TIDMPHI

RNS Number : 9840O

Pacific Horizon Investment Tst PLC

06 October 2023

Replacement RNS Announcement

Pacific Horizon Investment Trust PLC

GENERAL TEXT AMMENT

The following amendments has been made to the 'Pacific Horizon

Investmnt Trst Full year results' announcement released on

06/10/2023 at 7:00am under RNS No 8970o.

Typo in the index name in the sentence above the Chairman's

statement; it references 'MSCI China' and should read 'MSCI All

Country Asia ex Japan'.

All other details remain unchanged.

The full amended text is shown below.

Legal Entity Identifier: VLGEI9B8R0REWKB0LN95

Results for the year to 31 July 2023

Regulated Information Classification: Additional regulated

information required to be disclosed under the applicable laws and

regulations.

The following is the results announcement for the year to 31

July 2023 which was approved by the Board on 5 October 2023.

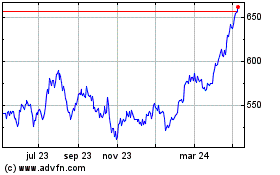

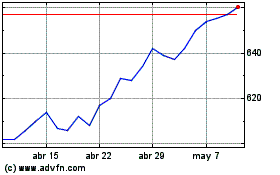

Over the year the Company's net asset value total return * was -

8.9 % and the share price total return was - 3.6 %, compared with a

total return of 0.8 % for the MSCI All Country Asia ex Japan Index

(in sterling terms) .

Chairman's statement

The portfolio managers aim to invest in high growth companies in

Asia, one of the fastest growing regions in the world. In the last

year these markets have been influenced by weaker than expected

post-Covid consumption recovery in China, ongoing geopolitical

tension between the US and China and rising US interest rates and

the consequent US dollar strength.

These have all challenged growth expectations and share price

returns across the region, making for a challenging environment for

growth investors. It is to be expected that there will be periods

during which growth investment will not be rewarded. We are in such

a phase now. As the portfolio managers present in their report

however, over the longer terms excess returns have been

considerable and the premium currently paid for growth is modest.

While it is too early to forecast an immediate improvement in

relative or absolute performance, it certainly looks as if growth

share valuations are at attractive levels across the region.

Performance

In the year to 31 July 2023, the total return for the Company's

net asset value per share (NAV) was a negative 3.6%* and for the

share price a negative 8.9%*. This compared to a positive total

return of 0.8%* for the MSCI All Country Asia ex Japan Index in

sterling terms over the same period. The shares ended the period at

an 8.0% discount to the NAV per share having been at a 2.7%

discount a year earlier.

The notable positive stock contributors to the portfolio's

relative performance over the year were Ramkrishna Forgings,

Samsung Engineering and EO Technics and the notable detractors were

Jadestone, Delhivery and JD.com. Fuller comment on the drivers to

returns, and thoughts on companies and their prospects can be found

within the Managers' review below.

Over the five years to 31 July 2023, the Company's NAV and share

price total return were 82.4% and 62.4% respectively whereas the

Company's comparative index returned 14.1% in sterling terms during

the same period.

Environmental, Social and Governance ('ESG')

Your Board is committed to responsible investment. It agrees

with the managers that a thoughtful approach is required when

looking at ESG factors in emerging markets. It is not appropriate

to impose a developed market standard on emerging markets companies

indiscriminately. The economic miracle of the last forty years has

resulted in over 800 million people in Asia being lifted out of

poverty through economic reform and globalisation. This wealth is

resulting in increased consumption and carbon emissions in Asia,

but still far below the per capita levels seen in developed

markets. Growth in carbon emissions has also been stimulated by the

West moving carbon emitting industries to Asia, flattering

developed markets' progress towards net zero.

The managers' view is that a precondition of a long-term

investment is that the businesses they invest in must be

sustainable. Asian countries need to transition to net zero and

companies in Asia must play their part. The timescales for this

will however be longer than in developed markets, reflecting their

different starting points on their paths to prosperity.

We agree with the managers' approach of engaging and working

with companies towards achieving positive change. We further

endorse the view that the absolute levels of emissions are not the

basis on which to judge a company but rather its approach to all

aspects of ESG. For example, nickel mining is an activity that

generates significant emissions, but nickel is a critical component

in manufacturing electric vehicles.

Gearing

The Board continues to set the gearing parameters within which

the portfolio managers are permitted to operate. These parameters

are reviewed regularly and at present the agreed range of equity

gearing is minus 15% (holding net cash) to plus 15%. As at 31 July

2023, gearing was nil, a position that has not changed since the

start of the Company's financial year. However, the deployment of

gearing is under active consideration at present.

The Company has a multi-currency revolving credit facility with

The Royal Bank of Scotland International Limited for up to GBP100

million. This facility expires in March 2025 and provides for

potential gearing of 17.2% at present.

Earnings and Dividend

Earnings per share this year were 4.56p per share, an increase

from the 4.21p per share reported last year. After the deduction of

the management fee and expenses, the Company is in a position to

pay a final dividend. The Board is therefore recommending that a

final dividend of 3.25p per share should be paid (3.00p per share

paid in 2022), subject to shareholder approval at the Annual

General Meeting ('AGM').

As highlighted in past reports, investors should not consider

investing in this Company if they require income from their

investment as the Company typically invests in high growth stocks

with little or no yield.

Issuance, Share Buybacks and Treasury

During the financial year to 31 July 2023, 200,000 shares were

issued from treasury at a premium to the Company's NAV per share

and 979,012 shares were bought back at a discount, resulting in a

year-on-year net 0.85% reduction in the amount of shares in issue.

The issuance occurred early in 2023, following the announcement

that the Company was being promoted into the FTSE 250 index,

whereas the buybacks were undertaken over the course of the

Company's financial year. Since the financial year end, a further

35,000 shares have been bought back.

At the forthcoming AGM in November, the Board will be seeking

10% non-preemptive issuance authority. Issuance will continue to be

undertaken only at a premium to the NAV per share, thereby avoiding

dilution for existing investors. When this authority is utilised in

this manner, it enhances NAV per share, improves liquidity in the

Company's shares and spreads the operating expenses of the Company

across a wider base, thus reducing costs to each shareholder.

Despite the net repurchase this year, ongoing charges for the year

were 0.72% compared to 0.74% for the prior year.

As part of this year's AGM business, the Board will be asking

shareholders to renew the authority to repurchase up to 14.99% of

the outstanding shares on an ad hoc basis, either for cancellation

or to be held in treasury, and also to permit the re-issuance of

any shares held in treasury at a premium to the NAV per share; the

Company has 993,012 shares held in treasury at present. The Board

intends to use the buyback authority opportunistically, considering

not only the level of the discount but also the underlying

liquidity and trading volumes in the Company's shares. This

approach allows the Board to seek to address any imbalance between

the supply and demand for the Company's shares that results in a

large discount to NAV whilst being cognisant that current and

potential shareholders have expressed a desire for continuing

liquidity.

Private Company Investments

In 2021, shareholders approved an increase in the maximum

permissible investment in unlisted securities from 10% to 15% (such

percentage being measured at the point of initial investment). As

at 31 July 2023, the Company had 5.1% of its total assets invested

in 5 private companies compared to 6.1% in 5 private companies a

year earlier.

Rightly, there has been a lot of market focus on the

reasonableness of private company valuations in the light of the

share price volatility of listed companies. Baillie Gifford

believes it takes a pro-active, robust approach to private company

valuations, including using the services of Markit Valuation

Services (now S&P Global) for external advice. The Board is

comfortable that marked-to-market values are kept as current as

possible for the purpose of calculating the Company's daily net

asset value. Investors should be mindful however that such

valuations, although based on many external (market) and internal

(company specific) comparators and having considered a number of

methodologies in line with International Private Equity and Venture

Capital Guidelines, are necessarily subjective.

We are fortunate on the Board to have specific expertise in this

area and we are comfortable with the strategy adopted by the

managers to invest in later stage private companies. This is very

different to being a venture capital investor which often involves

taking seats on company boards and providing specific advice on

managing aspects of the business. While private company investing

has added risk, there appears to be the potential for commensurate

reward.

Taking as an example one of our private company holdings,

ByteDance, according to publicly sourced data, the company's full

year EBITDA was US$25 billion. At our holding equity valuation of

US$225 billion that implies an EBITDA multiple of 8x. This is a

conservative valuation for a company which is achieving revenue and

profit growth of more than 30% and 80% respectively year on year.

It is the Board's view that exposure to companies like ByteDance is

attractive and justifies the additional risks of investing in

private companies. The Board is supportive of the managers

continuing to invest in them.

Details on the process and quantum of private company valuations

undertaken over the year can be found on page 36 of the annual

report and financial statements, immediately after the Managers'

review.

Changes to the Board

I joined the Board in 2017, becoming Chair at the conclusion of

the Company's Annual General Meeting in 2019. Thanks to my

predecessors, fellow Board members and the Managers, I have

presided over a period where the Company has made considerable

progress. The NAV of the Company has increased from GBP139 million

on my joining to GBP580 million as at 31 July 2023, it has become a

constituent of the FTSE 250 and provided a total return over the

period of 150%, outperforming its comparative index by 115%. Whilst

recent performance has reflected challenging market conditions and

growth investing being seemingly out of favour, this is to be

expected for an actively managed growth focussed long term

investment strategy such as that used by the portfolio manager. I

have every confidence that the approach will continue to reward

patient long term shareholders in the future.

After considerable thought, I have decided I should stand down

as Chair and a member of the Board. Someone new should have the

opportunity of chairing this Company and it is time for me to

pursue other roles. I will leave the Board once a suitable

successor has been appointed, which is expected to be around the

end of the first quarter of next year.

In the meantime, I would like to thank shareholders for giving

me the opportunity to Chair the Company and wish the Managers, the

Board and investors the best for the future.

The Company's portfolio managers

As announced in January, following consultation with the Board,

Mr Ben Durrant was appointed as deputy portfolio manager of the

Company, filling the role vacated by Mr Roderick Snell when he was

promoted to become the Company's lead portfolio manager in June

2021.

Mr Durrant is an investment manager in Baillie Gifford's

Emerging Markets Equity Team and joined Baillie Gifford in 2017

having previously worked for RBS in its Group Strategy and

Corporate Finance Team. He is also the co-portfolio manager on the

Baillie Gifford Pacific Fund alongside Mr Snell.

TCFD and Consumer Duty

Recently introduced regulations by the FCA require managers of

UK based investment vehicles, such as Pacific Horizon Investment

Trust, to produce product-level reports on the climate-related

risks and opportunities in the respective investment vehicle. These

are known as TCFD (Task Force on Climate-related Financial

Disclosures) reports and they are based on historic data at a

single point in time. The report produced by Baillie Gifford for

our Company, as at the end of December 2022 and which will be

updated annually, can be found at pacifichorizon.co.uk.

The FCA also introduced a new set of rules labelled as 'Consumer

Duty'. Investment Trusts, like Pacific Horizon, are not directly in

scope but Baillie Gifford, as the Company's Manager, is. The Duty

raises the standard of care that FCA regulated firms, like Baillie

Gifford, are expected to provide to retail consumers and includes a

number of obligations that will need to be met. One of these

obligations is to undertake an Assessment of Value on the

'products' managed. The relevant report on Pacific Horizon has

concluded that it does provide value, meaning that distributors

will be able to undertake their assessments and continue to make

shares in Pacific Horizon available to current and potential

shareholders. It should be noted that in addition to this new

assessment, over the course of each and every financial year, the

Company's Committees and Board assess various costs levied by

third-party service providers as well as the Managers and

Secretaries, the quality of service received along with

performance; this will continue to be the case.

Annual General Meeting

This year's AGM will take place on 23 November 2023 at the

offices of Baillie Gifford & Co in Edinburgh at 11.30am and

shareholders are encouraged to attend. If doing so, please

endeavour to arrive by 11.20am to allow time to register. There

will be a presentation from the portfolio managers who, along with

the Directors, will answer questions from shareholders. I hope to

see many of you there.

Should the situation change, further information will be made

available through the Company's website at pacifichorizon.co.uk and

the London Stock Exchange regulatory news service.

Outlook

The invasion of Ukraine ended the geopolitical consensus that

prevailed since the fall of the Berlin Wall. This consensus was an

impetus for globalisation and a key component of growth in Asia.

Today, we live in a much less certain time. It was perhaps

inevitable that, as economic power shifted to the East, tensions

with the hitherto economically dominant West were likely to

grow.

US and Western sanctions on a seemingly increasing number of

Chinese companies have made some of them uninvestible. There is

little doubt that foreign disinvestment from China is impacting

asset prices, at least in the short term. Should these sanctions be

materially extended, in response for example to military action,

there is a risk this could even render the market as a whole

uninvestible.

Domestic considerations in China are also of concern. The

Chinese Government is developing its own economic system, the

success of which remains to be seen. Coupled with escalating

tensions with the US, we recognise that in the future there is

likely to be greater complexity and risk in securing investment

exposure to the 'Asian economic miracle'.

Excess investment return is generated by judging and managing

risks. On the basis of the information currently available, the

Manager and your Board believe that the risks of investment in

China and the broader Asian region are justified by the potential

rewards. China is a critical trading partner of the West and only

the most extreme geopolitical confrontation would justify the

economic disruption of severing economic ties entirely.

More broadly, the economies of Asia including the Indian

Sub-continent are, as outlined in the Managers' review,

unencumbered by some of the issues affecting more developed

markets, such as high levels of debt and elevated levels of

inflation. The region is fostering competitive companies that are

well placed to benefit from key drivers of long- term growth such

as the rising wealth of the Asian consumer, the transition to

renewable energy and an AI led digital age of innovation. However,

it remains incumbent on our portfolio managers to unearth the right

investments. This requires patience and fortitude, an approach that

has served investors well in the past.

The region remains one of the fastest growing globally and

company valuations, particularly when set against western peers,

are undemanding; the Board is of the view that investing in the

fastest growing companies in the fastest growing region still

offers attractive long-term investment opportunities for patient

growth investors. The portfolio managers call this 'growth

squared'.

Angus Macpherson

Chairman

5 October 2023

(*) Baillie Gifford/Refinitiv and relevant underlying index

providers. See disclaimer at the end of this announcement.

The MSCI All Country Asia ex Japan Index (in sterling terms) is

the principal index against which performance is measured.

For a definition of terms see Glossary of Terms and Alternative

Performance Measures at the end of this announcement.

Past performance is not a guide to future performance.

Managers' review

Overview

What defines us is growth. We believe Asia, ex Japan, including

the Indian Sub-continent, will be one of the fastest growing

regions over the coming decades and we strive to be invested in its

fastest growing companies. It is growth multiplied by growth or, as

we like to call it, 'Growth Squared' ('Growth(2)').

Such an investment style has been well rewarded over the longer

term, with the Company's NAV outperforming the comparative index,

the MSCI All Country Asia ex Japan Index (in sterling terms) by

68.3 percentage points ('pp') over the past five years, and 28.8pp

over the past three years, while the share price outperformed by

48.3pp and 12.7pp over these time periods.

5 year 3 year

---------------------------------------- ------- -------

NAV total return* 82.4% 32.9%

Share price total return* 62.4% 17.0%

MSCI All Country C Asia ex Japan total

return (in sterling terms)* 14.1% 4.3%

---------------------------------------- ------- -------

By running a differentiated, high-conviction portfolio, there

will inevitably be periods of time when our growth style of

investing will be out of favour with the market, as has been the

case recently. Over the year to 31 July 2023, the Company's NAV

decreased by 3.6%, while the share price decreased by 8.9%,

compared to the comparative index which rose 0.8% in sterling terms

(all figures total return).

The period was characterised by significant volatility,

primarily emanating from events in China. In aggregate, markets in

the region fell nearly 20% to reach their nadir as President Xi

cemented his grip on power during the 20th Chinese Communist Party

Congress in October. Subsequently, Asian markets rallied hard as

China abandoned its zero Covid policy, before retreating once again

as the Chinese economy disappointed and concerns over the Chinese

property sector intensified.

Markets will likely remain volatile as investors continue to

grapple with an uncertain global economic outlook, heightened

geopolitical risks, and perceived fragility in China. We, however,

remain optimistic. Whilst many Western economies have experimented

with money printing and ultra low interest rates, Asian economies

are generally in superior health, will grow significantly faster

and trade at a significant discount.

Events in China will continue to play an important role for

investors, and whilst acknowledging the country faces several

headwinds including increasing geopolitical tensions, we believe

fears of an imminent collapse of the economy are misplaced. The

government has moved to support the domestic economy, the

regulatory crackdown on the technology sector has receded, and

fears over the domestic property market appear overly

pessimistic.

The broad exposure of the portfolio remains similar to last

year, with significant positions in both cyclical growth,

particularly materials and industrials, and secular growth,

including technology and consumer companies. Geographically,

notable additions were made to China and Vietnam. It is noteworthy

that, over the next year, our holdings on average are valued at

nearly the same price-to-earnings multiple as that of the

comparative index (13.7x vs. 12.9x), yet they are expected to grow

their earnings at nearly triple the rate (+14.8% vs. +5.7%).

Overall, we remain extremely positive on the long-term outlook

for the region. Asia already cemented itself as the lead

contributor to global demand growth, with China alone having

contributed more to global growth in US dollar terms than the US

over the past decade, while India is overtaking Japan. Asia is now

better positioned financially than much of the developed world and,

with a renewed investment cycle unfolding, Asian growth is likely

to significantly outperform.

Philosophy

We are growth investors endeavouring to invest in the top twenty

percent of the fastest growing companies in Asia. Across the region

we have found the most persistent source of outperformance to be

those companies that can grow their profits faster than the market,

in hard currency terms, over the long term. This trend persists

irrespective of starting valuations. Consequently, our research is

singularly focused on finding those companies whose share prices

can at least double, in sterling terms, on a five year view and we

expect most of this doubling to come from earnings growth.

We are particularly interested in three specific and persistent

inefficiencies:

01. Underappreciated growth duration

We believe one of the greatest investment inefficiencies is to

be found in companies with excellent long-term earnings growth

where profits are volatile from one quarter to the next. The market

typically shows an aversion to such companies, preferring the

predictability of smooth profit generation even if the long-term

growth rate turns out to be a fraction of that achieved by firms

more willing to reinvest in their business and with greater

ambition. This presents us with exciting investment opportunities,

but it requires an approach that allows near term volatility to be

ignored.

02. Underappreciated growth pace

The market consistently underestimates the likelihood of rapid

growth. The evidence shows that most investors cluster around a

narrow range of earnings growth predictions, which can in turn lead

to significant mispricing of those companies with the potential to

grow very rapidly. Our process is focused on finding these

companies. By looking further out and searching for low probability

but high impact growth opportunities, we endeavour to outperform

the broader market.

03. Underappreciated growth surprise

The final significant inefficiency lies in the interaction

between top-down and bottom-up investing. As investors in Asia, ex

Japan, and the Indian Sub-continent, we do not have the luxury of

ignoring macroeconomics. Purely bottom-up investment is a path to

ruin in a universe where industrial and economic cycles can

dominate investment returns over multi-year periods. The long-term

earnings for a vast number of companies - notably in the financial,

materials and industrial sectors - are determined by exogenous

macro factors beyond their control. This also provides

opportunities.

Our analysis shows that while it may pay to invest in those

companies that display consistently high levels of profitability,

the strongest returns are to be found in those companies that

transition from poor levels of profitability to high - a 'growth

surprise'.

This may seem obvious - rising levels of profitability are

normally accompanied by a re-rating, thereby providing a two-fold

kicker to share price performance - but identifying the drivers

behind this change is the key and has been a significant source of

outperformance for Pacific Horizon. We accept that timing these

inflection points perfectly is impossible, but when you have an

investment horizon measured over many years, successfully

anticipating the future direction of travel is hugely valuable.

Importantly, we are agnostic as to the type of growth

inefficiency we are exploiting and will invest wherever we are

finding the best opportunities. At times this will lead to a

concentration in particular sectors or countries, and at others to

a much broader, flatter portfolio, but growth will always be the

common theme.

MSCI AC

Asia ex

Pacific Japan

Horizon Index

------------------------------------- ---------- ---------

Historic earnings growth (5 years

trailing compound annual growth to

31 July 2023 9.8% 7.3%

One year forecast earnings growth

to 31 July 2024 14.8% 5.7%

Estimated p/e ratio for the year to

31 July 2024 13.7x 12.9x

Active share 82% n/a

Portfolio turnover 11.9% n/a

------------------------------------- ---------- ---------

Data as at 31 July 2023, source: Baillie Gifford, UBS PAS, APT,

MSCI (see disclaimer at the end of this announcement)

Review

In the last Interim management statement we articulated three

key reasons why Asian economies are generally far better positioned

than in the past, especially when compared to developed

markets.

They are:

-- Asian balance sheets are in superior shape having lacked the

profligate monetary and fiscal stimulus of the West. For example,

China's Covid stimulus equated to c.10% of GDP compared to c.70%

for many major European countries.

-- Most of Asia maintained positive interest rates for many

years, while Western markets operated with ultra-low or even

negative rates. Arguably, it is Asian countries that behaved like

orthodox developed countries while much of the developed world

behaved like the emerging markets of old. (Perhaps we are seeing

the beginning of 'converging markets').

-- Capital flows into Asia have been negative for a decade and

the region is therefore far less vulnerable to money outflows than

in the past.

The result is that today Asia's financial position is superior

to much of the developed world. Combine this with Asia's

structurally faster growth rates and valuations at multi-year lows

relative to developed markets, and the long-term outlook for Asian

investors is very encouraging. This, however, has not been

reflected in the recent performance of Asian markets, with China a

significant concern amongst investors. China certainly faces a

number of challenges, and there is no doubt that the country's

lockdowns and regulatory crackdowns have inhibited consumer and

entrepreneurial spirit, subduing the domestic economy. But the

extreme pessimism over the economy is too one-sided.

There are a number of signs that household consumption in China

is gaining momentum, with restaurant and bar sales up 12% and 17%

in May and June compared to the same pre-lockdown months in 2019,

while air passenger numbers are rapidly returning to pre-pandemic

levels. Our consumer related holdings in China have posted

impressive recent quarterly numbers: Alibaba's ecommerce business

grew +14% year-on-year ('YoY'), Baidu's core advertising division

grew +15% YoY and Kuaishou's short-form video sales grew +28%.

Improving consumer confidence will be key to accelerating

economic growth and mobilising the c.US$7tn of additional household

savings built up over the past couple of years. Time and patience

is needed; after all China's serious Covid trauma only ended at the

start of the year.

Increasing policy support is also likely to be a significant

catalyst. Moderate financial easing is underway, but perhaps more

importantly the government has clearly and very publicly stated its

support for the private sector. Notably in July the CCP Central

Committee and the State Council issued a joint statement on

'promoting the development and growth of the private economy'. It

described the private sector as 'a driving force behind promoting

the Chinese path to modernisation' and stated that the party wants

to 'promote a bigger, better and stronger private sector'.

Combined with a less zealous regulatory approach in many other

sectors, it seems clear that support is shifting behind the private

sector, and the regulatory clampdown that particularly impacted

technology and platform businesses for the past couple of years -

and where we have significant holdings - is receding.

Despite these positive tailwinds, valuations remain extremely

depressed. Stripping out cash and subsidiaries, Alibaba Group's

core ecommerce business and Baidu's core online search business

both trade on low single digit p/e multiples, while Ping An

Insurance, China's leading private life insurance company, trades

significantly below its book value.

We believe this presents us with a number of excellent long term

investment opportunities and we increased our listed equity

exposure to China by adding c.600 basis points ('bp') to Chinese

companies. Most additions were made to internet firms, including

Alibaba Group, JD.com (ecommerce), KE holdings (online property

portal) and Baidu. We also added to two financial companies, the

aforementioned Ping An Insurance and its subsidiary Ping An Bank.

One new purchase was also made in Silergy, a leading designer of

analogue chips in China (listed in Taiwan). Silergy has the largest

market share among domestic designers and is likely to be a key

beneficiary of Chinese attempts to become self-reliant in

semiconductor chips.

Combined, these Chinese purchases took the portfolio's exposure

to China to 34% compared to 17% eighteen months ago.

Just after period end, we also acquired a new holding in a

private (unlisted) company, Micro Connect. The business makes loans

to small and medium sized Chinese businesses which typically don't

have access to formal credit in exchange for a daily percentage of

the borrower's revenues (collected daily from the borrower's

account) which are then packaged and sold on the Micro Connect

exchange. The company was founded by the former long-time Hong Kong

exchange CEO Charles Li, has a strong balance sheet and is already

profitable.

Outside of China, we continue to believe Vietnam remains the

best structural growth story of any Asian economy, driven by its

successful export manufacturing base. After a period of significant

market weakness, driven by a corruption clampdown and funding

issues in the property sector, we took advantage of share price

weakness by adding to our existing holding in Vinh Hoan (food

processer) and making two new purchases: Mobile World, one of the

country's leading electronics and grocery retailers; and FPT,

Vietnam's largest information technology outsourcing company. This

takes Vietnam to a 7% absolute position, and our second largest

country overweight.

Funding came from three main sources. The most significant was a

reduction to a number of smaller (<60bp) holdings in South

Korea. These were across a range of sectors including green energy

businesses (LG Energy Solutions, SK IE Technology and S-Fuelcell),

cloud computing (Douzone Bizon) and speech recognition software

(Flitto). However, due to some small additions to other names in

South Korea, and the very strong performance of some of our

holdings, notably EO Technics (laser manufacturer for

semiconductors) and Samsung Engineering (engineering), our South

Korea weighting increased modestly over the period to 18%

absolute.

Towards the end of our financial year, we also exited our direct

nickel exposures in Indonesia, selling both Nickel Industries and

Vale Indonesia. We have become concerned by the huge capital

investments into the nickel market, predominantly by the Chinese.

In particular, it appears that the Chinese have successfully made

the difficult process of High-Pressure Acid Leaching (which is used

to convert non-battery grade nickel into battery grade nickel)

commercially viable and this is likely to bring significantly more

battery grade nickel to the market than expected.

We also reduced our exposure to India. Notable transactions

included the sales of Zomato, the online food delivery businesses,

as the company's unit economics are not as favourable as we hoped,

and Star Health & Allied Insurance Co (health insurance).

India, however, remains our second largest absolute (24%) and

largest relative (+7.6pp) country position.

We are keeping our eye on several interesting developments in

India. In particular, there are early signs that the country might

finally be building up a successful export manufacturing industry.

For years this has disappointed, with countries like Vietnam

leading the way, but thanks to a number of government reforms and

the establishment of several special economic zones, there are

signs that manufacturing is starting to move to India. For example,

Foxconn, Apple's iPhone manufacturer, is expanding in India with

iPhone exports quadrupling to US$5bn for the fiscal year 2022-23.

It is early days, but should India succeed in building up a strong

export manufacturing base it has the potential to transform the

economy over the coming years.

By sector, there have been limited changes, with the portfolio

continuing to look different to many of our growth-focused peer

funds. In absolute terms, our largest exposures remain focused on

the themes of the rising middle class, technology and innovation.

However, we have significant exposures to more cyclical industries

including materials and industrials which make up the two largest

relative positions within the portfolio.

Overall, the number of names in the portfolio reduced to 72 from

85 in the year to 31 July 2023. Private companies, of which there

were five in the portfolio as at 31 July 2023, accounted for 5% of

the portfolio, and invested gearing was nil.

Performance

As long-term growth investors, it is pleasing that over the past

three and five years our portfolio generated significant value for

shareholders. Recent periods have been more challenging as our

growth style faced numerous headwinds, including soaring inflation

and interest rates. This has been combined with generally poor

Asian markets held back by increasing geopolitical tensions,

weakness in China and a surging US Dollar syphoning liquidity from

the region. Our portfolio maintains a strong growth bias; we have

faith in the long-term growth prospects of the region and believe

we are well placed to add significant value for shareholders when

Asian markets turn.

As mentioned, over the year to 31 July 2023, the Company's NAV

decreased by 3.6%, while the share price decreased by 8.9%,

compared to the comparative index which rose by 0.8% in sterling

terms - all figures total return. The majority of underperformance

came from weakness in three significant holdings, all of which were

among the top five absolute holdings at the start of the period:

Jadestone (-ve 300bp to performance), Delhivery (-ve 230bp) and

JD.com (-ve 110bp).

Jadestone is an oil exploration and production company,

specialising in turning around small and medium sized assets,

usually from larger companies looking to divest. Unfortunately, the

company experienced a significant operational issue at its main

cash producing asset, Montara in Australia, resulting in production

halting for several months. The lack of cash strained the balance

sheet at a time when the company was gearing up for a major

investment phase to bring several new assets on stream, forcing it

to undertake a rights issue. The next 12 months are critical with

Jadestone's Akatara gas field due to come on stream in 2024 - the

success of the company very much rests on this asset coming on

stream in a timely manner.

Delhivery, India's largest private logistics company with a core

focus on ecommerce logistics, was, until listing in May 2022, held

in the portfolio as a private company. Due to strong share price

performance, the company was a 5.5% holding at the start of the

period. Unfortunately, Delhivery's quarterly results at the end of

2022 were weak. M&A integration challenges and a slowdown in

broader ecommerce growth in India pushed the share price down by

52%. We are hopeful these issues are short term and with key

private competitors finding funding far more difficult and

Delhivery the clear number one player, we continue to have faith in

the company (encouragingly, the shares have risen c.40% from their

lows).

Like much of the technology space in China, JD.com was weak

despite reasonable operational performance. Revenue growth was

slower and competition increased at the margin, with ByteDance

taking some low-end market share as it leveraged its large user

base to enter the ecommerce market. Nevertheless, JD.com has

focused on cost efficiencies resulting in improving profitability

and is clearly demonstrating the benefits of its scale and in-house

logistics capabilities.

By country, Singapore was the largest detractor due to the

issues at Jadestone, followed by China.

More positively, a number of our companies performed strongly.

Our top contributor to performance was Ramkrishna Forgings which

rose 189% over the period. The company is one of the leading

forging companies in India, focused on automotive and commercial

vehicles. After completing a major capacity expansion over the past

few years the company is seeing rapid sales growth amid a number of

significant new order wins.

Other industrial companies in India also performed well,

including Skipper, one of the leading manufacturers of telecom and

power transmission towers, which rose +213% amid India's increasing

demand for power infrastructure. Tata Motors was also strong as the

domestic commercial vehicle and auto business continued to see

buoyant demand while the company's electric vehicle investments

impressed.

India was our second best performing market, but stock selection

in South Korea was the most significant contributor. Samsung

Engineering contributed 110bp thanks to continued strong order

wins, especially from the Middle East and Mexico. EO Technics,

which produces advanced lasers for semiconductor manufacturing,

also contributed 110bp as the semiconductor cycle appears to have

bottomed, and orders began to accelerate. We are excited for EO

Technic's longer-term prospects; demand for its laser products is

likely to hit an inflection point as semiconductors become smaller

and more complex, at which point ceramic blades and drills will

need to be replaced by lasers in the manufacturing process. We

added significantly to this holding towards the end of the

period.

By sector, Materials was the best performing mainly from

strength in our copper companies MMG and Zijin Mining. This was

followed by Real Estate, predominantly from strength in India, and

Utilities where we had no holdings while the sector was down 18.5%.

Our worst performing sectors were Energy due to the issues at

Jadestone, followed by Communication Services and Consumer

Discretionary due to the weakness in our Chinese names.

Environmental, social and governance ('ESG') considerations

Our long-term, active approach to investment is based on

identifying and holding high quality growth businesses that enjoy

sustainable competitive advantages in their marketplace.

To identify these kinds of businesses, we often look beyond

current financial performance, undertaking proprietary research to

build up our in-depth knowledge of an individual company and form a

view of its long-term prospects. Material Environmental, Social and

Governance matters which affect the financial condition or

operating performance of a company, can positively or negatively

influence long-term investment returns. Such issues are considered

throughout the investment process through research, engagement and

voting.

Our approach is guided by our ESG principles:

-- Investment process founded on long-term ownership of growing

businesses: we want to help these companies fulfil their potential

and encourage them to ignore the short-term pressures of the

market.

-- Sustainability is central to our analytical task: businesses

engaging in practices that are harmful to society may be capable of

generating attractive returns in the short term but are unlikely to

do so over the periods we seek to invest.

-- We do not believe 'one size fits all': ESG practices need to

be assessed on a case-by-case basis, not reliant on formulaic and

backward-looking screens.

-- Not seeking 'perfect' companies: we prefer to consider the

likely direction of change in otherwise promising investments and

engage accordingly.

Company engagement is key to our process. We encourage steps to

maximise opportunities and minimise risks where we believe it is

material to the success of the company. Engagement priorities are

set through a combination of a subjective assessment of the

materiality of an issue and our ability to influence, as well as

use of more qualitative inputs to provide direction. We vote

wherever possible and will vote against management if we believe

that its actions are not in the interests of shareholders.

We are supported by a dedicated emerging markets ESG analyst and

a further 40 analysts who are part of Baillie Gifford's wider ESG

resource.

*Source: Baillie Gifford/Refinitiv and relevant underlying index

providers. See disclaimer at the end of this announcement.

For a definition of terms see Glossary of Terms and Alternative

Performance Measures at the end of this announcement.

Past performance is not a guide to future performance.

Valuing Private Companies

We aim to hold our private company investments at 'fair value'

i.e. the price that would be paid in an open-market transaction.

Valuations are adjusted both during regular valuation cycles and on

an ad hoc basis in response to 'trigger events'. Our valuation

process ensures that private companies are valued in both a fair

and timely manner.

The valuation process is overseen by a valuations group at

Baillie Gifford, which takes advice from an independent third party

(S&P Global). The valuations group is independent from the

investment team with all voting members being from different

operational areas of the firm, and the investment managers only

receive final notifications once they have been applied.

We revalue the private holdings on a three month rolling cycle,

with one third of the holdings reassessed each month. During stable

market conditions, and assuming all else is equal, each investment

would be valued two times in a six month period. For investment

trusts, the prices are also reviewed twice per year by the

respective investment trust boards and are subject to the scrutiny

of external auditors in the annual audit process.

Beyond the regular cycle, the valuations team also monitors the

portfolio for certain 'trigger events'. These may include: changes

in fundamentals; a takeover approach; an intention to carry out an

Initial Public Offering (IPO); company news which is identified by

the valuation team or by the portfolio managers, or meaningful

changes to the valuation of comparable public companies. Any ad hoc

change to the fair valuation of any holding is implemented swiftly

and reflected in the next published net asset value. There is no

delay.

The valuations team also monitors relevant market indices on a

weekly basis and updates valuations in a manner consistent with our

external valuer's (S&P Global) most recent valuation report

where appropriate.

Continued market volatility has meant that recent pricing has

moved much more frequently than would have been the case with the

quarterly valuations cycle.

Pacific Horizon Investment Trust

-------------------------------------------------

Instruments (lines of stock reviewed) 6

Revaluations performed 39

Percentage of portfolio revalued 2+ times 89%

Percentage of portfolio revalued 5+ times 33%

------------------------------------------- ----

In the year to 31 July 2023, most revaluations have been

decreases. A handful of companies have raised capital at an

increased valuation. The average movement in both valuation and

share price for those which have decreased in value is shown

below.

Average

Movement Average

in company Movement

valuation In share price

Pacific Horizon* (29.7%) (28.8%)

------------ -----------------

* Data reflecting period 1 August 2022-31 July 2023 to align

with the Trust's reporting period end.

Share prices have decreased less than headline valuations, which

is a result of holding classes of stock with preferential

liquidation rights and therefore provides down side protection.

The share price movement reflects a probability weighted average

of both the regular valuation, which would be realised in an IPO,

and the downside protected valuation, which would normally be

triggered in the event of a corporate sale or liquidation

List of Investments at 31 July 2023

2023 2023

Value % of

total

Name Geography Business GBP'000 assets

------------------------------------ ------------ ----------------------------------- --------- --------

Memory, phones and electronic

Samsung Electronics Korea components manufacturer 36,937 6.4

Ping An Insurance H Shares China Life insurance provider 21,418 3.7

Ramkrishna Forgings India Auto parts manufacturer 19,091 3.3

Logistics and courier services

Delhivery (p) India provider 18,399 3.2

Dailyhunt (VerSe Innovation)

Series I Preferred (u) India Indian news aggregator application 13,428 2.3

Dailyhunt (VerSe Innovation)

Series Equity (u) India Indian news aggregator application 2,462 0.4

Dailyhunt (VerSe Innovation)

Series J Preferred (u) India Indian news aggregator application 2,031 0.3

17,921 3.0

Zijin Mining Group Co H Shares China Gold and copper miner 16,602 2.9

Tata Motors India Automobile manufacturer 16,420 2.8

Manufacturer and distributor

EO Technics Korea of semiconductor laser markers 15,526 2.7

Samsung Engineering Korea Korean construction 14,926 2.6

JD.com China Online and mobile commerce 14,910 2.6

Alibaba Group China Online and mobile commerce 14,237 2.5

MMG China Chinese copper miner 14,237 2.5

Bank Rakyat Indonesia Consumer bank 13,684 2.4

Samsung SDI Korea Electrical equipment manufacturer 13,422 2.3

Reliance Industries India Indian petrochemical company 12,397 2.1

Domestic and commercial

Indiabulls Real Estate India real estate provider 11,988 2.1

Li Ning China Sportswear apparel supplier 11,503 2.0

Sea Limited ADR Singapore Internet gaming and ecommerce 11,414 2.0

ByteDance Series E-1 Preferred

(u) China Social media 11,413 2.0

Merdeka Copper Gold Indonesia Indonesian miner 10,170 1.8

Owner and operator of a

chain of Indian hotels and

Lemon Tree Hotels India resorts 9,559 1.6

HDBank Vietnam Consumer bank 9,521 1.6

Phoenix Mills India Commercial property manager 9,448 1.6

Baidu.com China Internet provider 9,272 1.6

PT Astra International Indonesia Automobile distributor 8,782 1.5

Server network equipment

Accton Technology Taiwan manufacturer 8,531 1.5

Dragon Capital Vietnam Enterprise

Investments Vietnam Vietnam investment fund 8,232 1.4

Steel and related products

Hoa Phat Group Vietnam manufacturer 8,150 1.4

KE Holdings China Real-estate platform 7,303 1.3

KE Holdings ADR China Real-estate platform 655 0.1

7,958 1.4

Midea A Shares China Household appliance manufacturer 7,941 1.4

Owner and operator of residential

Prestige Estate Projects India real estate properties 7,611 1.3

Transmission and distribution

Skipper India structures provider 7,610 1.3

Meituan China Local services aggregator 7,560 1.3

Chinese ecommerce distributor

Dada Nexus ADR China of online consumer products 7,315 1.3

TSMC Taiwan Semiconductor manufacturer 6,458 1.1

Chinese manufacturer of

cookware and home appliance

Zhejiang Supor Co A Shares China products 6,243 1.1

Taiwanese electronic component

MediaTek Taiwan manufacturer 6,100 1.1

Oil and gas explorer and

Jadestone Singapore producer 5,932 1.0

China Oilfield Services H

Shares China Oilfield services 5,893 1.0

Hyundai Mipo Dockyard Korea Korean shipbuilder 5,536 1.0

Coupang Korea Ecommerce business 5,490 0.9

Military Commercial Joint

Stock Bank Vietnam Retail and corporate bank 5,448 0.9

TISCO Thailand Retail and corporate bank 5,447 0.9

Koh Young Technology Korea 3D inspection machine manufacturer 5,169 0.9

Silergy Taiwan Semiconductor manufacturer 4,979 0.9

Ningbo Peacebird Fashion A

Shares China Chinese fashion 4,961 0.9

HDFC India Indian mortgage provider 4,872 0.8

LONGi Green Energy A Shares China Chinese semiconductor manufacturer 4,855 0.8

SK hynix Korea Semiconductor manufacturer 4,565 0.8

Electronic component and

KH Vatec Company Korea device manufacturer 4,331 0.7

Geely Automobile China Automobile manufacturer 4,271 0.7

Enterprise management software

Kingdee International Software China distributor 4,172 0.7

Manufacturer of trailers

CIMC Vehicles H Shares China and trucks 4,154 0.7

Stationary and lead frames

SDI Corporation Taiwan for semiconductors manufacturer 4,148 0.7

Ping An Bank A Shares China Consumer bank 3,767 0.6

Online financial services

Policybazaar India platform 3,725 0.6

Mobile World Investment Corporation Vietnam Electronic and grocery retailer 3,400 0.6

Chalice Mining China Miner 3,311 0.6

Property Guru Singapore Real-estate platform 3,148 0.5

Vinh Hoan Corporation Vietnam Food producer 2,907 0.5

Tsugami Precision China Industrial machinery manufacturer 2,877 0.5

Manufacturer of electronic

Wuxi Lead Intelligent Equipment capacitors, solar energy

Co A Shares China and lithium battery equipment 2,421 0.4

AirTac International Group Taiwan Pneumatic components manufacturer 2,243 0.4

Techtronic Industries Hong Kong Power tool manufacturer 2,088 0.3

Jio Financial Services India Financial service business 1,273 0.2

Binh Minh Plastics Joint Stock

Company Vietnam Plastic piping manufacturer 1,235 0.2

Nexteer Automotive China Producer of automotive components 1,111 0.2

Minibus and automotive components

Brilliance China Automotive China manufacturer 1,076 0.2

FPT Vietnam IT service provider 944 0.1

Chime Biologics (u) China Biopharmaceutical company 76 0.1

Eden Biologics (u) Taiwan Biopharmaceutical company 17 <0.1

Philtown Properties (u) Philippines Property developer - -

------------------------------------ ------------ ----------------------------------- --------- --------

Total Investments 572,748 98.7

--------------------------------------------------------------------------------------- --------- --------

Net Liquid Assets* 7,607 1.3

--------------------------------------------------------------------------------------- --------- --------

Total Assets 580,355 100.0

--------------------------------------------------------------------------------------- --------- --------

Details of the ten largest investments are given on pages 28 to

31 of the Annual Report and Financial Statements along with

comparative valuations.

* For a definition of terms see Glossary of Terms and

Alternative Performance Measures at the end of this

announcement.

(u) Denotes private company investment.

(p) Denotes listed security previously held in the portfolio as

a private company investment.

Listed Private company Net Total

equities Investments* liquid assets

% % assets %

%

-------------- ---------- ---------------- -------- --------

31 July 2023 93.6 5.1 1.3 100.0

-------------- ---------- ---------------- -------- --------

31 July 2022 93.6 6.1 0.3 100.0

-------------- ---------- ---------------- -------- --------

Figures represent percentage of total assets.

*Includes holdings in ordinary shares and preference shares.

For a definition of terms see Glossary of Terms and Alternative

Performance Measures at the end of this announcement .

Distribution of Total Assets

Geographical Analysis

At 31 July At 31 July

2023 2022

% %

=========== ================== ============ ============

Equities: China 28.5 20.4

India 23.9 24.2

Korea 18.3 17.4

Vietnam 6.7 5.4

Taiwan 5.7 4.5

Indonesia 5.7 8.9

China 'A' shares 5.2 7.1

Singapore 3.5 6.5

Hong Kong 0.3 4.9

Other 0.9 0.4

Total equities 98.7 99.7

Net Liquid Assets 1.3 0.3

=============================== ============ ============

Total assets 100.0 100.0

=============================== ============ ============

Sectoral Analysis

At 31 July At 31 July

2023 2022

% %

=========== ======================== ============ ============

Equities: Information Technology 22.0 19.5

Consumer Discretionary 20.3 20.2

Financials 12.9 9.9

Materials 12.5 14.6

Industrials 10.6 13.5

Communication Services 8.6 9.6

Real Estate 6.9 4.6

Energy 4.3 6.9

Consumer Staples 0.5 0.3

Healthcare 0.1 0.6

Total equities 98.7 99.7

Net liquid assets 1.3 0.3

===================================== ============ ============

Total assets 100.0 100.0

===================================== ============ ============

For a definition of terms see Glossary of Terms and Alternative

Performance Measures at the end of this announcement.

Income Statement

The following is the preliminary statement for the year to 31

July 2023 which was approved by the Board on 5 October 2023.

2023 2023 2023 2022 2022 2022

Revenue Capital Total Revenue Capital Revenue

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Losses on investments - (25,404) (25,404) - (118,594) (118,594)

Currency (losses)/gains - (791) (791) - 1,292 1,292

Income (note 2) 9,580 - 9,580 11,067 - 11,067

Investment management

fee (note 3) (3,419) - (3,419) (4,036) - (4,036)

Other administrative

expenses (762) - (762) (1,093) - (1,093)

------------------------ -------- -------- -------- -------- ---------- ----------

Net return before

finance costs

and taxation 5,399 (26,195) (20,796) 5,938 (117,302) (111,364)

------------------------ -------- -------- -------- -------- ---------- ----------

Finance costs of

borrowings (403) - (403) (756) - (756)

------------------------ -------- -------- -------- -------- ---------- ----------

Net return before

taxation 4,996 (26,195) (21,199) 5,182 (117,302) (112,120)

------------------------ -------- -------- -------- -------- ---------- ----------

Tax (830) (1,256) (2,086) (1,352) 5,288 3,936

------------------------ -------- -------- -------- -------- ---------- ----------

Net return after

taxation 4,166 (27,451) (23,285) 3,830 (112,014) (108,184)

------------------------ -------- -------- -------- -------- ---------- ----------

Net return per ordinary

share (note 4) 4.56p (30.05p) (25.49p) 4.21p (123.01p) (118.80p)

------------------------ -------- -------- -------- -------- ---------- ----------

The total column of this Statement represents the profit and

loss account of the Company. The supplementary revenue and capital

columns are prepared under guidance published by the Association of

Investment Companies.

All revenue and capital items in this Statement derive from

continuing operations.

A Statement of Comprehensive Income is not required as the

Company does not have any other comprehensive income and the net

return after taxation is both the profit and comprehensive income

for the year.

Balance Sheet

As at 31 July

2023 2023 2023 2023

GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------------- -------- ---------- -------- ----------

Fixed assets

Investments held at fair value through

profit or loss (note 6) 572,748 608,539

--------------------------------------- -------- ---------- -------- ----------

Current assets

Debtors 420 1,248

Cash and cash equivalents 12,442 5,399

--------------------------------------- -------- ---------- -------- ----------

12,862 6,647

--------------------------------------- -------- ---------- -------- ----------

Creditors

Amounts falling due within one year

(note 7):

Other creditors and accruals (1,163) (1,620)

--------------------------------------- -------- ---------- -------- ----------

Net current assets 11,699 5,027

--------------------------------------- -------- ---------- -------- ----------

Total assets less current liabilities 584,447 613,566

Creditors

Amounts falling due after more than

one year:

Provision for tax liability (note

8) (4,092) (3,016)

Net assets 580,355 610,550

Capital and reserves

Share capital 9,208 9,208

Share premium account 254,120 253,946

Capital redemption reserve 20,367 20,367

Capital reserve 287,783 319,573

Revenue reserve 8,877 7,456

Shareholders' funds 580,355 610,550

--------------------------------------- -------- ---------- -------- ----------

Net asset value per ordinary share 637.18p 664.65p

--------------------------------------- -------- ---------- -------- ----------

Ordinary share in issue (note 9) 92,074,961 92,074,961

--------------------------------------- -------- ---------- -------- ----------

Statement of Changes in Equity

For the year ended 31 July 2023

Share Share Capital Capital Revenue Shareholder's

capital premium redemption reserve reserve funds

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- -------- -------- ----------- -------- -------- -------------

Shareholders' funds at

1 August 2022 9,208 253,946 20,367 319,573 7,456 610,550

Net return after taxation - - - (27,451) 4,166 (23,285)

Ordinary shares bought back

into treasury (note 9) - - - (5,541) - (5,541)

Ordinary shares sold from

treasury (note 9) - 174 - 1,202 - 1,376

Ordinary shares issued - - - - - -

(note 9)

Dividends paid during the

year (note 5) - - - - (2,745) (2,745)

---------------------------- -------- -------- ----------- -------- -------- -------------

Shareholders' funds at

31 July 2023 9,208 254,120 20,367 287,783 8,877 580,355

---------------------------- -------- -------- ----------- -------- -------- -------------

For the year ended 31 July 2022

Share Share Capital Capital Revenue Shareholder's

capital premium redemption reserve reserve funds

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- -------- -------- ----------- --------- -------- -------------

Shareholders' funds at

1 August 2021 8,843 221,354 20,367 433,041 3,626 687,231

Net return after taxation - - - (112,014) 3,830 (108,184)

Ordinary shares bought

back into treasury (note

9) - - - (1,454) - (1,454)

Ordinary shares sold from - - - - - -

treasury (note 9)

Ordinary shares issued

(note 9) 365 32,592 - - - 32,957

Dividends paid during - - - - - -

the year (note 5)

-------------------------- -------- -------- ----------- --------- -------- -------------

Shareholders' funds at

31 July 2022 9,208 253,946 20,367 319,573 7,456 610,550

-------------------------- -------- -------- ----------- --------- -------- -------------

Cash Flow Statement

For the year ended 31 July

2023 2023 2022 2022

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------ -------- -------- --------- --------

Cash flows from operating activities

Net return before taxation (21,199) (112,120)

Net losses on investments 25,404 118,594

Currency losses/(gains) 791 (1,292)

Finance costs of borrowings 403 756

Overseas withholding tax incurred (881) (1,288)

Indian tax paid on transactions (180) (774)

Changes in debtors 523 (580)

Change in creditors (11) (9)

Cash from operations * 4,850 3,287

Interest paid (403) (765)

------------------------------------------ -------- -------- --------- --------

Net cash inflow from operating activities 4,447 2,522

------------------------------------------ -------- -------- --------- --------

Cash flows from investing activities

Acquisitions of investments (89,277) (197,017)

Disposals of investments 99,574 196,116

------------------------------------------ -------- -------- --------- --------

Net cash inflow/(outflow) from investing

activities 10,297 (901)

------------------------------------------ -------- -------- --------- --------

Cash flows from financing activities

Ordinary shares bought back into

treasury (note 9) (5,541) (1,454)

Ordinary shares sold from treasury

(note 9) 1,376 -

Proceeds from ordinary shares issued

(note 9) - 32,957

Borrowings drawn down - 119,372

Borrowings repaid - (182,957)

Equity dividends paid (2,745) -

------------------------------------------ -------- -------- --------- --------

Net cash outflow from financing

activities (6,910) (32,082)

------------------------------------------ -------- -------- --------- --------

Increase/(decrease) in cash and

cash equivalents 7,834 (30,461)

------------------------------------------ -------- -------- --------- --------

Exchange movements (791) 4,094

Cash and cash equivalents at 1 August 5,399 31,766

------------------------------------------ -------- -------- --------- --------

Cash and cash equivalents at 31

July 12,442 5,399

------------------------------------------ -------- -------- --------- --------

++ Cash from operations includes dividends received of

GBP9,925,000 (2022 - GBP10,279,000) and interest received of

GBP163,000 (2022 - GBP6,000).

Notes to the Financial Statements

1. Principal Accounting Policies

The Financial Statements for the year to 31 July 2023 have been

prepared in accordance with FRS 102 'The Financial Reporting

Standard applicable in the UK and Republic of Ireland' on the basis

of the accounting policies set out below which are unchanged from

the prior year and have been applied consistently.

2. Income

2023 2022

GBP'000 GBP'000

--------------------------------------------------------------- ------------ ------------

Income from investments

Overseas dividends 9,417 11,060

Other income

Deposit interest 163 7

--------------------------------------------------------------- ------------ ------------

Total income 9,580 11,067

--------------------------------------------------------------- ------------ ------------

Total income comprises:

Dividends from financial assets designated at fair

value through profit or loss 9,417 11,060

Interest from financial assets not at fair value

through profit or loss 163 7

--------------------------------------------------------------- ------------ ------------

9,580 11,067

--------------------------------------------------------------- ------------ ------------

3. Investment Management Fee

The Company has appointed Baillie Gifford & Co Limited, a

wholly owned subsidiary of Baillie Gifford & Co, as its

Alternative Investment Fund Managers ('AIFM') and Company

Secretaries. Baillie Gifford & Co Limited has delegated

portfolio management services to Baillie Gifford & Co. Dealing

activity and transaction reporting have been further sub-delegated

to Baillie Gifford Overseas Limited and Baillie Gifford Asia (Hong

Kong) Limited. The Managers may terminate the Management Agreement

on six months' notice and the Company may terminate on three

months' notice.

The annual management fee is 0.75% on the first GBP50 million of

net assets, 0.65% on the next GBP200 million of net assets and

0.55% on the remaining net assets. Management fees are calculated

and payable on a quarterly basis.

4. Net Return Per Ordinary Share

2023 2023 2023 2022 2022 2022

Revenue Capital Total Revenue Capital Total

----------------- -------- -------- -------- -------- --------- ---------

Net return after

taxation 4.56p (30.05p) (25.49p) 4.21p (123.01p) (118.80p)

----------------- -------- -------- -------- -------- --------- ---------

Revenue return per ordinary share is based on the net revenue

profit after taxation of GBP4,166,000 (2022 - net revenue profit of

GBP3,830,000) and on 91,364,427 (2022 - 91,063,205) ordinary

shares, being the weighted average number of ordinary shares in

issue (excluding treasury shares) during the year.

Capital return per ordinary share is based on the net capital

loss for the financial year of GBP27,451,000 (2022 - net capital

loss of GBP112,014,000) and on 91,364,427 (2022 - 91,063,205)

ordinary shares, being the weighted average number of ordinary

shares in issue (excluding treasury shares) during the year.

Total return per ordinary share is based on the total loss for

the financial year of GBP23,285,000 (2022 - total loss of

GBP108,184,000) and on 91,364,427 (2022 - 91,063,205) ordinary

shares, being the weighted average number of ordinary shares in

issue (excluding treasury shares) during the year.

There are no dilutive or potentially dilutive shares in

issue.

5. Ordinary Dividends

2023 2022

2023 2022 GBP'000 GBP'000

----------------------------------------- --------- -------- ------------ ------------

Amounts recognised as distributions

in the year:

Previous year's final dividend (paid

29 November 2022) 3.00p - 2,745 -

----------------------------------------- --------- -------- ------------ ------------

We set out below the total dividends proposed in respect of the

financial year, which is the basis on which the requirements of

section 1158 of the Corporation Tax Act 2010 are considered. There

is a revenue surplus for the year to 31 July 2023 of GBP4,166,000

which is available for distribution by way of a dividend payment

(2022- a revenue surplus of GBP3,830,000).

2023 2022

2023 2022 GBP'000 GBP'000

----------------------------------------- --------- --------- ------------ ------------

Amounts paid and payable in respect

of the financial year:

Proposed final dividend per ordinary

share (payable - 30 November 2023) 3.25p 3.00p 2,959 2,745

----------------------------------------- --------- --------- ------------ ------------

If approved, the recommended final dividend on the ordinary

shares will be paid on 30 November 2023 to shareholders on the

register at the close of business on 27 October 2023. The

ex-dividend date is 26 October 2023. The Company's Registrars offer

a Dividend Reinvestment Plan and the final date for elections for

this dividend is 9 November 2023.

6. Fair Value Hierarchy

As at Level 1 Level 2 Level 3 Total

31 July 2023 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------------- ------------ ------------ ------------ ------------

Listed equities* 542,048 1,273 - 543,321

Unlisted company equities - - 2,555 2,555

Unlisted company preference shares# - - 26,872 26,872

---------------------------------------- ------------ ------------ ------------ ------------

Total financial asset investments 542,048 1,273 29,427 572,748

---------------------------------------- ------------ ------------ ------------ ------------

As at Level 1 Level 2 Level 3 Total

31 July 2022 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------------- ------------ ------------ ------------ ------------

Listed equities 570,801 495 - 571,296

Unlisted company equities - - 4,051 4,051

Unlisted company preference shares# - - 33,192 33,192

---------------------------------------- ------------ ------------ ------------ ------------

Total financial asset investments 570,801 495 37,243 608,539

---------------------------------------- ------------ ------------ ------------ ------------

* During the period, Brilliance China listed on the Hong Kong

stock exchange having de-listed on 31 March 2021 and there was a

demerger with Reliance Industries, where shares of Jio Financial

Services were acquired but the company did not list until 21 August

2023.

# The investments in preference shares include liquidation

preference rights that determine the repayment (or multiple

thereof) of the original investment in the event of a liquidation

event such as a take-over.

During the year to 31 July 2023 no investments (31 July 2022 -

GBP23,341,000) were transferred from Level 3 to Level 1 on becoming

listed.

Investments in securities are financial assets held at fair

value through profit or loss. In accordance with Financial

Reporting Standard 102, the tables above provide an analysis of

these investments based on the fair value hierarchy described

below, which reflects the reliability and significance of the

information used to measure their fair value.

The fair value hierarchy used to analyse the fair values of

financial assets is described below. The levels are determined by

the lowest (that is the least reliable or least independently

observable) level of input that is significant to the fair value

measurement for the individual investment in its entirety as

follows:

Level 1 - using unadjusted quoted prices for identical

instruments in an active market;

Level 2 - using inputs, other than quoted prices included within

Level 1, that are directly or indirectly observable (based on

market data); and

Level 3 - using inputs that are unobservable (for which market

data is unavailable).

The Company's unlisted ordinary share investments at 31 July

2023 were valued using a variety of techniques. These include using

comparable company performance, comparable scenario analysis, and

assessment of milestone achievement at investee companies. The

determinations of fair value included assumptions that the

comparable companies and scenarios chosen for the performance

assessment provide a reasonable basis for the determination of fair

value. In some cases the latest dealing price is considered to be

the most appropriate valuation basis, but only following assessment

using the techniques described above.

7. Creditors - Amounts falling due within one year

2023 2022

GBP'000 GBP'000

------------------------------------------------------------------------------------------------------ ----------- -----------

Royal Bank of Scotland International Limited multi-currency revolving credit facility non-utilisation

fee 52 52

Investment purchases awaiting settlement

Investment management fee - 446

Other creditors and accruals 873 915

238 207

------------------------------------------------------------------------------------------------------ ----------- -----------

1,163 1,620

------------------------------------------------------------------------------------------------------ ----------- -----------

The Company has a multi-currency revolving credit facility with

The Royal Bank of Scotland International Limited for up to GBP100

million, with a non-utilisation rate of 0.4%. This facility expires

in March 2025. At 31 July 2023 there were no outstanding drawings

(31 July 2022 - nil). The main covenants relating to the loan are

that borrowings should not exceed 30% of the Company's adjusted net

asset value and the Company's net asset value should be at least

GBP300 million.

There were no breaches in the loan covenants during the

year.

None of the above creditors at 31 July 2023 or 31 July 2022 are

financial liabilities designated at fair value through profit or

loss.

8. Provision for Tax Liability

The tax liability provision at 31 July 2023 of GBP4,092,000 (31

July 2022 - GBP3,016,000) relates to a potential liability for

Indian capital gains tax that may arise on the Company's Indian

investments should they be sold in the future, based on the net

unrealised taxable capital gain at the period end and on enacted

Indian tax rates (long term capital gains are taxed at 10% and

short term capital gains are taxed at 15%). The amount of any

future tax amounts payable may differ from this provision,

depending on the value and timing of any future sales of such

investments and future Indian tax rates.

9. Share capital

2023 2022

Number of Number of

shares shares

------------------------------------------------------------------- -------------- --------------