BIO-key® International, Inc. (Nasdaq: BKYI), an innovative provider

of workforce and customer Identity and Access Management (IAM)

solutions featuring passwordless, phoneless and token-less

Identity-Bound Biometric (IBB) authentication, announced results

for its second quarter ended June 30, 2024 (Q2’24). Note, BIO-key’s

results for 2023 were restated at year-end and filed with the

Company’s 2023 Form 10-K, and as a result Q2’23 and six months

ended June 30, 2023 comparisons in this release have been restated.

BIO-key will host an investor call Thursday, August 15th at 10:00am

ET (details below).

Financial Highlights

- Q2’24 revenues decreased to $1.1M

from $1.9M in Q2’23, principally due to a delay in recognition of

approximately $450,000 in software license fees generated by the

Company’s European subsidiary and lower project-related services

revenue of approximately $200,000 as compared to the year-ago

period for one large customer.

- Gross profit improved to $0.9M

(77.0% gross margin) in Q2’24 vs. $0.3M (16.7% gross margin) in

Q2’23, primarily reflecting the impact of a $1M hardware reserve in

Q2’23.

- BIO-key trimmed Q2’24 operating

expenses by $0.2M versus Q2’23, reflecting ongoing cost management

initiatives.

- BIO-key reported a Q2’24 net loss

of $1.7M compared to a Q2’23 net loss of $2.6M, primarily due to a

$1M hardware reserve in Q2’23.

- Cash used in operating activities

improved 48% to $1.1M in the first six months of 2024 vs. $2.1M

used in the first six months of 2023. Improved operating cash flow

reflects the benefit of a Q1’24 $1.5M 2-year extension/expansion of

a biometric technology license with a long-term financial services

customer and continued reductions in S,G &A.

Recent Business Highlights

- Williamsburg, VA advanced its Zero

Trust initiative with BIO-key’s Identity-Bound Biometrics.

- Los Angeles LGBT Center secured its

IT Systems with BIO-key’s Seamless Badge-Tap Authentication

Solution.

- University of Iowa Hospital and

Dayton Children’s Hospital) expanded their BIO-key deployments in

Q2’24.

- BIO-key introduced Passkey:YOU, a

phish-resistant, phoneless and tokenless biometric FIDO Passkey

Authentication Solution.

- BIO-key won the Global InfoSec

Award for Multi-factor Authentication at RSA Conference 2024.

CommentaryBIO-key CEO, Mike

DePasquale commented, “Q2 was impacted by delays we experienced in

the closing of approximately $450,000 in software license contracts

and lower non-recurring, project-related services revenue of

approximately $200,000 versus the year-ago period for one large

customer in 2023.

“Despite our lower than expected revenues this

quarter, we remain very encouraged by the growing enterprise

awareness of the importance of implementing secure, zero-trust

Identity and Access Management solutions which form the core of our

offerings. We remain focused on driving revenue growth and

progressing our business to profitability and positive cash flow

over the next several quarters. We are working to support our

Channel Alliance Partners around the globe while also working to

progress larger-scale customer dialogues via our in-house direct

sales efforts.

“We are also excited by the growth potential for

our new Passkey:YOU solution which we believe provides a very

powerful, differentiated solution within the rapidly expanding

deployment of passkey solutions by some of the largest global

companies. Unlike other solutions, BIO-key’s Passkey:YOU utilizes

our industry leading biometric technology to deliver a unique

passwordless and device-less authentication solution able to meet a

broad range of needs, including some of the most challenging use

cases.

“We continue to expect to benefit from the

rollout and enforcement of increasingly stringent regulatory

standards and cyber insurance underwriting requirements, much of

which are now mandating multi-factor authentication or passwordless

security solutions that BIO-key is well positioned to provide on a

very competitive basis.

“Given our size, our performance will likely

remain variable on a quarter to quarter and year over year basis,

based on the impact and timing of customer contracts, though we

remain confident in our ability to drive sequential growth on a

full year basis. Importantly, we are building a growing base of

high-margin annually recurring revenues (ARRs) with solid potential

to expand as we move forward. We also continue to seek and

implement cost reduction opportunities and identify potential

strategic opportunities to leverage our core expertise to

accelerate our path to profitability and positive cash flow. For

these and other reasons, we believe BIO-key is well-positioned for

the future.”

Financial ResultsBIO-key

reported Q2’24 revenues of $1.1M compared to $1.9M in Q2’23. The

current-year period was negatively impacted by the delay in

recognition of approximately $450,000 in software license fees

generated by the Company’s European subsidiary and the year-ago

period benefitted from approximately $200,000 of non-recurring

services revenue for one large customer. For the six months ended

June 30, 2024, revenues were $3.3M compared to $4.1M in 2023,

principally due to the factors that impacted Q2’24 results.

Q2’24 Gross profit was $0.9M (77.0% gross

margin) versus $0.3M (16.7% gross margin) in Q2’23, primarily

reflecting the impact of a $1M hardware reserve in 2023 and higher

gross margins from services in Q2’24.

BIO-key was able to reduce operating expenses by

$0.2M in Q2’24 versus Q2’23, reflecting reductions in

administration, sales personnel costs and marketing show expenses,

including lower headquarters expense. Partially offsetting lower

SG&A costs, was a $33,000 increase in research, development and

engineering expense related to new product development.

Reflecting lower costs and the $1M hardware

reserve in 2023, BIO-key’s net loss improved to $1.7M, or $1.00 per

share, in Q2’24, from $2.6M, or $4.71 per share, in Q2’23.

Likewise, BIO-key trimmed its net loss for the first six months of

2024 to $2.2M, or $1.33 per share, compared to a net loss of $4.3M,

or $7.74 per share, in the first six months of 2023. Q2’23 results

included a hardware reserve of $1M and the first six months of 2023

included a hardware reserve of $1.5M.

Balance SheetAt June 30, 2024,

BIO-key had current assets of approximately $3.0M, including $1.3M

of cash and cash equivalents, $932,210 of net accounts receivable

and due from factor, and $433,182 of inventory. This compares to

current assets of approximately $2.6M, including $511,400 of cash

equivalents, $1.3M of net accounts receivable and due from factor,

and $445,740 of inventory, at December 31, 2023.

Conference Call Details

| Date /

Time: |

Thursday, August 15th at

10 a.m. ET |

| Call Dial In #: |

1-877-418-5460 U.S. or 1-412-717-9594 Int’l |

| Live Webcast / Replay: |

Webcast & Replay Link – Available for 3

months. |

| Audio Replay: |

1-877-344-7529 U.S. or 1-412-317-0088 Int’l; code 7767803 |

About BIO-key International,

Inc. (www.BIO-key.com)BIO-key is revolutionizing

authentication and cybersecurity with biometric-centric,

multi-factor identity and access management (IAM) software securing

access for over forty million users. BIO-key allows customers to

choose the right authentication factors for diverse use cases,

including phoneless, tokenless, and passwordless biometric options.

Its hosted or on-premise PortalGuard IAM solution provides

cost-effective, easy-to-deploy, convenient, and secure access to

computers, information, applications, and high-value

transactions.

BIO-key Safe Harbor

StatementAll statements contained in this press release

other than statements of historical facts are "forward-looking

statements" as defined in the Private Securities Litigation Reform

Act of 1995 (the "Act"). The words "estimate," "project,"

"intends," "expects," "anticipates," "believes" and similar

expressions are intended to identify forward-looking statements.

Such forward-looking statements are made based on management's

beliefs, as well as assumptions made by, and information currently

available to, management pursuant to the "safe-harbor" provisions

of the Act. These statements are not guarantees of future

performance or events and are subject to risks and uncertainties

that may cause actual results to differ materially from those

included within or implied by such forward-looking statements.

These risks and uncertainties include, without limitation, our

history of losses and limited revenue; our ability to raise

additional capital to satisfy working capital needs; our ability to

continue as a going concern; our ability to protect our

intellectual property; changes in business conditions; changes in

our sales strategy and product development plans; changes in the

marketplace; continued services of our executive management team;

security breaches; competition in the biometric technology

industry; market acceptance of biometric products generally and our

products under development; our ability to convert sales

opportunities to customer contracts; our ability to expand into

Asia, Africa and other foreign markets; our ability to integrate

the operations and personnel of Swivel Secure into our business;

fluctuations in foreign currency exchange rates; delays in the

development of products, the commercial, reputational and

regulatory risks to our business that may arise as a consequence

the restatement of our financial statements, including any

consequences of non-compliance with Securities and Exchange

Commission and Nasdaq periodic reporting requirements; our

temporary loss of the use of a Registration Statement on Form S-3

to register securities in the future; if we fail to increase our

stockholders’ equity to at least $2.5 million, our common stock

will be delisted from the Nasdaq Capital Market which could

negatively impact the trading price of our common stock and impair

our ability to raise capital, any disruption to our business that

may occur on a longer-term basis should we be unable to remediate

during fiscal year 2024 certain material weaknesses in our internal

controls over financial reporting, and statements of assumption

underlying any of the foregoing as well as other factors set forth

under the caption "Risk Factors" in our Annual Report on Form 10-K

for the year ended December 31, 2023 and other filings with the

SEC. Readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date made.

Except as required by law, we undertake no obligation to disclose

any revision to these forward-looking statements whether as a

result of new information, future events, or otherwise.

Engage with BIO-key

| Facebook –

Corporate: |

https://www.facebook.com/BIOkeyInternational/ |

| LinkedIn – Corporate: |

https://www.linkedin.com/company/bio-key-international |

| X – Corporate: |

@BIOkeyIntl |

| X – Investors: |

@BIO_keyIR |

| StockTwits: |

BIO_keyIR |

Investor ContactsWilliam Jones, David

CollinsCatalyst IRBKYI@catalyst-ir.com or 212-924-9800

|

|

|

|

BIO-KEY INTERNATIONAL, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE

LOSS(Unaudited) |

|

|

|

|

| |

|

|

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

|

|

|

June 30, |

|

|

June 30, |

|

| |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Services |

|

|

|

$ |

283,569 |

|

|

$ |

620,465 |

|

|

$ |

496,690 |

|

|

$ |

1,152,987 |

|

|

License fees |

|

|

|

|

774,225 |

|

|

|

1,235,771 |

|

|

|

2,724,659 |

|

|

|

2,814,327 |

|

|

Hardware |

|

|

|

|

83,492 |

|

|

|

72,693 |

|

|

|

101,140 |

|

|

|

145,382 |

|

| Total revenues |

|

|

|

|

1,141,286 |

|

|

|

1,928,929 |

|

|

|

3,322,489 |

|

|

|

4,112,696 |

|

| Costs and other expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of services |

|

|

|

|

73,385 |

|

|

|

360,156 |

|

|

|

212,234 |

|

|

|

514,957 |

|

|

Cost of license fees |

|

|

|

|

148,432 |

|

|

|

198,147 |

|

|

|

296,652 |

|

|

|

819,028 |

|

|

Cost of hardware |

|

|

|

|

40,455 |

|

|

|

47,808 |

|

|

|

53,029 |

|

|

|

92,400 |

|

|

Cost of hardware - reserve |

|

|

|

|

- |

|

|

|

1,000,000 |

|

|

|

- |

|

|

|

1,500,000 |

|

| Total costs and other

expenses |

|

|

|

|

262,272 |

|

|

|

1,606,111 |

|

|

|

561,915 |

|

|

|

2,926,385 |

|

| Gross profit |

|

|

|

|

879,014 |

|

|

|

322,818 |

|

|

|

2,760,574 |

|

|

|

1,186,311 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

|

|

|

1,941,866 |

|

|

|

2,143,164 |

|

|

|

3,724,839 |

|

|

|

4,074,896 |

|

|

Research, development and engineering |

|

|

|

|

591,234 |

|

|

|

558,181 |

|

|

|

1,198,755 |

|

|

|

1,248,340 |

|

| Total Operating Expenses |

|

|

|

|

2,533,100 |

|

|

|

2,701,345 |

|

|

|

4,923,594 |

|

|

|

5,323,236 |

|

|

Operating loss |

|

|

|

|

(1,654,086 |

) |

|

|

(2,378,527 |

) |

|

|

(2,163,020 |

) |

|

|

(4,136,925 |

) |

| Other income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

|

|

46 |

|

|

|

23 |

|

|

|

51 |

|

|

|

27 |

|

|

Loss on foreign currency transactions |

|

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(15,000 |

) |

| Loan fee amortization |

|

|

|

|

(4,000 |

) |

|

|

- |

|

|

|

(4,000 |

) |

|

|

- |

|

| Change in fair value of

convertible note |

|

|

|

|

- |

|

|

|

(44,568 |

) |

|

|

- |

|

|

|

97,423 |

|

|

Interest expense |

|

|

|

|

(8,910 |

) |

|

|

(56,806 |

) |

|

|

(10,267 |

) |

|

|

(113,725 |

) |

|

Total other income (expense), net |

|

|

|

|

(12,864 |

) |

|

|

(101,351 |

) |

|

|

(14,216 |

) |

|

|

(31,275 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before provision for

income tax |

|

|

|

|

(1,666,950 |

) |

|

|

(2,479,878 |

) |

|

|

(2,177,236 |

) |

|

|

(4,168,200 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Provision for (income tax) tax

benefit |

|

|

|

|

- |

|

|

|

(143,000 |

) |

|

|

- |

|

|

|

(143,000 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

|

|

$ |

(1,666,950 |

) |

|

$ |

(2,622,878 |

) |

|

$ |

(2,177,236 |

) |

|

$ |

(4,311,200 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive loss: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

|

|

$ |

(1,666,950 |

) |

|

$ |

(2,622,878 |

) |

|

$ |

(2,177,236 |

) |

|

$ |

(4,311,200 |

) |

|

Other comprehensive income (loss) – Foreign currency translation

adjustment |

|

|

|

|

24,220 |

|

|

|

19,884 |

|

|

|

(38,530 |

) |

|

|

92,030 |

|

|

Comprehensive loss |

|

|

|

$ |

(1,642,730 |

) |

|

$ |

(2,602,994 |

) |

|

$ |

(2,215,766 |

) |

|

$ |

(4,219,170 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted Loss per Common Share |

|

|

|

$ |

(1.00 |

) |

|

$ |

(4.71 |

) |

|

$ |

(1.33 |

) |

|

$ |

(7.74 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted Average

Common Shares Outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

|

|

1,663,042 |

|

|

|

556,758 |

|

|

|

1,639,183 |

|

|

|

556,758 |

|

All BIO-key shares issued and outstanding for all

periods reflect BIO-key’s 1-for-18 reverse stock split, which

was effective December 21, 2023.

|

|

|

|

BIO-KEY INTERNATIONAL, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE

SHEETS |

|

|

|

|

| |

|

June 30, |

|

|

December 31, |

|

| |

|

2024 |

|

|

2023 |

|

| |

|

(Unaudited) |

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

1,260,351 |

|

|

$ |

511,400 |

|

|

Accounts receivable, net |

|

|

904,046 |

|

|

|

1,201,526 |

|

|

Due from factor |

|

|

28,164 |

|

|

|

99,320 |

|

|

Inventory |

|

|

433,182 |

|

|

|

445,740 |

|

|

Prepaid expenses and other |

|

|

388,786 |

|

|

|

364,171 |

|

|

Total current assets |

|

|

3,014,529 |

|

|

|

2,622,157 |

|

|

Equipment and leasehold improvements, net |

|

|

174,419 |

|

|

|

220,177 |

|

|

Capitalized contract costs, net |

|

|

348,617 |

|

|

|

229,806 |

|

|

Operating lease right-of-use assets |

|

|

9,341 |

|

|

|

36,905 |

|

|

Intangible assets, net |

|

|

1,252,090 |

|

|

|

1,407,990 |

|

|

Total non-current assets |

|

|

1,784,467 |

|

|

|

1,894,878 |

|

|

TOTAL ASSETS |

|

$ |

4,798,996 |

|

|

$ |

4,517,035 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

1,539,548 |

|

|

$ |

1,316,014 |

|

|

Accrued liabilities |

|

|

1,164,681 |

|

|

|

1,305,848 |

|

|

Note payable |

|

|

2,010,293 |

|

|

|

- |

|

|

Government loan – BBVA Bank, current portion |

|

|

135,400 |

|

|

|

138,730 |

|

|

Deferred revenue, current |

|

|

715,193 |

|

|

|

414,968 |

|

|

Operating lease liabilities, current portion |

|

|

9,570 |

|

|

|

37,829 |

|

|

Total current liabilities |

|

|

5,574,685 |

|

|

|

3,213,389 |

|

|

Deferred revenue, long term |

|

|

142,949 |

|

|

|

28,296 |

|

|

Deferred tax liability |

|

|

22,998 |

|

|

|

22,998 |

|

|

Government loan – BBVA Bank – net of current portion |

|

|

114,656 |

|

|

|

188,787 |

|

|

Total non-current liabilities |

|

|

280,603 |

|

|

|

240,081 |

|

|

TOTAL LIABILITIES |

|

|

5,855,288 |

|

|

|

3,453,470 |

|

| |

|

|

|

|

|

|

|

|

|

Commitments and Contingencies |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Common stock — authorized, 170,000,000 shares; issued and

outstanding; 1,815,618 and 1,032,777 of $.0001 par value at June

30, 2024 and December 31, 2023, respectively |

|

|

182 |

|

|

|

103 |

|

|

Additional paid-in capital |

|

|

126,143,205 |

|

|

|

126,047,851 |

|

|

Accumulated other comprehensive loss |

|

|

(15,234 |

) |

|

|

22,821 |

|

|

Accumulated deficit |

|

|

(127,184,445 |

) |

|

|

(125,007,210 |

) |

|

TOTAL STOCKHOLDERS’ EQUITY |

|

|

(1,056,292 |

) |

|

|

1,063,565 |

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

$ |

4,798,996 |

|

|

$ |

4,517,035 |

|

All BIO-key shares issued and outstanding for all

periods reflect BIO-key’s 1-for-18 reverse stock split, which

was effective December 21, 2023.

|

|

|

|

BIO-KEY INTERNATIONAL, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS(Unaudited) |

|

|

|

|

| |

|

Six Months Ended June 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

| CASH FLOW FROM

OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(2,177,236 |

) |

|

$ |

(4,311,200 |

) |

|

Adjustments to reconcile net loss to net cash used for

operating activities: |

|

|

|

|

|

|

|

|

| Depreciation |

|

|

46,069 |

|

|

|

26,637 |

|

| Amortization of intangible

assets |

|

|

155,900 |

|

|

|

162,166 |

|

| Change in fair value of

convertible note |

|

|

- |

|

|

|

(97,423 |

) |

| Amortization of capitalized

contract costs |

|

|

80,074 |

|

|

|

80,717 |

|

| Reserve for inventory |

|

|

- |

|

|

|

1,500,000 |

|

| Operating leases right-of-use

assets |

|

|

27,564 |

|

|

|

112,745 |

|

| Share and warrant-based

compensation for employees and consultants |

|

|

96,561 |

|

|

|

120,767 |

|

| Stock based directors’

fees |

|

|

9,003 |

|

|

|

28,004 |

|

| Deferred income tax

benefit |

|

|

|

|

|

|

(13,000 |

) |

| Bad debts |

|

|

|

|

|

|

250,000 |

|

|

Change in assets and liabilities: |

|

|

|

|

|

|

|

|

| Accounts receivable |

|

|

297,480 |

|

|

|

(757,170 |

) |

| Due from factor |

|

|

71,156 |

|

|

|

(24,750 |

) |

| Capitalized contract

costs |

|

|

(198,885 |

) |

|

|

(75,096 |

) |

| Inventory |

|

|

12,558 |

|

|

|

50,271 |

|

| Prepaid expenses and

other |

|

|

(24,615 |

) |

|

|

14,799 |

|

| Accounts payable |

|

|

258,384 |

|

|

|

726,657 |

|

| Accrued liabilities |

|

|

(141,167 |

) |

|

|

(109,208 |

) |

| Income taxes payable |

|

|

- |

|

|

|

156,000 |

|

| Deferred revenue |

|

|

414,878 |

|

|

|

174,437 |

|

| Operating lease

liabilities |

|

|

(51,257 |

) |

|

|

(110,545 |

) |

|

Net cash used in operating activities |

|

|

(1,123,533 |

) |

|

|

(2,095,192 |

) |

| CASH FLOWS FROM

INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

|

(1,869 |

) |

|

|

- |

|

|

Net cash used in investing activities |

|

|

(1,869 |

) |

|

|

- |

|

| CASH FLOW FROM

FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

| Proceeds from Note

Payable |

|

|

2,000,000 |

|

|

|

- |

|

| Offering costs |

|

|

(13,470 |

) |

|

|

- |

|

|

Proceeds for exercise of warrants |

|

|

1,400 |

|

|

|

- |

|

| Receipt of cash from Employee

stock purchase plan |

|

|

1,939 |

|

|

|

13,934 |

|

|

Repayment of government loan |

|

|

(77,461 |

) |

|

|

(56,241 |

) |

|

Net cash used in financing activities |

|

|

1,912,408 |

|

|

|

(42,307 |

) |

| |

|

|

|

|

|

|

|

|

|

Effect of exchange rate changes |

|

|

(38,055 |

) |

|

|

67,490 |

|

| |

|

|

|

|

|

|

|

|

| NET INCREASE

(DECREASE) IN CASH AND CASH EQUIVALENTS |

|

|

748,951 |

|

|

|

(2,070,009 |

) |

| CASH AND CASH

EQUIVALENTS, BEGINNING OF PERIOD |

|

|

511,400 |

|

|

|

2,635,522 |

|

| CASH AND CASH

EQUIVALENTS, END OF PERIOD |

|

$ |

1,260,351 |

|

|

$ |

565,513 |

|

All BIO-key shares issued and outstanding for all

periods reflect BIO-key’s 1-for-18 reverse stock split, which

was effective December 21, 2023.

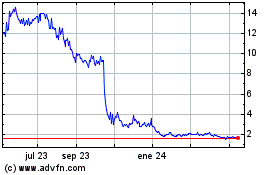

BIO key (NASDAQ:BKYI)

Gráfica de Acción Histórica

De Jul 2024 a Ago 2024

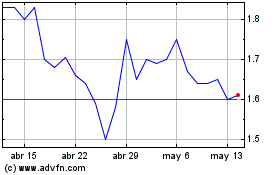

BIO key (NASDAQ:BKYI)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024