Serabi (AIM: SRB) (TSX: SBI), the Brazilian focused gold mining and

exploration company, today releases its audited results for the

year ended 31 December 2012.

Serabi's Directors Report and Financial Statements for the year

ended 31 December 2012 together the Chairman's Statement and the

Management Discussion and Analysis, will be available from the

Company's website (www.serabigold.com) and will be posted on SEDAR

at www.sedar.com.

Corporate Highlights

- On 17 January 2013 the Company completed the placement of 270

million new ordinary shares to raise in aggregate UK£ 16.2 million

to finance the development and start-up of underground mining

operations at its Palito Mine. The placement of new shares was

underwritten by Fratelli Investments Limited, one of the Company's

major shareholders.

- NCL Ingenieria y Construccion SA ("NCL") completed an

independent Preliminary Economic Assessment (the "PEA") into the

viability of re-establishing mining operations at the Palito Mine

in June 2012. The results were reported on 13 June 2012 and the

completed NI 43-101 compliant Technical Report was filed on 29 June

2012.

- Highlights of the PEA were as follows

- After-tax internal rate of return ("IRR") of 68% at a realised

gold price of US$1,400 per ounce;

- Project payback within two years of first gold production;

- Net after-tax cash flow generated over project life of US$72.2

million at a realised gold price of US$1,400 per ounce;

- After-tax net present value ("NPV") of US$38.2 million; based

on a 10% discount rate and a realised gold price of US$1,400 per

ounce;

- Average Life of Mine ("LOM") cash operating costs of US$739 per

ounce (gold equivalent) including royalties and refining

costs;

- Average annual free cash flow (after tax and sustaining capital

expenditure) of US$11.0 million;

- Average gold grade of 8.98 g/t gold producing a total gold

equivalent of 201,300 ounces;

- Average annual production of 24,400 gold equivalent ounces over

the initial 8 year period with a range of between 19,000 to 30,000

ounces gold equivalent per annum; and

- Initial capital expenditures of US$17.8 million prior to

production start-up.

- The Operational Environmental Licence for the Palito Mine was

renewed by Secretaria de Estado de Meio Ambiente ("SEMA"), the

state Environmental Agency for the State of Para on 27 April

2012.

- The Company completed a placing of 27,300,000 units on 24

January 2012 raising gross proceeds of UK£ 2.73 million. Each of

the 27,300,000 units were comprised of one ordinary share and

one-sixth of one ordinary share purchase warrant of the Company,

with each whole warrant being exercisable to acquire one ordinary

share at an exercise price of UK£ 0.15 until 23 January 2014.

Post year end highlights

- De-watering of the mine was completed in January 2013;

- A new mine management and technical team commenced in

mid-January 2013;

- The first items of mining equipment arrived at site on 15

February 2013;

- Initial contract mining personnel arrived at site on 15

February 2013;

- Remediation of the crushing and flotation sections of the

process plant commenced early in 2013; and

- The contract for the detailed engineering design on the milling

circuit and cyanidation plant has been awarded and work

commenced.

Mike Hodgson, CEO, said:

"Last year's PEA on the Palito Mine convinced us to put the mine

back into production. The PEA had concluded that a small scale,

high grade mining operation is viable at the site.

"Our objective now is to commence gold production in the coming

months. Palito has a clearly defined timeline and the finance in

place. We are already progressing with the project's initial

development."

Enquiries:

Serabi Gold plc

Michael Hodgson Tel: +44 (0)20 7246 6830

Chief Executive Mobile: +44 (0)7799 473621

Clive Line Tel: +44 (0)20 7246 6830

Finance Director Mobile: +44 (0)7710 151692

Email: contact@serabigold.com

Website: http://www.serabigold.com/

Beaumont Cornish Limited

Nominated Adviser

Roland Cornish Tel: +44 (0)20 7628 3396

Michael Cornish Tel: +44 (0)20 7628 3396

Fox Davies Capital Ltd

UK Broker

Simon Leathers Tel: +44 (0)20 3463 5010

Jonathan Evans Tel: +44 (0)20 3463 5010

Blythe Weigh Communications Ltd

Public Relations

Tim Blythe Tel: +44 (0)20 7138 3204

Mobile: +44 7816 924626

Rob Kellner Tel: +44 (0)20 7138 3204

Mobile: +44 7800 554377

Copies of this release are available from the Company's website

at www.serabigold.com.

Neither the Toronto Stock Exchange, nor any other securities

regulatory authority, has approved or disapproved of the contents

of this news release.

The following information, comprising the Chairman's Statement,

the Finance Review, the Income Statement, the Group Balance Sheet,

Group Statement of Changes in Shareholders' Equity and Group Cash

Flow, is extracted from these financial statements.

The Company will, in compliance with Canadian regulatory

requirements, post its Management Discussion and Analysis for the

year ended 31 December 2012 and its Annual Information Form on

SEDAR at www.sedar.com. These documents will also available from

the Company's website -- www.serabigold.com.

CHAIRMAN'S STATEMENT

2012 has been a transformational year for Serabi. During the

year, and on the back of a successful exploration programme

conducted in 2011, we progressed with the preparation of a PEA over

the viability of small scale production at the Palito mine. The

report was published in June 2012 and its conclusions supported our

earlier internal studies, which had demonstrated the viability of a

small scale, high grade operation using selective mining

techniques. Our decision to consider putting the mine into

production had been taken in the face of declining valuations for

pure exploration companies, a reflection of the altered risk

profiles adopted by investors in the wake of the continued

uncertainties over world economies. Whilst Serabi has not been

immune from the decline in the junior resource equity markets, its

ability during 2012 to deliver a PEA supporting a low capital

production start-up with the potential to generate cash flow

sufficient for its on-going exploration sets it apart from many of

its junior gold peers.

That the Company has then been able to obtain the financing to

place the Palito Mine into production in such a difficult market is

a testament to the project itself and the potential future growth

opportunities that its successful implementation will have.

Whilst there are signs of recovery in some world markets, there

remains a great deal of uncertainty in Europe and I believe that

Investors still want to find high quality investment opportunities

in the gold sector. There are many ways to assess this, but low

capital requirements, early cash-flow and limited technical and

environmental risk are all key metrics and on which I believe that

the Palito mine delivers. Our objective is to use our future

cash-flow to focus on improving the size and the sustainability of

the project, by seeking to grow the resource base using the

discoveries made to date, and if successful and viable, bringing

these discoveries into production.

The support of Fratelli Investments Limited throughout the last

12 months cannot be under-estimated and the Board and management

join me in extending thanks to them for the commitments they have

made. In Fratelli we have a financially strong, long term investor

that shares the Board's vision of developing and growing Serabi.

They share our belief in the potential of the Tapajos region of

Brazil and the objective of utilising the cash flow that initial

gold production would generate to re-invest in exploration to build

critical mass. Whilst last year we had offers of project debt

financing to meet some of the Palito project construction and

development costs, the requirements associated with such financing

would in the Board's view have restricted the Company's expansion

by re-directing free cash flow into supporting debt servicing and

security arrangements for the lenders. We were nevertheless

encouraged that a number of banks and other lenders were willing to

provide indicative terms and we will continue to consider the use

of debt to finance future production growth.

Over the remainder of the year, our objective is to deliver the

project, and commence gold production on time and within budget and

I look forward, in next year's Annual Report, to being able to

confirm that this objective has been achieved.

The junior gold sector has suffered heavily over the past few

years and equity funding for junior exploration companies is likely

to remain challenging for some period to come and undoubtedly

during this time there will be companies and projects that will no

longer be able to find favour with investors. It is for this reason

that we have been so keen to try to insulate Serabi in the future

from the funding cycle of exploration companies that requires them

to regularly return to the equity markets and in recent years this

has of, course, been at ever decreasing share prices. Sector

consolidation is probably overdue and should result in a smaller

pool of companies but between them managing a higher quality asset

base. With its potential production cash-flow our objective is that

Serabi will able to take advantage of opportunities that arise that

can add value for its shareholders. With a smaller pool of

companies satisfying the same size investor pool this should also

increase demand and liquidity which we can hope will translate into

seeing an improvement in valuations.

The remainder of 2013 presents a challenge to the Company but I

firmly believe that we have the building blocks in place to meet

this challenge. We have a robust project, the finance in place and

a senior team with the credentials to manage and deliver. We are

already well advanced in the initial development and rehabilitation

work and the timeline to completions is clearly defined.

Finally, on behalf of the board of directors I would

specifically like to thank Mike Hodgson, our CEO, and Clive Line,

our Finance Director, for their tireless work last year during

which they spearheaded the change in corporate strategy and

successfully managed the work on and completion of the PEA and then

more importantly, the capital raise that now has put Serabi back on

the path to production, and ultimately a rejuvenated Brazilian gold

growth story.

FINANCE REVIEW

The data included in the selected annual information table below

is taken from the Company's annual audited financial statements

which were prepared in accordance with International Financial

Reporting Standards in force at the reporting date and their

interpretations issued by the International Accounting Standards

Board ("IASB") and adopted for use within the European Union (IFRS)

and with IFRS and their interpretations issued by the IASB. There

are no material differences on application to the Group. The

consolidated financial statements have also been prepared in

accordance with those parts of the Companies Act 2006 applicable to

companies reporting under IFRS.

2012 2011 2010

US$ US$ US$

------------- ------------- -------------

Revenues - 3,807 1,229,551

Net loss (4,736,986) (5,935,823) (5,980,011)

Net loss per share (basic and

diluted) (5.29) cents (10.01) cents (15.21) cents

Total current assets 3,993,428 3,309,822 11,174,647

Development and deferred

exploration costs 17,360,805 16,648,884 9,797,406

Property plant and equipment 26,848,991 28,266,092 33,951,140

------------- ------------- -------------

Total assets 48,203,224 48,224,798 54,923,193

Total liabilities 8,942,223 4,940,318 10,571,375

------------- ------------- -------------

Equity shareholders' funds 39,261,001 43,284,480 44,351,818

------------- ------------- -------------

Results of Operations

Twelve month period ended 31 December 2012

compared to the twelve month period ended 31 December 2011

For the twelve month period ended 31 December 2012 the Company

recorded a net loss of US$4,736,986 (5.29 US cents per share)

compared to a net loss of US$5,935,823 (10.01 US cents per share)

for the comparative period last year.

The loss from operations for the year to 31 December 2012 was

reduced to US$477,961 by comparison with the year to 31 December

2011 when the loss incurred was US$567,705. It should be noted that

the year to 31 December 2012 only includes plant maintenance costs

related to the process plant up to 30 June 2012 after which time

all related costs have been treated as part of the development

expenditures of starting gold production operations at the Palito

Mine and therefore capitalised. Expenditures for the year ended 31

December 2011 of US$571,512 were for the full 12 month period and

also reflect that, for this 12 month period, the crushing section

of the plant was operational as the company was selling crushed

mine waste material for road aggregate, an activity which has now

ceased.

As noted earlier the company has, during the financial period

ended 31 December 2012, made a provision of BrR$546,436

(US$280,080) in respect of obsolete spare parts or items it

considers the Company will not use in the future operations.

Administration costs for the 12 month period to 31 December 2012

were US$2,513,272 compared with US$2,886,707 for the preceding

financial year. The reduction of US$373,435 is net of the income

generated in 2011 of US$506,575 from waste rock sales resulting in

an actual year on year reduction of US$880,010. Of this reduction

US$465,261 is the result of a reduced provision for the settlement

of past employment related claim. A further US$430,000 reduction is

also attributable to activities in Brazil. The reduction in

administration costs recorded in Brazilian Reals was BrR$526,000

(US$269,600) reflecting lower salary costs, reduced consulting fees

and expiring equipment rental arrangements. In addition the Company

made provision for additional taxes amounting to BrR$237,900

(US$142,430) in the period to 31 December 2011 and there has been

no similar provision required for the year to 31 December 2012. The

remainder is primarily the result of exchange rate effects

following the weakening of the exchange rate between the US$ and

the BrR$. For the 12 months to 31 December 2011 the average rate

was 1.6703 whilst for the corresponding period to 31 December 2012

the average rate was 1.9510.

In the year ended 31 December 2011 the Company recorded a

one-off charge relating to a provision against the recoverability

of certain taxes from the State of Para amounting to BrR$215,910

(US$129,264) and received a one-off income in the form of a

settlement of an outstanding charge with a supplier which reduced

the liability that had been recorded by the company by an amount

equivalent to US$540,441. There have been no such corresponding

events in the year ended 31 December 2012.

The Company has written off all exploration costs relating to

past exploration activity at the Modelo project amounting to

US$267,703. This follows the decision of management not to renew

exploration licences that it held for this project.

Depreciation charges for the year ended 31 December 2012 were

US$891,101 a reduction of approximately US$1.63 million. A

significant portion of the assets held by the Company have now been

fully depreciated.

The charge in respect of the fair value of share based payments

has reduced from US$263,861 for the year ended 31 December 2011 to

US$128,882 for the year ended 31 December 2012. Option awards are

valued using the Black-Scholes valuation method. Recent awards have

been made at lower exercise prices than in the past reflecting the

prevailing share prices and consequently generate lower valuations

for each option award.

Net interest expense for the year ended 31 December 2012 was

US$549,664 compared with US$478,114 for the year ended 31 December

2011. An analysis of the composition of these charges is set out in

the table below.

2012 2011

US$ US$

Interest on short term loan 80,745 -

Fee for provision of short term loan 180,000 -

Interest expense on convertible loan stock 56,304 45,722

Finance element of adjustment to rehabilitation 170,913 334,636

provision

Other interest and finance expenses 67,802 156,839

------------- -------------

555,835 537,197

Interest Income (6,171) (59,083)

------------- -------------

549,664 478,114

------------- -------------

Interest and fees on the short term loan relate to the provision

by Fratelli Investments Limited ("Fratelli") of a US$6.0 million

facility which was entered into on 1 October 2012. Under the loan

agreement a facility fee of 3% was payable to Fratelli and interest

accrued at the rate of 12% per annum. The facility was repaid in

January 2013 from the proceeds of a UK£ 16.2 million placement of

new shares that was completed on 17 January 2013.

The rehabilitation provision relates to the estimated costs of

the remediation of the Palito Mine site upon its eventual closure

and uses costs estimates made by the Company and submitted in its

reports to the DNPM. The provision represents the discounted

present value of the costs estimates which are themselves subject

to inflation adjustments. To the extent that the value of the

provision is varied through changes in exchange rates or changes in

inflation or interest rates such variations are treated as a

foreign exchange cost or an interest cost. Accordingly the

variation reflecting the reduced discount rate applied following

reductions in the Brazilian SELIC rate at the end of 2012 as well

as changes in inflation rates have been accounted for as interest

charges.

Other interest and finance expenses are primarily related to the

Brazilian operation and the reduction in the 12 months to 31

December 2012 compared with the 12 months to 31 December 2011

reflects reduced levels of settlements with long term creditors to

which interest is being applied and also reduced levels of penalty

from tax authorities for past adjustments of taxes due to be

collected by the Company on behalf of both the Federal and State

tax authorities.

Reduced levels of cash holdings explain the reduced level of

interest income derived in the twelve months ended 31 December 2012

compared with the corresponding period of 2011 falling from

US$59,083 to US$6,171.

Exchange differences on the currency translation of foreign

operations reflect the revaluation of the assets and liabilities of

those foreign operations. The Brazilian Real has fallen in value

relative to the United States Dollar over the twelve month period

ended 31 December 2012. The rate as at 31 December 2012 was 2.0435

Brazilian Real to one United States Dollar compared with a rate as

at 31 December 2011 of 1.8758. This decline has resulted in a

reduction in US Dollar terms of the book value of the assets of the

Company's Brazilian subsidiary in particular the values

attributable to the Palito Mine and the deferred exploration

interests. Any appreciation in the Brazilian Real will result in a

reversal of this exchange loss.

Summary of quarterly results

Quarter ended Quarter ended Quarter ended Quarter ended

31 December 30 September 30 June 31 March

2012 2012 2012 2012

US$ US$ US$ US$

---------------------------------- ------------- ------------- -------------

Revenues - - - -

Operating expenses (296,017) - (64,250) (117,694)

------------- ------------- ------------- -------------

Gross loss (296,017) - (64,250) (117,694)

Administration (679,272)

expenses (450,047) (573,167) (810,786)

Provision for -

indirect taxes - - -

Option costs (33,244) (33,244) (33,244) (29,150)

Write-off of past

exploration

expenditures (267,703) - - -

Gain on asset 9,857

disposals - 8,599 -

Depreciation of plant

and equipment (83,110) (223,150) (158,204) (426,637)

------------- ------------- ------------- -------------

Operating loss (1,349,489) (706,441) (820,266) (1,384,267)

Exchange (4,380) 9,434 (19,103) 87,190

Finance costs (498,343) (18,541) (14,731) (18,049)

------------- ------------- ------------- -------------

Loss before taxation (1,852,212) (715,548) (854,100) (1,315,126)

------------- ------------- ------------- -------------

Loss per ordinary

share (basic and

diluted) (2.03) cents (0.78) cents (0.94) cents (1.56) cents

Development and

deferred exploration

costs 17,360,805 18,249,489 17,405,081 17,998,296

Property, plant and 26,848,991

equipment 25,514,742 25,845,466 28,690,108

Total current assets 3,993,428 2,054,299 3,305,872 5,291,258

------------- ------------- ------------- -------------

Total assets 48,203,224 45,818,530 46,556,419 51,979,662

Total liabilities 8,942,223 4,358,930 4,219,578 4,537,035

------------- ------------- ------------- -------------

Shareholders' equity 39,261,001 41,459,600 42,336,841 47,442,627

------------- ------------- ------------- -------------

Quarter ended Quarter ended Quarter ended Quarter ended

31 December 30 September 30 June 31 March

2011 2011 2011 2011

US$ US$ US$ US$

---------------------------------- ------------- ------------- -------------

Revenues (99) 2,843 1,063 -

Operating expenses (103,429) (152,001) (132,260) (183,822)

------------- ------------- ------------- -------------

Gross loss (103,528) (149,158) (131,197) (183,822)

Administration

expenses (773,512) (745,990) (701,818) (665,387)

Settlement of

supplier claim - - - 540,441

Provision for

indirect taxes (129,264)

Option costs (77,151) (92,399) (63,740) -

Write-off of past

exploration

expenditures - - - (30,571)

Gain / (loss) on

asset disposals 38,803 (5,204) 11,178 (13,515)

Impairment - - - -

Depreciation of plant

and equipment (509,873) (580,845) (593,796) (567,336)

------------- ------------- ------------- -------------

Operating loss (1,554,525) (1,573,596) (1,479,373) (920,190)

Exchange 95,975 (168,309) (44,988) 187,297

Finance

(costs)/income (432,312) 2,221 (38,274) (9,749)

------------- ------------- ------------- -------------

Loss before taxation (1,890,862) (1,739,684) (1,562,635) (742,642)

------------- ------------- ------------- -------------

Loss per ordinary

share (basic and

diluted) (2.96) cents (2.72) cents (2.44) cents (1.65) cents

Development and

deferred exploration

costs 16,648,884 15,122,184 14,785,541 11,679,390

Property, plant and

equipment 28,266,092 29,132,327 34,843,749 34,088,905

Total current assets 3,309,822 6,376,759 10,897,744 13,933,052

------------- ------------- ------------- -------------

Total assets 48,224,798 50,631,270 60,527,034 59,701,347

Total liabilities 4,940,318 5,302,581 6,076,157 5,603,473

------------- ------------- ------------- -------------

Shareholders' equity 43,284,480 45,328,689 54,450,877 54,097,874

------------- ------------- ------------- -------------

Three month period ended 31 December 2012

compared to the three month period ended 31 December 2011

The loss from operations increased from US$103,528 for the 3

months ended 31 December 2011 to US$299,842 for the 3 month period

ended 31 December 2012. The Company has in the 3 months ended 31

December 2012 made provision of BrR$546,436 (US$280,280) in respect

of spare parts that it considers are obsolete or will not otherwise

be required by the Company in its planned gold production

operations. This represents approximately 27% of the inventory held

by the Company at 31 December 2012.

In the 3 months to 31 December 2011 all costs relating to the

maintenance of the process plant were treated as an operating

expense as they were incurred. For that 3 month period this costs

was BrR$192,411 (US$103,429). Since the decision was taken by the

Board, at the end of June 2012, to proceed with the commencement of

mining activities the plant has been considered to be in a state of

refurbishment and all costs related to the plant are being

capitalised as part of the overall mine development costs and

therefore there is no change to the income statement in the 3 month

period to 31 December 2012.

Notwithstanding the increased loss from operations the loss on

ordinary activities before interest has reduced from US$1,554,525

to US$1,349,489. Major contributors to the reduced level of loss

are a reduction in administration costs from US$773,512 to

US$679,272 and a reduction in depreciation charges from US$509,873

to US$83,110.

Administration costs for the 3 month period ended 31 December

2011 reflected income from the sale of crushed mined waste rock for

road aggregate amounting to approximately US$76,000. There has been

no similar revenue in the 3 month period ended 31 December 2012. In

Brazil administration costs have reduced by approximately

US$240,000. In the 3 month period ended 31 December 2011 the

Company made a provision for additional taxes amounting to

BrR$237,900 (US$142,430) for which there has been no corresponding

transaction in the 3 month period ended 31 December 2012.

Expenditure reductions between the corresponding periods have also

been realised on travel and information technology and from the

expiry of certain rental contracts for equipment. The level of

claims made against the Company with respect to past employment

disputes has also reduced from US$88,000 in the 3 month period to

31 December 2011 to approximately US$20,000 in the 3 month period

to 31 December 2012.

The reduction in depreciation charges between the two periods

reflects many of the Company's assets reaching the end of their

original forecast lives for amortisation purposes and have

therefore now been fully amortised.

During the period ended 31 December 2012, management took the

decision not to renew certain exploration licences relating to the

Modelo project. Accordingly accumulated exploration expenditures

amounting to US$267,703 have been written off.

The Company recorded a foreign exchange gain of US$95,975 in the

3 month period to 31 December 2011 although US$70,500 of this

related to the reversal of a previous foreign exchange charge

relating to the rehabilitation provision. Realised foreign exchange

gains in the 3 month period to 31 December 2011 were therefore

US$26,000 compared with a loss of US$799 for the 3 month period

ended 31 December 2012.

Net interest charges for the 3 month period to 31 December 2012

were US$498,343 compared with US$432,312 for the corresponding

period 3 month period to 31 December 2011. An analysis of the

composition of these charges is set out in the table below.

2012 2011

US$ US$

Interest on short term loan 80,745 -

Fee for provision of short term loan 180,000 -

Interest expense on convertible loan stock 14,131 11,254

Finance element of adjustment to rehabilitation 170,913 305,136

provision

Other interest and finance expenses 52,542 122,898

----------- -----------

498,385 439,288

Interest Income (42) (6,976)

----------- -----------

498,343 432,312

----------- -----------

Interest and fees on the short term loan relate to a US$6.0

million facility provided by Fratelli Investments Limited

("Fratelli") entered into on 1 October 2012. Under the loan

agreement a facility fee of 3% was payable to Fratelli and interest

accrued at the rate of 12% per annum. The facility was repaid in

January 2013 from the proceeds of a UK£ 16.2 million placement of

new ordinary shares that was completed on 17 January 2013.

The rehabilitation provision relates to the estimated costs of

the remediation of the Palito Mine site upon its eventual closure

and uses cost estimates made by the Company previously submitted in

reports to the DNPM. The provision represents the discounted

present value of the cost estimates which are themselves subject to

inflation adjustments. To the extent that the value of the

provision is varied through changes in exchange rates or changes in

inflation or interest rates such variations are treated as a

foreign exchange cost or an interest cost. Accordingly the

variation reflecting the reduced discount rate applied following

reductions in the Brazilian SELIC rate at the end of 2012 as well

as changes in inflation rates have been accounted for as interest

charges. Whilst management had been reviewing the level of

provision carried during prior quarters it had not recorded any

adjustment to the level of provision in any of the earlier 3 month

periods of 2012. Accordingly the movement in the provision for the

3 month period ended 31 December 2012 is the same as the movement

in the provision for the 12 month period ended 31 December

2012.

Other interest and finance expenses are primarily related to the

Brazilian operation and the reduction in the 3 months to 31

December 2012 compared with the 3 months to 31 December 2011

reflects reduced levels of settlements with long term creditors to

which interest is being applied and also reduced levels of penalty

from tax authorities for past adjustments of taxes due to be

collected by the Company on behalf of both the Federal and State

tax authorities.

Liquidity and Capital Resources

The Company had a working capital position of US$(2,760,104),

inclusive of a US$4.5 million short term loan received from a major

shareholder, at 31 December 2012 compared to US$625,602 at 31

December 2011. On 2 October 2012, the Company announced that it had

entered into a conditional subscription agreement with Fratelli

Investments Limited ("Fratelli"), one of its major shareholders, to

subscribe for and underwrite a placement of new shares to raise in

aggregate UK£ 16.2 million to finance the development and start-up

of underground mining operations at its Palito gold mine. In

addition, Fratelli agreed to provide an interim secured short term

loan facility of US$6.0 million to the Company to provide immediate

working capital to enable it to commence the initial works at

Palito. The Company made its first drawdown against this loan

facility on 2 October 2012 and as at 31 December 2012 the total

amount drawn down was US$4,500,000. The working capital position at

31 December 2012 includes cash and cash equivalents of US$2,582,046

(2011: US$1,406,458) and the outstanding loan to Fratelli of US$4.5

million, which was repaid in January 2013.

The Company does not have any asset backed commercial paper

investments. As the Company has no revenue and has in recent years

supported its activities by the issue of further equity, the

working capital position at any time reflects the timing of the

most recent share placement completed by the Company.

During the twelve month period ended 31 December 2012, the

Company issued 27,300,000 Ordinary Shares and 4,549,998 Warrants

for gross cash proceeds of UK£ 2.7 million. The placement comprised

the issue of 27,300,000 units where each unit consists of one

Ordinary Share and one sixth of a Warrant whereby each whole

Warrant entitles the holder to subscribe for one Ordinary Share at

a price of UK£ 0.15 at any time until 23 January 2014.

The Company has, during the twelve month period ended 31

December 2012, incurred costs of US$2,272,894 for development and

exploration expenditures on its mineral properties, including the

costs of the PEA undertaken by NCL, US$71,977 on asset purchases,

US$1,697,975 on rehabilitation and development of the Palito Mine

and used cash of US$3,439,852 to support its operating activities.

Further details of the exploration and development activities

conducted during the year are set out elsewhere in this

MD&A.

On 31 December 2012, the Company's total assets amounted to

US$48,203,224 which compares to the US$48,224,798 reported at 31

December 2011. The Current Asset component has increased by some

US$0.60 million reflecting higher cash balances offset by the write

off of inventory. Whilst some US$4.0 million has been expended on

non-current assets the devaluation of the Brazilian Real against

the United States Dollar has resulted in exchange variations

reducing the carrying value of exploration interests by US$1.3

million and of mining property, plant and equipment by US$2.3

million. The remaining reduction in value of some US$0.9 million is

attributable to depreciation charges raised during the period.

Total assets are mostly comprised of property, plant and equipment,

which as at 31 December 2012 totalled US$26,848,991 (December 2011:

US$28,266,092), of which US$1,622,093 relates to project

development expenditure at the Palito Mine and deferred exploration

and development cost which as at 31 December 2012 totalled

US$17,360,805 (December 2011: US$16,648,884), of which

US$16,298,769 relates to capitalised exploration expenditures at,

or in close proximity to, the Palito Mine. The Company's total

assets also included cash holdings of US$2,582,046 (December 2011:

US$1,406,458).

Receivables of US$85,509 as at 31 December 2012 are at similar

levels to 31 December 2011 when the receivables balance was

US$87,440. The receivables as of 31 December 2012 are primarily

deposits paid by the Company. Prepayments as of 31 December 2012

were US$603,005 compared with US$701,669 as at 31 December 2011, a

decrease of US$98,666. The prepayments primarily represent prepaid

taxes in Brazil amounting to US$514.493, of which the majority is

federal and state sales taxes which the Company expects to recover

either through off-set against other federal tax liabilities or

through recovery directly.

The Company's total liabilities at 31 December 2012 of

US$8,942,223 (December 2011: US$4,940,318) included the short term

loan payable to Fratelli Investments Limited which, including

interest, amounted to US$4,580,745 as well as accounts payable to

suppliers and other accrued liabilities of US$2,384,724 (December

2011: US$3,192,900). The total liabilities include US$364,656

including accrued interest (December 2011: US$296,122) attributable

to the £ 300,000 loan from a related party, which has a repayment

date of 31 October 2014 subject to the right of the holder at any

time, on one or more occasions, on or before the repayment date, to

convert any of the outstanding amounts owed by the Company to

Ordinary Shares at a price of 15 pence per Ordinary Share. It also

includes the amount of US$1,612,098 (December 2011: US$1,451,296)

in respect of provisions including US$1,223,392 (December 2011:

US$1,155,000) for the cost of remediation of the current Palito

Mine site at the conclusion of operational activity.

During the early part of 2012 the Company commissioned a

Preliminary Economic Assessment ("PEA") of the viability of

re-commencing mining operations at the Palito Mine. The report

which was completed and published in June 2012 was positive and the

Company entered into a conditional subscription agreement with

Fratelli Investments Limited ("Fratelli") on 2 October 2012 to

subscribe for and underwrite a placement of new shares to finance

the development and start-up of underground mining activities at

the Palito gold mine. In addition Fratelli agreed to provide an

interim secured loan facility of US$6.0 million to provide

additional working capital to the Company and to enable it to

commence the initial works at Palito. The placing of 270 million

new Ordinary Shares with Fratelli and other subscribers was

completed on 17 January 2013, raising gross proceeds of UK£ 16.2

million. The Company has repaid out of the proceeds the amount of

the loan facility that had been drawn down, which at that time was

US$4.5 million plus accrued interest. Management considers that the

Company has adequate access to capital to be able to complete the

necessary mine development and process plant and infrastructure

rehabilitation works that are required in order to be able to

commence gold production before the end of 2013. From the time that

production operations commence at planned rates management

anticipates that the Company will have sufficient cash flow to be

able to meet all its obligations as and when they fall due and to,

at least in part, finance the exploration and development

activities that it would like to undertake on its other exploration

projects.

There are, however, risks associated with the commencement of

any new mining and processing operation whereby unforeseen

technical and logistical events result in additional time being

required for commissioning or additional costs needing to be

incurred, giving rise to the possibility that additional working

capital may be required to fund these delays or additional capital

requirements. Should additional working capital be required the

Directors consider that further sources of finance could be secured

within the required timescale.

Statement of Comprehensive Income For the

year ended 31 December 2012

Group

--------------------------

For the year For the year

ended 31 ended 31

December December

2012 2011

US$ US$

CONTINUING OPERATIONS

Revenue - 3,807

Operating expenses (477,961) (571,512)

------------ ------------

Gross loss (477,961) (567,705)

Administration expenses (2,513,272) (2,886,707)

Provision for indirect taxes - (129,264)

Share-based payments (128,882) (263,861)

Write-off of past exploration costs (267,703) -

Settlement of supplier claim - 540,441

Gain on asset disposals 18,456 31,262

Depreciation of plant and equipment (891,101) (2,251,850)

------------ ------------

Operating loss (4,260,463) (5,527,684)

Foreign exchange gain 73,141 69,975

Finance expense (555,835) (537,197)

Finance income 6,171 59,083

------------ ------------

Loss before taxation (4,736,986) (5,935,823)

Income tax expense - -

------------ ------------

Loss for the period from continuing operations(1)

(2) (4,736,986) (5,935,823)

Other comprehensive income (net of tax)

Exchange differences on translating foreign

operations (3,531,144) (4,957,335)

------------ ------------

Total comprehensive loss for the period(2) (8,268,130) (10,893,158)

------------ ------------

Loss per ordinary share (basic and diluted) (5.29c) (10.01c)

------------ ------------

(1) All revenue and expenses arise from continuing operations

(2) The Group has no non-controlling interests and all income/(losses) are

attributable to the equity holders of the Parent Company

Balance Sheets

Group

2012 2011

US$ US$

------------ ------------

Non-current assets

Development and deferred exploration costs 17,360,805 16,648,884

Property, plant and equipment 26,848,991 28,266,092

Investments in subsidiaries - -

Other receivables - -

------------ ------------

Total non-current assets 44,209,796 44,914,976

------------ ------------

Current assets

Inventories 722,868 1,114,255

Trade and other receivables 85,509 87,440

Prepayments 603,005 701,669

Cash and cash equivalents 2,582,046 1,406,458

------------ ------------

Total current assets 3,993,428 3,309,822

------------ ------------

Current liabilities

Trade and other payables 2,001,683 2,538,055

Interest bearing liabilities 4,580,745 -

Accruals 171,102 146,165

------------ ------------

Total current liabilities 6,753,530 2,684,220

------------ ------------

Net current (liabilities)/assets (2,760,102) 625,602

------------ ------------

Total assets less current liabilities 41,449,694 45,540,578

------------ ------------

Non-current liabilities

Trade and other payables 211,939 508,680

Provisions 1,612,098 1,451,296

Interest bearing liabilities 364,656 296,122

------------ ------------

Total non-current liabilities 2,188,693 2,256,098

------------ ------------

Net assets 39,261,001 43,284,480

------------ ------------

Equity

Share capital 31,416,993 29,291,551

Share premium reserve 50,182,624 48,292,057

Option reserve 2,019,782 1,956,349

Other reserves 780,028 702,095

Translation reserve (4,606,311) (1,075,167)

Accumulated losses (40,532,115) (35,882,405)

------------ ------------

Equity shareholders' funds attributable to owners

of the parent 39,261,001 43,284,480

------------ ------------

Statements of Changes in Shareholders'

Equity For the year ended 31 December 2012

Share

Share Share option

Group capital premium reserve

US$ US$ US$

---------- ---------- ----------

Equity shareholders' funds

at 31 December 2010 27,752,834 40,754,032 1,648,484

---------- ---------- ----------

Foreign currency

adjustments - - -

Loss for year - - -

---------- ---------- ----------

Total comprehensive income

for the year - - -

Issue of new ordinary

shares for cash 731,412 4,229,767 -

Issue of new ordinary

shares on exercise of 807,305 4,004,807 -

special warrants

Costs associated with issue

of new ordinary shares for - (696,549) -

cash

Share option expense - - 307,865

---------- ---------- ----------

Equity shareholders' funds

at 31 December 2011 29,291,551 48,292,057 1,956,349

---------- ---------- ----------

Other Translation Accumulated

Group reserves reserve losses Total equity

US$ US$ US$ US$

---------- ----------- ------------ ------------

Equity shareholders' funds

at 31 December 2010 260,882 3,882,168 (29,946,582) 44,351,818

---------- ----------- ------------ ------------

Foreign currency

adjustments - (4,957,335) - (4,957,335)

Loss for year - - (5,935,823) (5,935,823)

---------- ----------- ------------ ------------

Total comprehensive income

for the year - (4,957,335) (5,935,823) (10,893,158)

Issue of new ordinary

shares for cash 208,229 - - 5,169,408

Issue of new ordinary

shares on exercise of 232,984 - - 5,045,096

special warrants

Costs associated with issue

of new ordinary shares for - - - (696,549)

cash

Share option expense - - - 307,865

---------- ----------- ------------ ------------

Equity shareholders' funds

at 31 December 2011 702,095 (1,075,167) (35,882,405) 43,284,480

---------- ----------- ------------ ------------

Foreign currency

adjustments - - -

Loss for year - - -

---------- ---------- ----------

Total comprehensive income

for the year - - -

Issue of new ordinary

shares for cash 2,125,442 2,047,509 -

Costs associated with issue

of new ordinary shares for - (156,942) -

cash

Share options lapsed - - (87,276)

Share option expense - - 150,709

---------- ---------- ----------

Equity shareholders' funds

at 31 December 2012 31,416,993 50,182,624 2,019,782

---------- ---------- ----------

Foreign currency

adjustments - (3,531,144) - (3,531,144)

Loss for year - - (4,736,986) (4,736,986)

---------- ------------ ------------ ------------

Total comprehensive income

for the year - (3,531,144) (4,736,986) (8,268,130)

Issue of new ordinary

shares for cash 77,933 - - 4,250,884

Costs associated with issue

of new ordinary shares for - - - (156,942)

cash

Share options lapsed - - 87,276 -

Share option expense - - - 150,709

---------- ------------ ------------ ------------

Equity shareholders' funds

at 31 December 2012 780,028 (4,606,311) (40,532,115) 39,261,001

---------- ------------ ------------ ------------

Cash Flow Statements For the year ended 31

December 2012

Group

For the For the

year ended year ended

31 December 31 December

2012 2011

US$ US$

------------ ------------

Cash outflows from operating activities

Operating loss (4,260,463) (5,527,684)

Depreciation - plant, equipment and mining

properties 891,101 2,251,850

(Gain)/loss on sale of assets (18,456) (31,262)

Deferred asset write-off 267,703 -

Option costs 128,882 263,861

Interest paid (247,802) (156,838)

Foreign exchange (261,974) (174,367)

Changes in working capital

Decrease/(increase) in inventories 313,248 162,979

Decrease/(increase) in receivables, prepayments

and accrued income 47,982 267,985

(Decrease)/increase in payables, accruals and

provisions (300,072) (269,289)

------------ ------------

Net cash flow from operations (3,439,851) (3,212,765)

------------ ------------

Investing activities

Proceeds of sale of fixed assets 19,724 212,887

Purchase of property, plant, equipment and

projects in construction (1,769,951) (119,974)

Exploration and development expenditure (2,251,067) (8,663,471)

Capital and loan investments in subsidiaries - -

Interest received 6,171 59,083

------------ ------------

Net cash outflow on investing activities (3,995,122) (8,511,475)

------------ ------------

Financing activities

Issue of ordinary share capital 4,250,883 4,961,180

Issue of special warrants - 208,229

Short term secured loan 4,500,000 -

Payment of share issue costs (156,942) (696,549)

Payment of special warrant issue costs - (14,900)

------------ ------------

Net cash inflow from financing activities 8,593,941 4,457,960

------------ ------------

Net increase/(decrease) in cash and cash

equivalents 1,158,968 (7,266,280)

Cash and cash equivalents at beginning of period 1,406,458 8,598,755

Exchange difference on cash 16,620 73,983

------------ ------------

Cash and cash equivalents at end of period 2,582,046 1,406,458

------------ ------------

Notes

1. General Information The financial

information set out above for the years ended 31 December 2012 and

31 December 2011 does not constitute statutory accounts as defined

in Section 434 of the Companies Act 2006, but is derived from those

accounts. Whilst the financial information included in this

announcement has been compiled in accordance with International

Financial Reporting Standards ("IFRS") this announcement itself

does not contain sufficient financial information to comply with

IFRS. A copy of the statutory accounts for 2011 has been delivered

to the Registrar of Companies and those for 2012 will be posted to

shareholders. The full audited financial statements for the years

end 31 December 2012 and 31 December 2011 do comply with IFRS.

2. Auditor's Opinion The auditor has

issued an unqualified opinion in respect of the financial

statements which does not contain any statements under the

Companies Act 2006, Section 498(2) or Section 498(3). The auditor

has raised an Emphasis of Matter in relation to going concern and

the availability of project finance as follows:

"In forming our opinion, which is not modified, we have

considered the adequacy of the disclosures made in Note 1(a) to the

financial statements concerning the group's ability to continue as

a going concern. The group is dependent on its ability to

successfully develop and commence gold production at the Palito

Mine in order to continue as a going concern. However, there are

risks associated with the commencement of a new mining and

processing operation and additional working capital may be required

to fund delays in the development of the mine should they occur.

These conditions, along with the other matters explained in Note

1(a) to the financial statements indicate the existence of a

material uncertainty which may cast significant doubt about the

company and the group's ability to continue as a going concern. The

financial statements do not include the adjustments that would

result if the company and the group were unable to continue as a

going concern"

NB: The reference to note 1(a) in the above is a reference to

the Basis of preparation note contained within the Financial

Statements from which the extracts reproduced below referring to

Going concern and Impairment are taken.

3. Basis of preparation The financial

statements have been prepared in accordance with International

Financial Reporting Standards ("IFRS") in force at the reporting

date and their interpretations issued by the International

Accounting Standards Board ("IASB") as adopted for use within the

European Union and with IFRS and their interpretations issued by

the IASB. The consolidated financial statements have also been

prepared in accordance with those parts of the Companies Act 2006

applicable to companies reporting under IFRS.

The Company has not adopted any standards or interpretations in

advance of the required implementation dates. There has been no

significant measurement impact on the consolidated financial

statements from new standards or interpretations effective in

2012.

It is not anticipated that the adoption in the future of the new

or revised standards or interpretations that have been issued by

the International Accounting Standards Board will have a material

impact on the Group's earnings or shareholders' funds.

Attention is drawn to the detailed disclosures made in the

audited Financial Statements regarding the Basis of Preparation and

in particular the following disclosures extracted directly from the

audited Financial Statements in respect of Going Concern and

Impairment.

Going concern and availability of project

finance

In common with many companies in the exploration and development

stages, the Company raises its finance for exploration and

development programmes in discrete tranches. During the early part

of 2012 the Company commissioned a Preliminary Economic Assessment

("PEA") of the viability of re-commencing mining operations at the

Palito Mine. The report which was completed and published in June

2012 was positive and the Company entered into a conditional

subscription agreement with Fratelli Investments Limited

("Fratelli") on 2 October 2012 to subscribe for and underwrite a

placement of new shares to finance the development and start-up of

underground mining activities at the Palito gold mine. In addition

Fratelli agreed to provide an interim secured loan facility of US$6

million to provide additional working capital to the Company and to

enable it to commence the initial works at Palito. The placing of

270 million new Ordinary Shares with Fratelli and other subscribers

was completed on 17 January 2013, raising gross proceeds of UK£

16.2 million. The Company has repaid out of the proceeds the amount

of the loan facility that had been drawn down, which at that time

was US$4.5 million plus accrued interest. Management considers that

the Company has adequate access to capital to be able to complete

the necessary mine development and process plant and infrastructure

rehabilitation works that are required in order to be able to

commence gold production before the end of 2013. From that time

management anticipate that the Company will have sufficient cash

flow to be able to meet all its obligations as and when they fall

due and to, at least in part, finance the exploration and

development activities that it would like to undertake on its other

exploration projects.

There are, however, risks associated with the commencement of

any new mining and processing operation whereby unforeseen

technical and logistical events result in additional time being

required for commissioning or additional costs needing to be

incurred, giving rise to the possibility that additional working

capital may be required to fund these delays or additional capital

requirements. Should additional working capital be required the

Directors consider that further sources of finance could be secured

within the required timescale. On this basis the Directors have

therefore concluded that it is appropriate to prepare the financial

statements on a going concern basis. However there is no certainty

that such additional funds will be forthcoming. These conditions

indicate the existence of a material uncertainty which may cast

doubt over the Group's and the Company's ability to continue as a

going concern and therefore that it may be unable to realise its

assets and discharge its liabilities in the normal course of

business.

These financial statements do not reflect the adjustments to

carrying values of assets and liabilities and the reported expenses

and balance sheet classifications that would be necessary should

the going concern assumption be inappropriate. These adjustments

could be material.

Impairment

The Directors have undertaken a review of the carrying value of

the mining and exploration assets of the Group and given particular

consideration to the results of the PEA, the current operational

status of Palito and the potential risks and implications of

starting up a past producing gold mine. As part of this review they

have assessed the value of the existing Palito Mine asset on the

basis of the projected value in use that could be expected should

the company follow the re-development, start-up and future mining

plans proposed in the PEA. The carrying values of assets have not

been adjusted to reflect a failure to raise sufficient funds, not

achieving the projected levels of operation or that, if a sale

transaction were undertaken, the proceeds may not ealize the value

as stated in the accounts.

4. Loss per share The calculation of the

basic loss per share of 5.29 cents (2011 loss per share: 10.01

cents) is based on the loss attributable to ordinary shareholders

of US$4,736,986 (2011: loss of US$5,935,823) and on the weighted

average number of ordinary shares of 89,552,955 (2011: 59,309,035)

in issue during the period. Diluted loss per share is the same as

the basic loss per share because the exercise of share options

would be anti-dilutive.

5. Development and Deferred Exploration

costs

Group

31 December 31 December

2012 2011

$ $

----------- -----------

Cost

Opening balance 16,648,884 9,797,406

Exploration and development expenditure 2,251,067 8,663,471

Share option charges capitalised 21,827 44,005

Write-off of past exploration costs (267,703) -

Foreign exchange movements (1,293,270) (1,855,998)

----------- -----------

Total as at end of period 17,360,805 16,648,884

----------- -----------

The value of these assets is dependent on the development of

mineral deposits.

6. Tangible Assets

Property, plant and equipment - Group

Land and Mining Projects in Plant and

buildings property construction equipment

- at cost - at cost - at cost - at cost Total

2012 $ $ $ $ $

----------- ----------- ------------ ----------- ------------

Cost

Balance at 31 -

December 2011 3,628,135 29,395,558 10,997,006 44,020,699

Additions 5,073 - 1,697,975 66,903 1,769,951

Foreign (75,882)

exchange (297,973) (2,115,419) (850,062) (3,339,336)

movements

Disposals - - - (87,139) (87,139)

----------- ----------- ------------ ----------- ------------

At 31 December 1,622,093

2012 3,335,235 27,280,139 10,126,708 42,364,175

----------- ----------- ------------ ----------- ------------

Depreciation

Balance at 31 -

December 2011 (3,513,375) (4,099,737) (8,141,495) (15,754,607)

Charge for -

period (198,220) - (692,881) (891,101)

Reclassification -

of

impairment 86,130 (86,130) - -

provision

Foreign -

exchange 290,230 146,123 608,300 1,044,653

movements

Eliminated on -

sale of asset - - 85,871 85,871

----------- ----------- ------------ ----------- ------------

At 31 December -

2012 (3,335,235) (4,039,744) (8,140,205) (15,515,184)

----------- ----------- ------------ ----------- ------------

Net book value 1,622,093

at 31 December - 23,240,395 1,986,503 26,848,991

2012

----------- ----------- ------------ ----------- ------------

Net book value -

at 31 December 114,760 25,295,821 2,855,511 28,266,092

2011

----------- ----------- ------------ ----------- ------------

7. Impairment

The Directors have considered each of the Group's exploration

and development assets on a project-by-project basis. It has

considered three general cash generating units for the purpose of

this assessment. These are:

- the Palito mine itself including the pre-operating cost,

exploration expenditures on establishing the current declared

reserve and resource base, land and buildings and plant and

machinery associated with the mining operations

- exploration expenditures on areas within the Palito environs

but which have not yet been exploited and do not form part of the

current declared reserves and resources; and

- exploration expenditures on other tenements.

The Directors note that the carrying value of the assets

relating to the Palito Mine (before impairments) has reduced to

US$27,814,608 compared with the value at 31 December 2011 of

US$30,838,229. This is primarily the result of exchange rates

variations and depreciation charges made during the period, with

the balance attributable to small levels of asset additions and

disposals. In making their assessment of the value in use

attributable to the Palito Mine the Directors have made certain

revisions to the underlying assumptions compared with those used in

making the calculation as of 31 December 2011. The current

assessment has been based on the economic assessment of the Palito

Mine project set out in the PEA and in particular the timing of the

commencement of production, projected capital and operating costs

and expected production levels. The Directors have based their

estimates of gold price on consensus forecasts of a selection of

analysts covering the gold sector The resulting post-tax Net

Present Value of the project still supports the carrying value of

US$25.2 million and therefore the Directors have not made any

adjustment to the impairment provision currently carried in the

books of the group.

In accordance with IAS 36 - Impairment of Assets, any impairment

must first be applied against any goodwill allocated to the unit

that is impaired and thereafter allocated to the other assets of

the unit pro-rata on the basis of the carrying amount of each asset

in the unit.

Group

The carrying value for the Group of the Palito cash generating

unit comprises:

Carrying value Impairment Carrying value

before impairment provision after impairment

$ $ $

----------------- ----------------- -----------------

Mining Property 25,364,208 2,123,814 23,240,394

Land and Buildings - - -

Plant and Equipment 2,450,400 466,718 1,983,682

----------------- ----------------- -----------------

27,814,608 2,590,532 25,224,076

----------------- ----------------- -----------------

An initial impairment provision against the carrying value of

the Palito cash generating unit for the Group was established in

the financial year ended 31 December 2009. The provision was first

applied against Goodwill of US$1,752,516 and accordingly the value

reported by the Group as Goodwill at that time was impaired in

full.

No impairment provision has been made in respect of any of the

other cash generating units.

Annual Report The Annual Report is

expected to be posted to shareholders before 30 April 2013.

Additional copies will be available to the public, free of charge,

from the Company's offices at 2nd floor, 30 - 32 Ludgate Hill,

London, EC4M 7DR and will be available to download from the

Company's website at www.serabigold.com.

This press release contains forward-looking statements. All

statements, other than of historical fact, that address activities,

events or developments that the Company believes, expects or

anticipates will or may occur in the future (including, without

limitation, statements regarding the estimation of mineral

resources, exploration results, potential mineralization, potential

mineral resources and mineral reserves) are forward-looking

statements. Forward-looking statements are often identifiable by

the use of words such as "anticipate", "believe", "plan", may",

"could", "would", "might" or "will", "estimates", "expect",

"intend", "budget", "scheduled", "forecasts" and similar

expressions or variations (including negative variations) of such

words and phrases. Forward-looking statements are subject to a

number of risks and uncertainties, many of differ materially from

those discussed in the forward-looking statements. Factors that

could cause actual results or events to differ materially from

current expectations include, among other things, without

limitation, failure to establish estimated mineral resources, the

possibility that future exploration results will not be consistent

with the Company's expectations, the price of gold and other risks

identified in the Company's most recent annual information form

filed with the Canadian securities regulatory authorities on

SEDAR.com. Any forward-looking statement speaks only as of the date

on which it is made and, except as may be required by applicable

securities laws, the Company disclaims any intent or obligation to

update any forward-looking statement.

Enquiries: Serabi Gold plc Michael Hodgson Chief

Executive Tel: +44 (0)20 7246 6830 Mobile: +44 (0)7799

473621

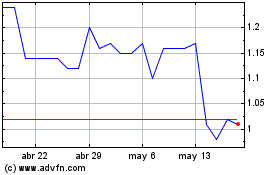

Serabi Gold (TSX:SBI)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Serabi Gold (TSX:SBI)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024