non-current assets

Intangible assets 5 293.5 330.7 331.9

Property, plant and equipment 80.5 78.6 79.7

Right-of-use assets 95.6 93.3 101.4

Deferred tax asset - 5.3 -

-------------------------------------------- ------ --------- ------------- ------------

469.6 507.9 513.0

-------------------------------------------- ------ --------- ------------- ------------

Current assets

Inventories 2.2 2.3 2.0

Trade and other receivables 66.8 72.6 70.0

Corporation tax receivable 0.3 - -

Cash and cash equivalents 25.3 29.9 30.2

-------------------------------------------- ------ --------- ------------- ------------

94.6 104.8 102.2

-------------------------------------------- ------ --------- ------------- ------------

Total assets 2 564.2 612.7 615.2

-------------------------------------------- ------ --------- ------------- ------------

LIABILITIES

Current liabilities

Trade and other payables (49.9) (55.7) (49.2)

Financial liabilities - lease liabilities (21.6) (20.2) (19.2)

Current tax liabilities - (2.6) (1.6)

Provisions (1.7) (1.4) (1.7)

-------------------------------------------- ------ --------- ------------- ------------

(73.2) (79.9) (71.7)

-------------------------------------------- ------ --------- ------------- ------------

Non-current liabilities

Financial liabilities - borrowings 10 (123.2) (133.4) (133.7)

Financial liabilities - lease liabilities (83.5) (87.4) (90.3)

Deferred tax liabilities (30.4) (33.2) (30.9)

Provisions (15.8) (7.9) (15.4)

-------------------------------------------- ------ --------- ------------- ------------

(252.9) (261.9) (270.3)

-------------------------------------------- ------ --------- ------------- ------------

Total liabilities 2 (326.1) (341.8) (342.0)

-------------------------------------------- ------ --------- ------------- ------------

Net assets 238.1 270.9 273.2

-------------------------------------------- ------ --------- ------------- ------------

EQUITY

Share capital 6.8 6.8 6.8

Share premium account 187.9 187.9 187.9

Other reserves 6.5 8.8 6.9

Retained earnings 36.9 67.4 71.6

-------------------------------------------- ------ --------- ------------- ------------

Equity attributable to owners of

parent 238.1 270.9 273.2

-------------------------------------------- ------ --------- ------------- ------------

Condensed Consolidated Statement of Changes in Equity

For the six months ended 30 June 2023

Attributable to owners of the parent

------------------------------------------------------

Share Share Other Retained Total

capital premium reserves earnings equity

GBP'm GBP'm GBP'm GBP'm GBP'm

----------------------------- --------- --------- ---------- ---------- --------

Balance at 1 January 2022

(audited) 6.8 187.9 7.0 63.5 265.2

Profit for the period - - - 10.3 10.3

----------------------------- --------- --------- ---------- ---------- --------

Total comprehensive loss

for the period - - - 10.3 10.3

----------------------------- --------- --------- ---------- ---------- --------

Transactions with owners

Dividends - - - (6.4) (6.4)

Share-based payments charge - - 1.8 - 1.8

Balance at 30 June 2022

(unaudited) 6.8 187.9 8.8 67.4 270.9

----------------------------- --------- --------- ---------- ---------- --------

Balance at 1 July 2022 6.8 187.9 8.8 67.4 270.9

Profit for the period - - - 6.5 6.5

----------------------------- --------- --------- ---------- ---------- --------

Total comprehensive income

for the period - - - 6.5 6.5

----------------------------- --------- --------- ---------- ---------- --------

Transactions with owners

Dividends - - - (3.5) (3.5)

----------------------------- --------- --------- ---------- ---------- --------

Share-based payments charge - - (0.1) - (0.1)

Deferred tax on share-based

payments - - (0.7) - (0.7)

Transfer* - - (2.1) 2.1 -

Purchase of treasury shares - - (1.1) - (1.1)

Disposal of treasury shares - - 2.1 (0.9) 1.2

----------------------------- --------- --------- ---------- ---------- --------

Balance at 31 December

2022 (audited) 6.8 187.9 6.9 71.6 273.2

----------------------------- --------- --------- ---------- ---------- --------

Balance at 1 January 2023 6.8 187.9 6.9 71.6 273.2

Loss for the period - - - (28.1) (28.1)

----------------------------- --------- --------- ---------- ---------- --------

Total comprehensive loss

for the period - - - (28.1) (28.1)

----------------------------- --------- --------- ---------- ---------- --------

Transactions with owners

Dividends - - - (6.6) (6.6)

Share-based payments charge - - (0.4) - (0.4)

----------------------------- --------- --------- ---------- ---------- --------

Balance at 30 June 2023

(unaudited) 6.8 187.9 6.5 36.9 238.1

----------------------------- --------- --------- ---------- ---------- --------

* In 2022 a net amount of GBP2.1 million was reclassified from

share-based payment reserve to retained earnings in respect of

lapsed and exercised options.

Condensed Consolidated Statement of Cash Flows

For the six months ended 30 June 2023

Note Unaudited Unaudited Audited

six months six months year ended

ended ended 31 December

30 June 2023 30 June 2022 2022

-------------------------------------- -----

GBP'm GBP'm GBP'm

-------------------------------------- ----- -------------- -------------- -------------

Cash generated from operating

activities 8 32.5 28.5 65.2

Net finance costs (5.5) (5.9) (11.4)

Income taxes paid (4.8) (2.8) (6.0)

-------------------------------------- ----- -------------- -------------- -------------

Net cash generated from operating

activities 22.2 19.8 47.8

Cash flows from investing

activities

Purchase of property, plant

and equipment and applications

software 2 (5.6) (5.1) (11.0)

Purchase of subsidiary, net

of cash acquired (1.1) (8.8) (10.8)

Purchase of trade and assets - (0.7) (0.7)

Cash flows used in investing

activities (6.7) (14.6) (22.5)

Cash flows from financing

activities

Dividends paid - - (9.9)

Purchase of treasury shares (0.2) - (1.1)

Proceeds from disposal of treasury

shares 0.1 - 1.2

Repayment of revolving credit

facility (35.0) - (145.8)

Drawdown of revolving credit

facility - 1.0 146.8

Drawdown of US Private Placement 25.0 - -

notes facility

Principal element of lease

repayments (10.3) (9.2) (19.2)

-------------------------------------- ----- -------------- -------------- -------------

Net cash used in financing

activities (20.4) (8.2) (28.0)

-------------------------------------- ----- -------------- -------------- -------------

Net decrease in cash and cash

equivalents (4.9) (3.0) (2.7)

Cash and cash equivalents

at start of period 30.2 32.9 32.9

-------------------------------------- ----- -------------- -------------- -------------

Cash and cash equivalents

at the end of period 10 25.3 29.9 30.2

-------------------------------------- ----- -------------- -------------- -------------

A reconciliation between the statutory results shown above and the

non-GAAP free cashflow measure is shown below:

--------------------------------------------------------------------------------------------

Cash generated from operating

activities 32.5 28.5 65.2

-------------------------------------- ----- -------------- -------------- -------------

Less: Income tax paid (4.8) (2.8) (6.0)

Less: Purchase of property,

plant and equipment and application

software (5.6) (5.1) (11.0)

Less: Principal element of

lease repayments (10.3) (9.2) (19.2)

Add: Adjusting items (excl.

impairment and amortisation) 3 2.2 0.9 5.6

Free cashflow* 14.0 12.3 34.6

-------------------------------------- ----- -------------- -------------- -------------

*Calculated as cash generated from operating activities less

income taxes paid, capital expenditure and lease payments, but

before adjusting items (excluding amortisation and impairment).

Notes to the Consolidated Interim report

For the six months ended 30 June 2023

1 Basis of Preparation

The half year report has been prepared in accordance with IAS

34, Interim Financial Reporting, adopting accounting policies that

are consistent with those of the previous financial year and

corresponding half year reporting period,

2 Segmental Analysis

The Group is organised into two main operating segments, Digital

and Information Management and Secure Lifecycle Services and incurs

central costs. The vast majority of trading of the Group is

undertaken within the United Kingdom. Segment assets include

intangibles, property, plant and equipment, right-of-use assets,

inventories, receivables and operating cash. Central assets include

deferred tax and head office assets. Segment liabilities comprise

operating liabilities. Central liabilities include income tax and

deferred tax, corporate borrowings and head office liabilities.

Capital expenditure comprises additions to computer software,

property, plant and equipment. Segment assets and liabilities are

allocated between segments on an actual basis.

Revenue - Continuing operations

====================================

Unaudited Unaudited Audited

30 June 30 June 31 December

2023 2022 2022

GBP'm GBP'm GBP'm

==================================== ---------- ---------- -------------

Restore Records Management 59.3 55.9 113.7

Restore Digital 25.8 31.2 54.5

==================================== ========== ========== =============

Digital and Information Management 85.1 87.1 168.2

==================================== ========== ========== =============

Restore Technology 16.3 17.2 35.8

Restore Datashred 18.6 18.3 37.4

Restore Harrow Green 19.6 17.7 37.6

------------------------------------ ---------- ---------- -------------

Secure Lifecycle Services 54.5 53.2 110.8

==================================== ========== ========== =============

Total revenue 139.6 140.3 279.0

==================================== ========== ========== =============

The revenue from external customers was derived from the Group's

principal activities primarily in the UK (where the Company is

domiciled).

Segment information

Unaudited Unaudited Audited

30 June 30 June 31 December

2023 2022 2022

GBP'm GBP'm GBP'm

---------- ---------- -------------

Digital and Information Management 20.9 23.8 44.8

Secure Lifecycle Services 2.8 5.5 11.0

Central (4.9) (2.6) (7.6)

Amortisation of intangible assets (6.3) (5.9) (12.1)

Impairment of intangible assets (32.5) - -

Share-based payment credit/(charge) 0.7 (1.8) (1.9)

Operating (loss)/profit (19.3) 19.0 34.2

Finance costs (6.6) (4.9) (10.9)

------------------------------------- ---------- ---------- -------------

(Loss)/profit before tax (25.9) 14.1 23.3

===================================== ========== ========== =============

The reconciliation between the statutory results shown above and

the non-GAAP alternative performance measures are shown below:

Digital and Information Management

------------------------------------

Unaudited Unaudited Audited

30 June 30 June 31 December

2023 2022 2022

GBP'm GBP'm GBP'm

------------------------------------ ---------- ---------- -------------

Operating profit 20.9 23.8 44.8

Adjusting Items - 0.8 2.6

------------------------------------ ---------- ---------- -------------

Adjusted operating profit 20.9 24.6 47.4

==================================== ========== ========== =============

Secure Lifecycle Solutions

------------------------------------

Unaudited Unaudited Audited

30 June 30 June 31 December

2023 2022 2022

GBP'm GBP'm GBP'm

------------------------------------ ---------- ---------- -------------

Operating profit 2.8 5.5 11.0

Adjusting Items 0.5 0.1 0.8

------------------------------------ ---------- ---------- -------------

Adjusted operating profit 3.3 5.6 11.8

==================================== ========== ========== =============

Unaudited

Digital and Information Secure Lifecycle 30 June 2023

Management Services Head Office Total

GBP'm GBP'm GBP'm GBP'm

============================== ======================= ================ =========== =============

Segment assets 431.5 120.8 11.9 564.2

Segment liabilities 108.8 53.9 163.4 326.1

Capital expenditure 4.4 1.1 0.1 5.6

Depreciation and amortisation 16.3 6.4 0.2 22.9

============================== ======================= ================ =========== =============

Unaudited

30 June 2022

============================== ======================= ================ =========== =============

Segment assets 441.3 152.3 19.1 612.7

Segment liabilities 117.2 52.6 172.0 341.8

Capital expenditure 3.9 1.2 - 5.1

Depreciation and amortisation 14.2 6.1 0.1 20.4

============================== ======================= ================ =========== =============

Audited

31 December

2022

============================== ======================= ================ =========== =============

Segment assets 446.3 158.3 10.6 615.2

Segment liabilities 115.4 63.7 162.9 342.0

Capital expenditure 8.4 2.2 0.4 11.0

Depreciation and amortisation 29.2 11.9 0.6 41.7

============================== ======================= ================ =========== =============

3 Adjusting items

Restore's strategy is to grow through organic expansion,

strategic acquisitions and margin enhancement through efficiency

and scale. To assess progress in delivery of this strategy,

management believe it is useful to provide readers of the accounts

with alternative performance measures ('APMs') that describe the

performance of the Group before the effects of significant costs or

income that are considered to be distorting due to their nature,

and non-cash amortisation primarily arising from acquired

intangible assets. Adjustments made from statutory measures to

adjusted measures are referred to as adjusting items and include

amortisation, expenses associated with acquisitions and subsequent

integration costs, costs associated with major restructuring

programmes, and other significant costs that are considered to be

distorting due to their nature when assessing the performance of

the business.

The GBP32.5m non-cash impairment of intangible assets relates to

the historic acquisition of Datashred. Amortisation of intangible

assets increased versus H1 2022 as a result of prior year

acquisitions.

For the six months ended 30 June 2023, adjusting administrative

costs were GBP2.2m, including GBP0.2m of acquisition related costs,

GBP1.0m of restructuring and redundancy costs and GBP1.0m in

respect of strategic IT reorganisation. For the six months ended 30

June 2022, adjusting costs were GBP0.9m, including GBP0.8m

acquisition related restructuring costs and GBP0.1m acquisition

related transaction costs. For the year ended 31 December 2022,

adjusting costs were GBP5.6m, including GBP1.4m of acquisition

related transaction/advisory costs, GBP2.6m of restructuring and

redundancy costs, GBP0.9m of property related costs and GBP0.7m in

respect of strategic IT reorganisation.

4 Taxation

The current tax charge for the period to 30 June 2023 is

anticipated to be GBP2.2m, based on the estimated effective tax

rate for the Group.

5 Intangible Assets

Trade

Goodwill Customer relationships names Applications software IT Total

GBP'm GBP'm GBP'm GBP'm GBP'm

========================================== ======== ====================== ====== ======================== ======

Cost

1 January 2022 212.5 168.8 4.3 10.3 395.9

Arising on acquisition of subsidiaries 3.5 5.1 - - 8.6

Arising on acquisition of trade and assets 0.2 0.6 - - 0.8

Additions - external - - - 0.1 0.1

Disposals - - - (0.4) (0.4)

------------------------------------------ -------- ---------------------- ------ ------------------------ ------

30 June 2022 216.2 174.5 4.3 10.0 405.0

------------------------------------------ -------- ---------------------- ------ ------------------------ ------

Arising on acquisition of subsidiaries 1.2 3.3 - 0.2 4.7

Arising on acquisition of trade and assets - 0.1 - - 0.1

Fair Value Adjustment 1.7 - - - 1.7

Additions - external - - - 0.8 0.8

Disposals - - - (0.3) (0.3)

30 December 2022 219.1 177.9 4.3 10.7 412.0

------------------------------------------ -------- ---------------------- ------ ------------------------ ------

Additions - external - - - 0.4 0.4

Disposals - - - - -

30 June 2023 219.1 177.9 4.3 11.1 412.4

========================================== ======== ====================== ====== ======================== ======

Accumulation amortisation and impairment

1 January 2022 17.6 42.6 2.8 5.7 68.7

Charge for the year - 5.2 0.1 0.6 5.9

Disposals - - - (0.3) (0.3)

30 June 2022 17.6 47.8 2.9 6.0 74.3

------------------------------------------ -------- ---------------------- ------ ------------------------ ------

Charge for the year - 5.2 0.1 0.9 6.2

Disposals - - - (0.4) (0.4)

31 December 2022 17.6 53.0 3.0 6.5 80.1

------------------------------------------ -------- ---------------------- ------ ------------------------ ------

Charge for the year - 5.4 0.1 0.8 6.3

Disposals - - - - -

Impairment 32.5 - - - 32.5

30 June 2023 50.1 58.4 3.1 7.3 118.9

========================================== ======== ====================== ====== ======================== ======

Carrying amount

30 June 2023 169.0 119.5 1.2 3.8 293.5

------------------------------------------ -------- ---------------------- ------ ------------------------ ------

31 December 2022 201.5 124.9 1.3 4.2 331.9

------------------------------------------ -------- ---------------------- ------ ------------------------ ------

30 June 2022 198.6 126.7 1.4 4.0 330.7

========================================== ======== ====================== ====== ======================== ======

For the purpose of impairment testing, goodwill and other

intangibles are allocated to business units which represent the

lowest level at which that those assets are monitored for internal

management purposes. The recoverable amount of each cash-generating

unit ('GCU') is determined from value-in-use calculations. The

calculations use pre-tax cash flow projections through to the end

of 2027 and a pre-tax discount rate.

An impairment review was conducted at HY 2023, as a result of

weak volume and quality of recycled asset sales in Technology, and

the recent drop in paper price as well as a re-assessment of

long-term volume in Datashred. The impairment review covered

Technology and Datashred only, as no impairment indicators were

identified in respect of the Group's other CGUs. The CGUs tested

for impairment at HY 2023 have compound average growth rates for

revenue ranging from 4%-6% over the period 2024-2027. Terminal cash

flows are based on projections for FY27, assumed to grow

perpetually at 2%. The forecasts have been discounted using a

pre-tax discount rate of 12.8%.

The impairment review performed, which included downside

scenario modelling, indicated the need for an impairment in

Datashred of GBP32.5m. An impairment has resulted from reduced

expectations on service activity, paper volumes and recycled paper

pricing, as well as an increase in the discount rate partly driven

by the change in interest rate.

No impairment was required to the Technology CGU.

Datashred

The impairment charge of GBP32.5m is sensitive to changes in

revenue assumptions as well as to changes in the discount rate.

More optimistic assumptions reduce the impairment, whereas more

conservative assumptions increase the impairment. The scenario

which forms the basis of the impairment assumes paper pricing of

GBP170-GBP175 per tonne, steady compound average growth in paper

tonnages of 1.0%, and 4.5% compound average growth in service

revenue.

Assuming 0% growth in paper tonnages increases the impairment

charge by GBP0.2m. A GBP5/tonne reduction in the paper price

increases the impairment by GBP2.1m. Reducing the compound average

growth rate of service revenue to 4% increases the impairment by

GBP4.2m. An increase in the discount rate by 0.5% results in an

additional impairment of GBP1.0m.

Technology

The reduced level of profitability in Technology is considered

to be cyclical, however an increase in the discount rate or the

businesses not achieving the growth in profitability forecast for

FY27 could result in an impairment. An increase in the discount

rate to 13.6% using management's base case would result in an

impairment of GBP0.4m, with a further increase of 0.1% resulting in

an impairment of GBP0.8m. A 10% reduction in the terminal year

EBITDA would result in an impairment of GBP1.5m. These downside

scenarios are before taking any mitigating actions such as capex

reductions, which would increase the headroom in the model.

6 Earnings per ordinary share

Basic earnings per share have been calculated on the profit for

the period after taxation and the weighted average number of

ordinary shares in issue during the period.

Unaudited Unaudited Audited

six months six months year ended

ended ended 31 December

30 June 2023 30 June 2022 2022

GBP'm GBP'm GBP'm

--------------------------------------- -------------- -------------- -------------

Weighted average number of shares

in issue 136,924,067 136,674,067 136,761,738

--------------------------------------- -------------- -------------- -------------

Total (loss)/profit for the period (GBP28.1m) GBP10.3m GBP16.8m

--------------------------------------- -------------- -------------- -------------

Total basic (loss)/earnings per

ordinary share (20.5p) 7.5p 12.3p

--------------------------------------- -------------- -------------- -------------

Weighted average number of shares

in issue 136,924,067 136,674,067 136,761,738

Share options 663,859 4,777,957 1,264,065

Weighted average fully diluted number

of shares in issue 137,587,926 141,452,024 138,025,803

--------------------------------------- -------------- -------------- -------------

Total fully diluted earnings per

share (20.5p) 7.3p 12.2p

--------------------------------------- -------------- -------------- -------------

Adjusted earnings per share

The Directors believe that adjusted earnings per share provide a

more appropriate representation of the underlying earnings derived

from the Group's business. The adjusting items are shown in the

table below:

Unaudited Audited

Unaudited six months year ended

six months ended ended 31 December

30 June 2023 30 June 2022* 2022

GBP'm GBP'm GBP'm

---------------------------------- ------------------ --------------- -------------

(Loss)/profit before tax (25.9) 14.1 23.3

Adjustments:

Adjusting items - Amortisation

of intangible assets 6.3 5.9 12.1

Adjusting items - Impairment 32.5 - -

Adjusting items - Administrative

expenses 2.2 0.9 5.6

Adjusted profit before tax 15.1 20.9 41.0

---------------------------------- ------------------ --------------- -------------

*GBP0.3m of bank refinancing charges were treated as adjusting

items in deriving the Group's alternative performance measures at

H1 22 but have been restated consistent with the presentation at

FY22.

The adjusted earnings per share, based on weighted average

number of shares in issue during the period, 136.9m (2022: 136.7m)

is calculated below:

Unaudited Unaudited Audited

six months six months year ended

ended ended 31 December

30 June 2023 30 June 2022* 2022

------------------------------------ ------------- -------------- ------------

Adjusted profit before tax (GBP'm) 15.1 20.9 41.0

Tax at 23.5% (2022: 19.0%) (GBP'm) (3.6) (4.0) (7.8)

------------------------------------ ------------- -------------- ------------

Adjusted profit after tax (GBP'm) 11.5 16.9 33.2

------------------------------------ ------------- -------------- ------------

Adjusted basic earnings per share 8.4p 12.4p 24.3p

------------------------------------ ------------- -------------- ------------

Adjusted fully diluted earnings per

share 8.4p 12.0p 24.1p

------------------------------------ ------------- -------------- ------------

*GBP0.3m of bank refinancing charges were treated as adjusting

items in deriving the Group's alternative performance measures at

H1 22 but have been restated consistent with the presentation at

FY22.

7 Dividends

In respect of the current period, the Directors declare an

interim dividend of 1.85 p per share (2022: GBP2.6p). The estimated

dividend to be paid is GBP2.5m (2022: GBP3.6m) and will be paid on

20 October 2023 to those shareholders on the register as at 22

September 2023.

8 Cash generated from operating activities

Unaudited Unaudited

six months six months Audited year

ended ended ended

30 June 30 June 31 December

2023 2022 2022

GBP'm GBP'm GBP'm

---------------------------------------------- ----------- ----------- ------------

Continuing operations

(Loss)/profit before tax (25.9) 14.1 23.3

Depreciation of property, plant and equipment

and right-of-use assets 16.6 14.5 29.6

Amortisation of intangible assets 6.3 5.9 12.1

Impairment of intangible assets 32.5 - -

Net finance costs 6.6 4.9 10.9

Share-based payments (credit)/charge (0.7) 1.8 1.9

Share-based payment settlement (0.4) - -

Increase in inventories (0.3) (0.1) (0.3)

Decrease/(increase) in trade and other

receivables 3.2 (14.8) (11.9)

(Decrease)/increase in trade and other

payables (5.4) 2.2 (0.4)

---------------------------------------------- ----------- ----------- ------------

Cash generated from operating activities 32.5 28.5 65.2

---------------------------------------------- ----------- ----------- ------------

10 Financial liabilities - borrowings

Unaudited Audited

30 June Unaudited 31 December

2023 30 June 2022 2022

GBP'm GBP'm GBP'm

------------------------- --------- ------------- ------------

Non-current

Bank loans - secured 125.0 135.0 135.0

Deferred financing costs (1.8) (1.6) (1.3)

------------------------- --------- ------------- ------------

123.2 133.4 133.7

------------------------- --------- ------------- ------------

Analysis of net debt

Cash at bank and in hand 25.3 29.9 30.2

Bank loans due within one year - - -

Bank loans due after one year (123.2) (133.4) (133.7)

------------------------------- ------- ------- -------

(97.9) (103.5) (103.5)

------------------------------- ------- ------- -------

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SFLFMIEDSEFA

(END) Dow Jones Newswires

August 16, 2023 02:00 ET (06:00 GMT)

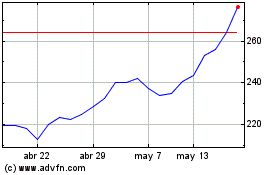

Restore (LSE:RST)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Restore (LSE:RST)

Gráfica de Acción Histórica

De May 2023 a May 2024