TIDMTEM

RNS Number : 1262J

Templeton Emerging Markets IT PLC

08 December 2022

Templeton Emerging Markets Investment Trust PLC ("TEMIT" or "the

Company")

Unaudited Half Yearly Report to 30 September 2022

Legal Entity Identifier 5493002NMTB70RZBXO96

Company Overview

Launched in June 1989, Templeton Emerging Markets Investment

Trust plc ("TEMIT" or the "Company") is an investment trust that

invests principally in emerging markets companies with the aim of

delivering capital growth to shareholders over the long term. While

the majority of the Company's shareholders are based in the UK,

shares are traded on both the London and New Zealand stock

exchanges.

TEMIT has a diversified portfolio of around 80 high quality

companies, actively selected for their long-term growth potential

and sustainable earnings, and with due regard to Environmental,

Social and Governance ("ESG") attributes. TEMIT's research-driven

investment approach and strong long-term performance has helped it

to grow to be the largest emerging markets investment trust in the

UK, with assets of GBP1.9 billion as at 30 September 2022. From its

launch to 30 September 2022, TEMIT's net asset value ("NAV") total

return was +3,481.8% compared to the benchmark total return of

+1,652.7%.

The Company is governed by a Board of Directors who are

committed to ensuring that shareholders' best interests,

considering the wider community of stakeholders, are at the

forefront of all decisions. Under the guidance of the Chairman, the

Board of Directors is responsible for the overall strategy of the

Company and monitoring its performance.

TEMIT at a glance

For the six months to 30 September 2022

Net asset value total Share price total MSCI Emerging Markets Interim dividend for

return (cum-income) (a) return(a) Index total return(a)(b) the financial year 2023

-8.3% -8.5% -7.4% 2.00p

(2021: -7.5%) (2021: -9.8%) (2021: -1.0%) (Interim dividend for

the financial year 2022:

1.00p)

------------------------ ----------------- ------------------------- -------------------------

Cumulative total return to 30 September 2022 (%)(a)

6 Months 1 Year 3 Years 5 Years 10 Years

Net asset value (cum-income) -8.3 -18.0 -2.4 6.6 58.3

-------- ------ ------- ------- --------

Share price -8.5 -20.1 -3.3 6.3 53.7

-------- ------ ------- ------- --------

MSCI Emerging Markets Index -7.4 -12.8 4.8 11.8 66.5

-------- ------ ------- ------- --------

(a) A glossary of alternative performance measures is included

on pages 37 and 38 of the full Half Yearly Report.

(b) Source: MSCI. The Company's benchmark is the MSCI Emerging

Markets Index, with net dividends reinvested.

Chairman's Statement

Market overview and investment performance

The difficult market conditions that I described in the most

recent Annual Report continued during the six-month period under

review. The news continues to be dominated by the Russian invasion

of Ukraine and its ramifications, particularly the impact on

commodity prices. While governments around the world have sought to

contain the effect, particularly on fuel and food prices, there is

a risk that inflation will become entrenched as workers naturally

seek to counterbalance the effects of price rises with wage rises,

which can form an inflationary spiral. In the developed world,

central banks have sought to counter inflation expectations with

increased interest rates but controlling demand while not stifling

growth is very difficult to achieve. While events in Ukraine have

overshadowed commodity and equity markets, there were also concerns

over Chinese growth in light of the government's interventions in

private companies and continued pursuit of lockdowns to control the

spread of COVID-19.

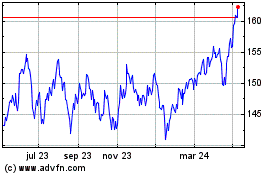

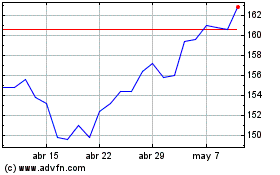

The Net Asset Value ("NAV") of TEMIT's shares was volatile over

the period. While by the end of August the shares had recorded a

small positive return, a very difficult September followed. This

resulted in a net asset value total return of -8.3%, compared with

-7.4% for the benchmark index for the six months to 30 September

2022. From 30 September 2022 to 6 December 2022, it has been

heartening to see a small recovery in markets. TEMIT's NAV total

return over this period was 6.0% compared with 1.7% for the

benchmark index.

Revenue and dividend

Net revenue earnings for the period under review amounted to

4.16 pence per share. As I have noted in the past, it is too early

to predict revenues for the full year but the majority of TEMIT's

earnings are typically received in the first half of the accounting

year. Brazil's national oil and gas company Petroleo Brasileiro, in

which the Investment Manager invested in January, rose on the back

of surging oil prices, which led to strong results for the second

quarter of 2022 and a dividend yield of around 20% in the same

quarter. Petroleo Brasileiro's long-life oil reserves, together

with its strategy of deleveraging its balance sheet and exiting

non-core assets allow for a particularly strong dividend

payout.

An interim dividend of 2.00 pence per share will be paid by

TEMIT on 27 January 2023 to shareholders on the register on 16

December 2022. This is an increase of 1.00 pence per share compared

with last year's interim dividend. This increase in the interim

dividend recognises that there was a large imbalance between the

interim and final dividend in recent years and shareholders should

note that this increase in the interim dividend does not imply any

intention to change the final dividend.

Borrowing

TEMIT has fixed borrowing of GBP100 million, and a revolving

credit facility under which up to GBP120 million in flexible debt

may be drawn down. As well as the fixed borrowing, throughout the

period GBP50 million was drawn under the revolving credit facility

which was subsequently repaid in October. The Investment Manager

continues to take a cautious view on the deployment of borrowing in

light of market circumstances. As at 30 September 2022, there was

significant cash in the portfolio and, net of this cash, the

portfolio was not geared. I would once again remind shareholders

that the level of debt deployed is not a result of views on market

direction but driven by investment opportunities presented by

individual companies.

Share rating

Our managers remain very active in promoting TEMIT's shares to a

wide variety of existing and potential investors and have continued

with their efforts to promote the Company despite the turbulent

markets. The Board was delighted that TEMIT won the award in the

"Emerging Markets Equity - Active" category in the prestigious AJ

Bell Fund and Investment Trust Awards in September 2022. This was

the third consecutive year that we have won this award. The award

is made on the basis of voting by private investors from a

shortlist of open-ended funds, ETFs and investment trusts drawn up

by investment experts.

The market conditions that I describe above naturally led to

pressure on the discount as investors sought safe havens. The Board

remains consistent in its view that share buybacks are a key tool

in managing the balance between supply and demand for the shares.

As set out in the most recent Annual Report, selling pressure

changed dramatically following the Russian invasion of Ukraine and

this has subsequently continued. In total over the six months to 30

September 2022, GBP18.4 million was spent on share buybacks and, as

all buybacks were at a discount to the prevailing NAV, this

resulted in an increase in the NAV of 0.15% to the benefit of

remaining shareholders.

First Stewardship Report launched

I set out in the most recent Annual Report that effective

stewardship of the Company's assets is a key element of the Board's

strategy for the Company. Consideration of governance and

sustainability issues has long been an integral part of our

Investment Manager's approach. In order to explain in more detail

their approach to this important topic, our inaugural Stewardship

Report for TEMIT was published in June and is available on our

website at www.temit.co.uk. This Report sets out in detail the

approach to investing your Company's assets sustainably and

includes TEMIT-specific case studies as well as data highlighting

the depth of engagement with companies. I encourage you to download

a copy if you have not already done so. The Investment Manager has

also provided a brief update of its stewardship activities as part

of the Investment Manager's Report.

The Board

As previously announced, Beatrice Hollond retired from the Board

at this year's Annual General Meeting and Simon Jeffreys assumed

the position of Senior Independent Director.

On 17 October 2022 we announced the appointment of Abigail

Rotheroe as a director effective 1 November 2022. Abigail has over

20 years of investment experience, most recently as the Investment

Director at Snowball Impact Management, a sustainable and

impact-focused asset manager. Previously Abigail has managed retail

and institutional Asia Pacific portfolios in Hong Kong and London

for Schroders, HSBC Asset Management Hong Kong and Columbia

Threadneedle Investments. She is a CFA Charterholder and has

experience in manager selection, sustainability, and impact

measurement.

Management fee reduction

As previously announced, with effect from 1 July 2022 the fee

paid to Franklin Templeton was reduced to:

-- 1.0% of the first GBP1 billion of net assets;

-- 0.75% of net assets between GBP1 billion and GBP2 billion; and

-- 0.5% of net assets over GBP2 billion.

Annual General Meeting

The Board was pleased to welcome shareholders to the AGM again

in July, having been obliged to hold the previous two years' AGMs

behind closed doors. All resolutions at the AGM were duly carried

by a large majority and I would like to thank shareholders for

their continuing support. I recognise that some shareholders are

unable to attend meetings in person and if you have any questions,

please send these by email to temitcosec@franklintempleton.com or

via www.temit.co.uk./investor/contact-us.

Outlook

It is likely that economic and market turbulence will continue

for some time and the risk of further political and economic shocks

remains elevated, not least as Russia's war on Ukraine continues.

The effects of high inflation, the resulting increases in interest

rates and strains on currency exchange rates are foremost in many

investors' minds. Uncertainties also continue in China where growth

and sentiment are being impacted by the continued zero-COVID policy

of the government which is currently resulting in widespread social

unrest. We will continue to focus on the Chinese government's

"common prosperity" agenda which has potential effects on the

profitability of some companies and on overall economic growth.

Geopolitical concerns, and particularly relations between China and

United States, also remain a key issue.

At the time of writing the value of the US dollar against a

basket of other currencies has moved down from the high levels

reached in September and equity markets are showing some signs of

recovery. Commentators often say that markets attempt to look 12-18

months into the future and it is possible that they are beginning

to reflect an eventual economic recovery. Our aim is to produce

attractive returns over the long term. Countries making up the

emerging markets currently contribute a large proportion of the

world's economic growth, and this appears likely to continue. The

markets in which our Investment Manager seeks opportunities have

many advantages, including relatively young and growing

populations, growing wealth and expanding economies. Further, many

of the companies in which we are able to invest are highly

innovative, and in some cases have world leading products and are

able to leapfrog their competitors in developed markets. As I said

in the recent Annual Report, your Board remains optimistic for

emerging market equities over the long term, and this view is based

on both the opportunities presented and the resources which our

Investment Manager deploys on shareholders' behalf.

Paul Manduca

Chairman

8 December 2022

Interim Management Report

Principal risks

The Company predominantly invests directly in the stock markets

of emerging markets. The principal categories of risks facing the

Company, determined by the Board and described in detail in the

Strategic Report within the Annual Report and Audited Accounts,

are:

-- Market and geo-political;

-- Pandemic;

-- Cyber;

-- Concentration;

-- Sustainability and climate change;

-- Foreign currency;

-- Portfolio liquidity;

-- Counterparty and credit;

-- Operational and custody;

-- Key personnel; and

-- Regulatory.

The Board has provided the Investment Manager with guidelines

and limits for the management of principal risks. The key emerging

risk faced by the Company during the year to 31 March 2022 was the

Russian invasion of Ukraine, and this was highlighted under

geo-political and liquidity risks. The Board and Investment Manager

are aware that the economic challenges continue to be the key issue

affecting investment markets around the world, including the

ongoing zero-COVID policy in China and its impact on economic

growth as well as the continued tensions between United States and

China over trade and Taiwan. There have been no further changes to

the principal and emerging risks reported in the Annual Report and,

in the Board's view, these principal and emerging risks are equally

applicable to the remaining six months of the financial year as

they were to the six months under review.

Related party transactions

There were no transactions with related parties during the

period other than the fees paid to the Directors and the AIFM.

Going concern

The Company's assets consist of equity shares in companies

listed on recognised stock exchanges and in most circumstances are

realisable within a short timescale. Having made suitable

enquiries, including consideration of the Company's objective, the

nature of the portfolio, net current assets, expenditure forecasts,

the principal and emerging risks and uncertainties described within

the Annual Report and with due consideration to the continuing

ramifications of the Russian invasion of Ukraine, the impact of the

ongoing zero-COVID policy in China and the potential impact of the

growing United States-China tensions around trade and Taiwan, the

Directors are satisfied that the Company has adequate resources to

continue to operate as a going concern for the period to 31 March

2024, which is at least 12 months from the date of approval of

these Financial Statements, and are satisfied that the going

concern basis is appropriate in preparing the Financial

Statements.

Statement of Directors' Responsibilities

The Disclosure Guidance and Transparency Rules of the UK Listing

Authority require the Directors to confirm their responsibilities

in relation to the preparation and publication of the Interim

Management Report and Financial Statements.

Each of the Directors, who are listed on page 35 of the full

Half Yearly Report, confirms that to the best of their

knowledge:

(a) the condensed set of Financial Statements, for the period

ended 30 September 2022, have been prepared in accordance with the

UK adopted International Accounting Standard (IAS) 34 "Interim

Financial Reporting"; and

(b) the Half Yearly Report includes a true and fair view of the

assets, liabilities, financial position and profit or loss of the

Company and a review of the information required by:

(i) DTR 4.2.7R of the Disclosure Guidance and Transparency

Rules, being an indication of important events that have occurred

during the first six months of the financial year and their impact

on the condensed set of Financial Statements, and a description of

the principal risks and uncertainties for the remaining six months

of the year; and

(ii) DTR 4.2.8R of the Disclosure Guidance and Transparency

Rules, being related party transactions that have taken place in

the first six months of the current financial year and that have

materially affected the financial position or performance of the

entity during that period, and any changes in the related party

transactions described in the last annual report that could do

so.

The Half Yearly Report was approved by the Board on 8 December

2022 and the above Statement of Directors' Responsibilities was

signed on its behalf by

Paul Manduca

Chairman

8 December 2022

Investment Manager's Report

Review of performance

Emerging markets collectively declined over the six months under

review as market sentiment remained weak. Rising inflation rates

and the continuation of central bank interest rate increases

depressed consumer and investor sentiment, although Asian emerging

markets experienced lower rates of increases than elsewhere. The

MSCI Emerging Markets Index returned -7.4% for the six-month period

under review, whilst TEMIT delivered a net asset value total return

of -8.3% (all figures are total return in sterling). Full details

of TEMIT's performance are on page 1 of the full Half Yearly

Report.

All regions declined during the period but Latin America was the

best relative performer, as positive performance in Chile limited

the region's decline. Asia was the worst performing region during

the six-month period despite strong returns in India, as tech-heavy

South Korea and Taiwan, as well as China, were largely responsible

for the region's lagging performance.

China was TEMIT's largest market exposure, although the

portfolio remained underweight relative to the benchmark. China was

amongst the region's strongest markets during the first three

months of the period, but regional lockdowns related to the

country's zero-COVID policy, continued regulatory uncertainty and a

reeling real estate market weighed on equity performance in the

second three months of the period. For the six months, Chinese

equities declined significantly as it dealt with a slowing economy

and weak investor sentiment. However, we believe that China's

government remains committed to fostering innovation as an economic

growth engine, and that we will see more regulatory clarity towards

the end of the year and hope that the government will also look to

plan an exit from the current zero-COVID policy.

TEMIT's second-largest market position was in South Korea, where

the portfolio was significantly overweight versus the benchmark.

South Korea experienced the largest emerging market decline, as its

technology-heavy market continued to struggle throughout the

period. An export powerhouse, several South Korean exporters are of

global importance, supplying vital hardware. World-leading

semiconductor and battery makers are benefitting from the secular

trends of increased computing power and greener mobility-some of

which have accelerated as we emerge from the COVID-19 pandemic.

South Korea's advantages in innovation and intellectual property

are also evident, whilst the country's internet sector has also

been thriving. However, the downtrend in the global technology

sector continues to weigh and an accompanying de-rating of sector

valuations affected South Korea in the third quarter of 2022.

The Taiwanese market also depressed the relative performance of

TEMIT as its technology sector experienced lower demand and higher

costs. TEMIT's overweight allocation to Taiwan is largely

attributable to exposure to the island's semiconductor industry,

chief amongst which was Taiwan Semiconductor Manufacturing

("TSMC"), which is also the portfolio's largest holding.

Technology's role as a key economic engine has only strengthened

during the pandemic. As technology has advanced, semiconductor

chips have become a growing part of almost all consumer goods with

the semiconductor industry experiencing a cyclical and secular boom

as growing digitalisation powers a surge in demand. Historically,

many chip designers outsourced manufacturing to key Taiwanese

companies such as TSMC with specialised manufacturing prowess and

lower costs. Some of these manufacturers are now counted amongst

the largest foundries globally and can partner with, and produce

chips for, clients anywhere in the world. This collaboration,

rather than direct competition, is a key advantage of their

business model. Over time, their advantage has shifted from

primarily cost-based to one of intellectual property, with fewer

competitors able to progress to the next level of technology.

Although we see a promising long term for the sector, a confluence

of factors makes the short term less certain. At the start of the

period, concerns around component shortages and the durability of a

price and demand recovery gave way to reduced demand, triggered in

part by higher global interest rates and inflation. However, we

maintain a positive long-term view on Taiwan's semiconductor

industry. Despite growing geopolitical concerns around China's

stated desire to absorb Taiwan, we expect the current status quo to

remain for the time being.

Although underweight relative to the benchmark, India was

TEMIT's fourth largest exposure at the end of September 2022. India

was also a relative outperformer, benefitting from a decline in oil

prices in the third quarter of the year. Over the longer-term, we

expect to see continued growth in Indian earnings due to positive

demographics for higher consumption, rising penetration in segments

like finance and health care, and growth in digitalisation. India

is also benefitting from the "China+1" strategy amongst

manufacturers. This strategy sees companies establish an additional

manufacturing base outside China to mitigate some of the supply

chain risks encountered during COVID-19. We remain focused on being

selective and identify bottom-up opportunities based on our

assessment of a company's growth, quality and earnings

sustainability.

Investment strategy, portfolio changes and performance

attribution

The following sections show how different investment factors

(stocks, sectors and geographies) accounted for the Company's

performance over the period.

We continue to emphasise our investment process that selects

companies based on their individual attributes and ability to

generate risk-adjusted returns for investors, rather than taking a

high-level view of sectors, countries or geographic regions to

determine our investment allocations.

Our investment style remains resolutely centred on finding good

quality companies with sustainable earnings power and whose shares

trade at a discount relative to their intrinsic worth. We see high

levels of leverage as a risk and we seek to avoid companies with

weak balance sheets.

We continue to utilise our research-based, active approach to

help us to find companies which have high standards of corporate

governance, respect their shareholder base and understand the local

intricacies that may determine consumer trends and habits.

Utilising our large team of analysts, we aim to maintain close

contact with the board and senior management of existing and

potential investments and believe in engaging constructively with

our investee companies.

Whilst the immediate outlook is uncertain, this approach should

help us best navigate the challenging market and economic backdrop.

Over time, we expect the long-term fundamentals of our holdings to

remain intact.

Performance attribution analysis %

Six months to 30 September 2022 2021 2020 2019 2018

--------------------------------------- ----- ----- ---- ----- -----

Net asset value total return(a) (8.3) (7.5) 31.3 6.3 (1.5)

--------------------------------------- ----- ----- ---- ----- -----

Expenses incurred 0.5 0.5 0.5 0.5 0.6

--------------------------------------- ----- ----- ---- ----- -----

Gross total return(a) (7.8) (7.0) 31.8 6.8 (0.9)

--------------------------------------- ----- ----- ---- ----- -----

Benchmark total return(a) (7.4) (1.0) 24.4 2.2 (1.8)

--------------------------------------- ----- ----- ---- ----- -----

Excess return(a) (0.4) (6.0) 7.4 4.6 0.9

--------------------------------------- ----- ----- ---- ----- -----

Stock selection 2.9 (4.3) 2.5 2.6 (0.2)

--------------------------------------- ----- ----- ---- ----- -----

Sector allocation (2.2) (1.4) 4.0 1.6 (0.5)

--------------------------------------- ----- ----- ---- ----- -----

Currency (1.1) (0.5) 0.5 0.4 1.1

--------------------------------------- ----- ----- ---- ----- -----

Share buyback impact 0.1 0.0 0.3 0.2 0.7

--------------------------------------- ----- ----- ---- ----- -----

Residual return(a) (0.1) 0.2 0.1 (0.2) (0.2)

--------------------------------------- ----- ----- ---- ----- -----

Total Investment Manager contribution (0.4) (6.0) 7.4 4.6 0.9

--------------------------------------- ----- ----- ---- ----- -----

Source: FactSet and Franklin Templeton.

(a) A glossary of alternative performance measures is included

on pages 37 and 38 of the full Half Yearly Report.

Top 10 contributors to relative performance by security

(%)(a)

Contribution to

portfolio relative

to MSCI

Share price Emerging

Top contributors Country Sector total return Markets Index

---------------------------- ---------------- ----------------------- ------------- -------------------

ICICI Bank India Financials 30.1 1.8

----------------------------- ----------------- ---------------------- ------------- -------------------

Daqo New Energy China/Hong Kong Information Technology 51.2 0.8

----------------------------- ----------------- ---------------------- ------------- -------------------

Petroleo Brasileiro Brazil Energy 37.3 0.7

----------------------------- ----------------- ---------------------- ------------- -------------------

Bajaj Holdings &

Investments(b) India Financials 42.8 0.5

----------------------------- ----------------- ---------------------- ------------- -------------------

Genpact(b)(c) United States Information Technology 19.0 0.5

----------------------------- ----------------- ---------------------- ------------- -------------------

Banco Santander Mexico(b) Mexico Financials 26.7 0.5

----------------------------- ----------------- ---------------------- ------------- -------------------

Prosus(b) China/Hong Kong Consumer Discretionary 16.1 0.4

----------------------------- ----------------- ---------------------- ------------- -------------------

Unilever(b)(c) United Kingdom Consumer Staples 17.1 0.3

----------------------------- ----------------- ---------------------- ------------- -------------------

Itaú Unibanco Brazil Financials 7.9 0.3

----------------------------- ----------------- ---------------------- ------------- -------------------

Guangzhou Tinci Materials

Technology China/Hong Kong Materials (1.1) 0.3

----------------------------- ----------------- ---------------------- ------------- -------------------

(a) For the period 31 March 2022 to 30 September 2022.

(b) Security not included in the MSCI Emerging Markets Index as

at 30 September 2022.

(c) This security, listed on a stock exchange in a developed

market, has significant exposure to operations from emerging

markets.

ICICI Bank is an Indian bank engaged in retail, corporate and

treasury services. The bank reported first quarter fiscal 2023

earnings which were ahead of expectations, led by a sharp increase

in non-interest income and an increase in net interest margins.

Momentum from a favourable quarterly report announced in late July

and good economic datapoints boosted returns. The bank's healthy

capital adequacy ratios and strong franchise place it in a good

position to capitalise on the growth opportunity in the Indian

economy.

Daqo New Energy , the Chinese producer of polysilicon for the

solar industry, experienced a sharp increase in its share price

during the period. The company raised its annual production volume

target and is positive on the outlook for polysilicon prices.

Investors are attracted to the company given its focus on renewable

energy which is forecast to continue growing significantly in the

coming years.

Brazil's national oil and gas company Petroleo Brasileiro

("Petrobras") rose on the back of surging oil prices, which led to

strong results for the second quarter of 2022 and a dividend yield

of around 20% in the same quarter. Petrobras' long-life oil

reserves, together with its strategy of deleveraging its balance

sheet and exiting non-core assets allow for a strong dividend

payout.

Top 10 detractors to relative performance by security (%)(a)

Contribution to

portfolio relative to

MSCI Emerging

Top detractors Country Sector Share price total return Markets Index

------------------------ ---------------- ----------------------- ------------------------ -----------------------

NAVER South Korea Communication Services (43.7) (1.2)

------------------------ ---------------- ----------------------- ------------------------ -----------------------

Taiwan Semiconductor

Manufacturing Taiwan Information Technology (24.3) (1.0)

------------------------ ---------------- ----------------------- ------------------------ -----------------------

Samsung Electronics South Korea Information Technology (23.4) (0.8)

------------------------ ---------------- ----------------------- ------------------------ -----------------------

MediaTek Taiwan Information Technology (28.7) (0.7)

------------------------ ---------------- ----------------------- ------------------------ -----------------------

Meituan(b) China/Hong Kong Consumer Discretionary 25.2 (0.4)

------------------------ ---------------- ----------------------- ------------------------ -----------------------

China Merchants Bank China/Hong Kong Financials (21.3) (0.3)

------------------------ ---------------- ----------------------- ------------------------ -----------------------

Cognizant Technology

Solutions(c)(d) United States Information Technology (24.0) (0.3)

------------------------ ---------------- ----------------------- ------------------------ -----------------------

Soulbrain(c) South Korea Materials (28.0) (0.3)

------------------------ ---------------- ----------------------- ------------------------ -----------------------

Americanas Brazil Consumer Discretionary (45.8) (0.3)

------------------------ ---------------- ----------------------- ------------------------ -----------------------

Alibaba China/Hong Kong Consumer Discretionary (18.2) (0.2)

------------------------ ---------------- ----------------------- ------------------------ -----------------------

(a) For the period 31 March 2022 to 30 September 2022.

(b) Security not held by TEMIT as at 30 September 2022.

(c) Security not included in the MSCI Emerging Markets Index as at 30 September 2022.

(d) This security, listed on a stock exchange in a developed

market, has significant exposure to operations from emerging

markets.

NAVER declined in the third quarter after it fell short of

consensus second quarter earnings estimates. The company operates

South Korea's largest search engine, and offers e-commerce, fintech

and digital content services. Its share price has been on a

declining trend due to slower growth in the post-COVID environment.

Concerns that expansion into unprofitable new businesses with lower

margins also negatively impacted market sentiment. However, we

believe that NAVER is in a good position to build a thriving

ecosystem integrating e-commerce, payments and digital content

based on its solid foundation in search and advertising.

After losing ground in August due to lower chip demand

throughout the industry, TSMC shares took another hit in late

September when Apple reported lower demand for its new iPhone 14.

TSMC is the world's largest foundry semiconductor manufacturer. The

company's share price has been under pressure, despite solid second

quarter results which saw management increase third quarter sales

guidance. The company is a beneficiary of the digitisation trend,

and of increased penetration of semiconductors in consumer goods

ranging from cars to domestic appliances. Nevertheless, it cannot

escape the short-term downtrend in the global technology sector and

the accompanying de-rating of sector valuations.

Samsung Electronics is one of the largest memory semiconductor

manufacturers in the world. The company experienced downward

pressure in its share price in the period under review as rising

inventory levels have converged with increased global economic

uncertainty, resulting in an inventory adjustment amongst

customers. In addition to the already weakening demand in PC and

mobile segments, there are concerns over the outlook for server

demand. Consensus estimates amongst analysts for sales in 2023

peaked in May and have been trending lower since then. We partially

reduced our overweight exposure during the period.

Top contributors and detractors to relative performance by

sector (%)(a)

Contribution to Contribution to

MSCI portfolio MSCI Emerging portfolio

Emerging Markets relative to MSCI Markets Index relative to MSCI

Index sector total Emerging Markets sector total Emerging Markets

Top contributors return Index Top detractors return Index

----------------- ------------------ ------------------ ------------------- ------------------ ------------------

Consumer

Financials (3.5) 2.4 Discretionary 1.9 (1.1)

----------------- ------------------ ------------------ ------------------- ------------------ ------------------

Communication

Energy 8.6 0.3 Services (14.6) (0.8)

----------------- ------------------ ------------------ ------------------- ------------------ ------------------

Information

Real Estate (10.5) 0.1 Technology (20.7) (0.5)

----------------- ------------------ ------------------ ------------------- ------------------ ------------------

Utilities 8.0 (0.3)

----------------- ------------------ ------------------ ------------------- ------------------ ------------------

Industrials (3.3) (0.3)

----------------- ------------------ ------------------ ------------------- ------------------ ------------------

(a) For the period 31 March 2022 to 30 September 2022.

Favourable stock selection and a significant overweight position

in the financial sector added to TEMIT's performance relative to

the benchmark. ICICI Bank, mentioned above, was the primary

contributor to the sector. The energy sector also contributed to

relative results, despite an underweight that detracted, thanks to

strong performance from Petrobras (discussed above). Real estate

was the only other sector in the portfolio to post a positive

result during the period, thanks to modest contributions from both

an underweight position and stock selection.

Stock selection in the consumer discretionary sector weighed on

relative performance, where Americanas, Alibaba, and a lack of

exposure to benchmark holding Meituan were all amongst the top 10

detractors in the portfolio. The communication services sector,

where stock selection weighed on results, also had a negative

impact. NAVER (discussed above) was the key detractor in the

communication services sector. A significant overweight position in

information technology hindered relative returns, although stock

selection helped mitigate some of the negative effect. TSMC and

Samsung Electronics (discussed above) were the heaviest decliners

relative to the benchmark in the information technology sector.

Top contributors and detractors to relative performance by

country (%)(a)

MSCI Contribution to Contribution to

Emerging Markets portfolio MSCI portfolio

Index sector relative to MSCI Emerging Markets relative to MSCI

total Emerging Markets Index sector total Emerging Markets

Top contributors return Index Top detractors return Index

------------------ ------------------ ----------------- ------------------ ------------------ -----------------

Brazil (2.6) 0.9 South Korea (21.9) (1.4)

------------------ ------------------ ----------------- ------------------ ------------------ -----------------

India 8.9 0.7 Taiwan (18.0) (1.1)

------------------ ------------------ ----------------- ------------------ ------------------ -----------------

South Africa (19.9) 0.7 Saudi Arabia(c) 3.2 (0.5)

------------------ ------------------ ----------------- ------------------ ------------------ -----------------

Mexico (6.1) 0.4 China/Hong Kong (5.6) (0.4)

------------------ ------------------ ----------------- ------------------ ------------------ -----------------

United Kingdom(b) - 0.3 Indonesia 15.9 (0.2)

------------------ ------------------ ----------------- ------------------ ------------------ -----------------

(a) For the period 31 March 2022 to 30 September 2022.

(b) No companies included in the MSCI Emerging Markets Index in

this country as at 30 September 2022.

(c) No companies held by TEMIT in this country as at 30

September 2022.

A significant overweight position in the underperforming South

Korean market hurt relative results. Key stocks included NAVER and

Samsung Electronics, discussed earlier. In Taiwan, selections

including the portfolio's largest holding, TSMC, hindered

performance, while MediaTek had a lesser negative effect. A slight

overweight in the market also hurt relative returns. China, as

discussed above, also detracted, although a slight underweight

helped mute underperformance. Lack of exposure to Meituan, a

food-delivery platform, and an overweight in China Merchants Bank

were the top detractors.

Brazil was the major positive contributor to relative

performance. An overweight exposure and favourable stock selection

had a positive impact, and Petrobras (discussed above and also

overweighted) contributed significantly. An overweight in

top-performing ICICI Bank (discussed above) led India to an

outsized positive result during the period, as did off-benchmark

exposure to Bajaj Holdings & Investments. Stock selection and

an underweight in South Africa also delivered positive results led

by an off-benchmark investment in Massmart.

Portfolio changes by sector

Total return in

sterling

30 September

31 March 2022 2022 market MSCI

market value Market value TEMIT Emerging

Sector GBPm Purchases GBPm Sales GBPm movement GBPm GBPm % Markets Index %

---------------- -------------- -------------- ---------- --------------- -------------- ------ ---------------

Information

Technology 737 27 (102) (137) 525 (17.4) (20.7)

---------------- -------------- -------------- ---------- --------------- -------------- ------ ---------------

Financials 473 51 (46) 24 502 6.3 (3.5)

---------------- -------------- -------------- ---------- --------------- -------------- ------ ---------------

Consumer

Discretionary 266 30 (30) (22) 244 (7.8) 1.9

---------------- -------------- -------------- ---------- --------------- -------------- ------ ---------------

Communication

Services 212 18 (11) (47) 172 (23.3) (14.6)

---------------- -------------- -------------- ---------- --------------- -------------- ------ ---------------

Materials 208 10 (34) (31) 153 (13.8) (12.8)

---------------- -------------- -------------- ---------- --------------- -------------- ------ ---------------

Industrials 62 28 (1) (7) 82 (7.9) (3.3)

---------------- -------------- -------------- ---------- --------------- -------------- ------ ---------------

Consumer Staples 82 5 (16) 10 81 14.4 7.7

---------------- -------------- -------------- ---------- --------------- -------------- ------ ---------------

Energy 36 25 (1) (2) 58 33.7 8.6

---------------- -------------- -------------- ---------- --------------- -------------- ------ ---------------

Health Care 33 7 (2) (5) 33 (11.4) (7.2)

---------------- -------------- -------------- ---------- --------------- -------------- ------ ---------------

Real Estate 16 - (6) - 10 (8.8) (10.5)

---------------- -------------- -------------- ---------- --------------- -------------- ------ ---------------

Utilities - 10 (11) 2 1 17.6 8.0

---------------- -------------- -------------- ---------- --------------- -------------- ------ ---------------

Total

Investments 2,125 211 (260) (215) 1,861

---------------- -------------- -------------- ---------- --------------- -------------- ------ ---------------

Sector asset allocation

As at 30 September 2022

Sector weightings vs benchmark (%)

TEMIT MSCI Emerging Markets Index

----------------------- ----- ---------------------------

Information Technology 28.2 18.2

----------------------- ----- ---------------------------

Financials 26.9 22.6

----------------------- ----- ---------------------------

Consumer Discretionary 13.1 14.0

----------------------- ----- ---------------------------

Communication Services 9.3 9.7

----------------------- ----- ---------------------------

Materials 8.2 8.7

----------------------- ----- ---------------------------

Industrials 4.4 5.8

----------------------- ----- ---------------------------

Consumer Staples 4.3 6.6

----------------------- ----- ---------------------------

Energy 3.2 5.3

----------------------- ----- ---------------------------

Health Care 1.8 3.9

----------------------- ----- ---------------------------

Real Estate 0.5 2.0

----------------------- ----- ---------------------------

Utilities 0.1 3.2

----------------------- ----- ---------------------------

Portfolio changes by country

Total return in

sterling

30 September

31 March 2022 2022 market MSCI

market value Market movement value TEMIT Emerging

Country GBPm Purchases GBPm Sales GBPm GBPm GBPm % Markets Index %

---------------- -------------- -------------- ---------- --------------- -------------- ------ ---------------

China/Hong Kong 605 63 (74) (50) 544 (7.7) (5.6)

---------------- -------------- -------------- ---------- --------------- -------------- ------ ---------------

South Korea 487 11 (67) (107) 324 (22.4) (21.9)

---------------- -------------- -------------- ---------- --------------- -------------- ------ ---------------

Taiwan 363 19 (15) (93) 274 (23.8) (18.0)

---------------- -------------- -------------- ---------- --------------- -------------- ------ ---------------

India 188 44 (47) 46 231 22.0 8.9

---------------- -------------- -------------- ---------- --------------- -------------- ------ ---------------

Brazil 210 29 (18) (15) 206 2.2 (2.6)

---------------- -------------- -------------- ---------- --------------- -------------- ------ ---------------

Other 272 45 (39) 4 282 - -

---------------- -------------- -------------- ---------- --------------- -------------- ------ ---------------

Total

Investments 2,125 211 (260) (215) 1,861

---------------- -------------- -------------- ---------- --------------- -------------- ------ ---------------

Geographic asset allocation

As at 30 September 2022

Country weightings vs benchmark (%)(a)

TEMIT MSCI Emerging Markets Index

--------------------- ----- ---------------------------

China/Hong Kong 29.2 31.4

--------------------- ----- ---------------------------

South Korea 17.4 10.7

--------------------- ----- ---------------------------

Taiwan 14.7 13.7

--------------------- ----- ---------------------------

India 12.4 15.3

--------------------- ----- ---------------------------

Brazil 11.1 5.7

--------------------- ----- ---------------------------

United States(b) 3.9 -

--------------------- ----- ---------------------------

Thailand 2.6 2.1

--------------------- ----- ---------------------------

Mexico 2.0 2.3

--------------------- ----- ---------------------------

United Kingdom(b) 1.8 -

--------------------- ----- ---------------------------

Indonesia 1.0 2.2

--------------------- ----- ---------------------------

Hungary 0.8 0.2

--------------------- ----- ---------------------------

South Africa 0.7 3.4

--------------------- ----- ---------------------------

Chile 0.6 0.6

--------------------- ----- ---------------------------

Peru 0.5 0.2

--------------------- ----- ---------------------------

Cambodia(b) 0.4 -

--------------------- ----- ---------------------------

Philippines 0.3 0.7

--------------------- ----- ---------------------------

Pakistan(b) 0.3 -

--------------------- ----- ---------------------------

Kenya(b) 0.3 -

--------------------- ----- ---------------------------

United Arab Emirates 0.0 1.4

--------------------- ----- ---------------------------

Russia(b)(c) 0.0 -

--------------------- ----- ---------------------------

(a) Other countries included in the benchmark are Colombia,

Czech Republic, Greece, Kuwait, Malaysia, Poland, Qatar, Romania,

Saudi Arabia, Singapore and Turkey.

(b) Countries not included in the MSCI Emerging Markets Index.

(c) All companies held by TEMIT in this country are valued at

zero.

Portfolio investments by fair value

As at 30 September 2022

Fair value

Holding Country Sector Trading(a) GBP'000 % of net assets

------------------------ ------------------ ----------------- ----------- ----------------- ---------------

Taiwan Semiconductor Information

Manufacturing Taiwan Technology NT 194,259 10.4

------------------------ ------------------ ----------------- ----------- ----------------- ---------------

ICICI Bank India Financials PS 128,805 6.9

------------------------ ------------------ ----------------- ----------- ----------------- ---------------

Information

Samsung Electronics South Korea Technology PS 108,780 5.8

------------------------ ------------------ ----------------- ----------- ----------------- ---------------

Consumer

Alibaba(b) China/Hong Kong Discretionary PS 102,744 5.5

------------------------ ------------------ ----------------- ----------- ----------------- ---------------

Communication

Tencent China/Hong Kong Services IH 74,610 4.0

------------------------ ------------------ ----------------- ----------- ----------------- ---------------

Information

MediaTek Taiwan Technology IH 63,147 3.4

------------------------ ------------------ ----------------- ----------- ----------------- ---------------

Petroleo Brasileiro(c) Brazil Energy IH 53,242 2.9

------------------------ ------------------ ----------------- ----------- ----------------- ---------------

Banco Bradesco(c)(d) Brazil Financials IH 51,332 2.7

------------------------ ------------------ ----------------- ----------- ----------------- ---------------

Communication

NAVER South Korea Services IH 50,508 2.7

------------------------ ------------------ ----------------- ----------- ----------------- ---------------

China Merchants Bank China/Hong Kong Financials IH 49,044 2.6

------------------------ ------------------ ----------------- ----------- ----------------- ---------------

TOP 10 LARGEST

INVESTMENTS 876,471 46.9

------------------------ ------------------ ----------------------------- ----------------- ---------------

LG South Korea Industrials NT 48,944 2.6

------------------------ ------------------ ----------------- ----------- ----------------- ---------------

Itaú Unibanco(c)(d) Brazil Financials IH 48,233 2.6

------------------------ ------------------ ----------------- ----------- ----------------- ---------------

Information

Genpact(e) United States Technology IH 44,124 2.4

------------------------ ------------------ ----------------- ----------- ----------------- ---------------

Guangzhou Tinci

Materials Technology China/Hong Kong Materials PS 43,740 2.3

------------------------ ------------------ ----------------- ----------- ----------------- ---------------

Consumer

Prosus(f) China/Hong Kong Discretionary PS 40,017 2.1

------------------------ ------------------ ----------------- ----------- ----------------- ---------------

Vale Brazil Materials IH 38,604 2.1

------------------------ ------------------ ----------------- ----------- ----------------- ---------------

Samsung Life Insurance South Korea Financials NT 36,388 2.0

------------------------ ------------------ ----------------- ----------- ----------------- ---------------

Banco Santander

Mexico(d) Mexico Financials NH 33,549 1.8

------------------------ ------------------ ----------------- ----------- ----------------- ---------------

Unilever(e) United Kingdom Consumer Staples PS 33,048 1.8

------------------------ ------------------ ----------------- ----------- ----------------- ---------------

Information

Daqo New Energy(d) China/Hong Kong Technology PS 30,710 1.6

------------------------ ------------------ ----------------- ----------- ----------------- ---------------

TOP 20 LARGEST

INVESTMENTS 1,273,828 68.2

------------------------ ------------------ ----------------------------- ----------------- ---------------

Cognizant Technology Information

Solutions(e) United States Technology NT 28,641 1.5

------------------------ ------------------ ----------------- ----------- ----------------- ---------------

Techtronic Industries China/Hong Kong Industrials IH 28,245 1.5

------------------------ ------------------ ----------------- ----------- ----------------- ---------------

HDFC Bank India Financials NH 27,945 1.5

------------------------ ------------------ ----------------- ----------- ----------------- ---------------

Kasikornbank Thailand Financials NT 25,329 1.3

------------------------ ------------------ ----------------- ----------- ----------------- ---------------

Bajaj Holdings &

Investments India Financials PS 23,088 1.2

------------------------ ------------------ ----------------- ----------- ----------------- ---------------

Soulbrain South Korea Materials IH 21,627 1.2

------------------------ ------------------ ----------------- ----------- ----------------- ---------------

POSCO South Korea Materials NT 21,153 1.1

------------------------ ------------------ ----------------- ----------- ----------------- ---------------

Uni-President China China/Hong Kong Consumer Staples IH 20,378 1.1

------------------------ ------------------ ----------------- ----------- ----------------- ---------------

Ping An Insurance China/Hong Kong Financials IH 19,475 1.0

------------------------ ------------------ ----------------- ----------- ----------------- ---------------

Tata Consultancy Information

Services India Technology PS 18,687 1.0

------------------------ ------------------ ----------------- ----------- ----------------- ---------------

TOP 30 LARGEST

INVESTMENTS 1,508,396 80.6

------------------------ ------------------ ----------------------------- ----------------- ---------------

Consumer

Astra International Indonesia Discretionary PS 18,465 1.0

----------------------- ------------------- ----------------- ----------- ----------------- ---------------

Brilliance China Consumer

Automotive(g) China/Hong Kong Discretionary NT 18,366 1.0

----------------------- ------------------- ----------------- ----------- ----------------- ---------------

Consumer

Zomato India Discretionary NH 17,069 0.9

----------------------- ------------------- ----------------- ----------- ----------------- ---------------

Consumer

Fila South Korea Discretionary NT 16,633 0.9

----------------------- ------------------- ----------------- ----------- ----------------- ---------------

Communication

Baidu China/Hong Kong Services IH 16,293 0.9

----------------------- ------------------- ----------------- ----------- ----------------- ---------------

Hon Hai Precision Information

Industry Taiwan Technology PS 16,093 0.8

----------------------- ------------------- ----------------- ----------- ----------------- ---------------

Information

Infosys Technologies India Technology IH 15,463 0.8

----------------------- ------------------- ----------------- ----------- ----------------- ---------------

Gedeon Richter Hungary Health Care NT 14,495 0.8

----------------------- ------------------- ----------------- ----------- ----------------- ---------------

Tencent Music Communication

Entertainment(d) China/Hong Kong Services PS 14,269 0.8

----------------------- ------------------- ----------------- ----------- ----------------- ---------------

Communication

NetEase China/Hong Kong Services PS 14,252 0.8

----------------------- ------------------- ----------------- ----------- ----------------- ---------------

TOP 40 LARGEST

INVESTMENTS 1,669,794 89.3

----------------------- ------------------- ----------------------------- ----------------- ---------------

China Resources Cement China/Hong Kong Materials PS 12,451 0.7

----------------------- ------------------- ----------------- ----------- ----------------- ---------------

Ping An Bank China/Hong Kong Financials NT 12,340 0.6

----------------------- ------------------- ----------------- ----------- ----------------- ---------------

Banco Santander

Chile(d) Chile Financials NH 10,700 0.5

----------------------- ------------------- ----------------- ----------- ----------------- ---------------

Intercorp Financial

Services Peru Financials IH 9,253 0.5

----------------------- ------------------- ----------------- ----------- ----------------- ---------------

Consumer

Americanas Brazil Discretionary IH 9,183 0.5

----------------------- ------------------- ----------------- ----------- ----------------- ---------------

Kiatnakin Phatra Bank Thailand Financials NT 8,952 0.5

----------------------- ------------------- ----------------- ----------- ----------------- ---------------

Keshun Waterproof

Technologies China/Hong Kong Materials PS 8,900 0.5

----------------------- ------------------- ----------------- ----------- ----------------- ---------------

LegoChem Biosciences South Korea Health Care IH 8,122 0.4

----------------------- ------------------- ----------------- ----------- ----------------- ---------------

Massmart South Africa Consumer Staples PS 8,016 0.4

----------------------- ------------------- ----------------- ----------- ----------------- ---------------

Thai Beverage Thailand Consumer Staples NT 7,639 0.4

----------------------- ------------------- ----------------- ----------- ----------------- ---------------

TOP 50 LARGEST

INVESTMENTS 1,765,350 94.3

----------------------- ------------------- ----------------------------- ----------------- ---------------

Consumer

NagaCorp Cambodia Discretionary PS 6,873 0.4

----------------------- ------------------- ----------------- ----------- ----------------- ---------------

LG Chem South Korea Materials PS 6,793 0.4

----------------------- ------------------- ----------------- ----------- ----------------- ---------------

H&H Group China/Hong Kong Consumer Staples IH 6,409 0.3

----------------------- ------------------- ----------------- ----------- ----------------- ---------------

Star Petroleum Refining Thailand Energy NH 6,145 0.3

----------------------- ------------------- ----------------- ----------- ----------------- ---------------

BDO Unibank Philippines Financials NT 5,885 0.3

----------------------- ------------------- ----------------- ----------- ----------------- ---------------

Netcare South Africa Health Care IH 5,740 0.3

----------------------- ------------------- ----------------- ----------- ----------------- ---------------

MCB Bank Pakistan Financials NT 4,993 0.3

----------------------- ------------------- ----------------- ----------- ----------------- ---------------

COSCO SHIPPING Ports China/Hong Kong Industrials IH 4,939 0.3

----------------------- ------------------- ----------------- ----------- ----------------- ---------------

East African Breweries Kenya Consumer Staples NT 4,913 0.3

----------------------- ------------------- ----------------- ----------- ----------------- ---------------

Wuxi Biologics China/Hong Kong Health Care PS 4,899 0.3

----------------------- ------------------- ----------------- ----------- ----------------- ---------------

TOP 60 LARGEST

INVESTMENTS 1,822,939 97.5

----------------------- ------------------- ----------------------------- ----------------- ---------------

China Resources Land China/Hong Kong Real Estate PS 4,793 0.3

------------------------ ----------------- ----------------- ----------- ----------------- ---------------

Longshine Technology Information

Group China/Hong Kong Technology PS 4,781 0.3

------------------------ ----------------- ----------------- ----------- ----------------- ---------------

Greentown Service Group China/Hong Kong Real Estate PS 4,760 0.2

------------------------ ----------------- ----------------- ----------- ----------------- ---------------

Consumer

Nemak Mexico Discretionary NT 4,417 0.2

------------------------ ----------------- ----------------- ----------- ----------------- ---------------

XP Inc Brazil Financials NT 4,384 0.2

------------------------ ----------------- ----------------- ----------- ----------------- ---------------

Consumer

Hankook Tire South Korea Discretionary NT 3,338 0.2

------------------------ ----------------- ----------------- ----------- ----------------- ---------------

Consumer

JD.com China/Hong Kong Discretionary NT 2,605 0.1

------------------------ ----------------- ----------------- ----------- ----------------- ---------------

Consumer

Weifu High-Technology China/Hong Kong Discretionary NT 2,461 0.1

------------------------ ----------------- ----------------- ----------- ----------------- ---------------

Communication

KT Skylife South Korea Services NT 2,179 0.1

------------------------ ----------------- ----------------- ----------- ----------------- ---------------

Consumer

BAIC Motor China/Hong Kong Discretionary NT 1,876 0.1

------------------------ ----------------- ----------------- ----------- ----------------- ---------------

TOP 70 LARGEST

INVESTMENTS 1,858,533 99.3

------------------------ ----------------------------------------------- ----------------- ---------------

Information

TOTVS Brazil Technology PS 885 0.1

------------------------ ----------------- ----------------- ----------- ----------------- ---------------

Dubai Electricity and United Arab

Water Authority Emirates Utilities NH 817 0.0

------------------------ ----------------- ----------------- ----------- ----------------- ---------------

Consumer

Chervon Holdings China/Hong Kong Discretionary PS 279 0.0

------------------------ ----------------- ----------------- ----------- ----------------- ---------------

Yandex(h) Russia Communication NT - -

Services

------------------------ ----------------- ----------------- ----------- ----------------- ---------------

LUKOIL(h) Russia Energy NT - -

------------------------ ----------------- ----------------- ----------- ----------------- ---------------

VK(h)(i) Russia Communication NT - -

Services

------------------------ ----------------- ----------------- ----------- ----------------- ---------------

Sberbank of Russia(h) Russia Financials NT - -

------------------------ ----------------- ----------------- ----------- ----------------- ---------------

TOTAL INVESTMENTS 1,860,514 99.4

------------------------ ----------------------------------------------- ----------------- ---------------

NET ASSETS 11,247 0.6

------------------------ ----------------------------------------------- ----------------- ---------------

TOTAL NET ASSETS 1,871,761 100.0

------------------------ ----------------------------------------------- ----------------- ---------------

(a) Trading activity during the year: (NH) New Holding, (IH)

Increased Holding, (PS) Partial Sale and (NT) No Trading.

(b) Company is listed on the Hong Kong and New York stock

exchanges.

(c) Preferred shareholders are entitled to dividends before ordinary shareholders.

(d) US listed American Depository Receipt.

(e) This company, listed on a stock exchange in a developed

market, has significant exposure to operations from emerging

markets.

(f) This company is listed in the Netherlands. The

classification of China/Hong Kong is due to most of its revenue

coming from its holding in Tencent.

(g) Trading of this company's shares on the Hong Kong stock

exchange has been suspended since 31 March 2021. Shares resumed

trading on 5 October 2022.

(h) This company is fair valued at zero as a result of its

trading being suspended on international stock exchanges.

(i) UK listed Global Depository Receipt.

Portfolio summary

As at 30 September 2022

All figures are a % of the net assets

30 31

September March

Communication Consumer Consumer Health Information Real Total Net 2022 2022

Services Discretionary Staples Energy Financials Care Industrials Technology Materials Estate Utilities Equities assets/(liabilities)(a) Total Total

------------------------ ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- --------- ----------------------- --------- -----

Brazil - 0.5 - 2.9 5.5 - - - 2.1 - - 11.0 - 11.0 10.0

------------------------ ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- --------- ----------------------- --------- -----

Cambodia - 0.4 - - - - - - - - - 0.4 - 0.4 0.4

------------------------ ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- --------- ----------------------- --------- -----

Chile - - - - 0.5 - - - - - - 0.5 - 0.5 -

------------------------ ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- --------- ----------------------- --------- -----

China/Hong Kong 6.5 8.9 1.4 - 4.3 0.3 1.8 1.9 3.4 0.5 - 29.0 - 29.0 28.8

------------------------ ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- --------- ----------------------- --------- -----

Egypt - - - - - - - - - - - - - - 0.1

------------------------ ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- --------- ----------------------- --------- -----

Germany - - - - - - - - - - - - - - 0.1

------------------------ ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- --------- ----------------------- --------- -----

Hungary - - - - - 0.8 - - - - - 0.8 - 0.8 0.7

------------------------ ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- --------- ----------------------- --------- -----

India - 0.9 - - 9.6 - - 1.8 - - - 12.3 - 12.3 9.1

------------------------ ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- --------- ----------------------- --------- -----

Indonesia - 1.0 - - - - - - - - - 1.0 - 1.0 0.9

------------------------ ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- --------- ----------------------- --------- -----

Kenya - - 0.3 - - - - - - - - 0.3 - 0.3 0.2

------------------------ ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- --------- ----------------------- --------- -----

Mexico - 0.2 - - 1.8 - - - - - - 2.0 - 2.0 1.6

------------------------ ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- --------- ----------------------- --------- -----

Pakistan - - - - 0.3 - - - - - - 0.3 - 0.3 0.4

------------------------ ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- --------- ----------------------- --------- -----

Peru - - - - 0.5 - - - - - - 0.5 - 0.5 0.5

------------------------ ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- --------- ----------------------- --------- -----

Philippines - - - - 0.3 - - - - - - 0.3 - 0.3 0.3

------------------------ ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- --------- ----------------------- --------- -----

Russia(b) - - - - - - - - - - - 0.0 - 0.0 0.0

------------------------ ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- --------- ----------------------- --------- -----

South Africa - - 0.4 - - 0.3 - - - - - 0.7 - 0.7 0.6

------------------------ ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- --------- ----------------------- --------- -----

South Korea 2.8 1.1 - - 2.0 0.4 2.6 5.8 2.7 - - 17.4 - 17.4 23.2

------------------------ ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- --------- ----------------------- --------- -----

Taiwan - - - - - - - 14.6 - - - 14.6 - 14.6 17.3

------------------------ ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- --------- ----------------------- --------- -----

Thailand - - 0.4 0.3 1.8 - - - - - - 2.5 - 2.5 2.1

------------------------ ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- --------- ----------------------- --------- -----

United Arab Emirates - - - - - - - - - - 0.1 0.1 - 0.1 -

------------------------ ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- --------- ----------------------- --------- -----

United Kingdom - - 1.8 - - - - - - - - 1.8 - 1.8 1.4

------------------------ ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- --------- ----------------------- --------- -----

United States - - - - - - - 3.9 - - - 3.9 - 3.9 3.4

------------------------ ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- --------- ----------------------- --------- -----

Net

assets/(liabilities)(a) - - - - - - - - - - - - 0.6 0.6 (1.1)

------------------------ ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- --------- ----------------------- --------- -----

30 September 2022 Total 9.3 13.0 4.3 3.2 26.6 1.8 4.4 28.0 8.2 0.5 0.1 99.4 0.6 100.0 -

------------------------ ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- --------- ----------------------- --------- -----

31 March 2022 Total 10.2 12.7 3.8 1.7 22.6 1.5 2.9 35.1 9.9 0.7 - 101.1 (1.1) - 100.0

------------------------ ------------- ------------- -------- ------ ---------- ------ ----------- ----------- --------- ------ --------- --------- ----------------------- --------- -----

(a) The Company's net assets/(liabilities) are the total of net

current assets plus non-current liabilities per the Statement of

Financial Position on page 25 of the full Half Yearly Report.

(b) All companies held by TEMIT in this country are valued at

zero.

Less than GBP1.5bn to GBP5bn to Greater than Net assets/ (liabilities)(a)

Market capitalisation breakdown (%) GBP1.5bn GBP5bn GBP25bn GBP25bn

------------------------------------ --------- ----------- --------- ------------ ----------------------------

30 September 2022 5.7 9.5 25.4 58.8 0.6

------------------------------------ --------- ----------- --------- ------------ ----------------------------

31 March 2022 7.7 8.0 16.5 68.9 (1.1)

------------------------------------ --------- ----------- --------- ------------ ----------------------------

30 September 31 March

Split between markets(b) (%) 2022 2022

------------------------------- ------------ --------

Emerging markets 93.0 95.6

------------------------------- ------------ --------

Developed markets(c) 5.7 4.9

------------------------------- ------------ --------

Frontier markets 0.7 0.6

------------------------------- ------------ --------

Net assets/(liabilities)(a) 0.6 (1.1)

------------------------------- ------------ --------

Source: FactSet Research System, Inc.

(a) The Company's net assets/(liabilities) are the total of net

current assets plus non-current liabilities per the Statement of

Financial Position on page 25 of the full Half Yearly Report.

(b) Geographic split between "Emerging markets", "Frontier

markets", "Developed markets" are as per MSCI index

classifications.

(c) Developed market exposure represented by companies listed in

United Kingdom and United States which have significant exposure to

operations from emerging markets.

Environmental, Social and Governance

We continue to embed governance and sustainability factors into

our fundamental bottom-up research and remain active owners across

our holdings. This involves integrating Environmental, Social and

Governance ("ESG") factors into our stock thesis, engaging with

investee companies on material ESG issues and actively voting on

behalf of our investors. In addition, we monitor the potential ESG

externalities that may be exhibited by our investee companies,

including TEMIT's portfolio carbon footprint where our portfolio

managers seek to understand the carbon risk profile. We provide

below a short summary of our process over the six-month period

under review.

Integrating ESG factors

During the six months, we purchased shares in HDFC Bank. HDFC

Bank is India's largest private sector bank by advances and remains

one of the fastest growing banks with consistent market share gains

while also maintaining high profitability and strong asset quality.

Considering its ESG practices, the bank remains one of the best

governed banks in India. The senior management team are well

respected within the industry, remuneration is in line with

industry best practices, and the bank's Employee Stock Option Plan

("ESOP") ensures alignment with shareholders. Post the CEO change,

governance and control mechanisms remain a critical focus to us. In

addition, the bank's internal policies and outcomes on

environmental and social issues are strong with no material red

flags. The bank has policies in place to consider environmental and

social impacts in its underwriting process. For large long-term

loans, the bank has put in place a Social and Environmental

Management System ("SEMS") framework that assesses and considers

numerous parameters such as social impact and emissions. We believe

the bank is well positioned to manage its operational ESG

footprint.

Climate change

TEMIT Carbon Footprint vs. MSCI EM Index - 30 September

2022(a)

Carbon Emissions Carbon Intensity Weighted Average Carbon

(tCO2e/$M invested) (tCO2e/$M sales) Intensity (tCO2e/$M sales)

Portfolio 269.2 369.3 216.1

-------------------- ----------------- ---------------------------

Benchmark 296.6 384.8 345.1

-------------------- ----------------- ---------------------------

(a) Source: MSCI ESG as at 11 October 2022, portfolio coverage

94% (79% reported, 15% estimated); MSCI EM coverage 100% (77%

reported, 23% estimated). Carbon emissions include scope 1 and

2.

Carbon Emissions - Measures the portfolio's normalised carbon

footprint per $1 million invested.

Carbon Intensity - Measures the portfolio's efficiency in terms

of the level of carbon emissions per dollar of sales generated by a

company.

Weighted Average Carbon Intensity - Measures the portfolio's

exposure to carbon-intensive companies.

The TEMIT Portfolio Carbon Emissions are 9.2% lower than the

MSCI Emerging Markets benchmark, Carbon Intensity is 4.0% lower and

Weighted Average Carbon Intensity ("WACI") is 37.4% lower. TEMIT's

portfolio carbon risk is concentrated amongst a small number of

companies, with the top five companies in terms of carbon intensity

representing 7.6% of the portfolio and accounting for 71.5% of the

total portfolio WACI.

Active ownership

As investors with a significant presence in emerging markets,

our investment team's active ownership efforts are a key part of

the overall approach to stewardship. Over the six-month period, we

have engaged with several of our investee companies on material

governance and sustainability issues. For example we (i) reached

out to KT Skylife to recommend that the company adopts a more

transparent and attractive dividend payout policy; (ii) had an

in-depth dialogue with Genpact where the conversation was focused

on learning more around the company's ESG strategy, its alignment

with UN Sustainable Development Goals ("SDGs") from a

product/services perspective, its thoughts on net-zero commitment

and its management of human capital; and (iii) engaged Soulbrain

across multiple areas to request clarification on topics such as

executive remuneration, whilst also encouraging improved disclosure

on ESG issues. These discussions help us to gain a number of

fundamental and sustainability insights. We believe that our

engagement efforts are key to developing both a detailed

understanding of companies and improving outcomes for shareholders

as well as stakeholders more broadly.

We look forward to sharing a more detailed account of our

stewardship practices in the next Annual Report and dedicated