Is The Worst Over For Bitcoin? Analyst Suggests Local Bottom May Be Here

05 Octubre 2024 - 12:00AM

NEWSBTC

A CryptoQuant analyst known as “caueconomy” recently published a

post indicating that Bitcoin (BTC) may have reached a local bottom.

The analyst points to a significant liquidation event as a key sign

that a short-term recovery could be on the horizon. Although

caueconomy acknowledged that Bitcoin has been going through a

period marked by bearish price sentiment and technical indicators

suggesting potential further decline, the analyst also highlighted

that emerging signs may indicate a stabilization in the

asset’s price. Related Reading: Bitcoin Miner Selloff Is Calming

Down: Green Sign For Rally To Continue? How Is BTC Long

Liquidations Suggesting Local Bottom? The post by caueconomy on the

CryptoQuant QuickTake platform titled “Liquidation of long

positions may have established a local bottom” sheds light on how

long-position liquidations in the futures market could influence

Bitcoin’s price. Caueconomy elaborates that in the face of notable

price declines, long contracts bought on future exchanges tend to

experience sharp reductions due to mass liquidations. This process,

in turn, diminishes the selling pressure that often exacerbates

price drops, potentially setting the stage for a recovery in the

asset’s price in the short term. On October 1st, over 4,000 BTC

long positions were liquidated, marking the second-largest

liquidation event of 2024 based on data compiled by CryptoQuant.

The analyst mentioned that such significant liquidation events

often indicate potential market reversals or local bottoms, as the

selling pressure from these positions is removed from the market.

However, caueconomy points out that it is crucial to keep a close

eye on the buying strength to gauge whether it can offset the

decline and facilitate recovery. The analyst advises that although

the current range may be sustained in the short term, the potential

for upward movement is contingent on renewed buying interest and

market activity. The analyst concluded in the post: At this point,

the price is likely to sustain the current range in the short term,

but it will be necessary to watch the buying strength to be able to

recover the decline. Is there Any Sign Of Buying Interest In

Bitcoin Currently? So far, Bitcoin appears to be seeing a gradual

rebound in price registering a 3.5% increase in the past day to

reclaim the $62,000 mark. At the time of writing, the asset

currently trades for $62,238. This increase in BTC has been

reflected in the overall crypto market, with the global crypto

market cap now up by 2% in the past day to a current valuation of

2.26 trillion. Meanwhile, a renowned crypto analyst known as Ali on

X recently reported a form of Bitcoin buying interest ongoing on an

exchange. Related Reading: Is Bitcoin On The Brink Of A Reversal?

Here’s What This Key Indicator Suggests In a post uploaded earlier

today on X, Ali pointed out that there has been a surge in the

Taker Buy/Sell Ratio on OKX, the fourth-largest cryptocurrency

exchange by 24-hour trading volume. There was a spike in the

#Bitcoin Taker Buy/Sell Ratio on @okx! This indicates a surge in

aggressive buying — a sign of upward momentum ahead!

pic.twitter.com/QgZ9qkhSls — Ali (@ali_charts) October 4, 2024 This

spike in the ratio indicates an increase in aggressive buying

activity within the market, a potential sign of renewed upward

momentum. Such behavior often reflects increased confidence from

buyers, hinting at the possibility of a price recovery or a new

upward trend. Featured image created with DALL-E, Chart from

TradingView

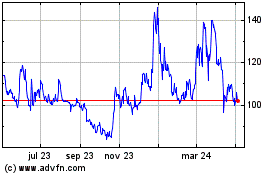

Quant (COIN:QNTUSD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

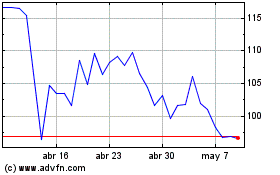

Quant (COIN:QNTUSD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024