Serabi (AIM: SRB) (TSX: SBI), the Brazilian focused gold

exploration and development company, today announces that the

resolution to approve a waiver of an obligation under Rule 9 of the

City Code on Takeovers and Mergers (the "

Waiver") in respect of the conditional subscription by

Fratelli Investments Limited and parties acting in concert with it

(the "

Concert Party") was duly approved today

by Independent Shareholders via a poll at the General Meeting.

On 1 October 2012, the Company entered into a conditional

subscription agreement with Fratelli Investments to subscribe for

and underwrite a placement of new Ordinary Shares to raise £ 16.2

million to finance the development and start-up of underground

mining operations at its Palito Gold project. The investment by

Fratelli Investments took the form of:

(a) A subscription for 90,403,000 new Ordinary Shares at the

Subscription Price of 6 pence per new Ordinary Share; and (b) A

conditional subscription for up to a further 179,597,000 new

Ordinary Shares at a subscription price of 6 pence per new Ordinary

Share, such number to be reduced by any subscriptions for new

Ordinary Shares from third party investors.

The Company is finalising the subscriptions by third party

subscribers and expects to announce the results of the subscription

and the new Ordinary Shares to be subscribed by Fratelli

Investments pursuant to the conditional subscription on 17 January

2013.

For the purposes of the Takeover Code, Fratelli Investments

together with its Connected Persons and other persons acting in

concert with it, full details of whom are set out in the Document,

form the Concert Party. The Concert Party is currently beneficially

interested in 19,257,317 Ordinary Shares, representing

approximately 21.1 per cent. of the Existing Ordinary Share

Capital. Immediately following completion of the Subscription, the

minimum and maximum interests of the Concert Party are set out

below:

Maximum

Minimum Interest in

Minimum Maximum Interest in the Second

Interest in Interest in Diluted Diluted

Enlarged Enlarged Enlarged Enlarged

Ordinary Ordinary Ordinary Ordinary

Share Share Share Share

Capital on Capital on Capital on Capital on

Concert Party Member Completion Completion Completion Completion

----------- ----------- ----------- -----------

(Notes 3,6) (Notes 3,7) (Notes 4,6) (Notes 5,7)

----------- ----------- ----------- -----------

Fratelli Investments

Limited (Note 1) 29.90% 79.61% 33.60% 79.69%

Piero Solari Donaggio

(Note 2) - - - -

Sandro Solari Donaggio

(Note 2) - - - -

Carlo Solari Donaggio

(Note 2) - - - -

Nicolas Bañados (Note 8) 0.44% 0.44% 0.48% 0.50%

Jorge Arancibia Pascal

(Note 9) 0.01% 0.01% 0.01% 0.01%

Total 30.35% 80.07% 34.08% 80.20%

----------- ----------- ----------- -----------

Note 1 Fratelli Investments Limited is a 99.9 per cent. owned subsidiary of

Inversiones Menevado Dos Limitada which is itself a 99.97 per cent.

owned subsidiary of Inversiones Menevado Limitada which is itself a

96.92 per cent. owned subsidiary of Inversiones Megeve Capital

Limitada. The shareholders of Inversiones Megeve Capital Limitada

comprise Asesorias e Inversiones Barolo Limitada, which is controlled

by Piero Solari Donaggio and his dependants, Asesorias e Inversiones

Brunello Limitada, which is controlled by Sandro Solari Donaggio and

his dependants and Asesorias e Inversiones Sangiovese Limitada, which

is controlled by Carlo Solari Donaggio and his dependants. Further

details are set out below in paragraph 3 of Part B of Part II of the

Document.

Note 2 Piero Solari Donaggio, Sandro Solari Donaggio and Carlo Solari

Donaggio are the sole directors and the ultimate beneficial

shareholders of Fratelli Investments.

Note 3 The Enlarged Ordinary Share Capital comprises the Existing Ordinary

Shares and the Subscription Shares.

Note 4 The Diluted Enlarged Ordinary Share Capital comprises the Existing

Ordinary Shares, the Subscription Shares, the new Ordinary Shares

issued on exercise of the Existing Warrants and the new Ordinary

Shares issued on exercise of the New Warrants.

Note 5 The Second Diluted Enlarged Ordinary Share Capital comprises the

Existing Ordinary Shares, the Subscription Shares and the new

Ordinary Shares issued on exercise of the Existing Warrants.

Note 6 Assumes that third parties subscribe for all the Third Party Shares

and that Fratelli Investments subscribes for the Minimum Subscription

and receives the maximum number of New Warrants as an underwriting

fee.

Note 7 Assumes that there are no third party subscribers for the

Subscription Shares and Fratelli Investments therefore subscribes for

all the Subscription Shares issued by the Company pursuant to the

Subscription Agreement.

Note 8 Nicolas Banados, an attorney-in-fact of Fratelli Investments,

directly owns 144,282 Ordinary Shares. In addition, Nicolas Banados

is the beneficial owner of 50 per cent. of the share capital of

Asesorias e Inversiones Asturias Limitada which beneficially owns 25

per cent. of the units in Fondo de Inversion Privado Santa Monica.

Asesorias e Inversiones Asturias Limitada is interested in 159,665

Ordinary Shares and Fondo de Inversion Privado Santa Monica is

interested in 1,300,000 Ordinary Shares and 216,666 Existing

Warrants. Accordingly, Nicolas Banados is interested in aggregate,

directly and indirectly, in 1,603,947 Ordinary Shares and 216,666

Existing Warrants.

Note 9 Jorge Arancibia Pascal, an attorney-in-fact of Fratelli Investments,

is the beneficial owner of 85 per cent. of the share capital of

Asesorias e Inversiones Hipa Limitada which is interested in 37,370

Ordinary Shares.

Full details of the Concert Party's interest were set out in

Part A of Part II of the Document.

If on Completion of the Subscription the

Concert Party holds less than 50 per cent. of the Company's voting

share capital but more than 30 per cent., any further increases in

the Concert Party's interests in Ordinary Shares following

Completion will be subject to the provisions of Rule 9.

If however, on Completion of the Subscription

the Concert Party holds more than 50 per cent. of the Company's

voting share capital, the Concert Party may be able to increase its

aggregate shareholding in the Company without incurring any

obligation under Rule 9 to make a general offer to the Company's

other Shareholders. Under the Takeover Code, whilst each member of

the Concert Party continues to be treated as acting in concert,

each member will be able to increase further his respective

percentage shareholding in the voting rights of the Company without

incurring an obligation under Rule 9 to make a general offer to

Shareholders to acquire the entire issued share capital of the

Company. However, individual members of the Concert Party will not

be able to increase their percentage shareholding through or

between a Rule 9 threshold, without the consent of the

Panel.

A further announcement will be made in due course on completion

of the Subscription.

Enquiries:

Serabi Gold plc

Michael Hodgson Tel: +44 (0)20 7246 6830

Chief Executive Mobile: +44 (0)7799 473621

Clive Line Tel: +44 (0)20 7246 6830

Finance Director Mobile: +44 (0)7710 151692

Email: contact@serabigold.com

Website:

http://www.serabigold.com/

Beaumont Cornish Limited

Nominated Adviser

Roland Cornish Tel: +44 (0)20 7628 3396

Michael Cornish Tel: +44 (0)20 7628 3396

Fox Davies Capital Ltd

UK Broker

Simon Leathers Tel: +44 (0)20 3463 5010

Jonathan Evans Tel: +44 (0)20 3463 5010

Blythe Weigh Communications Ltd

Public Relations

Tim Blythe Tel: +44 (0)20 7138 3204

Rob Kellner Tel: +44 (0)20 7138 3204

Copies of this release are available from the Company's website

at www.serabigold.com.

Neither the Toronto Stock Exchange, nor any other securities

regulatory authority, has approved or disapproved of the contents

of this news release.

APPENDIX 1

DEFINITIONS

The following words and expressions apply throughout this announcement

unless the context requires otherwise:

"City Code" or "Takeover Code" the City Code on Takeovers and Mergers, as

updated from time to time

"Company" or "Serabi" Serabi Gold plc

"Completion" the Subscription being completed and

Admission taking place

"Concert Party" Fratelli Investments Limited, its Connected

Persons and other persons acting in concert

with it, as described in Part II of the

Document

"Diluted Enlarged Ordinary 381,715,728 Ordinary Shares comprising the

Share Capital" Existing Ordinary Shares, the Subscription

Shares, 2,487,499 new Ordinary Shares to be

issued on full exercise of the Existing

Warrants and 17,959,700 new Ordinary Shares

to be issued on full exercise of the New

Warrants

"Document" the circular to Shareholders dated 11

December 2012 in relation to the proposals

including the notice of General Meeting

"Enlarged Ordinary Share the issued equity share capital of the

Capital" Company immediately following Admission

comprising the Existing Ordinary Share and

the Subscription Shares

"Existing Ordinary Shares" the existing 91,268,529 issued Ordinary

Shares as at the date of this announcement

and the Document

"Existing Ordinary Share the issued equity share capital of the

Capital" Company as at the date of this announcement

and the Document

"Existing Warrants" the existing 2,487,499 warrants to

subscribe for new Ordinary Shares owned by

Fratelli Investments and Fondo de Inversion

Privado Santa Monica as at the date of the

Document

"Fratelli Investments" Fratelli Investments Limited, a company

registered in the Bahamas with registered

number 136,354 B

"General Meeting" the general meeting of the Company convened

for 10.00 a.m. on 16 January 2013, the

notice convening which was set out at the

end of the Document

"New Warrants" up to 17,959,700 new Warrants to subscribe

for new Ordinary Shares at a price of 10

pence per Ordinary Shares to be issued to

Fratelli Investments pursuant to the

Subscription Agreement

"Ordinary Shares" the ordinary shares of 5 pence each in the

capital of the Company

"Panel" Panel on Takeover and Mergers

"Rule 9" Rule 9 of the Takeover Code

"Rule 9 Offer" the requirement for a general offer to be

made in accordance with Rule 9

"Second Diluted Enlarged 363,756,028 Ordinary Shares comprising the

Ordinary Share Capital" Existing Ordinary Shares, the Subscription

Shares and 2,487,499 new Ordinary Shares to

be issued on exercise of the Existing

Warrants

"Shareholders" Person(s) who is/are registered holder(s)

of Ordinary Shares from time to time

"Subscription" the conditional subscription by Fratelli

Investments to subscribe for and underwrite

a placement of up to 270,000,000 new

Ordinary Shares, further details of which

are set out in Part I of the Document

"Subscription Agreement" the agreement dated 1 October 2012 between

(1) the Company and (2) Fratelli

Investments, further details of which are

contained in Part IV of the Document

"Subscription Price" 6 pence per Subscription Share

"Subscription Shares" "Third 270,000,000 new Ordinary Shares to be

Party Shares" issued pursuant to the Subscription

Agreement

up to 179,597,000 Subscription Shares

available for subscription by third party

investors

"Waiver" the waiver granted by the Panel (subject to

the passing of the Whitewash Resolution) in

respect of the obligation of the Concert

Party to make a mandatory offer for the

entire issued share capital of the Company

not already held by the Concert Party which

might otherwise be imposed on the Concert

Party under Rule 9 of the Takeover Code as

a result of the issue of Subscription

Shares under the Subscription, as more

particularly described in paragraph 7 of

Part I of the Document

"Warrants" the warrants to subscribe for new Ordinary

Shares further details of which are set out

in paragraph 2.5 of Part IV of the Document

Enquiries: Serabi Gold plc Michael Hodgson Tel: +44

(0)20 7246 6830 Chief Executive Mobile: +44 (0)7799 473621

Clive Line Tel: +44 (0)20 7246 6830 Finance Director Mobile: +44

(0)7710 151692 Email: contact@serabigold.com Website:

www.serabigold.com Beaumont Cornish Limited Nominated

Adviser Roland Cornish Tel: +44 (0)20 7628 3396 Michael

Cornish Tel: +44 (0)20 7628 3396 Fox Davies Capital Ltd UK

Broker Simon Leathers Tel: +44 (0)20 3463 5010 Jonathan Evans Tel:

+44 (0)20 3463 5010 Blythe Weigh Communications Ltd Public

Relations Tim Blythe Tel: +44 (0)20 7138 3204 Rob Kellner

Tel: +44 (0)20 7138 3204

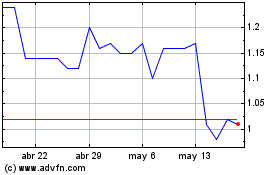

Serabi Gold (TSX:SBI)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Serabi Gold (TSX:SBI)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024