UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a‑16 OR 15d‑16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

FOR THE MONTH OF MAY 2024

COMMISSION FILE NUMBER 001-39081

BioNTech SE

(Translation of registrant’s name into English)

An der Goldgrube 12

D-55131 Mainz

Germany

+49 6131-9084-0

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20‑F or Form 40‑F: Form 20‑F ☒ Form 40‑F ☐

Indicate by check mark if the registrant is submitting the Form 6‑K in paper as permitted by Regulation S‑T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6‑K in paper as permitted by Regulation S‑T Rule 101(b)(7): ☐

DOCUMENTS INCLUDED AS PART OF THIS FORM 6-K

On May 6, 2024, BioNTech SE (the “Company”) issued a press release announcing its first quarter 2024 financial results and corporate update and details of a conference call to be held at 8:00 am EDT on May 6, 2024 to discuss the results. The press release and the conference call presentation are attached as Exhibits 99.1 and 99.2, respectively, and incorporated by reference herein.

The information contained in Exhibits 99.1 and 99.2 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, unless expressly set forth by specific reference in such a filing.

SIGNATURE

Pursuant to the requirements of the Exchange Act, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| BioNTech SE |

| | |

| | |

| By: | /s/ Jens Holstein |

| | Name: Jens Holstein |

| | Title: Chief Financial Officer |

Date: May 6, 2024

EXHIBIT INDEX

| | | | | |

| |

| Exhibit | Description of Exhibit |

| |

| 99.1 | |

| |

| 99.2 | |

| |

BioNTech Announces First Quarter 2024 Financial Results and Corporate Update

•Advancing toward goal of ten or more potentially registrational trials running by the end of 2024: first patient dosed in Phase 3 clinical trial evaluating BNT323/DB-1303 in HR+ HER2-low chemotherapy-naïve metastatic breast cancer patients, and a second Phase 3 trial with BNT323/DB-1303 in recurrent endometrial cancer planned to start soon

•Presented clinical data at the American Association for Cancer Research (“AACR”) Annual Meeting for individualized and off-the-shelf mRNA-based cancer vaccine candidates based on iNeST and FixVac platforms, including three-year follow-up data of an investigator-initiated trial in patients with resected pancreatic ductal adenocarcinoma (“PDAC”)

•Planning to share additional clinical data from multiple clinical programs at the American Society of Clinical Oncology (“ASCO”) Annual Meeting, including bispecific antibodies BNT311/GEN1046 (acasunlimab) and BNT327/PM8002 and antibody-drug conjugate (“ADC”) BNT326/YL202

•Continued development and commercial preparation for a 2024 season variant-adapted COVID-19 vaccine

•First quarter 2024 revenues of €187.6 million, net loss of €315.1 million and loss per share of €1.31 ($1.421)

•Maintained strong financial position with €16.9 billion in cash, cash equivalents and security investments

Conference call and webcast scheduled for May 6, 2024, at 8:00 a.m. EDT (2:00 p.m. CEST)

MAINZ, Germany, May 6, 2024 (GLOBE NEWSWIRE) -- BioNTech SE (Nasdaq: BNTX, “BioNTech” or “the Company”) today reported financial results for the three months ended March 31, 2024, and provided an update on its corporate progress.

“In the past weeks, we have reported positive preliminary data for both our individualized and off-the-shelf mRNA-based candidates which further underline the potential of our iNeST and FixVac platforms. We look forward to providing more updates this year across our oncology portfolio, including our bispecific antibody and ADC programs,” said Prof. Ugur Sahin, M.D., CEO and Co-Founder of BioNTech. “In the remainder of the year, we plan to develop and commercialize a variant-adapted COVID-19 vaccine and accelerate our clinical development activities towards realizing the full potential of our oncology pipeline with a view to becoming a commercial company with marketed medicines for cancer and infectious diseases.”

Financial Review for the First Quarter 2024

| | | | | | | | |

| in millions €, except per share data | First Quarter 2024 | First Quarter 2023 |

| Total Revenues | 187.6 | 1,277.0 |

| Net (Loss) / Profit | (315.1) | 502.2 |

(Loss) / Diluted Earnings per Share | (1.31) | 2.05 |

Total revenues reported were €187.6 million for the three months ended March 31, 2024, compared to €1,277.0 million for the comparative prior year period. The year-over-year change was mainly due to lower commercial revenues from the sales of BioNTech’s COVID-19 vaccine worldwide resulting from endemic-level demand for COVID-19 vaccines.

Cost of sales were €59.1 million for the three months ended March 31, 2024, compared to €96.0 million for the comparative prior year period. The change was mainly due to recognizing lower cost of sales from BioNTech’s decreased COVID-19 vaccine sales, which included the share of gross profit that BioNTech owes its collaboration partner Pfizer Inc. (“Pfizer”) and royalty expenses based on BioNTech’s sales. In addition, cost of sales was impacted by expenses arising from inventory write-offs and destruction of inventory.

Research and development (“R&D”) expenses were €507.5 million for the three months ended March 31, 2024, compared to €334.0 million for the comparative prior year period. R&D expenses were mainly influenced by progressing clinical studies for pipeline candidates. The increase was further driven by an increase in wages, benefits and social security expenses resulting from an increase in headcount.

General and administrative (“G&A”) expenses reached €117.0 million for the three months ended March 31, 2024, compared to €111.8 million for the comparative prior year period. G&A expenses were primarily driven by increased expenses for IT environment and wages, benefits, and social security expenses resulting from an increase in headcount.

Income taxes were realized with an amount of €16.7 million of tax income for the three months ended March 31, 2024, compared to €205.5 of tax expenses accrued for the comparative prior year period. The effective income tax rate for the three months ended March 31, 2024, was approximately 5.0% applicable on the negative income.

Net loss was €315.1 million for the three months ended March 31, 2024, compared to a net profit of €502.2 million for the comparative prior year period.

Cash and cash equivalents as well as security investments as of March 31, 2024, reached €16,939.3 million, comprising €8,976.6 million cash and cash equivalents and €7,962.7 million security investments, respectively.

Loss per share was €1.31 for the three months ended March 31, 2024, compared to diluted earnings per share of €2.05 for the comparative prior year period.

Shares outstanding as of March 31, 2024, were 237,725,735, excluding 10,826,465 shares held in treasury.

“We started the year making good progress across our oncology pipeline. We dosed the first patient in our second pivotal Phase 3 trial and aim to have ten or more potentially registrational trials by the end of 2024. Revenues in the first quarter reflect the seasonal demand for COVID-19 vaccines, and we expect to recognize approximately 90% of our full year revenues in the last months of 2024, mostly in Q4 of 2024. With a strong cash position of €16.9 billion, we are well positioned to invest in our

innovative R&D pipeline and scale the business for commercial readiness in oncology,” said Jens Holstein, CFO of BioNTech. “We remain committed to seizing the opportunity to transform the way cancer and infectious diseases are treated, especially with our tremendous experience in using our mRNA platforms. We will focus the remainder of the year on executing and delivering on this vision with the aim to drive sustainable long-term growth and to create future value for patients, society and our shareholders.”

Outlook for the 2024 Financial Year

The Company reiterates its prior outlook for the financial year:

| | | | | |

| Total revenues for the 2024 financial year | €2.5 billion - €3.1 billion |

BioNTech expects group revenues for the full 2024 financial year to be in the range of €2.5 to €3.1 billion. The range reflects certain assumptions, including, but not limited to, expectations regarding: the timing and granting of regulatory approvals and recommendations; COVID-19 vaccine uptake and price levels; inventory write-downs by BioNTech’s collaboration partner Pfizer that would negatively influence the Company’s revenues; seasonal variations in SARS-CoV-2 circulation and vaccination uptake, which are expected to lead to demand peaks in the autumn and winter compared to other seasons; and revenues from a pandemic preparedness contract with the German government as well as revenues from the BioNTech Group service businesses, namely InstaDeep Ltd., JPT Peptide Technologies GmbH, and in Idar-Oberstein at BioNTech Innovative Manufacturing Services GmbH. Generally, the Company continues to remain largely dependent on revenues generated in its collaboration partner’s territories in 2024.

Planned 2024 Financial Year Expenses and Capex2:

| | | | | |

R&D expenses3 | €2.4 billion - €2.6 billion |

SG&A expenses4 | €700 million - €800 million |

| Capital expenditures for operating activities | €400 million - €500 million |

The full interim unaudited condensed consolidated financial statements can be found in BioNTech’s Report on Form 6-K for the period ended March 31, 2024, filed today with the United States Securities and Exchange Commission (“SEC”) and available at https://www.sec.gov/.

Endnotes

1 Calculated applying the average foreign exchange rate for the three months ended March 31, 2024, as published by the German Central Bank (Deutsche Bundesbank).

2 Numbers reflect current base case projections and are calculated based on constant currency rates, and exclude external risks that are not yet known and/or quantifiable, including, but not limited to, the effects of ongoing and/or future legal disputes or related activity.

3 Numbers include effects identified from additional collaborations or potential M&A transactions to the extent disclosed and are subject to update due to future developments.

4Anticipated expenses related to external legal advice in connection with certain legal litigations are not reflected in SG&A but in other operating expenses. Guidance does not include and may be impacted by potential payments resulting from the outcomes of ongoing or future contractual and legal disputes or related activity, such as judgments or settlements.

Operational Review of the First Quarter 2024, Key Post Period-End Events and 2024 Outlook

Omicron XBB.1.5-adapted Monovalent COVID-19 Vaccine (COMIRNATY®)

BioNTech and Pfizer developed, manufactured and delivered their Omicron XBB.1.5-adapted monovalent COVID-19 vaccine, which has received multiple regulatory approvals, including full approvals, authorizations for emergency or temporary use, or marketing authorizations, in more than 40 countries and regions. BioNTech is now focused on preparing for variant strain vaccine adaptation to be ready for commercial launch ahead of the upcoming 2024/2025 vaccination season, pending approvals.

COVID-19 – Influenza Combination Vaccine Program

BNT162b2 + BNT161 is an mRNA-based combination vaccine program against COVID-19 and influenza being developed in collaboration with Pfizer. Top-line data from the Phase 1/2 trial (NCT05596734) demonstrated robust immune responses to influenza A, influenza B, and SARS-CoV-2 strains and that the safety profile of the candidates was consistent with the profile of the companies’ COVID-19 vaccine. A Phase 3 clinical trial (NCT06178991) is ongoing.

Select Oncology Pipeline Highlights

ADC Programs

BNT323/DB-1303 is an ADC candidate targeting Human Epidermal Growth Factor 2 (“HER2”) that is being developed in collaboration with Duality Biologics (Suzhou) Co. Ltd. (“DualityBio”). The program has been granted Breakthrough Therapy designation by the U.S. Food and Drug Administration (“FDA”) for the treatment of advanced endometrial cancer in patients who progressed on or after treatment with immune checkpoint inhibitors.

BNT323/DB-1303 is being evaluated in a Phase 1/2 clinical trial (NCT05150691) in patients with advanced/unresectable, recurrent or metastatic HER2-expressing solid tumors. A potentially registrational cohort is enrolling HER2-expressing (IHC3+, 2+, 1+ or ISH-positive) patients with advanced/recurrent endometrial carcinoma and aims to recruit 140 patients. A confirmatory Phase 3 trial (NCT06340568) in this patient population is planned to start in 2024.

In January, the first patient was dosed in a pivotal Phase 3 trial (NCT06018337) evaluating BNT323/DB-1303 in patients with Hormone Receptor-positive (“HR+”) and HER2-low metastatic breast cancer that have progressed on hormone therapy and/or cyclin-dependent kinase 4/6 (“CDK4/6”) inhibition.

BNT325/DB-1305 is an ADC candidate targeting TROP2 that is being developed in collaboration with DualityBio. In January, BioNTech and DualityBio received Fast Track designation for BNT325/DB-1305 from the U.S. FDA for the treatment of patients with platinum-resistant ovarian epithelial, fallopian tube, or primary peritoneal cancer who have received one to three prior systemic treatment regimens. A Phase 1/2 clinical trial (NCT05438329) is ongoing.

BNT326/YL202 is an ADC candidate targeting HER3 that is being developed in collaboration with MediLink Therapeutics (Suzhou) Co., Ltd. (“MediLink”). A multicenter, open-label, first-in-human

Phase 1 clinical trial (NCT05653752) evaluating BNT326/YL202 as a later-line treatment in patients with locally advanced or metastatic epidermal growth factor receptor (“EGFR”)-mutated non-small cell lung cancer (“NSCLC”) or HR+/HER2-negative breast cancer is ongoing in the United States and China. Preliminary data from this study are expected to be presented at the 2024 ASCO Annual Meeting.

Next-Generation Immune Checkpoint Immunomodulator Programs

BNT311/GEN1046 (acasunlimab) is a potential first-in-class bispecific antibody candidate combining PD-L1 checkpoint inhibition with 4-1BB costimulatory activation that is being developed in collaboration with Genmab A/S (“Genmab”). Data from a Phase 2 trial (NCT05117242) evaluating BNT311/GEN1046 in combination with pembrolizumab in pretreated NSCLC patients are expected to be presented at the 2024 ASCO Annual Meeting.

BNT327/PM8002 is an anti-VEGF-A antibody candidate fused to a humanized anti-PD-L1 VHH being developed in collaboration with Biotheus Inc. (“Biotheus”). BNT327/PM8002 is currently being evaluated in Phase 1 and Phase 2/3 clinical trials in China to assess the efficacy and safety of the candidate as monotherapy or in combination with chemotherapy in various indications. An Investigational New Drug application has been accepted by the U.S. FDA for further studies in the United States, and global trials are planned to start this year. Monotherapy data from the Phase 1/2 trials are planned to be presented at the 2024 ASCO Annual Meeting.

Cancer Vaccine Programs

BNT116 is based on BioNTech’s FixVac platform, and is a wholly owned, systemically administered, off-the-shelf uridine mRNA-lipoplex based cancer vaccine candidate encoding six shared lung cancer associated antigens. A randomized, controlled Phase 2 clinical trial (NCT05557591) is ongoing to evaluate BNT116 in combination with cemiplimab versus cemiplimab alone as first-line treatment in patients with advanced NSCLC whose tumors express PD-L1 in ≥ 50% of tumor cells.

In April 2024, data from a Phase 1 trial cohort (NCT05142189) were presented at the AACR Annual Meeting. Patients were treated with BNT116 in combination with docetaxel after progression on a PD-1/PD-L1 inhibitor and a platinum-based chemotherapy. Preliminary data of BNT116 in combination with docetaxel show encouraging antitumor activity, consistent induction of immune responses, a manageable safety profile, and no signs of additive toxicity. Efficacy results suggest that combination therapy with BNT116 and docetaxel was active with an overall response rate (“ORR”) of 30% and a disease control rate (“DCR”) of 85%.

Autogene cevumeran (BNT122) is a uridine mRNA-lipoplex based cancer vaccine candidate for individualized neoantigen-specific immunotherapy (“iNeST”) being developed in collaboration with Genentech, Inc., a member of the Roche Group (“Genentech”). Autogene cevumeran is being evaluated in ongoing Phase 2 trials in adjuvant resected PDAC (NCT05968326), first-line melanoma (NCT03815058) and adjuvant colorectal cancer (“CRC”) (NCT04486378). Epidemiologic data including post-operative circulating tumor DNA (“ctDNA”) prevalence and prognostic value from a non-interventional, observational study (NCT04813627) in patients with resected high-risk stage II/III CRC are expected to be presented at the 2024 ASCO Annual Meeting. A Phase 2 clinical trial in an additional indication is planned.

In April 2024, long-term follow-up data from an investigator-initiated Phase 1 trial in patients with resected PDAC were presented at the AACR Annual Meeting. The data showed that the individualized mRNA cancer vaccine candidate autogene cevumeran continues to show polyspecific T cell responses up to three years after vaccination and that vaccine responses correlate with delayed tumor recurrence. The investigator-initiated, single center Phase 1 trial (NCT04161755) evaluated the safety of autogene cevumeran in sequential combination with the anti-PD-L1 immune checkpoint inhibitor atezolizumab and standard-of-care chemotherapy in 16 patients with resected PDAC. Data from the 1.5-year median follow-up were previously published in Nature (Rojas, L.A et al. 2023).

Cell Therapy Programs

BNT211 consists of two investigational medicinal products: a CAR-T cell product candidate targeting Claudin-6 (“CLDN6”)-positive solid tumors, in combination with a CAR-T cell-amplifying RNA vaccine (“CARVac”) encoding CLDN6. After determination of the recommended Phase 2 dose, BioNTech plans to initiate a pivotal trial in patients with germ cell tumors. BioNTech plans to present an analysis of real world evidence investigating overall survival and treatment patterns of patients with testicular germ cell tumors receiving palliative chemotherapy at the 2024 ASCO Annual Meeting.

Corporate Update for the First Quarter 2024 and Key Post Period-End Events

In February, BioNTech entered into a strategic collaboration with Autolus Therapeutics plc (“Autolus”) aimed at advancing both companies’ autologous CAR-T programs towards commercialization, pending regulatory authorizations. The collaboration also grants BioNTech the option to access a suite of Autolus’s target binders and cell programming technologies.

In March, BioNTech announced that Annemarie Hanekamp will be joining the Company’s Management Board as Chief Commercial Officer on July 1, 2024. Sean Marett, current Chief Business and Commercial Officer, will retire as planned from the Management Board while remaining a specialist advisor. Sean Marett’s responsibilities as Chief Business Officer are being gradually transferred to James Ryan, Ph.D., Chief Legal Officer, who will also take on the role of Chief Business Officer at the end of the transition phase. BioNTech has also appointed a General Manager for the U.S. who has commenced building out commercial operations in the country and aims to establish further expertise in the Company’s global commercial group to drive its first global product launch.

Upcoming Investor and Analyst Events

•Annual General Meeting: May 17, 2024

•Second Quarter 2024 Financial Results and Corporate Update: August 5, 2024

•Innovation Series (Digital & AI Day): October 1, 2024

•Innovation Series: November 14, 2024

Conference Call and Webcast Information

BioNTech invites investors and the general public to join a conference call and webcast with investment analysts today, May 6, 2024, at 8:00 a.m. EDT (2:00 p.m. CEST) to report its financial results and provide a corporate update for three months ended March 31, 2024.

To access the live conference call via telephone, please register via this link. Once registered, dial-in numbers and a pin number will be provided.

The slide presentation and audio of the webcast will be available via this link.

Participants may also access the slides and the webcast of the conference call via the “Events & Presentations” page of the Investors' section of the Company’s website at www.BioNTech.com. A replay of the webcast will be available shortly after the conclusion of the call and archived on the Company’s website for 30 days following the call.

About BioNTech

Biopharmaceutical New Technologies (BioNTech) is a global next generation immunotherapy company pioneering novel therapies for cancer and other serious diseases. BioNTech exploits a wide array of computational discovery and therapeutic drug platforms for the rapid development of novel biopharmaceuticals. Its broad portfolio of oncology product candidates includes individualized and off-the-shelf mRNA-based therapies, innovative chimeric antigen receptor (CAR) T cells, several protein-based therapeutics, including bispecific immune checkpoint modulators, targeted cancer antibodies and antibody-drug conjugate (ADC) therapeutics, as well as small molecules. Based on its deep expertise in mRNA vaccine development and in-house manufacturing capabilities, BioNTech and its collaborators are developing multiple mRNA vaccine candidates for a range of infectious diseases alongside its diverse oncology pipeline. BioNTech has established a broad set of relationships with multiple global and specialized pharmaceutical collaborators, including Biotheus, DualityBio, Fosun Pharma, Genentech, a member of the Roche Group, Genevant, Genmab, MediLink, OncoC4, Pfizer and Regeneron.

For more information, please visit www.BioNTech.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including, but not limited to, statements concerning: BioNTech’s expected revenues and net profit/(loss) related to sales of BioNTech’s COVID-19 vaccine, referred to as COMIRNATY where approved for use under full or conditional marketing authorization, in territories controlled by BioNTech’s collaboration partners, particularly for those figures that are derived from preliminary estimates provided by BioNTech’s partners; the rate and degree of market acceptance of BioNTech’s COVID-19 vaccine and, if approved, BioNTech’s investigational medicines; expectations regarding anticipated changes in COVID-19 vaccine demand, including changes to the ordering environment and expected regulatory recommendations to adapt vaccines to address new variants or sublineages; the initiation, timing, progress, results, and cost of BioNTech’s research and development programs, including BioNTech’s current and future preclinical studies and clinical trials, including statements regarding the timing of initiation, enrollment, and completion of studies or trials and related preparatory work and the availability of results, and the timing and outcome of applications for regulatory approvals and marketing authorizations; the targeted timing and number of

additional potentially registrational trials, and the registrational potential of any trial BioNTech may initiate; discussions with regulatory agencies; BioNTech’s expectations with respect to intellectual property; the impact of BioNTech’s acquisition of InstaDeep Ltd. and its collaboration and licensing agreements; the development, nature and feasibility of sustainable vaccine production and supply solutions; and BioNTech’s estimates of revenues, research and development expenses, selling, general and administrative expenses, and capital expenditures for operating activities. In some cases, forward-looking statements can be identified by terminology such as “will,” “may,” “should,” “expects,” “intends,” “plans,” “aims,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue,” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words.

The forward-looking statements in this press release are based on BioNTech’s current expectations and beliefs of future events, and are neither promises nor guarantees. You should not place undue reliance on these forward-looking statements because they involve known and unknown risks, uncertainties, and other factors, many of which are beyond BioNTech’s control and which could cause actual results to differ materially and adversely from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to: the uncertainties inherent in research and development, including the ability to meet anticipated clinical endpoints, commencement and/or completion dates for clinical trials, regulatory submission dates, regulatory approval dates and/or launch dates, as well as risks associated with preclinical and clinical data, including the data discussed in this release, and including the possibility of unfavorable new preclinical, clinical or safety data and further analyses of existing preclinical, clinical or safety data; the nature of the clinical data, which is subject to ongoing peer review, regulatory review and market interpretation; BioNTech’s pricing and coverage negotiations regarding its COVID-19 vaccine with governmental authorities, private health insurers and other third-party payors; the future commercial demand and medical need for initial or booster doses of a COVID-19 vaccine; competition from other COVID-19 vaccines or related to BioNTech’s other product candidates, including those with different mechanisms of action and different manufacturing and distribution constraints, on the basis of, among other things, efficacy, cost, convenience of storage and distribution, breadth of approved use, side-effect profile and durability of immune response; the timing of and BioNTech’s ability to obtain and maintain regulatory approval for its product candidates; the ability of BioNTech’s COVID-19 vaccines to prevent COVID-19 caused by emerging virus variants; BioNTech’s and its counterparties’ ability to manage and source necessary energy resources; BioNTech’s ability to identify research opportunities and discover and develop investigational medicines; the ability and willingness of BioNTech’s third-party collaborators to continue research and development activities relating to BioNTech's development candidates and investigational medicines; the impact of COVID-19 on BioNTech’s development programs, supply chain, collaborators and financial performance; unforeseen safety issues and potential claims that are alleged to arise from the use of products and product candidates developed or manufactured by BioNTech; BioNTech’s and its collaborators’ ability to commercialize and market BioNTech’s COVID-19 vaccine and, if approved, its product candidates; BioNTech’s ability to manage its development and expansion; regulatory developments in the United States and other countries; BioNTech’s ability to effectively scale its production capabilities and manufacture its products and product candidates; risks relating to the global financial system and markets; and other factors not known to BioNTech at this time. You should review the risks and uncertainties described under the heading “Risk Factors” in BioNTech’s Report on Form 6-K for the period ended March 31, 2024 and in subsequent filings made by BioNTech with the SEC, which are available on the SEC’s website at www.sec.gov. These forward-looking statements speak only as of the date hereof. Except as required by law, BioNTech disclaims any intention or responsibility for updating or revising any

forward-looking statements contained in this press release in the event of new information, future developments or otherwise.

Contacts

Investor Relations

Victoria Meissner, M.D.

+1 617 528 8293

Investors@biontech.de

Media Relations

Jasmina Alatovic

+49 (0)6131 9084 1513

Media@biontech.de

Interim Consolidated Statements of Profit or Loss

| | | | | | | | |

| Three months ended March 31, |

| 2024 | 2023 |

| (in millions €, except per share data) | (unaudited) | (unaudited) |

| | |

| Revenues | 187.6 | 1,277.0 |

| Cost of sales | (59.1) | (96.0) |

| Research and development expenses | (507.5) | (334.0) |

| Sales and marketing expenses | (15.6) | (12.2) |

| General and administrative expenses | (117.0) | (111.8) |

Other operating expenses (1) | (23.9) | (125.7) |

Other operating income (1) | 28.3 | 57.1 |

| Operating income / (loss) | (507.2) | 654.4 |

| | |

| Finance income | 180.1 | 82.3 |

| Finance expenses | (4.7) | (29.0) |

| Profit / (Loss) before tax | (331.8) | 707.7 |

| | |

| Income taxes | 16.7 | (205.5) |

| Profit / (Loss) for the period | (315.1) | 502.2 |

| | |

| Earnings / (Loss) per share | | |

| Basic earnings / (loss) for the period per share | (1.31) | 2.07 |

| Diluted earnings / (loss) for the period per share | (1.31) | 2.05 |

(1) Adjustments to prior-year figures due to change in functional allocation of general and administrative expenses and other operating expenses.

Interim Consolidated Statements of Financial Position

| | | | | | | | | | | |

| | March 31, | December 31, |

| (in millions €) | | 2024 | 2023 |

| Assets | | (unaudited) | |

| Non-current assets | | | |

| Goodwill | | 368.7 | 362.5 |

| Other intangible assets | | 821.7 | 804.1 |

| Property, plant and equipment | | 802.6 | 757.2 |

| Right-of-use assets | | 228.3 | 214.4 |

| Other financial assets | | 1,587.2 | 1,176.1 |

| Other non-financial assets | | 83.2 | 83.4 |

| Deferred tax assets | | 91.0 | 81.3 |

| Total non-current assets | | 3,982.7 | 3,479.0 |

| Current assets | | | |

| Inventories | | 345.4 | 357.7 |

| Trade and other receivables | | 1,639.8 | 2,155.7 |

| Contract assets | | 12.1 | 4.9 |

| Other financial assets | | 6,689.9 | 4,885.3 |

| Other non-financial assets | | 337.0 | 280.9 |

| Income tax assets | | 273.3 | 179.1 |

| Cash and cash equivalents | | 8,976.6 | 11,663.7 |

| Total current assets | | 18,274.1 | 19,527.3 |

| Total assets | | 22,256.8 | 23,006.3 |

| | | |

| Equity and liabilities | | | |

| Equity | | | |

| Share capital | | 248.6 | 248.6 |

| Capital reserve | | 1,228.9 | 1,229.4 |

| Treasury shares | | (10.8) | (10.8) |

| Retained earnings | | 19,448.2 | 19,763.3 |

| Other reserves | | (946.7) | (984.6) |

| Total equity | | 19,968.2 | 20,245.9 |

| Non-current liabilities | | | |

| Lease liabilities, loans and borrowings | | 205.0 | 191.0 |

| Other financial liabilities | | 40.6 | 38.8 |

| Provisions | | 8.8 | 8.8 |

| Contract liabilities | | 379.2 | 398.5 |

| Other non-financial liabilities | | 9.6 | 13.1 |

| Deferred tax liabilities | | 39.4 | 39.7 |

| Total non-current liabilities | | 682.6 | 689.9 |

| Current liabilities | | | |

| Lease liabilities, loans and borrowings | | 31.3 | 28.1 |

| Trade payables and other payables | | 298.8 | 354.0 |

| Other financial liabilities | | 152.4 | 415.2 |

| Income tax liabilities | | 353.2 | 525.5 |

| Provisions | | 247.0 | 269.3 |

| Contract liabilities | | 361.3 | 353.3 |

| Other non-financial liabilities | | 162.0 | 125.1 |

| Total current liabilities | | 1,606.0 | 2,070.5 |

| Total liabilities | | 2,288.6 | 2,760.4 |

| Total equity and liabilities | | 22,256.8 | 23,006.3 |

Interim Consolidated Statements of Cash Flows

| | | | | | | | | | | |

| | Three months ended March 31, |

| | 2024 | 2023 |

| (in millions €) | | (unaudited) | (unaudited) |

| Operating activities | | | |

| Profit / (Loss) for the period | | (315.1) | 502.2 |

| Income taxes | | (16.7) | 205.5 |

| Profit / (Loss) before tax | | (331.8) | 707.7 |

| Adjustments to reconcile profit before tax to net cash flows: | | | |

| Depreciation and amortization of property, plant, equipment, intangible assets and right-of-use assets | | 38.3 | 31.4 |

| Share-based payment expenses | | 16.3 | 8.6 |

| Net foreign exchange differences | | (28.7) | 53.1 |

| Loss on disposal of property, plant and equipment | | — | 0.2 |

| Finance income excluding foreign exchange differences | | (174.9) | (82.3) |

| Finance expense excluding foreign exchange differences | | 4.7 | 1.2 |

| Government grants | | (9.1) | (3.0) |

| Net gain on derivative instruments at fair value through profit or loss | | 1.7 | 76.2 |

| Working capital adjustments: | | | |

| Decrease in trade and other receivables, contract assets and other assets | | 498.2 | 893.8 |

| Decrease in inventories | | 12.3 | 15.5 |

| Decrease in trade payables, other financial liabilities, other liabilities, contract liabilities, refund liabilities and provisions | | (288.0) | (861.6) |

| Interest received and realized gains from cash and cash equivalents | | 199.4 | 53.6 |

| Interest paid and realized losses from cash and cash equivalents | | (3.7) | (1.2) |

| Income tax paid | | (258.8) | (844.9) |

| Share-based payments | | (2.4) | (725.7) |

| Government grants received | | 9.2 | — |

| Net cash flows used in operating activities | | (317.3) | (677.4) |

| | | |

| Investing activities | | | |

| Purchase of property, plant and equipment | | (58.5) | (45.2) |

| Purchase of intangible assets and right-of-use assets | | (78.4) | (9.6) |

| Investment in other financial assets | | (4,895.1) | (680.6) |

| Proceeds from maturity of other financial assets | | 2,727.6 | — |

| Net cash flows used in investing activities | | (2,304.4) | (735.4) |

| | | |

| Financing activities | | | |

| Payments related to lease liabilities | | (7.8) | (9.3) |

| Share repurchase program | | — | (282.0) |

| Net cash flows used in financing activities | | (7.8) | (291.3) |

| | | |

| Net decrease in cash and cash equivalents | | (2,629.5) | (1,704.1) |

| Change in cash and cash equivalents resulting from exchange rate differences | | 6.8 | (27.1) |

| Change in cash and cash equivalents resulting from other valuation effects | | (64.4) | — |

| Cash and cash equivalents at the beginning of the period | | 11,663.7 | 13,875.1 |

| Cash and cash equivalents as of March 31 | | 8,976.6 | 12,143.9 |

1st Quarter 2024 Financial Results & Corporate Update May 6, 2024 Exhibit 99.2

This Slide Presentation Includes Forward-Looking Statements 2 This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including, but not limited to, statements concerning: BioNTech’s expected revenues and net profit/(loss) related to sales of BioNTech’s COVID-19 vaccine, referred to as COMIRNATY where approved for use under full or conditional marketing authorization, in territories controlled by BioNTech’s collaboration partners, particularly for those figures that are derived from preliminary estimates provided by BioNTech’s partners; the rate and degree of market acceptance of BioNTech’s COVID-19 vaccine and, if approved, BioNTech’s investigational medicines; expectations regarding anticipated changes in COVID-19 vaccine demand, including changes to the ordering environment and expected regulatory recommendations to adapt vaccines to address new variants or sublineages; the initiation, timing, progress, results, and cost of BioNTech’s research and development programs, including BioNTech’s current and future preclinical studies and clinical trials, including statements regarding the timing of initiation, enrollment, and completion of studies or trials and related preparatory work and the availability of results, and the timing and outcome of applications for regulatory approvals and marketing authorizations; the targeted timing and number of additional potentially registrational trials, and the registrational potential of any trial BioNTech may initiate; discussions with regulatory agencies; BioNTech’s expectations with respect to intellectual property; the impact of BioNTech’s acquisition of InstaDeep Ltd. and its collaboration and licensing agreements; the development, nature and feasibility of sustainable vaccine production and supply solutions; and BioNTech's estimates of revenues, research and development expenses, selling, general and administrative expenses, and capital expenditures for operating activities. In some cases, forward-looking statements can be identified by terminology such as “will,” “may,” “should,” “expects,” “intends,” “plans,” “aims,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue,” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. The forward-looking statements in this presentation are based on BioNTech’s current expectations and beliefs of future events, and are neither promises nor guarantees. You should not place undue reliance on these forward-looking statements because they involve known and unknown risks, uncertainties, and other factors, many of which are beyond BioNTech’s control and which could cause actual results to differ materially and adversely from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to: the uncertainties inherent in research and development, including the ability to meet anticipated clinical endpoints, commencement and/or completion dates for clinical trials, regulatory submission dates, regulatory approval dates and/or launch dates, as well as risks associated with preclinical and clinical data, including the data discussed in this release, and including the possibility of unfavorable new preclinical, clinical or safety data and further analyses of existing preclinical, clinical or safety data; the nature of the clinical data, which is subject to ongoing peer review, regulatory review and market interpretation; BioNTech’s pricing and coverage negotiations regarding its COVID-19 vaccine with governmental authorities, private health insurers and other third-party payors; the future commercial demand and medical need for initial or booster doses of a COVID-19 vaccine; competition from other COVID-19 vaccines or related to BioNTech’s other product candidates, including those with different mechanisms of action and different manufacturing and distribution constraints, on the basis of, among other things, efficacy, cost, convenience of storage and distribution, breadth of approved use, side-effect profile and durability of immune response; the timing of and BioNTech’s ability to obtain and maintain regulatory approval for its product candidates; the ability of BioNTech’s COVID-19 vaccines to prevent COVID-19 caused by emerging virus variants; BioNTech’s and its counterparties’ ability to manage and source necessary energy resources; BioNTech’s ability to identify research opportunities and discover and develop investigational medicines; the ability and willingness of BioNTech’s third-party collaborators to continue research and development activities relating to BioNTech's development candidates and investigational medicines; the impact of COVID-19 on BioNTech’s development programs, supply chain, collaborators and financial performance; unforeseen safety issues and potential claims that are alleged to arise from the use of products and product candidates developed or manufactured by BioNTech; BioNTech’s and its collaborators’ ability to commercialize and market BioNTech’s COVID-19 vaccine and, if approved, its product candidates; BioNTech’s ability to manage its development and expansion; regulatory developments in the United States and other countries; BioNTech’s ability to effectively scale its production capabilities and manufacture its products and product candidates; risks relating to the global financial system and markets; and other factors not known to BioNTech at this time. You should review the risks and uncertainties described under the heading “Risk Factors” in BioNTech’s Report on Form 6-K for the period ended March 31, 2024 and in subsequent filings made by BioNTech with the SEC, which are available on the SEC’s website at www.sec.gov. These forward-looking statements speak only as of the date hereof. Except as required by law, BioNTech disclaims any intention or responsibility for updating or revising any forward-looking statements contained in this presentation in the event of new information, future developments or otherwise.

Financial Results Jens Holstein, Chief Financial Officer3 Strategic Outlook Ryan Richardson, Chief Strategy Officer4 Pipeline Update Özlem Türeci, Co-founder & Chief Medical Officer2 1st Quarter 2024 Highlights Ugur Sahin, Co-founder & Chief Executive Officer1

1 1st Quarter 2024 Highlights Ugur Sahin, Founder & Chief Executive Officer

2024 Strategic Priorities and Achievements in Q1 2024 5 1. Partnered with Duality Biologics; 2 Partnered with Genentech, a member of the Roche group 3. Partnered with Pfizer. HER2 = human epidermal growth factor receptor 2; ADC = antibody drug conjugate, HR = hormone receptor; AACR = American Association for Cancer Research: mRNA = messenger ribonucleic acid; PDAC = pancreatic ductal adenocarcinoma; NSCLC = non-small cell lung cancer; TROP2 = trophoblast cell-surface antigen 2. Presented clinical data at AACR for our mRNA cancer vaccines autogene cevumeran (BNT122)2 in PDAC and BNT116 in NSCLC Appointed Annemarie Hanekamp as Chief Commercial Officer starting in July First patient dosed in Phase 3 clinical trial evaluating our HER2 ADC BNT323/DB-13031 in HR+/HER2-low breast cancer Received Fast Track designation for our TROP2-ADC BNT325/DB-13051 for the treatment of platinum-resistant ovarian epithelial cancer, fallopian tube cancer, or primary peritoneal cancer Advancing variant-adapted COVID-19 vaccine for the 2024/2025 season3 Clinical Execution in Oncology Commercial Readiness in Oncology COVID-19 Leadership Appointed further expertise in global commercial group to drive first global product launch Appointed General Manager US who has commenced building out US commercial operations

Intraindividual variability & intratumoral heterogeneity driving evasion and secondary resistance mechanism Addressing the Fundamental Challenge in Cancer Treatment Cancer cells Genetically diverse & adaptable5-20 years – up to 10,000 mutations Mutations DNA Mutation Healthy Cell Mutations Mutations Mutations Mutations Individual patients 6 Alexandrov L et al., Nature 2019; Kandoth C et al., Nature 2013; Yizhak K et al., Science 2019; Lim Z & Ma P, J Hematol Oncol 2019; Quazi MA et al., Ann Oncol 2017; Maryusk A et al., Cancer Cell 2023.

Our Oncology Approach 7 Strategy Portfolio covering compound classes with synergistic mechanisms of action • Immunomodulators • Targeted therapies • Individualized and off-the-shelf mRNA vaccines Programs across a wide range of solid tumors and stages of treatment Programs with first-in-class and / or best-in-class potential Unique therapeutic combinations Goals Address the continuum of cancer Bring novel therapies to cancer patients and establish new treatment paradigms Open up novel options to combine platforms and therapies

Towards a Potentially Curative Approach to Cancer: Differentiated Combinations Space for potentially curative approaches Immunomodulators Novel checkpoint inhibitors, cytokines, immune agonists mRNA vaccines Targeted therapy ADCs, CAR-T, TCR-T, small molecules SynergySynergy Synergy 8 ADC = antibody-drug conjugate; CAR = chimeric antigen receptor; TCR-T = T-cell receptor engineered T cell; IO = immune oncology. Immunomodulators • Focus on the most relevant and crucial IO pathways • Targeting different complementary players in the complex cancer immunity cycle may promote a thorough and durable anti-tumor effect mRNA cancer vaccines • Could eliminate polyclonal residual disease with individualized vaccines for potential long-term impact • Polyspecific activity by targeting multiple antigens at once Targeted therapy • Potent and precise therapies could rapidly reduce tumor burden • Designed to have clinical efficacy across the entire disease continuum including late lines

Our Next Stage of Growth in Oncology 9 2024 2025 2026+ 10+ potentially registrational trials in 2024 Build out commercial organization ahead of potential launches Plan to start combination trials Pivotal data updates in 2025 and beyond to support potential submissions Potential launches in multiple indications as early as 2026

2 Pipeline Update Özlem Türeci, Co-Founder & Chief Medical Officer

Our Multi-Platform Immuno-Oncology Pipeline Today 11 1. Partnered with Genentech, member of Roche Group; 2. Partnered with Regeneron; 3. Partnered with Genmab; 4. Partnered with OncoC4; 5. Partnered with DualityBio; 6. Partnered with MediLink Therapeutics. *Two phase 1/2 clinical trials in patients with solid tumors are ongoing in combination with immune checkpoint inhibitor +/- chemotherapy NSCLC = non-small cell lung cancer; SCLC = small cell lung cancer; mCRPC = metastatic castration resistant prostate cancer; HPV = human papillomavirus; PDAC = pancreatic ductal adenocarcinoma; CRC = colorectal cancer; CLDN = claudin; IL = interleukin; 1L = first line; R/R = relapsed/refractory; HER2/HER3 = human epidermal growth factor 2/3; sLeA = sialyl-Lewis A antigen; TROP2 = trophoblast cell-surface antigen 2; TNBC = triple negative breast cancer. Phase 1 Phase 1/2 Phase 2 Phase 3 BNT211 (CLDN6) Multiple solid tumors BNT311/GEN10463 (acasunlimab; PD-L1x4-1BB) Multiple solid tumors BNT312/GEN10423 * (CD40x4-1BB) Multiple solid tumors BNT313/GEN10533 (CD27) Multiple solid tumors BNT316/ONC-392 (gotistobart)4 (CTLA-4) Multiple solid tumors BNT151 (IL-2 variant) Multiple solid tumors BNT142 (CD3xCLDN6) Multiple CLDN6-pos. adv. solid tumors BNT325/DB-13055 (TROP2) Multiple solid tumors BNT316/ONC-392 (gotistobart)4 (CTLA-4) anti-PD-1/PD-L1 experienced NSCLC BNT323/DB-13035 (HER2) Multiple solid tumors BNT324/DB-13115 (B7H3) Multiple solid tumors BNT323/DB-13035 (HER2) HR+/HER2-low met. breast cancer BNT116 Adv. NSCLC BNT152 + BNT153 (IL-7, IL-2) Multiple solid tumors BNT221 Refractory metastatic melanoma BNT321 (sLea) Metastatic PDAC BNT322/GEN10563 Multiple solid tumors Autogene cevumeran (BNT122)1 Multiple solid tumors BNT314/GEN10593 (EpCAMx4-1BB) Multiple solid tumors mRNA Next generation IO Cell therapy Legend Small molecules ADCs BNT326/YL2026 (HER3) Multiple solid tumors BNT311/GEN10463 (acasunlimab; PD-L1x4-1BB) R/R met. NSCLC, +/- pembrolizumab BNT1112 aPD(L)1-R/R melanoma, + cemiplimab BNT113 1L rel./met. HPV16+ PDL-1+ head and neck cancer, + pembrolizumab Autogene cevumeran (BNT122)1 1L adv. melanoma, + pembrolizumab Autogene cevumeran (BNT122)1 Adj. ctDNA+ stage II or III CRC BNT1162 1L adv. PD-L1 ≥ 50% NSCLC, + cemiplimab Autogene cevumeran (BNT122)1 Adj. PDAC, + atezolizumab + mFOLFIRINOX BNT316/ONC-392 (gotistobart)4 (CTLA-4) Plat.-R. ovarian cancer, + pembrolizumab BNT316/ONC-392 (gotistobart)4 (CTLA-4) mCRPC, + radiotherapy BNT411 (TLR7) Multiple solid tumors BNT321 (sLea) adjuvant PDAC, +mFOLFIRINOX BNT323/DB-13035 (HER2) HER2-expressing rec. endometrial cancer PLANNED NEW NEW NEW

Focus on Clinical Trial Execution in Oncology 0 100 200 300 400 500 600 2020 2021 2022 2023 Q1 2024 + 424% BNT316/ONC-392 (gotistobart)1 anti-PD-1/PD-L1-experienced NSCLC BNT323/DB-13032 HR+, HER2-low met. breast cancer Autogene cevumeran (BNT122)3 Adj. PDAC, + atezolizumab + mFOLFIRINOX Autogene cevumeran (BNT122)3 Adj. CRC BNT113 PDL-1+, HPV16+ HNSCC, + pembrolizumab Phase 3 Phase 3 Phase 2 Phase 2 Phase 2 1. Partnered with OncoC4; 2. Partnered with DualityBio; 3. Partnered with Genentech, member of the Roche group. * Includes BNTX trials and partnered trials. PD-1 =programmed cell death protein 1; HR = hormone receptor; HER2 = human epidermal growth factor receptor 2; NSCLC = non-small cell lung cancer; PDAC = pancreatic ductal adenocarcinoma; CRC = colorectal cancer ; HPV = human papillomaviruses; HNSCC = head and neck squamous cell carcinoma. Select ongoing mid- to late-stage trials Average quarterly patient enrollment in trials* On track to have 10+ potentially registrational trials by YE 2024 # of P at ie nt s En ro lle d Quarterly average per year

BNT327/PM80021: a PD-L1/VEGF- A Targeting Bispecific Antibody 13 1. Partnered with Biotheus; PD-L1 = programmed cell death ligand 1; VEGF-A = vascular endothelial growth factor A; CTx = chemotherapy; 1/2L = first/second-line; TNBC = triple-negative breast cancer; SCLC = small cell lung cancer; SABCS = San Antonio Breast Cancer Symposium; ESMO = European Society for Medical Oncology; ORR = objective response rate; DCR = disease control rate, ITT = intention-to-treat; IO = immuno oncology; CTFI = chemotherapy-free interval; TTP = time to progression; PR = partial response; SD = stable disease; PD = progressive disease; CR = complete response. Phase 2 (NCT05918133): clinical activity of BNT327/PM8002 in combination with nab-paclitaxel in 1L TNBC Jiong Wu et al. Presented at SABCS 2023. Poster#PS08-06 Phase 2 (NCT05879068): clinical activity of BNT327/PM8002 in combination with paclitaxel in 2L SCLC Ying Cheng et al. Presented at ESMO 2023. Poster#1992P C ha ng e fr om B as el in e (% ) -100 60 40 0 -20 -40 -80 20 -60 CRPDSDPR Response ORR, % 78.6 DCR, % 95.2 - - - + + - + ○ + + √ ○ + + ○ - + + + + - √ ○ - - - - - + - ○ - - - ○ - - √ + - √ ○ - - - + - - IO-naïve + IO-treated ○ CTFI < 30 days √ TTP < 3 months Response ITT (n=36) IO-naïve (n=22) IO-treated (n=14) ORR, % 61.1 72.7 42.9 DCR, % 86.1 81.8 92.9 Ongoing trials across several indications and favorable safety profile established in > 600 patients Plan to start 2 pivotal trials in end 2024/begin 2025 Strong single compound activity, and high ORRs observed in combination with CTx in various indications CRPDSDPR -90 -70 -50 -30 -10 10 30 50 70

BioNTech – Full Exploitation of Cancer Vaccine Target Space 14 1. iNeST is being developed in collaboration with Genentech, a member of the Roche Group. *autogene cevumeran (BNT122); ** Amount of tumor antigens varies across programs; *** T cell responses analyzed by ex vivo multimer staining analysis in blood. TNBC = triple-negative breast cancer; MAGE = melanoma-associated antigen; NY-ESO-1 = New York esophageal squamous cell carcinoma-1; HPV = human papillomavirus E7. Individual patient samples (blood and tissue) Artificial intelligence- driven neoantigen prediction On-demand tailored RNA manufacturing Individualized immuno- therapy Mapping of mutations Fixed combination of shared tumor antigens** Multi-antigen approach tailored to each indication Neo- antigens Individualized therapy Multiple shared antigens Off-the-shelf therapy iNeST1,* FixVac individualized Neoantigen-Specific immunoTherapy Fixed Antigen Vaccine ANTIGEN 1 ANTIGEN 2 ANTIGEN 3 ANTIGEN 4 Strong vaccine- induced ex vivo CD8+ T cell responses across different cancer types*** 10.3% 10.1% HPV16-E7 Head & Neck Cancer BNT113, HARE40 trial Mutant Neoantigen TNBC, BNT114 TNBC-MERIT trial 5% MAGE-A3 Melanoma, BNT111, Lipo-MERIT trial 2.1% NY-ESO-1 Melanoma , BNT111, Lipo-MERIT trial mRNA- Lipoplex platform

High-Magnitude, Sustained Immunity upon Neoantigen mRNA Vaccination 15 HLA = human leukocyte antigen; IFN = interferon; PDAC = pancreatic ductal adenocarcinoma; TNBC = triple-negative breast cancer; CICON = International Cancer Immunotherapy Conference; ESMO = European Society for Medical Oncology. Adjuvant TNBC Vaccine-induced T cells persist over multiple years T cells are high-magnitude COX7A2(A84V) GVADVLLYR / HLA-A*1101 CLINT1(T472I) VSKILPSTW / HLA-B*5701 UTP6(H137Y) YSNKPALW / HLA-B*5701 0.015 0.055 0.064 4.5 Years after treatment start Mean Individual T cells are multiclonal T cells are functional 0 100 200 0 2 4 6 300 600 Days after treatment start P er c en t o f C D 8+ P01 PPP1R15B(S278T) Melanoma Sahin et al, NATURE 2017 & data on file Adjuvant PDAC Rojas et al, NATURE 2023 Multimer+ IFNγand TN IFNγ+ Prime Half-life Boost Half-life Life- spans Vaccine Booster Pe rc en ta ge o f a ll bl oo d ce lls Türeci, CICON 2023/ESMO 2020

Growing Portfolio of Cancer Vaccine Candidates Across Multiple Solid Tumors 16 1. Partnered with Genentech, member of Roche Group; 2. Sponsored by Regeneron. iNeST = individualized Neoantigen Specific Immunotherapy;1L = first line; R/R = relapsed/refractory; CRC = colorectal cancer; PDAC = pancreatic ductal adenocarcinoma; TNBC = triple-negative breast cancer; HPV = human papillomavirus; HNSCC = head and neck squamous carcinoma; NSCLC = non-small cell lung cancer; ADT = androgen deprivation therapy; CTx = chemotherapy; PFS = progression-free survival; ASCO = American Society of Clinical Oncology; AACR = American Association for Cancer Research; SITC = Society for Immunotherapy of Cancer; ESMO-IO = European Society for Medical Oncology Immono-Oncology. Six ongoing Phase 2 trials with cancer vaccine candidates in multiple disease settings Individualized vaccine: iNeST1 FixVac Adjuvant 1L R/R R/R Post-adj. Neo-adj, mCR 1L Multiple settings CRC Phase 2 PDAC Phase 2 Melanoma Phase 2 Solid Tumors Phase 1 Melanoma Phase 2 TNBC Phase 1 Prostate Cancer Phase 1/2 HPV16+ HNSCC Phase 2 NSCLC Phase 1 & 2 Autogene cevumeran (BNT122) Monotherapy Autogene cevumeran (BNT122) + Atezolizumab Autogene cevumeran (BNT122) + Pembrolizumab Autogene cevumeran (BNT122) + Atezolizumab BNT111 +/- Cemiplimab BNT114 BNT112 Monotherapy & + Cemiplimab + ADT BNT113 + Pembrolizumab vs. Pembrolizumab BNT116 Monotherapy & Cemiplimab or CTx Study ongoing Study started in Q4 2023 Data presented from investigator- initiated Ph 1 study at ASCO 2022 & AACR 2024 and published (Rojas et al. Nature.2023) Enrollment completed Analysis of PFS as primary endpoint will be based on events and define when we will report results Enrollment completed Data presented at AACR 2020 Manuscript in preparation Enrollment completed, study is ongoing Data presented from Ph1 at SITC 2021 and published (Sahin et al., Nature 2020) Manuscript in preparation Discontinued Data presented at SITC 2021 Study ongoing Data presented at ESMO-IO 2022 Ph 1 study ongoing Data presented at SITC 2023 and AACR 2024 Ph 2 in 1L NSCLC started in Q3 20232

Autogene Cevumeran (BNT122)1 Investigated in a Phase 2 Randomized Trial vs Watchful Waiting in Adjuvant Colorectal Cancer 17 1. Partnered with Genentech, member of Roche Group. 2. Kotani et al. Nature 2023, Nakamura et al. ESMO 2023; 3. André T et al. J Clin Onc. 2015 CT = computer tomography; CRC = colorectal cancer; SoC = standard of care; qxw = every X week(s); ctDNA = circulating tumor DNA; (m)DFS = (median) disease-free survival; OS = overall survival; RFS = relapse-free survival; TTR = time to response; TTF = time to treatment failure. Autogene cevumeran (BNT122) 15 doses: 6×q1w, 2×q2w, 7×q6w Observational watchful waiting Adjuvant SoC chemotherapy for 12–24 weeksInclusion criteria Patients with surgically-resected Stage II (high-risk) or Stage III CRC Screening 1 ctDNA status (post-operative) Screening 2 neoantigen selection for vaccine manufacture Screening 3 final eligibility (ctDNA-positive) n=164 R 1:1 Biomarker: BNT122 irrespective of ctDNA status (n=15) iNeST manufacturing ≤20 neo-epitopes Exploratory: BNT122 recurrent disease at Screening 3 (n≤20) Key endpoints Status • First patient dosed (randomized cohort): December 2021 • Study on track Primary: Disease-free survival Efficacy: RFS, TTR, TTF, OS Change in ctDNA status Phase 2, multi-site, open-label, randomized, controlled trial (NCT04486378) Historical efficacy in CRC patients2, 3 mDFS in ctDNA+ patients: 6 months 5-year DFS rate: stage II (high-risk) ~80%, stage III ~66% 5-year OS rate: stage II (high-risk) ~88%´, stage III ~76%

Autogene Cevumeran (BNT122)1 Investigated in a Phase 2 Randomized Trial vs SoC in Resected PDAC 18 1. Partnered with Genentech, member of Roche Group; 2. Conroy T. et al. JAMA Onc. 2022. SoC = standard of care; PDAC = pancreatic ductal adenocarcinoma; (m)DFS = (median) disease-free survival; (m)OS = (median) overall survival; FPD = first patient dosed Key endpoints Primary: DFS Secondary: DFS rates, OS, OS rates and safety Status • Recruitment ongoing • FPD October 2023 Inclusion criteria Screening Part A Determine ≥5 neo-epitopes from blood and tumor samples for custom manufacture of BNT122 Screening Part B Confirm patient eligibility based IN/EX criteria n=260 R 1:1 Treatment phases and dosing schedules During the study, patients are monitored at scheduled intervals until recurrence of PDAC, occurrence of new cancers, or unacceptable toxicity, whichever occurs first. Randomization 6-12 weeks following surgery Autogene cevumeran (BNT122) + atezolizumab + mFOLFIRINOX mFOLFIRINOX IMCODE003: Phase 2, open-label, multicenter, randomized trial (NCT05968326) • Resection margin • Nodal involvement Stratification factors Historical efficacy of mFOLFIRINOX monotherapy2 mDFS = 21.4 months, 5-year DFS = 26.1% mOS = 53.5 months, 5-year OS = 43.2% • Patients with resected PDAC • No prior systemic anti- cancer treatment for PDAC • No evidence of disease after surgery

Autogene Cevumeran (BNT122)1 Vaccine Response Correlates with Delayed PDAC Recurrence 1. Partnered with Genentech, member of Roche Group. PDAC = Pancreatic ductal adenocarcinoma; OS = overall survival, RFS = relapse-free survival. Phase 1, investigator-initiated trial in resectable PDAC: 3-year follow-up data Balachandran V et al. Presented at AACR 2024. # CT025 & Rojas et al. Nature. 2023. 19 At risk Responder 8 8 7 6 2 0 Non-responder 8 6 5 2 0 0 8 8 7 5 0 8 5 1 1 0 1.5-year median follow-up 3-year median follow-up 0 20 40 60 80 100 R FS (% ) Months 0 20 40 60 80 100 Years Median RFS: Not reached Median RFS: 13.4 months Immune responder (n = 8) Immune non-responder (n = 8) 0 6 12 18 24 30 0 1 2 3 4 Median RFS: Not reached Median RFS: 13.4 months P = 0.003, HR: 0.08 (0.01-0.4) P = 0.007, HR: 0.14 (0.03-0.59)

~ 85% of NSCLC patients express ≥1 TAA > 60% of NSCLC patients express ≥2 TAAs FixVac: Identification of Shared Tumor Antigen (TAA) Sets that Cumulatively Cover a Major Proportion of Patients 20 Data on file. TAA = tumor-associated antigen; RT-qPCR = real-time quantitative polymerase chain reaction; NSCLC = non-small cell lung cancer; TCGA = The Cancer Genome Atlas; GTEx = genotype-tissue expression; TEA = tissue engineering acoustophoretic; TRON = Helmholtz Institute for Translational Oncology; KK-LC-1 = Kita-Kyushu lung cancer antigen 1; MAGE = melanoma-associated antigen; PRAME = preferentially expressed antigen in melanoma; CLDN = claudin.. . Target selection for BNT116 – lung cancer1 Expression of tumor-associated antigens2,3,4 Next Generation Sequencing Evaluation I RT-qPCR (isoforms-indep.) Evaluation II RT-qPCR (includ. Isoforms) Target Selection and Revision RNAseq Databases TCGA: 466 lung adenocarcinoma (LUAD) TCGA: 415 lung squamous Carcinoma (LUSC) GTEx: 2719 health tissue specimen TEA: 119 healthy tissues (TRON) In-house Sample Material • 52 LUAD samples • 55 LUSC samples • 57 other Lung-Cancer samples • 176 healthy tissue samples Warehouse Targets Detailed target profiles including literature mining and epitope prediction Target discovery Candidate evaluation I/II TARGET FORCE Candidates for RT-qPCR evaluation Candidates for in depth evaluation Final target set for FixVac 261 predicted candidates 63 selected candidates in EVA I/II 15 selected candidates In silico analysis of transcript abundance of the six BNT116 TAAs in an NSCLC cohort In-house assessment of expression of the six BNT116 TAAs, Mage-A3, CLDN6. KK-LC-1, PRAME, MAGE-A4, and MAGE-C1 in a cohort from clinical routine using RT-qPCR (n=184)

N = 130N = 130 BNT116: Broad Evaluation in NSCLC as Monotherapy and in Combination 21 1. Sponsored by Regeneron; NSCLC = non-small cell lung cancer; FIH= first in human; PD-L1 = programmed cell death ligand 1; TPS = tumor proportion score; RECIST = Response Evaluation Criteria in Solid Tumors; ECOG PS = eastern cooperative oncology group performance status; DLT = dose limiting toxicity; ORR = overall response rate; DoR = duration of response; DCR = disease control rate; DDC = duration of disease control; PFS = progression-free survival; OS = overall survival; TEAE = treatment emergent adverse events; SAE = serious adverse event ; CRT = chemoradiotherapy. Primary Endpoints: DLT occurrence during Cycle 1, safety Secondary Endpoints: ORR, DoR, DCR, DDC, PFS, OS OS follow-up every 3 months for up to 24 months after end of treatment Primary Endpoint: ORR Secondary Endpoints: OS, PFS, DOR, TEAEs, SAEs LuCa-MERIT-1: FIH, Open Label Phase I Trial Evaluating Safety, Tolerability, and Preliminary Efficacy of BNT116 Alone and in Combinations in NSCLC (NCT05142189) EmpowerVax-Lung1: Phase 2 Study of Cemiplimab in Combination with BNT116 vs. Cemiplimab Monotherapy in First-Line Treatment of Patients with Advanced NSCLC with PD-L1 ≥50% (NCT05557591) Inclusion criteria Cohort 1–4: Unresectable (Stage III) or metastatic (Stage IV) NSCLC Cohort 5: Unresectable (Stage III) NSCLC after CRT Cohort 6: Resectable (Stage II or III at diagnosis) NSCLC Cohort 1, 4 and 5: ECOG PS 0-2 Cohort 2, 3 and 6: ECOG PS ≤1 Key inclusion criteria • Advanced untreated NSCLC (Stage IIIB, IIIC or IV squamous or non-squamous NSCLC, who are ineligible for surgical resection or definitive chemoradiation) • PD-L1 expression TPS ≥50% • At least 1 radiographically measurable lesion by RECIST 1.1 • ECOG-PS ≤1 BNT116 + cemiplimab (n=20) (frail patients) Optional: cemiplimab from cycle 3 onwards BNT116 monotherapy (n=30) Deme D. et al. SITC. 2023. BNT116 + cemiplimab (n=20) (PD-L1 ≥ 50%, progressive disease on PD-1 or PD-L1 inhibitor as first line/adj. Tx) BNT116 + docetaxel (n=20) Öven BB et al. AACR. 2024. BNT116 + cemiplimab (n=20) (after concurrent CRT) BNT116 + cemiplimab + carboplatin + paclitaxel (neoadj. therapy) > surgery > BNT116+ cemiplimab (adjuvant therapy) (n=20) 1 2 3 4 5 6 R 1:1 Arm A: Cemiplimab Arm B: BNT116 + cemiplimab Up to 24 months or until disease progression

Preliminary Results of BNT116 Show Encouraging Antitumor Activity and Manageable Safety Profile in Combination with Docetaxel 22 FIH = first in human; ORR = objective response rate; DCR = disease control rate; (m)PFS = (median) progression-free survivial; (m)OS = (median) overall survival; PR = partial response; SD = stable disease; PD = progressive disease; NSCLC = non-small cell lung cancer. Phase 1 FIH study (NCT05142189): Clinical activity and tolerability Öven BB. et al. Presented at AACR 2024. #CT051. Cohort 3 BNT116 + docetaxel (n=20) ORR, n (%) 6 (30) DCR, n (%) 17 (85) mPFS, m 4.4 Ch an ge o f t ar ge t l es io n su m fro m b as el in e (% ) -60 -50 -40 -30 -20 -10 0 10 20 30 40 50 60 0 50 100 150 200 250 300 350 Study day Overall response Best overall response PR SD PD Be st c ha ng e of ta rg et le si on s um fro m b as el in e (% ) -60 -50 -40 -30 -20 -10 0 10 20 30 Best overall response PR SD PD BNT116 + docetaxel shows activity in heavily pretreated patients with NSCLC Baseline PR –Partial response SD – Stable disease PD – Progressive disease Patient Historical efficacy of docetaxel monotherapy (Garon et al. Lancet. 2014): • ORR ~10% • mPFS ~ 3 months • mOS ~ 9 months Safety: • Manageable safety profile, comparable to other FixVac candidates • No signs of the combination treatment increasing the severity or duration of the adverse events were observed.

BioNTech at ASCO 2024 23 1. Partnered with Genmab; 2. Partnered with Biotheus; 3. Partnered with MediLink; 4. Partnered with Genentech, a member of the Roche group. Related Program Indication Study BNT311/ GEN1046 (acasunlimab)1 2L non-small cell lung cancer Phase 2 BNT327/PM80022 Cervical cancer and platinum- resistant ovarian cancer Phase 1/2 BNT327/PM80022 Non-small cell lung cancer Phase 1/2 BNT326/YL2023 Non-small cell lung cancer & breast cancer Phase 1 Autogene cevumeran (BNT122)4 Colorectal cancer Epidemiological study BNT211 Germ cell tumors Real-world data Across portfolio Data for making informed decisions about the direction of further development

3 Financial Results Jens Holstein, Chief Financial Officer

Q1 2024 Key Financial Figures1 25 1. Financial information is prepared and presented in Euros and numbers are rounded to millions and billions of Euros in accordance with standard commercial practice. 2. Consists of cash and cash equivalents of €8,976.6 million and security investments of €7,962.7 million, as of March 31, 2024. (Loss) before tax €(1.31) €(332)m€188 m €16.9 bn Total revenues (Loss) per Share Total cash plus security investments2

Q1 2024 Financial Results 26 1. Numbers have been rounded, numbers presented may not add up precisely to the totals and may have been adjusted in the table context. Presentation of the consolidated statements of profit or loss has been condensed. 2. BioNTech’s profit share is estimated based on preliminary data shared between Pfizer and BioNTech as further described in BioNTech's Report on Form 6-K for the three months ended March 31, 2024, filed on May 6, 2024. Any changes in the estimated share of the collaboration partner's gross profit will be recognized prospectively. Total revenues consist of COVID-19 vaccine revenues and other revenues as further described in BioNTech's Report on Form 6-K. 3. Adjustments to prior-year figures relate to costs for external legal advice in connection with certain legal litigations from general and administrative expenses to other operating expense to reflect changes in the internal reporting also in the external reporting. (in millions €, except per share data)1 2024 2023 Revenues2 187.6 1,277.0 Cost of sales (59.1) (96.0) Research and development expenses (507.5) (334.0) Sales and marketing expenses (15.6) (12.2) General and administrative expenses (117.0) (111.8) Other operating income less expenses3 4.4 (68.6) Operating income / (loss) (507.2) 654.4 Finance income less expenses 175.4 53.3 Profit / (Loss) before tax (331.8) 707.7 Income taxes 16.7 (205.5) Profit / (Loss) for the period (315.1) 502.2 Earnings / (Loss) per share Basic earnings / (loss) for the period per share (1.31) 2.07 Diluted earnings / (loss) for the period per share (1.31) 2.05 Three months ended March 31st Three months ended March 31st

Revenue guidance considerations: Top-line sensitivity mainly dependent on the following factors • Vaccination rates and price levels in markets where significant Comirnaty sales are expected • Inventory write-downs • Anticipated revenues related to service businesses, including InstaDeep, JPT Peptide Technologies, IMFS and from the German pandemic preparedness agreement 2024 Financial Year Guidance Reiterated1 27 1. Excluding external risks that are not yet known and/or quantifiable, including, but not limited to, the effects of ongoing and/or future legal disputes or related activity. 2. Numbers include effects identified from additional in-licensing arrangements, collaborations or potential M&A transactions to the extent disclosed and are subject to update due to future developments. 3. Anticipated expenses related to external legal advice in connection with legal litigations is not reflected in SG&A but in other operating expenses for the 2024 financial year. Guidance does not include and may be impacted by potential payments resulting from the outcomes of ongoing or future legal disputes or related activity, such as judgments or settlements. 4. The Company does not expect to report a positive net income figure for the 2024 financial year and expects the majority of our 2024 global revenues for Comirnaty to be recorded in the second half of the year. IMFS = BioNTech’s Innovative Manufacturing Services FY 2024 Guidance FY 2024 revenues Total revenues €2,500 – €3,100 m FY 2024 expenses, operating income and capex4 R&D expenses2 €2,400 – €2,600 m SG&A expenses3 €700 – €800 m Capital expenditure for operating activities €400 – €500 m

4 Strategic Outlook Ryan Richardson, Chief Strategy Officer

COVID-19 Vaccine Market Dynamics and Outlook1 1. Partnered with Pfizer. 2. Subject to regulatory approvals. WHO = World Health Organisation; ICMRA = International Coalition of Medicines Regulatory Authorities; EMA = European Medicines Agency; VRBPAC = Vaccines and Related Biological Products Advisory Committee; ACIP = Advisory Committee on Immunization Practices; FDA = Food and Drug Administration. WHO/ICMRA and EMA strain recommendations received for JN.1 variant May 2024 Expected Launch & Shipment shortly after approvals August 2024 Monitoring of emerging variants Planning for: Late summer launch in over 80 geographies of 2024 seasonally adapted vaccine2 Opening of private markets in selected geographies Significant increases in supply of pre-filled syringe doses Vaccine Development Possible FDA approval Possible EU approval Late July 2024April 2024 Expected VRBPAC strain selection June 2024 Expected ACIP recommendation 29 Expected regulatory submissions Potential expedited timeline for variant-adapted vaccine development

Innovative and Diversified Pipeline Poised to Drive Long-Term Growth 1. Listed indications reflect indications currently included in ongoing or planned clinical trials conducted by BioNTech or partners, including some indications only in Phase 1/2 clinical trials. Potential commercial opportunities of investigational programs are subject to the timing and successful outcome of clinical development, regulatory approval, and commercialization. BNT programs considered in each drug class: mRNA cancer vaccines: autogene cevumeran (BNT122), BNT116, BNT111, BNT113; Immunomodulators: BNT316, BNT311, BNT312, BNT327, BNT321; Antibody Drug Conjugates (ADCs): BNT323, BNT325, BNT324, BNT326; Cell Therapies: BNT211; Non-Covid ID: BNT163, BNT164, BNT165, BNT166, BNT167. Investing in innovative therapies across drug classes with blockbuster potential Drug Class Data Update(s) Expected in 2024 or 2025 Potential First Submission Year Potential Market Opportunity1 mRNA cancer vaccines 2027 Establish new pillar of individualized and off-the-shelf treatments with potential to address adjuvant and metastatic stage cancers, incl. CRC, PDAC, melanoma and NSCLC Immunomodulators 2027 Multiple potential next generation checkpoint immunomodulator backbones with potential to address NSCLC, HNSCC, TNBC, and SCLC ADCs 2026 Multiple fast follower and first-to-market opportunities with potential to address BC, NSCLC, EC, and PROC patients Cell Therapies2 2027 First-in-class potential for CAR-T + mRNA vaccine combination therapy with potential to address CLDN6+ testicular, ovarian and lung cancers Infectious Disease (Non-COVID) 2028 Infectious Disease vaccines with potential to address shingles, HSV, malaria, TB, mpox and HIV

Investing Through Waves of Innovation with the Aim to Transform Medicine 31 Mid Term 1st wave of oncology launches planned from 2026 onwards Unlock value with initial combination trials Expanding across indication and treatment lines Long Term Goal of 10 indication approvals in oncology by 2030 Initial launches of 2nd wave products Multi-product immunotherapy Company 10+ mid- to late- stage trials in 2024: Near Term Build out commercial organization ahead of potential launches

Save the date Annual General Meeting May 17, 2024 Innovation Series: Digital & AI October 1, 2024 Innovation Series November 14, 2024

Thank you

Appendix

Advancing our Pipeline: Select Data Milestones in 2024 35 1. Partnered with Genmab; 2. Partnered with OncoC4; 3. Partnered with DualityBio; 4. Partnered with Biotheus; 5. Partnered with Pfizer. NSCLC = non-small cell lung cancer, R/R = relapsed/refractors. Program Indication Targeted Milestone Oncology BNT311/GEN1046 (acasunlimab)1 R/R met. NSCLC, +/- pembrolizumab Phase 2 data BNT312/GEN10421 Multiple solid tumors Ph1/2 expansion cohort data BNT316/ONC-392 (gotistobart)2 Multiple solid tumors Ph1/2 expansion cohort data BNT323/DB-13033 Multiple solid tumors Ph1/2 expansion cohort data BNT325/DB-13053 Multiple solid tumors Ph1/2 data BNT327/PM80024 Multiple solid tumors Phase 2 data Infectious Disease BNT162b25 COVID-19, Omicron XBB.1.5 monovalent vaccine Phase 2/3 data BNT1675 Shingles Phase 1 trial update

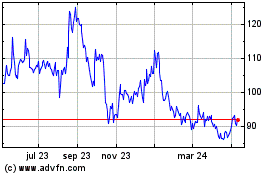

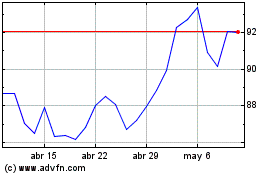

BioNTech (NASDAQ:BNTX)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

BioNTech (NASDAQ:BNTX)

Gráfica de Acción Histórica

De May 2023 a May 2024