UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of May 2024

Commission

File Number: 001-39803

Meiwu

Technology Company Limited

(Translation

of registrant’s name into English)

1602,

Building C, Shenye Century Industry

No.

743 Zhoushi Road, Bao’an District

Shenzhen,

People’s Republic of China

Telephone:

+86-755-85250400

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Note:

Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report

to security holders.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Note:

Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that

the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated,

domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on

which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to

be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the

subject of a Form 6-K submission or other Commission filing on EDGAR.

Entry

into Material Contracts

On

May 17, 2024, Meiwu Technology Company Limited (the “Company”) entered into a securities purchase agreement

with three unaffiliated investors (each, an “Investor”, collectively, the “Investors”), pursuant

to which, the Company agreed to issue a convertible note (each, a “Note”, collectively, the “Notes”)

with 10% original issuance discount (the “OID”) to each Investor (the “Offering”). The Company

expects to receive gross proceeds of $1,000,000, before any expenses, as the aggregate purchase price of the three Notes.

Each

of the Notes bears interest at a rate of 10% per annum compounding daily. All outstanding principal and accrued interest on the Notes

will become due and payable eighteen (18) months after the issuance date. Each of the Note includes an original issue discount that equals

10% of the purchase price. The Company may prepay all or a portion of the Notes at any time by paying 120% of the outstanding

balance elected for pre-payment. Each of the Investor can convert his or her Note at any time after the six-month anniversary of the

issuance date at a per share conversion price that is equal to the lower of (i) $0.50 or (ii) 80% of the lowest daily volume-weighted

average price of the Company’s ordinary shares, no par value (the “Ordinary Shares”), in the 20 trading

days prior to the date on which the conversion price is measured (the “Market Price”).

The

Company expects to issue the Notes and close this Offering on or prior to May 31, 2024. The issuance of the Notes and the Ordinary

Shares underlying the Notes will be exempt from the registration requirements of the Securities Act, pursuant to Section 4(a)(2) of the

Securities Act and/or Regulation D. The proceeds of this Offering will be used for working capital and general corporate purposes.

The

SPA also contains customary representation and warranties of the Company and the Investors, indemnification obligations of the Company,

termination provisions, and other obligations and rights of the parties.

The

SPA and the form of the Note are filed as Exhibits 10.1, 10.2 to this Current Report on Form 6-K, respectively; and such documents are

incorporated herein by reference. The foregoing is only a brief description of the material terms of the SPA and the Note and does not

purport to be a complete description of the rights and obligations of the parties thereunder and are qualified in their entirety by reference

to such exhibits.

EXHIBIT

INDEX

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Meiwu

Technology Company Limited |

| |

|

|

| |

By:

|

/s/

Xinliang Zhang |

| |

|

Xinliang

Zhang |

| |

|

Chief

Executive Officer |

Date:

May 20, 2024

EXhibit

10.1

Securities

Purchase Agreement

This

Securities Purchase Agreement (this “Agreement”),

dated as of May 17th, 2024, is entered into by and between Meiwu Technology Company

Limited., a British Virgin Islands exempt company (“Company”), and the undersigned therein (“Investors”).

A.

Company and Investors are executing and delivering this Agreement in reliance upon an exemption from securities registration afforded

by the Securities Act of 1933, as amended (the “1933 Act”), and the rules and regulations promulgated thereunder by

the United States Securities and Exchange Commission (the “SEC”).

B.

Each Investor, separately and note jointly, desires to purchase and Company desires to issue and sell, upon the terms and conditions

set forth in this Agreement, a convertible promissory note, in the form attached hereto as Exhibit A, to each Investor (each,

a “Note”, collectively, the “Notes”), convertible into ordinary shares, no par value per share,

of Company (the “Ordinary Shares”), upon the terms and subject to the limitations and conditions set forth in such

Note. The original principal amount of each Note is as set forth in Schedule A attached hereto respectively, and together in the

aggregate principal amount of $1,100,000.00.

C.

This Agreement, the Notes, and all other certificates, documents, agreements, resolutions and instruments delivered to any party under

or in connection with this Agreement, as the same may be amended from time to time, are collectively referred to herein as the “Transaction

Documents”.

D.

For purposes of this Agreement: “Conversion Shares” means all Ordinary Shares issuable upon conversion of all or any

portion of the Notes; and “Securities” means the Notes and the Conversion Shares.

NOW,

THEREFORE, in consideration of the above recitals and other good and valuable consideration, the receipt and sufficiency of which

are hereby acknowledged, Company and Investors hereby agree as follows:

1.

Purchase and Sale of Securities.

1.1.

Purchase of Securities. Company shall issue and sell to each Investor, and each Investor shall purchase from Company a Note. In

consideration thereof, each Investor shall pay the Purchase Price (as defined below) to Company.

1.2.

Form of Payment. On the Closing Date (as defined below), each Investor shall wire the Purchase Price in immediately available

funds to a bank account designated by Company against delivery of the Note.

1.3.

Closing Date. Subject to the satisfaction (or written waiver) of the conditions set forth in Section 5 and Section 6

below, the closing of the transactions contemplated by this Agreement (the “Closing”) shall be no later than May 31st,

2024 (the “Closing Date”), or another mutually agreed upon date. The Closing shall occur on the Closing Date by means

of the exchange by email of signed .pdf documents, but shall be deemed for all purposes to have occurred at the offices of Hunter Taubman

Fischer & Li LLC at 950 Third Avenue, Floor 19th, New York, NY 10022.

1.4.

Collateral for the Securities. The Notes shall be unsecured.

1.5.

Original Issue Discount. Each Note carries an original issue discount of $100,000.00 (the “OID”). The “Purchase

Price” for each Note, therefore, shall be $1,000,000.00, computed as follows: $1,100,000.00 initial principal balance, less

the OID.

2.

Investors’ Representations and Warranties. Each of the Investors separately and jointly represents and warrants to Company

that as of the Closing Date:

2.1.

Each of the Investors is an “accredited investors” as that term is defined in Rule 501(a) of Regulation D of the 1933 Act.

2.2.

Organization. Such Each of the Investors is either an individual or an entity, corporate, partnership, limited liability company,

duly incorporated or formed, validly existing and in good standing under the laws of the jurisdiction of its incorporated or formed with

full right, or similar power and authority to enter into and to consummate the transactions contemplated by this Agreement and otherwise

to carry out its obligations hereunder and thereunder.

2.3.

Authority. Each of the Investors has the requisite power and authority to enter into and perform this Agreement and to purchase

the Securities being sold to it hereunder. The execution, delivery and performance of this Agreement by such Investor and the consummation

by it of the transactions contemplated hereby and thereby have been duly authorized by all necessary corporate, partnership or limited

liability company action, and no further consent or authorization of such Investor or its Board of Directors, stockholders, partners,

members, or managers, as the case may be, is required. This Agreement has been duly authorized, executed and delivered by such Investor

and constitutes, or shall constitute when executed and delivered, a valid and binding obligation of such Investor enforceable against

such Investor in accordance with the terms hereof.

2.4.

Purchase Entirely for Own Account. This Agreement is made with each of the Investors in reliance upon each of the Investors’

representation to the Company, which by each of the Investors’ execution of this Agreement, each of the Investors hereby confirms

that the Securities to be acquired by each of the Investors will be acquired for investment for each of the Investors’ own account,

not as a nominee or agent, and not with a view to the resale or distribution of any part thereof, and that each of the Investors has

no present intention of selling, granting any participation in, or otherwise distributing the same. By executing this Agreement, each

of the Investors further represents that each of the Investors does not presently have any contract, undertaking, agreement or arrangement

with any Person to sell, transfer or grant participations to such Person or to any third Person, with respect to any of the Securities.

2.5.

Experience of each of the Investors. Each of the Investors, either alone or together with its representatives, has such knowledge,

sophistication and experience in business and financial matters so as to be capable of evaluating the merits and risks of the prospective

investment in the Securities, and has so evaluated the merits and risks of such investment.

2.6.

Ability to Bear Risk. Each of the Investors understands and agrees that purchase of the Securities is a high-risk investment and

each of the Investors is able to afford and bear an investment in a speculative venture having the risks and objectives of the Company,

including a risk of total loss of such investment. Each of the Investors must bear the substantial economic risks of the investment in

the Securities indefinitely because none of the Securities may be sold, hypothecated or otherwise disposed of unless subsequently registered

under the Securities Act and applicable state securities laws or an exemption from such registration(s) are available. Each of the Investors

represents that it is able to bear the economic risk of an investment in the Securities and is able to afford a complete loss of such

investment.

2.7.

Disclosure of Information. Each of the Investors has been given access to full and complete information regarding the Company

and has utilized such access to each of the Investors’ satisfaction for the purpose of obtaining such information regarding the

Company as each of the Investors has reasonably requested. In particular, each of the Investors: (i) has received and thoroughly read

and evaluated all the disclosures contained in this Agreement; and (ii) has been given a reasonable opportunity to review such documents

as each of the Investors has requested and to ask questions of, and to receive answers from, representatives of the Company concerning

the terms and conditions of the Securities and the business and affairs of the Company and to obtain any additional information concerning

the Company’s business to the extent reasonably available so as to understand more fully the nature of this investment and to verify

the accuracy of the information supplied. Each of the Investors is satisfied that it has received adequate information with respect to

all matters which he/she/it considers material to its decision to make this investment.

2.8.

No other documents. In evaluating the suitability of an investment in the Company, each of the Investors has not relied upon any

representation or other information (oral or written) other than as stated in this Agreement.

2.9.

Use of Purchase Price. Each of the Investors understands, acknowledges and agrees that management of the Company shall have sole

and absolute discretion concerning the use of the Purchase Price as well as the timing of its expenditures.

2.10.

Restricted Securities. Each of the Investors understands that the Securities have not been, and will not be, registered under

the Securities Act, by reason of a specific exemption from the registration provisions of the Securities Act, which depends upon, among

other things, the bona fide nature of the investment intent and the accuracy of each of the Investors’ representations as expressed

herein. Each of the Investors understands that the Securities are “restricted securities” under applicable U.S. federal and

state securities laws and that, pursuant to these laws, each of the Investors must hold the Securities indefinitely unless they are registered

with the SEC and qualified by state authorities, or an exemption from such registration and qualification requirements is available.

Except as otherwise provided herein, each of the Investors acknowledges that the Company has no obligation to register or qualify the

Securities. Each of the Investors further acknowledges that if an exemption from registration or qualification is available, it may be

conditioned on various requirements including, but not limited to, the time and manner of sale, the holding period for the Securities,

and on requirements relating to the Company that are outside of Each of the Investors’ control, and which the Company is under

no obligation and may not be able to satisfy.

2.11.

No General Solicitation. Each of the Investors is not purchasing the Securities as a result of any advertisement, article, notice

or other communication regarding the Securities published in any newspaper, magazine or similar media or broadcast over television or

radio or presented at any seminar or any other general solicitation or general advertisement.

2.12.

Exculpation Among Each of the Investors. Each of the Investors acknowledges that it is not relying upon any Person, other than

the Company and its officers and directors, in making its investment or decision to invest in the Company. Each of the Investors agrees

that each of the Investors is not liable to any other each of the Investors participated in this Offering for any action heretofore taken

or omitted to be taken by any of them in connection with the purchase of the Securities.

2.13.

Each of the Investors has been independently advised as to the restrictions with respect to trading the Securities and with respect to

the resale restrictions imposed by applicable securities laws, confirms that no representation has been made to it by or on behalf of

the Company with respect thereto, acknowledges the risks relating to an investment therein and of the fact that it may not be able to

resell the Securities except in accordance with limited exemptions under applicable securities legislation and regulatory policy until

expiry of the applicable restriction period and compliance with the other requirements of applicable law, that the each of the Investors

(or others for whom it is contracting hereunder) is solely responsible to find out what these restrictions are and each of the Investors

is solely responsible (and neither the Company is not in any way responsible) for compliance with applicable resale restrictions and

each of the Investors is aware that it may not be able to resell the Securities except in accordance with limited exemptions under applicable

securities laws, and it agrees that any certificates representing the Securities may bear a legend indicating that the resale of such

securities is restricted;

2.14.

Each of the Investors is aware that the Company is a “reporting company” (as such term is used in the Securities Exchange

Act of 1934, as amended) in the U.S.;

2.15.

Each of the Investors understands that the purchase of the Securities is a highly speculative investment and that an investment in the

Securities is suitable only for sophisticated investors and requires the financial ability and willingness to accept the possibility

of the loss of all or substantially all of such investment as well as the risks and lack of liquidity inherent in an investment in the

Company;

2.16.

Confidential Information. Each of the Investors agrees that such Investors and its employees, agents and representatives will

keep confidential and will not disclose, divulge or use (other than for purposes of monitoring its investment in the Company) any confidential

information which such Investors may obtain from the Company pursuant to financial statements, reports and other materials submitted

by the Company to such Investors pursuant to this Agreement, unless such information is (i) known to the public through no fault of such

Investors or his or its employees or representatives; (ii) becomes part of the public domain other than by a breach of this Agreement;

(iii) becomes known by the action of a third party not in breach of a duty of confidence; or (iv) is required to be disclosed to a third

party pursuant to any applicable law, government resolution, or decision of any court or tribunal of competent jurisdiction; provided,

however, that an Investor may disclose such information (i) to its attorneys, accountants and other professionals in connection with

their representation of such Investor in connection with such Investors’ investment in the Company, (ii) to any prospective permitted

transferee of the Securities, or (iii) to any general partner or affiliate of such Investor, so long as the prospective transferee agrees

to be bound by the provisions of this Section 2.16. In addition, each Investor acknowledges that the United States securities laws and

other laws prohibit any person or entity who has material non-public information (“MNPI”) concerning the Company from purchasing

or selling any of securities of the Company, and from communicating such information to any person or entity under circumstances in which

it is reasonably foreseeable that such person is likely to purchase or sell such securities. Each Investor acknowledges that some or

all of the confidential information may include MNPI for purposes of the federal securities laws. Each Investor acknowledges and agrees

that itself/himself/herself or any individual or entities (“Affiliate”) affiliated with or controlled by such Investor will

abide by all securities laws relating to the handling of and acting upon such information. Each Investor is expressly prohibited from

purchasing or selling securities of the Company based on such confidential information. Each Investor will take reasonable steps to ensure

that such Investor or its Affiliate will not purchase or sell the Company’s securities in reliance upon MNPI until such time as

no violation of the applicable securities laws would result from such securities trading. Each Investor and its Affiliates are prohibited

from informing, or “tipping”, any other person about such MNPI.

2.17.

No Advertisements or Direct Selling Effort. Each of the Investors is not subscribing for the Securities as a result of or subsequent

to any advertisement, article, notice or other communication published in any newspaper, magazine, or similar media or broadcast over

television or radio or via the Internet, or presented at any seminar or meeting. Each of the Investors has not acquired the Securities

as a result of, and will not itself engage in, any “directed selling efforts” (as defined in Regulation S) in the United

States in respect of any of the Securities which would include any activities undertaken for the purpose of, or that could reasonably

be expected to have the effect of, conditioning the market in the United States for the resale of any of the Securities; provided, however,

that each of the Investors may sell or otherwise dispose of any of the Securities pursuant to registration of any of the Securities pursuant

to the Securities Act and any applicable state securities laws or under an exemption from such registration requirements and as otherwise

provided herein.

2.18.

General. Each of the Investors understands that the Securities are being offered and sold in reliance on a transactional exemption

from the registration requirements of federal and state securities laws and the Company is relying upon the truth and accuracy of the

representations, warranties, agreements, acknowledgments and understandings of such Investor set forth herein in order to determine the

applicability of such exemptions and the suitability of such Investor to acquire the Securities.

3.

Company’s Representations and Warranties. Company represents and warrants to Investors that as of the Closing Date: (i)

Company is an exempt company with limited liability duly organized, validly existing and in good standing under the laws of the British

Virgin Islands and has the requisite corporate power to own its properties and to carry on its business as now being conducted; (ii)

Company is duly qualified as a foreign corporation to do business and is in good standing in each jurisdiction where the nature of the

business conducted or property owned by it makes such qualification necessary; (iii) Company has registered its Ordinary Shares under

Section 12(b) of the Securities Exchange Act of 1934, as amended (the “1934 Act”), and is obligated to file reports

pursuant to Section 13 or Section 15(d) of the 1934 Act; (iv) each of the Transaction Documents and the transactions contemplated hereby

and thereby, have been duly and validly authorized by Company and all necessary actions have been taken; (v) this Agreement, the Notes,

and the other Transaction Documents have been duly executed and delivered by Company and constitute the valid and binding obligations

of Company enforceable in accordance with their terms; (vi) the execution and delivery of the Transaction Documents by Company, the issuance

of Securities in accordance with the terms hereof, and the consummation by Company of the other transactions contemplated by the Transaction

Documents do not and will not conflict with or result in a breach by Company of any of the terms or provisions of, or constitute a default

under (a) Company’s formation documents or memorandum and articles of association, each as currently in effect, (b) any indenture,

mortgage, deed of trust, or other material agreement or instrument to which Company is a party or by which it or any of its properties

or assets are bound, including, without limitation, any listing agreement for the Ordinary Shares, or (c) any existing applicable law,

rule, or regulation or any applicable decree, judgment, or order of any court, United States federal, state or foreign regulatory body,

administrative agency, or other governmental body having jurisdiction over Company or any of Company’s properties or assets; (vii)

no further authorization, approval or consent of any court, governmental body, regulatory agency, self-regulatory organization, or stock

exchange or market or the stockholders or any lender of Company is required to be obtained by Company for the issuance of the Securities

to Investors or the entering into of the Transaction Documents; (viii) none of Company’s filings with the SEC contained, at the

time they were filed, any untrue statement of a material fact or omitted to state any material fact required to be stated therein or

necessary to make the statements made therein, in light of the circumstances under which they were made, not misleading; (ix) there is

no action, suit, proceeding, inquiry or investigation before or by any court, public board or body pending or, to the knowledge of Company,

threatened against or affecting Company before or by any governmental authority or non-governmental department, commission, board, bureau,

agency or instrumentality or any other person, wherein an unfavorable decision, ruling or finding would have a material adverse effect

on Company or which would adversely affect the validity or enforceability of, or the authority or ability of Company to perform its obligations

under, any of the Transaction Documents; (x) Company has not consummated any financing transaction that has not been disclosed in a periodic

filing or current report with the SEC under the 1934 Act; (xi) Company is not, nor has it been at any time in the previous twelve (12)

months, a “Shell Company,” as such type of “issuer” is described in Rule 144(i)(1) under the 1933 Act; (xii)

neither Investors nor any of its officers, directors, stockholders, members, managers, employees, agents or representatives has made

any representations or warranties to Company or any of its officers, directors, employees, agents or representatives except as expressly

set forth in the Transaction Documents and, in making its decision to enter into the transactions contemplated by the Transaction Documents,

Company is not relying on any representation, warranty, covenant or promise of Investors or its officers, directors, members, managers,

employees, agents or representatives other than as set forth in the Transaction Documents.

4.

Company Covenants. Until all of Company’s obligations under all of the Transaction Documents are paid and performed in full,

Company will at all times comply with the following covenants: (i) when issued, the Conversion Shares will be duly authorized, validly

issued, fully paid for and non-assessable, free and clear of all liens, claims, charges and encumbrances; (ii) the Ordinary Shares shall

be listed or quoted for trading on NYSE or Nasdaq; (iii) trading in Company’s Ordinary Shares will not be suspended, halted, chilled,

frozen, reach zero bid or otherwise cease trading on Company’s principal trading market; (iv) Company hereby grants to all the

Investors collectively a participation right, whereby all the Investors together shall have the right to participate in their discretion

in up to thirty percent (30%) of the amount raised in any subsequent equity or debt financing of Company to any U.S. Person as defined

in Regulation S of the Securities Act in the U.S. In furtherance thereof, should Company seek to raise capital via any transaction covered

by the foregoing participation right it shall provide Investors written notice of such proposed transaction, along with copies of the

proposed transaction documents. All the Investors together shall then have up to two (2) calendar days to elect to purchase up to thirty

percent (30%) of securities proposed to be issued in such transaction on the most favorable terms and conditions offered to any other

purchaser of the same securities.

5.

Conditions to Company’s Obligation to Sell. The obligation of Company hereunder to issue and sell the Securities to Investors

at the Closing is subject to the satisfaction, on or before the Closing Date, of each of the following conditions:

5.1.

Investors shall have executed this Agreement and delivered the same to Company.

5.2.

Investors shall have delivered the Purchase Price to Company in accordance with Section 1.2 above.

6.

Conditions to Investors’ Obligation to Purchase. The obligation of each Investor hereunder to purchase the Securities at

the Closing is subject to the satisfaction, on or before the Closing Date, of each of the following conditions, provided that the condition

are for each Investor’s sole benefit and may be waived by Investors at any time in its sole discretion:

6.1.

Company shall have executed this Agreement and the Notes and delivered the same to Investors.

In

the event any of the conditions in Sections 5 and 6 is not satisfied or waived by the Closing Date, the Agreement will be cancelled and

deemed void ab initio.

7.

Reservation of Shares. On the date hereof, Company will reserve 10,000,000 Ordinary Shares from its authorized and unissued Ordinary

Shares to provide for all issuances of Ordinary Shares under the Notes (the “Share Reserve”). Company further agrees

to add additional Ordinary Shares to the Share Reserve in increments of 100,000 shares as and when requested by Investors if as of the

date of any such request the number of shares being held in the Share Reserve is less than two (2) times the number of Ordinary Shares

obtained by dividing the Outstanding Balance (as defined in the Note) as of the date of the request by the Conversion Price (as defined

in the Note). Company shall further require the Transfer Agent to hold the Ordinary Shares reserved pursuant to the Share Reserve exclusively

for the benefit of Investors and to issue such shares to Investors promptly upon Investors’ delivery of a Conversion Notice under

the Note. Finally, Company shall require the Transfer Agent to issue Ordinary Shares pursuant to the Notes to Investors out of its authorized

and unissued shares, and not the Share Reserve, to the extent Ordinary Shares have been authorized, but not issued, and are not included

in the Share Reserve. The Transfer Agent shall only issue shares out of the Share Reserve to the extent there are no other authorized

shares available for issuance and then only with Investors’ written consent.

8.

OFAC; Patriot Act.

8.1.

OFAC Certification. Company certifies that (i) it is not acting on behalf of any person, group, entity, or nation named by any

Executive Order or the United States Treasury Department, through its Office of Foreign Assets Control (“OFAC”) or

otherwise, as a terrorist, “Specially Designated Nation”, “Blocked Person”, or other banned or blocked person,

entity, nation, or transaction pursuant to any law, order, rule or regulation that is enforced or administered by OFAC or another department

of the United States government, and (ii) Company is not engaged in this transaction on behalf of, or instigating or facilitating this

transaction on behalf of, any such person, group, entity or nation.

8.2.

Foreign Corrupt Practices. Neither Company, nor any of its subsidiaries, nor any director, officer, agent, employee or other person

acting on behalf of Company or any subsidiary has, in the course of his actions for, or on behalf of, Company, used any corporate funds

for any unlawful contribution, gift, entertainment or other unlawful expenses relating to political activity; made any direct or indirect

unlawful payment to any foreign or domestic government official or employee from corporate funds; violated or is in violation of any

provision of the U.S. Foreign Corrupt Practices Act of 1977, as amended, or made any bribe, rebate, payoff, influence payment, kickback

or other unlawful payment to any foreign or domestic government official or employee.

8.3.

Patriot Act. Company shall not (i) be or become subject at any time to any law, regulation, or list of any government agency (including,

without limitation, the OFAC) that prohibits or limits Investors from making any advance or extension of credit to Company or from otherwise

conducting business with Company, or (ii) fail to provide documentary and other evidence of Company’s identity as may be requested

by Investors at any time to enable Investors to verify Company’s identity or to comply with any applicable law or regulation, including,

without limitation, Section 326 of the USA Patriot Act of 2001, 31 U.S.C. Section 5318. Company shall comply with all requirements of

law relating to money laundering, anti-terrorism, trade embargos and economic sanctions, now or hereafter in effect. Upon Investors’

request from time to time, Company shall certify in writing to Investors that Company’s representations, warranties and obligations

under this Section 8.3 remain true and correct and have not been breached. Company shall immediately notify Investors in writing

if any of such representations, warranties or covenants are no longer true or have been breached or if Company has a reasonable basis

to believe that they may no longer be true or have been breached. In connection with such an event, Company shall comply with all requirements

of law and directives of governmental authorities and, at Investors’ request, provide to Investors copies of all notices, reports

and other communications exchanged with, or received from, governmental authorities relating to such an event. Company shall also reimburse

Investors any expense incurred by Investors in evaluating the effect of such an event on the loan secured hereby, in obtaining any necessary

license from governmental authorities as may be necessary for Investors to enforce its rights under the Transaction Documents, and in

complying with all requirements of law applicable to Investors as the result of the existence of such an event and for any penalties

or fines imposed upon Investors as a result thereof.

9.

Miscellaneous. The provisions set forth in this Section 9 shall apply to this Agreement, as well as all other Transaction

Documents as if these terms were fully set forth therein; provided, however, that in the event there is a conflict between any provision

set forth in this Section 9 and any provision in any other Transaction Document, the provision in such other Transaction Document

shall govern.

9.1.

Governing Law; Venue. This Agreement shall be construed and enforced in accordance with, and all questions concerning the construction,

validity, interpretation and performance of this Agreement shall be governed by, the internal laws of the State of New York without giving

effect to any choice of law or conflict of law provision or rule (whether of the State of New York or any other jurisdiction) that would

cause the application of the laws of any jurisdiction other than the State of New York.

9.2.

Counterparts. This Agreement may be executed in two (2) or more counterparts, each of which shall be deemed an original, but all

of which together shall constitute one and the same instrument. Counterparts may be delivered via facsimile, electronic mail (including

pdf or any electronic signature complying with the U.S. federal ESIGN Act of 2000, e.g., www.docusign.com) or other transmission method

and any counterpart so delivered shall be deemed to have been duly and validly delivered and be valid and effective for all purposes.

9.3.

Headings. The headings of this Agreement are for convenience of reference only and shall not form part of, or affect the interpretation

of, this Agreement.

9.4.

Severability. In the event that any provision of this Agreement is invalid or unenforceable under any applicable statute or rule

of law, then such provision shall be deemed inoperative to the extent that it may conflict therewith and shall be deemed modified to

conform to such statute or rule of law. Any provision hereof which may prove invalid or unenforceable under any law shall not affect

the validity or enforceability of any other provision hereof.

9.5.

Entire Agreement. This Agreement, together with the other Transaction Documents, contains the entire understanding of the parties

with respect to the matters covered herein and therein and, except as specifically set forth herein or therein, neither Company nor Investors

makes any representation, warranty, covenant or undertaking with respect to such matters. For the avoidance of doubt, all prior term

sheets or other documents between Company and Investors, or any affiliate thereof, related to the transactions contemplated by the Transaction

Documents (collectively, “Prior Agreements”), that may have been entered into between Company and Investors, or any

affiliate thereof, are hereby null and void and deemed to be replaced in their entirety by the Transaction Documents. To the extent there

is a conflict between any term set forth in any Prior Agreement and the term(s) of the Transaction Documents, the Transaction Documents

shall govern.

9.6.

Amendments. No provision of this Agreement may be waived or amended other than by an instrument in writing signed by both parties

hereto.

9.7.

Notices. Any notice required or permitted hereunder shall be given in writing (unless otherwise specified herein) and shall be

deemed effectively given on the earliest of: (i) the date delivered, if delivered by personal delivery as against written receipt therefor

or by email to an executive officer named below or such officer’s successor, or by facsimile (with successful transmission confirmation

which is kept by sending party), (ii) the earlier of the date delivered or the fifth (5th) Trading Day after deposit, postage

prepaid, with an international courier, or (iii) the earlier of the date delivered or the third Trading Day after mailing by express

courier, with delivery costs and fees prepaid, in each case, addressed to each of the other parties thereunto entitled at the following

addresses (or at such other addresses as such party may designate by five (5) calendar days’ advance written notice similarly given

to each of the other parties hereto):

If

to Company:

Meiwu

Technology Company Limited

Attn:

Xinliang Zhang, CEO

1602,

Building C, Shenye Century Industrial Center, No. 743 Zhoushi Road

Bao’an

District, Shenzhen, People’s Republic of China

Phone:

0755-85250400

Email:

meiwubs@usmeiwu.com

With

a copy to (which copy shall not constitute notice):

Hunter

Taubman Fischer & Li LLC

Attn:

Joan Wu

950

Third Avenue, Floor 19th

New

York, NY 10022

Email:

jwu@htflawyers.com

If

to Investors:

Investor

Attn:

Zhichao Yang

412,

Building 1, Dongyue Ecological Park, Junhe Avenue, Baiyun District, Guangzhou, People’s Republic of China

Phone:

13489472968

Email:

9.8.

Successors and Assigns. This Agreement or any of the severable rights and obligations inuring to the benefit of or to be performed

by Investors hereunder may be assigned by Investors to a third party, including its affiliates, in whole or in part, without the need

to obtain Company’s consent thereto. Company may not assign its rights or obligations under this Agreement or delegate its duties

hereunder, whether directly or indirectly, without the prior written consent of Investors, and any such attempted assignment or delegation

shall be null and void.

9.9.

Survival. The representations and warranties of Company and the agreements and covenants set forth in this Agreement shall survive

the Closing hereunder notwithstanding any due diligence investigation conducted by or on behalf of Investors. Company agrees to indemnify

and hold harmless Investors and all its officers, directors, employees, attorneys, and agents for loss or damage arising as a result

of or related to any breach or alleged breach by Company of any of its representations, warranties and covenants set forth in this Agreement

or any of its covenants and obligations under this Agreement, including advancement of expenses as they are incurred.

9.10.

Further Assurances. Each party shall do and perform, or cause to be done and performed, all such further acts and things, and

shall execute and deliver all such other agreements, certificates, instruments and documents, as the other party may reasonably request

in order to carry out the intent and accomplish the purposes of this Agreement and the consummation of the transactions contemplated

hereby.

9.11.

Attorneys’ Fees and Cost of Collection. In the event any suit, action or arbitration is filed by either party against the

other to interpret or enforce any of the Transaction Documents, the unsuccessful party to such action agrees to pay to the prevailing

party all costs and expenses, including attorneys’ fees incurred therein, including the same with respect to an appeal. The “prevailing

party” shall be the party in whose favor a judgment is entered, regardless of whether judgment is entered on all claims asserted

by such party and regardless of the amount of the judgment; or where, due to the assertion of counterclaims, judgments are entered in

favor of and against both parties, then the judge or arbitrator shall determine the “prevailing party” by taking into account

the relative dollar amounts of the judgments or, if the judgments involve nonmonetary relief, the relative importance and value of such

relief. Nothing herein shall restrict or impair an arbitrator’s or a court’s power to award fees and expenses for frivolous

or bad faith pleading. If (i) the Note is placed in the hands of an attorney for collection or enforcement prior to commencing arbitration

or legal proceedings, or is collected or enforced through any arbitration or legal proceeding, or Investors otherwise takes action to

collect amounts due under the Note or to enforce the provisions of the Note, or (ii) there occurs any bankruptcy, reorganization, receivership

of Company or other proceedings affecting Company’s creditors’ rights and involving a claim under the Note; then Company

shall pay the costs incurred by Investors for such collection, enforcement or action or in connection with such bankruptcy, reorganization,

receivership or other proceeding, including, without limitation, attorneys’ fees, expenses, deposition costs, and disbursements.

9.12.

Waiver. No waiver of any provision of this Agreement shall be effective unless it is in the form of a writing signed by the party

granting the waiver. No waiver of any provision or consent to any prohibited action shall constitute a waiver of any other provision

or consent to any other prohibited action, whether or not similar. No waiver or consent shall constitute a continuing waiver or consent

or commit a party to provide a waiver or consent in the future except to the extent specifically set forth in writing.

9.13.

Waiver of Jury Trial. EACH PARTY TO THIS AGREEMENT IRREVOCABLY WAIVES ANY AND ALL RIGHTS SUCH PARTY MAY HAVE TO DEMAND THAT ANY

ACTION, PROCEEDING OR COUNTERCLAIM ARISING OUT OF OR IN ANY WAY RELATED TO THIS AGREEMENT, ANY OTHER TRANSACTION DOCUMENT, OR THE RELATIONSHIPS

OF THE PARTIES HERETO BE TRIED BY JURY. THIS WAIVER EXTENDS TO ANY AND ALL RIGHTS TO DEMAND A TRIAL BY JURY ARISING UNDER COMMON LAW

OR ANY APPLICABLE STATUTE, LAW, RULE OR REGULATION. FURTHER, EACH PARTY HERETO ACKNOWLEDGES THAT SUCH PARTY IS KNOWINGLY AND VOLUNTARILY

WAIVING SUCH PARTY’S RIGHT TO DEMAND TRIAL BY JURY.

9.14.

Time is of the Essence. Time is expressly made of the essence with respect to each and every provision of this Agreement and the

other Transaction Documents.

9.15.

Voluntary Agreement. Company has carefully read this Agreement and each of the other Transaction Documents and has asked any questions

needed for Company to understand the terms, consequences and binding effect of this Agreement and each of the other Transaction Documents

and fully understand them. Company has had the opportunity to seek the advice of an attorney of Company’s choosing, or has waived

the right to do so, and is executing this Agreement and each of the other Transaction Documents voluntarily and without any duress or

undue influence by Investors or anyone else.

[Remainder

of page intentionally left blank; signature page follows]

IN

WITNESS WHEREOF, the undersigned Investors and Company have caused this Agreement to be duly executed as of the date first above written.

| |

INVESTOR: |

| |

|

|

| |

By:

|

|

| |

Name:

|

ZHICHAO

YANG |

| |

|

|

| |

INVESTOR: |

| |

|

|

| |

By:

|

/s/

Houqing He |

| |

Name:

|

HOUQING

HE |

| |

|

|

| |

INVESTOR: |

| |

|

|

| |

By:

|

/s/

Sunjian Ye |

| |

Name:

|

SUNJIAN

YE |

| |

|

|

| |

COMPANY: |

| |

|

|

| |

Meiwu

Technology Company Limited |

| |

|

|

| |

By: |

/s/

Xinliang Zhang |

| |

|

Xinliang

Zhang, CEO |

[Signature

Page to Securities Purchase Agreement]

ATTACHED

EXHIBITS:

| Exhibit |

A Form of the Note |

Exhibit

10.2

CONVERTIBLE

PROMISSORY NOTE

| Issuance

Date: May [ ], 2024 |

U.S.

$[ ] |

FOR

VALUE RECEIVED, Meiwu Technology Company Limited, a British Virgin Islands exempt company (“Borrower”), promises to

pay to [INVESTOR], or its successors or assigns (“Lender”), $[

] and any interest, fees, charges, and late fees accrued hereunder on the date that is eighteen (18) months after the Effective Date

(as defined below) (the “Maturity Date”) in accordance with the terms set forth herein and to pay interest on the

Outstanding Balance at the rate of ten percent (10%) per annum from the Effective Date until the same is paid in full. All interest calculations

hereunder shall be computed on the basis of a 360-day year comprised of twelve (12) thirty (30) day months, shall compound daily and

shall be payable in accordance with the terms of this Note. This Convertible Promissory Note (this “Note”) is issued

and made effective as of the date set forth above (the “Effective Date”). This Note is issued pursuant to that certain

Securities Purchase Agreement dated May 17, 2024, as the same may be amended from time to time, by and between Borrower and Lender (the

“Purchase Agreement”). Certain capitalized terms used herein are defined in Attachment 1 attached hereto and

incorporated herein by this reference.

This

Note carries an OID of $[ ]1 all of which amount is fully earned as of the Effective Date and included in the

initial principal balance. The purchase price for this Note shall be $[ ].00 (the “Purchase Price”), computed

as follows: $[ ].00 original principal balance, less the OID. The Purchase Price shall be payable by Lender by wire transfer

of immediately available funds.

1.

Payment; Prepayment

1.1.

Payment. All payments owing hereunder shall be in lawful money of the United States of America or Conversion Shares (as defined

below), as provided for herein, and delivered to Lender at the address or bank account furnished to Borrower for that purpose. All payments

shall be applied first to (a) costs of collection, if any, then to (b) fees and charges, if any, then to (c) accrued and unpaid interest,

and thereafter, to (d) principal.

1.2.

Prepayment. So long as no Event of Default (as defined below) has occurred, Borrower shall have the right, exercisable on not

less than five (5) Trading Days prior written notice to Lender to prepay the Outstanding Balance (less such portion of the Outstanding

Balance for which Borrower has received a Conversion Notice (as defined below) from Lender where the applicable Conversion Shares have

not yet been delivered) of this Note, in part or in full, in accordance with this Section 1.2. Any notice of prepayment hereunder (an

“Optional Prepayment Notice”) shall be delivered to Lender at its registered address or through email and shall state:

(i) that Borrower is exercising its right to prepay this Note, and (ii) the date of prepayment, which shall be not less than five (5)

Trading Days from the date of the Optional Prepayment Notice. On the date fixed for prepayment (the “Optional Prepayment Date”),

Borrower shall make payment of the Optional Prepayment Amount (as defined below) to or upon the order of Lender as may be specified by

Lender in writing to Borrower. For the avoidance of doubt, Lender shall be entitled to exercise its Conversion (as defined below) rights

until the Optional Prepayment Date. If Borrower exercises its right to prepay this Note, Borrower shall make payment to Lender of an

amount in cash equal to 120% multiplied by the then Outstanding Balance of this Note being prepaid (the “Optional Prepayment

Amount”). In the event Borrower delivers the Optional Prepayment Amount to Lender prior to the Optional Prepayment Date, the

Optional Prepayment Amount shall not be deemed to have been paid to Lender until the Optional Prepayment Date. In the event Borrower

delivers the Optional Prepayment Amount without an Optional Prepayment Notice, then the Optional Prepayment Date will be deemed to be

the date that is five (5) Trading Days from the date that the Optional Prepayment Amount was delivered to Lender and Lender shall be

entitled to exercise its conversion rights set forth herein during such five (5) Trading Day period. In addition, if Borrower delivers

an Optional Prepayment Notice and fails to pay the Optional Prepayment Amount due to Lender within five (5) Trading Days following the

Optional Prepayment Date, Borrower shall forever forfeit its right to prepay this Note.

1

The OID equals 10% of the Purchase Price.

2.

Security. This Note is unsecured.

3.

Lender Conversion. Lender has the right at any time after the six month anniversary of the Effective Date until the Outstanding

Balance has been paid in full, at its election, to convert (“Lender Conversion”) all or any portion of the Outstanding

Balance into fully paid and non-assessable ordinary shares (“Lender Conversion Shares”), no par value per share (the

“Ordinary Shares”), of Borrower as per the following conversion formula: the amount being converted (the “Conversion

Amount”) divided by the applicable “Conversion Price”, which shall equal to the greater of (i) Market Price (as

defined below) and (ii) $0.5 (the “Floor Price”). Conversion notices in the form attached hereto as Exhibit A

(each, a “Lender Conversion Notice”) may be effectively delivered to Borrower by any method set forth in the “Notices”

Section of the Purchase Agreement, and all Lender Conversions shall be cashless and not require further payment from Lender. Borrower

shall deliver the Lender Conversion Shares from any Lender Conversion to Lender in accordance with Section 7 below.

4.

Trigger Events, Defaults and Remedies.

4.1.

Trigger Events. The following are trigger events under this Note (each, a “Trigger Event”): (a) Borrower fails

to deliver any Conversion Shares (as defined below) in accordance with the terms hereof; (b) Borrower fails to pay any principal, interest,

fees, charges, or any other amount when due and payable hereunder; (c) Borrower becomes insolvent or generally fails to pay, or admits

in writing its inability to pay, its debts as they become due, subject to applicable grace periods, if any; (d) Borrower files a petition

for relief under any bankruptcy, insolvency or similar law (domestic or foreign); (e) an involuntary bankruptcy proceeding is commenced

or filed against Borrower; (f) Borrower fails to observe or perform any covenant set forth in Section 4 of the Purchase Agreement (other

than Section 4(vii) of the Purchase Agreement); or (g) Borrower fails to be DWAC Eligible.

4.2.

Trigger Event Remedies. At any time following the occurrence of any Trigger Event, Lender may, at its option, increase the Outstanding

Balance by applying the Trigger Effect (subject to the limitation set forth below).

4.3.

Defaults. At any time following the occurrence of a Trigger Event, Lender may, at its option, send written notice to Borrower

demanding that Borrower cure the Trigger Event within ten (10) Trading Days following the date of such written notice. If Borrower fails

to cure the Trigger Event within the required ten (10) Trading Day cure period, the Trigger Event will automatically become an event

of default hereunder (each, an “Event of Default”).

4.4.

Default Remedies. At any time and from time to time following the occurrence of any Event of Default, Lender may accelerate this

Note by written notice to Borrower, with the Outstanding Balance becoming immediately due and payable in cash at the Mandatory Default

Amount. Notwithstanding the foregoing, upon the occurrence of any Trigger Event described in clauses 4.1(c) – 4.1(g), an Event

of Default will be deemed to have occurred and the Outstanding Balance as of the date of the occurrence of such Trigger Event shall become

immediately and automatically due and payable in cash at the Mandatory Default Amount, without any written notice required by Lender

for the Trigger Event to become an Event of Default.. At any time following the occurrence of any Event of Default, upon written notice

given by Lender to Borrower, interest shall accrue on the Outstanding Balance beginning on the date the applicable Event of Default occurred

at an interest rate equal to the lesser of fifteen percent (15%) per annum or the maximum rate permitted under applicable law (“Default

Interest”). For the avoidance of doubt, Lender may continue making Conversions at any time following a Trigger Event or an

Event of Default until such time as the Note is paid in full. In connection with acceleration described herein, Lender need not provide,

and Borrower hereby waives, any presentment, demand, protest or other notice of any kind, and Lender may immediately and without expiration

of any grace period enforce any and all of its rights and remedies hereunder and all other remedies available to it under applicable

law. Such acceleration may be rescinded and annulled by Lender at any time prior to payment hereunder and Lender shall have all rights

as a holder of the Note until such time, if any, as Lender receives full payment pursuant to this Section 4.4. No such rescission or

annulment shall affect any subsequent Trigger Event or Event of Default or impair any right consequent thereon. Nothing herein shall

limit Lender’s right to pursue any other remedies available to it at law or in equity including, without limitation, a decree of

specific performance and/or injunctive relief with respect to Borrower’s failure to timely deliver Conversion Shares upon Conversion

of the Note as required pursuant to the terms hereof.

5.

Unconditional Obligation; No Offset. Borrower acknowledges that this Note is an unconditional, valid, binding and enforceable

obligation of Borrower not subject to offset, deduction or counterclaim of any kind. Borrower hereby waives any rights of offset it now

has or may have hereafter against Lender, its successors and assigns, and agrees to make the payments or Conversions called for herein

in accordance with the terms of this Note.

6.

Waiver. No waiver of any provision of this Note shall be effective unless it is in the form of a writing signed by the party granting

the waiver. No waiver of any provision or consent to any prohibited action shall constitute a waiver of any other provision or consent

to any other prohibited action, whether or not similar. No waiver or consent shall constitute a continuing waiver or consent or commit

a party to provide a waiver or consent in the future except to the extent specifically set forth in writing.

7.

Method of Conversion Share Delivery. On or before the close of business on the third (3rd) Trading Day following the

date of delivery of a Lender Conversion Notice, as applicable (the “Delivery Date”), Borrower shall, provided it is

DWAC Eligible at such time and such Conversion Shares are eligible for delivery via DWAC, deliver or cause its transfer agent to deliver

the applicable Conversion Shares electronically via DWAC to the account designated by Lender in the applicable Lender Conversion Notice.

If Borrower is not DWAC Eligible or such Conversion Shares are not eligible for delivery via DWAC, it shall deliver to Lender or its

broker (as designated in the Lender Conversion Notice), via reputable overnight courier, a certificate representing the number of Ordinary

Shares equal to the number of Conversion Shares to which Lender shall be entitled, registered in the name of Lender or its designee.

For the avoidance of doubt, Borrower has not met its obligation to deliver Conversion Shares by the Delivery Date unless Lender or its

broker, as applicable, has actually received the certificate representing the applicable Conversion Shares no later than the close of

business on the relevant Delivery Date pursuant to the terms set forth above.

8.

Omitted.

9.

Ownership Limitation. Notwithstanding anything to the contrary contained in this Note or the other Transaction Documents, Borrower

shall not effect any conversion of this Note to the extent that after giving effect to such conversion would cause Lender (together with

its affiliates) to beneficially own a number of shares exceeding 9.99% of the number of Ordinary Shares outstanding on such date (including

for such purpose the Ordinary Shares issuable upon such issuance) (the “Maximum Percentage”). For purposes of this

section, beneficial ownership of Ordinary Shares will be determined pursuant to Section 13(d) of the 1934 Act. By written notice to Borrower,

Lender may increase, decrease or waive the Maximum Percentage as to itself but any such waiver will not be effective until the 61st day

after delivery thereof. The foregoing 61-day notice requirement is enforceable, unconditional and non-waivable and shall apply to all

affiliates and assigns of Lender.

10.

Governing Law; Venue. This Note shall be construed and enforced in accordance with, and all questions concerning the construction,

validity, interpretation and performance of this Note shall be governed by, the internal laws of the State of New York, without giving

effect to any choice of law or conflict of law provision or rule (whether of the State of New York or any other jurisdiction) that would

cause the application of the laws of any jurisdiction other than the State of New York. The provisions set forth in the Purchase Agreement

to determine the proper venue for any disputes are incorporated herein by this reference.

11.

Cancellation. After repayment or conversion of the entire Outstanding Balance, this Note shall be deemed paid in full, shall automatically

be deemed canceled, and shall not be reissued.

12.

Amendments. The prior written consent of both parties hereto shall be required for any change or amendment to this Note.

13.

Assignments. Borrower may not assign this Note without the prior written consent of Lender. This Note and any Ordinary Shares

issued upon conversion of this Note may be offered, sold, assigned or transferred by Lender without the consent of Borrower.

14.

Notices. Whenever notice is required to be given under this Note, unless otherwise provided herein, such notice shall be given

in accordance with the subsection of the Purchase Agreement titled “Notices.”

15.

Liquidated Damages. Lender and Borrower agree that in the event Borrower fails to comply with any of the terms or provisions of

this Note, Lender’s damages would be uncertain and difficult (if not impossible) to accurately estimate because of the parties’

inability to predict future interest rates, future share prices, future trading volumes and other relevant factors. Accordingly, Lender

and Borrower agree that any fees, balance adjustments, Default Interest or other charges assessed under this Note are not penalties but

instead are intended by the parties to be, and shall be deemed, liquidated damages (under Lender’s and Borrower’s expectations

that any such liquidated damages will tack back to the Purchase Price Date for purposes of determining the holding period under Rule

144).

16.

Severability. If any part of this Note is construed to be in violation of any law, such part shall be modified to achieve the

objective of Borrower and Lender to the fullest extent permitted by law and the balance of this Note shall remain in full force and effect.

[Remainder

of page intentionally left blank; signature page follows]

IN

WITNESS WHEREOF, Borrower has caused this Note to be duly executed as of the Effective Date.

| |

BORROWER: |

| |

|

|

| |

Meiwu

Technology Company Limited |

| |

|

|

| |

By:

|

|

| |

|

Xinliang

Zhang, CEO |

| ACKNOWLEDGED,

ACCEPTED AND AGREED: |

|

| |

|

| LENDER: |

|

| |

|

|

| By:

|

|

|

[Signature

Page to Convertible Promissory Note]

ATTACHMENT

1

DEFINITIONS

For

purposes of this Note, the following terms shall have the following meanings:

A1.

“Closing Bid Price” and “Closing Trade Price” means the last closing bid price and last

closing trade price, respectively, for the Ordinary Shares on its principal market, as reported by Bloomberg, or, if its principal

market begins to operate on an extended hours basis and does not designate the closing bid price or the closing trade price (as the

case may be) then the last bid price or last trade price, respectively, of the Ordinary Shares prior to 4:00:00 p.m., New York time,

as reported by Bloomberg, or, if its principal market is not the principal securities exchange or trading market for the Ordinary

Shares, the last closing bid price or last trade price, respectively, of the Ordinary Shares on the principal securities exchange or

trading market where the Ordinary Shares is listed or traded as reported by Bloomberg, or if the foregoing do not apply, the last

closing bid price or last trade price, respectively, of the Ordinary Shares in the over-the-counter market on the electronic

bulletin board for the Ordinary Shares as reported by Bloomberg, or, if no closing bid price or last trade price, respectively, is

reported for the Ordinary Shares by Bloomberg, the average of the bid prices, or the ask prices, respectively, of any market makers

for the Ordinary Shares as reported by Nasdaq and any successor thereto. If the Closing Bid Price or the Closing Trade Price cannot

be calculated for the Ordinary Shares on a particular date on any of the foregoing bases, the Closing Bid Price or the Closing Trade

Price (as the case may be) of the Ordinary Shares on such date shall be the fair market value as mutually determined by Lender and

Borrower. All such determinations shall be appropriately adjusted for any stock dividend, stock split, stock combination or other

similar transaction during such period.

A2.

“Conversion” means a Lender Conversion under Section 3.

A3.

“DTC” means the Depository Trust Company or any successor thereto.

A4.

“DTC/FAST Program” means the DTC’s Fast Automated Securities Transfer program.

A5.

“DWAC” means the DTC’s Deposit/Withdrawal at Custodian system.

A6.

“DWAC Eligible” means that (a) Borrower’s Ordinary Shares is eligible at DTC for full services pursuant to

DTC’s operational arrangements, including without limitation transfer through DTC’s DWAC system; (b) Borrower has been

approved (without revocation) by DTC’s underwriting department; (c) Borrower’s transfer agent is approved as an agent in

the DTC/FAST Program; (d) the Conversion Shares are otherwise eligible for delivery via DWAC; and (e) Borrower’s transfer

agent does not have a policy prohibiting or limiting delivery of the Conversion Shares via DWAC.

A7.

“Floor Price” means $0.50.

A8.

“Major Trigger Event” means any Trigger Event occurring under Sections 4.1(b) – 4.1(f).

A9.

“Mandatory Default Amount” means the Outstanding Balance following the application of the Trigger

Effect.

A10.

“Market Price” means 80% multiplied by the lowest daily VWAP during the twenty (20) Trading Days immediately

preceding the date of the applicable Lender Conversion Notice.

A11.

“Minor Trigger Event” means any Trigger Event that is not a Major Trigger Event.

A12.

“OID” means an original issue discount.

A13.

“Other Agreements” means, collectively, all existing and future agreements and instruments between, among or by

Borrower (or an affiliate), on the one hand, and Lender (or an affiliate), on the other hand.

A14.

“Outstanding Balance” means as of any date of determination, the Purchase Price, as reduced or increased, as the

case may be, pursuant to the terms hereof for payment, Conversion, offset, or otherwise, plus the OID, accrued but unpaid interest,

collection and enforcements costs (including attorneys’ fees) incurred by Lender, transfer, stamp, issuance and similar taxes

and fees related to Conversions, and any other fees or charges (including without limitation Conversion Delay Late Fees) incurred

under this Note.

| Attachment 1 to Convertible Promissory Note, Page 1 |

A15.

“Trading Day” means any day on which Borrower’s principal market is open for trading.

A16.

“Trigger Effect” means multiplying the Outstanding Balance as of the date the applicable Trigger Event occurred

by (a) fifteen percent (15%) for each occurrence of any Major Trigger Event, or (b) five percent (5%) for each occurrence of any

Minor Trigger Event, and then adding the resulting product to the Outstanding Balance as of the date the applicable Trigger Event

occurred, with the sum of the foregoing then becoming the Outstanding Balance under this Note as of the date the applicable Trigger

Event occurred; provided that the Trigger Effect may only be applied one (1) time hereunder with respect to Major Trigger Events and

one (1) time hereunder with respect to Minor Trigger Events; and provided further that the Trigger Effect shall not apply to any

Trigger Event pursuant to Section 4.1(a) hereof.

A17.

“VWAP” means the volume weighted average price of the Ordinary Shares on the principal market for a particular

Trading Day or set of Trading Days, as the case may be, as reported by Bloomberg.

[Remainder

of page intentionally left blank]

| Attachment 1 to Convertible Promissory Note, Page 2 |

EXHIBIT

A

[INVESTOR

LETTERHEAD]

| Meiwu

Technology Company Limited |

Date:_________

|

Attn:

Xinliang Zhang

1602,

Building C, Shenye Century Industrial Center, No. 743 Zhoushi Road

Bao’an

District, Shenzhen, People’s Republic of China

LENDER

CONVERSION NOTICE

The

above-captioned Lender hereby gives notice to Meiwu Technology Company Limited , a British Virgin Islands exempt company (the “Borrower”),

pursuant to that certain Convertible Promissory Note made by Borrower in favor of Lender on April [ ], 2024 (the “Note”),

that Lender elects to convert the portion of the Note balance set forth below into fully paid and non-assessable Ordinary Shares of Borrower

as of the date of conversion specified below. Said conversion shall be based on the Lender Conversion Price set forth below. In the event

of a conflict between this Lender Conversion Notice and the Note, the Note shall govern, or, in the alternative, at the election of Lender

in its sole discretion, Lender may provide a new form of Lender Conversion Notice to conform to the Note. Capitalized terms used in this

notice without definition shall have the meanings given to them in the Note.

| A. | Date

of Conversion: ___________ |

| B. | Lender

Conversion #: ____________ |

| C. | Conversion

Amount: ____________ |

| D. | Lender

Conversion Price: _______________ |

| E. | Lender

Conversion Shares: _______________ (C divided by D) |

| F. | Remaining

Outstanding Balance of Note: ____________* |

*

Subject to adjustments for corrections, defaults, interest and other adjustments permitted by the Transaction Documents (as defined in

the Purchase Agreement), the terms of which shall control in the event of any dispute between the terms of this Lender Conversion Notice

and such Transaction Documents.

Please

transfer the Lender Conversion Shares electronically (via DWAC) to the following account:

| Broker: _________________________ |

|

Address: |

_____________________________ |

| DTC#: _________________________ |

|

|

_____________________________ |

| Account #: ______________________ |

|

|

_____________________________ |

| Account Name: __________________ |

|

|

|

To

the extent the Lender Conversion Shares are not able to be delivered to Lender electronically via the DWAC system, deliver all such certificated

shares to Lender via reputable overnight courier after receipt of this Lender Conversion Notice (by facsimile transmission or otherwise)

to:

_____________________________________

_____________________________________

_____________________________________

[Signature

Page Follows]

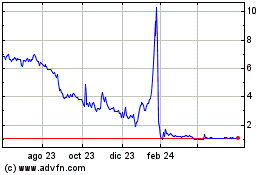

Meiwu Technology (NASDAQ:WNW)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

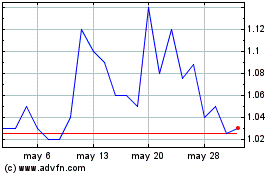

Meiwu Technology (NASDAQ:WNW)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024