TIDMIOG

RNS Number : 7713F

IOG PLC

12 July 2023

12 July 2023

IOG plc

Half-Year Operational Update

IOG plc ("IOG", or "the Company"), (AIM: IOG.L) provides an

operational update in advance of the Company's half-year 2023

results. The information contained herein has not been audited and

may be subject to further review. An accompanying presentation is

available on the IOG website and can be accessed via this link:

https://bit.ly/3LuKbPW

Rupert Newall, CEO, commented:

"Following the successful intervention and production ramp up,

the Blythe H2 gas rate has stabilised at 32 mmscf/d, within the

30-40 mmscf/d pre-well guidance range, with no indication of

formation water. As expected, initial H2 production data indicates

better reservoir quality than at H1 and supports our existing

Blythe gas in place and reserves estimates. We expect 2H23

production to average in the 20-30 mmscf/d range.

The team has significantly improved operating performance over

1H23, delivering 93% operating efficiency and a cost reduction

programme tackling both opex and overheads. In parallel we continue

the constructive dialogue with bondholders to address balance sheet

challenges caused by the Southwark A2 result and the sharp fall in

the gas market.

As a new management team, we have been reassessing the most

efficient strategy to create value for our stakeholders based on

operating data since First Gas in 2022 and updated technical

evaluation of the risks and rewards across the portfolio. In

addition to the established Saturn Banks production infrastructure

position, the portfolio comprises high permeability conventional

reservoirs as well as tighter gas reservoirs which require

stimulation. Whilst the latter have clear potential, the

conventional fields can deliver more compelling returns on capital

with lower development risk. Strategically, therefore, we plan to

prioritise these opportunities, from the Western Cluster (Blythe

and Elgood) to the Southern Cluster (Kelham, Abbeydale, Orrell) and

the Central Cluster, where our latest technical work indicates

conventional discovered gas development potential at Grafton and

Tenby.

Our "Conventional Core" incremental investment case illustrates

this potential for efficient capital deployment. This has a

management estimated unrisked pre-tax IRR of over 90% at an average

gas price of 75 p/therm (well below today's forward curve), which

would be substantially derisked by a successful Kelham appraisal

well. The broader portfolio has also extensive value to unlock

beyond this, which could be further enhanced if we are successful

in our nine 33(rd) Round block applications."

1H23 Operating Highlights

1H23 FY22

Gross average gas

rate mmscf/d 13.8 21.0

------------- ------ ------

Operating efficiency % 93.3% N/A

------------- ------ ------

Production efficiency % 81.4% 58.6%

------------- ------ ------

Net gas sales mmscf 511 3,444

------------- ------ ------

Average realised

gas price p/therm 124.0 201.4

------------- ------ ------

Net condensate sales MT 1,764 5,339

------------- ------ ------

Average condensate

price $/MT 599 805

------------- ------ ------

per 200,000

TRIR(1) hours 3.5 3.6

------------- ------ ------

Emissions intensity(2) kgCO e/boe 1.1 0.8

------------- ------ ------

Blythe Production

-- The H2 well gross gas rate tested at 42 mmscf/d directly

after the faulty downhole valve had been fully opened. The

subsequent gas rate ramp-up has stabilised at 32 mmscf/d, within

the pre-well 30-40 mmscf/d guidance range.

-- Initial H2 production data is in line with pre-well expectations:

o Better reservoir quality at H2 than at H1 area

o Indications that communication exists between H2 and H1

area

o No indication of formation water production from H2

o Consistent with remaining reserves estimates (FY2022: 1P / 2P

/ 3P 24.6 / 42.3 / 46.8 billion cubic feet equivalent (BCFE)

-- Gross 2H23 production is expected to average in the 20-30

mmscf/d range, based on initial decline rate expectations

o Perenco Bacton terminal annual maintenance shutdown expected

in Q3

-- Reduction in water production is expected to reduce unit opex

-- Shelf Drilling Perseverance rig has demobilised from Blythe

with the associated mandatory shut-in completed within three

days

o Rig and associated vessel contracts in process of being

terminated

Initial 1H23 Financial Information

-- Revenue before sales deductions in the period of GBP9.5m,

impacted by lower production rates, lower gas prices and higher

partner royalty payments

o In periods of declining production and gas prices, the joint

venture royalty formula increases the reduction in effective net

economic interest beyond 20.2% of IOG's net 50% working interest,

however in periods of higher production and gas prices this effect

can reverse

o The royalty is applicable to revenues from Blythe, Elgood and

Southwark and is capped at GBP91m; total aggregate royalty paid to

date is GBP16.1m

-- Cash balance at 30 June 2023 of GBP20.3m, of which GBP7.3m restricted

-- Maximising near-term cash flow remains a key priority ; capital expenditure being minimised

-- Ongoing constructive engagement with bondholders on near-term

liquidity and longer-term capital structure solutions

Saturn Banks Portfolio: strategic focus on conventional gas

Conventional discovered gas opportunities

-- Blythe: Potential for limited periodic H1 gas flow later in 2023, in addition to H2

-- Elgood: Further production targeted from existing well by

2024 from limited remaining reserves

-- Kelham: subject to funding, successful appraisal would open

up the Southern Cluster that includes the conventional gas

discoveries Abbeydale and Orrell

o Dual-lateral appraisal well would test both Kelham North and

Kelham Central structures

-- P2589 licence (part of Central Cluster): ongoing subsurface

re-evaluation indicates two conventional discovered gas

opportunities with development potential as subsea tiebacks to the

Southwark platform c.17km to the southwest:

o Grafton (formerly Sinope South)

o Tenby (previously Callisto North, initially developed in

2000)

o Both to be further defined technically and economically

o Additional conventional exploration prospects on block: Forest

Row and Brockley

-- Positive 33(rd) Licensing Round interviews held in May 2023

for nine SNS block applications which could add further

conventional and tight gas resources to the Saturn Banks

portfolio

Ongoing re-evaluation of tight gas assets

-- Southwark re-evaluation continues; further technical and

economic justification required for any return to A1 or A2

wells

-- Nailsworth and Elland subsurface and deliverability to

undergo further technical review over 2H2023 in light of Southwark

A2 learnings

-- Goddard due to be appraised by 31 March 2024 pursuant to

licence terms and up to 50% has been offered for farm-out by the

IOG-CalEnergy Resources (UK) Ltd joint venture

Incremental investment cases

Based on the latest subsurface and engineering work, two

incremental investment scenarios have been worked up that

demonstrate the significant value in the Saturn Banks portfolio.

The economics benefit from extensive synergies given the

established production infrastructure already in place.

Both scenarios also benefit from IOG's material tax loss and

investment allowance position, which as at 31 December 2022

included ring fence(3) tax losses of GBP239.3m and Energy Profits

Levy losses of GBP21.0m and non-ring fence losses of GBP24.2m.

Conventional Core incremental development scenario

-- Southern and Central Cluster conventional fields only

(includes Kelham North/Central which is subject to appraisal)

-- Base case gross unrisked recoverable resources of 239 BCF

-- Entirely focused on higher permeability reservoirs that do not require stimulation

-- 6 conventional subsea wells (3 per cluster): IOG classification: Tie back developments

-- Tied back to Southwark platform and delivered into Bacton via

Saturn Banks Pipeline System (SBPS)

-- Base case monthly peak gross gas rate of 142 mmscf/d

-- First gas 26 months from initial Final Investment Decision

-- Estimated pre-production gross capex of GBP284m; total capex

including compression, decommissioning and contingencies of GBP368m

(15.4 p/therm)

-- Gross project pre-tax Internal Rate of Return (IRR):

o 92% at average gas price of 75 p/therm

o 124% at average gas price of 100 p/therm

Full Portfolio incremental development scenario

-- Southern, Central and Northern cluster conventional and tight gas assets (includes both Kelham North/Central and Goddard, both subject to appraisal) plus certain 33(rd) Round assets (subject to successful award)

-- Base case gross unrisked recoverable resources of 591 BCF

-- 7 conventional and 11 tight gas wells

-- Two additional unmanned platforms, with tiebacks via the

Blythe and Southwark platforms into the SBPS and on to Bacton

-- Base case monthly peak gross gas rate of 239 mmscf/d

-- First gas 23 months from initial Final Investment Decision

-- Estimated pre-production gross capex of GBP743m; total capex

including compression, decommissioning and contingencies of

GBP1,091m (18.5 p/therm)

-- Gross project pre-tax Internal Rate of Return (IRR):

o 63% at average gas price of 75 p/therm

o 89% at average gas price of 100 p/therm

(1) TRIR is a 12-month rolling measure including all incidents

reportable by law to UK regulators, irrespective of size or

consequence, whether involving IOG personnel, duty holders or

contractors, per 200,000 hours worked

(2)Emissions intensity measures Scope 1 and 2 emissions in

kilograms of carbon dioxide equivalent per barrel of oil equivalent

produced

(3)Ring-fence tax losses are losses applicable under the Ring

Fence Corporation Tax (30%) and Supplementary Charge Tax (10%) that

are levied on companies involved in exploration and production

activities on the UK Continental Shelf

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the company's obligations under Article 17 of MAR.

Enquiries:

IOG plc

Rupert Newall (CEO)

James Chance (Head of Capital Markets & ESG) +44 (0) 20 7036 1400

finnCap Ltd

Christopher Raggett / Simon Hicks +44 (0) 20 7220 0500

Peel Hunt LLP

Richard Crichton / David McKeown +44 (0) 20 7418 8900

Vigo Consulting

Patrick d'Ancona / Finlay Thomson +44 (0) 20 7390 0230

About IOG:

IOG is a UK developer and producer of indigenous offshore gas.

The Company began producing gas in March 2022 via its offshore and

onshore Saturn Banks production infrastructure. In addition to its

production assets, IOG operates several UK Southern North Sea

licences containing gas discoveries and prospects which, subject to

future investment decisions, may be commercialised through the

Saturn Banks infrastructure. All its assets are co-owned 50:50 with

its joint venture partner CalEnergy Resources (UK) Limited. Further

details of its portfolio can be found at www.iog.co.uk .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDELLBFXDLXBBK

(END) Dow Jones Newswires

July 12, 2023 02:00 ET (06:00 GMT)

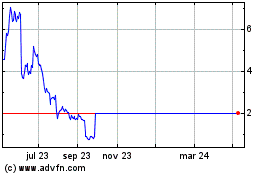

Iog (LSE:IOG)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Iog (LSE:IOG)

Gráfica de Acción Histórica

De May 2023 a May 2024