Interim Results

19 Septiembre 2008 - 7:41AM

UK Regulatory

RNS Number : 8661D

Northern Electric PLC

19 September 2008

NORTHERN ELECTRIC plc

HALF-YEARLY FINANCIAL REPORT

SIX MONTHS ENDED 30 JUNE 2008

NORTHERN ELECTRIC plc: INTERIM MANAGEMENT REPORT

Registered Number: 2366942

Registered Office: Lloyds Court, 78 Grey Street, Newcastle upon Tyne, NE1 6AF

Cautionary Statement

This interim management report has been prepared solely to provide additional information to shareholders to assess the strategies of

Northern Electric plc (the "Company") and its subsidiaries (the "Group") and the potential for those strategies to succeed and should not be

relied on by any other party or for any other purpose.

Operations

The principal activity of the Company during the six months to 30 June 2008 was to act as a holding company, with its main operating

subsidiaries being Northern Electric Distribution Limited ("NEDL") and Integrated Utility Services Limited ("IUS"). NEDL holds an

electricity distribution licence serving an area of approximately 14,400 sq km in the north east of England. It receives electricity from

the National Grid transmission system and distributes it to the 1.6 million customers connected to its electricity distribution network of

transformers, switchgear and overhead and underground cables, at voltages of up to 132kV. NEDL is subject to regulation by the Gas and

Electricity Markets Authority, which acts through the Office of Gas and Electricity Markets ("Ofgem"). IUS provides engineering contracting

services to a range of clients, including E-on, Network Rail, Scottish Water, Northumbrian Water and Yorkshire Water.

During the six months to 30 June 2008, NEDL distributed electricity to customers in its distribution services area and targeted its

investment strategy at delivering improvements in the overall performance of its electricity distribution network in an efficient and

cost-effective manner. NEDL's capital expenditure program included activities to refurbish, replace and construct assets such as

substations, transformers, switchgear, overhead and underground cables and associated equipment. IUS continued to develop its engineering

contracting business and operated as an independent connections provider but has experienced a difficult period in its "multi-utility"

business, in parallel with the general, national downturn in the housing market.

The Group has been experiencing a period of industrial action, which commenced on 26 June 2008 and involved the withdrawal of standby

and overtime working by its industrial employees. The Group implemented a mitigation plan, the focus of which was on the day to day

management of its field operations. The plan included monitoring of those operations and the identification and resolution of issues arising

and focused on the performance of the individual work teams, resourcing issues and safety management. Following lengthy discussions and

negotiations, the trades unions issued a statement to their members setting out the details of the position reached and recommending that it

was the best that could be achieved through the negotiation and conciliation process. The trades unions agreed to withdraw the ban on

overtime and standby working with effect from 8 September 2008 and issued ballot papers regarding that offer to their members with a closing

date for return of those papers of 19 September 2008.

In respect of its key customer service performance indicators, NEDL stated in the most recent regulatory accounts provided to Ofgem that

the initially reported performance for the regulatory year ended 31 March 2008 in respect of its Customer Interruptions ("CI") and Customer

Minutes Lost ("CML") targets was as follows:

Actual Target

CML: 70.5 (2007: 78.2) 69.4 (2007: 70.4)

CI: 66.3 (2007: 74.0) 74.5 (2007: 74.5)

NORTHERN ELECTRIC plc:

REGISTERED NUMBER: 2366942

INTERIM MANAGEMENT REPORT (CONTINUED)

Operations (Continued)

The initially reported performance of CML and CI excludes the impact of severe weather events, which are the subject of exemption claims

under the exceptional event process made by NEDL to and awaiting approval from Ofgem. It is expected that the results of those exceptional

event claims will be confirmed by October 2008.

In addition, during the regulatory year ended 31 March 2008, NEDL achieved a cumulative customer satisfaction score of 88.6%, narrowly

missing the Ofgem target of 90%.

The safety of its employees continued to be of paramount importance to the Group, with the on-going focus being on the goal that no

employees should be injured during their working time. In this respect, the six months to 30 June 2008 were somewhat disappointing, with the

Group having experienced 2 lost time accidents, against an annual target of zero (six months to 30 June 2007: 1) and 11 preventable vehicle

accidents, against an annual target of 14 (six months to 30 June 2007: 12). Work continues to reduce the accident rates and the lessons

learned from such incidents are incorporated into the Group's safety improvement plan.

Results for the six months ended 30 June 2008

The interim accounts for the six months ended 30 June 2008 consolidate the results of the Company and its subsidiaries and are prepared

under International Financial Reporting Standards. The interim accounts do not comprise statutory accounts within the meaning of Section 240

of the Companies Act 1985 and have not been subject to audit or review by the Company's auditors.

A summary of the key financial results is set out below:

Key financials

Revenue

Revenue at �138.0m was �6.9m higher than for the six months ended 30 June 2007 mainly due to the net impact of tariff changes

implemented by NEDL in the period.

Cash flow

Cash and cash equivalents as at 30 June 2008 were �177.2m which represented an increase of �0.4m when compared with the position at 31

December 2007. Cash inflows from operating activities (�44.8m) and net additional borrowings (�4.6m) were partly offset by cash outflows of

�49.0m associated with investing activities.

The Company has access to short-term borrowing facilities provided by Yorkshire Electricity Group plc, a related party, and to committed

revolving credit facilities priovided by Lloyds TSB Bank plc and Royal Bank of Scotland plc.

NORTHERN ELECTRIC plc:

REGISTERED NUMBER: 2366942

INTERIM MANAGEMENT REPORT (CONTINUED)

Financial position

Profit before tax at �57.0m was �6.4m higher than the six months ended 30 June 2007 mainly due to higher margins reflecting the impact

of the distribution tariff increases and higher returns from the electrical contracting operations.

Dividends

No ordinary dividends were paid in the period resulting in �56.0m being transferred to reserves.

Related party transactions

The Company provides certain corporate functions to the CE Electric UK group of companies (the "CE Group"), including financial and

management accounting, financial planning, treasury, taxation, procurement, pensions, internal audit, legal advice, insurance management,

claims handling and litigation services. Further details of the related party transactions entered into by the Group and Company are

included in Note 3 to this interim management report.

Pensions

The Company is the Principal Employer in the Northern Electric Group of the Electricity Supply Pension Scheme (the "Scheme"), a defined

benefit scheme, and, in March 2008, reached agreement with the Group Trustees to repair the Scheme deficit. The agreement comprises monthly

cash payments of �2.4m (�28.4m per annum). These payments aim to remove the shortfall of �95.1m by December 2010 subject to the actuarial

assumptions adopted for the triennial valuation as at 31 March 2007 being borne out in practice. The next triennial actuarial valuation of

the Scheme will take place as at 31 March 2010, with the associated arrangements for repair of the deficit or use of surplus, to be agreed

by 31 March 2011. Consequently, it is not expected that the Company's contributions to the Scheme will materially alter until that process

is complete. Further details of the Company's pension arrangements can be found in the annual report and accounts to 31 December 2007.

Risks and uncertainties

Regulation

One of the principal risks facing NEDL relates to possible changes in its allowed income as a result of modifications to the price

control formulae that are set out within the special conditions of the electricity distribution licence.

On 28 March 2008, Ofgem published its initial consultation document for the forthcoming electricity distribution price control review.

That review is likely to change the income that NEDL will be allowed to recover and retain from 1 April 2010 until 31 March 2015. In making

proposals to modify the special conditions of the electricity distribution licence, the Gas and Electricity Markets Authority must have

regard to, inter alia, the need to secure that licence holders are able to finance their licensed activities.

NORTHERN ELECTRIC plc:

REGISTERED NUMBER: 2366942

INTERIM MANAGEMENT REPORT (CONTINUED)

Regulation (Continued)

On 6 March 2008, Ofgem also announced a review of the regulatory regime for energy networks. This review will not report until 2010 and

Ofgem has stated that this review will not affect work for the next price control for electricity distribution. However, it may have

consequences for the regulation of electricity distribution charges thereafter.

As the price control formula does not constrain profits from year to year, but is a control on revenue that operates independently of

most of NEDL's costs and it has been the practice of Ofgem to review and reset the formula at five-year intervals, it is not expected that

such issues will have a material impact on NEDL's performance over the remaining six months of the financial year.

Financial

The Group addresses interest rate risk by having a policy of providing a stable, low cost of financing over time whilst observing

approved risk parameters being financed by long-term borrowings at fixed rates and having access to short-term borrowing facilities at

floating rates of interest. As at 30 June 2008, 93% of the Group's borrowings were at fixed rates and the average maturity for these

borrowings was 23 years.

Despite this position, the Group remains mindful of the current economic climate and the associated potential impact on the cost of its

short-term borrowings. No material currency risks are faced by the Group and it is policy that no trading in financial instruments should be

undertaken.

Further information on the principal long term risks and uncertainties and the internal control system are included in the Company's

latest annual report, which is available at www.ce-electricuk.com.

Short term

Given the regulatory environment in which NEDL operates, as detailed above, the financial risks to NEDL, during the term of the price

control, are that changes in most categories of cost incurred by NEDL will have a direct impact on its financial results.

Future strategy and objectives

The Company will continue to develop its business as a holding company in a manner that concentrates on the Group's core skills of

electricity distribution and engineering contracting.

NEDL will continue to operate its business with the goal of out-performing the allowances in the distribution price control, while

efficiently investing in its electricity distribution system with the aim of improving the quality of supply provided to its customers. The

majority of NEDL's distribution revenues for the period to 31 March 2010 have been set by Ofgem.

IUS will look to further develop its engineering contracting business by delivering a high standard of service to its existing clients

and pursuing opportunities in the health, education, industrial, chemical and manufacturing sectors.

NORTHERN ELECTRIC plc:

REGISTERED NUMBER: 2366942

INTERIM MANAGEMENT REPORT (CONTINUED)

Responsibility Statement

We confirm that to the best of our knowledge:

(a) the condensed set of finanical statements has been prepared in accordance with IAS 34, "Interim Financial

Reporting", and gives a true and fair view of the assets, liabilities, financial position and profit of the Group for

the six months to 30 June 2008

(b) the interim management report contains a fair review of the information required by DTR 4.2.7 (indication of

important events during the first six months of the year and description of the principal risks and uncertainties

for the remaining six months of the year); and

(c) the interim management report includes a fair review of the information required by DTR 4.2.8R (disclosure of

related parties' transactions and changes therein).

By order of the board

P A Jones

Director

19 September 2008

NORTHERN ELECTRIC plc

REGISTERED NUMBER: 2366942

CONDENSED FINANCIAL STATEMENTS - SIX MONTHS ENDED 30 JUNE 2008

CONSOLIDATED INCOME STATEMENT

6 Months ended 30 6 Months ended 30 Year ended

June 2008 June 2007 31 December

2007

Unaudited Unaudited Audited

�m �m �m

Revenue 138.0 131.1 282.0

Cost of sales (25.8) (27.4) (64.3)

Gross profit 112.2 103.7 217.7

Distribution costs (33.2) (31.8) (64.4)

Administrative expenses (10.4) (10.1) (22.1)

Operating profit 68.6 61.8 131.2

Share of profit after tax of 0.2 0.2 0.4

joint venture accounted for

using the equity method

Other gains 0.1 - 0.2

Investment income 5.9 7.0 14.9

Finance costs (17.8) (18.4) (37.7)

Profit before tax 57.0 50.6 109.0

Income tax expense (1.0) (5.9) (23.0)

Profit from ordinary 56.0 44.7 86.0

activities after tax

CONSOLIDATED STATEMENT OF RECOGNISED INCOME AND EXPENSE - SIX MONTHS ENDED 30 JUNE 2008

There is no other income or expense for the Group other than the profits reported above. NORTHERN ELECTRIC plc

REGISTERED NUMBER: 2366942

CONDENSED FINANCIAL STATEMENTS - SIX MONTHS ENDED 30 JUNE 2008

CONSOLIDATED BALANCE SHEET

30 June 30 June 31 December 2007

2008 2007

Unaudited Unaudited Audited

�m �m �m

Non-current assets

Property, plant and equipment 1,224.4 1,126.1 1,181.3

Intangibles 5.8 7.1 6.5

Investments in joint venture 3.0 3.0 3.2

Investments in other companies 0.1 0.1 0.1

Retirement benefit asset 72.5 25.3 44.7

Trade and other receivables 4.6 4.9 4.7

1,310.4 1,166.5 1,240.5

Current assets

Inventories 22.8 19.1 21.7

Trade and other receivables 49.1 43.2 59.5

Short-term securities - 100.0 -

Cash and cash equivalents 177.2 72.6 176.8

249.1 234.9 258.0

Total assets 1,559.5 1,401.4 1,498.5

Current liabilities

Trade and other payables (81.9) (64.6) (83.1)

Current income tax liabilities (14.0) (6.9) (16.1)

Deferred revenue (11.9) (9.7) (10.2)

Borrowings (26.5) (109.7) (21.9)

Provisions (1.7) (4.2) (3.2)

(136.0) (195.1) (134.5)

Net current assets 113.1 39.8 123.5

Non-current liabilities

Borrowings (347.0) (246.9) (347.0)

Deferred income tax liabilities (154.0) (160.5) (164.1)

Retirement benefit obligations (1.4) (1.3) (1.4)

Deferred revenue (364.3) (338.4) (350.7)

Provisions (1.2) (0.9) (1.2)

(867.9) (748.0) (864.4)

Total liabilities (1,003.9) (943.1) (998.9)

Net assets 555.6 458.3 499.6

EQUITY

Share capital 72.2 72.2 72.2

Share premium 158.8 158.8 158.8

Retained earnings 318.4 221.1 262.4

Other reserves 6.2 6.2 6.2

Total equity 555.6 458.3 499.6

The interim accounts were approved by the board of directors and authorised for issue on 19 September 2008 and were signed on its behalf

by:

P A Jones

Director

NORTHERN ELECTRIC plc

REGISTERED NUMBER: 2366942

CONDENSED FINANCIAL STATEMENTS - SIX MONTHS ENDED 30 JUNE 2008

CONSOLIDATED CASH FLOW STATEMENT

6 Months ended 6 Months ended 30 Year ended

30 June June 31 December

2008 2007 2007

Unaudited Unaudited Audited

�m �m �m

Net cash from operating 44.8 30.3 67.0

activities

Investing activities

Dividends received from joint 0.4 0.4 0.4

venture

Sale of long-term securities - - 100.0

Proceeds from disposal of 0.2 0.4 0.8

property, plant and equipment

Purchase of property, plant (75.0) (57.2) (117.9)

and equipment

Purchase of intangible assets - (1.7) (2.0)

Receipt of customer 25.4 25.9 41.8

contributions

Net cash (used in)/generated (49.0) (32.2) 23.1

from investing activities

Financing activities

Movement in loan from parent 5.6 (4.6) (3.4)

undertaking

New borrowings raised - - 11.0

Repayment of borrowings (1.0) - -

Net cash generated from/(used 4.6 (4.6) 7.6

in) financing activities

Net increase/(decrease) in 0.4 (6.5) 97.7

cash and cash equivalents

Cash and cash equivalents at 176.8 79.1 79.1

beginning of period

Cash and cash equivalents at 177.2 72.6 176.8

end of period

NORTHERN ELECTRIC plc

REGISTERED NUMBER: 2366942

CONDENSED FINANCIAL STATEMENTS - SIX MONTHS ENDED 30 JUNE 2008

NOTES TO THE ACCOUNTS

1. REVENUE AND SEGMENTAL ANALYSIS

The Group operates in two principal areas of activity, that of the distribution of electricity and engineering contracting in the United

Kingdom.

6 months ended 30 June 2008 (Unaudited)

Engineering

Distribution Contracting Other Total

�m �m �m �m

REVENUE

External sales 107.8 25.7 4.5 138.0

Inter-segment sales 0.2 - (0.2) -

Total Revenue 108.0 25.7 4.3 138.0

SEGMENT RESULTS

Operating profit 40.2 1.4 27.0 68.6

Share of profit after tax of

joint venture accounted for

using the equity method

0.2

Other gains 0.1

Investment income 5.9

Finance costs (17.8)

Profit before tax 57.0

OTHER INFORMATION

Capital additions 64.4 - (1.9) 62.5

Depreciation and amortisation 20.5 - (0.4) 20.1

Amortisation of deferred (5.3) - - (5.3)

revenue

"Other" comprises business support units and consolidation adjustments.

Sales and purchases between the different segments are made at commercial prices.

NORTHERN ELECTRIC plc

REGISTERED NUMBER: 2366942

CONDENSED FINANCIAL STATEMENTS - SIX MONTHS ENDED 30 JUNE 2008

NOTES TO THE ACCOUNTS (CONTINUED)

1. REVENUE AND SEGMENTAL ANALYSIS (continued)

6 months ended 30 June 2007 (Unaudited)

Engineering

Distribution Contracting Other Total

�m �m �m �m

REVENUE

External sales 101.8 25.1 4.2 131.1

Inter-segment sales 0.1 - (0.1) -

Total Revenue 101.9 25.1 4.1 131.1

SEGMENT RESULTS

Operating profit 42.0 (0.7) 20.5 61.8

Share of profit after tax of

joint venture accounted for

using the equity method

Other gains 0.2

Investment income 7.0

Finance costs (18.4)

50.6

Profit before tax

OTHER INFORMATION

Capital additions 55.1 - (1.8) 53.3

Depreciation and amortisation 19.5 0.1 (0.5) 19.1

Amortisation of deferred (4.6) - - (4.6)

revenue

"Other" comprises business support units and consolidation adjustments.

Sales and purchases between the different segments are made at commercial prices.

NORTHERN ELECTRIC plc

REGISTERED NUMBER: 2366942

CONDENSED FINANCIAL STATEMENTS - SIX MONTHS ENDED 30 JUNE 2008

NOTES TO THE ACCOUNTS (CONTINUED)

1. REVENUE AND SEGMENTAL ANALYSIS (continued)

Year ended 31 December 2007 (Audited)

Engineering

Distribution Contracting Other Total

�m �m �m �m

REVENUE

External sales 212.7 63.2 6.1 282.0

Inter-segment sales 0.3 - (0.3) -

Total revenue 213.0 63.2 5.8 282.0

SEGMENT RESULTS

Operating profit 90.3 1.2 39.7 131.2

Share of profit after tax of 0.4

joint venture accounted for

using the equity method

Other losses 0.2

Investment income 14.9

Finance costs (37.7)

Profit before tax 109.0

OTHER INFORMATION

Capital additions 132.0 0.1 (2.8) 129.3

Depreciation and amortisation 40.3 0.1 (0.9) 39.5

Amortisation of deferred (9.5) - - (9.5)

revenue

"Other" comprises business support units and consolidation adjustments.

Sales and purchases between the different segments are made at commercial prices.

NORTHERN ELECTRIC plc

REGISTERED NUMBER: 2366942

CONDENSED FINANCIAL STATEMENTS - SIX MONTHS ENDED 30 JUNE 2008

NOTES TO THE ACCOUNTS (CONTINUED)

2. INCOME TAX EXPENSE

6 months ended 30 June 6 months ended 30 June Year ended

31 December

2008 2007 2007

Unaudited Unaudited Audited

�m �m �m

Current tax 11.1 11.7 24.5

Deferred tax 5.9 4.3 9.1

Adjustment in relation to

prior years (16.0) - 0.7

Impact of rate change - (10.1) (11.3)

Total income tax expense 1.0 5.9 23.0

The underlying tax for the interim period is calculated by applying the effective average tax rate of 29% (2007: 29%) on profit before

preference dividends accrued.

Preference dividends are included within finance costs.

The UK Government introduced in the Finance Act 2008 legislation to phase out and withdraw from 2011 capital allowances on qualifying

buildings. This will lead to an increase in the deferred tax provision required for accelerated tax depreciation in the region of �7m and

will give rise to a one off deferred tax charge for this amount in the year ending 31 December 2008.

NORTHERN ELECTRIC plc

REGISTERED NUMBER: 2366942

CONDENSED FINANCIAL STATEMENTS - SIX MONTHS ENDED 30 JUNE 2008

NOTES TO THE ACCOUNTS (CONTINUED)

3. RELATED PARTY TRANSACTIONS

GROUP

Details of transactions between the Group and other related parties are disclosed below.

Loans

The Group has made loans to companies in the CE Group. The total interest included in investment income in the income statement for the

six months ended 30 June 2008 was �5.9m (six month ended 30 June 2007: �4.7m, year ended 31 December 2007: �10.2m). Included within cash and

cash equivalents is �176.5m as at 30 June 2008 (30 June 2007: �72.6m, 31 December 2007: �176.8m) in respect of these loans.

The Group has received loans from companies in the CE Group. The total interest included in finance costs in the income statement for

the six months ended 30 June 2008 was �4.7m (six months ended 30 June 2007: �5.5m, year ended 31 December 2007: �11.8m). Included within

borrowings is �116.4m as at 30 June 2008 (30 June 2007: �109.6m, 31 December 2007: �110.9m) and within trade and other payables �3.3m as at

30 June 2008 (30 June 2007: �3.0m, 31 December 2007: �nil) in respect of these loans.

Interest on loans to/from Group companies is charged at a commercial rate of interest.

NORTHERN ELECTRIC plc

REGISTERED NUMBER: 2366942

CONDENSED FINANCIAL STATEMENTS - SIX MONTHS ENDED 30 JUNE 2008

NOTES TO THE ACCOUNTS (CONTINUED)

3. RELATED PARTY TRANSACTIONS (CONTINUED)

GROUP (CONTINUED)

Trading transactions

During the year, Group entities entered into the following trading transactions with related parties that are not members of the Group:

Purchases from Amounts Owed by Amounts Owed to

Sales to Related Related Party Related Party Related Party

Party

Related Party

�m �m �m �m

June 2008:

CE Insurance Services Limited

- 0.3 - -

CE UK Gas Holdings Limited

0.1 - - -

Integrated Utility Services

Limited (Registered in Eire) - 0.5 - -

Vehicle Lease and Service

Limited 0.1 2.7 - -

Yorkshire Electricity

Distribution plc 6.8 2.9 - -

June 2007:

CE Insurance Services Limited

- 0.3 - -

CE UK Gas Holdings Limited

0.1 - - -

Integrated Utility Services

Limited (Registered in Eire) - 0.4 - -

Vehicle Lease and Service

Limited - 2.7 - 0.8

Yorkshire Electricity

Distribution plc 5.6 2.4 - -

NORTHERN ELECTRIC plc

REGISTERED NUMBER: 2366942

CONDENSED FINANCIAL STATEMENTS - SIX MONTHS ENDED 30 JUNE 2008

NOTES TO THE ACCOUNTS (CONTINUED)

3. RELATED PARTY TRANSACTIONS (CONTINUED)

GROUP (CONTINUED)

Trading transactions (Continued)

Purchases from Amounts Owed by Amounts Owed to

Sales to Related Related Party Related Party Related Party

Party

Related Party

�m �m �m �m

December 2007:

CE Insurance Services Limited

- 0.6 - -

CE UK Gas Holdings Limited

0.2 - - -

Integrated Utility Services

Limited (Registered in Eire) - 1.0 - -

Vehicle Lease and Service

Limited 0.2 4.8 0.3 1.2

Yorkshire Electricity

Distribution plc 14.0 5.9 - -

Sales and purchases from related parties were made at commercial prices.

The amounts outstanding are unsecured and will be settled in cash. No guarantees have been given or received. No provisions have been

made for doubtful debts in respect of amounts owed by related parties.

During 2008, 3 directors (30 June 2007: 3, 31 December 2007: 3) and 8 key personnel (30 June 2007: 8, 31 December 2007: 8) utilised the

services provided by Northern Transport Finance Limited, a company in the Group.

The amounts included in finance lease receivables owed by these directors and key personnel total �0.1m (30 June 2007: �0.1m, 31

December 2007: �0.1m) in respect of non-current and �0.1m (30 June 2007: �nil, 31 December 2007: �0.1m) in respect of current receivables.

NORTHERN ELECTRIC plc

REGISTERED NUMBER: 2366942

CONDENSED FINANCIAL STATEMENTS - SIX MONTHS ENDED 30 JUNE 2008

NOTES TO THE ACCOUNTS (CONTINUED)

3. RELATED PARTY TRANSACTIONS (CONTINUED)

COMPANY

Details of transactions between the Company and other related parties are disclosed below.

Loans

The Company has made loans to companies in the CE Group. The total interest included in investment income in the income statement for

the period ended 30 June 2008 was �4.6m (six months ended 30 June 2007: �3.5m, year ended 31 December 2007: �7.7m). Included within cash and

cash equivalents is �70.2m as at 30 June 2008 (30 June 2007: �29.1m, 31 December 2007: 76.1m) in respect of these loans.

The Company has received loans from companies in the CE Group. The total interest included in finance costs in the income statement for

the period ended 30 June 2008 was �3.0m (six months ended 30 June 2007: �2.8m, year ended 31 December 2007: �5.7m). Included within

borrowings is �16.7m as at 30 June 2008 (30 June 2007: �9.6m, 31 December 2007: �10.9m) in respect of these loans.

Interest on loans to/from Group companies is charged at a commercial rate of interest.

Trading transactions

During the year, the Company entered into the following trading transactions with other members of the CE Group:

NORTHERN ELECTRIC plc

REGISTERED NUMBER: 2366942

CONDENSED FINANCIAL STATEMENTS - SIX MONTHS ENDED 30 JUNE 2008

NOTES TO THE ACCOUNTS (CONTINUED)

3. RELATED PARTY TRANSACTIONS (CONTINUED)

COMPANY (CONTINUED)

Sales Purchases Dividends

to from received

Related Party Related Party from

Related Party Related

Party

�m �m �m

June 2008:

CE UK Gas Holdings Limited

0.1 - -

Integrated Utility Services

Limited 0.3 - -

Northern Electric Distribution

Limited 2.7 0.1 -

Northern Electric Properties

Limited 0.1 0.1 -

Yorkshire Electricity

Distribution plc 2.0 - -

June 2007:

CE UK Gas Holdings Limited

0.1 - -

Integrated Utility Services

Limited 0.4 - -

Northern Electric Distribution

Limited 2.7 0.1 -

Northern Electric Properties

Limited - 0.1 -

Yorkshire Electricity

Distribution plc 2.0 - -

NORTHERN ELECTRIC plc

REGISTERED NUMBER: 2366942

CONDENSED FINANCIAL STATEMENTS - SIX MONTHS ENDED 30 JUNE 2008

NOTES TO THE ACCOUNTS (CONTINUED)

3. RELATED PARTY TRANSACTIONS (CONTINUED)

COMPANY (CONTINUED)

Sales Purchases Dividends

to from received

Related Party Related Party from

Related Party Related

Party

�m �m �m

December 2007:

CE UK Gas Holdings Limited

0.2 - -

Integrated Utility Services

Limited 0.7 - 3.6

Northern Electric Distribution

Limited 6.2 0.2 20.0

Northern Electric Properties

Limited 0.1 0.2 -

Vehicle Lease and Service

Limited - - 0.4

Yorkshire Electricity 4.7

Distribution plc - -

Sales and purchases from related parties were made at commercial prices.

There are no amounts outstanding to other members of the CE Group.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR LKLFFVKBLBBV

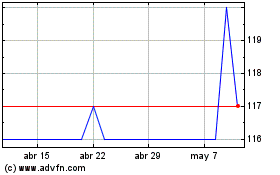

Nthn.elec.prf (LSE:NTEA)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Nthn.elec.prf (LSE:NTEA)

Gráfica de Acción Histórica

De May 2023 a May 2024