TIDMDATA

RNS Number : 5942X

GlobalData PLC

21 December 2023

21 December 2023

FOR IMMEDIATE RELEASE

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE MARKET ABUSE REGULATION (596/2014/EU) AS THE

SAME HAS BEEN RETAINED IN UK LAW AS AMENDED BY THE MARKET ABUSE

(AMENDMENT) (EU EXIT) REGULATIONS (SI 2019/310) ("UK MAR").

GlobalData Plc

(AIM: DATA; "GlobalData", "the Company", "the Group")

GlobalData announces a Group reorganisation and enters into a

transformational investment agreement with Inflexion for a

significant minority stake in its Healthcare division

Highlights

-- Launch of new growth plan and Group reorganisation to operate

across three customer-focused divisions - Healthcare, Consumer, and

Technology.

-- Inflexion acquires a 40% shareholding in GlobalData's

Healthcare division at a valuation of GBP1,115m, which represents a

22x multiple of June 2023 LTM EBITDA for the division (on a

standalone basis).

-- This compares to a market capitalisation of GBP1,352m for the

entire GlobalData Group (at the close of market on 20 December).

The Healthcare division represented 36% of GlobalData Group's June

2023 LTM revenue.

-- GlobalData Plc expects to receive net cash proceeds of

approximately GBP434m, which will provide flexibility for

accelerated value-creating M&A across the Group.

-- GlobalData Plc will own the remaining 60% of GlobalData

Healthcare, which will continue to be a fully consolidated

subsidiary of GlobalData Plc.

-- Transaction is expected to close during Q2 2024.

Mike Danson, CEO of GlobalData, said: "This is a significant

milestone in GlobalData's evolution, and we are delighted to

welcome Inflexion as a shareholder in our Healthcare division. The

investment highlights the significant value in our unique data

platform and gives us the flexibility to launch a more ambitious

approach to growth investment across our portfolio. We believe that

we can create substantial value for all shareholders and accelerate

GlobalData's profitable growth over the coming years."

David Whileman, Partner and Head of Partnership Capital at

Inflexion, said: "GlobalData is renowned for creating data and

analytical insight for its clients across many verticals. We are

really excited about our partnership with them to carve out and

expand an independent Healthcare division. This is a tried and

tested strategy we've successfully pursued many times and another

example of Inflexion being the leading minority investment

partner."

Group Reorganisation and Investment by Inflexion

Background

Fuelled by the Growth Optimisation Plan, GlobalData Group

revenues have grown by more than 50% over the last five years, from

GBP178m in 2019 to over GBP270m expected in 2023. GlobalData now

serves more than 4,700 customers with its world class

multi-industry platform. The Group has been strategically

transformed with significant organic investment across technology

and AI, enhanced go-to-market capabilities, as well as an excellent

track record of value creating M&A.

One of the most important pillars in the Growth Optimisation

Plan is Customer Obsession. The focus has been to 1) develop a

trusted, global brand synonymous with delivering exceptional

customer value and service; 2) build a global community of engaged

industry professionals; and 3) maintain a customer-centric culture

that informs the Group's strategy, operating model, and business

decisions. The success of GlobalData's Healthcare division

highlights the tremendous growth and value opportunity from a

focused approach to Customer Obsession. Under the new growth plan,

GlobalData will elevate its customer-focused approach throughout

the group, driving value-enhancing revenue and margin

expansion.

GlobalData will host a capital markets event in Q1 2024 to

provide further detail on the new growth strategy.

Investment by Inflexion

Monument Bidco Limited (an investment vehicle wholly owned by

funds managed or advised by Inflexion Private Equity Partners LLP

("Inflexion")) has agreed to acquire a 40% minority shareholding in

Washington Topco Limited ("Topco"), a new entity established as the

holding vehicle for GlobalData's Healthcare division. GlobalData

expects to receive net cash proceeds of approximately GBP434m. The

investment by Inflexion, a leading investor in the sector,

represents a strong endorsement and provides a meaningful partner

to drive the Healthcare division's growth. The majority

shareholding of 60% in Topco will remain with GlobalData, and Topco

and its subsidiaries will continue to be fully consolidated

subsidiaries of GlobalData. The Transaction is expected to close

during Q2 2024 and is subject to regulatory clearance and

completion of the reorganisation of the Healthcare division into a

separate corporate group headed by Topco.

GlobalData Healthcare's subscription service offers a one-stop

solution for over 2,000 global customers across large global

pharma, pharma & biotech, pharma suppliers, professional

services and medical devices manufacturers. The proprietary

Intelligence Centre platform that the business has developed

provides actionable insights into trends related to drugs, trials

and therapeutic reports, supporting research and development of

pharmaceuticals, and ultimately informing business intelligence

decisions. The division generated June 2023 LTM EBITDA of GBP50m

(on a standalone basis).

The Transaction represents a compelling crystallisation of value

for shareholders, with the Group receiving a significant cash

injection to fuel growth and demonstrates the significant value of

its mission-critical data. The implied value for the Healthcare

division on a debt free, cash free basis is GBP1,115m, which

compares to a market capitalisation of GBP1,352m for the entire

Group (as at close of market on 20 December).

Following the completion of the Transaction, it is anticipated

that GlobalData's balance sheet will go from net debt of GBP230.8m

(as at 30 June 2023), equivalent to 2.3x leverage, to being

debt-free and net cash. As well as improving the profitability and

cash flow of the Group, the de-levered balance sheet allows

management additional flexibility to accelerate value-creating

M&A across the Group.

GlobalData and Inflexion have entered into a shareholders'

agreement, which will take effect from completion of the

transaction, in order to govern the relationship between them.

GlobalData will, save in very limited circumstances, have a

majority of the voting rights on the Board of Directors of

GlobalData Healthcare. Furthermore, in addition to his role as CEO

of GlobalData, Mike Danson will serve as Executive Chairman of

GlobalData Healthcare.

GlobalData and Inflexion have also agreed to certain customary

provisions in relation to minority protections, shareholder consent

rights and exit provisions, including drag rights for either

shareholder in certain circumstances (subject to a customary right

of first offer for the other shareholder).

ENQUIRIES

GlobalData Plc

0207 936

Mike Danson, Chief Executive Officer 6400

Graham Lilley, Chief Financial Officer

J.P. Morgan Cazenove (Nomad, Joint Corporate Broker 0203 493

and Sole Financial Advisor) 8000

Bill Hutchings

Mose Adigun

Alex Bruce

0207 886

Panmure Gordon (Joint Broker) 2500

Rupert Dearden

Dougie McLeod

Deutsche Numis (Joint Broker)

Nick Westlake 0207 260

Iqra Amin 1000

0203 727

FTI Consulting (Financial PR) 1000

Edward Bridges

Dwight Burden

Emma Hall

J.P. Morgan Cazenove is acting as Sole Financial Advisor to

GlobalData Plc. Reed Smith LLP is acting as legal counsel to

GlobalData.

J.P. Morgan Securities plc, which conducts its UK investment

banking activities as J.P. Morgan Cazenove ("J.P. Morgan

Cazenove"), and which is authorised in the United Kingdom by the

Prudential Regulation Authority and regulated in the United Kingdom

by the Financial Conduct Authority and the Prudential Regulation

Authority, is acting exclusively as sole financial adviser for

GlobalData Plc and no one else in connection with the Transaction

and shall not be responsible to anyone other than GlobalData Plc

for providing the protections afforded to clients of J.P. Morgan

Cazenove or its affiliates, nor for providing advice in connection

with the Transaction or any other matter referred to herein

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCTBBFTMTTTMTJ

(END) Dow Jones Newswires

December 21, 2023 02:00 ET (07:00 GMT)

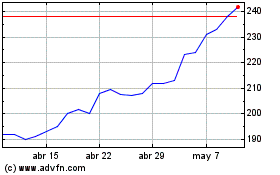

Globaldata (LSE:DATA)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Globaldata (LSE:DATA)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024