false000164289600016428962024-06-062024-06-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 6, 2024

SAMSARA INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

Delaware | 001-41140 | 47-3100039 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| |

1 De Haro Street San Francisco, California 94107 |

(Address of principal executive offices, including zip code) |

(415) 985-2400

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, $0.0001 par value per share | | IOT | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On June 6, 2024, Samsara Inc. (“Samsara” or the “Company”) issued a press release announcing its financial results for the three months ended May 4, 2024. A copy of the press release is attached hereto as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Item 2.02 and Item 9.01 of this Current Report on Form 8-K, including the exhibit attached hereto as Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing made by Samsara under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit Number | | Description of Exhibit |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | SAMSARA INC. |

| | |

Date: June 6, 2024 | By: | /s/ Adam Eltoukhy |

| | Adam Eltoukhy |

| | Executive Vice President, Chief Legal Officer and Corporate Secretary |

Exhibit 99.1

Samsara Reports First Quarter Fiscal Year 2025 Financial Results

•Q1 revenue of $280.7 million, representing 37% year-over-year growth

•Ending ARR of $1.176 billion, representing 37% year-over-year growth

•1,964 customers with ARR over $100,000, up 43% year-over-year

SAN FRANCISCO, June 6, 2024 — Samsara Inc. (NYSE: IOT), the pioneer of the Connected Operations Cloud, reported financial results for the first quarter ended May 4, 2024, and released a shareholder letter accessible from the Samsara investor relations website at investors.samsara.com.

“We delivered a strong first quarter of the new fiscal year with Q1 revenue of $280.7 million, growing 37% year-over-year, the same year-over-year adjusted revenue growth (1) as last quarter at a larger scale,” said Sanjit Biswas, CEO and co-founder of Samsara. “As the strategic partner to the world’s leading and most complex physical operations organizations, we are focused on delivering clear and fast ROI for our customers and improving their operations.”

First Quarter Fiscal Year 2025 Financial Highlights

(In millions, except percentage, percentage points, and per share data)

| | | | | | | | | | | | | | | | | |

| Q1 FY2025 | | Q1 FY2024 | | Y/Y Change |

| Annual Recurring Revenue (ARR) | $ | 1,175.7 | | | $ | 856.2 | | | 37 | % |

| Total revenue | $ | 280.7 | | | $ | 204.3 | | | 37 | % |

| | | | | |

| GAAP gross profit | $ | 212.1 | | | $ | 146.8 | | | $ | 65.3 | |

| GAAP gross margin | 76 | % | | 72 | % | | 4 | pts |

| Non-GAAP gross profit | $ | 215.9 | | | $ | 149.7 | | | $ | 66.2 | |

| Non-GAAP gross margin | 77 | % | | 73 | % | | 4 | pts |

| GAAP operating loss | $ | (66.0) | | | $ | (75.8) | | | $ | 9.8 | |

| GAAP operating margin | (24 | %) | | (37 | %) | | 14 | pts |

| Non-GAAP operating income (loss) | $ | 6.2 | | | $ | (19.0) | | | $ | 25.2 | |

| Non-GAAP operating margin | 2 | % | | (9 | %) | | 12 | pts |

| GAAP net loss per share, basic and diluted | $ | (0.10) | | | $ | (0.13) | | | $ | 0.03 | |

| Non-GAAP net income (loss) per share, basic and diluted | $ | 0.03 | | | $ | (0.02) | | | $ | 0.05 | |

| Net cash provided by operating activities | $ | 23.7 | | | $ | 10.5 | | | $ | 13.2 | |

| Net cash provided by operating activities margin | 8 | % | | 5 | % | | 3 | pts |

| | | | | |

| | | | | |

| Adjusted free cash flow | $ | 18.6 | | | $ | (2.2) | | | $ | 20.8 | |

| Adjusted free cash flow margin | 7 | % | | (1 | %) | | 8 | pts |

__________

Note: Numbers are rounded for presentation purposes.

(1)Q4 FY24 was a 14-week fiscal quarter instead of a typical 13-week fiscal quarter. To enable comparability across periods, adjusted revenue and adjusted revenue growth rate are calculated by multiplying Q4 FY24 revenue by 13/14 to remove the impact of an additional week of revenue recognition in Q4 FY24.

We report non-GAAP financial measures in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with generally accepted accounting principles (“GAAP”). See the section titled “Use of Non-GAAP Financial Measures” for an explanation of non-GAAP financial measures and the tables in the section titled “Reconciliation Between GAAP and Non-GAAP Financial Measures” for a reconciliation of GAAP to non-GAAP financial measures.

Financial Outlook

Our guidance includes GAAP and non-GAAP financial measures. For the second quarter and fiscal year 2025, Samsara expects the following:

| | | | | | | | | | | |

| Q2 FY2025 Outlook | | FY 2025 Outlook |

| Total revenue | $288 million – $290 million | | $1.205 billion – $1.213 billion |

| Year/Year revenue growth | 31% – 32% | | 29% |

Year/Year adjusted revenue growth (1) | | | 31% – 32% |

| Non-GAAP operating margin | (2%) | | 3% |

| Non-GAAP net income per share, diluted | $0.00 – $0.01 | | $0.13 – $0.15 |

__________

(1)Q4 FY24 was a 14-week fiscal quarter instead of a typical 13-week fiscal quarter. To enable comparability across periods, adjusted revenue and adjusted revenue growth rate are calculated by multiplying Q4 FY24 revenue by 13/14 to remove the impact of an additional week of revenue recognition in Q4 FY24.

A reconciliation of non-GAAP guidance financial measures to corresponding GAAP guidance financial measures is not available on a forward-looking basis without unreasonable effort due to the uncertainty and potential variability of expenses, such as stock-based compensation expense-related charges, that may be incurred in the future and cannot be reasonably determined or predicted at this time. It is important to note that these factors could be material to our results of operations computed in accordance with GAAP.

About Samsara

Samsara is the pioneer of the Connected Operations™ Cloud, which is a system of record that enables businesses that depend on physical operations to harness Internet of Things (IoT) data to develop actionable insights and improve their operations. With tens of thousands of customers across North America and Europe, Samsara is a proud technology partner to the people who keep our global economy running, including the world’s leading organizations across industries in transportation, construction, wholesale and retail trade, field services, logistics, utilities and energy, government, healthcare and education, manufacturing, food and beverage, and others. The company’s mission is to increase the safety, efficiency, and sustainability of the operations that power the global economy.

Investor Day and Customer Conference

Samsara will host an Investor Day on Thursday, June 27, 2024 at 12:30 p.m. Pacific Time (3:30 p.m. Eastern Time), where we will provide additional insights into Samsara’s trajectory and the overall state of physical operations. This event will be held in conjunction with our customer conference, Samsara Beyond, in Chicago, IL.

A live webcast of Investor Day may be accessed at https://investors.samsara.com/.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements may relate to, but are not limited to, expectations of future operating results or financial performance, the calculation of certain of our key financial and operating metrics, our market opportunity, industry developments and trends, customer demand for our solution, macroeconomic conditions and any expected benefits of our products, and our competitive position, as well as assumptions relating to the foregoing.

Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and could cause actual results and events to differ. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “goal,” “guidance,” “intend,” “may,” “objective,” “ongoing,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will,” “would,” or the negative of these terms or other comparable expressions that concern our expectations, strategies, plans, or intentions. You should not put undue reliance on any forward-looking statements. Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved, if at all. Forward-looking statements are based on information available at the time those statements are made, including information furnished to us by third parties that we have not independently verified, and/or management’s good faith beliefs and assumptions as of that time with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. In light of these risks and uncertainties, the forward-looking events and circumstances discussed in this press release may not occur and actual results could differ materially from those anticipated or implied in the forward-looking statements.

These risks and uncertainties include our ability to retain customers and expand the Applications used by our customers, our ability to attract new customers, our future financial performance, including trends in revenue and annual recurring revenue, net retention rate, costs of revenue, gross profit or gross margin, operating expenses, customer counts, non-GAAP financial measures (such as adjusted revenue, adjusted revenue growth rate, non-GAAP gross margin, non-GAAP operating margin, free cash flow margin, and adjusted free cash flow margin), our ability to achieve or maintain profitability, the demand for our products or for solutions for connected operations in general, the impact of the Russia-Ukraine conflict, geopolitical tensions involving China, the conflict in Israel and Gaza, the emergence of pandemics and epidemics, and macroeconomic conditions globally on our and our customers’, partners’ and suppliers’ operations and future financial performance, possible harm caused by silicon component shortages and other supply chain constraints, the length of our sales cycles, possible harm caused by a security breach or other incident affecting our or our customers’ assets or data, our ability to compete successfully in competitive markets, our ability to respond to rapid technological changes, and our ability to continue to innovate and develop new Applications. The forward-looking statements contained in this press release are also subject to other risks and uncertainties, including those more fully described in our filings and reports that we may file from time to time with the Securities and Exchange Commission, including our Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q.

Except as required by law, we do not undertake any obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments, or otherwise.

Use of Non-GAAP Financial Measures

This document includes certain non-GAAP financial measures. Reconciliations of non-GAAP financial measures to our financial results as determined in accordance with GAAP are included at the end of this press release following the accompanying financial data.

Non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation or as substitutes for financial information presented under GAAP. There are a number of limitations related to the use of non-GAAP financial measures versus comparable financial measures determined under GAAP. For example, other companies in our industry may calculate these non-GAAP financial measures differently or may use other measures to evaluate their performance. In addition, free cash flow and adjusted free cash flow do not reflect our future contractual commitments or the total increase or decrease of our cash balance for a given period. These and other limitations could reduce the usefulness of these non-GAAP financial measures as analytical tools. Investors are encouraged to review the related GAAP financial measures and the reconciliations of these non-GAAP financial measures to their most directly comparable GAAP financial measures and to not rely on any single financial measure to evaluate our business.

We present these non-GAAP financial measures to assist investors in seeing Samsara’s operating results through the eyes of management and because we believe that these measures provide an additional tool for investors to evaluate our business.

Expenses Excluded from Non-GAAP Performance Financial Measures—Stock-based compensation expense-related charges include the amortization of deferred stock-based compensation expense for capitalized software and employer taxes on employee equity transactions. Stock-based compensation expense-related charges are excluded because they are primarily a non-cash expense that management believes is not reflective of our ongoing operational performance. Employer taxes on employee equity transactions, which are a cash expense, are excluded because such taxes are directly tied to the timing and size of employee equity transactions and the future fair market value of our common stock, which may vary from period to period independent of the operating performance of our business.

Lease modification, impairment, and related charges, and legal settlements are excluded because management believes that such charges are not reflective of our ongoing operational performance.

Operating Metrics and Non-GAAP Financial Measures

Annual Recurring Revenue—We define ARR as the annualized value of subscription contracts that have commenced revenue recognition as of the measurement date.

Adjusted Revenue and Adjusted Revenue Growth Rate—Q4 FY24 was a 14-week fiscal quarter instead of a typical 13-week fiscal quarter. To enable comparability across periods, adjusted revenue and adjusted revenue growth rate are calculated by multiplying Q4 FY24 revenue by 13/14 to remove the impact of an additional week of revenue recognition in Q4 FY24.

Non-GAAP Gross Profit and Non-GAAP Gross Margin—We define non-GAAP gross profit as gross profit excluding the effect of stock-based compensation expense-related charges included in cost of revenue. Non-GAAP gross margin is defined as non-GAAP gross profit as a percentage of total revenue. We use non-GAAP gross profit and non-GAAP gross margin in conjunction with traditional GAAP measures to evaluate our financial performance. We believe that non-GAAP gross profit and non-GAAP gross margin provide our management and investors consistency and comparability with our past financial performance and facilitate period-to-period comparisons of operations.

Non-GAAP Income (Loss) from Operations and Non-GAAP Operating Margin—We define non-GAAP income (loss) from operations, or non-GAAP operating income (loss), as income (loss) from operations excluding the effect of stock-based compensation expense-related charges, lease modification, impairment, and related charges, and legal settlements. Non-GAAP operating margin is defined as non-GAAP operating income (loss) as a percentage of total revenue. We use non-GAAP income (loss) from operations and non-GAAP operating margin in conjunction with traditional GAAP measures to evaluate our financial performance. We believe that non-GAAP income (loss) from operations and non-GAAP operating margin provide our management and investors consistency and comparability with our past financial performance and facilitate period-to-period comparisons of operations.

Non-GAAP Net Income (Loss) and Non-GAAP Net Income (Loss) per Share—We define non-GAAP net income (loss) as net loss excluding the effect of stock-based compensation expense-related charges, lease modification, impairment, and related charges, and legal settlements. Our non-GAAP net income (loss) per share–basic is calculated by dividing non-GAAP net income (loss) by the weighted-average number of shares of common stock outstanding during the period. Our non-GAAP net income per share–diluted is calculated by giving effect to all potentially dilutive common stock equivalents (stock options, restricted stock units, and shares issued under our 2021 Employee Stock Purchase Plan) to the extent they are dilutive. Non-GAAP net loss per share–diluted is the same as non-GAAP net loss per share–basic as the inclusion of all potential dilutive common stock equivalents would be antidilutive. We use non-GAAP net income (loss) and non-GAAP net income (loss) per share in conjunction with traditional GAAP measures to evaluate our financial performance. We believe that non-GAAP net income (loss) and non-GAAP net income (loss) per share provide our management and investors consistency and comparability with our past financial performance and facilitate period-to-period comparisons of operations.

Free Cash Flow and Free Cash Flow Margin—We define free cash flow as net cash provided by (used in) operating activities reduced by cash used for purchases of property and equipment. Free cash flow margin is calculated as free cash flow as a percentage of total revenue. We believe that free cash flow and free cash flow margin, even if negative, are useful in evaluating liquidity and provide information to management and investors about our ability to fund future operating needs and strategic initiatives.

Adjusted Free Cash Flow and Adjusted Free Cash Flow Margin—We define adjusted free cash flow as free cash flow excluding the cash impact of non-recurring capital expenditures associated with the build-out of our corporate office facilities in San Francisco, California, net of tenant allowances, and legal settlements. Adjusted free cash flow margin is calculated as adjusted free cash flow as a percentage of total revenue. We believe that adjusted free cash flow and adjusted free cash flow margin, even if negative, are useful in evaluating liquidity and provide information to management and investors about our ability to fund future operating needs and strategic initiatives by excluding the impact of non-recurring events.

Webcast Information and Shareholder Letter

An investor presentation and accompanying shareholder letter is accessible from the Samsara investor relations website at https://investors.samsara.com/. Samsara will host a live webcast to discuss the results at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time) today. The live webcast may be accessed at https://investors.samsara.com/. Following the webcast, a replay will be accessible from the same website.

Investor Contact:

Mike Chang

ir@samsara.com

Media Contact:

Adam Simons

media@samsara.com

| | | | | | | | | | | |

| SAMSARA INC. |

CONDENSED CONSOLIDATED BALANCE SHEETS |

| (In thousands) |

| (Unaudited) |

| | | |

| As of |

| May 4, 2024 | | February 3, 2024 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 162,466 | | | $ | 135,536 | |

| Short-term investments | 431,862 | | | 412,126 | |

| Accounts receivable, net | 143,786 | | | 161,829 | |

| Inventories | 30,510 | | | 22,238 | |

| Connected device costs, current | 107,819 | | | 104,008 | |

| Prepaid expenses and other current assets | 47,289 | | | 51,221 | |

| Total current assets | 923,732 | | | 886,958 | |

| Restricted cash | 19,202 | | | 19,202 | |

| Long-term investments | 250,623 | | | 276,166 | |

| Property and equipment, net | 55,913 | | | 54,969 | |

| Operating lease right-of-use assets | 77,337 | | | 81,974 | |

| Connected device costs, non-current | 233,030 | | | 230,782 | |

| Deferred commissions | 182,679 | | | 177,562 | |

| Other assets, non-current | 6,917 | | | 7,232 | |

| Total assets | $ | 1,749,433 | | | $ | 1,734,845 | |

| Liabilities and stockholders’ equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 41,228 | | | $ | 46,281 | |

| Accrued expenses and other current liabilities | 60,566 | | | 61,437 | |

| Accrued compensation and benefits | 32,465 | | | 37,068 | |

| Deferred revenue, current | 447,031 | | | 426,369 | |

| Operating lease liabilities, current | 20,005 | | | 20,661 | |

| Total current liabilities | 601,295 | | | 591,816 | |

| Deferred revenue, non-current | 140,986 | | | 139,117 | |

| Operating lease liabilities, non-current | 73,618 | | | 78,830 | |

| Other liabilities, non-current | 9,646 | | | 9,935 | |

| Total liabilities | 825,545 | | | 819,698 | |

| | | |

| | | |

| Stockholders’ equity: | | | |

| Preferred stock | — | | | — | |

| Class A common stock | 10 | | | 9 | |

| Class B common stock | 23 | | | 23 | |

| Class C common stock | — | | | — | |

| Additional paid-in capital | 2,435,213 | | | 2,368,597 | |

| Accumulated other comprehensive income | 29 | | | 1,616 | |

| Accumulated deficit | (1,511,387) | | | (1,455,098) | |

| Total stockholders’ equity | 923,888 | | | 915,147 | |

| Total liabilities and stockholders’ equity | $ | 1,749,433 | | | $ | 1,734,845 | |

| | | | | | | | | | | | | | | |

SAMSARA INC. |

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS |

(In thousands, except share and per share data) |

(Unaudited) |

| | | | | | | |

| | | Three Months Ended |

| | | | | May 4, 2024 | | April 29, 2023 |

| Revenue | | | | | $ | 280,726 | | | $ | 204,320 | |

| Cost of revenue | | | | | 68,625 | | | 57,557 | |

| Gross profit | | | | | 212,101 | | | 146,763 | |

| Operating expenses: | | | | | | | |

| Research and development | | | | | 72,973 | | | 60,366 | |

| Sales and marketing | | | | | 147,437 | | | 118,955 | |

| General and administrative | | | | | 57,688 | | | 43,266 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Total operating expenses | | | | | 278,098 | | | 222,587 | |

| Loss from operations | | | | | (65,997) | | | (75,824) | |

| Interest income and other income, net | | | | | 10,084 | | | 8,895 | |

| Loss before provision for income taxes | | | | | (55,913) | | | (66,929) | |

| Provision for income taxes | | | | | 376 | | | 927 | |

| Net loss | | | | | $ | (56,289) | | | $ | (67,856) | |

| Other comprehensive loss: | | | | | | | |

| Foreign currency translation adjustments, net of tax | | | | | 100 | | | (913) | |

| Unrealized losses on investments, net of tax | | | | | (1,687) | | | (41) | |

| Other comprehensive loss | | | | | (1,587) | | | (954) | |

| Comprehensive loss | | | | | $ | (57,876) | | | $ | (68,810) | |

| Basic and diluted net loss per share: | | | | | | | |

| Net loss per share attributable to common stockholders, basic and diluted | | | | | $ | (0.10) | | | $ | (0.13) | |

| | | | | | | |

| Weighted-average shares used in computing net loss per share attributable to common stockholders, basic and diluted | | | | | 548,652,306 | | | 526,403,398 | |

| | | | | | | |

| | | | | | | | | | | | | | | |

SAMSARA INC. |

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (In thousands) |

| (Unaudited) |

| | | | | | | |

| | | Three Months Ended |

| | | | | May 4, 2024 | | April 29, 2023 |

| Operating activities | | | | | | | |

| Net loss | | | | | $ | (56,289) | | | $ | (67,856) | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | | | | | |

| Depreciation and amortization | | | | | 4,455 | | | 3,484 | |

| Stock-based compensation expense | | | | | 64,656 | | | 52,948 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net accretion of discounts on investments | | | | | (3,993) | | | (4,219) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Other non-cash adjustments | | | | | 1,330 | | | (1,944) | |

| Changes in operating assets and liabilities: | | | | | | | |

| Accounts receivable, net | | | | | 15,862 | | | 20,822 | |

| Inventories | | | | | (8,272) | | | 8,168 | |

| Prepaid expenses and other current assets | | | | | 3,932 | | | (1,179) | |

| Connected device costs | | | | | (6,059) | | | (9,707) | |

| Deferred commissions | | | | | (5,117) | | | (3,518) | |

| Other assets, non-current | | | | | 315 | | | 533 | |

| Accounts payable and other liabilities | | | | | (9,664) | | | (8,511) | |

| Deferred revenue | | | | | 22,531 | | | 23,377 | |

| Operating lease right-of-use assets and liabilities, net | | | | | (17) | | | (1,944) | |

| Net cash provided by operating activities | | | | | 23,670 | | | 10,454 | |

| Investing activities | | | | | | | |

| Purchase of property and equipment | | | | | (5,062) | | | (2,499) | |

| Purchases of investments | | | | | (142,313) | | | (192,389) | |

| | | | | | | |

| Proceeds from maturities and redemptions of investments | | | | | 150,426 | | | 177,159 | |

| | | | | | | |

| Net cash provided by (used in) investing activities | | | | | 3,051 | | | (17,729) | |

| Financing activities | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Proceeds from issuance of common stock in connection with equity compensation plans | | | | | 808 | | | 159 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Payment of principal on finance leases | | | | | (496) | | | (448) | |

Net cash provided by (used in) financing activities | | | | | 312 | | | (289) | |

| Effect of foreign exchange rate changes on cash, cash equivalents, and restricted cash | | | | | (103) | | | 146 | |

Net increase (decrease) in cash, cash equivalents, and restricted cash | | | | | 26,930 | | | (7,418) | |

| Cash, cash equivalents, and restricted cash, beginning of period | | | | | 154,738 | | | 223,766 | |

| Cash, cash equivalents, and restricted cash, end of period | | | | | $ | 181,668 | | | $ | 216,348 | |

SAMSARA INC.

RECONCILIATION BETWEEN GAAP AND NON-GAAP FINANCIAL MEASURES

(In thousands, except percentages and per share data)

(Unaudited)

| | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | | | | May 4, 2024 | | April 29, 2023 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Gross profit and gross margin reconciliation | | | | | | | |

| GAAP gross profit | | | | | $ | 212,101 | | | $ | 146,763 | |

| Add: | | | | | | | |

| | | | | | | |

| | | | | | | |

Stock-based compensation expense-related charges (1) | | | | | 3,766 | | | 2,915 | |

| Non-GAAP gross profit | | | | | $ | 215,867 | | | $ | 149,678 | |

| GAAP gross margin | | | | | 76 | % | | 72 | % |

| Non-GAAP gross margin | | | | | 77 | % | | 73 | % |

| | | | | | | |

Operating income (loss) and operating margin reconciliation | | | | | | | |

| GAAP loss from operations | | | | | $ | (65,997) | | | $ | (75,824) | |

| Add: | | | | | | | |

| | | | | | | |

| | | | | | | |

Stock-based compensation expense-related charges (1) | | | | | 72,156 | | | 56,793 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Non-GAAP income (loss) from operations | | | | | $ | 6,159 | | | $ | (19,031) | |

| GAAP operating margin | | | | | (24 | %) | | (37 | %) |

| Non-GAAP operating margin | | | | | 2 | % | | (9 | %) |

| | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | | | | May 4, 2024 | | April 29, 2023 |

| GAAP net loss | | | | | $ | (56,289) | | | $ | (67,856) | |

| Add: | | | | | | | |

| | | | | | | |

| | | | | | | |

| Stock-based compensation expense-related charges | | | | | 72,156 | | | 56,793 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Non-GAAP net income (loss) (3) | | | | | $ | 15,867 | | | $ | (11,063) | |

| | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | | | | May 4, 2024 | | April 29, 2023 |

| Net income (loss) per share, basic and diluted, reconciliation | | | | | | | |

| GAAP net loss per share attributable to common stockholders, basic and diluted | | | | | $ | (0.10) | | | $ | (0.13) | |

| Total impact on net loss per share, basic and diluted, from non-GAAP adjustments | | | | | 0.13 | | | 0.11 | |

Non-GAAP net income (loss) per share attributable to common stockholders, basic and diluted (4) | | | | | $ | 0.03 | | | $ | (0.02) | |

| Weighted-average shares used in computing GAAP net loss per share attributable to common stockholders, basic and diluted | | | | | 548,652,306 | | | 526,403,398 | |

| Weighted-average shares used in computing non-GAAP net income (loss) per share attributable to common stockholders, basic | | | | | 548,652,306 | | | 526,403,398 | |

Weighted-average shares used in computing non-GAAP net income (loss) per share attributable to common stockholders, diluted (4) | | | | | 573,154,525 | | | 526,403,398 | |

SAMSARA INC.

RECONCILIATION BETWEEN GAAP AND NON-GAAP FINANCIAL MEASURES

(In thousands, except percentages and per share data)

(Unaudited)

| | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | | | | May 4, 2024 | | April 29, 2023 |

| Free cash flow, adjusted free cash flow, free cash flow margin, and adjusted free cash flow margin reconciliation | | | | | | | |

| Net cash provided by operating activities | | | | | $ | 23,670 | | | $ | 10,454 | |

| Purchase of property and equipment | | | | | (5,062) | | | (2,499) | |

Free cash flow | | | | | 18,608 | | | 7,955 | |

Purchase of property and equipment for build-out of corporate office facilities, net of tenant allowances (5) | | | | | — | | | (10,179) | |

| | | | | | | |

Adjusted free cash flow | | | | | $ | 18,608 | | | $ | (2,224) | |

| Net cash provided by operating activities margin | | | | | 8 | % | | 5 | % |

Free cash flow margin | | | | | 7 | % | | 4 | % |

Adjusted free cash flow margin | | | | | 7 | % | | (1 | %) |

__________

(1)Stock-based compensation expense-related charges were included in the following line items of our condensed consolidated statements of operations and comprehensive loss as follows:

| | | | | | | | | | | | | | | |

| | | Three Months Ended |

| | | | | May 4, 2024 | | April 29, 2023 |

| Cost of revenue | | | | | $ | 3,766 | | | $ | 2,915 | |

| Research and development | | | | | 26,264 | | | 22,053 | |

| Sales and marketing | | | | | 20,682 | | | 16,320 | |

| General and administrative | | | | | 21,444 | | | 15,505 | |

Total stock-based compensation expense-related charges (2) | | | | | $ | 72,156 | | | $ | 56,793 | |

(2)Stock-based compensation expense-related charges included approximately $7.0 million and $3.8 million of employer taxes on employee equity transactions for the three months ended May 4, 2024 and April 29, 2023, respectively.

(3)There were no material income tax effects on our non-GAAP adjustments for all periods presented.

(4)For each period in which we had non-GAAP net income, diluted non-GAAP net income per share is calculated using weighted-average number of shares of common stock outstanding during the period, adjusted for dilutive potential shares that were assumed outstanding during the period.

(5)In April 2023, we settled a lease dispute which was primarily related to lease incentives associated with leasehold improvements in the form of a tenant allowance and received $11.3 million.

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

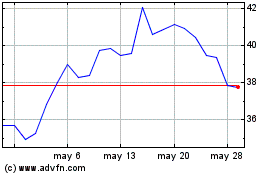

Samsara (NYSE:IOT)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Samsara (NYSE:IOT)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024