| As filed with the Securities and Exchange Commission on May 24, 2024 |

| |

Registration No. 333-

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Avinger, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware

|

3841

|

20-8873453

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer

Identification Number)

|

400 Chesapeake Drive

Redwood City, California 94063

(650) 241-7900

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Jeffrey M. Soinski

Chief Executive Officer

Avinger, Inc.

400 Chesapeake Drive

Redwood City, CA 94063

(650) 241-7900

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

David Marx, Esq.

Joshua Erekson, Esq.

Dorsey & Whitney LLP

111 S. Main Street, Suite 2100

Salt Lake City, UT 84111

(801) 933-7360

Approximate date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☒

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

|

Non-accelerated filer ☒

|

Smaller reporting company ☒

|

| |

Emerging growth company ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

|

PRELIMINARY PROSPECTUS (Subject to Completion)

|

Dated May 24, 2024

|

Up to Shares of Common Stock

Up to Pre-Funded Warrants to purchase up to Shares of Common Stock

Up to Common Warrants to purchase up to Shares of Common Stock

Up to Placement Agent Warrants to purchase up to Shares of Common Stock

Up to Shares of Common Stock Underlying the Common Warrants, the Pre-Funded Warrants and the Placement Agent Warrants

Avinger, Inc.

We are offering up to shares of common stock, par value $0.001 (“Common Stock”) together with common warrants to purchase up to shares of our Common Stock (the “Common Warrants”). The assumed combined public offering price for each share of Common Stock and accompanying Common Warrant is $ , which was the last sale price of our Common Stock on the Nasdaq Capital Market (“Nasdaq”) on, 2024. Each Common Warrant is assumed to have an exercise price of $ per share ( % of the combined public offering price per share of Common Stock and accompanying Common Warrant), will be exercisable upon issuance, and will expire from the date of issuance. The shares of Common Stock and Common Warrants will be issued separately and will be immediately separable upon issuance but will be purchased together in this offering.

We are also offering to each purchaser whose purchase of shares of our Common Stock in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the holder, 9.99%) of our outstanding shares of Common Stock immediately following consummation of this offering, the opportunity to purchase, if the purchaser so chooses, pre-funded warrants (the “Pre-Funded Warrants”) to purchase shares of Common Stock, in lieu of shares of Common Stock. Each Pre-Funded Warrant will be exercisable for one share of Common Stock. The purchase price of each Pre-Funded Warrant and accompanying Common Warrant will equal the price per share of Common Stock and accompanying Common Warrant being sold to the public in this offering, minus $0.001, and the exercise price of each Pre-Funded Warrant will be $0.001 per share. For each Pre-Funded Warrant that we sell, the number of shares of our Common Stock that we are offering will be decreased on a one-for-one basis. This offering also relates to the shares of Common Stock issuable upon exercise of the Pre-Funded Warrants, Placement Agent Warrants (as defined below) and Common Warrants.

We refer to the shares of Common Stock, the Pre-Funded Warrants, Placement Agent Warrants and Common Warrants to be issued in this offering collectively as the “Securities.”

This offering will terminate on , 2024, unless we decide to terminate the offering (which we may do at any time in our discretion) prior to that date. We will have a single closing for all Securities purchased in this offering and the combined public offering price per share of Common Stock (or Pre-Funded Warrant in lieu thereof) and accompanying Common Warrant will be fixed for the duration of this offering. We will deliver the Securities to be issued in connection with this offering delivery versus payment or receipt versus payment, as the case may be, upon receipt of investor funds received by us.

Our Common Stock is listed on Nasdaq under the symbol “AVGR.” We have assumed a combined public offering price of $ per share of Common Stock and accompanying Common Warrants, which was the last reported sale price on Nasdaq of our shares of Common Stock on , 2024. The actual combined public offering price per share of Common Stock (or Pre-Funded Warrant in lieu thereof) and accompanying Common Warrant will be negotiated between us and the investors, in consultation with the placement agent based on, among other things, the trading price of our Common Stock prior to the offering, our history and our prospects, the industry in which we operate, our past and present operating results, the previous experience of our executive officers and the general condition of the securities markets at the time of this offering, and may be at a discount to the current market price. Therefore, the assumed combined public offering price used throughout this prospectus may not be indicative of the final offering price. In addition, there is no established public trading market for the Pre-Funded Warrants or Common Warrants, and we do not expect a market for the Pre-Funded Warrants or Common Warrants to develop. We do not intend to apply for a listing of the Pre-Funded Warrants or Common Warrants on any national securities exchange. Without an active trading market, the liquidity of the Pre-Funded Warrants and Common Warrants will be limited.

We have engaged (the “Placement Agent”), to act as our exclusive placement agent in connection with this offering. The Placement Agent has agreed to use its reasonable best efforts to arrange for the sale of the securities offered by this prospectus. The Placement Agent is not purchasing or selling any of the securities we are offering and the Placement Agent is not required to arrange the purchase or sale of any specific number of securities or dollar amount. We have agreed to pay to the Placement Agent the Placement Agent fees set forth in the table below, which assumes that we sell all of the securities offered by this prospectus. We have also agreed to issue to the Placement Agent or its designees as compensation in connection with this offering, warrants to purchase up to shares of Common Stock as compensation in connection with this offering. There is no minimum number of securities or amount of proceeds required as a condition to closing in this offering. Because there is no minimum offering amount required as a condition to closing this offering, we may sell fewer than all of the securities offered hereby, which may significantly reduce the amount of proceeds received by us, and investors in this offering will not receive a refund in the event that we do not sell an amount of securities sufficient to pursue our business goals described in this prospectus. In addition, because there is no escrow trust or similar arrangement and no minimum offering amount, investors could be in a position where they have invested in our company, but we are unable to fulfill all of our contemplated objectives due to a lack of interest in this offering. Further, any proceeds from the sale of securities offered by us will be available for our immediate use, despite uncertainty about whether we would be able to use such funds to effectively implement our business plan. We will bear all costs associated with the offering. See “Plan of Distribution” on page 53 of this prospectus for more information regarding these arrangements.

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties referenced under the heading “Risk Factors” contained in this prospectus beginning on page 12 and under similar headings in the other documents that are incorporated by reference into this prospectus.

| |

|

Per Share

and Accompanying

Common Warrant

|

|

|

Per Pre-

Funded

Warrant

and

Accompanying

Common

Warrant

|

|

|

Total

|

|

|

Combined public offering price

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

Placement Agent’s fees (1)

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

Proceeds to us, before expenses (2)

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

(1)

|

We have agreed to pay the Placement Agent a total cash fee equal to % of the gross proceeds of the offering. In addition, we have agreed to issue to the Placement Agent, or its designees, as compensation in connection with this offering warrants to purchase a number of shares of our Common Stock equal to % of the aggregate number of shares of Common Stock being offered at an exercise price equal to % of the combined public offering price per share of Common Stock and accompanying Common Warrants. We have also agreed to reimburse the Placement Agent for its accountable offering-related legal and other expenses in an amount up to $ . See “Plan of Distribution” on page 53 of this prospectus for a description of the fees and expenses to be paid to the Placement Agent for services performed in connection with the offering.

|

|

(2)

|

The amount of the proceeds to us presented in this table does not give effect to any exercise of the Common Warrants.

|

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Delivery of the Securities to the purchasers is expected to be made on or about , 2024, subject to satisfaction of customary closing conditions.

The date of this Prospectus is , 2024

TABLE OF CONTENTS

|

About this Prospectus

|

1 |

|

Prospectus Summary

|

2 |

|

The Offering

|

8 |

|

Risk Factors

|

12 |

|

Special Note Regarding Forward-Looking Statements

|

21 |

|

Industry and Market Data

|

23 |

|

Use of Proceeds

|

24 |

|

Description of Capital Stock

|

25 |

|

Description of Securities We Are Offering

|

41 |

|

Dilution

|

44 |

|

Material United States Federal Income Tax Considerations

|

46 |

|

Plan of Distribution

|

53 |

|

Legal Matters

|

56 |

|

Experts

|

56 |

|

Where You Can Find More Information

|

56 |

|

Incorporation of Certain Information by Reference

|

56 |

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we have filed with the Securities and Exchange Commission (the “SEC”). You should rely only on the information contained in this prospectus or any related prospectus supplement.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below. You should read this prospectus in its entirety before making an investment decision. You should also read and consider the information in the documents to which we have referred you in the section of the prospectus entitled “Where You Can Find More Information.”

We have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus. We take no responsibility for and can provide no assurance as to the reliability of any other information that others may give you. This prospectus is an offer to sell only the Securities offered by this prospectus, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date. Our business, financial condition, results of operations, and prospects may have changed since that date.

Neither we nor the Placement Agent have authorized anyone to provide you with information other than that contained in this prospectus, or any free writing prospectus prepared by or on our behalf or to which we have referred you. We and the Placement Agent take no responsibility for and can provide no assurance as to the reliability of, any other information that others may give you. We and the Placement Agent are offering to sell, and seeking offers to buy, securities only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date on the front cover page of this prospectus, or other earlier date stated in this prospectus, regardless of the time of delivery of this prospectus or of any sale of our securities. Our business, financial condition, results of operations and future prospects may have changed since that date.

No action is being taken in any jurisdiction outside the United States to permit a public offering of our securities or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus applicable to that jurisdiction.

For investors outside the United States: We have not done anything that would permit the sale of our Securities in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the Securities and the distribution of this prospectus outside the United States.

Unless the context otherwise indicates, references in this prospectus to “Avinger” the “Company,” “we,” “us,” and “our” refer, collectively, to Avinger, Inc., a Delaware corporation, and its subsidiaries.

“Avinger,” “Pantheris,” “Lumivascular,” and “Tigereye” are trademarks of our company. Our logo and our other trade names, trademarks and service marks appearing in this prospectus are our property. Other trade names, trademarks and service marks appearing in this prospectus are the property of their respective owners. Solely for convenience, our trademarks and tradenames referred to in this prospectus appear without the ™ symbol, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights, or the right of the applicable licensor to these trademarks and tradenames.

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus or in filings we make with the SEC that are incorporated herein by reference. This summary does not contain all of the information that you should consider before deciding to invest in our securities. You should read the entire prospectus, including the documents and information incorporated by reference herein, carefully, including the section titled “Risk Factors,” included elsewhere in this prospectus, and in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and the related notes included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, which are incorporated herein by reference. Some of the statements in this prospectus constitute forward-looking statements. See “Special Note Regarding Forward-Looking Statements.”

Overview

We are a commercial-stage medical device company that designs, manufactures, and sells real-time high-definition image-guided, minimally invasive catheter-based systems that are used by physicians to treat patients with peripheral artery disease (“PAD”). Patients with PAD have a build-up of plaque in the arteries that supply blood to areas away from the heart, particularly the pelvis and legs. Our mission is to significantly improve the treatment of vascular disease through the introduction of products based on our Lumivascular platform, the only intravascular real-time high-definition image-guided system available in this market.

We design, manufacture, and sell a suite of products in the United States and select international markets. We are located in Redwood City, California. Our current Lumivascular platform consists of products including our Lightbox imaging console, the Ocelot and Tigereye family of devices, which are image-guided devices designed to allow physicians to penetrate a total blockage in an artery, known as a chronic total occlusion (“CTO”), and the Pantheris family of catheters, our image-guided atherectomy catheters which are designed to allow physicians to precisely remove arterial plaque in PAD patients.

We are in the process of developing CTO crossing devices to target the coronary CTO market. However, the market for medical devices in the coronary artery disease (“CAD”) space is highly competitive, dynamic, and marked by rapid and substantial technological development and product innovation and there is no guarantee that we will be successful in developing and commercializing any new CAD product. At this stage, we are working on understanding market requirements, and initiated the development process for the new CAD product, which we anticipate will require additional expenses.

We obtained CE Marking for our original Ocelot product in September 2011 and received from the U.S. Food and Drug Administration (“FDA”), 510(k) clearance in November 2012. We also received 510(k) clearance from the FDA for commercialization of Pantheris in October 2015. We received an additional 510(k) clearance for an enhanced version of Pantheris in March 2016 and commenced sales of Pantheris in the United States and select European countries promptly thereafter. In May 2018, we received 510(k) clearance from the FDA for our current next-generation version of Pantheris. In April 2019, we received 510(k) clearance from the FDA for our Pantheris Small Vessel (“SV”), a version of Pantheris targeting smaller vessels, and commenced sales in July 2019. In September 2020, we received 510(k) clearance for Tigereye, a next-generation CTO crossing system utilizing Avinger’s proprietary image-guided technology platform. Tigereye is a product line extension of Avinger’s Ocelot family of image-guided CTO crossing catheters. In January 2022, we received 510(k) clearance from the FDA for our Lightbox 3 imaging console, an advanced version of our Lightbox that allows for easy portability and offers significant reductions in size, weight, and production cost in comparison to the incumbent version.

In April 2023, we received 510(k) clearance from the FDA for Tigereye Spinning Tip (“ST”), a next-generation image-guided CTO crossing system. Tigereye ST is a line extension of our Ocelot and Tigereye family of CTO crossing catheters. This new image-guided catheter incorporates design upgrades to the tip configuration and catheter shaft to increase crossing power and procedural success in challenging lesions, as well as design enhancements for ease of image interpretation during the procedure. The low-profile Tigereye ST has a working length of 140 cm and 5 French sheath. We initiated a limited launch of Tigereye ST in the second quarter of 2023 and subsequently expanded to full commercial availability within the United States during the third quarter of 2023.

In June 2023, we received 510(k) clearance from the FDA for Pantheris Large Vessel (“LV”), a next generation image guided atherectomy system for the treatment of larger vessels, such as the superficial femoral artery (“SFA”) and popliteal arteries. Pantheris LV is a line extension of our Pantheris and Pantheris SV family of atherectomy products. This catheter offers higher speed plaque excision for efficient removal of challenging occlusive tissue and multiple features to streamline and simplify user-operation, including enhanced tissue packing and removal, a radiopaque gauge to measure volume of plaque excised during the procedure, and enhanced guidewire management. We initiated a limited launch of the Pantheris LV during the third quarter of 2023 and expect to expand to full commercial availability within the United States around mid-year 2024.

Current treatments for PAD, including bypass surgery, can be costly and may result in complications, high levels of post-surgery pain, and lengthy hospital stays and recovery times. Minimally invasive, or endovascular, treatments for PAD include stenting, angioplasty, and atherectomy, which is the use of a catheter-based device for the removal of plaque. These treatments all have limitations in their safety or efficacy profiles and frequently result in recurrence of the disease, also known as restenosis. We believe one of the main contributing factors to high restenosis rates for PAD patients treated with endovascular technologies is the amount of vascular injury that occurs during an intervention. Specifically, these treatments often disrupt the membrane between the outermost layers of the artery, which is referred to as the external elastic lamina (“EEL”).

We believe our Lumivascular platform is the only technology that offers radiation-free, high-definition real-time visualization of the inside of the artery during PAD treatment through the use of optical coherence tomography (“OCT”), a high resolution, light-based, radiation-free imaging technology. Our Lumivascular platform provides physicians with high-definition real-time OCT images from the inside of an artery, and we believe Ocelot and Pantheris are the first products to offer intravascular visualization during CTO crossing and atherectomy, respectively. We believe this approach will significantly improve patient outcomes by providing physicians with a clearer picture of the artery using radiation-free image guidance during treatment, enabling them to better differentiate between plaque and healthy arterial structures. Our Lumivascular platform is designed to improve patient safety by enabling physicians to direct treatment towards the plaque, while avoiding damage to healthy portions of the artery.

During the first quarter of 2015, we completed enrollment of patients in VISION, a clinical trial designed to support our August 2015 510(k) submission to the FDA for our Pantheris atherectomy device. VISION was designed to evaluate the safety and efficacy of Pantheris to perform atherectomy using intravascular imaging and successfully achieved all primary and secondary safety and efficacy endpoints. We believe the data from VISION allows us to demonstrate that avoiding damage to healthy arterial structures, and in particular disruption of the external elastic lamina, which is the membrane between the outermost layers of the artery, reduces the likelihood of restenosis, or re-narrowing, of the diseased artery. Although the original VISION study protocol was not designed to follow patients beyond six months, we worked with 18 of the VISION sites to re-solicit consent from previous clinical trial patients in order for them to evaluate patient outcomes through 12 and 24 months following initial treatment. Data collection for the remaining patients from participating sites was completed in May 2017, and we released the final 12- and 24-month results for a total of 89 patients in July 2017.

During the fourth quarter of 2017, we began enrolling patients in INSIGHT, a clinical trial designed to support a submission to the FDA to expand the indication for our Pantheris atherectomy device to include the treatment of in-stent restenosis. Patient enrollment began in October 2017 and was completed in July 2021. Patient outcomes were evaluated at thirty days, six months and one year following treatment. In November 2021, we received 510(k) clearance from the FDA for this new clinical indication for treating in-stent restenosis with Pantheris using the data collected and analyzed from INSIGHT. We expect this will expand our addressable market for Pantheris to include a high-incidence disease state for which there are few available indicated or effective treatment options.

We are pursuing additional clinical data programs including a post-market study, IMAGE-BTK, that is designed to evaluate the safety and efficacy of Pantheris SV in the treatment of PAD lesions below-the-knee. We completed enrollment in 2023. Patient outcomes are being evaluated at thirty days, six months and one year following treatment. We expect this will bolster the application of Pantheris SV as a primary interventional tool to address below-the-knee lesions for which there are few available effective treatment options.

We focus our direct sales force, marketing efforts and promotional activities on interventional cardiologists, vascular surgeons and interventional radiologists. We also work on developing strong relationships with physicians and hospitals that we have identified as key opinion leaders. Although our sales and marketing efforts are directed at these physicians because they are the primary users of our technology, we consider the hospitals and medical centers where the procedure is performed to be our customers, as they typically are responsible for purchasing our products. We are designing additional future products to be compatible with our Lumivascular platform, which we expect to enhance the value proposition for hospitals to invest in our technology. Pantheris qualifies for existing reimbursement codes currently utilized by other atherectomy products, further facilitating adoption of our products.

We have assembled a team with extensive medical device development and commercialization experience in both start-up and large, multi-national medical device companies. We assemble all of our catheter products at our manufacturing facility but certain critical processes, such as coating and sterilization, are performed by outside vendors. Our Lightbox 3 imaging console is assembled through a qualified contract manufacturer. We expect our current manufacturing facility in California, will be sufficient through at least 2024.

We generated revenues of $10.1 million in 2021, $8.3 million in 2022 and $7.7 million in 2023. Revenues during these years were tangentially affected by COVID-19 as hospitals continued to defer elective procedures in certain jurisdictions while increasing volume to accommodate previously deferred procedures in others, which among other things, created unpredictability in case volume. This unpredictability created more volatility in our revenues which continued to affect our business in the aforementioned years. The decline in revenue in 2022 and 2023 was primarily attributable to the adverse effects of staffing shortages, resource constraints on our customers as hospitals deferred elective procedures, and the impact of a very competitive market for talent on the retention of our commercial team.

Recent Developments

CRG Loan Exchange and Nasdaq Listing

On May 16, 2024, the Company and CRG Partners III L.P. and certain of its affiliated funds (collectively, “CRG”) entered into a Securities Purchase Agreement pursuant to which the Company issued 11,000 shares of a newly authorized Series H convertible preferred stock, par value $0.001 (“Series H Preferred Stock”), in exchange for CRG surrendering for cancellation $11 million of outstanding principal and accrued interest of the senior secured term loan under the Loan Agreement (as defined below) (the “Exchange”). Each share of Series H Preferred Stock has a stated value of $1,000 per share and is convertible into 259 shares of the Company’s Common Stock at a conversion price of $3.86 per share, provided that the shares of Series H Preferred Stock cannot be converted into Common Stock to the extent the applicable holder would beneficially own in excess of 9.99% of the Company’s outstanding voting power, unless approved by the Company's stockholders in accordance with Nasdaq Listing Rule 5635(b).

Nasdaq Delisting Notice – Minimum Bid Price Requirement

On April 25, 2023, we received notice (the “Bid Price Deficiency Letter”) from the Listing Qualifications Department (the “Staff”) of The Nasdaq Stock Market, LLC notifying us that we were not in compliance with Nasdaq Listing Rule 5550(a)(2) (the “Bid Price Requirement”), as the minimum bid price for our listed securities was less than $1.00 for the previous 30 consecutive business days. We had a period of 180 calendar days, or until October 23, 2023, to regain compliance with the rule referred to in this paragraph. As part of our efforts to regain compliance with the aforementioned rule, we effected a 1-for-15 reverse stock split on September 12, 2023.

On September 27, 2023, we received a letter from Nasdaq notifying us that the Staff had determined that the closing bid price of our Common Stock had been at $1.00 per share or greater for at least 10 consecutive business days and, accordingly, that we had regained compliance with the Bid Price Requirement. While we have regained compliance with the Bid Price Requirement, there can be no assurance that we will be able to maintain compliance with the Bid Price Requirement, or other continued listing requirements of Nasdaq, in the future.

Nasdaq Delisting Notice – Minimum Stockholders’ Equity Requirement

On May 18, 2023, we received notice (the “Stockholders’ Equity Deficiency Letter”) from the Staff that we no longer satisfy the $2.5 million stockholders’ equity requirement for continued listing on Nasdaq, or the alternatives to that requirements – a $35 million market value of listed securities or $500,000 in net income in the most recent fiscal year or two of the last three fiscal years – as required by Nasdaq Listing Rule 5550(b) (the “Equity Requirement”).

As with the Bid Price Deficiency Letter, the Stockholders’ Equity Deficiency Letter had no immediate effect on our continued listing on Nasdaq. In accordance with the Nasdaq Listing Rules, we were provided 45 calendar days, or until July 3, 2023, to submit a plan to regain compliance with the Equity Requirement (the “Compliance Plan”). We submitted the Compliance Plan to Nasdaq on July 3, 2023. On July 31, 2023, we received a letter from Nasdaq notifying us that the Staff had determined to grant us an extension of 180 calendar days from the date of the Staff’s notice, or November 14, 2023, to regain compliance with the Equity Requirement.

On November 21, 2023, the Staff formally notified us that the Staff had determined that we were unable to demonstrate compliance with the Equity Requirement and that our securities would be delisted at the open of business on November 30, 2023, unless we timely requested a hearing before the Nasdaq Hearings Panel (the “Panel”). On November 28, 2023, we requested and were granted a hearing before the Panel which took place on February 20, 2024. At the hearing, we presented a plan to regain and sustain compliance with the Equity Requirement and requested an extension to do so. On March 14, 2024, the results from the hearing were rendered in which we were granted an extension by the Panel. This extension stayed any further action by Nasdaq with respect to our continued listing until May 20, 2024.

Strategic Collaboration

On March 4, 2024, we entered into a License and Distribution Agreement (the “License Agreement”) with Zylox-Tonbridge, pursuant to which we will license and distribute certain of our products (including consumables) in the Greater China region, including mainland China, Hong Kong, Macao, and Taiwan (the “Territory”). Zylox-Tonbridge will lead all regulatory activities for the registration of our products in the Territory. We will also license our intellectual property and know-how related to our products to Zylox-Tonbridge so that Zylox-Tonbridge can manufacture the localized products in the Territory. All sales of our products locally manufactured by Zylox-Tonbridge with regulatory approval by the regulatory authorities in the Territory and commercialized in the Territory will be royalty bearing to us at varying percentages depending on the amount of gross revenue and product gross margin.

In connection with the License Agreement, we also entered into a Strategic Cooperation and Framework Agreement with Zylox-Tonbridge (the “Collaboration Agreement” and, together with the License Agreement, the “Strategic Collaboration”), which provides the opportunity for us to access certain Zylox-Tonbridge peripheral vascular products for distribution in the U.S. and Germany. The agreement also provides the option for us to source finished goods inventory from Zylox-Tonbridge following registration of Zylox-Tonbridge’s manufacturing facility with the FDA.

Financing Agreements

On March 4, 2024, in connection with the Strategic Collaboration, we and Zylox-Tonbridge Medical Limited, a wholly-owned subsidiary of Zylox-Tonbridge (the “Purchaser”), entered into a Securities Purchase Agreement (the “Purchase Agreement”), pursuant to which the Purchaser agreed to purchase, in two tranches, up to an aggregate of $15 million in shares of our Common Stock, par value $0.001 per share (the “Common Stock”), and shares of two new series of our preferred stock (the “Private Placement”). On March 5, 2024, (the “Initial Closing”), we issued to the Purchaser 75,327 shares of the Common Stock at a purchase price per share of $3.664 (the “Purchase Price”), and 7,224 shares of a newly authorized Series F convertible preferred stock, par value $0.001 per share (the “Series F Preferred Stock”), at a purchase price per share of $1,000, for an aggregate purchase price of $7.5 million.

Each share of Series F Preferred Stock has a stated value of $1,000 and is initially convertible into approximately 273 shares of Common Stock at a conversion price equal to the Purchase Price, subject to the terms of the Certificate of Designation of Preferences, Rights, and Limitations of the Series F Preferred Stock (the “Series F Certificate of Designation”).

Upon completion of the following as mutually agreed upon by us and the Purchaser: (i) the successful registration and listing under 21 CFR part 807 with the FDA of the Purchaser and one of its designated affiliates to manufacture our products, and (ii) us achieving an aggregate of $10 million in gross revenue within any four consecutive fiscal quarters after the Initial Closing, excluding any gross revenue achieved by us under the License Agreement discussed above (together, the “Milestones”), the Purchaser will invest an additional $7.5 million (the “Milestone Closing”) to purchase shares of our new Series G convertible preferred stock, par value $0.001 per share (the “Series G Preferred Stock”). Each share of Series G Preferred Stock will have a stated value of $1,000 and will be convertible into shares of Common Stock at a conversion price of equal to the lowest of (x) the Purchase Price, (y) the closing price of the Common Stock on the date immediately preceding the Milestone Closing, and (z) the average closing price for the last five trading days preceding the Milestone Closing, provided that the conversion price will be no less than $0.20.

Series A Preferred Stock Exchange

On March 5, 2024, we entered into a Securities Purchase Agreement (the “A-1 Securities Purchase Agreement”) to exchange all outstanding shares of Series A convertible preferred stock, par value $0.001 (the “Series A Preferred Stock”), for 10,000 shares of Series A-1 convertible preferred stock, par value $0.001 (the “Series A-1 Preferred Stock”). Among other things, the shares of Series A-1 Preferred Stock: (i) are convertible into an aggregate of approximately 2,729,257 shares of Common Stock at a conversion price equal to the Purchase Price, (ii) do not accrue or pay dividends payable solely on the Series A-1 Preferred Stock, (iii) will have no liquidation preference and (iv) will be junior in rank to shares of our Series E convertible preferred stock, par value $0.001 (the “Series E Preferred Stock”), Series F Preferred Stock and Series G Preferred Stock.

CRG Loan Amendment

On March 5, 2024, we also entered into Amendment No. 9 to the Loan Agreement effective as of the Initial Closing with CRG, which amends the Loan Agreement to, among other things: (i) extend the interest-only period through December 31, 2026; (ii) provide that interest payable through December 31, 2026 may be payable in kind rather than in cash; and (iii) permit the payment of dividends on the preferred stock issued or issuable to the Purchaser.

Lease Extension

On March 6, 2024, we entered into an amendment to the lease which extended the lease term for a period of one year, subsequent to the original expiration of November 30, 2024. As amended, the lease will expire on November 30, 2025. Under the terms of the amendment, we will be obligated to pay approximately $1.3 million in base rent payments through November 2025, beginning on December 1, 2024. This amendment also provides an optional one year extension of the lease following the end of the current term, as amended.

2023 Reverse Stock Split

On September 11, 2023, our board of directors approved an amendment to our amended and restated certificate of incorporation to effect a 1-for-15 reverse stock split of our issued and outstanding Common Stock (the “reverse stock split”). The reverse stock split became effective on September 12, 2023. The par value of the Common Stock was not adjusted as a result of the reverse stock splits. All Common Stock, stock options, restricted stock units, and per share amounts in this prospectus and have been retroactively adjusted for all periods presented to give effect to the reverse stock split, however, certain of the documents filed with the SEC prior to September 12, 2023, do not give effect to the reverse stock split.

Implication of Being a Smaller Reporting Company

We are a “smaller reporting company” as defined in Item 10(f)(1) of Regulation S-K. Smaller reporting companies may take advantage of certain reduced disclosure obligations, including, among other things, providing only two years of audited financial statements. We will remain a smaller reporting company until the last day of any fiscal year for so long as either (1) the market value of our shares of Common Stock held by non-affiliates does not equal or exceed $250.0 million as of the prior June 30th, or (2) our annual revenues did not equal or exceed $100.0 million during such completed fiscal year and the market value of our shares of Common Stock held by non-affiliates did not equal or exceed $700.0 million as of the prior June 30th. To the extent we take advantage of any reduced disclosure obligations, it may make comparison of our financial statements with other public companies difficult or impossible.

Company Information

We were incorporated in Delaware on March 8, 2007. Our principal executive offices are located at 400 Chesapeake Drive, Redwood City, CA 94063, and our telephone number is (650) 241-7900. Our website address is www.avinger.com. The information on, or that may be accessed through, our website is not incorporated by reference into this prospectus and should not be considered a part of this prospectus. We make available, free of charge on our corporate website at www.avinger.com, copies of our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, Proxy Statements, and all amendments to these reports, as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC, pursuant to Section 13(a) or 15(d) of the Securities Exchange Act. We also show detail about stock trading by corporate insiders by providing access to SEC Forms 3, 4 and 5. The SEC maintains a website that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that website is www.sec.gov. The information in or accessible through the websites referred to above are not incorporated into, and are not considered part of, this filing. Further, our references to the URLs for these websites are intended to be inactive textual references only.

THE OFFERING

|

Issuer

|

|

Avinger, Inc., a Delaware corporation

|

| |

|

|

|

Common Stock Offered by us

|

|

Up to shares of Common Stock based on an assumed combined public offering price of $ per share of Common Stock and accompanying Common Warrant, which is based on the last sale price of our Common Stock as reported by Nasdaq on 2024.

|

| |

|

|

|

Pre-Funded Warrants Offered by us

|

|

We are also offering to those purchasers, if any, whose purchase of Common Stock in this offering would result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or at the election of the purchaser, 9.99%) of our outstanding Common Stock immediately following consummation of this offering, the opportunity to purchase, if they so choose, Pre-Funded Warrants in lieu of Common Stock that would otherwise result in ownership in excess of 4.99% (or 9.99%, as applicable) of our outstanding Common Stock.

The purchase price of each Pre-Funded Warrant and accompanying Common Warrant will equal the price per share of Common Stock and accompanying Common Warrant being sold to the public in this offering, minus $0.001, and the exercise price of each Pre-Funded Warrant will be $0.001 per share.

Each Pre-Funded Warrant will be immediately exercisable and may be exercised at any time until exercised in full. There is no expiration date for the Pre-Funded Warrants. To better understand the terms of the Pre-Funded Warrants, you should carefully read the “Description of Securities We Are Offering” section of this prospectus. You should also read the form of Pre-Funded Warrant, which will be filed as an exhibit to the registration statement that includes this prospectus.

This prospectus also relates to the offering of the shares of Common Stock issuable upon exercise of the Pre-Funded Warrants.

|

|

Common Warrants Offered by us

|

|

We are also offering up to Common Warrants to purchase up to shares of Common Stock. Each Common Warrant will be exercisable for one share of Common Stock, will have an exercise price of $ per share (representing % of the price at which a share of Common Stock and accompanying Common Warrant are sold to the public in this offering), will be exercisable immediately, and will expire from the date of issuance.

The shares of Common Stock and Pre-Funded Warrants, and the accompanying Common Warrants, as the case may be, can only be purchased together in this offering but will be issued separately and will be immediately separable upon issuance. Because we will issue a Common Warrant for each share of our Common Stock and for each Pre-Funded Warrant sold in this offering, the number of Common Warrants sold in this offering will not change as a result of a change in the mix of the shares of our Common Stock and Pre-Funded Warrants sold.

To better understand the terms of the Common Warrants, you should carefully read the “Description of Securities We Are Offering” section of this prospectus. You should also read the form of Common Warrant, which will be filed as an exhibit to the registration statement that includes this prospectus. This prospectus also relates to the offering of the shares of Common Stock issuable upon exercise of the Common Warrants.

|

| |

|

|

|

Placement Agent Warrants Offered by us

|

|

We have also agreed to issue to the Placement Agent or its designees as compensation in connection with this offering, warrants to purchase up to shares of Common Stock (the “Placement Agent Warrants”) as compensation in connection with this offering. The Placement Agent Warrants will be exercisable immediately and will have substantially the same terms as the Common Warrants, except that the Placement Agent Warrants will have an exercise price of $ per share (representing % of the combined public offering price per share of Common Stock and accompanying Common Warrant) and a termination date that will be from the commencement of the sales pursuant to this offering. See “Plan of Distribution” below.

To better understand the terms of the Placement Agent Warrants, you should carefully read the descriptions of the Placement Agent Warrants in the “Description of Securities We Are Offering” and “Plan of Distribution” sections of this prospectus. You should also read the form of Placement Agent Warrant, which will be filed as an exhibit to the registration statement that includes this prospectus. This prospectus also relates to the offering of the shares of Common Stock issuable upon exercise of the Placement Agent Warrants.

|

| |

|

|

|

Common Stock Outstanding

|

|

1,702,226 shares as of May 17, 2024 (including 115,792 of unvested restricted stock awards).

|

|

Common Stock to be Outstanding After This Offering

|

|

shares of Common Stock, assuming exercise in full of all Pre-Funded Warrants and no exercise of the Common Warrants and Placement Agent Warrants being offered in this offering. To the extent Pre-Funded Warrants are sold, the number of shares of Common Stock sold in this offering will be reduced on a one-for-one basis.

|

| |

|

|

|

Use of Proceeds

|

|

We estimate that the net proceeds of this offering based upon an assumed combined public offering price of $ per share of Common Stock and accompanying Common Warrant, which was the closing price of our Common Stock on Nasdaq on , 2024, after deducting Placement Agent fees and estimated offering expenses, will be approximately $ , assuming the exercise in full of all Pre-Funded Warrants offered hereby and assuming no exercise of the Common Warrants and Placement Agent Warrants.

We currently intend to use the net proceeds from this offering for working capital and general corporate purposes.

|

| |

|

|

|

Risk Factors

|

|

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 12 and other information included and incorporated by reference in this prospectus for a discussion of factors that you should carefully consider before deciding to invest in our Common Stock.

|

| |

|

|

|

Lock-Up Agreements

|

|

The Company and our directors and officers have agreed with the Placement Agent, subject to certain exceptions, not to sell, transfer or dispose of, directly or indirectly, any of our Common Stock or securities convertible into or exercisable or exchangeable for our Common Stock for a period of ( ) days after the closing of this offering. See “Plan of Distribution” for more information.

|

| |

|

|

|

Nasdaq Listing

|

|

Our Common Stock is listed on Nasdaq under the symbol “AVGR.” We do not intend to apply for the listing of the Pre-Funded Warrants, Placement Agent Warrants or Common Warrants on any national securities exchange or other trading system. Without an active trading market, the liquidity of the Pre-Funded Warrants, Placement Agent Warrants and Common Warrants will be limited.

|

The number of shares of Common Stock to be outstanding immediately after this offering is based on 1,702,226 shares of our Common Stock outstanding as of May 17, 2024 and excludes (in each case as of May 17, 2024):

| |

●

|

15 shares of Common Stock issuable upon the exercise of stock options outstanding with a weighted average exercise price of $183,340 per share;

|

| |

●

|

7,752,174 shares of Common Stock issuable upon conversion of outstanding preferred stock, comprised of 2,729,257 shares of Common Stock issuable upon conversion of outstanding Series A-1 Preferred Stock, 23,205 shares of Common Stock issuable upon conversion of outstanding Series B convertible preferred stock, par value $0.001 (the “Series B Preferred Stock”), 178,560 shares of Common Stock issuable upon conversion of outstanding Series E Preferred Stock, 1,972,152 shares of Common Stock issuable upon conversion of outstanding Series F Preferred Stock and 2,849,000 shares of Common Stock issuable upon conversion of outstanding Series H Preferred Stock;

|

| |

●

|

497,034 shares of Common Stock issuable upon exercise of outstanding warrants, comprised of 2,993 shares of Common Stock issuable upon exercise of outstanding Series 1 Warrants, 2,903 shares of Common Stock issuable upon exercise of outstanding Series 2 Warrants, 53,833 shares of Common Stock issuable upon exercise of outstanding January 2022 financing warrants, 4,433 shares of Common Stock issuable upon exercise of outstanding placement agent warrants issued in the January 2022 financing, 190,259 shares of Common Stock issuable upon exercise of outstanding Series A Preferred Investment Options issued in the August 2022 financing, 190,259 shares of Common Stock issuable upon exercise of outstanding Series B Preferred Investment Options issued in the August 2022 financing,11,416 shares of Common Stock issuable upon exercise of outstanding placement agent warrants issued in the August 2022 financing, and 40,938 of Common Stock issuable upon the exercise of outstanding Advisor Warrants issued in the March 2024 financing; and

|

| |

●

|

68,109 shares of Common Stock reserved for future issuance under our 2015 Equity Incentive Plan, or our 2015 Plan, and any additional shares that become available under our 2015 Plan pursuant to provisions thereof that automatically increase the share reserve under the plan each year.

|

Unless otherwise indicated, the information in this prospectus, including the number of shares outstanding after this offering, does not reflect:

| |

●

|

any issuance, exercise, vesting, expiration, or forfeiture of any additional equity awards under our equity incentive plans or stock purchase plans that occurred after May 17, 2024; and

|

| |

●

|

any exercise of the Common Warrants or the Placement Agent Warrants, and exercise in full of all Pre-Funded Warrants issued in this offering.

|

RISK FACTORS

An investment in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully the risks described below and discussed under this section, together with other information in this prospectus and the documents incorporated by reference in this prospectus, including the information set forth under the caption “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2024. If any of these risks actually occurs, our business, financial condition or results of operations could be seriously harmed. This could cause the trading price of our Common Stock to decline, resulting in a loss of all or part of your investment.

Risks Related to Our Business

You should read and consider risk factors specific to our business and indebtedness, our securities and this offering in their entirety before making an investment decision. Those risks are described below and in the sections entitled “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, our Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, and in other documents incorporated by reference into this prospectus. Please be aware that additional risks and uncertainties not currently known to us or that we currently deem to be immaterial could also materially and adversely affect our business, results of operations, financial condition, cash flows or prospects.

There is substantial doubt about our ability to continue as a going concern, and we will need additional financing to execute our business plan, to fund our operations and to continue as a going concern, and, if we are unable to obtain additional financing, may be required to pursue a reorganization proceeding under applicable bankruptcy or insolvency laws, including under Chapter 11 of the U.S. Bankruptcy Code.

Since inception, we have experienced recurring operating losses and negative cash flows and we expect to continue to generate operating losses and consume significant cash resources for the foreseeable future. There is substantial doubt regarding our ability to continue as a going concern. Our independent registered public accounting firm has expressed in its auditors’ report on our 2023 financial statements, included our Annual Report on Form 10-K filed on March 20, 2024, an emphasis of matter paragraph relating to our ability to continue as a “going concern,” meaning that our recurring losses from operations and negative cash flows from operations raise substantial doubt regarding our ability to continue as a going concern. We have prepared our financial statements on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities and commitments in the normal course of business. Our financial statements do not include any adjustment to reflect the possible future effects on the recoverability and classification of assets or the amounts and classification of liabilities that may result from the outcome of this uncertainty, with the exception that all borrowings are classified as current on the balance sheets.

Under our Term Loan Agreement (the “Loan Agreement”) with CRG, a “Material Adverse Change” or “Material Adverse Effect” (each as defined in the Loan Agreement) is an “Event of Default” thereunder, which gives Majority Lenders (as defined in the Loan Agreement) the right to declare amounts outstanding under the Loan Agreement immediately due and payable. Due to the substantial doubt about our ability to continue operating as a going concern and the Event of Default that could result due to a Material Adverse Change under the Loan Agreement, the entire amount of borrowings at March 31, 2024 and December 31, 2023 are classified as current. In addition, we may not be able to generate sufficient liquidity or revenue to satisfy minimum liquidity and minimum revenue covenants under the Loan Agreement. If we fail to satisfy such requirements, we will be in default under the Loan Agreement and all outstanding amounts under the Loan Agreement will become immediately due.

Majority Lenders have not purported that an Event of Default has occurred as a result of a Material Adverse Change or breach of other financial covenants. However, there can be no guarantee that Majority Lenders will not invoke such Event of Default in the future, or that we will not experience other Material Adverse Changes or other Material Adverse Effects, or otherwise breach our financial or other covenants under the Loan Agreement, that could give rise to an Event of Default under the Loan Agreement.

If we are unable to generate sufficient revenue and liquidity to service our debt, we may be required to pursue a reorganization proceeding under applicable bankruptcy or insolvency laws, including protection (“Bankruptcy Protection”) under Chapters 7 or 11 of the U.S. Bankruptcy Code. Holders of our Common Stock will likely not receive any value or payments in a restructuring or similar scenario.

Risks Related to this Offering

Purchasers who purchase our securities in this offering pursuant to a securities purchase agreement may have rights not available to purchasers that purchase without the benefit of a securities purchase agreement.

In addition to rights and remedies available to all purchasers in this offering under federal securities and state law, the purchasers that enter into a securities purchase agreement will also be able to bring claims of breach of contract against us. The ability to pursue a claim for breach of contract provides those investors with the means to enforce the covenants uniquely available to them under the securities purchase agreement including: (i) timely delivery of shares; (ii) agreement to not enter into variable rate financings for ( ) year from closing, subject to certain exceptions; (iii) agreement to not enter into any financings for ( ) days from closing; and (iv) indemnification for breach of contract.

This is a reasonable best efforts offering, with no minimum amount of securities is required to be sold, and we may not raise the amount of capital we believe is required for our business plans, including our near-term business plans, nor will investors in this offering receive a refund in the event that we do not sell an amount of securities sufficient to pursue the business goals outlined in this prospectus.

The Placement Agent has agreed to use its reasonable best efforts to solicit offers to purchase the securities in this offering. The Placement Agent has no obligation to buy any of the securities from us or to arrange for the purchase or sale of any specific number or dollar amount of the securities. We may sell fewer than all of the securities offered hereby, which may significantly reduce the amount of proceeds received by us, and investors in this offering will not receive a refund in the event that we do not sell an amount of securities sufficient to support our business goals and continued operations, including our near-term continued operations. Thus, we may not raise the amount of capital we believe is required for our operations in the short-term and may need to raise additional funds to complete such short-term operations. Such additional capital may not be available or available on terms acceptable to us, or at all.

There is no required minimum number of securities that must be sold as a condition to completion of this offering, and we have not, nor will we, establish an escrow account in connection with this offering. Because there is no minimum offering amount required as a condition to the closing of this offering, the actual offering amount, the Placement Agent fees and proceeds to us are not presently determinable and may be substantially less than the maximum amounts set forth herein. Because there is no escrow account and no minimum offering amount, investors could be in a position where they have invested in us, but we are unable to fulfill our objectives due to a lack of interest in this offering. Further, because there is no escrow account in operation and no minimum investment amount, any proceeds from the sale of securities offered by us will be available for our immediate use, despite uncertainty about whether we would be able to use such funds to effectively implement our business plan. Investor funds will not be returned under any circumstances whether during or after the offering.

You will experience immediate and substantial dilution in the net tangible book value of the shares you purchase in this offering and may experience additional dilution in the future.

The combined public offering price per share of Common Stock and related Common Warrant, and the combined public offering price of each Pre-Funded Warrant and related Common Warrant, will be substantially higher than the pro forma as adjusted net tangible book value per share of our Common Stock after giving effect to this offering.

Assuming the sale of shares of our Common Stock and Common Warrants to purchase up to shares of Common Stock at an assumed combined public offering price of $ per share and accompanying Common Warrant, the closing sale price per share of our Common Stock on Nasdaq on , 2024, assuming the exercise in full of any Pre-Funded Warrants in this offering, no exercise of the Common Warrants and Placement Agent Warrants being offered in this offering and after deducting the Placement Agent fees and estimated offering expenses payable by us, you will incur immediate dilution of approximately $ per share. As a result of the dilution in net tangible book value to investors purchasing securities in this offering, investors may receive significantly less than the purchase price paid in this offering, if anything, in the event of the liquidation of our company. See the section entitled “Dilution” on page 44 for a more detailed discussion of the dilution you will incur if you participate in this offering. To the extent shares are issued under outstanding options and warrants at exercise prices lower than the combined public offering price of our Common Stock in this offering, including the shares underlying the Pre-Funded Warrants, Placement Agent Warrants and the Common Warrants, holders will incur further dilution.

There is no public market for the Pre-Funded Warrants or the Common Warrants sold in this offering.

There is no established public trading market for the Pre-Funded Warrants or Common Warrants being sold in this offering. We will not list the Pre-Funded Warrants or Common Warrants on any securities exchange or nationally recognized trading system, including Nasdaq. Therefore, we do not expect a market to ever develop for the Pre-Funded Warrants or Common Warrants. Without an active market, the liquidity of the Pre-Funded Warrants and the Common Warrants will be limited.

The Pre-Funded Warrants and Common Warrants are speculative in nature. Holders of the Pre-Funded Warrants and the Common Warrants offered hereby will have no rights as common stockholders with respect to the shares our Common Stock underlying such warrants until such holders exercise their warrants and acquire our Common Stock, except as otherwise provided in the Pre-Funded Warrants and the Common Warrants.

The Pre-Funded Warrants and Common Warrants do not confer any rights of Common Stock ownership on their holders, such as voting rights or the right to receive dividends, but merely represent the right to acquire shares of Common Stock at a fixed price. Commencing on the date of issuance, holders of the Pre-Funded Warrants and the Common Warrants may exercise their right to acquire the underlying shares of Common Stock and pay the respective stated warrant exercise price per share. Following this offering, the market value of the Common Warrants is uncertain and there can be no assurance that the market value of the Common Warrants, if any, will equal or exceed their combined public offering prices. There can be no assurance that the market price of the shares of Common Stock will ever equal or exceed the exercise price of the Common Warrants, and consequently, whether it will ever be profitable for holders of Common Warrants to exercise the Common Warrants.

Until holders of the Pre-Funded Warrants and the Common Warrants acquire shares of our Common Stock upon exercise thereof, holders of such Pre-Funded Warrants and Common Warrants will have no rights with respect to shares of our Common Stock, except as provided in the Pre-Funded Warrants and the Common Warrants, respectively. Upon exercise of the Pre-Funded Warrants and Common Warrants, such holders will be entitled to the rights of a common stockholder only as to matters for which the record date occurs after the exercise date.

We have broad discretion in how we use the net proceeds of this offering, and we may not use these proceeds effectively or in ways with which you agree.

Our management will have broad discretion as to the application of the net proceeds of this offering and could use them for purposes other than those contemplated at the time of the offering. We currently intend to use the net proceeds, if any, from this offering for working capital and general corporate purposes. Our stockholders may not agree with the manner in which our management chooses to allocate and spend the net proceeds. Moreover, our management may use the net proceeds for corporate purposes that may not increase the market price of our Common Stock or other securities. See the section of this prospectus titled “Use of Proceeds” on page 24.

Risks Related to our Securities

You may experience future dilution as a result of future equity offerings or other equity issuances.

In order to raise additional capital, we believe that we will offer and issue additional shares of our Common Stock or other securities convertible into or exchangeable for our Common Stock in the future. We cannot assure you that we will be able to sell shares of our Common Stock or other securities in any other offering at a price per share that is equal to or greater than the price per share paid by purchasers in this offering, and investors purchasing other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional shares of our Common Stock or other securities convertible into or exchangeable for our Common Stock in future transactions may be higher or lower than the price per share in this offering.

Further, we have a significant number of warrants outstanding. To the extent that outstanding warrants have been or may be exercised, outstanding restricted stock units or restricted stock awards vest, instruments that are convertible or exercisable into Common Stock, if any, are converted or exercised, or other shares issued, you may experience further dilution. Further, we may choose to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plan.

Nasdaq may delist our securities from its exchange, which could harm our business and limit our stockholders’ liquidity.

Our Common Stock is currently listed on Nasdaq, which has qualitative and quantitative listing criteria. However, we cannot assure you that our Common Stock will continue to be listed on Nasdaq in the future. In order to continue listing our Common Stock on Nasdaq, we must maintain certain financial, distribution and stock price levels. Generally, we must maintain a minimum amount in stockholders’ equity, a minimum number of holders of our Common Stock and a minimum bid price.

On May 18, 2023, we received notice (the “Stockholders’ Equity Deficiency Letter”) from the Staff that we no longer satisfy the $2.5 million stockholders’ equity requirement for continued listing on Nasdaq, or the alternatives to that requirements - a $35 million market value of listed securities or $500,000 in net income in the most recent fiscal year or two of the last three fiscal years - as required by Nasdaq Listing Rule 5550(b) (the “Equity Requirement”).

The Stockholders’ Equity Deficiency Letter has no immediate effect on our continued listing on Nasdaq. In accordance with the Nasdaq Listing Rules, we were provided 45 calendar days, or until July 3, 2023, to submit a plan to regain compliance with the Equity Requirement (the “Compliance Plan”). We submitted the Compliance Plan to Nasdaq on July 3, 2023. On July 31, 2023, the Staff granted our request for an extension of the deadline to regain compliance with the Equity Requirement to November 14, 2023 and on March 14, 2024, the Staff granted our request for an extension of the deadline to regain compliance to May 20, 2024.

If Nasdaq delists our Common Stock from trading on its exchange and we are not able to list our securities on another national securities exchange, we expect our securities could be quoted on an over-the-counter market. If this were to occur, we could face significant material adverse consequences, including:

| |

●

|

a limited availability of market quotations for our securities;

|

| |

●

|

reduced liquidity for our securities;

|

| |

●

|

a determination that our Common Stock is a “penny stock” which will require brokers trading in our Common Stock to adhere to more stringent rules and possibly result in a reduced level of trading activity in the secondary trading market for our securities;

|

| |

●

|

a limited amount of news and analyst coverage; and

|

| |

●

|

a decreased ability to issue additional securities or obtain additional financing in the future.

|

The National Securities Markets Improvement Act of 1996, which is a federal statute, prevents or preempts the states from regulating the sale of certain securities, which are referred to as “covered securities.” If our Common Stock continues to be listed on Nasdaq, our Common Stock will be a covered security. Although the states are preempted from regulating the sale of our securities, the federal statute does allow the states to investigate companies if there is a suspicion of fraud, and, if there is a finding of fraudulent activity, then the states can regulate or bar the sale of covered securities in a particular case.

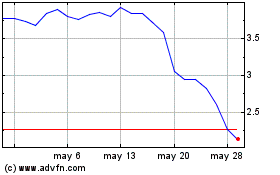

Our stock price may be volatile, and purchasers of our Common Stock could incur substantial losses.

Our stock price has fluctuated significantly since our IPO and is likely to continue to fluctuate substantially. As a result of this price fluctuation, investors may experience losses on their investments in our stock. In addition, the development stage of our operations may make it difficult for investors to evaluate the success of our business to date and to assess our future viability. The market price for our Common Stock may be influenced by many factors, including:

| |

●

|

sales of stock by our existing stockholders, including our affiliates;

|

| |

●

|

market acceptance of our Lumivascular platform and products;

|

| |

●

|

the results of our clinical trials;

|

| |

●

|

changes in analysts’ estimates, investors’ perceptions, recommendations by securities analysts or our failure to achieve analysts’ and our own estimates;

|

| |

●

|

the financial projections we may provide to the public, any changes in these projections or our failure to meet these projections;

|

| |

●

|

actual or anticipated fluctuations in our financial condition and operating results;

|

| |

●

|

quarterly variations in our or our competitors’ results of operations;

|

| |

●

|

general market conditions and other factors unrelated to our operating performance or the operating performance of our competitors;

|

| |

●

|

changes in operating performance and stock market valuations of other technology companies generally, or those in the medical device industry in particular;

|

| |

●

|

the loss of key personnel, including changes in our board of directors and management;

|

| |

●

|

legislation or regulation of our business;

|

| |

●

|

lawsuits threatened or filed against us;

|

| |

●

|

the announcement or approvals of new products or product enhancements by us or our competitors;

|

| |

●

|

announcements related to patents issued to us or our competitors and to litigation; and

|

| |

●

|

developments in our industry.

|

From time to time, our affiliates may sell stock for reasons due to their personal financial circumstances. These sales may be interpreted by other stockholders as an indication of our performance and result in subsequent sales of our stock that have the effect of creating downward pressure on the market price of our Common Stock. In addition, the stock prices of many companies in the medical device industry have experienced wide fluctuations that have often been unrelated to the operating performance of those companies.

The market price and trading volume of our Common Stock has been volatile, and it may continue to be volatile. We cannot predict the price at which our Common Stock will trade in the future and it may decline. The price at which our Common Stock trades may fluctuate significantly and may be influenced by many factors, including our financial results; developments generally affecting our industry; general economic, industry and market conditions; the depth and liquidity of the market for our Common Stock; investor perceptions of our business; reports by industry analysts; announcements by other market participants, including, among others, investors, our competitors, and our customers; regulatory action affecting our business; and the impact of other “Risk Factors” discussed in this Annual Report. In addition, changes in the trading price of our Common Stock may be inconsistent with our operating results and outlook. The volatility of the market price of our Common Stock may adversely affect investors’ ability to purchase or sell shares of our Common Stock.

We may not be able to secure additional financing on favorable terms, or at all, to meet our future capital needs and our failure to obtain additional financing when needed could force us to delay, reduce or eliminate our product development programs and commercialization efforts or cause us to become insolvent.

On March 5, 2024, we entered into a financing as part of a broader strategic collaboration with Zylox-Tonbridge Medical Technology Co., Ltd. (“Zylox-Tonbridge”) in which we received an aggregate of $7.5 million before any commissions, legal and accounting fees, and other ancillary expenses. We believe that our cash and cash equivalents of $7.2 million at March 31, 2024 and expected revenues, debt and financing activities and funds from operations will be sufficient to allow us to fund our current operations through the end of the second quarter of 2024. Even though we received proceeds of $7.5 million from the sale of our Common Stock and Series F Preferred Stock in March 2024, we will need to raise additional funds through future equity or debt financings in the near future to meet our operational needs and capital requirements for product development, clinical trials and commercialization. We can provide no assurance that we will be successful in raising funds pursuant to additional equity or debt financings or that such funds will be raised at prices that do not create substantial dilution for our existing stockholders. Given the volatility of our stock price, any financing that we undertake could cause substantial dilution to our existing stockholders.