Azincourt to Acquire Advanced Peruvian Uranium Company

22 Noviembre 2013 - 12:00AM

Marketwired Canada

AZINCOURT URANIUM INC. ("Azincourt" or "the Company") (TSX VENTURE:AAZ) a

Saskatoon based uranium exploration company, announces that it has entered into

definitive share purchase agreements dated November 20, 2013 with each of: (a)

Cameco Corporation (TSX:CCO) and its wholly-owned subsidiary Cameco Global

Exploration Ltd. ("Cameco"); and (b) Vena Resources Inc. (TSX:VEM) ("Vena") for

the acquisition of 100% of the issued shares of Minergia S.A.C. ("Minergia") a

private Peruvian company (the "Acquisition"). Minergia owns 100% of the rights

and interests in the advanced stage Macusani and early stage Munani uranium

exploration projects in the Puno department of south-eastern Peru covering a

combined area of 14,700 hectares (the "Projects").

Acquisition Summary

-- Azincourt to purchase 100% of Minergia from Cameco and Vena for total

consideration of $2 million in cash and Azincourt shares.

-- Over $12 million spent by Minergia on project exploration work between

2007-2011.

-- Minergia has defined 18 million lbs U3O8 current mineral resources

(measured and indicated) and 17 million lbs U3O8 inferred, to September

2011.

-- Exploration and processing work by Minergia and others in the Macusani

region suggests potential for future low cost production.

-- Additional targets exist on the projects and Azincourt is committed to

advancing the resources, targets and to developing the Macusani region.

-- Vena's Chairman and CEO, Juan Vegarra to join Azincourt board as an

independent director.

Macusani Project Highlights

-- Advanced-stage 4,900 hectare project

-- October 2011 NI 43-101 compliant report calculated(i) in-place U3O8

resources of:

-- 5.7 million pounds in the measured category

-- 12.5 million pounds indicated

-- 17.4 million pounds inferred

-- $12 million of prior exploration work

(i)Cut-off of 90.72 ppm (0.18 pounds/ton)

Munani Project Highlights

-- Early-stage 9,600 hectare project.

-- Uranium mineralization identified in both sandstone and intermediate

volcanic rock outcrops.

-- Detailed airborne surveys and ground prospecting complete.

-- Initial drill targets already established and prioritized.

Ted O'Connor, the Company's President and CEO, stated "Based on the work by

Minergia and others in the region, we believe the Macusani region has tremendous

exploration up- side. In particular, the uranium resources already identified

have the future potential to be developed as open pit, acid heap leach

operations with low capital and operating costs. This forms part of Azincourt's

plan to acquire strong projects and in-ground uranium resources now in order to

capitalize on the future uranium market turnaround and complements our excellent

Athabasca Basin PLN Joint Venture project with Fission Uranium."

Macusani Project Key Details

More than $12,000,000 of exploration work has been conducted at the 4,900

hectare project. This includes 37,958 metres of exploration drilling in 232

diamond drill holes targeting anomalies generated through systematic

scintillometer surveying. Five individual target areas were drilled with the

bulk of the drilling concentrated on the Tantamaco prospect.

The Macusani uranium deposits are hosted in the uppermost Yapamayo member of the

Quenamari volcanics, a series of peraluminous alkaline ignimbritic rhyolite to

rhyodacite extrusive volcanic rocks up to 500 m thick. The Pliocene Quenemari

volcanics (ca. 6-21 Ma) filled a distinct caldera-like graben approximately 40

km's in diameter to form a present day plateau. All known uranium deposits and

most uranium occurrences are located near the northeastern edge of the caldera,

exclusively in the Yapamayo member.

Mineralization at the Macusani project consists primarily of yellowish-green

hexavalent (U+6) minerals autunite and meta-autunite. Mineralization occurs

within brittle fractures and disseminated into the host volcanic rocks.

Disseminated mineralization also forms discrete subhorizontal lenses within

certain Yapamayo member volcanic flow units.

Munani Project Key Details

The Munani project covers an area of 9,600 hectares. Minergia has completed

regional and detailed scintillometer prospecting and Alpha Cup radon surveys

over the project area as well as detailed geological mapping, sampling and

limited trenching. Uranium mineralization has been found in both sandstone and

intermediate volcanic rock outcrops on the project. The Munani project has never

been drill tested, but targets have been established and prioritized for future

drilling.

Proposed Acquisition of Minergia S.A.C

Under the terms of the separate Share Purchase Agreements, the Company has

agreed, subject to the satisfaction of certain conditions precedent to acquire

each of Cameco's and Vena's 50% of the issued capital of Minergia in exchange

for consideration of C$1,000,000 payable to each of Cameco and Vena as follows:

i. C$750,000 worth of common shares of the Company, being 2,525,252 common

shares (the "Consideration Shares") calculated based on the volume

weighted average trading price of the Company's common shares on the TSX

Venture Exchange (the "Exchange") for the 10 trading days immediately

prior to signing of the Share Purchase Agreements; and

ii. C$250,000 in cash.

The Consideration Shares to be issued to both Cameco and Vena will be subject to

a statutory hold period of four months and one day from the date of their

issuance. In addition, the Consideration Shares issued to Vena will be subject

to voluntary resale restrictions for a period of one year from the date of

issuance, following which Vena's Consideration Shares will become freely

tradable as to 15% of the Consideration Shares on the 12 month anniversary of

their issuance and an additional 15% on each of the 15th, 18th and 21st and 24th

month anniversaries of their issuance with the remaining 25% on the 27th month

anniversary of the issuance date.

The Acquisition is at arm's length and no finder's fee is payable in relation to

the Acquisition.

The parties' obligations to complete the Acquisition are subject to the

satisfaction of standard conditions precedent including:

a. the receipt of all necessary approvals of the Exchange and all other

regulatory authorities and third parties to the Acquisition;

b. the Company completing all necessary due diligence on Minergia and the

mineral concessions making up the Projects; and

c. the receipt of legal opinions from Peruvian counsel as to certain

corporate matters relating to Minergia and the Projects.

Summary of the Macusani Project

The following is a summary of the Macusani Project is based upon a NI 43-101

compliant report authored by Henkle & Associates, entitled "Updated Technical

Report of the Macusani Uranium Exploration Project", dated October 25, 2011 and

addressed to Vena, which was filed in November 2011 under Vena's SEDAR profile.

The Macusani Project contains partially drill defined uranium deposits, and is

comprised of nine non-contiguous mineral concessions covering a combined total

area of 4,900 hectares. The Project is located approximately 650 kilometres

southeast of Lima and about 230 kilometres by road north of the city of Juliaca.

Access to the Project is from the Interoceanico Highway ("IH"), a tarred road

that passes about 11 kilometres, directly to the east of Minergia's exploration

camp. The Company's exploration camp is located in the pueblo of Isivilla, near

the center of the Project area. Access from the IH, to the concessions is via a

network of gravel roads, all of which are passable by a two-wheel drive vehicle.

Uranium in the Macusani Project Area is hosted in ignimbritic volcanic

rhyolites, and is found in both fractures and as disseminated crystals within

distinct mineralized zones. Mineralized zones are correlatable as distinct

strata/elevation related zones, from drill hole to drill hole, much as a

supergene blanket is in a copper deposit. To date, five separate prospects have

been defined containing potentially economic mineralization in both Level A and

Level B rock units within the Macusani Project area.

Little exploration activity had taken place on the Macusani Project prior to

Vena's involvement in 2006. In 2006, Vena commenced scintillometer prospecting,

radon and surface outcrop sampling over various IPEN ("Instituto Peruano de

Energia Nuclear", an agency within the Peruvian Ministry of Energy and Mines)

uranium showings.

The total amount of drilling at the Macusani Project area since 2006 is 232 core

holes for a total of 37,958 m. A breakdown of drill statistics for each of the

prospects within the Project Area is shown in the following table:

----------------------------------------------------------------------------

PROSPECT # CORE HOLE METRES DRILLED

----------------------------------------------------------------------------

Tantamaco 128 core holes 23,287 m

----------------------------------------------------------------------------

Nueva Corani 57 core holes 6,961 m

----------------------------------------------------------------------------

Isivilla 27 core holes 3,597 m

----------------------------------------------------------------------------

Tuturumani 11 core holes 2,484 m

----------------------------------------------------------------------------

Calvario Real 9 core holes 1,629 m

----------------------------------------------------------------------------

TOTAL 232 core holes 37,958 m

----------------------------------------------------------------------------

Based upon drilling and assaying to date, the report writer calculated the

following resource estimate over the five drilled prospects making up the

Macusani Project: http://media3.marketwire.com/docs/913276.pdf.

The Minergia projects have not seen active exploration drilling for the past two

years and have been on care and maintenance due to depressed uranium market

conditions. Azincourt is working with the existing Minergia team and Vena to

develop a meaningful program and budget to restart active exploration work in

Peru. The 2014 plans will include completing the necessary community agreements

and all required permitting work to recommence diamond drilling of existing

targets on the projects.

Board Appointment

Concurrently with the completion of the Acquisition, the Company intends to

appoint Mr. Juan Vegarra as an independent director. Mr. Vegarra is a founder

and the Chairman and CEO of Vena Resources Inc. Mr. Vegarra is a native of Peru

and continues to foster his significant base of contacts within both the

Peruvian government and the mining industry. Prior to his appointment as

Chairman and CEO of Vena Resources in 2003, Mr. Vegarra enjoyed a successful

career as a Microsoft executive. He holds an engineering bachelor degree from

the University of Maryland as well as an MBA from the University of Washington.

Qualified Person

The technical information in this news release has been prepared in accordance

with the Canadian regulatory requirements set out in National Instrument 43-101

and reviewed on behalf of the company by Ted O'Connor, P.Geo. President and CEO

of Azincourt Uranium Corp., a qualified person.

The TSX Venture Exchange has in no way passed upon the merits of the proposed

Acquisition and has neither approved nor disapproved the contents of this press

release.

About Azincourt Uranium Inc.

Azincourt Uranium Inc. is a Canadian based resource company specializing in the

strategic acquisition, exploration and development of uranium properties and is

headquartered in Vancouver, British Columbia. Its common shares are listed on

the TSX Venture Exchange under the symbol "AAZ".

ON BEHALF OF THE BOARD OF AZINCOURT URANIUM INC.

Ted O'Connor, CEO and President

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT

TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS

RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

This press release includes "forward-looking statements", including forecasts,

estimates, expectations and objectives for future operations that are subject to

a number of assumptions, risks and uncertainties, many of which are beyond the

control of Azincourt. Investors are cautioned that any such statements are not

guarantees of future performance and that actual results or developments may

differ materially from those projected in the forward-looking statements. Such

forward-looking information represents management's best judgment based on

information currently available. No forward- looking statement can be guaranteed

and actual future results may vary materially.

FOR FURTHER INFORMATION PLEASE CONTACT:

Azincourt Uranium Inc.

Dwane Brosseau

Investor Relations

Direct: 604 662 4955

dwane@azincourturanium.com

www.azincourturanium.com

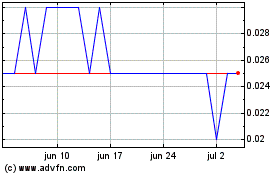

Azincourt Energy (TSXV:AAZ)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

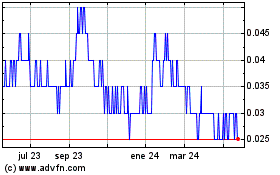

Azincourt Energy (TSXV:AAZ)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024