TIDMMAI

RNS Number : 8342M

Maintel Holdings PLC

19 September 2023

Maintel Holdings Plc

("Maintel", the "Company" or the "Group")

Interim results for the six months to 30 June 2023

Project delivery delays unwind in the first half of 2023,

business transformation accelerates.

Maintel Holdings Plc, a leading provider of cloud and managed

communication services, is pleased to announce its unaudited

interim results for the six months to 30 June 2023.

Key Financial Information

Unaudited results for 6 months Increase/

ended 30 June: 2023 2022 (decrease)

Group revenue (GBP'm) 47.5 46.7 1.7%

Gross profit (GBP'm) 16.0 15.3 4.6%

Adjusted EBITDA 3.7 3.6 2.8%

(Loss)before tax (GBP'm) (2.9) (0.5) 480.0%

Adjusted profit before tax ([4])

(GBP'm) 2.0 2.4 (20.8)

Basic (loss)/ earnings per share

(p) (19.1) (1.8) (961.1)%

Adjusted earnings per share ([2])

(p) 2.6 11.1 (76.6)%

Net cash debt([3]) (GBP'm) 21.4 19.4 10.3%

Contracted cloud seats 181,000 160,000 13.1%

Highlights

-- Group revenue was GBP 47.5 m, up 1.7 % (2022: GBP46.7m) with

recurring revenue representing 75.1 % of total revenue (2022:

73.7%).

-- Revenue has increased year-on-year following the easing of

supply chain shortages and the continued successful unwinding of

our contracted order book built up during 2022.

-- Significant progress in implementing the first phase of the

business's turnaround plan and moving to a more efficient operating

model. The Company continues to focus on shifting from generalist

to specialist communications solution designer and provider,

allowing us to add more value to our customers through identifying

joint value creation.

-- In turn recurring revenue grew by 3.3% compared to the same

period in 2022, faster than project revenue (-4.0%), increasing

from 73.7% to 75.1%. We continue to grow secured, contracted and

regular revenues through our cloud communications, network and

security managed service products which have performed well through

the pandemic and still have good prospects for future growth.

-- Revenues from Cloud and software customers increased as a

proportion of total Group revenue to 48.8% (H1 2022: 42.4%) which

is important to the business's market position as a digital

communications specialist.

-- Gross profit increased to GBP16.0m (2022: GBP15.3m) with

gross margin increasing to 33.6% (H1 2022: 32.8% ). This increase

flows from improved commercial relationships with our vendors and

focus and in turn being more successful in securing higher value

contracts within our customer base.

-- Adjusted EBITDA has increased by 2.8%to GBP3.7m (H1 2022: GBP3.6m).

-- Basic loss per share at 19.1p (H1 2022: loss per share at

1.8p), flows from one-off restructuring costs (GBP1.9m) which pay

back within one year, plus increased interest charges (FY23:

GBP1.0m, FY22: GBP0.4m) arising from rising SONIA interest

rates.

-- The business's net debt([3]) increased to GBP21.4m, (2022:

GBP19.4m) owing almost exclusively to restructuring exceptional

costs and increased debt servicing charges. The benefits of

restructuring will be realised quickly and permanently.

Operational highlights

-- H1 has been a period of focus on the turnaround plan and

implementation of new ways of working which will have sustainable

and progressive benefits.

-- The product and sales teams are now fully aligned on the

design and provision of specialist digital communications, a

strategic pivot from our historic focus on being a generalist

telecoms provider. Our sales force has been realigned to support

and deliver this strategic pivot.

-- New working practices have been established which are already

yielding results, such as the acceleration of project

implementation due to closer engagement with our customer base,

shortening the timescale from win to bill, which will improve free

cash generation in H2 2023.

-- We are actively revisiting and exiting loss-making contracts

and have won a number of new high value contracts such as

Kingfisher Group, Harrods, Vanquis Banking Group, Angus Council,

Northampton General Hospital NHS Trust and The Leeds Teaching

Hospital. Major new and existing customer contract awards exceed

GBP25m total contract value (TCV), of which over GBP17m will be

recurring revenue.

-- Continued progress in cloud and managed services has

delivered a 13.1% increase in contracted cloud seats to 181,000 at

the half year-end (H1 2022: 160,000).

-- Our sales order pipeline amounts to GBP32.0m. Following the

2022 delay in project roll-out, we have been able to accelerate

service to our customers in H1 2023, shortening the time from

project to recurring revenue into H2 2023 and 2024.

-- The sales team has delivered above target results despite all

the changes in H1 and made significant progress signing deals in

the private sector.

-- However, the implementation of new procurement framework

change with a 3 to 5 year cycle has led to a slow-down in public

sector tenders.

-- Having secured our place on the new framework agreement,

activity is now returning to normal levels.

-- The Company expects to release annualised P&L

improvements of c.GBP11.0m (combining both revenue benefits and

cost savings, as an exit run rate from the end of December 2023),

of which GBP3.0m fall into H1. Part of the benefits will be

re-invested in future growth, such as R&D, to generate

operational scalability.

The Company announces that its nominated adviser and broker

finnCap Ltd, has changed its name to Cavendish Capital Markets

Limited, following a merger.

Commenting on the Group's results, Carol Thompson, Executive

Chairman/Chief Executive Officer said:

"2023 is proving a stimulating and positive year for the

business. The outcome of the first half giving greater clarity on

where Maintel sits in its market and future strategic imperatives.

From that perspective the team feels strong and well equipped to

move forward at pace, delivering consistently high levels of

service to clients and doubling down in high growth areas where we

have historically seen success.

Remote and hybrid working have meant that technology providers

have had to evolve faster than any time in the last 10 years and

Maintel is well placed to support the new hybrid working and cloud

centric environment within which our products sit perfectly. In

order to help our customers support this new way of working and

ensure collaboration, cooperation and productivity are not lost,

Maintel assumes the hybrid working environment as a medium-term

feature and are working hard on our new product innovations to

service customers who find themselves trying to find ways of making

the "new normal" work for them.

The business made a strategic move into unified communications,

secure connectivity and customer experience solutions prior to the

pandemic but due to supply chain issues and slowdown in procurement

cycles, the business's success was constrained. These issues are

resolved and we are now capitalising on our early adoption and

working with our vendors on developing next generation efficiency

and effectiveness models for our customers. Known for being design

experts and vendor agnostic, we are able to create the optimal

environment for our clients, safe in the knowledge we are highly

regarded by global providers such as Avaya, Cisco, Genesys, Mitel,

RingCentral and Unify. We aim to add new vendors to that list where

the technology gives our customers the edge both in terms of

productivity and cost.

We are clear on our strategy, product, IP investment and

customer engagement model. The remainder of the financial year and

beyond is about executing on that strategy, building on the

positive trading momentum continuing into H2 2023 from H1. Adjusted

EBITDA is tracking ahead of management's expectation and Maintel's

strong order book and focused sales strategy underpins management's

confidence in the remainder of the year and now anticipates

achieving adjusted EBITDA for the financial year ahead of initial

management expectations, whilst total net debt is forecasted

slightly higher to support further investment in restructuring and

the normalisation of the working capital.

The search for a new permanent CEO continues, along with a new

senior independent non-executive director.

Whilst the dual role is in place, I continue to be supported by

John Booth as Deputy Chairman. During H1 we welcomed Clare Bates to

the board as Chair of the Remuneration Committee and she brings

significant expertise, experience and balance to the board. We are

delighted to have her as part of the team.

Notes

[1] Adjusted EBITDA is EBITDA of GBP1.6m (H1 2022: GBP3.2m),

adjusted for exceptional items (including one-off restructuring

costs) and share based payments (note 5).

[2] Adjusted earnings per share is basic (loss) per share of

(19.1)p (H1 2022: loss per share of (1.8)p), adjusted for

intangibles amortisation, exceptional items and share based

payments (note 4). The weighted average number of shares in the

period was 14.4m (H1 2022: 14.4m).

[3] Interest bearing debt (excluding issue costs of debt and

IFRS 16 debt) minus cash.

[4] Adjusted (loss) before tax of GBP1.9m (H1 2022: 2.4m) is

basic (loss) before tax, adjusted for intangibles amortisation,

exceptional items and share based payments.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014

C Thompson

Executive Chairman

19 September 2023

For further information please contact:

Carol Thompson, Executive Chair

Gab Pirona, Chief Financial Officer

Dan Davies, Chief Technology Officer 0344 871 1122

Cavendish Capital Markets, (Nomad

and Broker)

Jonny Franklin-Adams / Emily Watts

(Corporate Finance)

Sunila de Silva (Corporate Broking) 020 7220 0500

Business review

Results for the six month period to 30 June 2023

Group revenue increased by 1.7% to GBP47.5m (H1 2022:

GBP46.7m).

Recurring revenue grew by 3.3% compared to the same period in

2022, faster than project revenue (-4.0%), increasing from 73.7% to

75.1%, as a percentage of total revenue.

Our managed services and technology division declined marginally

in revenue by 2.1% to GBP24.5m

(2022: GBP25.0m), with the managed service support base stable

year on year at GBP25.6m (annualised base figure), predominantly

due to contract losses and erosion stabilising, following price

increases on renewals, and on-premise customers transitioning to

managed cloud services. Technology division revenues decreased by

3.9% to GBP11.8m, in comparison to a particularly strong equivalent

period in 2022 (2022: GBP12.3m) aided by the project delivery of

orders closed in FY22, as well as licences associated with new

SD-WAN sales, hardware for cloud deployments and licences for

existing system expansions. The GBP11.8m revenue delivered in the

first half of the current financial year represents strong progress

compared to GBP8.6m generated in the second half of 2022.

The number of contracted seats on our ICON and public cloud

platforms increased by 13.1% to 181,000 with revenue from cloud and

software customers now totalling GBP23.1m, 48.80% of Group revenue.

The Group's cloud portfolio continues to be enhanced by both public

and private cloud solutions, and revenue from cloud subscriptions

and associated managed services grew 19.8% to GBP7.0m. The

continued revenue benefit from the additional contracted seats will

be realised in 2023 and beyond as these projects continue to be

delivered.

With regard to cost management, to date the business has

delivered annualised exit run-rate P&L improvements totalling

GBP11.0m, of which GBP3.0m impacted the period reported.

The cash conversion of the business was impacted in the period

by the exceptional costs associated with the cost restructure of

the business, the increased debt servicing charge and to a lesser

extent the normalisation of working capital. These exceptional cash

flows pay back within one year and are complete as at the end of

H1.

Adjusted EBITDA([1]) increased by 2.8 % mainly reflecting the

revenue dynamic in the first half of the year as well as the impact

of the restructuring programme.

The Group incurred a loss before tax of GBP 2.9 m (H1 2022: loss

of GBP0.5m) and loss per share of 19.1p (H1 2022: loss per share of

1.8p). This includes a net exceptional charge of GBP 1.9 m (H1

2022: GBP0.3m) (refer note 7) and intangibles amortisation of GBP

2.8 m (H1 2022: GBP2.6m).

A djusted earnings per share (EPS) decreased by 76.6 % to 2.6 p

(H1 2022: 11.1p) based on a weighted average number of shares in

the period of 14.4 m (H1 2022: 14.3m).

6 months 6 months

to 30 to 30

June 2023 June 2022

Increase/

GBP000 GBP000 (decrease)

Revenue 47,461 46,746 1.7 %

----------- ------------ ------------

(Loss) before tax (2,928) (575)

Add back intangibles amortisation 2,842 2,651

Exceptional items (note

7) 1,946 261

Share based remuneration 124 71

Adjusted profit before tax 1,984 2,408 (17.6) %

----------- ------------ ------------

Interest 974 398

Depreciation 757 808

Adjusted EBITDA([1]) 3,715 3,614 2.8 %

----------- ------------ ------------

Basic (loss) per share (19.1)p (1.8)p (961.1)%

Diluted (19.1)p (1.8)p (961.1)%

----------- ------------ ------------

Adjusted (loss) per share([2]) 2.6p 11.1p (76.6) %

Diluted adjusted (loss)

per share 2.6p 11.1p (76.6) %

----------- ------------ ------------

Review of operations

Maintel is a Managed Services Provider, with a focus on three

core areas, Unified Comms and Collaboration, Customer Experience

and Secure Connectivity. Our vision is to help every organisation

to thrive through the application of technology with a human touch.

We see technology as the enabler, not the outcome. Success for us

is delivering tangible business benefits for our customers, whether

that be through increasing productivity, velocity, or

collaboration, strengthening their relationships with their own

customers, helping them grow, protecting them from cyber threats,

reducing downtime or saving cost.

The ways in which we can help our customers thrive are many and

varied, and our exceptional people apply the human touch to ensure

that our customer's journey with us is a true partnership and that

we deliver on our promises. This approach allows us to apply a

common blueprint across everything we do, allowing us to cover a

diverse range of technology but with a common and consistent

customer experience.

Elements of cloud services revenues are currently accounted for

in both the managed services and technology division (under the

technology revenue line) and the network services division.

The following table shows the performance of the three operating

segments of the Group.

6 months 6 months

to 30 June to 30

2023 June 2022

(Decrease)

Revenue analysis GBP000 GBP000 / increase

Managed services related 12,674 12,730 (0.4) %

Technology(a) 11,801 12,279 (3.9) %

---------------------------- ------------ ----------- ------------

Managed services and

technology division 24,475 25,009 (2.1) %

Network services division 20,892 19,504 7.1 %

Mobile division 2,094 2,233 (6.2) %

Total Group 47,461 46,746 1.5 %

============================ ============ =========== ============

(a)Technology includes revenues from hardware, software,

professional services and other sales.

Managed services and technology division

The managed services and technology division contains two

distinct revenue lines:

-- Managed services : all support and managed service recurring

revenues for hardware and software located on customer premises.

This combines both legacy PBX and Contact Centre systems, which are

in a managed decline across the sector as organisations migrate to

more effective and efficient cloud solutions, with areas of

technology such as Local Area Networking (LAN), WIFI and security,

which are still very much current and developing technology areas

and therefore enduring sources of revenue.

-- Technology : all non-recurring revenues from hardware,

software, professional and consultancy services and other

non-recurring sales.

Services are predominantly provided across the UK, with some

customers also having international footprints. The division also

supplies and installs project-based technology, professional and

consultancy services to our direct clients and through our partner

relationships.

6 months 6 months

to 30 June to 30 June

2023 2022

Increase

GBP000 GBP000 / (decrease)

Divisional revenue 24,475 25,009 (2.1)%

Divisional gross profit 6,525 6,610 (1.3) %

Gross margin (%) 26.6% 26.4%

========================== ============ ============ ==============

Revenue in this division decreased by 2.1 % to GBP 24.5 m.

Whilst the revenue from the legacy on premise managed service

business remained relatively flat, with the expected churn in this

space counteracted by new additions to the legacy estate (most

notably an outsourcing contract from Atos), the Technology revenues

declined by 3.9% as a result of the continued drive from upfront

perpetual software license purchases, to subscription based

licensing models and the mix of projects delivered in the

period.

Network services division

The Network Services division is made up of three strategic

revenue lines:

-- Cloud - subscription and managed service revenues from cloud contracts

-- Data - subscription, circuit, co-location and managed service

revenues from Wide Area Network (WAN), SD-WAN, Internet access and

managed security service contracts

-- Call traffic and line rental - recurring revenues from both

legacy voice and modern SIP Trunking contracts

6 months

to 30 6 months

June to 30

2023 June 2022

Increase

GBP000 GBP000 / (decrease)

Call traffic 1,498 1,443 3.8%

Line rental 3,481 3,715 (6.3)%

Data connectivity services 8,742 8,116 7.7 %

Cloud 6,959 6,006 15.9 %

Other 212 224 (5.4) %

----------------------------- --------- ----------- --------------

Total division 20,892 19,504 7.1%

Division gross profit 8,437 7,918 6.6 %

Gross margin (%) 40.4% 40.9%

============================= ========= =========== ==============

Network services revenue grew by 7.1 % in the period, whilst the

gross margin of the division contracted slightly to 40.4 % (H1

2022: 40.9%). This reflects the positive contribution of the

continued significant growth in cloud subscription revenues, up

15.9 %, and a return to steady growth for data connectivity (up 7.7

% vs a contraction of (1.7%) from H1 2021 to H1 2022), driven by

our success in winning and rolling out large Software Defined Wide

Area Network (SD_WAN) contracts since 2021 and the normalisation of

the hardware supply chain we've seen in the first half of this

year.

Calls and lines line rental revenue declined by 6.3%, driven by

a continued migration away from the legacy PSTN services due to be

turned off by BT at the end of 2025. This was partially

counteracted by an increase in call traffic revenues (up 3.8%)

driven by an increase in the volume of Inbound Calling services,

predominantly from large Contact Centre deployments.

Maintel cloud services

Maintel has continued to grow its cloud services for both

unified communications and contact centre applications - with

181,000 contracted cloud seats (up 13.1 % on H1 2022) and revenues

from cloud & software customers now at GBP 23.1 m, representing

48.6 % of revenue (H1 2022: 42.4% of revenue). During the first

half of 2023, we continued to make good progress in delivering our

contracted cloud projects and have closed additional new key

contracts for the future in both the Private and Public cloud

spaces.

Mobile division

Maintel's mobile division generates revenue primarily from

commissions received as part of its dealer agreements with O2 which

scales in line with growth in partner revenues, in addition to

value added services sold alongside mobile such as mobile fleet

management and mobile device management.

6 months 6 months

to 30 to 30

June 2023 June

2022

GBP000 GBP000 Decrease

Revenue 2,094 2,234 (6.2)%

Gross profit 1,002 823 21.7%

Gross margin (%) 47.8% 36.8%

=================== =========== ========= =========

Number of customers 523 619 (15.5)%

Number of connections 28,671 27,341 4.8%

======================== ======= ======= ========

Revenue decreased by 6.2 % to GBP 2.1 m (H1 2022: GBP2.2m) with

gross profits at GBP 1.0 m (H1 2022: GBP0.8m), and higher margins

of 47.8 % compared to 36.8% in the prior period. The main

contributing factor was the positive impact of bonuses earnt in the

year from our main partners.

O2 continues to be our core partner and route to market,

bolstered by our Vodafone agreement and our newly established

relationship with Three, which enhances our commercial offering as

well as increasing our ability to serve our customers more

effectively and efficiently. Lastly, our own ICON Mobilise

wholesale offering is ideal for customers who require an agile

solution that caters for unique billing, network, and commercial

requirements.

Maintel's mobile go-to-market proposition will continue to focus

on the mid-market and low-end enterprise segments where our

portfolio is best suited. We continued to invest in this area

during the period, with the launch of mobile usage threshold

alarming within our ICON Portal digital customer engagement

platform.

Administrative expenses

Administrative expenses mainly comprise costs related to the

sales and marketing teams, the support functions and the managerial

positions, as well as the associated growth generating investments

and general costs. On a comparable basis, the total other

administrative expenses, excluding depreciation, amounted to GBP

12.6m for the period, slightly increased from GBP12.1m in H1 2022.

The net GBP0.5m increase mainly reflects salary increases in line

with inflation.

The overall headcount dropped by 6.3% or 31 FTEs and now stands

at 465 (H1 2022: 496) as a result of the Group's programme of

re-adapting to a scalable efficient business to facilitate our

transition to a communications specialist .

Cash flow

The Group net debt (excluding IFRS 16 liabilities and issue

costs of debt) of GBP 21.4 m at 30 June 2023, compared to GBP 16.6

m net debt at 31 December 2022.

6 months 6 months

to 30 June to 30 June

2023 2022

GBP000 GBP000

Cash (used in)/generated by operating activities (1,898) 3,954

Taxation (paid) - (370)

Capital expenditure (1,195) (2,087)

Finance cost (net) (849) (471)

Issue costs of debt - (234)

------------- ------------

Free cashflow (3,942) 792

Payments in respect of prior period business

combination - (311)

Proceeds from borrowings 2,500 22,500

Repayment of borrowings (1,200) (15,500)

Lease liability repayments (644) (517)

(Decrease)/ Increase in cash and cash equivalents (3,286) 6,964

Cash and cash equivalents at start of period 6,136 (3,869)

Exchange differences (24) (5)

Cash and cash equivalents at end of period 2,826 3,090

Bank borrowings (24,200) (22,500)

------------- ------------

Net debt excluding issue costs of debt (21,374) (19,410)

Adjusted EBITDA (note 5) 3,715 3,614

============= ============

The Group generated -GBP1.9m of cash from operating activities

compared to H1 2022 comparator of GBP3.9m.

Capital expenditure outlay of GBP1.2m in the period (H1 2023:

GBP2.0m) was driven by our continued investment across Maintel's

product and service portfolio.

No tax paid was paid in the first half of the financial year. In

prior years payments have been made in relation to the Groups

historical losses being fully utilised and taxable profits arising

in the year ended 31 December 2022.

Dividends

In line with previous periods, the Board has made the decision

to continue to pause dividend payments. As such, the Board will not

declare an interim dividend for 2023 (H1 2022: Nil).

Outlook

The solid performance of our sales team year-to-date supports

our expectations of a strong performance for the second half of

2023. The sales order book currently extends revenue potential

beyond our original expectations. Private sector business secured

in the early months of 2023 is now being delivered and supports

strong project revenue streams. Whilst public sector contract

awards in the first half of the year were awaiting the

implementation of the new public framework, we expect an increase

in tendering activity during H2 and into 2023 as investment

continues in digital transformation across local government,

health, housing and education sectors.

Leveraging the positive outcome of the first phase of the

business transformation, the performance in the second half of the

year will benefit from the full impact of the P&L improvement

initiatives. Those benefits will be compounded with the

implementation of the second phase of the transformation programme

focussing on our property strategy, the delivery model and growth

acceleration.

The Board therefore expects H2 2023 trading to show further

momentum building on the period reported. Consequently, the Board

is confident that Maintel will achieve full year adjusted EBITDA

ahead of initial expectations for the financial year ending 31

December 2023. Total net debt is forecasted slightly higher to

support further investment in restructuring and the normalisation

of the working capital.

Although the Board does not feel it is timely to resume dividend

payments, this will be kept under review as conditions further

improve.

On behalf of the board

C Thompson

Executive Chairman

19 September 2023

Maintel Holdings Plc

Consolidated statement of comprehensive income (unaudited)

for the 6 months ended 30 June 2023

6 months 6 months

to 30 June to 30 June

2023 2022

Note GBP000 GBP000

(Unaudited) (Unaudited)

Revenue 2 47,461 46,746

Cost of sales (31,497) (31,395)

------------ ------------

Gross profit 15,964 15,351

Other operating income 3 339 455

Administrative expenses

---------------------------------------- ----- ------------ ------------

Intangibles amortisation (2,842) (2,651)

Exceptional items 7 (1,946) (261)

Share based payments (124) (71)

Other administrative expenses (13,345) (13,000)

---------------------------------------- ----- ------------ ------------

(18,257) (15,982)

Operating (loss) (1,954) (177)

Net financial costs (974) (398)

(Loss) before taxation (2,928) (575)

Taxation credit 180 323

------------ ------------

(Loss) for the period and attributable

to owners of the parent (2,748) (252)

Other comprehensive income

for the period

Exchange differences on translation

of foreign operations (20) 9

------------ ------------

Total comprehensive (loss)

for the period attributable

to the owners of the parent (2,768) (243)

============ ============

(Loss) per share from continuing

operations attributable to

the ordinary equity holders

of the parent

Basic 4 (19.1)p (1.8)p

Diluted 4 (19.1)p (1.8)p

============ ============

Maintel Holdings Plc

Consolidated statement of financial position (unaudited)

at 30 June 2023

30 June 31 December

2023 2022

Note GBP000 GBP000

(Unaudited) (Audited)

Non-current assets

Intangible assets 51,267 52,989

Right-of-use assets 2,052 2,711

Property, plant and equipment 1,142 1,427

Trade and other receivables - 360

54,461 59,287

------------ ------------

Current assets

Inventories 3,123 1,592

Trade and other receivables 31,555 29,089

Income tax 68 92

Cash and cash equivalents 2,826 3,090

37,572 33,863

------------ ------------

Total assets 92,033 93,150

Current liabilities

Trade and other payables 48,066 43,087

Lease liabilities 843 840

Borrowings 8 2,257 2,400

Total current liabilities 51,166 46,327

Non-current liabilities

Other payables 326 482

Lease liabilities 1,219 1,853

Deferred tax liability 778 1,224

Borrowings 8 21,800 19,887

Total non-current liabilities 24,123 23,449

Total liabilities 75,289 69,773

------------ ------------

Total net assets 16,744 23,377

============ ============

Equity

Issued share capital 144 144

Share premium 24,588 24,588

Other reserves 60 70

Retained earnings (8,048) (1,425)

Total equity 16,744 23,377

============ ============

Maintel Holdings Plc

Consolidated statement of changes in equity (unaudited)

for the 6 months ended 30 June 2023

Share Other Retained

capital Share reserves earnings Total

premium

Note GBP000 GBP000 GBP000 GBP000 GBP000

At 31 December 2021 144 24,588 61 (1,244) 23,549

Loss for the period - - - (252) (252)

Other comprehensive

income:

Foreign currency

translation differences - - 9 - 9

--------------------------------- ---------- ---------- ----------- ----------- --------

Total comprehensive

(loss) for the period - - 9 (252) (243)

Share based payments - - - 71 71

At 30 June 2022 144 24,588 70 (1,425) 23,377

(Loss) for the period - - - (4,109) (4,109)

Other comprehensive -

income: - - - -

Foreign currency

Translation differences - - 10 - 10

--------------------------------- ---------- ---------- ----------- ----------- --------

Total comprehensive

loss for the period - - 10 10

Share based payments - - - 110 110

---------------------------------

At 31 December 2022 144 24,588 80 (5,424) 19,388

--------------------------------- ---------- ---------- ----------- ----------- --------

Loss for the period - - - (2,748) (2,748)

Other comprehensive - - - - -

income:

Foreign currency

translation differences - - (20) - (20)

--------------------------------- ---------- ---------- ----------- ----------- --------

Total comprehensive

income for the period - - (20) - (2,768)

Share based payments - - - 124 124

--------------------------------- ---------- ---------- -----------

At 30 June 2023 144 24,588 60 (8,048) 16,744

================================= ========== ========== =========== =========== ========

Maintel Holdings Plc

Consolidated statement of cash flows (unaudited)

for the 6 months ended 30 June 2023

6 months 6 months

to 30 June to 30 June

2023 2022

GBP000 GBP000

Operating activities

(Loss)before taxation (2,928) (575)

Adjustments for:

Intangibles amortisation 2,842 2,651

Share based payment charge 124 71

Depreciation of plant and equipment 314 330

Depreciation of right of use asset 443 478

Interest expense (net) 974 398

Operating cash flows before changes in working

capital 1,769 3,353

Increase in inventories (529) (583)

(Increase) / decrease in trade and other receivables (4,045) 1,410

Increase / (decrease) in trade and other payables 907 (226)

------------ ------------

Cash generated from operating activities (1,898) 3,954

Tax paid - (370)

------------ ------------

Net cash flows (used in) / generated from operating

activities (1,898) 3,584

------------ ------------

Investing activities

Purchase of plant and equipment (75) (667)

Purchase of software (1,120) (1,420)

Purchase price in respect of prior period business

combinations - (311)

Net cash flows used in investing activities (1,195) (2,398)

------------ ------------

Maintel Holdings Plc

Consolidated statement of cash flows (continued) (unaudited)

for the 6 months ended 30 June 2023

6 months 6 months

to 30 to 30

June 2023 June 2022

GBP000 GBP000

Financing activities

Proceeds from borrowings 2,500 22,500

Repayment of borrowings (1,200) (15,500)

Lease liability repayments (644) (517)

Interest paid (849) (471)

Issue costs of debt - (234)

Net cash flows generated from financing

activities (193) 5,778

----------- -----------

Net (decrease) / increase in cash

and cash equivalents (3,286) 6,964

Cash and cash equivalents at start

of period 6,136 (3,869)

Exchange differences (24) (5)

Cash and cash equivalents at end of

period 2,826 3,090

=========== ===========

Maintel Holdings Plc

Notes to the interim financial information

1. Basis of preparation

The financial information in these unaudited interim results is

that of the holding company and all its subsidiaries (the Group).

The financial information for the half-years ended 30 June 2023 and

30 June 2022 does not comprise statutory financial information

within the meaning of s434 of the Companies Act 2006 and is

unaudited. It has been prepared in accordance with the recognition

and measurement requirements of UK adopted International Accounting

Standards (IAS) but does not include all the disclosures that would

be required under IAS. The accounting policies adopted in the

interim financial statements are consistent with those adopted in

the last annual report for financial year 2022 and those applicable

for the year ended 31 December 2023.

2. Segmental information

For management reporting purposes and operationally, the Group

consists of three business segments: (i) telecommunications managed

service and technology sales, (ii) telecommunications network

services, and (iii) mobile services. Each segment applies its

respective resources across inter-related revenue streams which are

reviewed by management collectively under these headings. The

businesses of each segment and a further analysis of revenue are

described under their respective headings in the business

review.

The chief operating decision maker has been identified as the

board, which assesses the performance of the operating segments

based on revenue and gross profit.

Six months to 30 June 2023 (unaudited)

Managed

service Network

and technology services Mobile Total

GBP000 GBP000 GBP000 GBP000

Revenue 24,475 20,892 2,094 47,461

================ =========== ========= =========

Gross profit 6,525 8,437 1,002 15,964

---------------- ----------- ---------

Other operating income 339

Other administrative

expenses (13,345)

Share based payments (124)

Intangibles amortisation (2,842)

Exceptional items (1,946)

---------

Operating (loss) (1,954)

Interest (net) (974)

---------

(Loss) before taxation (2,928)

Income tax credit 180

(Loss) after taxation (2,748)

=========

Further analysis of revenue streams is shown in the business

review.

The board does not regularly review the aggregate assets and

liabilities of its segments and accordingly, an analysis of these

is not provided.

Managed Central/

service Network inter-

and technology services Mobile company Total

GBP000 GBP000 GBP000 GBP000 GBP000

Intangibles amortisation - - - 2,842 2,842

Exceptional items - - - 1,946 1,946

================= =========== ========== ========= =======

Six months to 30 June 2022 (unaudited)

Managed

service Network

and technology services Mobile Total

GBP000 GBP000 GBP000 GBP000

Revenue 25,009 19,504 2,233 46,746

================ =========== ========= =========

Gross profit 6,610 7,918 823 15,351

---------------- ----------- ---------

Other operating income 455

Other administrative

expenses (13,000)

Share based payments (71)

Intangibles amortisation (2,651)

Exceptional items (261)

---------

Operating (loss) (177)

Interest (net) (398)

---------

(Loss) before taxation (575)

Income tax credit 323

(Loss) after taxation (252)

=========

Further analysis of revenue streams is shown in the business

review.

The board does not regularly review the aggregate assets and

liabilities of its segments and accordingly, an analysis of these

is not provided.

Managed Central/

service Network inter-

and technology services Mobile company Total

GBP000 GBP000 GBP000 GBP000 GBP000

Intangibles amortisation - - - 2,651 2,651

Exceptional items 107 - - 154 261

================ ========== ========= ========= =======

3. Other operating income

6 months 6 months to

to 30 June 30 June 2022

2023

GBP000 GBP000

(unaudited) (unaudited)

Other operating income 339 455

============ ==============

Other operating income of GBP0.3m in the period relates to

monies associated with the recovery of research and development

expenditure credits (H1 2022: GBP0.5m).

4. Earnings per share

Earnings per share and adjusted earnings per share is calculated

by dividing the (loss) / profit after tax for the period by the

weighted average number of shares in issue for the period. These

figures being prepared as follows:

6 months 6 months

to 30 June to 30 June

2023 2022

GBP000 GBP000

(unaudited) (unaudited)

Earnings used in basic and diluted EPS,

being (loss) after tax (2,748) (252)

Adjustments: Amortisation of intangibles

on business combinations 1,893 2,099

Exceptional items (note 7) 1,946 261

Tax relating to above adjustments (842) (607)

Share based payments 124 71

Interest charge on deferred consideration - 18

Adjusted earnings used in adjusted EPS 373 1,590

============ ============

The adjustments above have been made to provide a clearer

picture of the trading performance of the Group.

6 months 6 months

to 30 June to 30 June

2023 2022

Number GBP000 Number GBP000

Weighted average number of ordinary shares

of 1p each 14,362 14,362

Potentially dilutive shares - 19

-------------- --------------

14,362 14,362

============== ==============

(Loss) per share

Basic (19.1)p (1.8)p

Diluted (19.1)p (1.8p)

Adjusted - basic after the adjustments

in the table above 2.6p 11.1p

Adjusted - diluted after the adjustments

in the table above 2.6p 11.1p

======== =======

In calculating adjusted diluted earnings per share, the weighted

average number of ordinary shares in issue is adjusted to assume

conversion of all potentially dilutive ordinary shares. The Group

has one category of potentially dilutive ordinary share, being

those share options granted to employees where the exercise price

is less than the average price of the Company's ordinary shares

during the period.

5. Earnings before interest, tax, depreciation and amortisation (EBITDA)

The following table shows the calculation of EBITDA and adjusted

EBITDA:

6 months 6 months

to 30 June to 30 June

2023 2022

GBP000 GBP000

(unaudited) (unaudited)

(Loss) before tax (2,928) (575)

Net interest payable 974 398

Depreciation of property, plant and

equipment 314 330

Depreciation of right of use asset 443 478

Amortisation of intangibles 2,842 2,651

------------ ------------

EBITDA 1,645 3,282

Share based payments 124 71

Exceptional items (note 7) 1,946 261

Adjusted EBITDA 3,715 3,614

============ ============

6. Dividends

The directors have decided not to declare an interim dividend

for 2023 (2022: nil).

7. Exceptional items

6 months 6 months

to 30 June to 30 June

2023 2022

GBP000 GBP000

(unaudited) (unaudited)

Staff restructuring and other employee

related costs 965 153

Costs relating to business transformation 606 -

Fees relating to revised credit facilities

agreement 375 154

Gain on disposal of the managed print

services business - (16)

(Income) relating to onerous lease provision - (30)

1,946 261

============ ============

8. Borrowings

30 June 31 December

2023 2022

GBP000 GBP000

(unaudited) (audited)

Current bank loan - secured 2,257 5,226

Current RCF - secured 17,500

------------ ------------

2,257 22,726

Non- Current bank loan - secured 1,800 -

Non - Current RCF - secured 20,000 -

------------ ------------

21,800 -

24,057 22,726

============ ============

In the previous year, the Company signed a new agreement with

HSBC Bank plc ("HSBC") to replace the previous facility. The new

facility with HSBC consists of a revolving credit facility ("RCF")

of GBP20m with a GBP6m term loan on a reducing basis. The maturity

date of the agreement is 3 years from the signing date. The term

loan is being repaid in equal monthly instalments, starting in

October 2022. The principal balance of the term loan at 30 June

2023 was GBP4.2m and of the RCF was GBP20.0m.

Interest on the borrowings is the aggregate of the applicable

margin and SONIA for Pound Sterling / SOFR for US Dollar / EURIBOR

for Euros.

Covenants based on EBITDA to Net Finance Charges and Total Net

Debt to EBITDA are tested on a quarterly basis.

The current bank borrowings above are stated net of unamortised

issue costs of debt of GBP0.2m (31 December 2022: GBP0.1m).

The facilities are secured by a fixed and floating charge over

the assets of the Company and its subsidiaries. Interest is payable

on amounts drawn on the revolving credit facility and loan facility

at a covenant-depending tiered rate of 2.60 % to 3.25% per annum

over SONIA, with a reduced rate payable on the undrawn

facility.

The Directors consider that there is no material difference

between the book value and fair value of the loan.

9. Post balance sheet events

There have been no events subsequent to the reporting date which

would have a material impact on the interim financial result.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR KVLFFXKLBBBE

(END) Dow Jones Newswires

September 19, 2023 02:00 ET (06:00 GMT)

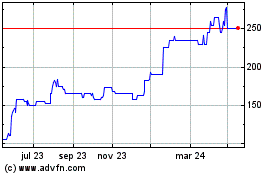

Maintel (LSE:MAI)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

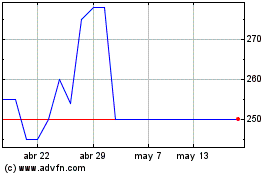

Maintel (LSE:MAI)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024