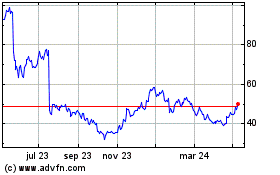

TIDMWJG

RNS Number : 5908A

Watkin Jones plc

23 January 2024

23 January 2024

Watkin Jones plc

(the 'Group')

FY 2023 Results

Well positioned to capitalise on a market recovery

The Group announces its annual results for the year ended 30

September 2023 ('FY23'):

Adjusted Results (1) Statutory Results

FY23 FY22 Change FY23 FY22 Change

(%) (%)

---------- ---------- --------- ----------- ---------- ---------

Revenue GBP413.2m GBP407.1m 1.5% GBP413.2m GBP407.1m 1.5%

---------- ---------- --------- ----------- ---------- ---------

Gross profit GBP34.9m GBP67.6m (48.4)% GBP34.9m GBP67.6m (48.4)%

---------- ---------- --------- ----------- ---------- ---------

Operating profit/(loss) GBP0.2m GBP54.7m (99.6)% GBP(38.0)m GBP24.3m (256.4)%

---------- ---------- --------- ----------- ---------- ---------

(Loss)/profit before

tax GBP(2.9)m GBP48.8m (105.9)% GBP(42.5)m GBP18.4m (331.0)%

---------- ---------- --------- ----------- ---------- ---------

Basic (loss)/earnings

per share (0.6)p 14.8p (104.1)% (12.7)p 5.2p (344.2)%

---------- ---------- --------- ----------- ---------- ---------

Dividend per share 1.4p 7.4p (81.1)% 1.4p 7.4p (81.1)%

---------- ---------- --------- ----------- ---------- ---------

Adjusted net cash(2) GBP43.9m GBP82.6m (46.9)%

---------- ---------- --------- ----------- ---------- ---------

(1) For FY23 Adjusted Operating profit, Adjusted Loss before tax

and Adjusted Basic Loss per share are calculated before the impact

of the exceptional charge of GBP35.0 million for the further costs

of building safety remedial works and restructuring costs of GBP3.1

million

(2) Adjusted net cash is stated after deducting interest bearing

loans and borrowings, but before deducting IFRS 16 operating lease

liabilities of GBP45.2 million at 30 September 2023 (30 September

2022: GBP49.1 million)

Key Highlights

-- Revenue of GBP413.2 million from our previously sold

developments on site and two forward sales

-- Adjusted operating profit of GBP0.2 million, reflecting low

levels of forward sale market activity, together with:

o lower margins across certain in-build schemes as anticipated,

together with additional site-specific costs related to accelerated

completions on two schemes and a third-party contractor

insolvency

o GBP4.6 million book loss on the sale of three PRS assets

o impairment charge of GBP5.5 million on our non-core land bank

and certain pipeline assets which are no longer economically

viable

-- Exceptional charge in the year of GBP38.1 million

o GBP35.0 million further provision for building safety remedial

works. Costs expect to be incurred over a period of up to five

years

o GBP3.1 million one-off restructuring costs associated with

realignment of the Group's cost base, delivering c.GBP4.0 million

of annualised run rate savings

-- End year with c.GBP500 million of contractually secure forward sold revenue

-- Gross and adjusted net cash balance of GBP72.4 million and

GBP43.9 million respectively, reflecting strong cash collections in

the later part of the year and proceeds from non-core asset

sales

-- The Board has decided not to recommend a final dividend in

respect of FY23 given the uncertain market backdrop but remains

committed to its progressive dividend policy as earnings

recover

Outlook: FY24

-- Current secured revenue from previously sold developments, on

site, of c.GBP300 million, covering FY24 cost base

-- Forward fund market showing early signs of recovery as interest rates stabilise

-- All current development schemes on track, supported by

continuing moderation in build cost inflation

-- Guidance for FY24 adjusted operating profit of GBP15-20 million unchanged.

Outlook: Medium term

-- Market leading business operating in the most attractive

segments of the UK residential for rent market, where we continue

to see strong tenant demand and rental growth

-- Significant pent up investor demand and growing allocations for high quality assets

-- Secured development pipeline of GBP1.5 billion (estimated future revenue):

o GBP0.5 billion forward sold; GBP0.3 billion secured with

planning; GBP0.7 billion in planning (of which GBP0.1 billion

secured since the year end)

-- Currently in exclusivity on a further GBP0.4 billion of land

opportunities (subject to planning)

-- Partnership track record, delivery capability and Fresh are material differentiators

-- Strategic focus on extracting more value from the Group's

existing capabilities, through Development Partnerships and Refresh

(refurbishment / repurposing development opportunities).

Alex Pease, Chief Executive Officer of Watkin Jones, said

"Significant cost inflation and volatility in real estate funding

markets meant that FY23 represented a period of unprecedented

challenge for the business. However, I am pleased that against this

backdrop the Group demonstrated resilience and agility, taking a

number of important actions operationally.

Whilst funding conditions remain difficult, the outlook is

gradually improving and the strong asset performance in PBSA and

BTR sectors gives me confidence in the longer-term market recovery

and return to growth. In the near term, we remain focussed on

driving improvements to the productivity and efficiency of the

business, as well as looking at opportunities to extract more value

from our sector expertise and end-to-end capabilities.

Watkin Jones continues to have a market-leading team and

offering to the residential for rent sectors and we are taking the

right steps to ensure we are well placed to capitalise on this, as

conditions improve."

Analyst meeting

A meeting for analysts will be held in person at 11.00am today,

Tuesday 23rd January 2024, at Buchanan, 107 Cheapside, London EC2V

6DN. A copy of the Full Year results presentation is available at

the Group's website: http://www.watkinjonesplc.com

An audio webcast of the meeting with analysts will be available

after 12pm today:

https://stream.buchanan.uk.com/broadcast/65952d93b012a6d30b474616

For further information:

Watkin Jones plc

Alex Pease, Chief Executive Officer Tel: +44 (0) 20 3617 4453

Sarah Sergeant, Chief Financial Officer www.watkinjonesplc.com

Peel Hunt LLP (Nominated Adviser & Joint Corporate Broker) Tel: +44 (0) 20 7418 8900

Mike Bell / Ed Allsopp www.peelhunt.com

Jefferies Hoare Govett (Joint Corporate Broker) Tel: +44 (0) 20 7029 8000

James Umbers/David Sheehan / Paul Bundred www.jefferies.com

Media enquiries:

Buchanan

Henry Harrison-Topham / Steph Whitmore Tel: +44 (0) 20 7466 5000

watkinjones@buchanan.uk.com www.buchanancomms.co.uk

Notes to Editors

Watkin Jones is the UK's leading developer and manager of

residential for rent, with a focus on the build to rent, student

accommodation and affordable housing sectors. The Group has strong

relationships with institutional investors, and a reputation for

successful, on-time-delivery of high quality developments. Since

1999, Watkin Jones has delivered 48,000 student beds across 143

sites, making it a key player and leader in the UK purpose-built

student accommodation market, and is increasingly expanding its

operations into the build to rent sector. In addition, Fresh, the

Group's specialist accommodation management business, manages over

22,000 student beds and build to rent apartments on behalf of its

institutional clients. Watkin Jones has also been responsible for

over 80 residential developments, ranging from starter homes to

executive housing and apartments.

The Group's competitive advantage lies in its experienced

management team and capital-light business model, which enables it

to offer an end-to-end solution for investors, delivered entirely

in-house with minimal reliance on third parties, across the entire

life cycle of an asset.

Watkin Jones was admitted to trading on AIM in March 2016 with

the ticker WJG.L. For additional information please visit

www.watkinjonesplc.com

CHIEF EXECUTIVE OFFICER'S REVIEW

This has been a challenging year and while we performed well

operationally, tough conditions in the investment market combined

with build cost inflation, a third-party contractor liquidation and

acceleration costs to complete certain developments contributed to

weaker financial results.

Although we faced severe headwinds this year, we remain a

resilient business with leadership positions in highly attractive

markets. The supply and demand dynamics in both BTR and PBSA are

more attractive than ever, with a genuine shortage of

accommodation. This is resulting in very high occupancy levels,

good letting and retention rates, and robust rental growth. At the

same time, economic conditions and planning challenges mean less

stock is being delivered. In PBSA for example, only 12,000 new beds

have been delivered for 2023/24, well down on previous years.

Higher interest rates and economic uncertainty resulted in the

investment market being effectively closed for much of the year but

there is still significant institutional capital waiting to be

allocated to residential for rent. Asset values have remained

relatively steady, as higher rental income has compensated for

softer yields. Combined with less new stock coming through, these

factors should help the investment market gradually rebound.

Performance

We delivered a good operational performance in FY23, completing

four schemes to our high quality standards. One further development

completed following the year end. We also continued to acquire

sites and progress them through planning.

Build cost inflation was a significant challenge. Although it

has eased as the year progressed, several projects completing this

year had been priced and forward sold prior to the unprecedented

build cost inflation and this caused erosion of margin. We worked

in partnership with our supply chain to manage this and limit its

impact on our developments as far as possible. In addition, we

incurred additional costs at our co-living scheme in Exeter, where

the main contractor went into liquidation during 2023. This

required us to step in, which our self -- build expertise enabled

us to do quickly and effectively. The scheme reached practical

completion in September 2023. We also decided to exercise caution

in the prevailing market conditions and not accelerate the

development of some pipeline assets.

Overall, revenue was GBP413.2 million (FY22: GBP407.1 million),

up 1.5%. Gross profit declined to GBP34.9 million (FY22: GBP67.6

million), while adjusted operating profit before exceptional items

was GBP0.2 million (FY22: GBP54.7 million), reflecting the

reduction in forward sales, lower margins across certain in-build

schemes as anticipated, the impairment of our non-core land bank

and certain pipeline assets and the book loss on disposal of the

non-core private rented sector assets. At the year end, we had

adjusted net cash of GBP43.9 million and total cash and available

facilities of GBP103.6 million, meaning the Group remains soundly

financed. We were also pleased to extend the maturity of our bank

facility to November 2025.

BTR was the largest contributor to our results, reflecting

progress with the developments under construction and modest

revenues from a forward sale. PBSA saw revenue decline, due to the

number of sites in-build and the stage of their development, and

the completion of only one forward sale in the year. Fresh, our

accommodation management business, performed well, with higher

revenues and an attractive gross margin.

Strategy

Our strategic focus is on growing our presence in residential to

rent, driving operational efficiency and ensuring we are a

responsible business. While our strategic direction is the right

one, we also recognise the need to adapt it to the conditions we

face.

We are therefore looking at every aspect of our business to

ensure we optimise our margin and performance. For example, we have

further improved the way we manage procurement to maximise buying

benefits, revamped our design guides for schemes to ensure

efficiency and consistency, and continued to build the connections

between our teams to increase operational effectiveness.

We are also determined to be well positioned to rebuild our

pipeline when market conditions turn, as we did successfully coming

out of both the global financial crisis and the pandemic. We will

be very disciplined in doing so and expect to see good

opportunities to acquire sites as land prices reduce. Alongside

securing sites on our usual subject-to-planning basis, we will

explore the potential to partner with capital providers on land

with existing planning. This has the dual advantage of lower risk

and increased speed for bringing developments forward.

The two forward sales we completed in the year demonstrated our

ability to act quickly in the brief periods the market was open,

but we also want to be entrepreneurial and creative in our approach

to the investment market. This means looking at more innovative

transaction structures, while still delivering a high return on

capital employed.

More broadly, we see potential in opening up additional revenue

streams. Examples include helping our institutional clients to

refurbish their older housing stock to meet residents' needs, while

also making the buildings safer and more environmentally efficient.

This has the benefit of generating revenue without additional

investment, and leveraging our existing skill set.

Sustainability

We have continued to successfully implement our Future

Foundations sustainability strategy, which sets out our approach to

our people, the places we build and our impact on the planet.

We look to maintain a positive culture and our people approach

is informed by our employee engagement survey. During the year, we

focused on providing better training and development opportunities,

recognising people's efforts and celebrating inspirational

performance. Our Star Awards are one such initiative. These reward

exceptional contributions from colleagues across a range of

categories. I am also pleased that we have maintained our

exceptional health and safety record, with an incident rate of just

4.9% of the industry average in FY23.

The places we develop continue to evolve. We are designing

buildings to higher environmental standards than ever before, and

we have evolved our specification both to standardise our products

and to take account of feedback from institutional clients and

residents. In particular, the feedback we receive from Fresh

residents is an important advantage for us.

From an environmental perspective, we are on a journey to net

zero and have further refined our understanding of our carbon

emissions during the year. We have published our assessment of the

climate -- related risks and opportunities facing the Company and

our climate -- related financial disclosure statement can be found

within the Watkin Jones plc Annual Report for the year ended 30

September 2023 .

Building safety

It goes without saying that the safety of our buildings is

paramount. We increased our building safety provision during the

year, following the evolution of government initiatives, greater

access to properties identified as being at risk, the receipt of

fire safety reports, related cost estimates, and the evolution and

conclusion of legal proceedings and settlement and contribution

agreements with building owners.

The remedial works for properties included in our building

safety provision are progressing well. We remain committed to

working collaboratively with building owners and leaseholders to

address issues with these legacy buildings.

Outlook

We continue to operate in the most attractive segments of the

residential for rent market, with strong tenant demand and rental

growth in our core PBSA and BTR sectors.

In the short term, current secured revenue of circa GBP300

million from previously sold developments is expected to cover our

FY24 cost base. All developments under construction are on track,

supported by continuing moderation in build cost inflation. Our

secured development pipeline stands at GBP1.5 billion.

Encouragingly, the forward fund market is showing early signs of

recovery as interest rates stabilise. Should interest rates trend

downwards, we anticipate that there will be growing investor demand

and capital allocations for high quality assets in our sectors.

While we remain focused on our core forward fund model, we will

look at potential opportunities to diversify our revenue streams

through development partnerships and refurbishment opportunities

for institutional clients. This should generate revenue and margin

without requiring significant capital investment.

Finally, on a personal note, I would like to thank the Board for

giving me the opportunity to lead this Company. I have worked at

Watkin Jones for 13 years and can confidently say that it is a

fantastic business with extremely dedicated and talented

colleagues. I am incredibly proud to be its Chief Executive

Officer.

I would also like to thank my colleagues for their support, both

to me personally as I have taken on my new role, and to the

business during what has been a challenging year. I am confident

that we are well placed to take advantage of a recovery once

markets improve.

Alex Pease

Chief Executive Officer

23 January 2024

OPERATIONAL REVIEW

Build To Rent

BTR apartments by estimated year of practical

completion

-----------------------------------------------------

Total pipeline FY24 FY25 FY26 FY27

---------------------------------- --------------------- ------ ------ ------- -----

Forward sold 2,907 672 809 1,110 316

Forward sales in the market 70 - - 70 -

Sites secured subject to planning 625 - - 230 395

---------------------------------- --------------------- ------ ------ ------- -----

Total secured 3,602 672 809 1,410 711

---------------------------------- --------------------- ------ ------ ------- -----

Total revenues for the year were GBP207.7 million (FY22:

GBP191.2 million), up 8.6%.

Revenues included the build-out of our forward sold developments

in Hove, Lewisham, Birmingham and Leatherhead, and a development

partnership scheme in Cardiff. Subsequent to the year end Hove

reached practical completion and we handed over one block at

Lewisham to the client.

We also forward sold a development in Belfast, which includes

627 BTR units and 81 social rent affordable homes. Construction on

this development will start meaningfully in FY24 and the

contribution to FY23 was restricted to a small profit on the land

transaction, as expected.

In FY23, we did not acquire or secure planning on any sites. The

current secured development pipeline for BTR is shown in the table

above.

The secured development pipeline has an estimated future revenue

value to us of c.GBP0.6 billion (FY22: GBP1.0 billion), of which

c.GBP447 million is currently forward sold (FY22: GBP517

million).

Gross profit for the year was GBP19.8 million (FY22: GBP32.8

million), a decrease of 39.6%. The gross margin was 9.5% (FY22:

17.2%), reflecting the lower margin of the schemes we forward sold

towards the end of FY22 and the impact of build cost inflation.

The affordable housing business, which relates to single-family

homes, achieved 36 sales completions (FY22: 40) and delivered

revenue of GBP19.6 million (FY22: GBP14.5 million) and gross profit

of GBP1.9 million (FY22: GBP1.9 million), as we continued to

progress our developments in Crewe and Preston.

Student Accommodation

PBSA beds by estimated year of practical completion

Total pipeline FY24 FY25 FY26 FY27 onwards

---------------------------------- ------------------- ------- ----- ----- ---------------

Forward sold 1,601 1,601 - - -

Forward sales in the market 1,510 - 260 727 523

Sites secured subject to planning 2,919 - - - 2,919

---------------------------------- ------------------- ------- ----- ----- ---------------

Total secured 6,030 1,601 260 727 3,442

---------------------------------- ------------------- ------- ----- ----- ---------------

Revenues from PBSA were GBP175.7 million (FY22: GBP180.0

million), down 2.4%. During the year, we delivered four

developments, comprising student schemes in Edinburgh, Colchester

and Swansea, and a 133-unit co-living scheme in Exeter.

We also forward sold one development, an 819-bed scheme in

Bedminster, Bristol, for delivery in FY24. The development is in a

key regeneration area and has strong environmental credentials,

with a target BREEAM rating of Excellent.

Gross profit for the year was GBP11.4 million (FY22: GBP26.4

million), resulting in a gross margin of 6.5% (FY22: 14.7%). The

reduction in margin was in part due to additional build costs on

the Exeter scheme, where the third-party main contractor went into

liquidation, and acceleration costs required to achieve completion

on certain schemes. In Exeter our self-build capabilities enabled

us to step in quickly and effectively, to minimise the delay and

deliver to the revised timetable agreed with the client. Build cost

inflation also reduced the margin on some schemes during the

year.

In FY23, we acquired 2 sites and secured planning on 2 sites,

with the potential to deliver around 590 beds. The current secured

development pipeline for PBSA is shown in the table above.

The secured development pipeline has an estimated future revenue

value to us of c.GBP0.9 billion (FY22: GBP1.0 billion), of which

c.GBP60 million is currently forward sold (FY22: GBP130

million).

Accommodation Management

Key statistics

Student beds and BTR apartments under management

23,064

FY23

22,896

FY22

Net promoter scores

+35

FY23

+34

FY22

Revenues in Fresh were GBP9.5 million (FY22: GBP9.1 million).

The growth reflects increased variable fee income related to higher

student occupancy, as well as the number of student beds and BTR

apartments under management at the start of FY23 (22,896) compared

to FY22 (22,155).

Gross profit rose to GBP6.0 million (FY22: GBP5.9 million), at a

margin of 63.2% (FY22: 64.8%).

Fresh took on two new student schemes with 500 beds in the year

and finished FY23 with 23,064 units under management across 71

schemes. However, 6,800 student beds left Fresh management in

October 2023, to be managed in-house by clients. These losses are

partially offset by new contract wins, leaving Fresh with

approximately 19,000 units under management across 71 schemes at

the start of FY24.

During the year, Fresh introduced a new delivery model to

enhance its focus on residents and clients, ensure clear

accountability within the organisation, support the ability to

scale, and offer career paths to retain talent. Fresh also

continued to develop the Yardi property management software

introduced in the prior year, in particular to refine it for the

student market.

The business has developed its branding, putting in place the

Fresh Student and Fresh Renting brands, to support online searches

and reflect the differing needs of the two sectors. Fresh has also

created a white-label offering, which is seeing strong interest

from clients and allows, for example, the development of branding

for individual buildings for BTR clients.

Fresh has continued to support its student residents, focusing

on the Be wellbeing programme. This is reflected in its record net

promoter score of +35 (FY22: +34) and the award of Platinum status

in the Global Student Living Index and winning Best Student Private

Housing Provider for the third year in a row. The Be wellbeing

programme won the prestigious Health and Wellbeing Award at the

Property Week Student Housing Awards.

FINANCIAL REVIEW

Revenue

Revenue of GBP413.2 million was delivered in the year,

increasing 1.5% from GBP407.1 million in FY22, despite the subdued

market conditions for forward sales. Our position was however

cushioned by secured revenues from forward sales completed in prior

years.

BTR development revenues grew by 8.6% to GBP207.7 million (FY22:

GBP191.2 million), with revenues from our existing portfolio of

developments supplemented by the forward sale of our new project at

Titanic Quarter, Belfast during the year.

Revenues from our PBSA development business were GBP175.7

million (FY22: GBP180.0 million), a decrease of 2.4%, with four

schemes completed and our new development in Bedminster forward

sold during the year. PBSA revenues also include the rental income

from our four leased student accommodation assets. The rental

income on these was GBP9.0 million (FY22: GBP13.6 million), a

decrease of 33.8%, with the impact of the prior year disposal of

two assets offset by continued strong student occupancy at our

remaining sites.

The Affordable Homes business delivered revenues of GBP19.6

million, up 35.2% on the GBP14.5 million recorded in FY22 as plots

reach completion at both our Preston and Crewe developments.

Fresh, our Accommodation Management business, achieved record

revenues of GBP9.5 million (FY22: GBP9.1 million), with further

increases to occupancy levels across its portfolio.

Operating profit

Gross profit for the year was GBP34.9 million (FY22: GBP67.6

million), a decrease of 48.4%, both as a result of trading

performance described below and the impact of impairments to land

assets in the period of GBP5.5 million. We re-assessed the carrying

value of our non-core land bank as well as certain pipeline assets

on the balance sheet, where early stage development opportunities

were strategically aborted in response to volatile market

conditions. This resulted in a decreased gross margin of 8.4%

(FY22: 16.6%).

Both our BTR and PBSA segments have been impacted by the

reduction in forward sales compared to the prior year, supply chain

pressures and build cost inflation, and acceleration costs required

to achieve completion on certain of our schemes.

BTR development gross profit decreased by 39.6% in the year to

GBP19.8 million (FY22: GBP32.8 million), with gross margin

softening to 9.5% (FY22: 17.2%). Gross profit from PBSA development

was GBP11.4 million (FY22: GBP26.4 million), with gross margin of

6.5% (FY22: 14.7%). The decrease reflected incremental costs at our

scheme in Exeter due to the main contractor going into liquidation,

as well as acceleration costs to physically complete a number of

schemes in the summer.

In Affordable Homes, gross profit was GBP1.9 million (FY22:

GBP1.9 million), with a reduced gross margin of 9.7% (FY22: 13.2%)

reflecting the impact of build cost inflation and an increase in

the sales mix of affordable units.

Fresh generated a gross profit of GBP6.0 million (FY22: GBP5.9

million) with the gross margin remaining broadly flat at 63.1%

(FY22: 64.8%).

During the year, we completed the disposal of a portfolio of

non-core private rental sector (PRS) assets on an accelerated

timetable ahead of the completion of remedial works, to allow the

business to focus on its strategic priorities.

This disposal resulted in gross anticipated cash receipts of

GBP17.2 million before repayment of associated borrowings, of which

GBP1.9 million is deferred to next year. A book loss on disposal of

GBP4.6 million was recorded within administrative expenses.

Administrative expenses increased to GBP72.8 million (FY22:

GBP43.4 million) with the effect of this disposal and exceptional

items recorded in the year.

Excluding the impact of the above loss on disposal and the

profit on disposal of investment properties in the year ended 30

September 2022, administrative expenses before exceptional items

decreased by 3.5% to GBP30.1 million (FY22: GBP31.2 million),

reflecting the impact of the cost out programme implemented during

the year.

Adjusted operating profit of GBP0.2 million (FY22: GBP54.7

million) reflects the reduction in new forward sales across the BTR

and PBSA segments, and both the impairment of land assets and the

loss on disposal of the PRS assets. The Group's operating loss was

GBP38.0 million (FY22: operating profit of GBP24.3 million)

including the impact of exceptional items in the year.

Exceptional items

An exceptional provision of GBP35.0 million has been made for

remedial costs associated with building safety matters, on which

further details are included in note 4. This is in addition to

provisions made in prior years as a consequence of:

-- the introduction of secondary legislation and the evolution

of government initiatives during 2023, bringing a further four

properties into the provision.

-- further access to and intrusive surveys conducted on relevant

buildings, the receipt of fire safety reports and related cost

estimates, alongside further experience of completing the

works.

-- the evolution and conclusion of legal proceedings, settlement

and contribution agreements with building owners during the

year.

This is a highly complex area with significant estimates in

respect of the cost of remedial works, the quantum of any legal

expenditure associated with the defence of the Group's position in

this regard, and the extent of those properties within the scope of

the applicable government guidance and legislation, which continue

to evolve. All our buildings were signed off by approved inspectors

as compliant with the relevant building regulations at the time of

completion. The investigation of the works required at many of the

buildings is at an early stage and therefore it is possible that

these estimates may change over time or if government legislation

and regulation further evolves.

One of the areas we also looked at during the year was

management of the Group's cost base. This resulted in a reduction

in headcount and GBP3.1 million of one-off restructuring costs in

the year.

Finance costs

Finance costs for the year were GBP5.0 million (FY22: GBP6.0

million). These costs relate to the finance cost of capitalised

leases under IFRS 16, which totalled GBP1.8 million (FY22: GBP4.5

million), which decreased following the disposal of the Dunaskin

and New Bridewell student leasehold properties in the prior year,

and the impact of the exceptional charge of GBP1.5 million (FY22:

GBPnil) for the unwind of the discounting of the building safety

provision made in prior periods. The balance of our finance costs

represents the fees associated with the availability of our

revolving credit facility (RCF) with HSBC and the interest cost of

the loans previously held with Svenska Handelsbanken AB.

Loss before tax

Loss before tax for the year was

GBP42.5 million (FY22: profit before tax of GBP18.4 million).

Adjusted loss before tax, which excludes the impact of the

exceptional items, was GBP2.9 million (FY22: adjusted profit before

tax of GBP48.8 million).

Taxation

The corporation tax credit was GBP9.9 million (FY22: charge of

GBP5.0 million). The effective tax rate of 23% (FY22: 27%) was more

than the standard UK corporation tax rate of 22% for the year,

primarily as a result of the remeasurement of deferred tax assets

to the future UK corporation tax rate of 25% which will be

effective when those assets are expected to unwind.

Information on our tax strategy can be found in the Investor

section of our website, watkinjonesplc.com.

Earnings per share

Basic earnings per share from continuing operations for the year

was a loss of 12.7 pence (FY22: earnings of 5.2 pence). Adjusted

basic earnings per share, which excludes the impact of the

exceptional items, was a loss of 0.6 pence (FY22: earnings of 14.8

pence).

Dividends

The Board proposed an interim dividend of 1.4 pence per share

(FY22: 2.9 pence per share) which was paid in June 2023.

Since then, we have continued to face into a very challenging

end market. As such, the Board decided that there will be no

further dividend paid in respect of FY23. This gives a total

dividend for the year of 1.4 pence per share (FY22: 7.4 pence per

share).

At 30 September 2023, the Company had distributable reserves of

GBP41.1 million available to pay dividends.

EBITDA

EBITDA, which is calculated as set out below, was a loss of

GBP21.0 million (FY22: profit of GBP14.5 million) after the

inclusion of exceptional items of GBP38.1 million (FY22: GBP30.4

million). Adjusted EBITDA, which excludes exceptional items, was

GBP17.2 million (FY22: GBP44.8 million), with an adjusted EBITDA

margin of 4.2% (FY22: 11.0%).

Return on capital employed

The return on capital employed (ROCE) for the year, calculated

as set out below, was impacted by the lower operating profit in the

period at 0.2% (FY22: 63.1%).

Statement of financial position

At 30 September 2023, non-current assets amounted to GBP60.2

million (FY22: GBP49.6 million), with the most significant item

being the carrying value of the leased student accommodation

investment properties amounting to GBP24.2 million (FY22: GBP27.3

million).

The deferred tax asset, predominantly relating to carried

forward losses from the year ended 30 September 2023, amounted to

GBP12.1 million (FY22: GBP1.9 million) and is expected to be fully

utilised in the short to medium term.

Right -- of -- use assets relating to office and car leases

amounted to GBP5.3 million (FY22: GBP4.7 million). Intangible

assets relating to Fresh amounted to GBP11.6 million (FY22: GBP12.2

million) and were reduced by the amortisation charge of GBP0.6

million in the year.

Reimbursement assets related to agreed client contributions

towards building safety remedial costs of GBP10.9m have been

recognised in the period (FY22: GBPnil).

Inventory and work in progress was GBP123.5 million (FY22:

GBP147.1 million), with the decrease reflecting the forward sale

during the period of our Bedminster PBSA site and the disposal of

our PRS assets, offset by investment in new land sites for

development in Guildford and Bristol.

Contract assets increased significantly in the year to GBP66.4

million (FY22: GBP50.8 million). These mainly relate to the final

payment balances which are received on completion of developments

in build. The increase in the year reflects the increased

contributions from BTR developments which typically have a longer

construction period and don't reach practical completion dates just

prior to the Group's year end as PBSA developments typically do.

Contract liabilities reduced by GBP3.6 million during the year to

GBP1.5 million.

The Building Safety provision of GBP65.6 million is

predominantly classified as non -- current liabilities, based on

our anticipated expenditure over the next five years. The increase

in the provision of GBP32.2 million includes an additional

exceptional provision made in the year (considered in the review of

'Exceptional items' above) and the utilisation of the brought --

forward provision.

Interest-bearing loans and borrowings stood at GBP28.5 million

at 30 September 2023 (FY22: 28.3 million).

Cash and net debt

FY23 FY22

GBPm GBPm

-------------------------------------------- ------ ------

Operating profit before exceptional items 0.2 54.7

Profit on disposal of fixed assets (0.3) (20.9)

Depreciation and amortisation 11.5 8.4

Increase in working capital (28.6) (61.7)

Finance costs paid (2.8) (5.8)

Tax paid (11.5) (1.6)

-------------------------------------------- ------ ------

Net cash outflow from operating activities (31.5) (26.9)

Sale of fixed assets 15.0 11.6

Dividends paid (15.1) (21.8)

Payment of lease liabilities (6.8) (4.7)

Cash flow from borrowings - 16.3

-------------------------------------------- ------ ------

Decrease in cash (38.4) (25.5)

Cash at beginning of year 110.8 136.3

-------------------------------------------- ------ ------

Cash at end of year 72.4 110.8

Less: borrowings (28.5) (28.2)

-------------------------------------------- ------ ------

Net cash before deducting lease liabilities 43.9 82.6

Less: lease liabilities (45.2) (49.1)

-------------------------------------------- ------ ------

Net (debt)/cash (1.3) 33.5

-------------------------------------------- ------ ------

Total cash and available facilities

FY23 FY22

GBPm GBPm

-------------------------- ------ ------

Cash and cash equivalents 72.4 110.8

Revolving credit facility

(RCF) 50.0 100.0

Drawn balance on RCF (28.8) (24.8)

Overdraft 10.0 10.0

-------------------------- ------ ------

Total cash and available

facilities 103.6 196.0

-------------------------- ------ ------

Lease liabilities arising from the adoption of IFRS 16 'Leases'

in the prior year were reduced by GBP3.9 million to GBP45.2 million

(FY22: GBP49.1 million), reflecting capital repayments made in the

year offset by indexed rent increases on our student leased

investment properties.

At the year end, we had a cash balance of GBP72.4 million and

loans of GBP28.5 million, resulting in a net cash position of

GBP43.9 million. At 30 September 2022, we had a cash balance of

GBP110.8 million and loans of GBP28.2 million, resulting in a net

cash position of GBP82.6 million.

Net cash balances are stated before deducting the lease

liabilities of GBP45.2 million (30 September 2022: GBP49.1

million), arising as a result of applying IFRS 16.

The lease liabilities relate primarily to several historic

student accommodation sale and leaseback properties, for which the

future lease rental liabilities are expected to be substantially

covered by the future net student rental incomes to be

received.

In a typical year, the Group's cash balance peaks around the

year end, as we receive the final payments on student accommodation

developments completing ahead of the new academic year, as well as

initial proceeds from the latest forward sales.

The Group is then a net user of cash until the following year

end, as a result of outflows such as tax and dividend payments,

overhead costs and land purchases. However, in FY24, as a result of

the physical completions of some of our BTR developments, we will

be receiving these final payments throughout the year and therefore

the profile will be more evenly spread than in previous years.

The cash balance at the year end is still important for funding

our day -- to -- day cash requirements and for putting the Group in

a strong position when bidding for new sites.

The Group's net cash outflow from operating activities for the

year was GBP31.5 million (FY22: outflow of GBP26.9 million),

reflecting investment in new development sites and the stages of

development of sites under construction.

Net finance costs paid totalled GBP2.8 million (FY22: GBP5.8

million), including the finance charges on the capitalised lease

liabilities of GBP1.8 million (FY22: GBP4.5 million), which

substantially reduced following the disposal of certain leased

student accommodation investment properties in the prior year.

Dividends paid in the year totalled GBP15.1 million (FY22:

GBP21.8 million). Dividends paid in FY23 comprised the final

dividend for FY22 and the interim dividend for FY23.

Bank facilities

During the year the Group extended its RCF with HSBC for a

further six months to run to November 2025 in order to allow the

borrowings and forward sales markets time to stabilise following

recent volatility. It has a maximum available facility of GBP50.0

million (30 September 2022: GBP100.0 million), of which GBP28.8

million was drawn against the facility at the year end (30

September 2022: GBP24.8 million), giving headroom of GBP21.2

million. This facility can be accessed to fund land acquisitions

and development works. The total facility was reduced during the

year, given the anticipated volume of land acquisitions, and to

benefit from lower non-utilisation fees.

We also have an undrawn overdraft facility of GBP10.0 million.

Total cash and available facilities at 30 September 2023 therefore

stood at GBP103.6 million (FY22: GBP196.0 million).

On disposal of the PRS assets during the year ended 30 September

2023, the Group repaid its associated loan facilities with Svenska

Handelsbanken AB. The outstanding balance at the year end was

therefore GBPnil (30 September 2022: GBP4.0 million).

Going concern

We have undertaken a thorough review of the Group's ability to

continue to trade as a going concern for the period to 31 January

2025. The basis of the review and an analysis of the downside risks

is set out in note 2.1.

Alternative performance measures (APMs)

We use APMs as part of our financial reporting, alongside

statutory reporting measures. These APMs are provided for the

following reasons:

1) to present users of the annual report with a clear view of

what we consider to be the results of our underlying operations,

enabling consistent comparisons over time and making it easier for

users of the report to identify trends;

2) to provide additional information to users of the annual

report about our financial performance or position;

3) to show the performance measures used by the Board in

determining dividend payments; and

4) to show the performance measures that are linked to

remuneration for the Executive Directors.

The following APMs appear in this annual report

Reconciliation

----------------------------------------------------------------

FY23 FY22

Reason for use GBP'000 GBP'000

------------------------------------ -------------- ---------------------------------- ------------- -------------

Adjusted operating profit 1 Operating (loss)/profit (37,970) 24,319

Add: exceptional items in

administrative expenses 38,140 30,365

---------------------------------- ------------- -------------

Adjusted operating profit 170 54,684

------------------------------------ -------------- ---------------------------------- ------------- -------------

Adjusted (loss)/profit before tax 1,4 (Loss)/profit before tax (42,459) 18,393

Add: exceptional items 39,598 30,365

---------------------------------- ------------- -------------

Adjusted (loss)/profit before tax (2,861) 48,758

------------------------------------ -------------- ---------------------------------- ------------- -------------

Adjusted basic (loss)/earnings per

share 1,3,4 (Loss)/profit after tax (32,547) 13,414

Add: exceptional items 39,598 30,365

Less: tax on exceptional items (8,716) (5,769)

---------------------------------- ------------- -------------

Adjusted (loss)/profit after tax (1,665) 38,010

Weighted average number of shares 256,434,903 256,385,882

---------------------------------- ------------- -------------

Adjusted basic (loss)/earnings per (0.649) pence 14.825 pence

share

------------------------------------ -------------- ---------------------------------- ------------- -------------

EBITDA 1 Operating (loss)/profit (37,970) 24,319

Add: share of loss in joint

ventures (13) (16)

Add: impairment of land assets 5,496 -

Add: loss/(profit) on disposal of

non-core assets 4,584 (18,253)

Add: depreciation 6,388 7,852

Add: amortisation 559 559

---------------------------------- ------------- -------------

EBITDA (20,956) 14,461

------------------------------------ -------------- ---------------------------------- ------------- -------------

Adjusted EBITDA 1 EBITDA (20,956) 14,461

Add: exceptional items in

administrative expenses 38,140 30,365

---------------------------------- ------------- -------------

Adjusted EBITDA 17,184 44,826

------------------------------------ -------------- ---------------------------------- ------------- -------------

Adjusted net cash 2 Net cash/(debt) (1,294) 33,454

Add: lease liabilities 45,195 49,099

---------------------------------- ------------- -------------

Adjusted net cash 43,901 82,553

------------------------------------ -------------- ---------------------------------- ------------- -------------

Return on capital employed 1,2 Adjusted operating profit 170 54,684

---------------------------------- ------------- -------------

Net assets at 30 September 130,005 176,953

Less: adjusted net cash (43,901) (82,553)

Less: intangible assets (11,606) (12,165)

Less: investment property (leased) (24,240) (27,331)

Less: right-of-use assets (5,276) (4,738)

Add: lease liabilities 45,195 49,099

---------------------------------- ------------- -------------

Adjusted net assets at 30

September 90,177 99,265

Adjusted net assets at 1 October 99,265 73,972

---------------------------------- ------------- -------------

Average adjusted net assets 94,721 86,619

---------------------------------- ------------- -------------

Return on capital employed 0.2% 63.1%

------------------------------------ -------------- ---------------------------------- ------------- -------------

Sarah Sergeant

Chief Financial Officer

23 January 2024

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the year ended 30 September 2023

Year ended 30 September 2023 Year ended 30 September 2022

----------------------------------- -----------------------------------

Before Before

Exceptional exceptional Exceptional exceptional

items items Total items items Total

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------- ----- ----------- ----------- --------- ----------- ----------- ---------

Continuing operations

Revenue 5 413,236 - 413,236 407,076 - 407,076

Cost of sales (378,377) - (378,377) (339,450) - (339,450)

------------------------------------- ----- ----------- ----------- --------- ----------- ----------- ---------

Gross profit 34,859 - 34,859 67,626 - 67,626

Administrative expenses 6 (34,689) (38,140) (72,829) (12,942) (30,365) (43,407)

------------------------------------- ----- ----------- ----------- --------- ----------- ----------- ---------

Operating profit/(loss) 170 (38,140) (37,970) 54,684 (30,365) 24,319

Share of loss in joint ventures (13) - (13) (16) - (16)

Finance income 496 - 496 72 - 72

Finance costs (3,514) (1,458) (4,972) (5,982) - (5,982)

------------------------------------- ----- ----------- ----------- --------- ----------- ----------- ---------

(Loss)/profit before tax (2,861) (39,598) (42,459) 48,758 (30,365) 18,393

Income tax credit/(expense) 8 1,196 8,716 9,912 (10,778) 5,769 (4,979)

------------------------------------- ----- ----------- ----------- --------- ----------- ----------- ---------

(Loss)/profit for the year

attributable to ordinary equity

holders of the parent (1,665) (30,882) (32,547) 37,980 (24,596) 13,414

------------------------------------- ----- ----------- ----------- --------- ----------- ----------- ---------

Other comprehensive income

That will not be reclassified to

profit or loss in subsequent periods:

Net (loss)/gain on equity instruments

designated at fair value through

other comprehensive

income, net of tax (188) - (188) 157 - 157

------------------------------------- ----- ----------- ----------- --------- ----------- ----------- ---------

Total comprehensive (loss)/income for

the year attributable to ordinary

equity holders of

the parent (1,853) (30,882) (32,735) 38,137 (24,596) 13,571

------------------------------------- ----- ----------- ----------- --------- ----------- ----------- ---------

Pence Pence Pence Pence Pence Pence

------------------------------------- ----- ----------- ----------- --------- ----------- ----------- ---------

Earnings per share for the year

attributable to ordinary equity

holders of the parent

Basic (loss)/earnings per share 9 (0.649) (12.043) (12.692) 14.825 (9.593) 5.232

------------------------------------- ----- ----------- ----------- --------- ----------- ----------- ---------

Diluted (loss)/earnings per share 9 (0.649) (12.043) (12.692) 14.748 (9.543) 5.205

------------------------------------- ----- ----------- ----------- --------- ----------- ----------- ---------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

as at 30 September 2023

30 September 30 September

2023 2022

Notes GBP'000 GBP'000

------------------------------------------------ ----- ------------ ------------

Non-current assets

Intangible assets 11,606 12,165

Investment property (leased) 24,240 27,331

Right-of-use assets 5,276 4,738

Property, plant and equipment 1,796 2,009

Investment in joint ventures 1 1

Reimbursement assets 4,007 -

Deferred tax assets 12,096 1,941

Other financial assets 1,129 1,366

------------------------------------------------ ----- ------------ ------------

60,151 49,551

------------------------------------------------ ----- ------------ ------------

Current assets

Inventory and work in progress 123,516 147,118

Contract assets 66,368 50,821

Trade and other receivables 35,104 28,628

Reimbursement assets 11 6,858 -

Current tax receivable 7,088 -

Cash and cash equivalents 72,431 110,841

------------------------------------------------ ----- ------------ ------------

311,365 337,408

------------------------------------------------ ----- ------------ ------------

Total assets 371,516 386,959

------------------------------------------------ ----- ------------ ------------

Current liabilities

Trade and other payables (100,723) (89,717)

Contract liabilities (1,469) (5,052)

Interest-bearing loans and borrowings - -

Lease liabilities (7,567) (6,248)

Provisions 11 (24,457) (7,713)

Current tax liabilities - (4,402)

------------------------------------------------ ----- ------------ ------------

(134,216) (113,132)

------------------------------------------------ ----- ------------ ------------

Non-current liabilities

Interest-bearing loans and borrowings (28,530) (28,288)

Lease liabilities (37,628) (42,851)

Provisions 11 (41,137) (25,735)

------------------------------------------------ ----- ------------ ------------

(107,295) (96,874)

------------------------------------------------ ----- ------------ ------------

Total liabilities (241,511) (210,006)

------------------------------------------------ ----- ------------ ------------

Net assets 130,005 176,953

------------------------------------------------ ----- ------------ ------------

Equity

Share capital 2,564 2,564

Share premium 84,612 84,612

Merger reserve (75,383) (75,383)

Fair value reserve of financial assets at FVOCI 425 662

Share -- based payment reserve 1,407 526

Retained earnings 116,380 163,972

------------------------------------------------ ----- ------------ ------------

Total equity 130,005 176,953

------------------------------------------------ ----- ------------ ------------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the year ended 30 September 2023

Fair value

reserve of

financial Share-based

Share Share Merger assets at payment Retained

capital premium reserve FVOCI reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------------------- ------- ------- -------- ---------- ----------- -------- --------

Balance at 30 September 2021 2,562 84,612 (75,383) 536 2,824 169,660 184,811

--------------------------------------------- ------- ------- -------- ---------- ----------- -------- --------

Profit for the year - - - - - 13,414 13,414

Other comprehensive income - - - 126 - 31 157

--------------------------------------------- ------- ------- -------- ---------- ----------- -------- --------

Total comprehensive income - - - 126 - 13,445 13,571

--------------------------------------------- ------- ------- -------- ---------- ----------- -------- --------

Share-based payments 2 - - - 209 - 211

Recycled reserve for fully vested share-based

payment schemes - - - - (2,507) 2,507 -

Deferred tax debited directly to equity - - - - - 141 141

Dividend paid - - - - - (21,781) (21,781)

--------------------------------------------- ------- ------- -------- ---------- ----------- -------- --------

Balance at 30 September 2022 2,564 84,612 (75,383) 662 526 163,972 176,953

--------------------------------------------- ------- ------- -------- ---------- ----------- -------- --------

Loss for the year - - - - - (32,547) (32,547)

Other comprehensive income - - - (237) - 49 (188)

--------------------------------------------- ------- ------- -------- ---------- ----------- -------- --------

Total comprehensive income - - - (237) - (32,498) (32,735)

--------------------------------------------- ------- ------- -------- ---------- ----------- -------- --------

Share-based payments - - - - 1,067 - 1,067

Recycled reserve for fully vested share-based

payment schemes - - - - (186) 186 -

Deferred tax debited directly to equity - - - - - (151) (151)

Dividend paid - - - - - (15,129) (15,129)

--------------------------------------------- ------- ------- -------- ---------- ----------- -------- --------

Balance at 30 September 2023 2,564 84,612 (75,383) 425 1,407 116,380 130,005

--------------------------------------------- ------- ------- -------- ---------- ----------- -------- --------

CONSOLIDATED STATEMENT OF CASH FLOWS

for the year ended 30 September 2023

Year ended Year ended

30 September 30 September

2023 2022

Notes GBP'000 GBP'000

--------------------------------------------------------------------- ----- ------------ ------------

Cash flows from operating activities

Cash outflow from operations 12 (17,215) (19,592)

Interest received 496 72

Interest paid (3,315) (5,782)

Tax paid (11,466) (1,557)

--------------------------------------------------------------------- ----- ------------ ------------

Net cash outflow from operating activities (31,500) (26,859)

--------------------------------------------------------------------- ----- ------------ ------------

Cash flows from investing activities

Acquisition of property, plant and equipment (550) (660)

Proceeds on disposal of property, plant and equipment 210 4,341

Proceeds on disposal of right-of-use assets - 7,897

Proceeds on disposal of PRS assets 15,323 -

Cash flow from joint venture interests - -

--------------------------------------------------------------------- ----- ------------ ------------

Net cash inflow from investing activities 14,983 11,578

--------------------------------------------------------------------- ----- ------------ ------------

Cash flows from financing activities

Dividends paid 10 (15,129) (21,781)

Proceeds from exercise of share options - -

Payment of principal portion of lease liabilities (6,806) (4,717)

Payment of capital element of other interest -- bearing loans - (389)

Drawdown of RCF 27,579 20,625

Repayment of bank loans and RCF (27,537) (3,909)

--------------------------------------------------------------------- ----- ------------ ------------

Net cash outflow from financing activities (21,893) (10,171)

--------------------------------------------------------------------- ----- ------------ ------------

Net decrease in cash (38,410) (25,452)

Cash and cash equivalents at 1 October 2022 and 1 October 2021 110,841 136,293

--------------------------------------------------------------------- ----- ------------ ------------

Cash and cash equivalents at 30 September 2023 and 30 September 2022 72,431 110,841

--------------------------------------------------------------------- ----- ------------ ------------

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

for the year ended 30 September 2023

1. General information

Watkin Jones plc (the 'Company') is a public limited company

incorporated in the United Kingdom under the Companies Act 2006

(registration number 9791105) and its shares are listed on the

Alternative Investment Market of the London Stock Exchange. The

Company is domiciled in the United Kingdom and its registered

address is 12 Soho Square, London, United Kingdom, W1D 3QF.

The principal activities of the Company and its subsidiaries

(collectively the 'Group') are those of property development and

the management of properties for multiple residential

occupation.

The consolidated financial statements for the Group for the year

ended 30 September 2023 comprise the Company and its subsidiaries.

The basis of preparation of the consolidated financial statements

is set out in note 2 below.

2. Basis of preparation

The financial statements of the Group have been prepared and

approved by the Directors in accordance with International

Accounting Standards in conformity with the requirements of the

Companies Act 2006 and in accordance with United Kingdom adopted

International Accounting Standards.

The preparation of financial information in conformity with IFRS

requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities at the date of the

financial statements and the reported amounts of revenues and

expenses during the reporting period. Although these estimates are

based on management's best knowledge of the amount, event or

actions, actual events may ultimately differ from those

estimates.

The financial information set out above does not constitute the

Group's statutory accounts for the years ended 30 September 2023 or

2022, but is derived from those accounts. Statutory accounts for

2022 have been delivered to the Registrar of Companies, and those

for 2023 will be delivered in due course. The auditor has reported

on those accounts; their reports were (i) unqualified, (ii) did not

include a reference to any matters to which the auditor drew

attention by way of emphasis without qualifying their report and

(iii) did not contain statements under Section 498(2) or (3) of the

Companies Act 2006.

The accounting policies set out in the notes have, unless

otherwise stated, been applied consistently to all periods

presented in these financial statements. The financial statements

are prepared on the historical cost basis except as disclosed in

these accounting policies.

The financial statements are presented in pounds sterling and

all values are rounded to the nearest thousand (GBP'000), except

when otherwise indicated.

2.1 Going Concern

The Directors have undertaken a thorough review of the Group's

ability to continue to trade as a going concern for the period to

31 January 2025 (the 'forecast period'). This review has been

undertaken taking

into consideration the following matters.

Liquidity

At 30 September 2023, the Group had a robust liquidity position,

with cash and available headroom in its banking facilities

totalling GBP103.6 million.

Strong liquidity has been maintained through the first quarter

of the year ending 30 September 2024, providing the Group with a

good level of cash and available banking facilities for the year

ahead.

The Group's revolving credit facility (RCF) is committed and has

recently been extended to November 2025 to give flexibility to a

renewal given the current market conditions. The total facility was

reduced during the year, given the anticipated volume of land

acquisitions, and to benefit from lower non-utilisation fees. All

financial covenants under this facility were met at 30 September

2023 and are forecast to be met throughout the period to 31 January

2025.

Business Model

Our forward sale business model is capital light. By forward

selling the majority of our build to rent (BTR) and purpose built

student accommodation (PBSA) developments, we receive payment for

the land either at the same time as or shortly after we complete

the purchase, and before we commit to any significant development

expenditure. Once forward sold, we receive payment for the

development works as

they progress. By being in control of our development pipeline

we are able to ensure that we only commit construction expenditure

to developments that are either forward sold or to undertake a

modest level

of enabling works. In certain circumstances we may decide to

continue construction activities beyond the initial enabling phase,

without a forward sale agreement in place, but we take this

decision based on our

available liquidity and can suspend the works should it prove

necessary. This greatly limits our exposure to development

expenditure which is not covered by cash income.

Sites are normally secured on a subject to satisfactory planning

basis, which gives us time to manage the cash requirements and to

market them for forward sale. We also take a cautious approach to

managing our land acquisition programme to ensure that we have

sufficient liquidity available to complete the acquisition of the

sites without any new forward sales being secured.

The Fresh business receives a regular contractual monthly fee

income from its multiple clients and the short to medium -- term

risk to its revenue stream is low.

For our Affordable Homes business, which is currently relatively

small and only has a few sites in build, we manage our development

expenditure so that, other than for infrastructure works, we only

commit expenditure where it is supported by a forward sales

position. In addition, a significant portion of our largest site

has been forward sold such that we will receive payment for

development works as they

progress.

We also receive rental income from tenants on our leased PBSA

assets. The PBSA assets are anticipated to be fully occupied for

the 2023/24 academic year. Our business model and approach to cash

management therefore provides a high degree of resilience.

Counterparty Risk

The Group's clients are predominantly blue-chip institutional

funds, and the risk of default is low. The funds for a forward sold

development are normally specifically allocated by the client or

backed by committed debt funding.

For forward sold developments, our cash income remains ahead of

our development

expenditure through the life of the development, such that if we

were exposed to a client payment default, we could suspend the

works, thereby limiting any cash exposure.

Fresh has many clients and these are mostly institutional funds

with low default risk.

Base case cash forecast

We have prepared a base case cash forecast for the forecast

period, based on our current business plan and trading assumptions

for the year. This is well supported by our forward sold pipeline

of three PBSA developments and seven BTR developments for delivery

during the period FY24 to FY27, as well as the

reserved/exchanged and forward sales for our Affordable Homes

business and the contracted income for Fresh. Our currently secured

cash flow, derived from our forward sold developments and other

contracted income, net of overheads and tax, results in a modest

cash utilisation over the forecast period, with the result that our

liquidity position is maintained.

In addition to the secured cash flow, the base case forecast

assumes a number of new forward sales and further house sales,

which if achieved will result in a further strengthening of our

liquidity position, after

allowing for dividend payments.

Risk Analysis

In addition to the base case forecast, we have considered the

possibility of continued disruption to the forward sale market

given the market turbulence seen in the UK over the last 12 months.

This is our most significant risk as it would greatly limit our

ability to achieve any further forward sales.

We have run various model scenarios to assess the possible

impact of the above risks, including an extreme downside scenario

assuming no further forward sales are achieved.

The cash forecast prepared under this scenario illustrates that

adequate liquidity is maintained through the forecast period and

the financial covenants under the RCF would still be met.

The minimum gross cash balance under this scenario was GBP32.4

million (excluding the GBP10.0 million overdraft). In addition we

have reviewed the potential impact on the Group's Tangible Net

Worth Covenant of any additional increase in the provision for

Building Safety. The headroom on this covenant under the extreme

downside scenario would allow for a further four properties to be

provided for, assuming an average provision per property of GBP2.1

million.

We consider the likelihood of events occurring which would

exhaust the total cash and available facilities balances remaining

to be remote. However, should such events occur, management would

be able to implement reductions in discretionary expenditure and

consider the sale of the Group's land sites to ensure that the

Group's liquidity was maintained.

While there remains sufficient headroom under this scenario for

all the financial covenants, a sale of the Group's land sites would

enable the repayment of the RCF balance (as the RCF is drawn down

against

these assets). There would then be no requirement for the

covenants to be tested.

Conclusion

Based on the thorough review and robust downside forecasting

undertaken, and having not identified any material uncertainties

that may cast any significant doubt, the Board is satisfied that

the Group will be able to continue to trade for the period to 31

January 2025 and has therefore adopted the going concern basis

in preparing the financial statements.

3. Accounting policies

The results for the year have been prepared on a basis

consistent with the accounting policies set out in the Watkin Jones

plc Annual Report for the year ended 30 September 2023.

4. Building Safety provision

Our contract obligations

In January 2020, following the Grenfell Tower fire in June 2017,

the Government issued guidance on the suitability of certain

cladding solutions used on high rise residential buildings. The

Group subsequently carried out a detailed assessment of its

property portfolio.

Taking into account the prevailing Government guidance and legal

framework at the time, as well as consultation with building owner

clients and technical and legal advice, the assessment encompassed

buildings completed in 2008 or later (i.e. within the 12 year

contractual period). The assessment identified:

1) Buildings of any height that featured aluminium composite material ('ACM') and

2) Buildings above 18m in height that featured high pressure

laminate ('HPL').

The Group identified 15 buildings that featured significant ACM;

of these, 13 have been remediated by the Company. The remaining two

builds were undertaken by external contractors, are within the

contractual period, and benefit from insurance-backed warranties

provided by the external contractor and architect. One of these

buildings has been remediated and the external contractor retained

liability for this.

The Group took an exceptional provision in the year ended 30

September 2020 of GBP14,800,000 for the remedial costs of these

properties, which included contributions agreed with the respective

owners.

Further legislation in England

In January 2022 this guidance was withdrawn and in April the

Building Safety Act 2022 (the 'BSA') was enacted, with the

government announcing its intention to:

i) extend the scope of developers' responsibility to 30

years;

ii) increase the scope by including buildings above 11 metres;

and

iii) expand the scope to incorporate life critical safety

defects.

In the year ended 30 September 2022, the Group performed a

review of buildings above 11 metres developed by the Company over

the last 30 years. Industry practice is not to retain records for

buildings that are out of contract and therefore we do not have

fulsome documentation for buildings that were out of contract. In

such cases, the Group undertook a number of procedures to evaluate

the risk to the Group. These procedures included a review of the

external façade materials, carrying out intrusive surveys where

constructive dialogue with property owners had commenced and making

enquiries of employees who worked on the relevant construction

projects. This review concluded that an exceptional provision of

GBP30,365,000 should be made for these potential costs. This

provision was made in relation to 18 properties.

During the year ended 30 September 2023, following the

introduction of the secondary legislation that provided greater

clarity on the scope and approach of the BSA in relation to

leasehold buildings, the Group was formally approached to sign up

to the Responsible Actors' Scheme ('RAS') which came into force on

4 July 2023. By signing up to the RAS the Group is required to sign

the Developer's Remediation Contract ('the Contract') which

requires us to:

-- Take responsibility for all necessary work to address

life-critical fire safety-defects arising from the design and

construction of buildings 11 metres and over in height that we

developed or refurbished in England over the 30 years ending on 4

April 2022

-- Keep residents in those buildings informed about progress towards meeting this commitment

-- Reimburse taxpayers for funding spent on remediating their

buildings, i.e. where leaseholders have accessed the Building

Safety Fund to remediate their properties

The Group signed the Contract in December 2023.

The Contract is intended to cover leasehold buildings rather

than PBSA or BTR, and therefore the significant majority of

buildings that the Group has developed over the last 30 years are

outside the scope of the contract. There are thirteen leasehold

buildings falling within the scope of the RAS, and five of these

are included within the provision. One of these properties relates

to remediation works that have been undertaken as a result of the

building owner accessing the Building Safety Fund. Based on our

internal review procedures described above, the provision includes

an estimation of works required in relation to buildings identified

as requiring remediation.

Under the obligations of the scheme, and where information is

available, we will write out to building owners to understand their

position regarding those buildings.

Legislation in Wales

In 2023, the Welsh Government's announced a new scheme with

developers to tackle fire safety defects in medium highrise

residential buildings. The Group has been approached in respect of

one property which we have provided for on the basis that certain

remedial works are required. In our view, based on the

investigative procedures that we have carried out, there are no

further remedial works required to other Welsh properties.

Legislation in Scotland

The Housing (Cladding Remediation) (Scotland) Bill was published

in November 2023 and has not yet been finalised. It is the Group's

expectation that the basis for this Bill will be consistent with

the RAS, such that it is intended to cover leasehold buildings. The

Group has constructed one leasehold property in Scotland, which

remains under contract. In our view, based on the investigative

procedures that we have carried out, there is no remedial work

required on that property.

Overall landscape

Historically PBSA and BTR properties that are out of contract

have been considered to be out of time for claims, although in

England there remains uncertainty over how the BSA will be applied

in this regard. However, as set out above, the RAS does not

specifically apply to PBSA and BTR properties, noting that the

overall objective of the government policy was to protect

individual leaseholders in the wake of the Grenfell Tower fire.

Since the implementation of the BSA, we have been in contact

with government and industry bodies and other housebuilders and

developers to confirm that our interpretation of the legislation is

consistent with others. We also engaged an independent consultant

to assess the scope and cost of our remedial works on relevant

properties to ensure that our approach was appropriate.

We will continue to keep abreast of any changes to legislation

and guidance, recognising that the approach to building safety

continues to evolve.

Impact on financial statements

Provisions are recognised when three criteria are met: 1) the

Group has a present obligation as a result of a past event; 2) it

is probable that an outflow of resources will be required to settle

the obligation; and 3) a reliable estimate can be made of the

obligation.

A further net exceptional provision of GBP35.0 million has been

made for these remedial costs in the year ended 30 September 2023

as a result of:

-- The introduction of secondary legislation and the evolution

of government initiatives during 2023 as set out above which has

brought two further properties into the provision;

-- Greater access to the various properties which were

identified as being at risk, further intrusive surveys conducted on

relevant buildings, the receipt of fire safety reports and related

cost estimates, alongside further experience of completing the

works; these have led to additional costs required compared to

initial expectations; and

-- The evolution and conclusion of legal proceedings, settlement