UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May, 2024.

Commission File Number 001-38755

Suzano S.A.

(Exact name of registrant as specified in its charter)

SUZANO INC.

(Translation of Registrant’s Name into English)

Av. Professor Magalhaes Neto, 1,752

10th Floor, Rooms 1010 and 1011

Salvador, Brazil 41 810-012

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☑ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Enclosures:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: May 17, 2024

| | | | | | | | |

| | SUZANO S.A. |

| | |

| By: | /s/ Marcelo Feriozzi Bacci |

| Name: | Marcelo Feriozzi Bacci |

| Title: | Chief Financial and Investor Relations Officer |

SUZANO S.A.

Publicly Held Company

CNPJ/MF No. 16.404.287/0001-55

NIRE No. 29.300.016.331

EXTRACT OF THE MINUTES OF THE BOARD OF DIRECTORS’ ORDINARY MEETING HELD ON MAY 9, 2024

1.Date, Time, and Venue: On May 9, 2024, at 2 pm, at Suzano S.A. branch (“Company”) located at Av. Brigadeiro Faria Lima, 1355, 8th floor, in the City of São Paulo, State of São Paulo, through the Company’s videoconference system, a meeting of its Board of Directors (“Board”) was held.

2. Attendance: The following Directors of the Company attended the Meeting, representing their entirety: David Feffer (Chairman of the Board of Directors), Daniel Feffer (Vice-Chairman of the Board of Directors), Nildemar Secches (Vice-Chairman of the Board of Directors), Gabriela Feffer Moll, Maria Priscila Rodini Vansetti Machado, Paulo Rogerio Caffarelli, Paulo Sergio Kakinoff, Rodrigo Calvo Galindo e Walter Schalka. Additionally, José Alberto de Abreu, Statutory Executive Officer without specific designation, Marcelo Bacci, Chief Financial and investor Relations Officer, Caroline Carpenedo, Chief Human Resources and Communication Officer, other members of the Executive Board of Officers attended the meeting, as guests, and Mr. Marcos Moreno Chagas Assumpção, attended as secretary.

3. Call: The meeting has been timely convened under article 13 of the Company’s Bylaws and clause 6.1 of the Board’s Internal Regulations.

4. Board Composition: the meeting was chaired by Mr. David Feffer and Mr. Marcos Moreno Chagas Assumpção acted as secretary.

5. Agenda: (...) (8) Amendment of the CEI Regulations; (9) Appointment of Committees; (10) Appointment of Risk Expert; (11) Approval of the Board of Officers’ Compensation Plans.

6. Minutes in Summary Form: The Directors approved the drawing up of these minutes in summary form unanimously and without reservations.

7. Presentation, discussions on the agenda, and resolutions:

“7.8. The Directors, with an affirmative opinion from the Management and Finance Committee, unanimously and without reservations approved the proposal to amend the Internal Regulations of the Strategy and Innovation Committee to adapt the Committee composition from a maximum of 7 members to 8 members, amending item 6 to come into force with the following wording: “The Committee will be comprised of a minimum of 3 and a maximum of 8 members, indicated by the Board of Directors, one of whom will be appointed as Coordinator of the Committee. The Secretary may or may not be a member of the Committee. Committee members may participate in more than one Committee, at the discretion of the Board of Directors.” It is agreed that the Internal Regulations restatement will be carried out in a future revision of the Internal Regulations. Once the approval was completed, they moved on to the next item on the agenda.

7.9 The Directors unanimously and without reservations approved the appointment of the members of the non-statutory advisory committees to the Board of Directors, under the Company’s Bylaws, this Board of Directors resolutions, and its respective internal regulations, as detailed below.

(i) Approve the appointment of the following members to form the Company’s Statutory Audit Committee for a term of office of two (2) years, up to the first meeting of the Board of Directors to be held after the Company’s Ordinary General Meeting that decides on the accounts regarding the fiscal year ending on December 31, 2025, under article 25 of the Company’s Bylaws: (i) ANA PAULA PESSOA, Brazilian, married, economist, enrolled with CPF/ME under No. 865.873.407-25, holder of Identity Card RG No. 06.329.796-4 IFP/RJ, resident and domiciled in the City of Rio de Janeiro, State of Rio de Janeiro, at Rua General Tasso Fragoso, 33, block 5, apartment 401, ZIP Code 22470-170; (iii) CARLOS BIEDERMANN, Brazilian, married, accountant, enrolled with CPF/ME under No. 220.349.270-87, holder of Identity Card RG No. 9003183911 SSP/RS, resident and domiciled in the City of Porto Alegre, State of Rio Grande do Sul, at Rua João Caetano, 507, apartment 301, Três Figueiras, ZIP Code 90470-260; and (iii) PAULO ROGERIO CAFFARELLI, Brazilian, married, executive, enrolled with CPF/ME under No. 442.887.279-87, holder of Identity Card RG No. 33813902 PR, resident and domiciled in the City of São Paulo, State of São Paulo, with commercial address at Rua Renato Paes de Barros, 1017, 13th floor, Itaim Bibi, ZIP Code: 04530-001; and Mr. PAULO ROGERIO CAFFARELLI, was appointed as this Committee’s Coordinator;

(ii) To form the Strategy and Innovation Committee for a term of office of two (2) years, up to the first meeting of the Board of Directors to be held after the Company’s Ordinary General Meeting that decides on the accounts regarding the fiscal year ending on December 31, 2025: (i) DAVID FEFFER, Brazilian, divorced, business owner, enrolled with CPF/ME under No. 882.739.628-49, holder of Identity Card RG No. 4.617.720-6 SSP/SP; (ii) GABRIELA FEFFER MOLL, Brazilian, married, business administrator, enrolled with CPF/ME under No. 315.806.998-98, holder of Identity Card RG No. 30.082.370-8 SSP/SP; (iii) MARCELO MOSES DE OLIVEIRA LYRIO, Brazilian, divorced, economist, enrolled with CPF/ME under No. 746.597.157-87, holder of Identity Card RG No. 59.168.992-3 SP/SP; (iv) MARCELO STRUFALDI CASTELLI, Brazilian, married, mechanical engineer, enrolled with CPF/ME under No. 057.846.538-81, holder of Identity Card RG No. 11778104-6 SSP/SP; (v) NILDEMAR SECCHES, Brazilian, widower, mechanical engineer, enrolled with CPF/ME under No. 589.461.528-34, holder of Identity Card RG No. 3.997.339-6 SSP/SP; (vi) PAULO SERGIO KAKINOFF, Brazilian, married, business administrator, enrolled with CPF/ME under No. 194.344.518-41, holder of Identity Card RG No. 25.465.939-1 SSP/SP; (vii) RODRIGO CALVO GALINDO, Brazilian, married, business administrator, enrolled with CPF/ME under No. 622.153.291-49, holder of Identity Card RG No. 961.394 SSP/MT; and (viii) WALTER SCHALKA, Brazilian, married, engineer, enrolled with CPF/ME under No. 060.533.238-02, holder of Identity Card RG No. 6.567.956-8 SSP/SP, and Mr. DAVID FEFFER was appointed as this Committee’s Coordinator.

(iii) To form the Management and Finance Committee for a term of office of two (2) years, up to the first meeting of the Board of Directors to be held after the Company’s Ordinary General Meeting that decides on the accounts regarding the fiscal year ending on December 31, 2025: (i) DAVID FEFFER, identified above; (ii) GABRIELA FEFFER

MOLL, identified above; (iii) MARCELO STRUFALDI CASTELLI, identified above; (iv) NILDEMAR SECCHES, identified above; (v) PAULO SERGIO KAKINOFF, identified above; (vi) RODRIGO CALVO GALINDO, identified above; and (vii) WALTER SCHALKA, identified above; and Mr. DAVID FEFFER was appointed as this Committee’s Coordinator.

(iv) To form the People Committee for a term of office of two (2) years, up to the first meeting of the Board of Directors to be held after the Company’s Ordinary General Meeting that decides on the accounts regarding the fiscal year ending on December 31, 2025: (i) DAVID FEFFER, identified above; (ii) GABRIELA FEFFER MOLL, identified above; (iii) MARCELO STRUFALDI CASTELLI, identified above; (iv) NILDEMAR SECCHES, identified above; (v) PAULO SERGIO KAKINOFF, identified above; (vi) RODRIGO CALVO GALINDO, identified above; and (vii) WALTER SCHALKA, identified above, and Mr. NILDEMAR SECCHES was appointed as this Committee’s Coordinator;

(v) To form the Sustainability Committee for a term of office of two (2) years, up to the first meeting of the Board of Directors to be held after the Company’s Ordinary General Meeting that decides on the accounts regarding the fiscal year ending on December 31, 2025: (i) CLARISSA DE ARAÚJO LINS, Brazilian, married, economist, enrolled with CPF/ME under No. 851.458.317-49, holder of Identity Card RG No. 7.354.713-5; (ii) DAVID FEFFER, identified above; (iii) DANIEL FEFFER, Brazilian, married, lawyer, enrolled with CPF/ME under No. 011.769.138-08, holder of Identity Card RG No. 4.617.718-8 SSP/SP; (iv) FABIO COLLETTI BARBOSA, Brazilian, married, administrator, enrolled with CPF/ME under No. 771.733.258-20, holder of Identity Card RG 5.654.446 SSP/SP; (v) GABRIELA FEFFER MOLL, identified above; (vi) HAAKON LORENTZEN, Norwegian, married, business owner, enrolled with CPF/ME under No. 667.258.797-72, holder of Identity Card RNE No. W-2064-10-E; (vii) MARIA PRISCILA RODINI VANSETTI MACHADO, Brazilian, married, engineer, enrolled with CPF/ME under No. 036.618.448-22, holder of Identity Card RG No. 8.812.418-6 SSP/SP; (viii) PHILIPPE MARIE JOSEPH JOUBERT, French and Brazilian, married, economist, enrolled with CPF/ME No. 595.652.097-34, holder of Identity Card RG No. 04880781; and (ix) Walter Schalka, identified above, with Ms. MARIA PRISCILA RODINI VANSETTI MACHADO was appointed as this Committee’s Coordinator.

(vi) To form the Appointment and Compensation Committee for a term of office of two (2) years, up to the first meeting of the Board of Directors to be held after the Company’s Ordinary General Meeting that decides on the accounts regarding the fiscal year ending on December 31, 2025: (i) EDUARDO NUNES GIANINI, Brazilian, married, consultant, enrolled with CPF/ME under No. 610.317.478-34, holder of Identity Card RG No. 6.408.968-7; (ii) LILIAN MARIA FEREZIM GUIMARÃES, Brazilian, married, business administrator, enrolled with CPF/ME under No. 063.940.958-00, holder of Identity Card RG No. 10999165- 5; and (iii) NILDEMAR SECCHES, identified above; and Mr. NILDEMAR SECCHES was appointed as this Committee’s Coordinator.

7.10 State that, according to article 15 of the Company’s Bylaws, the non-statutory advisory committee’s recommendations to the Board of Directors will only issue opinions, and the members of such Committees will not have any decision-making power or responsibility for the resolutions that may be approved based on the referred recommendations. Once the approval was completed, they moved on to the next item on the agenda.

7.11 The Directors, by the majority and without reservations, with Mr. Paulo Rogerio Caffarelli’s abstention, approved the appointment as Risk Expert of the Board of Directors and the Company’s Statutory Audit Committee, of Mr. PAULO ROGERIO CAFFARELLI, identified above, elected (i) to as an independent member of the Board of Directors by the Company’s Ordinary General Meeting held on April 25, 2024; and, as per the resolution above, (ii) as member of the Statutory Audit Committee, to verify the requirements established by the Governance indexes. Once the approval was completed, they moved on to the next item on the agenda.

7.12 The Directors, with an affirmative opinion from the Appointment and Compensation Committee, unanimously and without reservations, approved the following ILP Suzano Plans: (i) Phantom Shares: ILP Suzano and ILP PLUS Program, as submitted at this meeting and with the following characteristics: (a) Eligible: Board of Officers (Executive and Functional), Management (Executive and Functional), and Middle Leadership. To be defined by the Executive Board of Officers and CEO (Executive Management and Functional Board of Officers) or People Committee (Executive Board of Officers); (b) Grant parameters: Reference amounts conditioned on position level.; (c) Settlement vehicle: Program in phantom shares with a cash settlement.; (d) Grace period: 36 months from the grant date; (e) Performance Conditions: TSR (Total Shareholder Return): The concept used to assess the performance of shares of different companies over a certain period, combining the share price to demonstrate the return provided to the shareholder; (f) Term of exercise: The program redemption will occur in 4 windows with a half-yearly frequency between them, the first being immediately after the Grace Period conclusion and the last being 18 months from the end date of the Grace Period; (ii) Performance Shares: Membership Program with the following characteristics: (a) Eligible: Board of Officers (Executive and Functional) and Executive Management. Concessions are to be defined by the People Committee. (b) Overall Limit: Maximum of 2% of the Company’s total share capital on 04/25/2024 (26,082,352 shares); (c) Grant parameters: Reference amounts of around 1 total annual cash from 1 to 2 steps above the current position, thus providing vertical shielding, that is, for positions at a higher level in the market. (d) Settlement vehicle: Program in restricted shares; (e) Grace period: 36 to 60 months from the grant date; (f) Performance Conditions: TSR (Total Shareholder Return): The concept used to assess the performance of shares of different companies over a certain period, combining the share price to demonstrate the return provided to the shareholder. (g) Term of exercise: Immediate recordkeeping of actions upon compliance with the program’s grace and performance conditions. Finally, powers were authorized and delegated to the Company’s Executive Board of Officers to carry out all related, associated, and/or complementary acts that may be necessary and/or convenient to carry out the resolution provided in this item. Once the approval was completed, they moved on to the next item on the agenda.”

7. Closing: There being no further matters to be discussed, the meeting was closed. The Meeting minutes were drawn up, read, and signed in electronic form by all Directors in attendance, and such signatures shall have retroactive effect to the date of the meeting. It is recorded that the documents and submissions that supported the matters discussed in this meeting have been filed with the Governance Website.

I certify that this is an extract of the minutes of the Board of Directors Ordinary Meeting of Suzano S.A. held on the date hereof, and the foregoing resolutions reflect the decisions passed by the Board of Directors.

São Paulo, SP, May 9, 2024.

Marcos Moreno Chagas Assumpção

Secretary

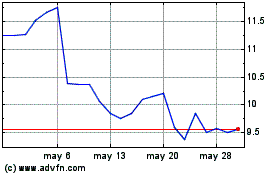

Suzano (NYSE:SUZ)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

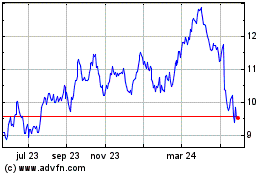

Suzano (NYSE:SUZ)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024