UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED

PURSUANT

TO RULE 13d-1(a) AND AMENDMENTS THERETO FILED

PURSUANT TO RULE 13d-2(a)

Under the Securities Exchange Act of 1934

(Amendment No. 9)*

Masimo Corporation

(Name of Issuer)

Common Stock, par value $0.001 per share

(Title of Class of Securities)

574795100

(CUSIP Number)

Quentin Koffey

Politan Capital Management LP

106 West 56th Street, 10th

Floor

New York, New York 10019

646-690-2830

With a copy to:

Richard M. Brand

Cadwalader, Wickersham & Taft LLP

200 Liberty Street

New York, NY 10281

212-504-6000

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

May 9, 2024

(Date of Event Which Requires Filing of This

Statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e),

13d-1(f) or 13d-1(g), check the following box. ¨

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7

for other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

| CUSIP No. 574795100 |

|

Page 2 |

| 1 |

NAME OF REPORTING PERSON

Politan Capital Management LP |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) x (b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

OO (See Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) OR 2(e)

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

Number of

shares

beneficially

owned by

each

reporting

person

with |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

4,713,518 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

4,713,518 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,713,518 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

8.9%* |

| 14 |

TYPE OF REPORTING PERSON

IA |

| |

|

|

|

* All percentage calculations set forth herein are based upon the aggregate

of 53,085,556 shares of Common Stock outstanding as of March 30, 2024, as reported in the Issuer’s Quarterly Report on Form 10-Q

for the period ended March 30, 2024, filed with the Securities and Exchange Commission (the “SEC”) on May 7, 2024 (the

“Q1 2024 10-Q”).

| CUSIP No. 574795100 |

|

Page 3 |

| 1 |

NAME OF REPORTING PERSON

Politan Capital Management GP LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) x (b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO (See Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) OR 2(e)

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

Number of

shares

beneficially

owned by

each

reporting

person

with |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

4,713,518 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

4,713,518 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,713,518 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

8.9%* |

| 14 |

TYPE OF REPORTING PERSON

IA |

| |

|

|

|

* All percentage calculations set forth herein are based upon the aggregate

of 53,085,556 shares of Common Stock outstanding as of March 30, 2024, as reported in the Q1 2024 10-Q.

| CUSIP No. 574795100 |

|

Page 4 |

| 1 |

NAME OF REPORTING PERSON

Politan Capital Partners GP LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) x (b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO (See Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) OR 2(e)

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

Number of

shares

beneficially

owned by

each

reporting

person

with |

7 |

SOLE VOTING POWER

0 |

| 8 |

SHARED VOTING POWER

4,713,518 |

| 9 |

SOLE DISPOSITIVE POWER

0 |

| 10 |

SHARED DISPOSITIVE POWER

4,713,518 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,713,518 |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

8.9%* |

| 14 |

TYPE OF REPORTING PERSON

IA |

| |

|

|

|

* All percentage calculations set forth herein are based upon the aggregate

of 53,085,556 shares of Common Stock outstanding as of March 30, 2024, as reported in the Q1 2024 10-Q.

| CUSIP No. 574795100 |

|

Page 5 |

| 1 |

NAME OF REPORTING PERSON

Quentin Koffey |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) x (b) ¨ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS

OO (See Item 3) |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) OR 2(e)

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

Number of

shares

beneficially

owned by

each

reporting

person

with |

7 |

SOLE VOTING POWER

1,228 |

| 8 |

SHARED VOTING POWER

4,713,518 |

| 9 |

SOLE DISPOSITIVE POWER

1,228 |

| 10 |

SHARED DISPOSITIVE POWER

4,713,518 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,714,746* |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

8.9%** |

| 14 |

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

* Includes Mr. Koffey’s 1,228 restricted

share units granted to him on June 26, 2023 by virtue of his position as a director on the Board and that vest upon the earliest of the

first anniversary of the grant date, the date of the next annual meeting of stockholders, or a change in control of the Issuer.

** Mr. Koffey’s percentage calculations set forth herein are

based upon the aggregate of 53,085,556 shares of Common Stock outstanding as of March 30, 2024, as reported in the Q1 2024 10-Q.

| CUSIP No. 574795100 |

|

Page 6 |

This Amendment No. 9 to Schedule

13D (this “Amendment No. 9”) amends and supplements the Schedule 13D filed on August 16, 2022 (as amended and supplemented

through the date of this Amendment No. 9, collectively, the “Schedule 13D”) by the Reporting Persons, relating to the

common stock, par value $0.001 per share, of Masimo Corporation, a Delaware corporation (the

“Issuer”). Capitalized terms not defined in this Amendment No. 9 shall have the meaning ascribed to them in the Schedule

13D.

The information set forth

in response to Item 4 below shall be deemed to be a response to all Items where such information is relevant.

ITEM 4. PURPOSE OF TRANSACTION

Item

4 of the Schedule 13D is hereby amended and supplemented with the following information:

On May 9, 2024, Politan, a Reporting Person, sent a letter to Craig

Reynolds, the Lead Independent Director of the Board, regarding corporate governance matters. The letter is qualified in its entirety

by reference to Exhibit 99.11, which is attached hereto and is incorporated herein by reference.

| ITEM 7. |

MATERIAL TO BE FILED AS AN EXHIBIT |

| Exhibit 99.1 |

Joint Filing Agreement among Politan Capital Management LP, Politan Capital Management GP LLC, Politan Capital Partners GP LLC, and Quentin Koffey* |

| |

|

| Exhibit 99.2 |

Trading Data* |

| |

|

| Exhibit 99.3 |

Trading Data* |

| |

|

| Exhibit 99.4 |

Form of Verified Complaint, filed with the Delaware Court of Chancery on October 21, 2022* |

| |

|

| Exhibit 99.5 |

Form of Second Amended and Supplemented Complaint, filed as an Exhibit to the Motion for Leave to Amend with the Delaware Court of Chancery on March 10, 2023* |

| |

|

| Exhibit 99.6 |

Form of Engagement and Indemnification Agreement entered into by and between Politan Capital Management LP and Michelle Brennan* |

| |

|

| Exhibit 99.7 |

Trading Data* |

| |

|

| Exhibit 99.8 |

Press Release, dated June 26, 2023* |

| |

|

| Exhibit 99.9 |

Form of Engagement and Indemnification Agreement entered into by and between Politan Capital Management LP and each of William Jellison

and Darlene Solomon* |

| |

|

| Exhibit 99.10 |

Demand Letter, dated May 8, 2024* |

| |

|

| Exhibit 99.11 |

Politan Letter, dated May 9, 2024 |

*Previously filed.

| CUSIP No. 574795100 |

|

Page 7 |

SIGNATURES

After reasonable inquiry and to the best of each

of the undersigned’s knowledge and belief, each of the undersigned certifies that the information set forth in this statement is

true, complete and correct.

Date: May 9, 2024

| |

POLITAN CAPITAL MANAGEMENT LP |

| |

|

|

| |

By: |

Politan Capital Management GP LLC,

its general partner |

| |

|

|

| |

By: |

/s/ Quentin Koffey |

| |

|

Name: |

Quentin Koffey |

| |

|

Title: |

Managing Member |

| |

|

|

|

| |

POLITAN CAPITAL MANAGEMENT GP LLC |

| |

|

|

| |

By: |

/s/ Quentin Koffey |

| |

|

Name: |

Quentin Koffey |

| |

|

Title: |

Managing Member |

| |

|

|

| |

POLITAN CAPITAL PARTNERS GP LLC |

| |

|

|

| |

By: |

/s/ Quentin Koffey |

| |

|

Name: |

Quentin Koffey |

| |

|

Title: |

Managing Member |

| |

|

|

| |

QUENTIN KOFFEY |

| |

|

|

| |

By: |

/s/ Quentin Koffey |

| |

|

Name: |

Quentin Koffey |

| CUSIP No. 574795100 |

|

Page 8 |

INDEX TO EXHIBITS

| Exhibit |

|

Description |

| Exhibit 99.1 |

|

Joint Filing Agreement among Politan Capital Management LP, Politan Capital Management GP LLC, Politan Capital Partners GP LLC, and Quentin Koffey* |

| |

|

|

| Exhibit 99.2 |

|

Trading Data* |

| |

|

|

| Exhibit 99.3 |

|

Trading Data* |

| |

|

|

| Exhibit 99.4 |

|

Form of Verified Complaint, filed with the Delaware Court of Chancery on October 21, 2022* |

| |

|

|

| Exhibit 99.5 |

|

Form of Second Amended and Supplemented Complaint, filed as an Exhibit to the Motion for Leave to Amend with the Delaware Court of Chancery on March 10, 2023* |

| |

|

|

| Exhibit 99.6 |

|

Form of Engagement and Indemnification Agreement entered into by and between Politan Capital Management LP and Michelle Brennan* |

| |

|

|

| Exhibit 99.7 |

|

Trading Data* |

| |

|

|

| Exhibit 99.8 |

|

Press Release, dated June 26, 2023* |

| |

|

|

| Exhibit 99.9 |

|

Form of Engagement and Indemnification Agreement entered into by and between Politan Capital Management LP and each of William Jellison

and Darlene Solomon* |

| |

|

|

| Exhibit 99.10 |

|

Demand Letter, dated May 8, 2024* |

| |

|

|

| Exhibit 99.11 |

|

Politan Letter, dated May 9, 2024 |

*Previously filed.

Exhibit 99.11

May 9, 2024

Craig Reynolds

Masimo Corporation

52 Discovery

Irvine, CA 92618

Craig,

I am writing to respond to your various communications

proposing that Politan withdraw its nominations in return for Masimo seating one Politan nominee on the Masimo Board.

I would like to make clear that Politan welcomes

genuine efforts to avoid a proxy contest. However, we question the productiveness of your approach: First, you called me to make the offer

and later told me it expired within less than 24 hours. When I made it clear that I would not make a rushed decision, you then chose to

send me a letter that you made public an hour later. It is hard not to see this proposal as little more than gamesmanship, rather than

a genuine effort to resolve the deep-seated and recurring governance failures at Masimo that have resulted in substantial harm to the

company and its shareholders.

Irrespective of the above, we have taken time

to carefully consider your proposal. We think it falls well short of resolving the fundamental governance problems at Masimo, while simultaneously

introducing others. Masimo’s Chairman and CEO, Joe Kiani, refuses to provide basic information to the Board and does not seek its

approval for any of his spending. Without a majority of truly independent directors not selected by Mr. Kiani, there will be no majority

vote to require information to be provided to, nor authority to be sought from, the Board. Your proposal of seating one Politan nominee

will simply deadlock the Board—something broadly criticized by governance experts which would merely continue the status quo under

which Mr. Kiani can do whatever he wants however he wants with no Board oversight. Further, it is telling that you are publicly proposing

to deadlock the Board only one day after I have had to make a 220 demand under Delaware law just to learn information as basic and fundamental

as the name of the JV counterparty with whom Mr. Kiani is in discussions.

Masimo needs a majority of truly independent directors.

There is a straightforward and clear solution: add Darlene Solomon and Bill Jellison to Masimo’s Board immediately. Politan will

not oppose the re-election of Mr. Kiani to the Board (as you know, we have made multiple offers to allow Mr. Kiani to stay on the Board).

Darlene and Bill are unquestionably qualified—bringing sorely needed financial, technical, and corporate-spinoff/separation experience.

They are both also unquestionably independent—no one on Masimo’s Board or at Politan has any pre-existing relationship with

either of them and Politan used a nationally-recognized search firm to identify and contact them.

By adding Bill and Darlene to the Board while

allowing Mr. Kiani to remain, Masimo will have seven directors. This would avoid a deadlocked board and finally fulfill Masimo’s

promise (made in 2015 and again last year) to expand to seven members.

Given your decision to make your letter public,

we are making this response public so that shareholders can have clarity on what has occurred and how we have responded. However, should

you wish to engage constructively and privately, we welcome it.

Sincerely,

Quentin

Politan Capital Management LP

106 West 56th Street, 10th Floor

| New York, NY 10019

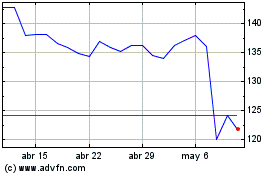

Masimo (NASDAQ:MASI)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

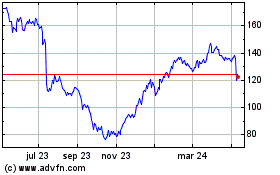

Masimo (NASDAQ:MASI)

Gráfica de Acción Histórica

De May 2023 a May 2024