TIDMJGC

RNS Number : 8507F

Jupiter Green Investment Trust Plc

13 July 2023

Jupiter Green Investment Trust plc ('the company')

Legal Entity Identifier: 549300MFRCR13CT1L845

Annual Financial Results for the year ended 31 March 2023

Financial Highlights for the year ended 31 March 2023

Capital Performance As at As at

31 March 31 March

2023 2022

Total assets less current liabilities (GBP'000) 54,578 55,390

Ordinary Share Performance As at As at

31 March 31 March % change

2023 2022

Mid-market price (p) 224.00 210.00 +6.7

Undiluted net asset value per ordinary

share 258.58 258.43 +0.0

Diluted net asset value per ordinary share 259.86 259.18 +0.3

MSCI World Small Cap Index*** 390.67 412.12 -5.2

Discount to net asset value (%) 13.37 18.74

Ongoing charges ratio (%) excluding finance

costs (Note 6) 1.72 1.57

Performance (excluding dividend income) Since Launch

Year-

on-year

Net asset change in Year-

Total assets value Dividends Net Asset on-year

less per declared Value per change in

per

current ordinary ordinary ordinary benchmark

Year ended 31 March liabilities share share share index***

GBP'000 p p % %

8 June 2006 (launch) 24,297 97.07 - - -

2007 31,679 118.07 - +22.3* -

2008 52,734 114.14 - -3.9** -

2009 33,809 76.86 - -32.7 -36.5

2010 43,590 106.65 - +38.8 +41.6

2011 41,085 120.49 0.40 +13.0 +11.0

2012 36,181 108.49 0.60 -10.0 -23.8

2013 37,571 124.42 1.20 +14.7 +10.3

2014 38,142 145.00 1.10 +16.5 +28.6

2015 38,545 152.35 0.55 +5.1 +10.6

2016 33,418 150.79 0.65 -1.0 -3.3

2017 38,509 184.33 1.20 +22.2 +28.4

2018 40,147 191.31 1.30 +3.8 +3.7

2019 35,934 188.70 2.20 -1.4 +6.0

2020 32,581 173.31 2.40 -8.2 +3.4

2021 53,304 266.73^ 0.64 +53.9 +61.0

2022 55,390 258.43 0.00 -3.1 +2.6

2023 54,578 258.58^ 0.00 0.0 -5.2

* In September 2006, new ordinary shares totalling 1,058,859

were issued and in November 2006, new ordinary shares totalling

600,000 were issued. Investment performance adjusted for the new

issues of Ordinary shares.

** In April, July and August 2007, new ordinary shares totalling

20,249,074 were issued and a total of 737,963 ordinary shares were

cancelled in March 2008. Investment performance adjusted for the

new issues and the subsequent cancellation of shares.

*** With effect from 2 September 2020 the Company

retrospectively changed its benchmark from the FTSE ET100 Total

Return Index to the MSCI World Small Cap Index, both expressed in

sterling terms.

^ Being the exercise price for the purposes of the 2023 subscription rights.

No final dividend will be paid.

Strategic Report

Chairman's Statement

Performance

Against the backdrop of a tumultuous year in 2022 in which the

Russian invasion of Ukraine led to sharply rising fossil fuel

prices and the inflationary pressures that ensued continued to

dominate market sentiment, we are pleased to present the Annual

Report and Accounts for your Company for the twelve months to 31

March 2023.

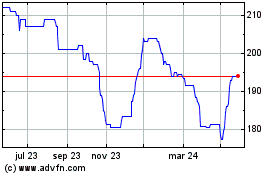

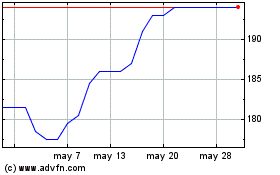

The Company's Net Asset Value total return delivered -0.4%,

outperforming the wider Global small Cap index, -3.1%. The

Company's share price however delivered a +6.7% return over the

same period.

It is encouraging that the absolute return of the portfolio over

the 12-month period was positive, although this should be viewed in

the context of a volatile year for equity markets, in particular

environmental solutions companies, in the face of significant macro

and geopolitical headwinds, and one in which the NAV of the Company

sharply recovered from the lows in 2022.

The Company's 12-month financial reporting period covers the

entire timeframe since Russia's invasion of Ukraine in February

2022, which catalysed an inflationary crisis in the global economy

and an orchestrated effort by central banks to tame inflation with

tighter monetary policy, making for an extremely challenging

environment for all investors, particularly those focused on

smaller companies in the early stages of their growth.

Energy has undoubtedly been the area of greatest disruption

feeding inflationary pressures into all sectors which rely on

fossil fuels. This fossil fuel energy shock highlights how critical

energy systems are to everyday life and living standards.

Furthermore, that environmental solutions - on both the demand and

supply-side of the energy equation - are pivotal to urgently

shaping sustainable and resilient energy systems.

Last summer, new legislation providing the greatest support for

environmental solutions in the history of the United States passed

into law. Yet you would hardly have known it from the name. The

Inflation Reduction Act of 2022 (IRA), signed into law by President

Joe Biden on 16 August 2022, was originally billed as the 'Build

Back Better Act', but neither name reflects the true intentions

behind the law - combatting climate change and reinvigorating US

industrial and strategic policy in the process.

Not only does the IRA give the US a meaningful chance of meeting

its greenhouse gas reduction targets of 40% below 2005 levels by

2030, but it also presents an unprecedented catalyst for companies

in the environmental solutions space. The IRA provides $369 billion

of spending over ten years, including $158bn on clean energy, $13bn

on electric vehicle incentives, $14bn in home energy efficiency

upgrades, and $22bn in home energy supply improvements. Moreover,

there is upwards of $37bn for simple, effective advanced

manufacturing incentives that have already begun to shift the

corporate investment landscape.

In response, the EU's Net-Zero Industry Act and European

Critical Raw Materials Act, both part of a Green Deal Industrial

Plan and dubbed the 'EU IRA', are designed to prevent the bloc

falling further behind. The proposed legislation sets a headline

benchmark of ensuring that at least 40% of low-carbon technology

needs are met by manufacturing within the EU by 2030.

The pace and scope of this investment, and the regulatory change

that accompanies, provides a welcome boost to the universe of

environmental solutions businesses. Naturally, there will be both

winners and losers from any process of change. Ultimately, thematic

investment is an acceptance of, and appetite for, the future to be

different to the past. By capturing structural growth opportunities

through economic cycles, the Company's investment managers seek to

provide investors with above-market returns over the long term.

While the structural growth opportunity is accelerating, so too is

its complexity, placing specialist active managers at an

advantage.

Discount management

The Board remains committed to its stated policy of using share

buy-backs with the intention of ensuring that, in normal market

conditions, the market price of the company's shares will track

their underlying net asset value.

The discount at which the ordinary shares trade was 13.4% as at

the 31 March. During the year the Company's shares traded at a

discount to its NAV ranging between -6.5% to -25%. The Board

continues to monitor the level at which the Company's shares trade

and may seek to limit any future volatility through the prudent use

of share buybacks, as the circumstances require. The company bought

back a total of 328,726 shares for cancellation at an average

discount of 14.4%, adding 0.3% to NAV.

Subscription issue

Each year shareholders are entitled to subscribe for new

ordinary shares on the basis of one new ordinary share for every

ten held. This year, the subscription price was 258.43 (being the

audited undiluted net asset value of the ordinary shares as at 31

March 2022). The prevailing market price on the subscription date

was 224p. As such a small number of subscription requests received

resulting in the issue of 13,639 ordinary shares from treasury.

Board succession

We were delighted to welcome Baroness Bryony Worthington to join

the Board as non-executive director in September 2022. Bryony has a

wealth of experience in the environmental campaigning and policy,

with time spent at Friends of the Earth the Department for

Environment, Food and Rural Affairs working as the lead author in

the team which drafted the UK's 2008 Climate Change Act. Bryony

launched Sandbag in 2008 to raise public awareness of and improve

the European Union's Emissions Trading Scheme (ETS).

Life of the company

The company does not have a fixed life, however, the Board

considers it desirable that shareholders should have the

opportunity to review the future of the company every three years.

Accordingly, the directors will propose Resolution 10 of the notice

of the meeting, as an ordinary resolution for the continuation of

the company in its current form at the AGM of the company to be

held on 14 September 2023. The Directors have no indication that

the vote will not pass and will all be voting in favour of

continuation, and we encourage shareholders to do the same.

Outlook

The Jupiter Environmental Solutions team has a long-established

record of investing in emerging and established Green technologies,

and it is their long-held conviction that solving environmental

challenges will be critical to continued global development.

Addressing both the causes and effects of these climate

challenges will become inevitable, and as such Environmental

Solutions as an asset class are no longer deemed peripheral. The

development of technologies through innovation are key to

combatting the world's climate and environmental crisis. These

solutions are now setting the pace for policy and regulation - a

welcome reversal to the previous relationship. The scale of change

required to reverse global warming is creating significant

opportunities for investors to support environmental solutions

companies, which provide products and services which are critical

to achieving sustainability targets. It is becoming ever more

evident that these solutions will spread widely and to as-yet

unpenetrated sectors of the global economy.

Governments are likely to continue to play a major role, in

terms to encouraging the development of environmental solutions as

part of the path to achieving net zero by 2050, and through the

regulation of all companies to improve transparency around climate

and biodiversity impact.

As attitudes toward addressing climate solutions shift, there is

a broadening of the value chain beyond the conventional lens. The

opportunities throughout the market that this creates will be

plentiful and we firmly believe the Jupiter Green Investment Trust

remains well-positioned to identify them.

Michael Naylor

Chairman

12 July 2023

Investment Adviser's Review

Market review

The first several months of the period under review were

characterised by a continued slump in global stock and bond markets

as concerns grew around persistent inflation, moderating economic

growth and hawkish central bank policy. In Europe, energy prices

surged as Russia cut supplies in retaliation for sanctions related

to the war in Ukraine. In China, the economy was constrained by a

faltering property market and lockdowns intended to control

COVID-19.

Markets began to pick up in the second half of 2022 and into the

first quarter of 2023, latterly due to investor optimism from

China's reopening. European stocks benefited in-part from being one

of their largest trading partners and the market continued to

rebound in the region on falling natural gas prices and improving

investor sentiment from depressed levels. In the US, gradually

moderating inflation and signals of economic resilience led the

market to view the Federal Reserve's slowing pace of interest rate

rises as a signal that a deep recession can be averted.

In July, a largely unexpected breakthrough in Washington led to

the Inflation Reduction Act (IRA), which was subsequently passed by

Congress in August. The Act represents the largest government

investment in addressing climate change in US history and provides

$370bn over 10 years for climate solutions.

In response to the US Inflation Reduction Act (IRA) published

last year, the European Commission published two important

components of its Green Deal Industrial Plan in March: (1) the

Net-Zero Industry Act, to scale up manufacturing and attract

investment for strategic net-zero technologies in the EU; and (2)

the Critical Raw Materials Act to ensure the EU's access to

resilient and sustainable supply of critical raw materials.

Policy review

The Company's approach to investing in sustainable solutions

remains focussed on six environmental solutions themes:

* Circular economy: solutions for sustainable materials

and resource stewardship

* Clean energy: generation, storage and distribution

* Sustainable Oceans & Freshwater Systems: conservation

and management

* Green Mobility: technologies and services for

sustainable movement

* Green Buildings & Industry: enabling a low carbon

transition

* Sustainable Agriculture & Land Ecosystems: solutions

protecting natural resources and well-being

Within those themes, the Company is focused on companies - many

of them on the smaller end of the market capitalisation spectrum -

that are at the forefront of innovating technological solutions to

environmental challenges with a large potential market

('innovators'), as well as companies that are already rapidly

delivering proven solutions in their markets ('accelerators'). We

believe this approach should deliver attractive capital growth to

shareholders over the long term.

Despite the economic turbulence and volatility across investment

markets, the period under review offered continued evidence that

the Company's focus on global environmental solutions can deliver

attractive investment returns. In the wake of passage of the US IRA

(which we believe will in time present a multi-year catalyst for

environmental solutions), the Clean Energy theme, which includes

companies such as First Solar, was particularly buoyant.

Infineon and Monolithic Power also both performed well. We added

to these two names in Q4 following a sell-off across much of the

semiconductor sector, which overlooked the structural growth

opportunity and leadership both companies have in energy-efficient

power solutions.

Another key contributor to performance was Ansys (which was

bought during the period). Ansys is the world's leading engineering

simulation software provider with diversified end-market exposure

and a strong financial profile. Sitting in our Circular Economy

theme, Ansys provides solutions to reduce customers' resource and

material use by reducing physical prototypes in the R&D and

testing phase of product development. Ansys released a strong set

of full year results and guidance in February, which led to share

price outperformance versus its peers.

The Sustainable Agriculture and Land theme was a notable

detractor on a thematic basis, with European materials stocks such

as DSM and Borregaard among the bottom of the portfolio

contributors. A Eurocentric client base combined with energy cost

pressures in Europe have presented a challenging near-term

environment for such businesses. Another notable detractor was

Advanced Drainage (Circular Economy), which issued a profits

warning. In one of its divisions there was a destocking of

inventories, which was more severe than management had anticipated

and dampened expectations significantly.

Outlook

We have a long-held conviction that environmental challenges are

central to global development in the long term. Addressing both the

causes and effects of these challenges is in our view becoming

inevitable, with environmental solutions currently crossing a

watershed moment where they are no longer deemed peripheral, but

instead integral to future pathways and markets.

The great energy shock of the last 18 months - and the critical

role that "clean" solutions are playing in responding to the

long-term challenges of energy security, affordability and climate

change - serve to highlight the crucial importance of environmental

solutions in solving these unavoidable and era-defining issues.

We expect the volatility in equity markets to continue into the

near term, presenting opportunities for long-term active investors

focussing on structural trends such as energy transition and more

widely across our six environmental solution investment themes.

Jon Wallace

Fund Manager

Jupiter Asset Management Limited

Investment Adviser

12 July 2023

Top five contributors and detractors

Detail

Total Returns Contribution to Return

(%) (%)

Contributors

FIRST SOLAR INC 176.65 2.27

VALMONT INDUSTRIES 53.42 1.08

INFINEON TECHNOLOGIES AG 27.68 0.87

PRYSMIAN SPA 32.45 0.83

WATTS WATER TECHNOLOGIES-

A 29.48 0.64

Detail

Total Returns Contribution to Return

(%) (%)

Detractors

ORSTED O/S -25.91 -0.68

CERES POWER HOLDINGS PLC -47.02 -0.72

HANNON ARMSTRONG SUSTAINABLE -32.05 -0.98

BEFESA SA -37.79 -1.01

KONINKLIJKE DSM NV -29.11 -1.03

Investment Portfolio as at 31 March 2023

31 March 31 March

2023 2022

Market Market

value Percentage value Percentage

Company Country of Listing GBP'000 of Portfolio GBP'000 of Portfolio

Veolia Environnement France 1,851 3.4 1,824 3.4

Infineon Technologies Germany 1,845 3.3 1,474 2.7

Evoqua Water Technologies United States of America 1,785 3.2 2,176 4.0

Prysmian Italy 1,728 3.1 1,329 2.5

Schneider Electric France 1,707 3.1 1,684 3.1

Monolithic Power Systems United States of America 1575 2.9 1,537 2.9

Vestas Wind Systems Denmark 1,575 2.9 1,530 2.8

Stantec Canada 1,551 2.8 1,042 1.9

Daikin Industries Japan 1,508 2.7 1,331 2.5

ANSYS United States of America 1,494 2.7 - -

Watts Water Technologies United States of America 1,447 2.6 1,077 2.0

Waste Connections Canada 1,415 2.6 - -

Clean Harbors United States of America 1,402 2.5 869 1.6

Acuity Brands United States of America 1,371 2.5 931 1.7

SolarEdge Technologies United States of America 1,319 2.4 1,316 2.5

Trimble United States of America 1,301 2.4 - -

NextEra Energy Partners United States of America 1,287 2.3 1,657 3.1

Borregaard Norway 1,277 2.3 1,248 2.3

Koninklijke DSM Netherlands 1,272 2.3 1,830 3.4

First Solar United States of America 1,263 2.3 1,125 2.1

Renewi United Kingdom 1,225 2.2 1,336 2.5

Xylem United States of America 1,186 2.2 776 1.5

Republic Services United States of America 1,163 2.1 - -

TOMRA Systems Norway 1,145 2.1 1,176 2.2

Eurofins Scientific Luxembourg 1,113 2.0 - -

Orsted Denmark 1,099 2.0 1,396 2.6

Alfa Laval Sweden 1,045 1.9 - -

Advanced Drainage

Systems United States of America 1,044 1.9 1,216 2.3

Aptiv Jersey 1,021 1.9 1,023 1.9

Hannon Armstrong Sustainable

Infrastructure Capital,

REIT United States of America 972 1.8 1,513 2.8

Novozymes Denmark 971 1.8 769 1.4

Littelfuse United States of America 960 1.7 - -

Shimano Japan 944 1.7 881 1.6

Horiba Japan 941 1.7 821 1.5

Daiseki Japan 917 1.7 909 1.7

Ormat Technologies United States of America 908 1.7 - -

Befesa Luxembourg 837 1.5 1,370 2.6

Flat Glass Group China 830 1.5 852 1.6

Sensirion Holding Switzerland 754 1.4 1,672 3.1

Re:NewCell Sweden 745 1.4 810 1.5

Azbil Japan 701 1.3 707 1.3

Ceres Power Holdings United Kingdom 686 1.2 726 1.4

Atlas Copco Sweden 617 1.1 600 1.1

Brambles Australia 585 1.1 455 0.8

Innergex Renewable

Energy Canada 581 1.1 800 1.5

Corbion Netherlands 579 1.0 573 1.1

Greencoat Renewables Ireland 530 1.0 531 1.0

Sensata Technologies

Holding United Kingdom 529 1.0 900 1.7

Hoffmann Green Cement

Technologies France 208 0.4 544 1.0

Agronomics Isle of Man 193 0.3 339 0.6

Agronomics Warrant

11/12/2023 Isle of Man - - - -

Total Investments 55,002 100.0

The holdings listed above are all equity shares unless otherwise

stated

Cross Holdings in other Investment Companies

As at 31 March 2023, 1.0% of the Company's total assets was

invested in Greencoat Renewables, an Irish listed investment

Company.

Whilst the requirements of the UK Listing Authority permit the

Company to invest up to 10% of the value of the total assets of the

Company (before deducting borrowed money) in other investment

companies (including investment trusts) listed on the Main Market

of the London Stock Exchange, it is the directors' current

intention that the Company invests not more than 5% in other

investment companies.

Analysis of Investments by Investment Theme, Stage of

Development, Geography and Economic Sector

Analysis of Investments by Investment Theme and Stage of

Development

As at 31 March 2023 (ex-cash)

Environmental theme

Sustainable Sustainable

Green agriculture Ocean &

Buildings

Circular Clean & Green and Land Freshwater

economy Energy Industry Mobility ecosystems Systems Total

Stage of Development % % % % % % %

Innovators* 3.92 3.54 0.39 0.00 0.35 0.00 8.20

Accelerators* 10.64 17.92 20.74 3.60 11.85 7.29 72.04

Leaders* 9.72 0.00 3.02 4.39 0.00 2.63 19.76

Total 2023 24.28 21.46 24.15 7.99 12.20 9.92 100.00

* Innovators are companies that are innovating technological

change to environmental challenges. Accelerators are companies that

already have a proven solution to environmental challenges and are

set to continue rapid growth within their addressable market.

Established leaders are larger companies which have developed a

commanding presence in their chosen markets.

Analysis of Investments by Geography and Economic Sector

As at 31 March 2023 (ex-cash)

United

States of United

America Japan France Kingdom Denmark Others Total

Sectors % % % % % % %

Basic Materials - - - - - 3.7 3.7

Consumer Discretionary - 1.7 - - - 1.9 3.6

Consumer Staples - - - - - 3.3 3.3

Energy 4.7 - - 1.2 2.9 - 8.8

Health Care - - - - 1.8 2.3 4.1

Industrials 13.3 5.7 3.5 1.0 - 15.0 38.5

Real Estate 1.8 - - - - - 1.8

Technology 5.6 - - - - 3.3 8.9

Utilities 11.8 1.7 3.4 2.2 2.0 6.2 27.3

Total 2023 37.2 9.1 6.9 4.4 6.7 35.7 100.0

Strategic Review

The Strategic Report has been prepared in accordance with the

Companies Act 2006 (Strategic Report and Directors' Report)

Regulations 2013.

The Strategic Report seeks to provide shareholders with the

relevant information to enable them to assess the performance of

the Directors of the Company during the period under review.

Business and Status

During the year the Company carried on business as an investment

trust with its principal activity being portfolio investment. The

Company has been approved by HM Revenue & Customs ('HMRC') as

an investment trust subject to the Company continuing to meet the

eligibility conditions of sections 1158 and 1159 of the Corporation

Taxes Act 2010 and the ongoing requirements for approved companies

as detailed in Chapter 3 of Part 2 of the Investment Trust

(Approved Company) (Tax) Regulations 2011. In the opinion of the

Directors, the Company has conducted its affairs in the appropriate

manner to retain its status as an investment trust.

The Company is a public limited Company and is an investment

Company within the meaning of section 833 of the Companies Act

2006. It is also an Alternative Investment Fund (AIF) for the

purposes of the EU Alternative Investment Fund Managers

Directive.

The Company has a fixed share capital although it may issue or

purchase its own shares subject to shareholder approval, usually

sought annually.

The Company is not a close Company within the meaning of the

provisions of the Corporation Tax Act 2010 and has no

employees.

The Company was incorporated in England & Wales on 12 April

2006 and started trading on 8 June 2006, immediately following the

Company's launch.

Reviews of the Company's activities are included in the

Chairman's Statement and Investment Adviser's Review.

There has been no significant change in the activities of the

Company during the year to 31 March 2023 and the Directors

anticipate that the Company will continue to operate in the same

manner during the current financial year.

Investment Objective

The investment objective of the Company is to achieve capital

growth and income, both over the long term, through investment in a

diverse portfolio of companies providing environmental

solutions.

Investment Strategy

The Investment Adviser has adopted a bottom-up approach. The

Investment Adviser, supported by Jupiter's Governance and

Sustainability team, researches companies, ensuring that each

potential investment falls within the Company's stated investment

policy. Consideration is also given to a potential investment's

risk/return profile and growth prospects before an investment is

made. Once companies operating within the appropriate theme have

been identified and due diligence has been carried out, the

Investment Adviser will decide whether a particular investment

would be appropriate.

Investment Policy

From the year ended 31 March 2021, the Company's investment

focus was adjusted towards a greater emphasis on Companies which

are innovating technological solutions to sustainability challenges

('innovators') and companies that are already rapidly delivering

proven sustainable solutions in their markets ('accelerators'). A

by-product of these changes is a greater focus on smaller companies

which are at the forefront of the innovation driving sustainable

solutions.

The following investment restrictions are observed:

* no more than 5% of the Company's total assets (at the

time of such investment) may be invested in unlisted

securities;

* no more than 15% of the total assets of the Company

(before deducting borrowed money) is lent to or

invested in any one Company or group at the time the

investment or loan is made. For this purpose any

existing holding in the Company or group concerned is

aggregated with the proposed investment;

* distributable income is principally derived from

investments;

* not more than 10%, in aggregate, of the value of the

total assets of the Company (before deducting

borrowed money) is invested in other UK listed

investment companies (including investment trusts)

listed on the Official List. Whilst the requirements

of the UK Listing Authority permit the Company to

invest up to this 10% limit, it is the Directors'

current intention that the Company invests not more

than 5%, in aggregate, of the value of the total

assets of the Company (before deducting borrowed

money) in such other investment companies; and

* the Company at all times invests and manages its

assets in a way which is consistent with its

objective of spreading investment risk.

In accordance with the requirements of the UK Listing Authority,

any material changes in the principal investment policies and

restrictions of the Company would only be made with the approval of

shareholders by ordinary resolution.

Future Developments

It is the Board's ambition to continue to grow the asset base of

the Company through a combination of organic growth of net asset

value and issuance of new shares with a view to achieving the

critical mass necessary to attract broader demand from large

national discretionary wealth managers, and other long-term

institutional buyers of investment trust shares.

Benchmark Index

The Company's benchmark is the MSCI World Small Cap Index.

Management

The Company has no employees and most of its day to day

responsibilities are delegated to Jupiter Asset Management Limited

('JAM'), who act as the Company's Investment Adviser and Company

secretary. Further details of the Company's arrangement with JAM

and the Alternative Investment Fund Manager ('AIFM'), Jupiter Unit

Trust Managers Limited, can be found in Note 22 to the accounts.

Both JAM and JUTM are part of the Jupiter Group which comprises

Jupiter Fund Management PLC and all of its subsidiaries

('Jupiter').

J.P. Morgan Europe Limited ('JPMEL') acts as the Company's

depository. The Company has also entered into an outsourcing

arrangement with J.P. Morgan Chase Bank N.A. ('JPMCB') for the

provision of accounting and administration services.

Although JAM is named as the company secretary, JPMEL provides

administrative support to the Company secretary as part of its

formal mandate to provide broader fund administration services to

the Company.

Viability Statement

In accordance with Provision 36 of the Code of Corporate

Governance as issued by the Association of Investment Companies in

February 2019 (the 'AIC Code'), the Board has assessed the

prospects of the Company over a longer period than the twelve

months required by the 'Going Concern' provision, reviewing in line

with the three year cycle of the continuation vote. In doing so the

Board believes that there will be no issue in the next continuation

vote being passed. The Company's investment objective is to achieve

capital growth and income, both over the long term and the Board

regards the Company as a long-term investment.

The Board has considered the Company's business model including

its investment objective and investment policy as well as the

principal and emerging risks and uncertainties that may affect the

Company.

In addition, the Board has considered the reporting produced by

the Jupiter Investment Risk Team concerning a number of potential

future scenarios resulting from ongoing market volatility. The

Board continues to monitor income and expense forecasts for the

Company.

The Board has noted that:

* The Company holds a highly liquid portfolio invested

predominantly in listed equities.

* The investment management fee is the most significant

expense of the Company. It is charged as a percentage

of the portfolio value and so would reduce if the

market value of the portfolio were to fall. The

remaining expenses are more modest in value and are

predicable in nature. No significant increase to

ongoing charges or operational expenses is

anticipated.

* Green and sociably responsible investing is now high

on the agenda of many retail investors and that the

Company is well placed to attract these retail

investors through targeted marketing.

* Climate change is a key issue for asset managers and

their investors. ESG issues are integrated into the

Company's investment processes and these are

continually monitored to ensure that the investment

objectives are followed to mitigate any risk of the

perception of greenwashing and any related

litigation.

* The Board is satisfied that Jupiter and the Company's

other key third-party suppliers maintain suitable

processes and controls to ensure that they can

continue to provide their services to the Company.

The Board has therefore concluded that there is a reasonable

expectation that the Company will be able to continue in operation

and meet its liabilities as they fall due over the next three

years.

As part of its assessment, the Board has noted that shareholders

will be required to vote on the continuation of the Company at the

2023 AGM.

Further information regarding the planned life of the Company

can be found within the Report and Accounts.

Gearing

Gearing is defined as the ratio of a Company's debt less cash

held compared to its equity capital, expressed as a percentage. The

effect of gearing is that in rising markets the Company tends to

benefit from any growth of the Company's investment portfolio above

the cost of payment of the prior ranking entitlements of any

lenders and other creditors. Conversely, in falling markets the

Company suffers more if the Company's investment portfolio

underperforms the cost of those prior entitlements.

The Company may utilise gearing at the director's discretion for

the purpose of financing the Company's portfolio and enhancing

shareholder returns. In particular, the Company may be geared by

bank borrowings which will rank in priority to the ordinary shares

for repayment on a winding up or other return of capital.

The Articles provide that, without the sanction of the Company

in a general meeting, the Company may not incur borrowings above a

limit of 25% of the Company's total assets at the time of drawdown

of the relevant borrowings.

Loan facility

The Company has a revolving loan facility agreement with Royal

Bank of Scotland International Limited of GBP5 million which the

Investment Adviser has been authorised by the Board to draw down

for investment purposes. The facility to gear the Company's

investment portfolio is deployed tactically by the Investment

Adviser with a view to enhancing shareholder returns. The Directors

have determined that the maximum level of gearing will be 25% of

the Company's total assets at the time of

drawdown. The finance costs shown in the Statement of

Comprehensive Income are in respect of interest charges on the

utilised balance along with the costs incurred for non-utilisation

of the facility during the year to the end of the loan term.

Use of Derivatives

The Company may invest in derivative financial instruments

comprising options, futures and contracts for difference for

investment, hedging and efficient portfolio management, as more

fully described in the investment policy. There is a risk that the

use of such instruments will not achieve the goals desired. Also,

the use of swaps, contracts for difference and other derivative

contracts entered into by private agreements may create a

counterparty risk for the Company. This risk is mitigated by the

fact that the counterparties must be institutions subject to

prudential supervision and that the counterparty risk on a single

entity must be limited in accordance with the individual

restrictions. There were no open derivatives at year end.

Currency Hedging

The Company's accounts are maintained in sterling while

investments and revenues are likely to be denominated and quoted in

currencies other than sterling. Although it is not the Company's

present intention to do so, the Company may, where appropriate and

economic to do so, employ a policy of hedging against fluctuations

in the rate of exchange between sterling and other currencies in

which its investments are denominated.

Key Performance Indicators

At their quarterly Board meetings the Directors consider a

number of performance indicators to help assess

the Company's success in achieving its objectives. The key

performance indicators used to measure the

performance of the Company over time are as follows:

* Net asset value changes over time;

* Ordinary share price movement;

* A comparison of ordinary share price and net asset

value to benchmark;

* Discount and premium to net asset value; and

* Growth in assets under management.

Information on some of the above key performance indicators and

how the Company has performed against them can be found within the

Report and Accounts.

In addition, a history of the net asset values, the price of the

ordinary shares and the benchmark index are shown on the monthly

factsheets which can be viewed on the Investment Adviser's website

www.jupiteram.com/JGC and which are available on request from the

company secretary.

Discount to Net Asset Value

The Directors review the level of the discount or premium

between the middle market price of the Company's ordinary shares

and their net asset value on a regular basis.

The Directors have powers granted to them at the last AGM to

purchase ordinary shares and either cancel or hold them in treasury

as a method of controlling the discount to net asset value and

enhancing shareholder value.

The Company repurchased 328,726 ordinary shares for holding in

treasury during the year under review at a discount of 14.40%.

Under the Listing Rules, the maximum price that may currently be

paid by the Company on the repurchase of any ordinary shares is

105% of the average of the middle market quotations for the

ordinary shares for the five business days immediately preceding

the date of repurchase. The minimum price will be the nominal value

of the ordinary shares. The Board is proposing that its authority

to repurchase up to approximately 14.99% of its issued share

capital should be renewed at the AGM. The new authority to

repurchase will last until the conclusion of the AGM of the Company

in 2023 (unless renewed earlier). Any repurchase made will be at

the discretion of the Board in light of prevailing market

conditions and within guidelines set from time to time by the

Board, the Companies Act, the Listing Rules and Model Code.

Treasury Shares

In accordance with the Companies (Acquisition of Own Shares)

(Treasury Shares) Regulations 2003 (the 'Regulations') which came

into force on 1 December 2003 any ordinary shares repurchased,

pursuant to the above authority, may be held in treasury. These

ordinary shares may subsequently be cancelled or sold for cash.

This would give the Company the ability to reissue shares quickly

and cost effectively and provide the Company with additional

flexibility in the management of its capital. The Company issued

2,567 ordinary shares from treasury during the year under

review.

Principal and Emerging Risks and Uncertainties

The Directors confirm that they have carried out a robust

assessment of the emerging and principal risks facing the Company,

including those that would threaten its business model, future

performance, solvency or liquidity. Most of these risks are market

related and are similar to those of other investment trusts

investing primarily in listed markets. The Audit Committee reviews

the Company's risk control summary at each meeting, and as part of

this process, gives consideration to identifying emerging risks.

Any emerging risks that are identified, that are considered to be

of significance will be recorded on the Company's Risk Control

Summary with any mitigations. In carrying out this assessment,

consideration is being given to the current market conditions which

may impact the Company. No emerging risks have been identified.

Investment policy and process - Inappropriate investment

policies and processes may result in under performance against the

prescribed benchmark index and the Company's peer group.

The Board manages these risks by ensuring a diversification of

investments and regularly reviewing the portfolio asset allocation

and investment process. In addition, certain investment

restrictions have been set and these are monitored as

appropriate.

Investment Strategy and Share Price Movements -The Company is

exposed to the effect of variations in the price of its

investments. A fall in the value of its portfolio will have an

adverse effect on shareholders' funds. It is not the aim of the

Board to eliminate entirely the risk of capital loss, rather it is

its aim to seek capital growth. The Board reviews the Company's

investment strategy and the risk of adverse share price movements

at its quarterly Board meetings taking into account the economic

climate, market conditions and other factors that may have an

effect on the sectors in which the Company invests. There can be no

assurances that appreciation in the value of the Company's

investments will occur but the Board seeks to reduce this risk.

Liquidity Risk - The Company may invest in securities that have

a very limited market which will affect the ability of the

Investment Adviser to dispose of securities when it is no longer

felt that they offer the potential for future returns. Likewise the

Company's shares may experience liquidity problems when

shareholders are unable to realise their investment in the Company

because there is a lack of demand for the Company's shares. At its

quarterly meetings the Board considers the current liquidity in the

Company's investments and the level of liabilities when setting

restrictions on the Company's exposure. The Board also reviews, on

a quarterly basis, the Company's buy-back programme and in doing so

is mindful of the liquidity in the Company's shares.

Gearing Risk - The Company's gearing can impact the Company's

performance by accelerating the decline in value of the Company's

net assets at a time when the Company's portfolio is declining.

Conversely gearing can have the effect of accelerating the increase

in the value of the Company's net assets at a time when the

Company's portfolio is rising. The Company's level of gearing is

under constant review by the Board who take into account the

economic environment and market conditions when reviewing the

level.

Regulatory Risk - The Company operates in a complex regulatory

environment and faces a number of regulatory risks. A breach of

section 1158 of the Corporation Tax Act 2010 could result in the

Company being subject to capital gains tax on portfolio movements.

Breaches of other regulations such as the UKLA Listing rules, could

lead to a number of detrimental outcomes and reputational damage.

Breaches of controls by service providers such as the Investment

Adviser could also lead to reputational damage or loss. The Board

monitors regulatory risks at its quarterly Board meetings and

relies on the services of its Company secretary, JAM, and its

professional advisers to ensure compliance with, amongst other

regulations, the Companies Act 2006, the UKLA Listing Rules, the

FCA's Disclosure Guidance and Transparency Rules and the

Alternative Investment Fund Managers' Directive. In order to ensure

that the Company remains compliant, the Board directly and via the

Audit Committee/ Management Engagement Committee receives regular

updates from the Investment Adviser and the Company's other key

service providers. The Investment Adviser is contractually obliged

to ensure that its conduct of business conforms to applicable laws

and regulations.

Credit and Counterparty Risk - The failure of the counterparty

to a transaction to discharge its obligations under that

transaction could result in the Company suffering a loss. Further

details of the management of this risk can be found in Note 13 to

the accounts of the Annual Report.

Loss of Key Personnel - The day-to-day management of the Company

has been delegated to the Investment Adviser. Loss of the

Investment Adviser's key staff members could affect investment

return. The Board is aware that JAM recognises the importance of

its employees to the success of its business. Its remuneration

policy is designed to be market competitive in order to motivate

and retain staff and succession planning is regularly reviewed. The

Board also believes that suitable alternative experienced personnel

could be employed to manage the Company's portfolio in the event of

an emergency.

Operational - Failure of the core accounting systems, or a

disastrous disruption to the Investment Adviser's business or that

of the administration provider JPMCB, could lead to an inability to

provide accurate reporting and monitoring.

Financial - Inadequate financial controls could result in

misappropriation of assets, loss of income and debtor receipts and

inaccurate reporting of net asset value per share. The Board

annually reviews the Investment Adviser's report on its internal

controls and procedures.

Details of how the Board monitors the operational services and

financial controls of Jupiter and J.P. Morgan are included within

the Internal Control section of the Report of the Directors.

Enterprise risk is reviewed twice a year, taking into its remit

emerging risks as they become immediate, whist still maintaining a

long-term perspective where they are evolving at a fast rate.

Climate change and its potential impacts is under scrutiny at every

meeting, this being the very purpose of the Company.

Climate Change - the impact of climate change risk has been

considered and it is concluded that it does not have a material

impact on the Company's investments. In line with IFRS investments

are valued at fair value, which for the Company are quoted bid

prices for investments in active markets at the Statement of

Financial Position date and therefore reflect market participants

view of climate change. Given the nature of the Company all

investments are monitored to ensure that they are in line with the

investment objective to mitigate any risk of

the perception of greenwashing and any related litigation.

Geopolitical - There is increasing risk to market stability and

investment opportunities from geopolitical conflicts such as

between Russia and Ukraine.

The Company has no exposure to Russian Stocks.

Capital Gains Tax Information

The closing price of the ordinary shares on the first date of

dealing for capital gain tax purposes was 99p.

Directors

Details of the Directors of the Company and their biographies

are set out within the Report and Accounts.

The Company's policy on Board diversity is included in the

Corporate Governance section of the Report of the Directors.

As at 31 March 2023, the Board comprises of one female and three

male Directors.

Employees, Environmental, Social and Human Rights issues

The Company has no employees as the Board has delegated the day

to day management and administration functions to JUTM, JAM and

other third-party suppliers. There are therefore no disclosures to

be made in respect of employees.

Integration of Environmental, Social and Governance ('ESG')

considerations into the Investment Adviser's Investment Process

JAM has a 30 year record of integrating ESG factors into the

investment process. Its Governance and Sustainability team

leverages its relationships with partner organisations such as the

UN Principles for Responsible Investment ("UN PRI"), the Investor

Forum and Institutional Investors Group on Climate Change ("IIGCC")

and regularly engages with these and other industry bodies to

ensure it remains at the forefront of ESG integration. Where

relevant, lessons learned are disseminated across JAM's wider

investment team via its Stewardship Committee. JAM considers

stewardship to be an integral component of its investment process.

Typically, JAM does not seek to exclude companies based on headline

risk factors, disclosures or practices, instead believing that

engagement aimed at enhancing long-term outcomes for investors

requires a more rigorous and nuanced approach. Moreover, the

Investment Adviser is of the view that compelling opportunities can

arise in companies where there is evidence of positive change in

the areas of environmental and social risk mitigation and

governance practices, but where the market may be yet to reflect

this in investee Company share prices.

Modern Slavery Act

The Modern Slavery Act 2015 requires certain companies to

prepare a slavery and human trafficking statement. As the Company

has no employees and does not supply goods and services, it is not

required to make such a statement.

Global Greenhouse Gas Emissions

The Company has no greenhouse gas emissions to report from its

operations as the day to day management and administration

functions have been outsourced to third-parties and it neither owns

physical assets, property nor has employees of its own. It

therefore does not have responsibility for any other emissions

producing sources under the Companies Act 2006 (Strategic Report on

Directors' Reports) Regulations 2013.

Section 172 Statement

Under section 172 of the Companies Act 2006, the directors have

a duty to act in good faith and to promote the success of the

Company for the benefit of its shareholders as a whole. This

includes taking into consideration the likely consequences of their

decisions on the long term and on the Company's stakeholders such

as its shareholders, employees and suppliers, while acting fairly

between stakeholders. The Directors must also consider the impact

of the Company's decisions on the environment, the community and

its reputation for maintaining high standards of business

conduct.

The Company ensures that the Directors are able to discharge

this duty by, amongst other things, providing them with relevant

information and training on their duties. The Company also ensures

that information pertaining to it is provided, as required, to the

Directors as part of the information presented in regular Board

meetings in order that stakeholder considerations can be factored

into the Board's decision-making. The Directors' responsibilities

are also set out in the schedule of matters reserved for the Board

and the terms of reference of its committees, both of which are

reviewed regularly by the Board. At all times the Directors can

access as a Board, or individually, advice from its professional

advisers including the company secretary and independent external

advisers.

The Company's investment objective, to achieve capital and

income growth over the long term, supports the Directors' statutory

obligations to consider the long-term consequences of the Company's

decisions. How the long-term focus of the Company is achieved, is

set out in more detail in the Annual Report and above where the

Investment Adviser's approach to environmental, social and

governance issues is explained in the section entitled Integration

of ESG considerations into the Investment Adviser's investment

process. This approach is fundamental to the Company achieving

long-term success for the benefit of all of its stakeholders.

The Company's corporate purpose is to generate a total return by

investing in companies which are developing and implementing

solutions for the world's environmental challenges. The Company is

also aware of its own potential impact on the environment and has a

number of practical policies in place to reduce that impact.

Examples include the use and sharing of electronic documents by the

Board rather than printing documentation and the provision of

electronic copies of the annual report and accounts which are

available to shareholders and others on the Company website. Where

physical copies of the annual and half yearly financial reports are

made, they use materials and processes designed to both minimise

the environmental impact and to maximise the recycling potential as

described in more detail on the inside back cover of this document.

The proxy voting form previously printed in the annual report and

accounts and posted back to the registrars has been removed and

shareholders are invited to vote via the registrar's secure portal.

The Board will continue to review its travel arrangements and will

seek to minimise physical meetings. The Directors as a matter of

course continue to seek new opportunities and to make use of new

technologies and processes that will further enhance environmental

operation of the Company.

Engagement with stakeholders and the effect on principal

decisions

The Shareholders - The shareholders of the Company are both

institutional and retail in nature and details of those with

substantial shareholdings are detailed within the Report and

Accounts.

The Board believe that shareholders have a vital role in

encouraging a higher level of corporate performance and is

committed to listening to the views of its shareholders and giving

useful and timely information by providing open and accessible

channels of communication including those listed below.

The AGM - The Company encourages participation from shareholders

at its AGMs where they can communicate directly with the Directors

and investment adviser. Given the environmental ethos of the

Company shareholders are encouraged to submit their votes by proxy

ahead of the meeting, or attend the meeting remotely, rather than

attending in person. Further details of how the AGM will be held

can be found within the Report and Accounts. The Board and

investment adviser welcome your questions which may be submitted to

Nick.Black@jupiteram.com. Subject to confidentiality, we will

respond to any questions submitted either directly or by publishing

our response on the company's website. All views of the

shareholders will be taken into consideration and action taken

where appropriate.

Online Information - The Company's website

(www.jupiteram.com/JGC) contains the Annual and Half Yearly

Financial Report along with monthly factsheets and commentaries and

video updates from the investment adviser. The daily NAV per share,

monthly top ten portfolio listings, dividend announcements and

various regulatory announcements can be found on the regulatory

news service of the London Stock Exchange. Jupiter Green Investment

Trust PLC JGC Stock | London Stock Exchange.

Shareholder Communications

Shareholders can raise issues or concerns at any time by writing

to the Chairman or the Senior Independent Director at the

registered office.

Further details about how the Board incorporates the views of

the company's shareholders in its decision-making process can be

found in the UK Stewardship Code and the Exercise of Voting Powers

section. Further information about how the Board ensures that each

director develops an understanding of the views of the Company's

shareholders and can be found in the section entitled Shareholder

Relations.

The Investment Adviser

The investment management function is critical to the long-term

success of the Company. The Board and the investment adviser

maintain an open and constructive relationship, with meetings

taking place a minimum of four times per annum with monthly updates

and additional meetings as circumstances require. The Audit

Committee meets at least twice a year and as part of its role

considers the internal controls put in place by the investment

adviser.

The 'Management of the Company' section in the report details

the Board's consideration of the investment adviser's performance,

its terms of appointment and their annual assessment of its

continued stewardship of the portfolio and its oversight of the

administrative functions. The day to day responsibilities of the

Company are delegated to the investment adviser who is the key

service provider and supplies investment management, administration

and Company secretarial services. The investment adviser oversees

the activities of the Company's other third-party suppliers on

behalf of the Company and maintains open and collaborative

relationships to maintain quality, efficiency and cost control

through regular communication with dedicated members of the

investment adviser's operational teams. The Board regularly reviews

reports from its investment

adviser, the AIFM, the depositary, the Company broker, the

investor relations research provider and the auditors. These

provide vital information concerning changes in market practice or

regulation which affect the Company and assist the Board in its

decision-making process. Representatives from these providers

attend Company Board meetings and give presentations on a regular

basis enabling in depth discussions concerning both their findings

and their performance.

The Board reviews the culture and values of the investment

adviser as part of its ongoing assessment of its performance to

ensure these are aligned to those of the Board. Further information

on the investment adviser's culture and values can be found in the

'Integration of ESG considerations into the investment adviser's

investment process' section of the Annual Report.

Other Third-Party Suppliers

As an externally managed investment Company with no employees or

physical assets, the principal stakeholders of the Company are its

shareholders, investment adviser, AIFM, depositary, custodian,

administrator and registrar.

The Investment Adviser works with the key service providers to

ensure the adequacy of the services provided to the Company. On

occasion, representatives of the key service providers are invited

to attend to present to the Board in addition to the regular

updates provided by the Investment Adviser.

Principal Decisions

The Directors take into account the s172 considerations in all

material decisions of the Company ensuring in Board discussions

that appropriate attention is given to the short and long-term

benefits for stakeholders. Examples of significant Board

discussions and decisions made in the period are set out below:

* Discount Management: Following discussion at the

Board and with the Company's broker, the Board

decided to use the share buy-back programme within

agreed parameters. This resulted in a decision to

buyback 328,726 ordinary shares of the Company during

the year.

* Board Evaluation: The independent non-executive

directors undertake on, an annual basis, an appraisal

in relation to their oversight and monitoring of the

performance of the investment adviser and other key

service providers. In addition the directors

undertake, on an annual basis, a written assessment

of the effectiveness of the Board as a whole by

completion of a formal evaluation questionnaire. The

SID also leads a formal evaluation of the performance

of the Chairman.

* Board Succession: In 2022, the Board decided that

Michael Naylor should continue as Chairman of the

Company for another 5 years. Although this exceeds

the usual time that a director is appointed to an

Investment Trust he remains independent of mind and

given his skills, experience and knowledge of the

Company the directors unanimously opined that he

still had more to offer.

Simon Baker was appointed to the Board on 31 July 2015. The Annual

General Meeting in September 2023 represents the eighth anniversary

of his appointment. The Nomination Committee met on 4 July 2023

and concluded that although exceeding the usual tenure for a Director

to be appointed to an investment trust his passion and dedication

to the Company would be a benefit over the next 3 years. Furthermore,

the Directors noted that Simon Baker remained independent of mind

and able to provide the appropriate level of challenge to portfolio

managers.

* Loan: A revolving loan facility agreement with Royal

Bank of Scotland International Limited of GBP5

million was approved by the Board, and the Investment

Adviser has been authorised by the Board to draw down

for investment purposes. The Loan facility has been

drawn down to GBP3 million of the GBP5 million

facility.

* Annual General Meeting: As a result of the additional

cost and the level of take-up at the hybrid AGM, the

Board decided that shareholders would be offered an

opportunity to attend the AGM in person and ask

questions.

* Third-Party Suppliers: The Board decided to make no

changes to its principal third party suppliers in the

period.

* Geopolitical Considerations: The Board has discussed

the investment risks and risks in respect of third

parties and has noted that the fund had no exposure

to Russian stocks. The Board considers that the

levels of risk within the Company are acceptable and

in line with its investment objective.

In Summary

The structure of the Board and its various committees and the

decisions it makes are underpinned by the duties of the Directors

under s172 on all matters. The Board firmly believes that the

sustainable long-term success of the Company depends upon taking

into account the interests of all the Company's key

stakeholders.

Michael Naylor

Chairman

12 July 2023

Statement of Directors' Responsibilities

The Directors are responsible for preparing the Annual Report

and financial statements in accordance with UK adopted

International Accounting standards.

Under Company law the Directors must not approve the financial

statements unless they are satisfied that they give a true and fair

view of the state of affairs of the Company and of the return or

loss of the Company for that period.

In preparing those financial statements, the Directors are

required to:

a) select suitable accounting policies in accordance with UK adopted

International Accounting standards 8 Accounting Policies, Changes

in Accounting Estimates and Errors and then apply them consistently;

b) present information, including accounting policies, in a manner

that provides relevant, reliable, comparable and understandable

information

c) provide additional disclosures when compliance with the specific

requirements in UK adopted International Accounting standards is

insufficient to enable users to understand the impact of particular

transactions, other events and conditions on the entity's financial

position and financial performance

d) state that the Company has complied with UK adopted International

Accounting standards subject to any material departures disclosed

and explained in the financial statements; and

e) make judgements and estimates that are reasonable and prudent.

The Directors are responsible for the maintenance and integrity

of the corporate and financial information included on the

Company's website www.jupiteram.com/JGC. The work carried out by

the auditors does not include consideration of the maintenance and

integrity of the website and accordingly the auditors accept no

responsibility for any changes that have occurred to the financial

statements when they are presented on the website.

The financial statements are published on www.jupiteram.com/JGC,

which is a website maintained by Jupiter Asset Management

Limited.

Visitors to the website need to be aware that legislation in the

United Kingdom governing the preparation and dissemination of

financial statements may differ from legislation in other

jurisdictions.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy at any time the

financial position of the Company and enable them to ensure that

the financial statements comply with the Companies Act 2006. They

are also responsible for safeguarding the assets of the Company and

hence for taking reasonable steps for the prevention and detection

of fraud and other irregularities.

Under applicable law and regulations, the Directors are also

responsible for preparing a Strategic Report, Directors' Report,

Directors' Remuneration Report and Statement of Corporate

Governance that comply with that law and those regulations.

Each of the Directors, who are listed the report, confirm to the

best of their knowledge that:

a) the financial statements, prepared in accordance with UK adopted

International Accounting standards, give a true and fair view of

the assets, liabilities, financial position and profit or loss of

the Company;

b) the report includes a fair view of the development and performance

of the business and the position of the Company together with a

description of the principal and emerging risks and uncertainties

that the Company faces; and

c) in their opinion, the Annual Report and Accounts taken as a whole,

is fair, balanced and understandable and it provides the information

necessary to assess the Company's performance, business model and

strategy

So far as each Director is aware at the time the report is

approved:

a) there is no relevant audit information of which the Company's

Auditors are unaware; and

b) the Directors have taken all steps required of a Company director

to make themselves aware of any relevant audit information and to

establish that the Company's Auditors are aware of that information.

By order of the Board

Michael Naylor

Chairman

12 July 2023

Statement of Comprehensive Income

for the year ended 31 March 2023

Year ended 31 March Year ended 31 March

2023 2022

Revenue Capital Total Revenue Capital Total

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Loss on investments at

fair value through

profit or loss 10 - (265) (265) - (356) (356)

Foreign exchange gain - 465 465 - 155 155

Income 3 759 - 759 692 - 692

Total income/(loss) 759 200 959 692 (201) 491

Investment management fee 4 (92) (277) (369) (102) (307) (409)

Other expenses 5 (539) - (539) (500) - (500)

Total expenses (631) (277) (908) (602) (307) (909)

Net return/(loss) before

finance costs and tax 128 (77) 51 90 (508) (418)

Finance costs 7 (27) (82) (109) (10) (29) (39)

Return/(loss) on ordinary

activities

before taxation 101 (159) (58) 80 (537) (457)

Taxation 8 (91) - (91) (86) - (86)

Net loss after taxation 10 (159) (149) (6) (537) (543)

Loss per ordinary share 9 0.05p (0.75)p (0.70)p (0.03)p (2.51)p (2.54)p

Diluted Loss per ordinary

share 9 0.05p (0.75)p (0.70)p (0.03)p (2.51)p (2.54)p

* There is no other comprehensive income and therefore the 'Net

loss after taxation' is the total comprehensive expense for the

year.

The total column of this statement is the income statement of

the Company, prepared in accordance with UK adopted international

accounting standards. The supplementary revenue return and capital

return columns are both prepared under guidance produced by the

Association of Investment Companies (AIC). All items in the above

statement derive from continuing operations.

Statement of Financial Position as at 31 March 2023

2023 2022

Note GBP'000 GBP'000

Non current assets

Investments held at fair value through profit

or loss 10 55,002 53,776

Current assets

Prepayments and accrued income 11 1,459 181

Cash and cash equivalents 2,954 4,614

4,413 4,795

Total assets 59,415 58,571

Current liabilities

Other payables 12 (4,837) (3,181)

Total assets less current liabilities 54,578 55,390

Capital and reserves

Called up share capital 15 34 34

Share premium 16 2,468 2,465

Redemption reserve* 17 239 239

Retained earnings* 18 51,837 52,652

Total equity shareholders' funds 54,578 55,390

Net Asset Value per ordinary share 19 258.58p 258.43p

Diluted Net Asset Value per ordinary share 19 259.86p 259.18p

* Under the company's Articles of Association, dividends may be

paid out of any distributable reserve of the company.

Approved by the Board of directors and authorised for issue on

12 July 2023 and signed on its behalf by:

Michael Naylor

Chairman

Company Registration Number 05780006

Statement of Changes in Equity for the year ended 31 March

2023

Share Share Redemption Retained

Capital Premium Reserve Earnings Total

For the year ended 31

March 2023 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 31 March 2022 34 2,465 239 52,652 55,390

Net loss for the year - - - (149) (149)

Ordinary shares reissued

from treasury - 3 - 3 6

Ordinary shares repurchased - - - (669) (669)

Balance at 31 March 2023 34 2,468 239 51,837 54,578

Share Share Redemption Retained

Capital Premium Reserve Earnings Total

For the year ended 31

March 2022 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 31 March 2021 34 1,563 239 51,468 53,304

Net loss for the year - - - (543) (543)

Dividend paid - - - (137) (137)

Ordinary shares reissued

from treasury - 902 - 2,052 2,954

Ordinary shares repurchased - - - (188) (188)

Balance at 31 March 2022 34 2,465 239 52,652 55,390

Dividends paid during the period were paid out of revenue

reserves.

Cash Flow Statement for the year ended 31 March 2023

2023 2022

Note GBP'000 GBP'000

Cash flows from operating activities

Investment income received (gross) 712 693

Deposit interest received 27 1

Investment management fee paid (338) (438)

Other cash expenses (475) (455)

Interest paid (109) (39)

Net cash outflow from operating activities

before taxation (183) (238)

Taxation (91) (86)

Net cash outflow from operating activities 20 (274) (324)

Net cash flows from investing activities

Purchases of investments (12,177) (14,268)

Sale of investments 10,989 11,161

Net cash outflow from investing activities (1,188) (3,107)

Cash flows from financing activities

Shares repurchased (669) (188)

Shares reissued from treasury 6 2,954

Drawdown of short-term bank loan - 2,100

Equity dividends paid - (137)

Net cash (outflow)/inflow from financing

activities 21 (663) 4,729

(Decrease)/increase in cash (2,125) 1,298

Change in cash and cash equivalents

Cash and cash equivalents at start

of year 4,614 3,161

Realised gain on foreign currency 465 155

Cash and cash equivalents at end of

year 2,954 4,614

Notes to the accounts

1. Accounting policies

The Accounts comprise the financial results of the Company for

the year to 31 March 2023. The Accounts are presented in pounds

sterling, as this is the functional currency of the Company. The

Accounts were authorised for issue in accordance with a resolution

of the directors on 12 July 2023. All values are rounded to the

nearest thousand pounds (GBP'000) except where indicated.

The accounts have been prepared in accordance with UK adopted

International Accounting Standards.

Where presentational guidance set out in the Statement of

Recommended Practice (SORP) for Investment Trusts issued by the

Association of Investment Companies (AIC) in April 2021 is

consistent with the requirements of UK adopted International

Accounting Standards, the directors have sought to prepare the

financial statements on a basis compliant with the recommendations

of the SORP.

Basis of preparation

In preparing these financial statements the Directors have

considered the impact of climate change risk as a principal risk,

and have concluded that it does not have a material impact on the

Company's investments. In line with IFRS investments are valued at

fair value, which for the Company are quoted prices for the

investments in active markets at the Balance Sheet date and

therefore reflect market participants view of climate change

risk.

The financial statements have been prepared on a going concern

basis. In considering this, the directors took into account the

Company's investment objective, risk management policies and

capital management policies, the diversified portfolio of readily

realisable securities which can be used to meet short-term funding

commitments and the ability of the Company to meet all of its

liabilities and ongoing expenses as for the period to 31 July 2024,

which is a period of at least 12 months from the date the financial

statements were authorised for issue. The directors have also

considered the continuation vote, due to be proposed at the

upcoming AGM, and have no reason to believe that this resolution

will not pass.

(a) Income recognition

Income includes dividends from investments quoted ex-dividend on

or before the date of the Statement of Financial Position.

Dividends receivable from equity shares are taken to the revenue

return column of the Statement of Comprehensive Income.

Special dividends are treated as repayment of capital or as

revenue depending on the facts of each particular case.

(b) Presentation of Statement of Comprehensive Income

In order to better reflect the activities of an investment trust

company and in accordance with guidance issued by the Association

of Investment Companies (AIC), supplementary information which

analyses the Statement of

Comprehensive Income between items of a revenue and capital

nature has been presented alongside the statement.

An analysis of retained earnings broken down into revenue

(distributable) items and capital (distributable) items is given in

Note 19. Investment Management fees and finance costs are charged

75 per cent. to capital and 25 per cent. to revenue (2022: 75 per

cent. to capital and 25 per cent. to revenue). All other

operational costs (including administration expenses to capital)

are charged to revenue.

(c) Basis of valuation of investments

Investments are recognised and derecognised on a trade date

where a purchase and sale of an investment is under contract whose

terms require delivery of the investment within the timeframe

established by the market concerned, and are initially measured at

cost, being the consideration given.

All investments are classified as held at fair value through

profit or loss. All investments are measured at fair value with

changes in their fair value recognised in the Statement of

Comprehensive Income in the period in which they arise. The fair

value of listed investments is based on their quoted bid price at

the reporting date without any deduction for estimated future

selling costs.

Foreign exchange gains and losses on fair value through profit

and loss investments are included within the changes in the fair

value of the investments.

For investments that are not actively traded and/or where active

stock exchange quoted bid prices are not available, fair value is

determined by reference to a variety of valuation techniques. These

techniques may draw, without limitation, on one or more of: the

latest arm's length traded prices for the instrument concerned;