Ready To Strike? Bitcoin Poised For A Big Move After Major Consolidation

10 Junio 2024 - 3:30AM

NEWSBTC

Bitcoin (BTC) seems poised for a major breakout, if prominent

analysts are to be believed. The world’s most popular

cryptocurrency has been stuck in a consolidation phase for a

record-breaking 87 days, but experts say this slumbering giant

might be about to awaken with a vengeance. Related Reading: Bitcoin

Buoyed By Big Money: Whales Gobble More BTC, Signaling Bullish

Outlook Charting A Course For Breakout Faibik, a well-known crypto

analyst, has identified a technical pattern on the Bitcoin daily

chart that hints at a potential explosion. This pattern, known as a

Descending Broadening Wedge, suggests a price squeeze that often

precedes a significant breakout. Faibik believes that a surge past

the crucial $71,000 resistance level would be a strong bullish

signal, indicating a potential reversal of the recent downtrend.

$BTC Descending Broadening Wedge formation still in Play on the

Daily timeframe Chart..📈 Once Bitcoin bulls clinch the 71.3k

Crucial Resistance, the Party will start. 🔥🚀 Trust the

Process..✍️#Crypto #Bitcoin #BTC pic.twitter.com/gBas14jIDo —

Captain Faibik (@CryptoFaibik) June 9, 2024 The DBW on the BTC

chart is a sign that the price is getting tighter and tighter,

explained Faibik in a recent post. This typically leads to a

breakout in one direction or another, and based on the current

market sentiment, a bullish breakout seems more likely. A Quick

Bitcoin Price Overview Using trend lines to connect the three lower

highs and three higher lows, the price of bitcoin broke out of the

symmetrical triangle pattern on June 4. Nevertheless, the weekly

resistance at the $71,280 level refused the breakout. At the

$68,500 mark, which is the upper edge of the symmetrical triangle

pattern, BTC is now finding support. Bitcoin might rise 7% to reach

its all-time high of $73,777 if current support holds. Will Bitcoin

Emerge A Bullish Butterfly? Mags, another popular crypto analyst,

takes a slightly different approach. He views the current

consolidation phase as the longest Bitcoin has ever experienced,

surpassing previous periods before significant price increases. The

analyst compares this extended consolidation to a butterfly in its

chrysalis, suggesting a potential transformation on the horizon.

Historically, Bitcoin has exhibited a pattern of consolidation

around all-time highs, followed by a price discovery phase that

precedes sharp price movements, the analyst said. The current

87-day consolidation period shatters previous records, potentially

indicating a massive price move could be in the offing. Mags

highlights prior instances where similar consolidation periods

preceded major bull runs. In 2017, for example, Bitcoin

consolidated for 48 days before a breakout, while in 2020, the

consolidation phase lasted 21 days before a significant price

increase. Related Reading: Scalpers Rejoice! Top Analyst Predicts

Chainlink (LINK) Short-Term Surge The $71.3k Resistance Level Both

Faibik and Mags agree that a breakout from the current

consolidation phase could be a game-changer for Bitcoin. They

advise investors to keep a close eye on the $71,300 resistance

level, as a surge past this point could signal the start of a

bullish trend. Featured image from Buy Sites, chart from

TradingView

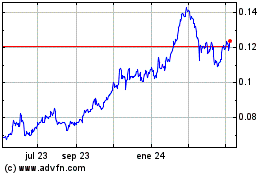

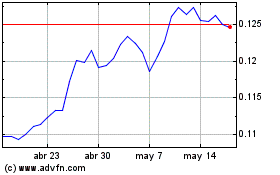

TRON (COIN:TRXUSD)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

TRON (COIN:TRXUSD)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024