TIDMPPH

RNS Number : 8661K

PPHE Hotel Group Limited

31 August 2023

31 August 2023

PPHE Hotel Group Limited

("PPHE" or the "Group")

Unaudited Interim Results for the six months ended 30 June

2023

Strong Group performance across main markets

PPHE Hotel Group, the international hospitality real estate

group which develops, owns and operates hotels and resorts,

announces its unaudited interim results for the six months ended 30

June 2023 (the "Period").

Commenting on the results, Boris Ivesha, President and Chief

Executive Officer, PPHE Hotel Group said:

"We are very pleased to report a strong performance for the

Group across our main markets, with record revenues following

significant increases on last year and the pre-pandemic period.

This momentum has continued into the second half, giving us

confidence in our full-year outlook and longer-term growth.

Our strong performance also enables us to reward our

shareholders for their continued trust and support by returning to

our historical capital returns policy of distributing approximately

30% of adjusted EPRA earnings, whilst also continuing to support

investment in future growth opportunities.

We are now entering a very exciting time for the Group, with our

GBP300+ million pipeline nearing completion. New property openings

are afoot in the next nine months, in Belgrade, Zagreb, Rome and

London Hoxton and, upon stabilisation of trading, these new hotels

are targeted to generate at least GBP25 million of EBITDA for the

Group.

We are encouraged by the strong trading seen over the summer

period and are thankful to our teams for delivering such exemplary

results and providing our guests with great hospitality across all

our destinations."

Financial highlights

-- Total revenue was up 59.0% year-on-year at GBP180.0 million

(H1 2022: GBP113.2 million) and up 15.9% on the pre-pandemic levels

(H1 2019: GBP155.3 million) with strong quarter-on-quarter momentum

in the Period.

-- Revenue growth was led by strong room rate growth. Average

room rate was GBP159.6, up 13.1% compared with H1 2022 and up 31.2%

on H1 2019.

-- The recovery in occupancy rates continues, with H1 occupancy

up to 69.1% compared with 48.0% in H1 2022 and 76.8% in H1

2019.

-- RevPAR at GBP110.3, materially above pre-pandemic levels (H1

2019: GBP93.4) and last year (H1 2022:

GBP67.8).

-- EBITDA of GBP45.2 million, up 165.7% versus H1 2022 (H1 2022:

GBP17.0 million), and in line with H1 2019 levels (H1 2019: GBP45.7

million) with margins improving.

-- EPRA NRV per share* at 30 June 2023 was flat at GBP25.05 (31

December 2022: GBP25.17), driven entirely by the change in the

GBP/EUR currency conversion rate. Revaluations will be completed at

the year end, as per usual course of business.

-- Adjusted EPRA Earnings of 106 pence for the twelve months

ended 30 June 2023 was up by 112% versus 2022 (31 December 2022: 50

pence).

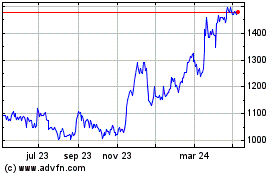

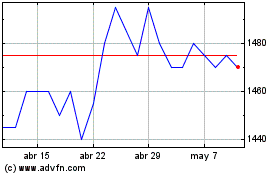

-- Given the strength of trading and confidence in outlook, the

Board believes the Company is now in a position to return to its

historical capital returns policy of distributing approximately 30%

of adjusted EPRA earnings (reported at GBP1.06 in the twelve month

period to 30 June 2023), while continuing to support investment in

future growth opportunities. In light of the continued significant

share price discount (c60% as at 31 August 2023) relative to EPRA

NRV per share, the Board intends to consult with shareholders

regarding the most appropriate and effective mechanism for such

distributions to take place, including dividends, share buybacks,

tender offers or a combination thereof. The Board looks forward to

updating the market on this capital return policy in the near

future.

(*) EPRA NRV and EPRA NRV per share were calculated based on the

independent external valuations prepared in December 2022.

Operational highlights

-- Strong growth in the Group's key markets - the United Kingdom and the Netherlands - driven by international corporate, leisure and meetings demand and a particularly strong London events calendar, even before the benefit of the coronation of King Charles III.

-- The Croatian summer season has enjoyed a solid start and the

Group expect to derive further benefits from recently refurbished

and relaunched properties. In the smallest region, Germany, trading

at the Group's properties started to improve from Q2 onwards.

Strategic highlights

-- February saw the full opening of the first art'otel in the

UK, art'otel London Battersea Power Station, which is operated by

the Group's hospitality management platform.

-- Significant progress with the development pipeline, and on

track to open four properties between October 2023 and H1 2024.

o The fourth quarter 2023 will see the opening of the Radisson

RED Belgrade in Serbia, which is the second hotel to open under the

recently extended partnership with Radisson and the first Radisson

RED to be operated by the Group.

o Three premium lifestyle art'otel properties are set to open,

starting with art'otel Zagreb in October 2023, then art'otel London

Hoxton in Q1 2024 and art'otel Rome in H1 2024.

-- Regulatory approvals were obtained for the new EUR250 million

European Hospitality Real Estate Fund, taking advantage of the

Group's flexible and scalable in-house hospitality management

platform. The Fund enables the Group to capture attractive

acquisition opportunities via the use of non-dilutive third-party

capital as well as increasing the number of assets managed on our

platform.

ESG highlights

-- The Company has taken several measures to increase

transparency and stakeholder accountability for its ESG strategy.

Management has increased its focus on the Group's strategic

approach to sustainability and responsible business, with a view to

publication of its strategy, targets and KPIs in the 2023 Annual

Report and Accounts. This includes dedicated increased resources

including staff hires to ESG as well as retaining external

specialist consultancies to advise on carbon foot-printing and

reporting to stakeholders.

-- Reporting on ESG in a way that is most useful for investors

and customers is an ongoing priority. The Group has submitted its

annual CDP data for 2023, which CDP expect to publish at year-end,

and which will allow year-on-year progress-tracking on ESG.

Globally recognised and standardised reporting channels such as CDP

allow stakeholders to engage with all businesses on ESG.

-- The Group completed a full carbon footprint for scopes 1, 2

and 3. This is for the purpose of analysis of the tonnage of carbon

dioxide equivalent (CO2e) emitted both in operations and in the

supply chain, and design actions for carbon reduction.

-- The Company is in the process of reviewing its water

consumption and waste outputs. The objective is to ensure robust

data collection on water usage, benchmarking consumption against

comparators, and identifying strategic targets and KPIs for

minimising consumption and consequent contribution to water

stress.

Current trading and outlook

-- Entering the strongest half of the year, th e previously

announced strong trading conditions have been maintained through Q2

and into Q3 across all main market segments of leisure, corporate

travel and meetings and events.

-- Continued focus on maintaining and driving room rates, to

cover inflationary pressures, while continuing to rebuild

occupancy.

-- The Board remains confident in the Group's longer-term

growth, underpinned by the persistent strength of consumer leisure

demand internationally, its quality assets, fully-funded

development pipeline and strong financial position.

-- As previously announced, the Group expects to deliver FY 2023

revenue of at least GBP400 million and EBITDA of at least GBP120

million.

-- Entering an exciting time for the Group as GBP300+ million

pipeline nears completion, with four new openings afoot in the next

nine months, targeted to generate at least GBP25 million EBITDA on

stabilised trading.

Enquiries:

PPHE Hotel Group Limited

Daniel Kos,

Chief Financial Officer & Executive Director

Robert Henke Tel: +31 (0)20 717 8600

Executive Vice President of Commercial

Affairs

Hudson Sandler

Wendy Baker / Charlotte Cobb / India Laidlaw Tel: +44 (0)20 7796

4133

Email: pphe@hudsonsandler.com

Notes to Editors

PPHE Hotel Group is an international hospitality real estate

company, with a GBP2.0 billion portfolio, valued as at December

2022 by Savills and Zagreb nekretnine Ltd (ZANE), of primarily

prime freehold and long leasehold assets in Europe.

Through its subsidiaries, jointly controlled entities and

associates it owns, co-owns, develops, leases, operates and

franchises hospitality real estate. Its portfolio includes

full-service upscale, upper upscale and lifestyle hotels in major

gateway cities and regional centres, as well as hotel, resort and

campsite properties in select resort destinations. The Group's

strategy is to grow its portfolio of core upper upscale city centre

hotels, leisure and outdoor hospitality and hospitality management

platform.

PPHE Hotel Group benefits from having an exclusive and perpetual

licence from the Radisson Hotel Group, one of the world's largest

hotel groups, to develop and operate Park Plaza(R) branded hotels

and resorts in Europe, the Middle East and Africa. In addition,

PPHE Hotel Group wholly owns, and operates under, the art'otel(R)

brand and its Croatian subsidiary owns, and operates under, the

Arena Hotels & Apartments(R) and Arena Campsites(R) brands.

PPHE Hotel Group is a Guernsey registered company with shares

listed on the London Stock Exchange. PPHE Hotel Group also holds a

controlling ownership interest in Arena Hospitality Group, whose

shares are listed on the Prime market of the Zagreb Stock

Exchange.

Company websites: www.pphe.com |

www.arenahospitalitygroup.com

For reservations:

www.parkplaza.com | www.artotel.com | www.arenahotels.com |

www.arenacampsites.com

BUSINESS & FINANCIAL REVIEW

BUSINESS REVIEW

The first six months of 2023 saw continued strong trading

conditions and positive forward booking momentum across the Group's

property portfolio and regions and across all market segments of

leisure, corporate travel and meetings and events. This enabled the

Group to achieve record H1 revenue and a full recovery in EBITDA.

When we look at the key metrics of room rate and RevPAR, the Group

is now trading consistently and materially above pre-pandemic

levels, whilst occupancy continues to recover strongly. We now

believe the worst effects of the pandemic have been successfully

overcome.

Strategically, the Group continued to take a disciplined

rates-led approach across its portfolio, which helped mitigate

industry-wide cost inflation and further illustrated the strong

international demand for our hotels. In the Period, average room

rates were up 13.1% compared with H1 2022, and up 31.2% on

pre-pandemic levels reported in H1 2019. Notably, the average room

rate in all our operating regions exceeded those achieved in 2019,

with average room rates during Q1 up 24.6% and in Q2 up 35.6% on

the same period in 2019.

The Group's hotels in the UK and The Netherlands remained the

strongest performing across the portfolio, driven by a combination

of continuing rate growth and occupancy recovery. Occupancy levels

further improved, tracking closer to 2019 levels in the UK and The

Netherlands. Meanwhile, the Group's hotel and camping assets in

Croatia experienced a solid start to the summer season, supporting

confidence in the Group's wider full year outlook. As previously

announced, while the German region had a slower start to the year

it has seen an improving trend in bookings through Q2 and into

Q3.

Additionally, the Group continued to make excellent progress

with its development projects with four new h otels scheduled to

open during H2 2023 and H1 2024, consisting of two repositioned

properties and two new hotels.

As a result, total revenue in the Period increased by 59.0% to

GBP180.0 million, representing an improved performance of 15.9%

versus pre-pandemic levels (H1 2022: GBP113.2m, H1 2019:

GBP155.3m). RevPAR was GBP110.3 (H1 2022: GBP67.8, H1 2019:

GBP93.4).

Despite macroeconomic challenges and inflationary pressures, the

Group achieved enhanced operational profit in H1 2023 with EBITDA

at GBP45.2 million, compared with GBP17.0 million in H1 2022.

EBITDA was in line with the pre-pandemic H1 2019 of GBP45.7

million.

Alongside maintaining its disciplined rates-led strategy and

growing occupancy, the Group successfully mitigated a number of

inflationary and sector-specific issues through the implementation

of innovative solutions and forward planning focused on enhancing

its sustainability and energy efficiency. For example, staffing is

much less of a constraint for the Group due to its proactive

approach to investment in people, automation and employer brand.

Furthermore, the Group's utility cost hedging has been important in

mitigating energy cost increases, alongside a multitude of internal

innovations and efforts to reduce energy consumption across our

operations.

Given the strength of trading and confidence in outlook, the

Board believes the Company is now in a position to return to its

historical capital returns policy of distributing approximately 30%

of adjusted EPRA earnings (reported at GBP1.06 in the twelve month

period to 30 June 2023), while continuing to support investment in

future growth opportunities. In light of the continued significant

share price discount (c60% as at 31 August 2023) relative to EPRA

NRV per share, the Board intends to consult with shareholders

regarding the most appropriate and effective mechanism for such

distributions to take place, including dividends, share buybacks,

tender offers or a combination thereof. The Board looks forward to

updating the market on this capital return policy in the near

future.

Strategic progress and development pipeline

Reflecting its strong track record in developing, launching and

operating hospitality properties, the Group remained focused on its

consistent strategic investment in its portfolio of premium

assets.

In London, the art'otel London Battersea Power Station fully

opened to critical acclaim in February 2023, operated by PPHE under

a management agreement through its hospitality management platform,

and initial trading has been strong.

In Croatia, recently completed repositioning projects have

supported the initial strong start to peak trading in the region.

Grand Hotel Brioni in Pula will trade through its first summer

season fully open as a Radisson Collection Hotel under the expanded

strategic partnership with Radisson Hotel Group ("RHG"), following

an extensive repositioning project completed in 2022, alongside the

improvements made to properties at Arena Stoja Campsite (luxury

mobile homes) in Pula. In Austria, Arena FRANZ Ferdinand hotel in

Nassfeld benefited from development investment in enhanced

facilities, including a pool and spa facilities.

At the International Hospitality Investment Forum in May 2023,

PPHE further cemented its expanded partnership with RHG with a

commitment to continue to grow and leverage the brands of each

company's portfolio internationally. RHG integrated the art'otel

brand as its tenth brand to be operated and marketed under one

overarching Radisson Hotel Group umbrella.

Further evidence of the significant opportunity that remains in

the Group's GBP300+ million development pipeline includes the

ongoing conversion of an iconic office building in the centre of

Zagreb into Croatia's first art'otel (opening H2 2023), the

repositioning of a new art'otel in Rome (reopening H1 2024), and

construction of art'otel London Hoxton (opening Q1 2024) which is

progressing well following the appointment of globally recognised

British contemporary street artist D*Face as its Signature Artist

during the Period. As ever, the Company continues to invest in its

development pipeline to both expand the portfolio and deliver

attractive shareholder returns.

The second half of 2023 and early 2024 will be exceptionally

busy for our teams as we prepare to open a number of further

premium hotels internationally. In addition to the three new

art'otels, the pipeline includes a Radisson RED in Belgrade,

Serbia. Previously branded Arena 88 Rooms Hotel, the property is

being refurbished to re-open as an upscale Radisson RED hotel.

European Hospitality Real Estate Fund

As part of the Group's long-term growth ambitions, regulatory

approvals for PPHE's inaugural European Hospitality Real Estate

Fund ("the Fund") were secured during the Period following its

launch in March 2023. The Fund of up to EUR250 million equity

enables the Group to further accelerate its strategy of

identifying, acquiring and developing attractive hotel assets

across a range of key European markets. Hotels acquired by the Fund

will be operated by PPHE's hospitality management platform,

building further scale in the platform.

PPHE has committed to participate in the Fund for an amount up

to EUR50 million in cash and/or assets. In March 2023, the Group

announced Clal Insurance as the Fund's cornerstone investor, which

has committed to invest up to EUR75 million. In March, our property

in Rome (soon to open as art'otel Rome) was contributed as a seed

asset.

Following receipt of regulatory approvals, with full equity

subscription and combined with a targeted 50% bank leverage, the

investment potential of the Fund will be around EUR500 million.

The Fund is consistent with PPHE's longstanding approach to

building shareholder value through the careful stewardship of its

own balance sheet and partnership with third-party capital

providers, and we look forward to sharing further progress over

coming months.

The Board

The composition of the Board and its diversity remains critical

to the Group's approach to governance. As previously announced,

Kevin McAuliffe, Non-Executive Chairman resigned from the Board at

the conclusion of the 2023 Annual General Meeting (AGM). The Board

has distributed his responsibilities to other non-executive

directors.

In addition, following more than a decade with the Group, Greg

Hegarty, Deputy Chief Executive Officer & Chief Operating

Officer, was appointed as an Executive Director of the Company and

joined the Board, effective from the conclusion of the AGM. The

Directors believe that Greg's appointment will enhance the

leadership attributes of the Board by strengthening its strategic

capacity, whilst also providing invaluable operational expertise of

the Group's day-to-day business and grassroot implementation of its

strategy. Greg has significant experience in investor relations and

is keen to meet with investors on a regular basis. This appointment

forms part of the Group's wider commitment to periodically refresh

the Board and is also in keeping with its internal talent

management strategy of promoting intra-group mobility.

The Company continues to take every step to engage with

shareholders both before and after the AGM, however it does

recognise that shareholders expressed concerns on some elements of

the Group's corporate governance. The feedback session held after

the AGM in April 2023 provided very useful information regarding

investor priorities, and our work to meet investor expectations is

ongoing.

Environmental, Social and Governance ("ESG")

Stakeholder engagement:

The Group has taken a number of steps to increase resources

within its ESG function. The Group's Corporate & Legal team has

been expanded to ensure that the Group's ESG strategy

implementation is appropriately resourced, including to enable

ongoing reporting against KPIs and ensure greater transparency for

all stakeholders. The Company completed further CDP reporting, and

will further expand into the Global Reporting Initiative (GRI) and

Workforce Disclosure Initiative (WDI) reporting. This will allow

investors and customers alike to compare ESG scores across

standardised metrics. Company disclosures made in line with UK

requirements arising from the Task Force on Climate-related

Financial Disclosures (TCFD) in 2021 and 2022 shall be updated in

2023. Additionally, we anticipate the introduction of new IFRS S1

and S2 reporting standards from 2024 onwards, and will be taking

steps to report in the required manner when the new requirements

are implemented.

People:

The Group reviewed its 'pulse' survey feedback and identified

ESG as a target area for greater transparency and communications

with the wider workforce. We therefore introduced new ESG

communication methods, including a dedicated learning and

development calendar for ESG issues such as diversity, equity and

inclusion. We also identified grass-roots initiatives to support

career development and local communities, and are implementing

targets to ensure that the social value of these are correctly

measured and communicated.

Carbon & energy :

During the Period, we completed a full Group-wide carbon

footprint exercise covering all regions over the last 12 months.

This is the first time our full footprint including our supply

chain ("scope 3 emissions") has been mapped in its entirety. The

data will be used for benchmarking the business and prioritising

carbon reduction activities in order to confirm the Group's Carbon

Net Zero target. This will allow us to ask the Science-Based

Targets Initiative (SBTi) to verify our target, and for us to

publish it alongside other ESG targets at year end in the Annual

Report and Accounts.

Governance :

Details of Board changes in the Period are detailed above. We

have also moved ahead with adopting ESG targets, to which we can be

held publicly accountable moving forwards, and are looking ahead to

new corporate governance requirements which will affect our

reporting in the future. Our year end Annual Report and Accounts

will contain full details.

Current trading and outlook

The second half of the year is typically the Group's strongest

trading period, particularly with the onset of the summer leisure

season, which leads to the opening of our well-invested portfolio

of hotel and camping assets in Croatia. Strong forward booking

momentum in Q2 has continued into Q3, and further significant

revenue contribution is expected from the recently refurbished and

relaunched properties. As previously announced, EUR200 million has

been invested in the Croatia region in total since 2008, with EUR50

million alone invested in the last two years, so we are encouraged

by the prospects in what is now one of the Group's largest

operating regions.

As announced in our Trading Update in June 2023, the Board

expects EBITDA margins to continue to improve as we continue

through the second half of FY 2023, despite broader cost inflation

that has been largely absorbed over the last 12 months. The Board

anticipates that this cost inflation effect will diminish through

FY 2024 and beyond, as forward energy cost hedges flow through at

substantially lower levels than those fixed for FY 2023.

The Group continues to expect to deliver FY 2023 revenue of at

least GBP400 million and EBITDA of at least GBP120 million.

In the medium to longer term, the Board's confidence in the

future of the Group is stronger than ever in spite of ongoing

macroeconomic uncertainties. Given the persistent strength of

consumer leisure demand internationally, the Group's investment in

its high-quality portfolio of assets and development pipeline, and

its strong financial position, PPHE remains well-positioned to

continue to take advantage of ongoing momentum in the sector and

deliver enhanced returns for shareholders.

FINANCIAL PERFORMANCE

H1 Reported in GBP (GBP)

-------------- ------------------------------------------------------------------------------------------------------

Six months Six months Change(1) Six months Change(1)

ended ended ended

30 June 30 June 30 June

2023 2022 2019

-------------- --------------------------------- ---------------------------- ---------- ----------- ------------

GBP180.0 GBP155.3

Total revenue million GBP113.2 million 59.0% million 15.9%

------------------ ----------------------------- ---------------------------- ---------- ----------- ------------

GBP133.6 GBP109.1

Room revenue million GBP82.0 million 63.0% million 22.4%

------------------ ----------------------------- ---------------------------- ---------- ----------- ------------

GBP46.4 GBP46.5

EBITDAR million GBP18.2 million 155.9% million (0.1)%

------------------ ----------------------------- ---------------------------- ---------- ----------- ------------

GBP45.2 GBP45.7

EBITDA million GBP17.0 million 165.7% million (0.9)%

------------------ ----------------------------- ---------------------------- ---------- ----------- ------------

(430)

EBITDA margin 25.1% 15.0% 1,010 bps 29.4% bps

------------------ ----------------------------- ---------------------------- ---------- ----------- ------------

Reported GBP(26.1) GBP4.3

PBT GBP2.0 million million n/a million (52.6)%

------------------ ----------------------------- ---------------------------- ---------- ----------- ------------

Normalised GBP(23.9) GBP5.5

PBT GBP3.6 million million n/a million (32.1)%

------------------ ----------------------------- ---------------------------- ---------- ----------- ------------

(770)

Occupancy 69.1% 48.0% 2,110 bps 76.8% bps

------------------ ----------------------------- ---------------------------- ---------- ----------- ------------

Average room

rate GBP159.6 GBP141.1 13.1% 121.7 31.2%

------------------ ----------------------------- ---------------------------- ---------- ----------- ------------

RevPAR GBP110.3 GBP67.8 62.6% 93.4 18.1%

------------------ ----------------------------- ---------------------------- ---------- ----------- ------------

(1) Percentage change figures are calculated from actual figures

as opposed to the rounded figures included in the above table.

Q2 Reported in GBP (GBP)

--------------- ---------------------------------------------------------------------------------------------------

Three months Three months Change(1) Three months Change(1)

ended ended ended

30 June 30 June 30 June

2023 2022 2019

--------------- ----------------------------- ----------------------------- ---------- ------------- ----------

GBP92.8

Total revenue GBP111.2 million GBP81.2 million 36.9% million 19.8%

--------------- ----------------------------- ----------------------------- ---------- ------------- ----------

GBP65.7

Room revenue GBP83.2 million GBP59.4 million 40.0% million 26.6%

--------------- ----------------------------- ----------------------------- ---------- ------------- ----------

GBP33.7

EBITDAR GBP40.3 million GBP22.6 million 78.2% million 19.6%

--------------- ----------------------------- ----------------------------- ---------- ------------- ----------

GBP33.8

EBITDA GBP39.7 million GBP22.0 million 80.6% million 17.4%

--------------- ----------------------------- ----------------------------- ---------- ------------- ----------

(70)

EBITDA margin 35.7% 27.1% 860 bps 36.4% bps

--------------- ----------------------------- ----------------------------- ---------- ------------- ----------

1,200 (630)

Occupancy 70.8% 58.8% bps 77.1% bps

--------------- ----------------------------- ----------------------------- ---------- ------------- ----------

Average room

rate GBP171.0 GBP148.9 14.8% 126.1 35.6%

--------------- ----------------------------- ----------------------------- ---------- ------------- ----------

RevPAR GBP121.0 GBP87.5 38.2% 97.2 24.5%

--------------- ----------------------------- ----------------------------- ---------- ------------- ----------

H1 saw a strong rebound in activity across all of the Group's

key markets, particularly in the UK. This trend continued

consistently through the first half.

This recovery across our regions, driven by demand for leisure

stays, helped to deliver a reported total revenue of GBP180.0

million; an increase of 59.0% compared with the prior year (H1

2022: GBP113.2 million).

In the first half RevPAR increased by 62.6% to GBP110.3, driven

by a 13.1% increase in average room rate to GBP159.6 (H1 2022:

GBP141.1). Occupancy rose by 2,110 bps to 69.1% (H1 2022: 48.0%).

Notably, average room rate in the Period was 31.2% ahead of the

same period pre-pandemic (H1 2019: GBP121.7).

In Q2 average room rate increased to GBP171.0; 14.8% higher than

the prior year and 35.6% higher than the rates achieved in Q2 2019.

Occupancy rose by 1,200 bps to 70.8% (Q2 2022: 58.8%). This

delivered Q2 RevPAR of GBP121.0 (Q2 2022: GBP87.5, Q2 2019:

GBP97.2).

Group reported EBITDA in the Period increased to GBP45.2 million

(H1 2022: GBP17.0 million, H1 2019: GBP45.7 million) and the EBITDA

margin improved to 25.1% (H1 2022: 15.0%, H1 2019: 29.4%).

Reconciliation of reported profit before tax to normalised

profit before tax

Six months Six months 12 months 12 months

ended ended ended ended

30 June 30 June 30 June 31 December

In GBP millions 2023 2022 2023 2022

---------------------------------- ---------- ---------- --------- ------------

Reported profit (loss) before

tax 2.0 (26.1) 39.6 11.5

---------------------------------- ---------- ---------- --------- ------------

Loss on buy back of units in Park

Plaza Westminster Bridge London

from private investors 1.3 0.7 2.1 1.5

---------------------------------- ---------- ---------- --------- ------------

Revaluation of finance lease 1.9 1.8 3.8 3.7

---------------------------------- ---------- ---------- --------- ------------

Revaluation of Park Plaza County

Hall London Income Units - - (0.3) (0.3)

---------------------------------- ---------- ---------- --------- ------------

Disposals and Other non-recurring

expenses (including pre-opening

expenses) 0.2 1.0 0.7 1.5

---------------------------------- ---------- ---------- --------- ------------

Revaluation of share appreciation

rights (2.4) 1.4 (3.7) 0.1

---------------------------------- ---------- ---------- --------- ------------

Fair value IRS 0.6 (2.7) (6.4) (9.7)

---------------------------------- ---------- ---------- --------- ------------

Normalised profit (loss) before

tax 3.6 (23.9) 35.8 8.3

---------------------------------- ---------- ---------- --------- ------------

Shareholder returns

Given the strength of trading and confidence in outlook, the

Board believes the Company is now in a position to return to its

historical capital returns policy of distributing approximately 30%

of adjusted EPRA earnings (reported at GBP1.06 in the twelvemonth

period to 30 June 2023), while continuing to support investment in

future growth opportunities. In light of the continued significant

share price discount (c60% as at 31 August 2023) relative to EPRA

NRV per share, the Board intends to consult with shareholders

regarding the most appropriate and effective mechanism for such

distributions to take place, including dividends, share buybacks,

tender offers or a combination thereof. The Board looks forward to

updating the market on this capital return policy in the near

future.

EPRA accounting information

The Group is a developer, owner and operator of hotels, resorts

and campsites and realises returns through both developing and

owning assets as well as the operations of those assets to their

full potential. Certain EPRA performance measurements are disclosed

to aid investors in analysing the Group's performance and

understanding the value of its assets and earnings from a property

perspective.

EPRA performance indicators

The Group's last 12 months adjusted EPRA earnings per share to

30 June 2023 increased to 106 pence per share. A summary of the

Group's EPRA performance measures is set out in the table

below.

30 June 2023 31 December 2022

GBP million GBP million

--------------------------------------- ------------- ----------------

EPRA earnings (LTM)(1) 58.1 32.7

--------------------------------------- ------------- ----------------

Adjusted EPRA earnings (LTM)(1) 44.9 21.2

--------------------------------------- ------------- ----------------

EPRA NRV(2) 1,063.1 1,078.7

--------------------------------------- ------------- ----------------

Per share figures: 30 June 31 December

2023 2022

GBP GBP

--------------------------------------- ------------- ----------------

EPRA Earnings per share (LTM) 1.37 0.77

--------------------------------------- ------------- ----------------

Adjusted EPRA earnings per share (LTM) 1.06 0.50

--------------------------------------- ------------- ----------------

EPRA NRV per share(2) 25.05 25.17

--------------------------------------- ------------- ----------------

(1) EPRA earnings and adjusted EPRA earnings for 30 June 2023

are calculated for the last 12-month period ended on 30 June

2023.

(2) EPRA NRV and EPRA NRV per share were calculated based on the

independent external valuations prepared in December 2022.

EPRA performance measures

a. EPRA net asset value

To guide investors on the market value of the Group's property

portfolio and performance, the Group has been reporting various

EPRA key performance indicators since 2018, alongside its

operational metrics. Property valuations have historically been

undertaken once a year by independent external valuers, using

established and widely recognised methods including applying

appropriate discount rates to property cash flow generation and

applying capitalisation rates from precedent transactions.

In December 2022, the Group's properties (with the exception of

operating leases, managed and franchised properties) were

independently valued by Savills (in respect of properties in the

Netherlands, UK and Germany) and by Zagreb nekretnine Ltd (ZANE)

(in respect of properties in Croatia). Based on those valuations

the Directors had updated the Group's EPRA NRV, EPRA NTA and EPRA

NDV for 30 June 2023. The EPRA NRV as at 30 June 2023, set out in

the table below, amounts to GBP1,063.1 million (2022: GBP1,078.7

million), which equates to GBP25.05 per share (2022: GBP25.17).

This NRV slight decline was mainly as a result of the change in the

GBP/EUR currency conversion rate and a dividend distribution in the

Period. The Group's annual revaluation will take place in December

2023.

30 June 2023

GBP million

------------------------------------- -------------------------------------------------------------------------------

EPRA NRV EPRA NTA(4) EPRA NDV

(Net Reinstatement Value) (Net Tangible Assets) (Net Disposal Value)

------------------------------------- ---------------------------- ------------------------ -----------------------

NAV per the financial statements 304.7 304.7 304.7

Effect of exercise of options - - -

Diluted NAV, after the exercise of

options(1) 304.7 304.7 304.7

Includes:

Revaluation of owned properties in

operation (net of non-controlling

interest)(2) 747.7 747.7 747.7

Revaluation of the JV interest held

in two German properties (net of

non-controlling interest)

(2) 6.8 6.8 6.8

Fair value of fixed interest rate

debt - - (8.3)

Deferred tax on revaluation of

properties - - (31.0)

Real estate transfer tax(3) 18.5 - -

Excludes:

Fair value of financial instruments 23.1 23.1 -

Deferred tax (8.5) (8.5) -

Intangibles as per the IFRS balance - 11.1 -

sheet

EPRA NAV 1,063.1 1,033.5 1,019.9

Fully diluted number of shares (in

thousands)(1) 42,433 42,433 42,433

EPRA NAV per share (in GBP) 25.05 24.36 24.04

(1) The fully diluted number of shares excludes treasury shares

but includes 132,848 outstanding dilutive options (as at 31

December 2022: 407,223).

(2) The fair values of the properties were determined on the

basis of independent external valuations prepared in December 2022.

The properties under development are measured at cost.

(3) EPRA NTA and EPRA NDV reflect fair value net of transfer

costs. Transfer costs are added back when calculating EPRA NRV.

(4) NTA is calculated under the assumption that the Group does

not intend to sell any of its properties in the long run.

31 December 2022

GBP million

------------------------------------- -------------------------------------------------------------------------------

EPRA NRV EPRA NTA(4) EPRA NDV

(Net Reinstatement Value) (Net Tangible Assets) (Net Disposal Value)

------------------------------------- ---------------------------- ------------------------ -----------------------

NAV per the financial statements 315.1 315.1 315.1

------------------------------------- ---------------------------- ------------------------ -----------------------

Effect of exercise of options 3.0 3.0 3.0

------------------------------------- ---------------------------- ------------------------ -----------------------

Diluted NAV, after the exercise of

options(1) 318.1 318.1 318.1

------------------------------------- ---------------------------- ------------------------ -----------------------

Includes:

------------------------------------- ---------------------------- ------------------------ -----------------------

Revaluation of owned properties in

operation (net of non-controlling

interest)(2) 746.9 746.9 746.9

------------------------------------- ---------------------------- ------------------------ -----------------------

Revaluation of the JV interest held

in two German properties (net of

non-controlling interest)

(2) 6.8 6.8 6.8

------------------------------------- ---------------------------- ------------------------ -----------------------

Fair value of fixed interest rate

debt - - (9.2)

------------------------------------- ---------------------------- ------------------------ -----------------------

Deferred tax on revaluation of

properties - - (31.7)

------------------------------------- ---------------------------- ------------------------ -----------------------

Real estate transfer tax(3) 18.7 - -

------------------------------------- ---------------------------- ------------------------ -----------------------

Excludes:

------------------------------------- ---------------------------- ------------------------ -----------------------

Fair value of financial instruments 21.1 21.1 -

------------------------------------- ---------------------------- ------------------------ -----------------------

Deferred tax (9.3) (9.3) -

------------------------------------- ---------------------------- ------------------------ -----------------------

Intangibles as per the IFRS balance

sheet - 12.8 -

------------------------------------- ---------------------------- ------------------------ -----------------------

EPRA NAV 1,078.7 1,047.2 1,030.9

------------------------------------- ---------------------------- ------------------------ -----------------------

Fully diluted number of shares (in

thousands)(1) 42,846 42,846 42,846

------------------------------------- ---------------------------- ------------------------ -----------------------

EPRA NAV per share (in GBP) 25.17 24.44 24.06

------------------------------------- ---------------------------- ------------------------ -----------------------

(1) The fully diluted number of shares excludes treasury shares

but includes 407,223 outstanding dilutive options (as at 31

December 2021: 585,867).

(2) The fair values of the properties were determined on the

basis of independent external valuations prepared in December

2022.

(3) EPRA NTA and EPRA NDV reflect fair value net of transfer

costs. Transfer costs are added back when calculating EPRA NRV.

(4) NTA is calculated under the assumption that the Group does

not intend to sell any of its properties in the long run.

EPRA earnings

The basis for calculating the Company's adjusted EPRA earnings

of GBP44.9 million for the 12 months to 30 June 2023 (12 months to

31 December 2022: GBP21.2 million) and the Company's adjusted EPRA

earnings per share of 106 pence for the 12 months to 30 June 2023

(12 months to 31 December 2022: 50 pence) is set out in the table

below.

12 months ended 12 months ended

30 June 2023 31 December 2022

GBP million GBP million

-------------------------------------------------------------------------------- ---------------- ------------------

Earnings attributed to equity holders of the parent company 36.1 10.2

-------------------------------------------------------------------------------- ---------------- ------------------

Depreciation and amortisation expenses 40.6 40.0

-------------------------------------------------------------------------------- ---------------- ------------------

Revaluation of Park Plaza County Hall London Income Units (0.3) (0.3)

-------------------------------------------------------------------------------- ---------------- ------------------

Changes in fair value of financial instruments (10.1) (9.6)

-------------------------------------------------------------------------------- ---------------- ------------------

Non-controlling interests in respect of the above(3) (8.2) (7.6)

-------------------------------------------------------------------------------- ---------------- ------------------

EPRA earnings 58.1 32.7

-------------------------------------------------------------------------------- ---------------- ------------------

Weighted average number of shares (in thousands) (LTM) 42,503 42,523

-------------------------------------------------------------------------------- ---------------- ------------------

EPRA earnings per share (in pence) 137 77

-------------------------------------------------------------------------------- ---------------- ------------------

Company specific adjustments(1) :

-------------------------------------------------------------------------------- ---------------- ------------------

Capital loss on buy-back of Income Units in Park Plaza Westminster Bridge

London 2.1 1.5

-------------------------------------------------------------------------------- ---------------- ------------------

Remeasurement of lease liability(4) 3.8 3.7

-------------------------------------------------------------------------------- ---------------- ------------------

Disposals and Other non-recurring expenses (including pre-opening expenses)(7) 0.7 1.5

-------------------------------------------------------------------------------- ---------------- ------------------

Adjustment of lease payments(5) (2.2) (2.2)

-------------------------------------------------------------------------------- ---------------- ------------------

One off tax adjustments(6) (5.9) (5.8)

-------------------------------------------------------------------------------- ---------------- ------------------

Maintenance capex(2) (15.9) (13.2)

-------------------------------------------------------------------------------- ---------------- ------------------

Non-controlling interests in respect of the above(3) 4.2 3.0

-------------------------------------------------------------------------------- ---------------- ------------------

Company adjusted EPRA earnings(1) 44.9 21.2

-------------------------------------------------------------------------------- ---------------- ------------------

Company adjusted EPRA earnings per share (in pence) 106 50

-------------------------------------------------------------------------------- ---------------- ------------------

Reconciliation Company adjusted EPRA earnings to normalised reported profit

before tax

-------------------------------------------------------------------------------- ---------------- ------------------

Company adjusted EPRA earnings 44.9 21.2

-------------------------------------------------------------------------------- ---------------- ------------------

Reported depreciation and amortisation (40.6) (40.0)

-------------------------------------------------------------------------------- ---------------- ------------------

Non-controlling interest in respect of reported depreciation and

amortisation(3) 8.2 7.6

-------------------------------------------------------------------------------- ---------------- ------------------

Maintenance capex(2) 15.9 13.2

-------------------------------------------------------------------------------- ---------------- ------------------

Non-controlling interest on maintenance capex and the company specific

adjustments(3) (4.2) (3.0)

-------------------------------------------------------------------------------- ---------------- ------------------

Adjustment of lease payments(5) 2.2 2.2

-------------------------------------------------------------------------------- ---------------- ------------------

One off tax adjustments(6) 5.9 5.8

-------------------------------------------------------------------------------- ---------------- ------------------

Reported profit attributable to non-controlling interest 5.6 4.7

-------------------------------------------------------------------------------- ---------------- ------------------

Reported tax (2.1) (3.4)

-------------------------------------------------------------------------------- ---------------- ------------------

Normalised profit before tax 35.8 8.3

-------------------------------------------------------------------------------- ---------------- ------------------

(1) The 'Company specific adjustments' represent adjustments of

non-recurring or non-trading items.

(2) Calculated as 4% of revenues, which represents the expected

average maintenance capital expenditure required in the operating

properties.

(3) Non-controlling interests include the non-controlling

shareholders in Arena, third-party investors in income units of

Park Plaza Westminster Bridge London and the non-controlling

shareholders in the partnership with Clal that was entered into in

June 2021 and March 2023 respectively.

(4) Non-cash revaluation of finance lease liability relating to minimum future CPI/RPI increases.

(5) Lease cash payments which are not recorded as an expense in

the Group's income statement due to the implementation of IFRS

16.

(6) Mainly relates to deferred tax asset recorded in 2022 (see

Note 22b in the 2022 annual consolidated financial statements).

(7) Mainly relates to pre-opening expense and net profit and

loss on disposal of property, plant and equipment.

REVIEW OF OPERATIONS

United Kingdom

Hotel operations

Reported in GBP

----------------------------------------- -----------------------------

Six months Six months ended

ended 30 June 2022

30 June 2023

-------------------------------- ------------------- -----------------

Total revenue GBP110.0 million GBP71.1 million

-------------------------------- ------------------- -----------------

EBITDAR GBP32.0 million GBP16.2 million

-------------------------------- ------------------- -----------------

EBITDA GBP31.8 million GBP16.1 million

-------------------------------- ------------------- -----------------

Occupancy 81.7% 56.5%

-------------------------------- ------------------- -----------------

Average room rate GBP184.3 GBP169.2

-------------------------------- ------------------- -----------------

RevPAR GBP150.5 GBP95.6

-------------------------------- ------------------- -----------------

Room revenue GBP85.9 million GBP54.6 million

-------------------------------- ------------------- -----------------

Hotel portfolio performance

The United Kingdom remained our strongest performing region,

driven by a combination of growth in room rate, which continued to

exceed 2019 levels, as well as an ongoing recovery in occupancy.

This was achieved throughout the Group's main segments of leisure,

corporate and meetings and events alike, as events such as the

coronation of King Charles III and a return to business travel

encouraged a good level of new bookings and activity in London.

All of the Group's UK hotels achieved or exceeded their fair

market share in occupancy terms and the majority of its London

hotels also outperformed their competitor sets in terms of average

room rate(1) .

Total revenue increased by 54.7% to GBP110.0 million (H1 2022:

GBP71.1 million). The Group's disciplined focus on driving rates

meant that the average room rate increased by 8.9% to GBP184.3 (H1

2022: GBP169.2), which was 28.0% higher than the average room rate

pre-pandemic (H1 2019: GBP144.0). Occupancy improved to 81.7% (H1

2022: 56.5%), which resulted in RevPAR of GBP150.5 (H1 2022:

GBP95.6).

EBITDA increased by 98.1% to GBP31.8 million (H1 2022: GBP16.1

million).

In February 2023, we fully opened - to much acclaim - the UK's

first art'otel, located at Battersea Power Station. This hotel is

managed by the Group under a long-term operating agreement and as a

result, its financial performance is not included in the

performance reported in this segment. Management fees are accounted

for in the Management and Central Services segment.

The United Kingdom hotel market*

RevPAR was up 24.4% at GBP84.8 (H1 2022: GBP68.2), driven by a

13.4% increase in average room rate to GBP113.0 (H1 2022: GBP99.5)

and a 9.7% increase in occupancy to 75.0% (H1 2022: 68.5%).

In London, RevPAR increased by 34.0% to GBP144.1 compared with

GBP108.1 in H1 2022, reflecting a 15.4% increase in occupancy to

76.9% (H1 2022: 66.9%) and a 16.1% increase in average room rate to

GBP187.5 (H1 2022: GBP161.5).

(1) STR Hotel Benchmarking, June 2023

*STR European Hotel Review, June 2023

The Netherlands

Hotel operations

Reported in GBP Reported in local currency

EUR(1)

--------------- ----------------------------------- ----------------------------------

Six months Six months Six months Six months

ended ended ended ended

30 June 30 June 30 June 30 June

2023 2022 2023 2022

---------------- ---------------- ---------------- ---------------- ----------------

Total revenue GBP30.2 million GBP14.7 million EUR34.6 million EUR17.5 million

---------------- ---------------- ---------------- ---------------- ----------------

EBITDAR GBP9.5 million GBP3.1 million EUR10.8 million EUR3.6 million

---------------- ---------------- ---------------- ---------------- ----------------

EBITDA GBP9.4 million GBP3.1 million EUR10.8 million EUR3.6 million

---------------- ---------------- ---------------- ---------------- ----------------

Occupancy 79.6% 40.9% 79.6% 40.9%

---------------- ---------------- ---------------- ---------------- ----------------

Average room

rate GBP149.6 GBP139.5 EUR171.2 EUR165.3

---------------- ---------------- ---------------- ---------------- ----------------

RevPAR GBP119.1 GBP57.0 EUR136.3 EUR67.5

---------------- ---------------- ---------------- ---------------- ----------------

Room revenue GBP23.1 million GBP11.1 million EUR26.5 million EUR13.1 million

---------------- ---------------- ---------------- ---------------- ----------------

(1 Average exchange rate from Euro to Pound Sterling for the

period ended 30 June 2023 was 1.144 and for the period ended 30

June 2022 was 1.185, representing a 3.4% decrease.)

Hotel portfolio performance

The Netherlands continued to perform strongly. As in the United

Kingdom, the performance was also driven by a combination of rate

growth and occupancy recovery.

All of the Group's hotels in the Netherlands exceeded their fair

market share in occupancy terms and two out of three of its

Amsterdam city centre hotels also outperformed their competitor

sets in terms of average room rate(1) .

Total revenue (in local currency) increased to EUR34.6 million

(H1 2022: EUR17.5 million), which represented an increase of 16.8%

on H1 2019 (EUR29.6 million). Average room rate increased by 3.6%

to EUR171.2 (H1 2022: EUR165.3); an increase of 18.0% compared to

H1 2019: EUR145.0. Occupancy improved to 79.6% which, together with

the improvement in average room rate, led to RevPAR of EUR136.3 (H1

2022: EUR67.5).

EBITDA improved by EUR7.2 million to EUR10.8 million (H1 2022:

EUR3.6 million).

The Dutch hotel market*

During H1 2022 RevPAR increased by 49.6% to EUR106.3 compared to

EUR71.3 in H1 2022. Occupancy increased by 27.8% to 69.4% (H1 2022:

54.3%), and the average room rate was EUR153.2 (H1 2022: EUR131.3);

17.0% higher than in H1 2022.

In Amsterdam, our main market in The Netherlands, RevPAR

increased by 58.0% to EUR132.0 (H1 2022: EUR84.1). Occupancy levels

increased by 34.1% to 72.7% (H1 2022: 53.9%), and the average daily

room rate increased by 17.9% to EUR181.5 (H1 2022: EUR155.9).

(1) STR Hotel Benchmarking, June 2023

*STR European Hotel Review, June 2023

Croatia

Hotel operations

Reported in GBP Reported in local currency

EUR(1)

----------------- ------------------------------------ ------------------------------------

Six months Six months Six months Six months

ended 30 June ended 30 June ended ended

2023 2022 30 June 2023 30 June 2022(3)

----------------- ----------------- ----------------- ----------------- -----------------

Total revenue GBP22.1 million GBP16.2 million EUR25.3 million EUR19.3 million

----------------- ----------------- ----------------- ----------------- -----------------

EBITDAR GBP0.5 million GBP(0.1) million EUR0.6 million EUR(0.1) million

----------------- ----------------- ----------------- ----------------- -----------------

EBITDA GBP(0.4) million GBP(0.9) million EUR(0.5) million EUR(1.1) million

----------------- ----------------- ----------------- ----------------- -----------------

Occupancy(2) 47.2% 43.6% 47.2% 43.6%

----------------- ----------------- ----------------- ----------------- -----------------

Average room

rate(2) GBP102.3 GBP84.5 EUR117.0 EUR100.2

----------------- ----------------- ----------------- ----------------- -----------------

RevPAR(2) GBP48.3 GBP36.8 EUR55.3 EUR43.6

----------------- ----------------- ----------------- ----------------- -----------------

Room revenue(2) GBP12.6 million GBP8.7 million EUR14.4 million EUR10.3 million

----------------- ----------------- ----------------- ----------------- -----------------

(1 Average exchange rate from Euro to Pound Sterling for the

period ended 30 June 2023 was 1.144 and for the period ended 30

June 2022 was 1.185, representing a 3.4% decrease.)

(2 The room revenue, average room rate, occupancy and RevPAR

statistics include all accommodation units at hotels and

self-catering apartment complexes and excludes campsite and mobile

homes.)

(3. The results for June 2022, which were previously presented

in HRK, were translated to Euro using average exchange rate from

HRK to EUR for the period ended 30 June 2023 of 7.546.)

Hotel portfolio performance

The seasonality of our operations in Croatia meant that as

usual, activity in the region started to accelerate during the

second quarter as our hotels, apartments and campsites opened for

the summer season. The Group saw strong trading in the early season

with ongoing booking momentum as the period progressed.

The revenue performance for H1 showed strong growth compared

with last year and exceeded the same period pre-pandemic in 2019.

Total revenue (in local currency) increased significantly to

EUR25.3 million (H1 2022: EUR19.3 million).

This performance was driven by strong rate growth across the

Group's hotels, with average room rate up 16.9% to EUR117.0.

Occupancy improved from 43.6% in H1 2022 to 47.2% in H1 2023. As a

result, RevPAR rose significantly to EUR55.3 (H1 2022: EUR43.6); an

increase of 36.3% compared with pre-pandemic levels in 2019 (H1

2019: EUR40.6).

Despite the strong revenue performance, EBITDA was impacted by

cost inflation for utilities, food and payroll. Overall, the EBITDA

loss was reduced to EUR0.5 million (H1 2022: EUR(1.1) million).

Since PPHE first acquired an interest in Arena Hospitality Group

(AHG) in 2008, the business has been transformed through an

extensive programme of new asset acquisitions, asset repositioning,

operational improvements and ongoing capital expenditure. In total,

the Group has invested approximately EUR200 million into the

Croatian leisure assets, including approximately EUR50 million in

the more recent relaunch of the Grand Hotel Brioni Pula and the

upcoming art'otel Zagreb, which are yet to contribute meaningfully

to the Group.

Further revenue contributed from a number of recently

refurbished and relaunched properties is also expected to be

significant. Additional works were completed at Arena Stoja

Campsite, where phase two investments included the introduction of

a new reception and restaurant and bar, supporting the 2022

introduction of luxury mobile homes.

From 1 January 2023, Croatia joined the Eurozone. Consequently,

from the start of FY 2023 the financial performance for the region

is reported in Euros.

Germany

Hotel operations

Reported in GBP Reported in local currency

EUR(1)

--------------- --------------------------------- ---------------------------------

Six months Six months Six months Six months

ended 30 June ended 30 June ended 30 June ended 30 June

2023 2022 2023 2022

--------------- ---------------- --------------- ---------------- ---------------

Total revenue GBP10.6 million GBP6.4 million EUR12.1 million EUR7.6 million

--------------- ---------------- --------------- ---------------- ---------------

EBITDAR GBP2.3 million GBP2.7 million EUR2.6 million EUR3.2 million

--------------- ---------------- --------------- ---------------- ---------------

EBITDA GBP2.3 million GBP2.7 million EUR2.6 million EUR3.2 million

--------------- ---------------- --------------- ---------------- ---------------

Occupancy 56.1% 42.0% 56.1% 42.0%

--------------- ---------------- --------------- ---------------- ---------------

Average room

rate GBP125.1 GBP98.9 EUR143.1 EUR117.2

--------------- ---------------- --------------- ---------------- ---------------

RevPAR GBP70.2 GBP41.5 EUR80.3 EUR49.2

--------------- ---------------- --------------- ---------------- ---------------

Room revenue GBP9.1 million GBP5.4 million EUR10.4 million EUR6.4 million

--------------- ---------------- --------------- ---------------- ---------------

(1 Average exchange rate from Euro to Pound Sterling for the

period ended 30 June 2023 was 1.144 and for the period ended 30

June 2022 was 1.185, representing a 3.4% decrease.)

Hotel portfolio performance

As previously reported, the German region had a slower start to

the year than other regions, due to market dynamics impacting rate

and occupancy growth. However, the Group saw an improving trend in

bookings through Q2 and expects this to continue into Q3 and

beyond.

Total revenue (in local currency) was EUR12.1 million, compared

with EUR7.6 million for the same period last year. In line with our

strategy to drive rates, average room rate increased by 22.1% to

EUR143.1 (H1 2022: EUR117.2) and was 29.9% above the average room

rate in H1 2019 (H1 2019: EUR110.2). However, occupancy improved at

a slower rate to 56.1% (H1 2022: 42.0%). As a result, RevPAR

increased to EUR80.3, up from EUR49.2.

EBITDA decreased to EUR2.6 million, compared to EUR3.2 million

in the prior year and EUR3.7 million in 2019. In H1 2022, our

EBITDA performance included EUR2.5 million in government grants to

support payroll and operating costs, demonstrating the underlying

strong performance in 2023.

The German hotel market*

The German market experienced a 44.0% increase in RevPAR to

EUR70.7 (H1 2022: EUR49.4), resulting from a 24.5% improvement in

occupancy to 62.2% (H1 2022: 50.1%) and a 15.7% increase in average

room rate to EUR113.7 (H1 2022: EUR98.5).

In Berlin, RevPAR increased by 44.0% to EUR82.1 (H1 2022:

EUR58.6) and occupancy increased by 19.6% to 68.9% (H1 2022:

57.6%). Average room rate increased 17.0% to EUR119.1 (H1 2022:

EUR101.8).

*STR European Hotel Review, June 2023

Other Markets: Austria, Hungary, Italy and Serbia

Hotel operations

Reported in GBP

------------------- ------------------------------------

Six months Six months ended

ended 30 June 2022

30 June 2023

------------------- ----------------- -----------------

Total revenue GBP3.8 million GBP3.2 million

------------------- ----------------- -----------------

EBITDAR GBP(0.2) million GBP0.2 million

------------------- ----------------- -----------------

EBITDA GBP(0.2) million GBP0.2 million

------------------- ----------------- -----------------

Occupancy 36.3% 27.8%

------------------- ----------------- -----------------

Average room rate GBP140.4 GBP103.9

------------------- ----------------- -----------------

RevPAR GBP51.0 GBP28.9

------------------- ----------------- -----------------

Room revenue GBP2.9 million GBP2.3 million

------------------- ----------------- -----------------

Hotel portfolio performance

The Group's recently refurbished property in Austria, the FRANZ

Ferdinand Mountain Resort Nassfeld, performed well during the

winter ski season; its second under the Group's ownership. Since

then, we have invested further in a number of amenities to support

the hotel's opening year-round, including air-conditioning

throughout the property and the creation of relaxation and wellness

areas including indoor and outdoor swimming pools.

In Hungary, following its post-pandemic reopening in 2022, our

refurbished property in Budapest also performed well, with a

bedroom renovation programme currently at planning stages.

In Italy, the repositioning of the Group's property in Rome

continued apace. The 99-room hotel in the city centre, which closed

in the second half of 2022, is set to transform into an upper

upscale lifestyle art'otel. The hotel is expected to reopen in H1

2024.

Finally, in Serbia, the repositioning of the 88 Rooms Hotel in

Belgrade is nearing completion and the hotel is scheduled to reopen

as Radisson RED Belgrade in the fourth quarter of 2023.

Total revenue was GBP3.8 million and EBITDA was GBP(0.2) million

mainly as a result of the closing of our Rome property for

repositioning.

The Italian hotel market*

The Italian market experienced a 37.9% increase in RevPAR to

EUR134.7, resulting from a 21.2% improvement in occupancy to 68.1%

and a 13.8% increase in average room rate to EUR197.8.

In Rome, RevPAR increased by 50.2% to EUR160.3 and occupancy

increased by 21.3% to 71.2%. Average room rate increased 23.8% to

EUR225.1.

The Hungarian hotel market*

The Hungarian market experienced a 39.6% increase in RevPAR to

EUR70.1, resulting from a 18.8% increase in occupancy to 63.5% and

a 17.5% increase in average room rate to EUR110.4.

In Budapest, RevPAR increased by 39.4% to EUR72.5 and occupancy

increased by 19.2% to 63.1%. Average room rate increased 16.9% to

EUR115.0.

The Belgrade hotel market*

In Belgrade, RevPAR increased by 36.9% to EUR68.2 and occupancy

increased by 16.5% to 61.9%. Average room rate increased by 17.6%

to EUR110.2.

*Source STR European Hotel Review, June 2023

Management and Central Services

Reported in GBP

--------------------------------------- ----------------------------------

Six months ended Six months ended

30 June 2023 30 June 2022

--------------------------------- -------------------- ------------------

Total revenue before elimination GBP21.5 million GBP13.3 million

--------------------------------- -------------------- ------------------

Revenues within the consolidated GBP(18.2) million GBP(11.8) million

Group

--------------------------------- -------------------- ------------------

External and reported revenue GBP3.3 million GBP1.5 million

--------------------------------- -------------------- ------------------

EBITDA GBP2.3 million GBP(4.0) million

--------------------------------- -------------------- ------------------

Our performance

Revenues in this segment are primarily management, sales,

marketing and franchise fees, and other charges for central

services.

These are predominantly charged within the Group and therefore

eliminated upon consolidation. For the six months ended 30 June

2023 the segment showed an EBITDA profit of GBP2.3 million, as both

internally and externally charged management fees exceed the costs

in this segment (H1 2022: loss of GBP4.0 million).

Management, Group Central Services and licence, sales and

marketing fees are calculated as a percentage of revenues and

profit, and therefore these are affected by underlying hotel

performance.

PRINCIPAL RISKS AND UNCERTAINTIES

Our proactive risk management practices and reporting ensure

that key business decisions are taken with full knowledge of both

our existing risk environment and any emerging threats which could

have a notable impact on our business.

While our current risk profile is largely in line with the

principal risks detailed on pages 77-84 of the 2022 Annual Report,

in some key areas we have updated and reduced the residual risk

assessments where our mitigating actions have resulted in a more

positive outlook.

Risk update

Annual Report Assessment Interim update

Principal Risks Inherent Risk Residual Risk Inherent Risk Residual Risk Movement

for 2023 Assessment Assessment Assessment Assessment

------------------- ------------------ ------------------ ------------------ ------------------- ----------

1 Undetected / Very High High Very High High

unrestricted

cyber-attack

------------------- ------------------ ------------------ ------------------ ------------------- ----------

2 Adverse economic High High High High

climate

------------------- ------------------ ------------------ ------------------ ------------------- ----------

3 Significant Very High High Very High High

development

project delays or

unforeseen cost

increases

------------------- ------------------ ------------------ ------------------ ------------------- ----------

4 Difficulty in High High High Medium

attracting,

engaging and

retaining talent

------------------- ------------------ ------------------ ------------------ ------------------- ----------

5 Market dynamics - High High High Medium

significant and

prolonged decline

in global travel

and market demand

------------------- ------------------ ------------------ ------------------ ------------------- ----------

6 Technology High Medium High Medium

disruption -

prolonged failure

of core

technology

------------------- ------------------ ------------------ ------------------ ------------------- ----------

7 Serious data Very High Medium Very High Medium

privacy breach

(GDPR)

------------------- ------------------ ------------------ ------------------ ------------------- ----------

8 Funding and High Medium High Medium

liquidity risk

(including breach

of debt

covenants)

------------------- ------------------ ------------------ ------------------ ------------------- ----------

9 Significant High Medium High Medium

operational

disruption

------------------- ------------------ ------------------ ------------------ ------------------- ----------

10 Negative High Medium High Medium

stakeholder

perception of the

Group with regard

to Environmental,

Social and

Governance

(ESG) matters

------------------- ------------------ ------------------ ------------------ ------------------- ----------

11 Serious threat to High Medium High Medium

guest, team

member or 3rd

party health,

safety and

security

------------------- ------------------ ------------------ ------------------ ------------------- ----------

12 Fraud High Medium High Low

------------------- ------------------ ------------------ ------------------ ------------------- ----------

The adverse economic climate continues to pose a threat, with

uncertainty driven by high inflation and interest rate increases.

While the risk remains high, we are well positioned to withstand

these pressures and continue to thrive in the challenging

conditions.

While the labour market continues to present challenges, we are

pleased that our initiatives to tackle the difficulties in

attracting and retaining talent have seen improved results and

decreased the residual risk impact. As such, our overall assessment

of this key risk area has reduced from High to Medium.

Our assessment of our market dynamics risk has also been

downgraded since the year-end as our performance to date and

business on the books continues to outperform expectations.

We have reduced our residual risk assessment for the threat of

fraud as our internal control environment has continued to mature

throughout 2023. The inherent assessment is still considered to be

high, and the risk will continue to be monitored closely.

The Group has not identified any new principal risks or emerging

risks that will impact the remaining six months of the financial

year.

STATEMENT OF DIRECTORS' RESPONSIBILITIES

The directors confirm that, to the best of their knowledge,

these interim condensed consolidated financial statements have been

prepared in accordance with IAS 34 "Interim Financial Reporting"

and give a true and fair view of the assets, liabilities, financial

position and profit or loss of the Company and the undertakings

included in the consolidation as a whole for the period ended 30

June 2023. The interim management report includes a fair review of

the information required by DTR 4.2.7 R and DTR 4.2.8 R,

namely:

-- An indication of important events which have occurred during

the first six months and their impact on the condensed set of

financial statements, plus a description of the principal risks and

uncertainties for the remaining six months of the financial year;

and

-- Material related-party transactions in the first six months

and any material changes in the related party transactions

described in the last annual report for the year ended 31 December

2022; and

-- The directors of the Company are listed in the last annual

report for the year ended 31 December 2022. A current list of

directors is maintained on the website of the Company (

www.pphe.com ).

GOING CONCERN

The Board believes it is taking all appropriate steps to support

the sustainability and growth of the Group's activities. Detailed

budgets and cash flow projections have been prepared for 2023 and

2024 which show that the Group's hotel operations will be cash

generative during the period. The Directors have assessed the

viability of the Group over a period to 31 December 2025, as set

out further on page 85 of the last annual report for the year ended

31 December 2022. The Directors have determined that the Company is

likely to continue in business for at least 12 months from the date

of this announcement. This, taken together with their conclusions

on the matters referred to herein and in Note 1 to the consolidated

financial statements, has led the Directors to conclude that it is

appropriate to prepare the half year consolidated financial

statements on a going concern basis.

INDEPENT REVIEW REPORT TO PPHE HOTEL GROUP LIMITED

To: The Board of Directors of PPHE Hotel Group Limited

Introduction

We have reviewed the accompanying interim condensed consolidated

financial statements of PPHE Hotel Group Limited and its

subsidiaries (the Group) as of 30 June 2023 which comprise the

interim consolidated statement of financial position as of 30 June

2023 and the related interim consolidated income statement,

consolidated statements of comprehensive income, changes in equity

and cash flows statement for the six-month period then ended, and

explanatory notes.

Management is responsible for the preparation and presentation

of this interim financial information in accordance with

International Accounting Standard 34 Interim Financial Reporting

(IAS 34) and the Disclosure Guidance and Transparency Rules of the

United Kingdom's Financial Conduct Authority.

Our responsibility is to express a conclusion on this interim

financial information based on our review.

Scope of Review

We conducted our review in accordance with International

Standard on Review Engagements 2410, "Review of Interim Financial

Information Performed by the Independent Auditor of the Entity". A

review of interim financial information consists of making

inquiries, primarily of persons responsible for financial and

accounting matters, and applying analytical and other review

procedures. A review is substantially less in scope than an audit

conducted in accordance with International Standards on Auditing

and consequently does not enable us to obtain assurance that we

would become aware of all significant matters that might be

identified in an audit. Accordingly, we do not express an audit

opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the accompanying interim condensed