TIDMIGG

RNS Number : 3713M

IG Group Holdings plc

14 September 2023

14 September 2023

LEI No: 2138003A5Q1M7ANOUD76

IG GROUP HOLDINGS PLC

First Quarter Revenue Update

'Solid Group revenue performance set against much softer market

conditions, driven by strong client retention rates and continued

high levels of client money balances.'

IG Group Holdings plc, the home of active traders worldwide,

today issues its scheduled revenue update for the three months to

31 August 2023 ("Q1 FY24"), representing the first quarter of the

financial year ending 31 May 2024 ("FY24").

Business performance

Total revenue of GBP242.9 million reflected the benefit of

business diversification over the past few years, as some

moderation in OTC derivatives revenue in the quarter was offset by

exchange traded derivatives and stock trading, both of which grew

revenues significantly year over year.

Total revenue by product Q1 FY24 Q1 FY23 % Change

(GBPm)

OTC derivatives 182.7 199.0 (8%)

Exchange traded derivatives 49.8 36.4 37%

Stock trading and investments 10.4 6.4 61%

Total revenue 242.9 241.8 -

------------------------------- -------- -------- ---------

Similar to trends seen in Q4 FY23, a decrease in net trading

revenue reflected substantially lower volatility across a range of

asset classes, which was more than offset by strong growth in

interest income, which resulted from a combination of higher

interest rates and stable client money balances from the year

end.

Net interest income within total revenue was GBP34.4 million (Q1

FY23: GBP7.1 million). Of this, GBP11.8 million related to OTC

derivatives (Q1 FY23: GBP1.2 million), GBP18.0 million was

attributable to exchange traded derivatives (Q1 FY23: GBP5.6

million) and GBP4.6 million related to stock trading and

investments (Q1 FY23: GBP0.3 million).

Total revenue by portfolio Q1 FY24 Q1 FY23 % Change

(GBPm)

Core Markets+ 188.7 200.3 (6%)

High Potential Markets 54.2 41.5 30%

Total revenue 242.9 241.8 -

---------------------------- -------- -------- ---------

Total revenues within the Core Markets+ portfolio reduced by 6%

to GBP188.7 million, reflecting softer market conditions through

most of the quarter, although client money balances remained

strong, indicating clients' interest in and propensity to trade

when they see opportunities in the market.

Within the High Potential Markets portfolio, tastytrade achieved

another record level of quarterly total revenue (USD), which

increased by 48% to $60.0 million; on a reported GBP basis, total

revenues increased 39% to GBP47.1 million (Q1 FY23: GBP33.9

million). Within total revenue, net trading revenue increased by

10% and 3% in USD and GBP terms, respectively, to $37.1 million (Q1

FY23: $33.8 million) and GBP29.1 million (Q1 FY23: GBP28.3

million). Total client equity on the platform reached record levels

with average balances in the quarter up 9% on the prior quarter, as

we continue to attract large balance accounts.

Total active clients across the Group in the quarter were

267,000 (Q1 FY23: 279,300), a resilient performance reflecting the

quality of our clients and our ability to engage and retain client

cohorts through superior technology, trade execution, and overall

customer service.

Total client money balances of GBP4.1 billion remained stable on

the year end balances as clients maintained their interest in

trading financial markets around the world.

Capital update

In July, the Board announced a GBP250 million share buyback

programme. The first tranche of GBP100 million commenced during the

quarter. As at 12 September, approximately 5.9 million shares have

been re-purchased, at a cost of GBP39.6 million. The first tranche

is anticipated to be completed on or before 12 December 2023.

On 1 January 2022, the Group transitioned to the Investment Firm

Prudential Regime ("IFPR"). Following our first Supervisory Review

and Evaluation Process ("SREP") under the new regime, the Group's

regulatory capital requirement reduced from GBP497 million at 31

May 2023 to GBP290 million as at 31 August 2023, evidencing the

high quality and strength of our risk management frameworks and

controls, following years of steady investment and development. The

Group continues to be highly cash-generative, and this reduction in

our regulatory capital requirement further strengthens our

financial capacity for strategic growth initiatives and to deliver

distributions to our shareholders. The Board will continue to

allocate capital in a disciplined manner, in line with our Capital

Allocation Framework adopted last year.

Outlook

The Group remains confident of achieving its medium-term

targets. We are progressing with plans to drive even greater cost

efficiency, leveraging the scale advantages that we have as a

global Group.

As announced on 29 August 2023, the Board has commenced a

comprehensive search process for a permanent CEO and expects to

make an appointment in the coming months.

The Group's next scheduled market announcement will be the half

year FY24 results in January 2024.

For further information, please contact:

IG Group Investor IG Group Press FTI Consulting

Relations

Martin Price / Simon Angela Warburton / Alayna Edward Berry / Katherine

Wright Francis Bell

07703 330 199 / 079 7687

020 7573 0020 / 0099 020 7633 5382 / 5395 0961

investors@ig.com press@ig.com edward.berry@fticonsulting.com

/ katherine.bell@fticonsulting.com

Disclaimer - Forward-looking statements

This statement, prepared by IG Group Holdings plc (the

"Company"), may contain forward-looking statements about the

Company and its subsidiaries (the "Group"). Such forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believes", "projects",

"estimates", "plans", "anticipates", "targets", "aims",

"continues", "expects", "intends", "hopes", "may", "will", "would",

"could" or "should" or, in each case, their negative or other

various or comparable terminology.

Forward-looking statements involve known and unknown risks,

uncertainties, assumptions and other factors which are beyond the

Company's control and are based on the Company's beliefs and

expectations about future events as of the date the statements are

made. If the assumptions on which the Group bases its

forward-looking statements change, actual results may differ from

those expressed in such statements. There are a number of factors

that could cause actual results and developments to differ

materially from those expressed or implied by these forward-looking

statements, including those set out under "Principal Risks" in the

Company's annual report for the financial year ended 31 May 2023.

The annual report can be found on the Company's website

(www.iggroup.com).

Forward-looking statements speak only as of the date they are

made. Except as required by applicable law and regulation, the

Company undertakes no obligation to update these forward-looking

statements. Nothing in this statement should be construed as a

profit forecast.

About IG

IG Group (LSEG:IGG) is an innovative, global fintech company

that delivers dynamic online trading platforms and a robust

educational ecosystem to power the pursuit of financial freedom for

the ambitious. For nearly 50 years, the Company has evolved its

technology, risk management, financial products, and education and

content to meet the needs of its retail and institutional clients.

IG Group continues to innovate its offering for the new generation

of tomorrow's investors through its IG, tastytrade, IG Prime,

Spectrum, and DailyFX brands.

Established in 1974, IG Group is a London-headquartered FTSE 250

company offering its clients access to 19,000 financial markets

through its offices spread across Europe, North America, Africa,

Asia-Pacific and the Middle East.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTKZGMLVFZGFZM

(END) Dow Jones Newswires

September 14, 2023 02:00 ET (06:00 GMT)

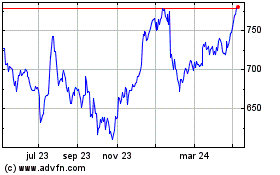

Ig (LSE:IGG)

Gráfica de Acción Histórica

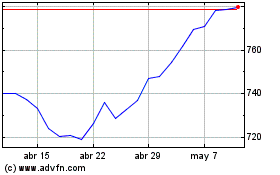

De Abr 2024 a May 2024

Ig (LSE:IGG)

Gráfica de Acción Histórica

De May 2023 a May 2024