Chinese Yuan Advances To 2-day High Against US Dollar

10 Septiembre 2009 - 7:29PM

RTTF2

Friday during Asian deals, the Chinese yuan advanced to a 2-day

high against its US counterpart as slew of economic reports

released from China indicated a strengthening recovery in the

world's third-biggest economy.

Industrial production was up 12.3 percent on year, topping

forecasts for an 11.9 percent annual increase after the 10.8

percent gain a month earlier.

Urban fixed asset investment for the period of January to August

was up 33 percent on year beating economists' expectations. That

was more than a 32.9 percent gain through July and the 32.7 percent

median estimate in the survey of economists.

Consumer prices in China were down 1.2 percent on year in

August, the National Bureau of Statistics said today - slightly

below forecasts for a 1.3 percent decline after the 1.8 percent

contraction in July.

Producer prices declined 7.9 percent on year versus expectations

for a 7.8 percent annual contraction after the 8.2 percent fall on

year in the previous month.

Retail sales also were roughly in line, gaining 15.4 percent on

year compared to forecasts for a 15.3 percent increase following

the 15 percent gain in July.

Chinese shares rose today after better economic reports.

Yesterday, China's Premier Wen Jiabao said the government does not

have any plan to withdraw stimulus measures now as it wants to see

stable and strong economic growth.

In a speech at the World Economic Forum in Dalian, a city in

China, Wen said China's economic recovery is unstable, unbalanced

and not yet solid.

"We cannot and will not change the direction of our policies at

such an inappropriate time," he said.

The Chinese yuan traded higher against its US counterpart during

Friday's early Asian trading. The yuan is now trading at 6.8287

versus the buck, and if it rises further 6.82 is seen as the next

target level. At Thursday's New York session close, the pair was

quoted at 6.8302.

The People's Bank of China has set today's central parity rate

for the dollar-yuan pair at 6.8282. The pair is allowed to move 5%

above or below the target rate.

From U.S, the Department of Commerce will release its import and

export price reports for August at 8:30 am ET.

At 10:00 am ET, the Commerce Department is due to release its

wholesale inventories report. Economists expect wholesale

inventories at the end of July to show a 0.1% decline.

The preliminary reading of the University of Michigan's consumer

sentiment index for September is due to be released at the same

time. The report is expected to show that the consumer sentiment

index rose to 67.5 in the month.

In early trading on Friday, the Chinese yuan slid to its lowest

level since December 18, 2008 against the euro. The yuan touched

9.9763, with 10.05 seen as the next downside target level. At

Thursday's New York session close, the pair was quoted at

9.9603.

The People's Bank of China has set today's central parity rate

for the euro-yuan pair at 9.8027.

In the European session, Italian July industrial production and

European central bank's monthly report are expected.

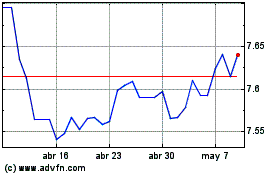

Euro vs CNY (FX:EURCNY)

Gráfica de Divisa

De Abr 2024 a May 2024

Euro vs CNY (FX:EURCNY)

Gráfica de Divisa

De May 2023 a May 2024