Ethereum’s Wild Fluctuations: Here’s What ETH Implied Volatility Tells Us

07 Mayo 2024 - 2:00PM

NEWSBTC

The cryptocurrency market has recently exhibited distinct

divergences in the behavior of its two leading assets, Bitcoin and

Ethereum. While Bitcoin appears to be stepping into a phase of

relative stability, Ethereum’s journey paints a contrasting picture

of sustained uncertainty, particularly in its options market. This

divergence is highlighted by the sustained high levels of implied

volatility associated with Ethereum options, signaling a cautious

outlook among investors regarding its future price movements.

Related Reading: Ethereum Burn Rate Hits Yearly Low: What This

Means For ETH’s Future Ethereum Persisting Volatility: A

Comparative Analysis Implied volatility (IV) serves as a crucial

indicator in the options market, providing insights into the

expected price fluctuations of an asset over a specific period. It

reflects the market’s temperature, gauging the intensity of

potential price movements traders anticipate. Recent analyses

suggest that while Bitcoin’s implied volatility has settled down

significantly post-halving, Ethereum’s has not followed suit. As

Bitcoin’s IV dipped to a multi-month low, indicating a calming

market, Ethereum’s IV remains stubbornly high. Contrary to the

calming waves in the Bitcoin market, Ethereum wrestles with

heightened volatility. According to data from Bitfinex Alpha

Report, Bitcoin’s volatility index sharply declined from 72% at the

time of its latest halving event to about 55%. On the other hand,

Ethereum saw a more modest reduction in its volatility index,

dropping from 76% to 65% in the same period. This persistent

volatility in Ethereum’s market is primarily fueled by

uncertainties surrounding significant upcoming regulatory decisions

and broader market implications. The Ethereum market is

particularly jittery in anticipation of the US Securities and

Exchange Commission’s (SEC) impending decision on two spot Ethereum

ETFs, slated for late May 2024. This upcoming regulatory milestone

is considered a critical event that could either catalyze a major

market move or exacerbate the current volatility. The Bitfinex

Alpha report underscores that regulatory uncertainty is a primary

driver behind Ethereum’s less significant drop in its Volatility

Risk Premium (VRP) compared to Bitcoin’s. ETH And BTC Show Signs of

Recovery Amid Volatility Ethereum and Bitcoin have shown signs of

recovery over the past week in terms of trading performance.

Bitcoin has seen a 4.1% increase, while Ethereum reported a more

modest gain of 2.4%. However, the last 24 hours have been less

favorable for Ethereum, with a slight dip of 0.7%, underscoring the

ongoing volatility and investor caution. Moreover, Ethereum’s

network dynamics also reflect a subdued activity with a marked

decrease in ETH burn rate attributed to reduced transaction

fees. This technical aspect further complements a cautious Ethereum

market narrative, poised on the brink of potentially significant

shifts depending on external regulatory actions. Related Reading:

Bitcoin’s Make-Or-Break Moment: Trading Guru Predicts Rally Amid

Market Uncertainty Despite all these, analysts like Ashcrypto

suggest that the current volatility could set the stage for a

strong rebound in the year’s third quarter. Drawing on historical

patterns, Ethereum’s speculative forecast is potentially reaching

the $4,000 mark, provided market conditions align favorably.

Featured image from Unsplash, Chart from TradingView

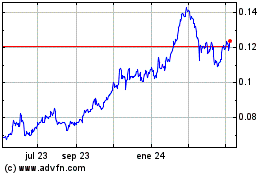

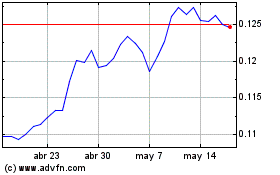

TRON (COIN:TRXUSD)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

TRON (COIN:TRXUSD)

Gráfica de Acción Histórica

De May 2023 a May 2024