TIDMSMT

RNS Number : 0636G

Scottish Mortgage Inv Tst PLC

11 November 2022

RNS Announcement

Scottish Mortgage Investment Trust PLC

Legal Entity Identifier: 213800G37DCS3Q9IJM38

Results for the six months to 30 September 2022

The following is the unaudited Interim Financial Report for the

six months to 30 September 2022 which was approved by the Board on

10 November 2022.

Interim Management Report

Scottish Mortgage's long-term capital appreciation has come from

financing and patiently supporting the development of growth

companies. The trust was founded to provide capital to businesses

with big opportunities but restricted access to funding following

the market panic of 1907. It is important at times of stress to

remember this founding story: corporate potential has little to do

with the cycles of greed and fear in stock markets.

Long-term growth investing is crucial for driving society

forward. After a long period of global expansion, it's easy to slip

into the mindset that investors passively benefit from broader

progress and economic growth. We believe causality flows in the

other direction: long-term investment enables growth and progress.

Technology and new ways of doing things aren't adopted simply

because their time has come. They happen because investors give

entrepreneurs the financing and time to build their visions into

reality.

Without investment in technology, infrastructure and

entrepreneurship, it will be tough to dig ourselves out of our

current malaise. If so little of aggregate savings are directed

into ventures exploring new technologies and approaches, what does

it imply for the future? We risk condemning ourselves to the

environment of anaemic growth and stagnant wages that has

characterised the United Kingdom over the past decade.

Financing the development of long-term growth companies is not

what interests most investors. To understand that, you need only

observe the commentary of recent months, focused on 'risk off',

deleveraging and the flight to safety. The market's focus has

narrowed to a handful of economic variables. Stock prices react

dramatically to each monthly update. This environment is

off-putting, but it is not relevant to our investment

decision-making. Instead, we must evaluate the ongoing position of

our holdings, unpicking the growth engines of recent years and

verifying that they're still functioning. At the same time, we are

redoubling our efforts to find new investments that can adapt to

difficult economic conditions and position themselves to do well in

the future.

Returns

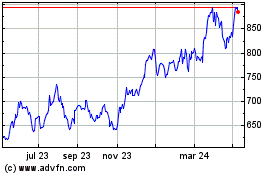

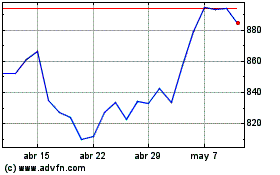

Over ten years, Scottish Mortgage's net asset value per share

with debt at fair value (NAV) has increased by 528% versus a 208%

increase in the FTSE All-World index (both in total return terms).

Over five years, it has increased by 115% against 53%. Six months

of data is always too short a period to infer much that is useful

from stock prices. However, since the end of March, our NAV has

decreased by 15% compared to a 7% decrease in the index.

Although our focus remains on long-term capital appreciation, we

are aware that a small but consistent dividend is of value to many

shareholders. The Board is therefore recommending an interim

dividend of 1.60p per share, an increase of 5% over last year's

payment of 1.52p. We do not believe that this increase will have

any bearing on our investment decisions or unduly constrain future

capital appreciation.

Portfolio

Moderna, the mRNA therapeutics company, remains our largest

holding. It continues to make progress in its infectious disease

portfolio with the bivalent booster for Covid but one practical

example. It was particularly encouraging to see pharmaceutical

company Merck paying Moderna $250m to jointly develop and

commercialise a personalised cancer vaccine to treat melanoma. Our

contention has always been that Moderna's technology would have

applications well beyond Covid, and commercial partners are now

committing serious capital to such developments.

Despite the economic headwinds, Tesla has been able to sell

every car it can manufacture and continues to scale up its

production capabilities rapidly. Its execution in a challenging

operating environment has been impressive, as has its ability to

control costs whilst growing sales. The Model Y SUV is the crucial

volume driver over the next few years, with production ramping in

Berlin and Texas. Scaling the battery cells supply chain remains

the most significant constraint.

We made a further investment into Northvolt during the period

and it is now one of our largest positions. This private European

battery producer is looking increasingly well-placed to supply the

rapidly growing demand for electric vehicles. We also supported

capital raisings from two nascent private companies with ambitious

plans to reduce the world's carbon footprint. Swiss company

Climeworks is developing a technology for capturing carbon directly

from the air, which is likely to be necessary given the finite

capacity for re-forestation. Its challenge is to scale up its

impact. Upside Foods is seeking to produce animal protein in

bioreactors which will allow for meat production without the carbon

emissions from rearing and slaughtering animals. It is working with

regulators towards product launches.

We have reduced several Chinese holdings, including

long-standing investments in Alibaba and Tencent. The regulatory

environment in China remains challenging, and we are concerned that

ongoing uncertainty will harm the risk-tolerant culture that has

driven the long-term success of China's private sector.

Outlook

Powerful forces of change are creating significant

opportunities. These include society's transition away from

carbon-fuelled transport and energy generation and the application

of information technology to our understanding of the molecular

basis of disease. While rising interest rates and increasing

friction between the United States and China create a problematic

environment to navigate, the long-term advantages of companies are

often built in periods of stress and capital shortage.

The principal risks and uncertainties facing the Company are set

out at the end of this document.

10 November 2022

For a definition of terms see Glossary of Terms and Alternative

Performance Measures at the end of this document

Total return information sourced from Refinitiv/StatPro/Baillie

Gifford.

See disclaimer at end of this document.

Past performance is not a guide to future performance.

Responsibility Statement

We confirm that to the best of our knowledge:

a) the condensed set of Financial Statements has been prepared

in accordance with FRS 104 'Interim Financial Reporting';

b) the Interim Management Report includes a fair review of the

information required by Disclosure and Transparency Rule 4.2.7R

(indication of important events during the first six months, their

impact on the condensed set of Financial Statements and a

description of the principal risks and uncertainties for the

remaining six months of the year); and

c) the Interim Financial Report includes a fair review of the

information required by Disclosure and Transparency Rule 4.2.8R

(disclosure of related party transactions and changes therein).

By order of the Board

Fiona McBain

Chair

10 November 2022

Income Statement (unaudited)

For the six months ended For the six months ended

30 September 2022 30 September 2021

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

================================================== ======== =========== =========== ======== ========= =========

(Losses)/gains on investments - (2,368,395) (2,368,395) - 2,721,589 2,721,589

Currency losses - (176,320) (176,320) - (15,778) (15,778)

Income from investments and interest receivable 25,904 - 25,904 13,640 - 13,640

Investment management fee (note 3) - (18,557) (18,557) - (27,179) (27,179)

Other administrative expenses (3,135) - (3,135) (3,644) - (3,644)

================================================== ======== =========== =========== ======== ========= =========

Net return before finance costs and taxation 22,769 (2,563,272) (2,540,503) 9,996 2,678,632 2,688,628

================================================== ======== =========== =========== ======== ========= =========

Finance costs of borrowings - (32,405) (32,405) - (19,526) (19,526)

================================================== ======== =========== =========== ======== ========= =========

Net return on ordinary activities before taxation 22,769 (2,595,677) (2,572,908) 9,996 2,659,106 2,669,102

================================================== ======== =========== =========== ======== ========= =========

Tax on ordinary activities (2,050) (471) (2,521) (1,281) (4,905) (6,186)

================================================== ======== =========== =========== ======== ========= =========

Net return on ordinary activities after taxation 20,719 (2,596,148) (2,575,429) 8,715 2,654,201 2,662,916

================================================== ======== =========== =========== ======== ========= =========

Net return per ordinary share (note 4) 1.44p (180.36p) (178.92p) 0.62p 187.38p 188.00p

================================================== ======== =========== =========== ======== ========= =========

Dividends proposed per ordinary share (note 5) 1.60p 1.52p

================================================== ======== =========== =========== ======== ========= =========

The accompanying notes on the following pages are an integral

part of the Financial Statements.

The total column of this statement is the profit and loss

account of the Company. The supplementary revenue and capital

return columns are prepared under guidance published by the

Association of Investment Companies.

All revenue and capital items in this statement derive from

continuing operations.

A Statement of Comprehensive Income is not required as all gains

and losses of the Company have been reflected in the above

statement.

Balance Sheet (unaudited)

At 31 March At 31 March

At 30 September At 30 September 2022 2022

2022 2022 (audited) (audited)

Notes GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- ----- --------------- --------------- ----------- -------------

Fixed assets

Investments held at fair

value through profit or loss 6 14,003,641 16,669,469

------------------------------- ----- --------------- --------------- ----------- -------------

Current assets

Debtors 2,948 13,142

Cash and cash equivalents 230,387 229,962

------------------------------- ----- --------------- --------------- ----------- -------------

233,335 243,104

------------------------------- ----- --------------- --------------- ----------- -------------

Creditors

Amounts falling due within

one year:

Bank loans 7 (403,117) (502,032)

Buybacks outstanding and

related stamp duty (11,579) -

Other creditors and accruals (23,080) (23,814)

------------------------------- ----- --------------- --------------- ----------- -------------

(437,776) (525,846)

------------------------------- ----- --------------- --------------- ----------- -------------

Net current liabilities (204,441) (282,742)

------------------------------- ----- --------------- --------------- ----------- -------------

Total assets less current

liabilities 13,799,200 16,386,727

------------------------------- ----- --------------- --------------- ----------- -------------

Creditors

Amounts falling due after

more than one year:

Bank loans 7 (609,074) (516,384)

Loan notes 7 (1,041,561) (985,613)

Debenture stocks 7 (127,388) (127,559)

Provision for deferred tax

liability (1,642) (1,172)

------------------------------- ----- --------------- --------------- ----------- -------------

(1,779,665) (1,630,728)

------------------------------- ----- --------------- --------------- ----------- -------------

Net assets 12,019,535 14,755,999

------------------------------- ----- --------------- --------------- ----------- -------------

Capital and reserves

Share capital 74,239 74,239

Share premium account 928,400 928,400

Capital redemption reserve 19,094 19,094

Capital reserve 10,977,083 13,717,685

Revenue reserve 20,719 16,581

------------------------------- ----- --------------- --------------- ----------- -------------

Shareholders' funds 12,019,535 14,755,999

------------------------------- ----- --------------- --------------- ----------- -------------

Net asset value per ordinary

share

(after deducting borrowings

at book)* 841.7p 1,021.8p

------------------------------- ----- --------------- --------------- ----------- -------------

Ordinary shares in issue 9 1,428,019,945 1,444,131,650

------------------------------- ----- --------------- --------------- ----------- -------------

* See Glossary of Terms and Alternative Performance Measures at the end of this announcement.

The accompanying notes on the following pages are an integral

part of the Financial Statements

Statement of Changes in Equity (unaudited)

For the six months ended 30 September 2022

Called Share Capital Capital

up share premium redemption reserve Revenue Shareholders'

capital account reserve * reserve funds

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ ----- --------- -------- ----------- --------------- -------- -------------

Shareholders' funds

at 1 April 2022 74,239 928,400 19,094 13,717,685 16,581 14,755,999

Net return on ordinary

activities

after taxation - - - (2,596,148) 20,719 (2,575,429)

Shares bought back 9 - - - (131,171) - (131,171)

Dividends paid during

the period 5 - - - (13,283) (16,581) (29,864)

------------------------ ----- --------- -------- ----------- --------------- -------- -------------

Shareholders' funds at

30 September 2022 74,239 928,400 19,094 10,977,083 20,719 12,019,535

------------------------ ----- --------- -------- ----------- --------------- -------- -------------

For the six months ended 30 September 2021

Called Share Capital Capital

up share premium redemption reserve Revenue Shareholders'

capital account reserve * reserve funds

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------- ----- --------- -------- ----------- --------------- -------- -------------

Shareholders' funds

at 1 April 2021 74,239 781,771 19,094 16,105,297 9,069 16,989,470

Net return on ordinary

activities

after taxation - - - 2,654,201 8,715 2,662,916

Shares bought back 9 - - - (137,732) - (137,732)

Shares sold from treasury 9 - 3,175 - 9,038 - 12,213

Dividends paid during

the period 5 - - - (18,915) (9,069) (27,984)

--------------------------- ----- --------- -------- ----------- --------------- -------- -------------

Shareholders' funds

at 30 September 2021 74,239 784,946 19,094 18,611,889 8,715 19,498,883

--------------------------- ----- --------- -------- ----------- --------------- -------- -------------

* The Capital Reserve balance at 30 September 2022 includes

investment holding gains on fixed asset investments of

GBP3,838,304,000 (30 September 2021 - gains of

GBP12,122,474,000).

The accompanying notes on the following pages are an integral

part of the Financial Statements

Cash Flow Statement (unaudited)

For the six months ended 30 September

2022 2021

Notes GBP'000 GBP'000

----------------------------------------------------- ----- ----------- -----------

Cash flows from operating activities

Net return on ordinary activities before taxation (2,572,908) 2,669,102

Losses/(gains) on investments 2,368,395 (2,721,589)

Currency losses 176,320 15,778

Finance costs of borrowings 32,405 19,526

Overseas capital gains tax incurred - (3,335)

Overseas withholding tax incurred (2,286) (1,281)

Changes in debtors and creditors 2,964 1,657

----------------------------------------------------- ----- ----------- -----------

Cash from operations 4,890 (20,142)

Interest paid (31,937) (18,518)

----------------------------------------------------- ----- ----------- -----------

Net cash outflow from operating activities (27,047) (38,660)

----------------------------------------------------- ----- ----------- -----------

Net cash inflow/(outflow) from investing activities 348,800 (172,338)

----------------------------------------------------- ----- ----------- -----------

Equity dividends paid 5 (29,864) (27,984)

Shares bought back into treasury and stamp duty

thereon (119,592) (163,149)

Shares sold from treasury - -

Bank loans repaid (1,026,906) -

Bank loans drawn down and loan notes issued 7 855,034 386,090

----------------------------------------------------- ----- ----------- -----------

Net cash (outflow)/inflow from financing activities (321,328) 194,957

----------------------------------------------------- ----- ----------- -----------

Increase/(decrease) in cash and cash equivalents 425 (16,041)

Exchange movements - 2,748

Cash and cash equivalents at start of period 229,962 212,128

----------------------------------------------------- ----- ----------- -----------

Cash and cash equivalents at end of period * 230,387 198,835

----------------------------------------------------- ----- ----------- -----------

* Cash and cash equivalents represent cash at bank and short

term money market deposits repayable on demand.

The accompanying notes are an integral part of the Financial

Statements.

Holding Period of Investments as at 30 September 2022

(unaudited)

More than 5 years 2-5 years Less than 2 years

=================================== ================================ ====================================

Name % of Name % of Name % of

total total total

assets assets assets

========================= ======== ====================== ======== ========================== ========

Tesla Inc 6.8 Northvolt AB U 3.6 Moderna 6.9

Space Exploration

Technologies

ASML 5.2 U 3.2 Adyen 1.3

Illumina 10 4.2 Blockchain.com U 0.8

Meituan (p) 3.4 MercadoLibre 2.9 Solugen Inc U 0.7

ByteDance Ltd Redwood Materials

Amazon.com 10 2.9 U 2.5 Inc U 0.7

Tencent Holdings

10 2.8 NIO Inc p 2.2 Roblox 0.5

Tempus Labs Inc ChargePoint Holdings

Kering 10 2.4 U 2.0 Inc 0.5

The Brandtech Blockstream Corporation

Group U 2.0 Stripe Inc U 1.9 Inc U 0.5

Ginkgo BioWorks

Inc p 1.8 Pinduoduo Inc 1.8 Databricks Inc U 0.5

Snowflake Inc

Wise Plc p 1.7 p 1.4 Rappi Inc U 0.5

Epic Games Inc

Delivery Hero 1.6 U 1.3 Nuro Inc U 0.5

Zipline International

Ferrari 1.6 Inc U 1.1 GoPuff Inc U 0.4

Ant International Salt Pay Co Ltd

NVIDIA 1.4 Ltd U 1.0 U 0.4

Recursion

Denali Therapeutics Pharmaceuticals Honor Technology

p 1.2 Inc p Inc U 0.4

Relativity Space

Netflix 1.1 0.8 Inc U 0.4

Alibaba Group The Production Horizon Robotics

p 10 0.9 Board U 0.7 U 0.4

Spotify Technology

SA p 0.8 Carbon Inc U 0.6 Climeworks AG U 0.3

Housing Development

Finance Corporation Jiangxiaobai Holdings

10 Ltd U 0.5 Capsule Corp U 0.3

Affirm Holdings

0.8 Inc p 0.5 10x Genomics 0.3

Workrise Technologies

Zalando 0.7 Zoom 0.5 Inc U 0.3

HelloFresh p 0.7 Ocado 0.5 Cloudflare 0.3

Indigo Agriculture

Inc U 0.5 Shopify 0.4 DoorDash 0.3

Atlas Copco 10 0.5 Tanium Inc U 0.4 PsiQuantum U 0.1

Vir Biotechnology Bolt Threads Inc Upside Foods Inc

Inc p 0.5 U 0.4 U 0.1

JRSK Inc (Away)

Kinnevik 0.4 U 0.4 Clear Secure Inc 0.1

Essence Healthcare Clover Health Investments

U 0.4 Convoy Inc U 0.3 p 0.1

Thumbtack Inc Uptake Technologies ARCH Ventures Fund

U 0.3 Inc U 0.3 XI U <0.1

Warby Parker Aurora Innovation ARCH Ventures Fund

Inc p 0.3 Inc p 0.3 XII U <0.1

Antler East Africa

Zocdoc Inc U 0.2 Wayfair 0.3 Fund I LP U <0.1

Sinovation Fund

III U 0.1 Lilium NV p 0.3 Beam Therapeutics <0.1

ARCH Ventures Heartflow Inc

Fund IX U 0.1 U 0.3

WI Harper Fund KSQ Therapeutics

VIII U 0.1 U 0.2

Sana Biotechnology

Udacity Inc U 0.1 Inc p 0.2

Innovation Works

Development Joby Aviation

Fund U 10 Inc p 0.2

0.1 Carvana 0.1

WI Harper Fund 0.1 ARCH Ventures

VII U 10 Fund X

Overage U

0.1

Global AI Opportunities ARCH Ventures

Fund 10 <0.1 Fund X U 0.1

Rubius Therapeutics <0.1 Zymergen Inc p <0.1

Inc p

Intarcia Therapeutics -

U

Total 47.7 Total 33.3 Total 17.6

========================= ======== ====================== ======== ========================== ========

(U) Denotes unlisted (private company) security.

(p) Denotes listed security previously held in the portfolio as

an unlisted (private company) security (.)

(10) (Denotes security held for more than 10 years.)

(Net liquid assets represent 1.4% of total assets. See Glossary

of Terms and Alternative Performance Measures at the end of this

announcement)

List of Investments at 30 September 2022 (unaudited)

Fair value % Contribution Fair value

30 September of to absolute 31 March

2022 total performance* 2022

Name Business GBP'000 assets % Notes GBP'000

-------------------- ------------------------------ ------------- ------- ------------- ------------- ----------

Clinical stage biotechnology

Moderna company 974,886 6.9 (1.1) 1,204,059

Electric cars, autonomous

driving and solar

Tesla Inc energy 971,935 6.8 (1.1) 1,115,783

ASML Lithography 735,111 5.2 (1.9) 1,080,697

Illumina Biotechnology equipment 577,118 4.1 (3.0) 1,078,156

Battery developer

and

manufacturer, specialised

Northvolt in

AB lithium-ion technology

Series E1 for

Pref. (U) electric vehicles 273,451 1.9 0.3 232,425

Battery developer

and

manufacturer, specialised

Northvolt in

AB lithium-ion technology

Series E2 for

Pref. (U) electric vehicles 142,647 1.0 0.2 119,977

Battery developer

and

manufacturer, specialised

Northvolt in

AB lithium-ion technology

Promissory for

Note (U) electric vehicles 78,832 0.5 - New purchase -

Battery developer

and

manufacturer, specialised

Northvolt in

AB lithium-ion technology

Series A for

Ord. (U) electric vehicles 30,660 0.2 - 26,060

Battery developer

and

manufacturer, specialised

Northvolt in

AB lithium-ion technology

Series D1 for

Pref. (U) electric vehicles 995 - - 845

------------- ------- ------------- ------------- ----------

526,585 3.6 0.5 379,307

------------- ------- ------------- ------------- ----------

Meituan (p) Local services aggregator 488,205 3.4 0.8 389,841

Space Exploration

Technologies Designs, manufactures

Series J and launches rockets

Pref. (U) and spacecraft 202,281 1.4 0.4 144,901

Designs, manufactures

Space Exploration and

Technologies launches rockets

Series N and

Pref. (U) spacecraft 162,575 1.1 0.4 116,458

Designs, manufactures

Space Exploration and

Technologies launches rockets

Class A and

Common (U) spacecraft 79,306 0.5 0.2 56,810

Designs, manufactures

Space Exploration and

Technologies launches rockets

Class C and

Common (U) spacecraft 24,461 0.2 0.1 17,523

------------- ------- ------------- ------------- ----------

468,623 3.2 1.1 335,692

------------- ------- ------------- ------------- ----------

Latin American e-commerce Significant

MercadoLibre platform 418,298 2.9 (0.5) addition 333,435

Online retailer

and cloud

Amazon.com computing 409,676 2.9 (0.6) 500,852

Significant

Tencent Holdings Internet services 395,527 2.8 (0.8) reduction 708,821

ByteDance

Ltd

Series E

Pref. (U) Social media 189,407 1.3 0.2 165,590

ByteDance

Ltd

Series E-1

Pref. (U) Social media 170,396 1.2 0.2 148,970

------------- ------- ------------- ------------- ----------

359,803 2.5 0.4 314,560

------------- ------- ------------- ------------- ----------

Luxury goods producer

and

Kering retailer 338,969 2.4 (0.4) 409,853

Designs and manufactures

electric and autonomous

NIO Inc (p) vehicles 317,065 2.2 (0.1) 359,220

The Brandtech

Group Class

A-3 (U) Digital advertising 214,538 1.5 (0.1) 240,053

The Brandtech

Group Class

A-1 (U) Digital advertising 73,026 0.5 (0.2) 81,711

------------- ------- ------------- ------------- ----------

287,564 2.0 (0.3) 321,764

------------- ------- ------------- ------------- ----------

Offers molecular

diagnostics

tests for cancer

Tempus Labs and

Inc aggregates clinical

Series E oncology

Pref. (U) records 133,217 0.9 0.1 114,805

Offers molecular

diagnostics

tests for cancer

Tempus Labs and

Inc aggregates clinical

Series F oncology

Pref. (U) records 48,627 0.4 - 41,906

Offers molecular

diagnostics

tests for cancer

Tempus Labs and

Inc aggregates clinical

Series G-3 oncology

Pref. (U) records 44,004 0.3 - New purchase -

Offers molecular

diagnostics

tests for cancer

Tempus Labs and

Inc aggregates clinical

Series G-2 oncology

Pref. (U) records 41,221 0.3 - 35,187

Offers molecular

diagnostics

tests for cancer

Tempus Labs and

Inc aggregates clinical

Series G oncology

Pref. (U) records 7,848 0.1 - 6,763

------------- ------- ------------- ------------- ----------

274,917 2.0 0.1 198,661

------------- ------- ------------- ------------- ----------

Stripe Inc

Series

G Pref.

(U) Online payment platform 178,763 1.3 - 166,921

Stripe Inc

Class B

Common (U) Online payment platform 62,937 0.4 - 58,768

Stripe Inc

Series

H Pref.

(U) Online payment platform 26,678 0.2 - 24,487

------------- ------- ------------- ------------- ----------

268,378 1.9 - 250,176

------------- ------- ------------- ------------- ----------

Pinduoduo

Inc Chinese e-commerce 261,463 1.8 1.0 142,114

Ginkgo BioWorks Bio-engineering

Inc (p) company 253,779 1.8 (0.1) 277,228

Online platform

Wise Plc to send and

(p) receive money 245,042 1.7 0.5 183,614

Delivery Online food delivery

Hero service 231,231 1.6 0.1 231,834

Ferrari Luxury automobiles 228,722 1.6 - 228,349

Significant

NVIDIA Visual computing 195,357 1.4 (1.6) reduction 582,378

Developer of a SaaS-based

Snowflake cloud data warehousing Significant

Inc (p) platform 192,587 1.4 (0.1) addition 163,321

Adyen Global payment company 191,335 1.3 (0.4) 223,895

Epic Games

Inc (U) Gaming platform 186,870 1.3 0.3 144,064

Denali

Therapeutics

(p) Biotechnology 169,181 1.2 0.2 150,121

Subscription service

for TV shows and

Netflix movies 161,031 1.1 (0.4) 264,214

Logistics company

that

Zipline designs, manufactures

International and

Inc operates drones

Series D to deliver

Pref. (U) medical supplies 56,172 0.4 - 58,508

Logistics company

that

Zipline designs, manufactures

International and

Inc operates drones

Series E to deliver

Pref. (U) medical supplies 48,330 0.4 - 44,887

Logistics company

that

Zipline designs, manufactures

International and

Inc operates drones

Series C to deliver

Pref. (U) medical supplies 47,969 0.3 - 49,964

------------- ------- ------------- ------------- ----------

152,471 1.1 - 153,359

------------- ------- ------------- ------------- ----------

Ant International Online financial

Ltd Class services

C Ord. (U) platform 136,322 1.0 - 136,502

Online retailing

Alibaba Group and financial Significant

(p) services 135,032 0.9 (0.4) reduction 419,268

Uses image

recognition/machine

learning

Recursion and automation

Pharmaceuticals to improve

Inc (p) drug discovery 132,756 0.8 0.5 75,850

Spotify

Technology Online music streaming

SA (p) service 127,851 0.8 (0.4) 189,643

Blockchain.com Software platform

Series C-1 for digital

Pref. (U) assets 51,988 0.4 (1.1) 182,169

Blockchain.com Software platform

Series D for digital

Pref. (U) assets 51,056 0.4 (0.2) 75,950

Blockchain.com Software platform

Inc Promissory for digital

note (U) assets 4,479 - - New purchase -

------------- ------- ------------- ------------- ----------

107,523 0.8 (1.3) 258,119

------------- ------- ------------- ------------- ----------

Housing

Development

Finance Indian mortgage

Corporation provider 106,950 0.8 0.1 101,717

International online

clothing

Zalando retailer 99,729 0.7 (0.9) 220,640

Solugen exists to

scale

synthetic biology

Solugen Inc and bring

Series C-1 green chemicals

Pref. (U) to the world 98,185 0.7 0.2 67,922

HelloFresh

(p) Grocery retailer 89,238 0.7 (0.5) 161,987

Redwood

Materials

Inc

Series C Environmental battery

Pref. (U) recycling 85,550 0.7 0.1 74,535

The Production

Board Series Holding company

A-2 for food

Pref. (U) technology companies 50,882 0.4 (0.2) 77,166

The Production

Board Series Holding company

A-3 for food

Pref. (U) technology companies 34,593 0.3 - 28,266

------------- ------- ------------- ------------- ----------

85,475 0.7 (0.2) 105,432

------------- ------- ------------- ------------- ----------

Carbon Inc Manufactures and

Series D develops

Pref. (U) 3D printers 49,627 0.4 - 49,205

Carbon Inc Manufactures and

Series E develops

Pref. (U) 3D printers 31,046 0.2 - 30,782

------------- ------- ------------- ------------- ----------

80,673 0.6 - 79,987

------------- ------- ------------- ------------- ----------

Indigo Agriculture

Inc Series Analyses plant microbiomes

D to increase crop

Pref. (U) yields 28,569 0.2 - 25,049

Indigo Agriculture

Inc Series Analyses plant microbiomes

E to increase crop

Pref. (U) yields 19,912 0.1 - 14,670

Indigo Agriculture

Inc Series Analyses plant microbiomes

F to increase crop

Pref. (U) yields 18,942 0.1 - 14,776

Indigo Agriculture

Inc Series Analyses plant microbiomes

G to increase crop

Pref. (U) yields 11,689 0.1 - 9,447

Indigo Agriculture Analyses plant microbiomes

Inc Common to increase crop

(U) yields 1,047 - - 2,221

------------- ------- ------------- ------------- ----------

80,159 0.5 - 66,163

------------- ------- ------------- ------------- ----------

Human co-experience

platform enabling

shared

experiences among

Roblox users 79,871 0.5 (0.1) New purchase -

Jiangxiaobai

Holdings

Ltd

Series C Producer of alcoholic

Pref. (U) beverages 75,305 0.5 0.1 55,950

ChargePoint Electric vehicle

Holdings charging Significant

Inc solutions 76,055 0.5 - addition 69,111

Atlas Copco Engineering 73,141 0.5 - 86,205

Online platform

which

provides lending

Affirm Holdings and

Inc Class consumer credit

A (p) services 68,947 0.5 (0.5) 144,207

Remote conferencing

service

Zoom provider 67,691 0.5 (0.1) 91,537

Blockstream

Corporation

Inc

Series B-1 Financial software

Pref. (U) developer 66,713 0.5 (0.1) 71,135

Online grocery retailer

and Significant

Ocado technology provider 66,289 0.5 (0.6) addition 102,395

Databricks

Inc

Series H

Pref. (U) Data software solutions 66,222 0.5 - 58,997

Biotechnology company

Vir Biotechnology developing anti-infective

Inc (p) therapies 65,664 0.5 - 73,365

Provider of an on-demand

delivery platform

designed to

Rappi Inc connect consumers

Series F with

Pref. (U) local stores 64,951 0.5 - 58,899

Delivery business,

using self-

Nuro Inc driving purpose-built

Series C electric

Pref. (U) vehicles 39,217 0.3 (0.1) 55,561

Delivery business,

using self-

Nuro Inc driving purpose-built

Series D electric

Pref. (U) vehicles 25,693 0.2 - 28,433

------------- ------- ------------- ------------- ----------

64,910 0.5 (0.1) 83,994

------------- ------- ------------- ------------- ----------

Cloud-based commerce

Shopify platform provider 62,916 0.4 (0.5) 133,802

GoPuff Inc

(GoBrands) On demand retail

Series G delivery

Pref. (U) service 61,948 0.4 - 55,476

Salt Pay

Co Ltd

Non-Voting

Ordinary Payment and management

Shares (U) solutions 53,520 0.4 (0.1) 60,434

Salt Pay

Co Ltd

Voting Ordinary Payment and management

Shares (U) solutions 1 - - 1

------------- ------- ------------- ------------- ----------

53,521 0.4 (0.1) 60,435

------------- ------- ------------- ------------- ----------

Honor

Technology

Inc

Series D Provider of home-care

Pref. (U) services 31,498 0.3 (0.1) 37,375

Honor

Technology

Inc

Series E Provider of home-care

Pref. (U) services 21,989 0.1 - 24,766

------------- ------- ------------- ------------- ----------

53,487 0.4 (0.1) 62,141

------------- ------- ------------- ------------- ----------

Tanium Inc

Class Provides security

B Common and systems

(U) management solutions 53,227 0.4 (0.4) 104,374

Relativity Aerospace company,

Space designs

Inc Series and builds rockets

D using 3D

Pref. (U) printers 32,902 0.3 - 44,217

Relativity Aerospace company,

Space designs

Inc Series and builds rockets

E using 3D

Pref. (U) printers 19,666 0.1 (0.1) 21,583

------------- ------- ------------- ------------- ----------

52,568 0.4 (0.1) 65,800

------------- ------- ------------- ------------- ----------

Bolt Threads

Inc Natural fibres and

Series D fabrics

Pref. (U) manufacturer 27,621 0.2 - 25,308

Bolt Threads

Inc Natural fibres and

Series E fabrics

Pref. (U) manufacturer 23,860 0.2 - 21,696

------------- ------- ------------- ------------- ----------

51,481 0.4 - 47,004

------------- ------- ------------- ------------- ----------

Kinnevik Investment company 50,675 0.4 (0.2) 85,605

Designer and developer

of AI

chips and algorithms

principally for

advanced

driving assistance

Horizon Robotics systems

Series C and autonomous

Pref. (U) vehicles 49,819 0.4 - 44,187

Essence

Healthcare

Series 3 Cloud-based health

Pref. (U) provider 49,569 0.4 0.1 38,304

JRSK Inc

(Away)

Series D

Pref. (U) Manufactures luggage 20,085 0.1 - 17,355

JRSK Inc

(Away)

Series Seed

Pref. (U) Manufactures luggage 10,830 0.1 - 9,651

JRSK Inc

(Away)

Convertible

Promissory

Note (U) Manufactures luggage 8,653 0.1 - 8,034

JRSK Inc

(Away)

Convertible

Promissory

Note

2021 (U) Manufactures luggage 8,653 0.1 - 8,034

------------- ------- ------------- ------------- ----------

48,221 0.4 - 43,074

------------- ------- ------------- ------------- ----------

Thumbtack

Inc Online directory

Series G service for

Pref. (U) local businesses 28,948 0.2 - 33,513

Thumbtack

Inc Online directory

Series I service for

Pref. (U) local businesses 11,022 0.1 - 11,741

Thumbtack

Inc Online directory

Series H service for local

Pref. (U) businesses 5,790 - - 6,703

Thumbtack

Inc Online directory

Class A service for

Common (U) local businesses 871 - - 3,023

Thumbtack

Inc Online directory

Series A service for

Pref. (U) local businesses 514 - - 1,783

Thumbtack

Inc Online directory

Series C service for

Pref. (U) local businesses 150 - - 521

Thumbtack

Inc Online directory

Series B service for

Pref. (U) local businesses 35 - - 121

------------- ------- ------------- ------------- ----------

47,330 0.3 - 57,405

------------- ------- ------------- ------------- ----------

Climeworks

AG

Series F

Preferred Renewable energy

(U) equipment 46,925 0.3 - New purchase -

Climeworks

AG

Non Voting Renewable energy

Shares (U) equipment 358 - - New purchase -

------------- ------- ------------- ------------- ----------

47,283 0.3 - -

------------- ------- ------------- ------------- ----------

Digital platform

providing

Capsule Corp home delivery of

Series D prescription

Pref. (U) medication 46,779 0.3 - 47,719

A life science and

diagnostics

10x Genomics company 45,611 0.3 (0.4) 103,343

Convoy Inc Marketplace for

Series D truckers and

Pref. (U) shippers 28,978 0.2 - 27,763

Convoy Inc Marketplace for

Series E truckers and

Pref. (U) shippers 16,909 0.1 - 15,190

------------- ------- ------------- ------------- ----------

45,887 0.3 - 42,953

------------- ------- ------------- ------------- ----------

Uptake

Technologies

Inc

Promissory Designs and develops

Note (U) enterprise software 24,870 0.2 - 22,785

Uptake

Technologies

Inc

Series D Designs and develops

Pref. (U) enterprise software 20,435 0.1 (0.2) 41,545

------------- ------- ------------- ------------- ----------

45,305 0.3 (0.2) 64,330

------------- ------- ------------- ------------- ----------

Workrise

Technologies Online platform

Inc connecting

Series E contractors with

Pref. (U) work 45,165 0.3 (0.1) 51,918

Online and physical

Warby Parker glasses

Inc (p) retailer 45,092 0.3 (0.4) 96,854

Application software

Cloudflare developer 43,023 0.3 - New purchase -

Provides restaurant

food

DoorDash delivery services 40,849 0.3 (0.3) 81,972

Aurora Innovation Developer of driverless

Inc Common vehicle

(p) technology 40,349 0.3 (0.4) 86,922

Online household

goods

Wayfair retailer 38,716 0.3 (0.5) 111,760

Lilium NV

(p) On demand air transportation 36,309 0.3 (0.1) 53,503

Develops software

Heartflow for

Inc cardiovascular

Series E disease

Pref. (U) diagnosis and treatment 33,066 0.3 (0.1) 41,525

KSQ Therapeutics

Inc Series

C

Pref. (U) Biotechnology company 22,792 0.1 - 19,996

KSQ Therapeutics

Inc Series

D

Pref. (U) Biotechnology company 8,476 0.1 - 7,303

------------- ------- ------------- ------------- ----------

31,268 0.2 - 27,299

------------- ------- ------------- ------------- ----------

Biotechnology company

Sana creating and delivering

Biotechnology engineered cells

Inc (p) as medicine 29,976 0.2 - 35,003

Online platform

for searching

Zocdoc Inc for doctors and

Series D-2 booking

Pref. (U) appointments 29,630 0.2 0.1 22,321

Joby Aviation

Inc (p) Electric aircraft 29,391 0.2 - 38,040

PsiQuantum

Series D Operates as a biotechnology

Pref. (U) company 21,084 0.1 - 18,988

Upside Foods

Inc

Series C-1 Cultivated meat

Pref. (U) producer 20,602 0.1 - New purchase -

Clear Secure Biometric security

Inc firm 20,478 0.1 - 20,393

Online platform

for buying

Carvana used cars 18,343 0.1 (0.5) 83,168

Sinovation

Fund Venture capital

III (U) fund 13,692 0.1 - 10,145

ARCH Ventures Venture capital

Fund IX fund to invest

(U) in biotech start-ups 13,655 0.1 - 16,579

Illumina

CVR Biotechnology equipment 13,524 0.1 - -

WI Harper

Fund Venture capital

VIII (U) fund 12,134 0.1 - 9,757

Clover Health

Investments

B Healthcare insurance

Common (p) provider 7,785 0.1 - -

Clover Health

Investments

A Common Healthcare insurance

(p) provider 4,005 - (0.1) 20,938

------------- ------- ------------- ------------- ----------

11,790 0.1 20,938

------------- ------- ------------- ------------- ----------

Udacity Inc

Series D

Pref. (U) Online education 10,572 0.1 - 8,269

Innovation

Works

Development Venture capital

Fund (U) fund 10,431 0.1 - 16,201

ARCH Ventures

Fund X Venture capital

Overage fund to invest

(U) in biotech start-ups 8,706 0.1 - 6,840

Venture capital

ARCH Ventures fund to invest

Fund X (U) in biotech start-ups 8,412 0.1 - 6,331

WI Harper

Fund Venture capital

VII (U) fund 8,066 0.1 - 7,589

ARCH Ventures Venture capital

Fund XI fund to invest Significant

(U) in biotech start-ups 6,448 <0.1 - addition 3,362

Zymergen Developer of molecular

Inc (p) technology 5,511 <0.1 - 4,840

Global AI Artificial intelligence

Opportunities based

Fund algorithmic trading 4,466 <0.1 - 5,114

ARCH Ventures Venture capital

Fund XII fund to invest

(U) in biotech start-ups 1,571 <0.1 0.1 New purchase -

Rubius

Therapeutics

Inc (p) Biotechnology 1,334 <0.1 - 14,309

VC Fund helping

Antler East entrepreneurs establish

Africa their

Fund I LP businesses in

(U) East Africa 990 <0.1 - 276

Beam

Therapeutics Biotechnology company 440 <0.1 - 447

Intarcia Implantable drug - - - -

Therapeutics delivery

Inc system

Common ++

(U)

Intarcia Implantable drug - - - -

Therapeutics delivery

Inc system

Convertible

Bond ++

(U)

Intarcia Implantable drug - - - -

Therapeutics delivery

Inc system

Series EE

Pref. ++

(U)

- - -

-------------------- ------------------------------ ------------- ------- ------------- ------------- ----------

Total Investments 14,003,641 98.6

Net Liquid

Assets # 198,676 1.4

---------------------------------------------------- ------------- ------- ------------- ------------- ----------

Total Assets

# 14,202,317 100.0

---------------------------------------------------- ------------- ------- ------------- ------------- ----------

* Contribution to absolute performance has been calculated on a

total return basis over the period 1 April 2022 to 30 September

2022. For a definition of total return please see the Glossary of

Terms and Alternative Performance Measures at the end of this

announcement.

Significant additions and reductions to investments have been

noted where the change is at least a 20% movement from the value of

the holding at 31 March 2022. The change in value over the period

also reflects the share price performance and the movement in

exchange rates.

# See Glossary of Terms and Alternative Performance Measures at the end of this announcement.

++ The Intarcia Therapeutics holdings are valued at nil at 30 September 2022.

(U) Denotes unlisted (private company) security.

(p) Denotes listed security previously held in the portfolio as

an unlisted (private company) security.

Source: Baillie Gifford/StatPro. See disclaimer at the end of

this announcement.

Distribution of Assets* (unaudited)

Geographical Analysis

At At

30 September 2022 31 March 2022

% %

================= ============= ================== ==============

North America 58.8 59.7

United States 57.9 58.5

Canada 0.9 1.2

Europe 21.8 21.9

United Kingdom 2.4 2.0

Eurozone 14.1 15.5

Developed Europe (non Euro) 5.3 4.4

South America 2.9 2.0

Brazil 2.9 2.0

Asia 16.5 16.4

China 15.7 15.8

India 0.8 0.6

Total assets 100.0 100.0

================================ ================== ==============

Sectoral Analysis

At At

30 September 2022 31 March 2022

% %

============ ============ ================== ==============

Consumer Staples 3.0 3.0

Consumer Discretionary 33.7 33.5

Technology 22.4 24.9

Healthcare 18.6 19.4

Financials 5.8 5.3

Industrials 10.4 9.1

Basic Materials 3.6 2.7

Real Estate 0.0 0.1

Energy 1.1 0.7

Net Liquid Assets 1.4 1.3

Total assets 100.0 100.0

========================== ================== ==============

(*) See Glossary of Terms and Alternative Performance Measures

at end of this announcement.

Unlisted

Unlisted (private

Listed (private company) company) Net liquid

equities securities bonds assets Total

% % % % %

--------- ------------------------------------- --------- ----------

30 September

2022 66.8 30.9 0.9 1.4 100.0

31 March 2022 73.9 24.6 0.2 1.3 100.0

--------------- --------- ------------------------------------- --------- ---------- ------

Includes holdings in preference shares and ordinary shares.

http://www.rns-pdf.londonstockexchange.com/rns/0636G_2-2022-11-10.pdf

http://www.rns-pdf.londonstockexchange.com/rns/0636G_1-2022-11-10.pdf

Absolute Performance to 30 September 2022 (unaudited)

Total return Total return Total return (%)#

(%)# (%)# since inception

for five years For ten years (2 June 2010)++

------------------------------ ---------------- --------------- ------------------

Overall investment portfolio 106.7 495.4 625.5

Private and previously

private companies 92.0 886.0 726.0

FTSE All-World Index (in

sterling terms) 52.7 207.9 273.9

# For a definition of total return please see Glossary of Terms

and Alternative Performance Measures at the end of this

announcement.

++ Date of investment in first private company security. Source:

StatPro/Baillie Gifford and underlying index providers.

Valuing Private Companies

We aim to hold our private company investments at 'fair value'

i.e., the price that would be paid in an open-market transaction.

Valuations are adjusted both during regular valuation cycles and on

an ad hoc basis in response to 'trigger events'. Our valuation

process ensures that private companies are valued in both a fair

and timely manner.

The valuation process is overseen by a valuations committee at

Baillie Gifford which takes advice from an independent third party

(S&P Global). The portfolio managers feed into the process, but

the valuations committee owns the process and the portfolio

managers only receive final valuation notifications once they have

been applied.

We revalue the private holdings on a three-month rolling cycle,

with one-third of the holdings reassessed each month. The prices

are also reviewed twice per year by the Scottish Mortgage Board and

are subject to the scrutiny of external auditors in the annual

audit process.

Recent market volatility has meant that recent pricing has moved

much more frequently than would have been the case with the

quarterly valuations cycle.

Beyond the regular cycle, the valuations committee also monitors

the portfolio for certain 'trigger events'. These may include:

changes in fundamentals; a takeover approach; an intention to carry

out an Initial Public Offering (IPO); or changes to the valuation

of comparable public companies.

The valuations committee also monitors relevant market indices

on a weekly basis and update valuations in a manner consistent with

our external valuer's (S&P Global) most recent valuation report

where appropriate. When market volatility is particularly

pronounced the team undertake these checks daily. Any ad hoc change

to the fair valuation of any holding is implemented swiftly and

reflected in the next published NAV. There is no delay.

Scottish Mortgage Investment Trust

Instruments valued 87

Revaluations performed 297

Percentage of portfolio revalued

2+ times 97%

Percentage of portfolio revalued

4+ times 40%

================================== ====

Year to date, most revaluations have been decreases. A handful

of companies have raised capital at an increased valuation. The

average movement in both valuation and share price for those which

have decreased in value is shown below.

Average movement Average movement

in investee company in investee company

valuation* share price

Scottish

Mortgage* (17.8%) (13.7%)

* Data reflecting period 1 April 2022 - 30 September

2022 to align with the Company's reporting period

end

============================================================

Share prices have decreased less than headline valuations

because Scottish Mortgage typically holds preference stock, which

provides downside protection. The share price movement reflects a

probability weighted average of both the regular valuation, which

would be realised in an IPO, and the downside protected valuation,

which would be normally be triggered in the event of a corporate

sale or liquidation.

Notes to the Condensed Financial Statements (unaudited)

1. The condensed Financial Statements for the six months to 30

September 2022 comprise the statements set out on above together

with the related notes below. They have been prepared in accordance

with FRS 104 'Interim Financial Reporting' and the AIC's Statement

of Recommended Practice issued in November 2014 and updated in July

2022 with consequential amendments. They have not been audited or

reviewed by the Auditor pursuant to the Auditing Practices Board

Guidance on 'Review of Interim Financial Information'. The

Financial Statements for the six months to 30 September 2022 have

been prepared on the basis of the same accounting policies as set

out in the Company's Annual Report and Financial Statements at 31

March 2022.

Going Concern

The Directors have considered the nature of the Company's

assets, its liabilities, projected income and expenditure together

with its investment objective and policy, dividend policy and

principal risks and uncertainties, as set out at the end of this

document. The Board has, in particular, considered the impact of

heightened market volatility since the Covid-19 pandemic and over

recent months due to the macroeconomic and geopolitical concerns,

including the Russia-Ukraine war and US-China tensions. It has

reviewed the results of specific leverage and liquidity stress

testing, but does not believe the Company's going concern status is

affected. The Company's assets, the majority of which are in quoted

securities which are readily realisable, exceed its liabilities

significantly. All borrowings require the prior approval of the

Board. Gearing levels and compliance with borrowing covenants are

reviewed by the Board on a regular basis. The Company has continued

to comply with the investment trust status requirements of section

1158 of the Corporation Tax Act 2010 and the Investment Trust

(Approved Company) Regulations 2011. Accordingly, the Directors

considered it appropriate to adopt the going concern basis of

accounting in preparing these Financial Statements and confirm that

they are not aware of any material uncertainties which may affect

the Company's ability to continue in operational existence for a

period of at least twelve months from the date of approval of these

Financial Statements.

2. The financial information contained within this Interim

Financial Report does not constitute statutory accounts as defined

in sections 434 to 436 of the Companies Act 2006. The financial

information for the year ended 31 March 2022 has been extracted

from the statutory accounts which have been filed with the

Registrar of Companies. The Auditors' Report on those accounts was

not qualified, did not include a reference to any matters to which

the Auditors drew attention by way of emphasis without qualifying

its report and did not contain statements under sections 498 (2) or

(3) of the Companies Act 2006.

3. Baillie Gifford & Co Limited, a wholly owned subsidiary

of Baillie Gifford & Co, has been appointed by the Company as

its Alternative Investment Fund Manager ('AIFM') and Company

Secretary. The investment management function has been delegated to

Baillie Gifford & Co. The management agreement can be

terminated on six months' notice. The annual management fee is

0.30% on the first GBP4 billion of total assets less current

liabilities (excluding short term borrowings for investment

purposes) and 0.25% thereafter, calculated and payable

quarterly.

4. Net Return per Ordinary Share

Six months to Six months to

30 September 30 September

2022 2021

GBP'000 GBP'000

Revenue return on ordinary activities

after taxation 20,719 8,715

Capital return on ordinary activities

after taxation (2,596,148) 2,654,201

------------- -------------

Total net return (2,575,429) 2,662,916

------------- -------------

Weighted average number of ordinary

shares in issue 1,439,460,353 1,416,515,214

------------- -------------

The net return per ordinary share figures are based on the above

totals of revenue and capital and the weighted average number of

ordinary shares in issue during each period.

There are no dilutive or potentially dilutive shares in

issue.

5. Dividends

Six months to Six months to

30 September 30 September

2022 2021

GBP'000 GBP'000

Amounts recognised as distributions

in the period:

Previous year's final dividend

of 2.07p (2021 - 1.97p), paid

1 July 2022 29,864 27,984

------------- -------------

29,864 27,984

------------- -------------

Dividends proposed in the period:

Interim dividend for the year

ending 31 March 2023 of 1.60p

(2022 - 1.52p) 22,848 21,459

------------- -------------

22,848 21,459

------------- -------------

The interim dividend was declared after the period end date and

has therefore not been included as a liability in the Balance

Sheet. It is payable on 16 December 2022 to shareholders on the

register at the close of business on 25 November 2022. The

ex-dividend date is 24 November 2022. The Company's Registrars

offer a Dividend Reinvestment Plan and the final date for elections

for this dividend is 29 November 2022.

6. Fair Value Hierarchy

The fair value hierarchy used to analyse the basis on which the

fair values of financial instruments held at fair value through the

profit and loss account are measured is described below. The levels

are determined by the lowest (that is the least reliable or least

independently observable) level of input that is significant to the

fair value measurement for the individual investment in its

entirety as follows:

Level 1 - using unadjusted quoted prices for identical

instruments in an active market;

Level 2 - using inputs, other than quoted prices included within

Level 1, that are directly or indirectly observable (based on

market data); and

Level 3 - using inputs that are unobservable (for which market

data is unavailable).

The Company's investments are financial assets designated at

fair value through profit or loss. An analysis of the Company's

financial asset investments based on the fair value hierarchy

described above is shown below.

Investments held at fair value through profit or loss

Level 1 Level 2 Level 3 Total

As at 30 September 2022 GBP'000 GBP'000 GBP'000 GBP'000

Equities/funds 9,471,002 - - 9,471,002

Private company ordinary shares - - 656,843 656,843

Private company preference

shares * - - 3,652,682 3,652,682

Private company convertible

note - - 125,486 125,486

Limited Partnership Investments - - 84,104 84,104

Contingent Value Rights - - 13,524 13,524

--------- -------- --------- ----------

Total financial asset investments 9,471,002 - 4,532,639 14,003,641

--------- -------- --------- ----------

Level 1 Level 2 Level 3 Total

As at 31 March 2022 (audited) GBP'000 GBP'000 GBP'000 GBP'000

Equities/funds 12,473,650 - - 12,473,650

Private company ordinary shares - - 609,779 609,779

Private company preference

shares * - - 3,470,105 3,470,105

Private company convertible

note - - 38,853 38,853

Limited Partnership Investments - - 77,082 77,082

---------- -------- --------- ----------

Total financial asset investments 12,473,650 - 4,195,819 16,669,469

---------- -------- --------- ----------

During the period, no investments were transferred from Level 3

to Level 1 on becoming listed. The fair value of listed investments

is bid value or, in the case of holdings on certain recognised

overseas exchanges, last traded price. Listed Investments are

categorised as Level 1 if they are valued using unadjusted quoted

prices for identical instruments in an active market and as Level 2

if they do not meet all these criteria but are, nonetheless, valued

using market data.

* The investments in preference shares are not classified as

equity holdings as they include liquidation preference rights that

determine the repayment (or multiple thereof) of the original

investment in the event of a liquidation event such as a

take-over.

Private company investments

The Company's holdings in unlisted (private company) investments

are categorised as Level 3. Private company investments are valued

at fair value by the Directors following a detailed review and

appropriate challenge of the valuations proposed by the Managers.

The Managers' private company investment policy applies techniques

consistent with the International Private Equity and Venture

Capital Valuation Guidelines 2018 ('IPEV'). The techniques applied

are predominantly market-based approaches. The market-based

approaches available under IPEV are set out below and are followed

by an explanation of how they are applied to the Company's private

company portfolio:

3/4 Multiples;

3/4 Industry Valuation Benchmarks; and

3/4 Available Market Prices.

The nature of the private company portfolio will influence the

valuation technique applied. The valuation approach recognises

that, as stated in the IPEV Guidelines, the price of a recent

investment, if resulting from an orderly transaction, generally

represents fair value as at the transaction date and may be an

appropriate starting point for estimating fair value at subsequent

measurement dates. However, consideration is given to the facts and

circumstances as at the subsequent measurement date, including

changes in the market or performance of the investee company.

Milestone analysis is used where appropriate to incorporate the

operational progress of the investee company into the valuation.

Additionally, the background to the transaction must be considered.

As a result, various multiples-based techniques are employed to

assess the valuations particularly in those companies with

established revenues. Discounted cashflows are used where

appropriate. An absence of relevant industry peers may preclude the

application of the Industry Valuation Benchmarks technique and an

absence of observable prices may preclude the Available Market

Prices approach. All valuations are cross-checked for

reasonableness by employing relevant alternative techniques.

The private company investments are valued according to a three

monthly cycle of measurement dates. The fair value of the private

company investments will be reviewed before the next scheduled

three monthly measurement date on the following occasions:

3/4 At the year end and half year end of the Company; and

3/4 Where there is an indication of a change in fair value as

defined in the IPEV guidelines (commonly referred to as 'trigger'

events).

Further information on the private company valuation process is

provided under 'Valuing Private Companies' above.

7. The total value of the borrowings (at book) is

GBP2,181,140,000 (31 March 2022 - GBP2,131,588,000).

The bank loans falling due within one year are a US$350 million

revolving 3 year loan with National Australia Bank Limited ('NAB')

and a US$100 million revolving 3 year loan with Scotiabank (31

March 2022 - US$391 million revolving 3 year loan with NAB, a US$50

million revolving 5 year loan with The Royal Bank of Scotland

International Limited ('RBSI'), a US$100 million revolving 3 year

loan with Scotiabank and a US$120 million revolving 3 year loan

with Industrial and Commercial Bank of China ('ICBC')).

During the period, the US$391 million revolving 3 year loan with

NAB was reduced to a facility of US$350 million and the ICBC US$120

million revolving 3 year loan was repaid. The RBSI US$50 million

revolving 5 year loan facility was repaid and subsequently reduced

to a facility of US$25 million.

The bank loans falling due after more than one year are a US$200

million fixed rate loan and a US$180 million fixed rate loan with

RBSI and a US$300 million fixed rate loan with Scotiabank ( 31

March 2022 - US$200 million fixed rate loan and a US$180 million

fixed rate loan with RBSI and a US$300 million fixed rate loan with

Scotiabank).

8. The fair value of the borrowings at 30 September 2022 was GBP1,705,071,000 (31 March 2022 - GBP2,001,685,000).

9. Share Capital: Ordinary Shares of 5p Each

At 31 March

At 30 September 2022

2022 (audited)

No. of shares No. of shares

Allotted, called up and fully paid

ordinary shares of 5p each 1,428,019,945 1,444,131,650

Treasury shares of 5p each 56,760,935 40,649,230

--------------- --------------

Total 1,484,780,880 1,484,780,880

--------------- --------------

In the six months to 30 September 2022, the Company sold no

ordinary shares from treasury (year to 31 March 2022 - 34,950,000

ordinary shares at a premium to net asset value, with a nominal

value of GBP1,747,500 raising net proceeds of GBP518,246,000).

In the six months to 30 September 2022, 16,111,705 ordinary

shares with a nominal value of GBP805,585 were bought back at a

total cost of GBP131,171,000 and held in treasury (year to 31 March

2022 - 12,437,319 shares with a nominal value of GBP621,000 were

bought back at a total cost of GBP157,597,000 and held in

treasury). At 30 September 2022 the Company had authority remaining

to buy back 204,723,592 ordinary shares.

10. Transaction costs on acquisitions within the portfolio

amounted to GBP383,000 (30 September 2021 - GBP382,000) and

transaction costs on sales amounted to GBP1,089,000 (30 September

2021 - GBP190,000). These costs are included in the book cost of

acquisitions and in the net proceeds of disposals.

11. Related Party Transactions

There have been no transactions with related parties during the

first six months of the current financial year that have materially

affected the financial position or the performance of the Company

during that period and there have been no changes in the related

party transactions described in the last Annual Report and

Financial Statements that could have had such an effect on the

Company during that period.

None of the views expressed in this document should be construed

as advice to buy or sell a particular investment.

Glossary of Terms and Alternative Performance Measures (APM)

Total Assets

Total assets less current liabilities, before deduction of all

borrowings.

Net Asset Value

Also described as shareholders' funds. Net Asset Value ('NAV')

is the value of total assets less liabilities (including

borrowings). Net Asset Value is calculated on the basis of

borrowings stated at book value or fair value. An explanation of

each basis is provided below. The NAV per share is calculated by

dividing this amount by the number of ordinary shares in issue

(excluding treasury shares).

Net Asset Value (Borrowings at Book)/Shareholders' Funds

Borrowings are valued at adjusted net issue proceeds. The value

of the borrowings at book is set out in note 7 above.

Net Asset Value (Borrowings at Fair Value) (APM)

Borrowings are valued at an estimate of their market worth. The

value of the borrowings at fair is set out in note 8 above and a

reconciliation to Net Asset Value with borrowings at book value is

provided below.

30 September 31 March

2022 2022

Net Asset Value per ordinary share (borrowings

at book value) 841.7p 1,021.8p

Shareholders' funds (borrowings at book GBP12,019,535,000 GBP14,755,999,000

value)

Add: book value of borrowings GBP2,181,140,000 GBP2,131,588,000

Less: fair value of borrowings (GBP1,705,071,000) (GBP2,001,885,000)

------------------ ------------------

Net Asset Value (borrowings at fair value) GBP12,495,604,000 GBP14,885,702,000

------------------ ------------------

Shares in issue at year end (excluding

treasury shares) 1,428,019,945 1,444,131,650

Net Asset Value per ordinary share (borrowings

at fair value) 875.0p 1,030.8p

------------------ ------------------

Net Liquid Assets

Net liquid assets comprise current assets less current

liabilities, excluding borrowings.

Discount/Premium (APM)

As stockmarkets and share prices vary, an investment trust's

share price is rarely the same as its NAV. When the share price is

lower than the NAV per share it is said to be trading at a

discount. The size of the discount is calculated by subtracting the

share price from the NAV per share and is usually expressed as a

percentage of the NAV per share. If the share price is higher than

the NAV per share, it is said to be trading at a premium.

30 September 2022 30 September 2021

2022 2022 2021 2021

NAV (book) NAV (fair) NAV (book) NAV (fair)

----- ----------------- ---------------- ---------------- ----------------

Net Asset Value per

share (a) 841.7p 875.0p 1,381.1p 1,378.8p

Share price (b) 782.4p 782.4p 1,428.0p 1,428.0p

----- ----------------- ---------------- ---------------- ----------------

Discount ((b)-(a))

÷ (a) (7.0%) (10.6%) 3.4% 3.6%

----------------- ---------------- ---------------- ----------------

Gearing (APM)

At its simplest, gearing is borrowing. Just like any other

public company, an investment trust can borrow money to invest in

additional investments for its portfolio. The effect of the

borrowing on the shareholders' assets is called 'gearing'. If the

Company's assets grow, the shareholders' assets grow

proportionately more because the debt remains the same, but if the

value of the Company's assets falls, the situation is reversed.

Gearing can therefore enhance performance in rising markets but can

adversely impact performance in falling markets. Gearing represents

borrowings at book value less cash and cash equivalents (including

any outstanding trade settlements) expressed as a percentage of

shareholders' funds.

30 September 31 March

2022 2022

Borrowings (at book value) GBP2,181,140,000 GBP2,131,588,000

Less: cash and cash equivalents (GBP230,387,000) (GBP229,962,000)

Less: sales for subsequent settlement - (GBP6,450,000)

Add: purchases for subsequent - -

settlement

---- ----------------- -----------------

Adjusted borrowings (a) GBP1,950,753,000 GBP1,895,176,000

---- ----------------- -----------------

Shareholders' funds (b) GBP12,019,535,000 GBP14,755,999,000

---- ----------------- -----------------

Gearing: (a) as a percentage

of (b) 16% 13%

----------------- -----------------

30 September 31 March

2022 2022

Borrowings (at book value) (a) GBP2,181,140,000 GBP2,131,588,000

Shareholders' funds (b) GBP12,019,535,000 GBP14,755,999,000

---- ----------------- -----------------

Potential gearing: (a) as a

percentage of (b) 18% 14%

----------------- -----------------

Turnover (APM)

Annual turnover is calculated on a rolling 12 month basis. The

lower of purchases and sales for the 12 months is divided by the

average assets, with average assets being calculated on assets as

at each month's end.

Active Share (APM)

Active share, a measure of how actively a portfolio is managed,

is the percentage of the portfolio that differs from its

comparative index. It is calculated by deducting from 100 the

percentage of the portfolio that overlaps with the comparative

index. An active share of 100 indicates no overlap with the index

and an active share of zero indicates a portfolio that tracks the

index.

Total Return (APM)

The total return is the return to shareholders after reinvesting

the net dividend on the date that the share price goes

ex-dividend.

30 September 2022 30 September 2021

NAV NAV Share NAV NAV Share

(book) (fair) price (book) (fair) price

---------- --------- -------- -------- --------- -------- --------

Closing NAV per

share/share price (a) 841.7p 875.0p 782.4p 1,381.1p 1,378.8p 1,428.0p

Dividend adjustment

factor * (b) 1.0025 1.0024 1.0026 1.0020 1.0012 1.0016

---------- --------- -------- -------- --------- -------- --------

Adjusted closing (c =

NAV per share/share a x

price b) 843.8p 877.1p 784.4p 1,383.9p 1,380.4p 1,430.3p

---------- --------- -------- -------- --------- -------- --------

Opening NAV per

share/share price (d) 1,021.8p 1,030.8p 1,026.0p 1,195.1p 1,190.0p 1,137.0p

---------- --------- -------- -------- --------- -------- --------

(c ÷

Total return d)-1 (17.4%) (14.9%) (23.5%) 15.8% 16.0% 25.8%

---------- --------- -------- -------- --------- -------- --------

Principal Risks and Uncertainties

The principal risks facing the Company are financial risk,

private company investments risk, investment strategy risk, climate

and governance risk, discount risk, regulatory risk, custody and

depositary risk, operational risk, leverage risk, political risk

and emerging risks. An explanation of these risks and how they are

managed is set out on pages 9 and 10 of the Company's Annual Report

and Financial Statements for the year to 31 March 2022 which is

available on the Company's website: scottishmortgage.com.

The principal risks and uncertainties have not changed since the

date of that report.

Shareholders will be notified on or around 18 November 2022 that

the Interim Financial Report has been published and will be

available on the Scottish Mortgage page of the Managers' website

scottishmortgageit.com. (++)

None of the views expressed in this document should be construed

as advice to buy or sell a particular investment.

Scottish Mortgage Investment Trust PLC is an actively managed,

low cost investment trust, investing in a concentrated global

portfolio of companies with the aim of maximising its total return

over the long term. It looks for strong businesses with

above-average returns and aims to achieve a greater return than the

FTSE All-World Index (in sterling terms) over a five year rolling

period.

You can find up to date performance information about Scottish

Mortgage on the Scottish Mortgage page of the Managers' website at

scottishmortgageit.com++

++ Neither the contents of the Managers' website nor the

contents of any website accessible from hyperlinks on the Managers'

website (or any other website) is incorporated into, or forms part

of, this announcement.

Scottish Mortgage is managed by Baillie Gifford & Co, the

Edinburgh based fund management group with over GBP 221 billion

under management and advice in active equity and bond portfolios

for clients in the UK and throughout the world (as at 10 November

2022).

Investment Trusts are UK public limited companies and are not

authorised or regulated by the Financial Conduct Authority.

Past performance is not a guide to future performance. The value

of an investment and any income from it is not guaranteed and may

go down as well as up and investors may not get back the amount

invested. This is because the share price is determined by the

changing conditions in the relevant stock markets in which the

Company invests and by the supply and demand for the Company's

shares.

10 November 2022

For further information please contact:

Stewart Heggie, Baillie Gifford & Co

Tel: 0131 275 5117

Jonathan Atkins, Four Communications

Tel: 0203 920 0555 or 07872 495396

Automatic Exchange of Information

In order to fulfil its obligations under UK tax legislation

relating to the automatic exchange of information, Scottish

Mortgage Investment Trust PLC is required to collect and report

certain information about certain shareholders.

The legislation requires investment trust companies to provide

personal information to HMRC on certain investors who purchase

shares in investment trusts. Accordingly, Scottish Mortgage

Investment Trust PLC will have to provide information annually to

the local tax authority on the tax residencies of a number of

non-UK based certificated shareholders and corporate entities.

Shareholders, excluding those whose shares are held in CREST, who

come on to the share register will be sent a certification form for

the purposes of collecting this information.

For further information, please see HMRC's Quick Guide:

Automatic Exchange of Information - information for account holders

gov.uk/government/publications/

exchange-of-information-account-holders.

Third Party Data Provider Disclaimer

No third party data provider ('Provider') makes any warranty,

express or implied, as to the accuracy, completeness or timeliness

of the data contained herewith nor as to the results to be obtained

by recipients of the data. No Provider shall in any way be liable

to any recipient of the data for any inaccuracies, errors or

omissions in the index data included in this document, regardless

of cause, or for any damages (whether direct or indirect) resulting

therefrom.

No Provider has any obligation to update, modify or amend the

data or to otherwise notify a recipient thereof in the event that

any matter stated herein changes or subsequently becomes

inaccurate.