TIDMPTY

RNS Number : 0743O

Parity Group PLC

29 September 2023

PARITY GROUP PLC

INTERIM RESULTS FOR THE SIX MONTHS TO 30 JUNE 2023

29 September 2023

Parity Group plc ("Parity" or the "Group"), the data and

technology focused professional services business, announces its

half year results for the six months ended 30 June 2023 ("H1

2023").

Headlines

-- In spite of challenging market conditions, revenue for the

first half of 2023 was just 10% lower than the second half of

2022.

-- Close to break even on an Adjusted EBITDA basis for H1 2023.

-- Net debt significantly reduced.

Mark Braund, Executive Chairman of Parity Group plc, said:

"The team has completed the task of rebuilding the core

recruitment business after years of underinvestment, to position

Parity as a recruiter of strength in the UK's public sector, at a

time when there are increasing headwinds affecting the broader

recruitment market.

Whilst our business in the public sector has been resilient, we

too have been affected by these headwinds in areas where we sought

to grow such as the UK's commercial private sector.

The changes made to the business have enabled Parity to act

quickly, tuning itself far more rapidly than before to operate at a

fit-for-purpose scale and cost base.

As we reflect on Parity's position in the market, we continually

review the Company's businesses to determine the best medium and

long-term direction for Parity for the benefit of its

shareholders."

Contacts

Parity Group PLC www.parity.net

Mark Braund, Executive Chairman

Mike Johns, CFO + 44 (0) 208 171 1729

Allenby Capital Limited (Nominated Adviser

and Broker)

David Hart / Dan Dearden-Williams (Corporate

Finance)

Tony Quirke /Guy McDougal (Sales and Corporate

Broking) +44 (0) 20 3328 5656

Overview

After years of underinvestment and neglect, the team has

completed the task of rebuilding the core recruitment business to

position Parity as a recruiter of strength in the UK's public

sector.

In the year prior we had removed the substantial overhead

associated with the previous management team's failure to build a

profitable consulting business and reinvested a small portion into

re-establishing Parity's heritage as a well-recognised recruitment

brand.

In line with many others within the recruitment sector, Parity

has seen market conditions become more challenging with economic

uncertainty resulting in clients and new business opportunities

deferring hiring decisions. As a result, first half revenues were

10% lower than that achieved in the second half of 2022.

During H1 2023, Parity successfully won a place on the coveted

public sector RM6277 framework, which has an estimated spend of

circa GBP2bn over the next four years, though it is not possible at

this stage to quantify what level of revenue might accrue to

Parity. This framework, which went live on 25 July 2023, represents

a significant opportunity for Parity to expand further into the

public sector at a time when there are increasing headwinds

affecting the broader recruitment market.

In spite of the lower H1 performance, the business has improved

its working capital management and reduced net debt to GBP0.7m as

at the 30 June 2023 (compared with GBP2.3m net debt as at 31

December 2022).

With market conditions not expected to improve in the near term

and a key commercial client in the private sector signaling a shift

towards a more global supply chain, Parity is prioritising

resources to exploit its strengths and opportunity within the

public sector, and in particular the new RM6277 framework. As a

consequence, the new business initiatives targeting the private

sector, which included permanent recruitment services, were scaled

back, with a resultant reduction in headcount.

Historically, Parity's core business, servicing contract

recruitment within the public sector, has been one of the most

resilient areas when recruitment markets turn down. The Company

sees this as a core strength of the business and will be looking at

how the Company can leverage this.

As we consider the scale of the business, its strength and value

in public sector, we continually review the Company's businesses to

determine the best medium and long-term direction for Parity for

the benefit of its shareholders.

Financial Summary

Revenue and net fee income

Group revenues in H1 2023 of GBP17.6m were 10% lower than those

in the second half of 2022 and 16% lower than H1 2022.

Net fee income in H1 2023 of GBP1.3m was 18% lower than the

second half of 2022 with a shift in the mix of clients resulting in

average margin reducing from 7.4% to 7.0%. Against H1 2022, net fee

income was 35% lower. However, H1 2022 included GBP0.3m from a

legacy managed service contract that ended in Q1 2022. Excluding

this discontinued business line, net fee income for H1 2023 was 21%

lower than the same period in 2022, with lower permanent

recruitment accounting for 3% and lower contract recruitment

18%.

Operating costs

At the beginning of the 2023, the Group took the decision to

invest in existing and new business areas to facilitate growth. A

consequence of this was that the business carried a higher cost

base through the first half and incurred an overall adjusted EBITDA

loss for the period of GBP0.3m. With the additional costs

associated with servicing the working capital facility, pension

deficit contributions and IFRS16 amortisation, the overall loss

before tax for H1 2023 was GBP0.6m.

Following a review of the business at the end of the half year,

the Group has rationalised the cost base to facilitate a return in

the future to a positive adjusted EBITDA. This cost rationalisation

is expected to deliver a net reduction in monthly expenditure by

GBP75k.

Cash and net debt

Net debt as at 30 June 2023, excluding adjustments for IFRS 16

lease liabilities, was GBP0.7m (30 June 2022: net debt of GBP4.5m,

31 December 2022: net debt of GBP2.3m).

The significant fall in net debt since the end of 2022 is

primarily due to the improved debtor performance and payment by a

key client of outstanding and overdue invoices following the

resolution of their internal processes.

The Group continues to rely upon its asset-based lending (ABL)

debt facility from Leumi. The current facility is in place until

October 2025 and is secured against billed and unbilled receivables

to manage both intra month and inter month movements in working

capital.

Consolidated condensed income statement

For the six months ended 30 June 2023

Six months Six months Year

to 30.06.23 to 30.06.22 to 31.12.22

(Unaudited) (Unaudited) (Audited)

Notes GBP'000 GBP'000 GBP'000

------------------------------------ ------- -------------- ------------- -------------

Revenue 3 17,634 21,054 40,648

Contractor costs (16,378) (19,137) (37,184)

------------------------------------ ------- -------------- ------------- -------------

Net fee income 1,256 1,917 3,464

Other operating income - - 950

Operating costs (1,702) (1,839) (5,443)

------------------------------------ ------- -------------- ------------- -------------

Operating (loss)/profit (446) 78 (1,029)

------------------------------------ ------- -------------- ------------- -------------

Analysed as:

Underlying operating (loss)/profit

before non-underlying items (446) 101 (4)

Non-underlying costs 4 - (23) (1,975)

Non-underlying income 4 - - 950

------------------------------------ ------- -------------- ------------- -------------

Operating (loss)/profit (446) 78 (1,029)

------------------------------------ ------- -------------- ------------- -------------

Finance costs 5 (203) (160) (310)

------------------------------------ ------- -------------- ------------- -------------

Loss before tax (649) (82) (1,339)

------------------------------------ ------- -------------- ------------- -------------

Analysed as:

Adjusted loss before tax(1) (649) (59) (314)

Non-underlying costs 4 - (23) (1,975)

Non-underlying income 4 - - 950

Loss before tax (649) (82) (1,339)

------------------------------------ ------- -------------- ------------- -------------

Tax charge 6 (459) (213) (376)

------------------------------------ ------- -------------- ------------- -------------

Loss for the period attributable

to owners of the parent (1,108) (295) (1,715)

------------------------------------ ------- -------------- ------------- -------------

Loss per share

Basic 7 (1.07p) (0.29p) (1.66p)

Diluted 7 (1.07p) (0.29p) (1.66p)

---------------- ---- ---------- --------- ---------

All activities comprise continuing operations.

(1) Adjusted loss before tax is a non-IFRS alternative

performance measure, defined in Note 1 of the notes to the interim

results.

Consolidated condensed statement of comprehensive income

For the six months ended 30 June 2023

Six months Six months Year

to 30.06.23 to 30.06.22 to 31.12.22

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

------------------------------------------- -------------- ------------- -------------

Loss for the period (1,108) (295) (1,715)

Other comprehensive income

Items that will never be reclassified

to profit or loss

Remeasurement of defined benefit pension

scheme (569) (783) (841)

Deferred taxation on remeasurement

of defined benefit pension scheme 199 274 290

------------------------------------------- -------------- ------------- -------------

Other comprehensive income for the

period after tax (370) (509) (551)

------------------------------------------- -------------- ------------- -------------

Total comprehensive income for the

period attributable to owners of the

parent (1,478) (804) (2,266)

------------------------------------------- -------------- ------------- -------------

Consolidated condensed statement of changes in equity

For the six months ended 30 June 2023

Six months to 30.06.23 (Unaudited)

Share Capital

Share premium redemption Other Retained

capital reserve reserve reserves earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- --------- --------- ------------ ---------- ---------- ---------

At 1 January 2023 2,062 33,270 14,319 34,560 (79,400) 4,811

Share options - value of

employee services - - - - 21 21

---------------------------- --------- --------- ------------ ---------- ---------- ---------

Transactions with owners - - - - 21 21

---------------------------- --------- --------- ------------ ---------- ---------- ---------

Loss for the period - - - - (1,108) (1,108)

Other comprehensive income

for the period - - - - (370) (370)

At 30 June 2023 2,062 33,270 14,319 34,560 (80,857) 3,354

---------------------------- --------- --------- ------------ ---------- ---------- ---------

Six months to 30.06.22 (Unaudited)

Share Capital

Share premium redemption Other Retained

capital reserve reserve reserves earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- --------- --------- ------------ ---------- ---------- ---------

At 1 January 2022 2,062 33,270 14,319 34,560 (77,184) 7,027

Share options - value of

employee services - - - - 20 20

---------------------------- --------- --------- ------------ ---------- ---------- ---------

Transactions with owners - - - - 20 20

---------------------------- --------- --------- ------------ ---------- ---------- ---------

Loss for the period - - - - (295) (295)

Other comprehensive income

for the period - - - - (509) (509)

At 30 June 2022 2,062 33,270 14,319 34,560 (77,968) 6,243

---------------------------- --------- --------- ------------ ---------- ---------- ---------

Year to 31.12.22 (Audited)

Share Capital

Share premium redemption Other Retained

capital reserve reserve reserves earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- --------- --------- ------------ ---------- ---------- ---------

At 1 January 2022 2,062 33,270 14,319 34,560 (77,184) 7,027

Share options - value of

employee services 50 50

---------------------------- --------- --------- ------------ ---------- ---------- ---------

Transactions with owners - - - - 50 50

---------------------------- --------- --------- ------------ ---------- ---------- ---------

Loss for the year - - - - (1,715) (1,715)

Other comprehensive income

for the year - - - - (551) (551)

At 31 December 2022 2,062 33,270 14,319 34,560 (79,400) 4,811

---------------------------- --------- --------- ------------ ---------- ---------- ---------

Consolidated condensed statement of financial position

As at 30 June 2023

As at As at As at

30.06.23 30.06.22 31.12.22

(Unaudited) (Unaudited) (Audited)

Notes GBP'000 GBP'000 GBP'000

------------------------------- ------ -------------- ------------- -----------

Assets

Non-current assets

Goodwill 2,642 4,594 2,642

Other intangible assets 157 136 188

Property, plant and equipment 7 13 10

Right-of-use assets 88 97 174

Deferred tax assets 260 557 521

Retirement benefit asset 8 769 1,243 1,269

------------------------------- ------ -------------- ------------- -----------

Total non-current assets 3,923 6,640 4,804

------------------------------- ------ -------------- ------------- -----------

Current assets

Trade and other receivables 3,750 7,803 5,909

Cash and cash equivalents 512 150 2,053

Total current assets 4,262 7,953 7,962

------------------------------- ------ -------------- ------------- -----------

Total assets 8,185 14,593 12,766

------------------------------- ------ -------------- ------------- -----------

Liabilities

Current liabilities

Loans and borrowings (1,169) (4,657) (4,356)

Lease liabilities (96) (173) (203)

Trade and other payables (3,555) (3,478) (3,340)

Total current liabilities (4,820) (8,308) (7,899)

------------------------------- ------ -------------- ------------- -----------

Non-current liabilities

Lease liabilities - - (14)

Provisions (11) (42) (42)

Total non-current liabilities (11) (42) (56)

------------------------------- ------ -------------- ------------- -----------

Total liabilities (4,831) (8,350) (7,955)

------------------------------- ------ -------------- ------------- -----------

Net assets 3,354 6,243 4,811

------------------------------- ------ -------------- ------------- -----------

Shareholders' equity

Called up share capital 2,062 2,062 2,062

Share premium account 33,270 33,270 33,270

Capital redemption reserve 14,319 14,319 14,319

Other reserves 34,560 34,560 34,560

Retained earnings (80,857) (77,968) (79,400)

------------------------------- ------ -------------- ------------- -----------

Total shareholders' equity 3,354 6,243 4,811

------------------------------- ------ -------------- ------------- -----------

Consolidated condensed statement of cash flows

For the six months ended 30 June 2023

Six months Six months Year

to 30.06.23 to 30.06.22 to 31.12.22

(Unaudited) (Unaudited) (Audited)

Notes GBP'000 GBP'000 GBP'000

----------------------------------- ------- -------------- ------------- -------------

Operating activities

Loss for the period (1,108) (295) (1,715)

Adjustments for:

Net finance expense 5 203 160 310

Share-based payment expense 21 20 50

Income tax charge 6 459 213 376

Amortisation of intangible assets 31 - 3

Depreciation of property, plant

and equipment 3 7 10

Depreciation and impairment

of right-to-use assets 86 177 346

Impairment of goodwill - - 1,952

(305) 282 1,332

Working capital movements

Decrease/(increase) in trade

and other receivables 2,159 (3,036) (1,112)

Increase/(decrease) in trade

and other payables 215 (130) (343)

Decrease in provisions (31) - -

Payments to retirement benefit

plan 8 (176) (166) (331)

----------------------------------- ------- -------------- ------------- -------------

Net cash flow from/(used in)

operating activities 1,862 (3,050) (454)

----------------------------------- ------- -------------- ------------- -------------

Investing activities

Purchase of property, plant

and equipment - (4) (5)

Development of intangible assets - (54) (109)

----------------------------------- ------- -------------- ------------- -------------

Net cash flow used in investing

activities - (58) (114)

----------------------------------- ------- -------------- ------------- -------------

Financing activities

Drawdown/(repayment) of finance

facility (3,187) 2,377 2,077

Principal repayment of lease

liabilities (121) (190) (433)

Interest paid 5 (95) (50) (144)

----------------------------------- ------- -------------- ------------- -------------

Net cash (used in)/from financing

activities (3,403) 2,137 1,500

----------------------------------- ------- -------------- ------------- -------------

Net (decrease)/increase in cash

and cash equivalents (1,541) (971) 932

----------------------------------- ------- -------------- ------------- -------------

Cash and cash equivalents at the

beginning of the period 2,053 1,121 1,121

-------------------------------------------- -------------- ------------- -------------

Cash and cash equivalents at the

end of the period 512 150 2,053

-------------------------------------------- -------------- ------------- -------------

Notes to the interim results

1 Accounting policies

Basis of preparation

The condensed interim financial statements comprise the

unaudited results for the six months to 30 June 2023 and 30 June

2022 and the audited results for the year ended 31 December 2022.

The financial information for the year ended 31 December 2022

herein does not constitute the full statutory accounts for that

period. The 2022 Annual Report and Accounts have been filed with

the Registrar of Companies. The Independent Auditor's Report on the

Annual Report and Financial Statements for 2022 was unqualified,

did not draw attention to any matters by way of emphasis and did

not contain a statement under 498(2) or 498(3) of the Companies Act

2006.

The condensed financial statements have been prepared using the

recognition and measurement requirements of UK adopted

international accounting standards (IFRS) in a manner consistent

with the accounting policies set out in the Group financial

statements for the year ended 31 December 2022.

The condensed financial statements for the period ended 30 June

2023 have been prepared in accordance with IAS 34 'Interim

Financial Reporting'. The information in these condensed financial

statements does not include all the information and disclosures

made in the annual financial statements.

Going concern

The interim financial statements have been prepared on a going

concern basis. The Directors have reviewed the Group's cash flow

forecasts for the period to 30 September 2024 and have considered

possible changes in trading performance including a further

reduction in contractor numbers.

The Group continues to rely upon its asset-based lending (ABL)

debt facility from Leumi to manage its short-term cash

requirements. This facility is in place until October 2025 and

requires the Group to meet two covenant tests on a monthly basis; a

positive three-month rolling EBITDA; and a positive headroom of at

least GBP400,000.

The twelve-month cashflow forecast to 30 September 2024

indicates that the Group can continue to meet the three-month

rolling EBITDA covenant but will need to raise additional funds to

meet the headroom covenant from January 2024. The Directors are

actively discussing a number of funding options and based on

progress to date, believe that the Group will be able to secure

sufficient funds to continue to meet its headroom covenant over the

next twelve months.

Whilst acknowledging that there is material uncertainty

regarding the Group's funding position, the Directors remain

confident of securing the additional funds required and consider it

appropriate to prepare the unaudited interim financial information

on a going concern basis.

Financial instruments

Unless otherwise indicated, the carrying amounts of the Group's

financial assets and liabilities are a reasonable approximation of

their fair values.

Alternative performance measures

In the reporting of its financial performance, the Group uses

certain measures that are not defined under IFRS, the Generally

Accepted Accounting Principles ("GAAP") under which the Group

reports. The Directors believe that these non-GAAP measures assist

with the understanding of the performance of the business. These

non-GAAP measures are not a substitute, or superior to, any IFRS

measures of performance but they have been included as the

Directors consider them to be an important means of comparing

performance across periods and they include key measures used

within the business for assessing performance.

Net fee income

Net fee income represents revenue less cost of sales and consist

of the margin earned on the placement of contractors, the fees

earned on permanent recruitment and the revenue less the cost of

third-party contractors for managed service and consultancy

work.

NFI margin is the net fee income expressed as a percentage of

revenue.

Both net fee income and NFI margin are metrics commonly used by

businesses delivering recruitment services to measure the element

of revenue that is attributable to the recruitment-based services

that the Group provides to clients.

The Directors consider that net fee income and NFI margin are

important measurements used by the Board to evaluate the

performance of the Group.

Non-underlying items

The presentation of the alternative performance measures of

adjusted EBITDA, adjusted operating (loss)/profit and adjusted loss

before tax excludes non-underlying items. The Directors consider

that an underlying profit measure better illustrates the underlying

performance of the Group and allows a more meaningful comparison of

performance across periods. Items are classified as non-underlying

by nature of their magnitude, incidence or unpredictable nature and

their separate identification results in a calculation of an

underlying profit measure that is consistent with that reviewed by

the Board in their monitoring of the performance of the Group.

Events which may give rise to the classification of items as

non-underlying include gains or losses on the disposal of a

business, the proceeds from the sale of assets outside of normal

trading activities, restructuring of a business, transaction costs,

litigation and similar settlements, asset impairments and onerous

contracts.

Adjusted EBITDA

Operating profit before non-underlying items and before the

deduction of depreciation, amortisation changes and shared based

payments. This is considered a useful measure, commonly accepted

and widely used when evaluating business performance and used by

the Directors to evaluate performance of the Group and its

subsidiaries.

Adjusted EBITDA

Six months Six months Year

to 30.06.23 to 30.06.22 to 31.12.22

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Operating (loss)/profit (446) 78 (1,029)

Add back:

Adjustment for amortisation &

depreciation 120 184 360

Adjustment for goodwill impairment - - 1,952

-------------- ------------- -------------

EBITDA (326) 262 1,283

Adjustment for share based payment

charge 21 20 50

Add back Non-underlying items:

Income from trademark sale - - (950)

Non-underlying costs - 23 23

-------------- ------------- -------------

Adjusted EBITDA (305) 305 406

-------------- ------------- -------------

Net debt

Net debt is the amount of bank debt less available cash balances

and is regarded as a useful measure of the level of external debt

utilised by the Group to fund its operations. Net debt is presented

on a pre-IFRS 16 basis which excludes lease liabilities.

Accounting policies: new standards, amendments and

interpretations

At the date of authorisation of these interim financial

statements, several new, but not yet effective, standards,

amendments to existing standards and interpretations have been

published. None of these have been adopted early by the Group. New

standards, amendments and interpretations not adopted in the

current year have not been disclosed as they are not expected to

have a material impact on the Group.

2 Segmental information

The basis by which the Group is organised and its operating

model is structured, is by customer sectors, being the public

sector and the private sector. The reporting of financial

information presented to the Chief Operating Decision Maker, being

the Group Board of Directors, is consistent with these reporting

segments. As these reporting segments are supported by a combined

back office, there is no allocation of overheads.

Six months to 30.06.23 (Unaudited)

Public Private Total

sector sector

GBP'000 GBP'000 GBP'000

Revenue 8,762 8,872 17,634

Contractor costs (8,140) (8,238) (16,378)

------------------------------------ --------- ---------- ---------

Net fee income 622 634 1,256

------------------------------------ --------- ---------- ---------

Six months to 30.06.22 (Unaudited)

Public sector Private Total

sector

GBP'000 GBP'000 GBP'000

Revenue 12,137 8,917 21,054

Contractor costs (11,137) (8,000) (19,137)

------------------------------------ ---------------- ---------- ---------

Net fee income 1,000 917 1,917

------------------------------------ ---------------- ---------- ---------

Year to 31.12.22 (Audited)

Public sector Private Total

sector

GBP'000 GBP'000 GBP'000

Revenue 22,616 18,032 40,648

Contractor costs (20,530) (16,654) (37,184)

---------------------------- ---------------- ---------- ---------

Net fee income 2,086 1,378 3,464

---------------------------- ---------------- ---------- ---------

3 Revenue

The Group's revenue disaggregated by pattern of revenue

recognition is as follows:

Six months Six months Year to

to 30.06.23 to 30.06.22 31.12.22

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

--------------------------------- -------------- ------------- -----------

Services transferred over time 17,615 20,985 40,484

Services transferred at a point

in time 19 69 164

Revenue 17,634 21,054 40,648

--------------------------------- -------------- ------------- -----------

4 Non-underlying items

Six months Six months Year to

to to 31.12.22

30.06.23 30.06.22 (Audited)

(Unaudited) (Unaudited) GBP'000

GBP'000 GBP'000

-------------------------------- --------------- ------------- -----------

Restructuring

- Costs related to employees - 23 23

- Goodwill impairment - - 1,952

- Income from sale and licence

back of Parity trademark - - (950)

Total non-underlying items - 23 1,025

-------------------------------- --------------- ------------- -----------

Items are classified as non-underlying by nature of their

magnitude, incidence or unpredictable nature and their separate

identification results in a calculation of an underlying profit

measure that is consistent with that reviewed by the Board in their

monitoring of the performance of the Group.

5 Finance costs

Six months Six months Year to

to to 31.12.22

30.06.23 30.06.22 (Audited)

(Unaudited) (Unaudited) GBP'000

GBP'000 GBP'000

--------------------------------------- -------------- ------------- -----------

Interest expense on financial

liabilities 94 50 143

Interest expense on lease liabilities 2 4 9

Interest income on lease assets - (1) (2)

Net finance costs in respect of

post-retirement benefits 107 107 160

203 160 310

--------------------------------------- -------------- ------------- -----------

The interest expense on financial liabilities represents

interest paid on the Group's asset-based financing facilities.

6 Taxation

Six months Six months Year to

to to 31.12.22

30.06.23 30.06.22 (Audited)

(Unaudited) (Unaudited) GBP'000

GBP'000 GBP'000

------------------------------------ -------------- ------------- -----------

Recognised in the income statement

Current tax charge - - 75

Deferred tax charge 459 213 301

------------------------------------ -------------- ------------- -----------

Total tax charge 459 213 376

------------------------------------ -------------- ------------- -----------

Recognised in other comprehensive

income

Deferred tax credit (199) (274) (290)

------------------------------------ -------------- ------------- -----------

7 Earnings per ordinary share

Basic earnings per share is calculated by dividing the basic

earnings for the period by the weighted average number of fully

paid ordinary shares in issue during the period. Diluted earnings

per share is calculated on the same basis as the basic earnings per

share with a further adjustment to the weighted average number of

fully paid ordinary shares to reflect the effect of all dilutive

potential ordinary shares.

Six months to 30.06.23 Six months to 30.06.22 Year to 31.12.22

(Unaudited) (Unaudited) (Audited)

------------------- ------------------------------- ------------------------------- -------------------------------

Weighted Weighted Weighted

average average average

number Loss number Loss number Loss

Loss of per Loss of per Loss of per

GBP'000 shares share GBP'000 shares share GBP'000 shares share

000's Pence 000's Pence 000's Pence

------------------- ---------- --------- -------- ---------- --------- -------- ---------- --------- --------

Basic loss

per share (1,108) 103,076 (1.07) (295) 103,076 (0.29) (1,715) 103,076 (1.66)

Effect of dilutive - - - - - - - - -

options

Diluted loss

per share (1,108) 103,076 (1.07) (295) 103,076 (0.29) (1,715) 103,076 (1.66)

As at 30 June 2023, the number of ordinary shares in issue was

103,075,633 (30 June 2022: 103,075,633 and 31 December 2021:

103,075,633). There were 8,000,000 unexercised share options which

did not have any dilutive impact (30 June 2022: 8,010,000 and 31

December 2022: 8,010,000).

8 Pension commitments

The Group operates a small number of pension schemes. With the

exception of the Parity Group Retirement Benefits Plan, all of the

schemes are defined contribution plans and the assets are held in

separately administered funds. The details of the Parity Group

Retirement Benefits Plan are disclosed in the 2022 Annual Report

and Accounts. At the interim reporting date, the major assumptions

used in assessing the defined benefit pension scheme liability have

been reviewed and updated based on a roll-forward of the last

formal actuarial valuation, which was carried out as at April

2021.

The following principal estimates have been applied in the

valuation of the pension scheme assets and liabilities in

accordance with the measurement requirements of IAS 19:

30.06.23 30.06.22 31.12.22

--------------------------------- --------- --------- ---------

Rate of increase in pensions in 3.7-4.0% 3.7-4.0% 3.6-3.9%

payment

Discount rate 5.2% 3.8% 4.8%

Retail price inflation 3.3% 3.4% 3.2%

Consumer price inflation 2.3% 2.4% 2.2%

--------------------------------- --------- --------- ---------

The net pension scheme surplus has reduced by GBP500,000 since

31 December 2022.

9 Related party transactions

Transactions between the parent company and its subsidiaries,

which are related parties, have been eliminated on consolidation

and are therefore not disclosed.

In 2021, the Group engaged the marketing services of CRM Squad.

The Executive Chairman Mark Braund is an owner and director of CRM

Squad. The total value of services received from CRM Squad in the

six months to 30 June 2023 was GBP38,000 (Six months to 30 June

2022: GBP31,500 and Year to 31 December 2022: GBP66,530).

10 Events after the reporting period

There are no events after the reporting period not reflected in

the interim financial statements.

This announcement contains certain statements that are or may be

forward-looking with respect to the financial condition, results or

operations and business of Parity Group plc. By their nature

forward-looking statements involve risk and uncertainty because

they relate to events and depend on circumstances that will occur

in the future. There are a number of factors that could cause

actual results and developments to differ materially from those

expressed or implied by such forward-looking statements. These

factors include, but are not limited to (i) adverse changes to the

current outlook for the UK IT recruitment and solutions market,

(ii) adverse changes in tax laws and regulations, (iii) the risks

associated with the introduction of new products and services, (iv)

pricing and product initiatives of competitors, (v) changes in

technology or consumer demand, (vi) the termination or delay of key

contracts and (vii) volatility in financial markets.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UWUBROWUKUAR

(END) Dow Jones Newswires

September 29, 2023 02:00 ET (06:00 GMT)

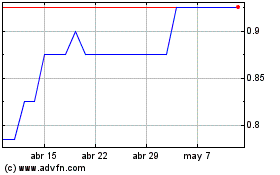

Partway (LSE:PTY)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Partway (LSE:PTY)

Gráfica de Acción Histórica

De May 2023 a May 2024