UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant |

☒ |

| Filed by a Party other than the Registrant |

☐ |

Check the appropriate box:

| ☒ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☐ |

Soliciting Material Pursuant to §240.14a-12 |

CYNGN INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check the appropriate

box):

| ☐ |

No fee required. |

| |

|

| ☐ |

Fee paid previously with preliminary materials. |

| |

|

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a- 6(i)(1) and 0-11. |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 25, 2024

To the Stockholders of Cyngn Inc.:

You

are invited to attend the Annual Meeting of Stockholders of Cyngn Inc. which will be held at 12:00 p.m. Eastern Time at the offices

of Sichenzia Ross Ference Carmel LLP, 1185 Avenue of the Americas, 31st Floor,

New York, NY 10036, on Tuesday June 25, 2024.

At the Annual Meeting, you

will be asked to act on the following matters:

| 1. | to elect a Class III director to serve a three-year

term expiring at the 2027 annual meeting of stockholders and until such director’s successor is duly elected and qualified; |

| 2. | to approve an amendment to our certificate of incorporation

to increase the number of shares of authorized common stock from 200,000,000 to 400,000,000; |

| 3. | to grant discretionary authority to our board of directors

to (i) amend our certificate of incorporation to combine outstanding shares of our common stock into a lesser number of outstanding shares,

or a “reverse stock split,” at a specific ratio within a range of one-for-five (1-for-5) to a maximum of a one-for-one hundred

(1-for-100) split, with the exact ratio to be determined by our board of directors in its sole discretion; and (ii) effect the reverse

stock split, if at all, within one year of the date the proposal is approved by stockholders (the “Reverse Stock Split Proposal”); |

| |

4. |

to approve an amendment to our 2021 Equity Incentive Plan (the “2021 Plan”) to amend the automatic increase “evergreen” clause within the 2021 Plan to increase the number of shares available under the 2021 Plan in future years; |

| 5. | to ratify the selection of Marcum LLP as our independent

registered public accounting firm for our fiscal year ending December 31, 2024; and |

| 6. | to consider and transact such other business as may be properly

brought before the Annual Meeting and any adjournments thereof. |

Only holders of record of

shares of our common stock at the close of business on May 6, 2024 are entitled to receive notice of and to vote at the Annual Meeting

or any postponements or adjournments of the meeting. The accompanying Proxy Statement contains details concerning the foregoing items,

as well as information on how to vote your shares. Other detailed information about our business and operations, including our audited

financial statements, are included in our Annual Report on Form 10-K. We urge you to read and consider these documents carefully.

Your vote is very important. Whether

or not you plan to attend the Annual Meeting, we encourage you to submit your proxy or voting instructions as soon as possible. For specific

instructions on how to vote your shares, please refer to the instructions on the proxy card you received in the mail, and the additional

information in the accompanying Proxy Statement.

| Dated: May , 2024 |

By Order of the Board of Directors of Cyngn Inc. |

| |

|

| |

Sincerely, |

| |

|

| |

|

| |

Lior Tal |

| |

Chairman and Chief Executive Officer |

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Proxy Statement contains

forward-looking statements within the meaning of the federal securities laws. Forward-looking statements may relate to our future

financial performance, business operations, and executive compensation decisions, or other future events. You can identify forward-looking statements

by the use of words such as “anticipate,” “believe,” “could,” “expect,” “intend,”

“may,” “will,” or the negative of such terms, or other comparable terminology. Forward-looking statements

also include the assumptions underlying or relating to such statements. We have based these forward-looking statements on our current

expectations and projections about future events that we believe may affect our business, results of operations and financial condition.

The outcomes

of the events described in these forward-looking statements are subject to risks, uncertainties and other factors described in the

section titled “Risk Factors,” and elsewhere, in the Annual Report on Form 10-K for the fiscal year ended December 31,

2023, as well as the other reports we file with the Securities and Exchange Commission. We cannot assure you that the events and circumstances

reflected in the forward-looking statements will be achieved or occur, and actual results could differ materially from those expressed

or implied in the forward-looking statements. We undertake no obligation to update any forward-looking statement to reflect

events or circumstances after the date on which the statement is made except as may be required under applicable securities law.

CYNGN INC.

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 25, 2024

TABLE OF CONTENTS

1015 O’Brien Dr.

Menlo Park, CA 94025

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

JUNE 25, 2024

This

proxy statement contains information related to the Annual Meeting of Stockholders of Cyngn Inc. which will be held at 12:00 p.m.

Eastern Time at the offices of Sichenzia Ross Ference Carmel LLP, 1185 Avenue of the Americas, 31st Floor,

New York, NY 10036, on Tuesday, June 25, 2024, and any postponements or adjournments of the meeting. We first mailed these proxy

materials to stockholders on or about May 24, 2024. In this proxy statement, “Company,” “Cyngn,” “we,”

“us,” and “our” each refer to Cyngn Inc. and its subsidiaries.

ABOUT THE PROXY MATERIALS

We

are furnishing proxy materials to our stockholders of record on May 6, 2024, in connection with the solicitation of proxies by our Board

of Directors (the “Board”) for use at the Annual Meeting of stockholders to be held at the offices of Sichenzia Ross Ference

Carmel LLP, 1185 Avenue of the Americas, 31st Floor,

New York, NY 10036. This proxy is being solicited by the Board, and the cost of solicitation of the proxies will be paid by

Cyngn. Our officers, directors and regular employees, without additional compensation, also may solicit proxies by further mailing, by

telephone or personal conversations. We have no plans to retain any firms or otherwise incur any extraordinary expense in connection with

the solicitation.

IMPORTANT NOTICE REGARDING THE AVAILABILITY

OF PROXY MATERIALS FOR THE 2024

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 25, 2024

This Proxy Statement, the

enclosed proxy card, and the Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the “Annual

Report”) are available at www.cstproxy.com/cyngn/2024. The Annual Report, however, is not a part of the proxy solicitation

material.

Stockholder of Record: Shares Registered

in Your Name

If you are a stockholder

of record, you may vote using the following methods:

| ● | At the Annual Meeting. To vote

at the Annual Meeting, attend the Annual Meeting and follow the instructions. |

| ● | By Internet. To vote by proxy

via the Internet, follow the instructions described on the proxy card. |

| ● | By Telephone. To vote by proxy

via telephone within the United States and Canada, use the toll-free number on the proxy card. |

| ● | By Mail. To vote by mail, complete,

sign, and date the proxy card and return it in the envelope provided. |

Whether or not you plan to

attend the Annual Meeting, we urge you to vote by proxy using one of the methods described above to ensure your vote is counted. You may

still attend the Annual Meeting and vote even if you have already voted by proxy.

Beneficial Owner: Shares Registered in

the Name of a Broker or Bank

If you are a beneficial owner

of shares registered in the name of your broker or other nominee, you may vote using the following methods:

| ● | At the Annual Meeting. To vote

at the Annual Meeting, you must obtain a valid proxy from your broker or other nominee. Follow the instructions from your broker or other

nominee, or contact them to request a proxy form. |

| ● | By Internet. You may vote through

the Internet if your broker or other nominee makes this method available, in which case the instructions will be included in the proxy

materials provided to you. |

| ● | By Telephone. You may vote

by telephone if your broker or other nominee makes this method available, in which case the instructions will be included in the proxy

materials provided to you. |

| ● | By Mail. If you received a

proxy card and voting instructions from the broker or other nominee holding your shares rather than from us, follow the instructions

on the proxy card. |

What You Are Voting On

At the Annual Meeting, there

are four matters scheduled for a vote of the stockholders:

| ● | Election of Directors. The

election of a Class III director to serve a three-year term expiring at the 2027 annual meeting of stockholders and until such director’s

successor has been duly elected and qualified; |

| ● | Increase in Authorized Common Stock. Amendment

to our certificate of incorporation to increase the number of shares of authorized common stock from 200,000,000 to 400,000,000; |

| ● | Reverse Stock Split. To

grant discretionary authority to the Board to (i) amend our certificate of incorporation to combine outstanding shares of our common

stock into a lesser number of outstanding shares, or a “reverse stock split,” at a specific ratio within a range of one-for-five

(1-for-5) to a maximum of a one-for-one hundred (1-for-100) split, with the exact ratio to be determined by our board of directors in

its sole discretion; and (ii) effect the reverse stock split, if at all, within one year of the date the proposal is approved by stockholders

(the “Reverse Stock Split Proposal”); |

| |

● |

Amendment to our 2021 Equity Incentive Plan. Amendment to our 2021 Equity Incentive Plan (the “2021 Plan”) to amend the automatic increase “evergreen” clause within the 2021 Plan to increase the number of shares available under the 2021 Plan in future years; and |

| ● | Ratification of the Appointment of Independent Registered

Public Accounting Firm. Ratification of the appointment of Marcum LLP as the Company’s independent

registered public accounting firm for its fiscal year ending December 31, 2024. |

You may vote “For the

Nominee” or “Withhold Authority for the Nominee”. For the other matters to be voted on, you may vote “For”

or “Against” or abstain from voting. If you receive more than one proxy card, your shares are registered in more than one

name or are registered in different accounts. Please complete, sign and return each proxy card to ensure that all of your shares are voted.

Quorum and Required Votes

Only holders of record of

shares of Cyngn’s common stock at the close of business on May 6, 2024, the record date, are entitled to vote at the Annual Meeting

or any postponements or adjournments of the meeting. As of the record date, Cyngn had 141,542,715 shares of common stock outstanding.

The presence at the meeting

of 33 1/3% of the outstanding shares, in person or by proxy relating to any matter to be acted upon at the meeting, is necessary to constitute

a quorum for the meeting. Each outstanding share of common stock is entitled to one vote.

Proxies marked “Abstain”

and broker “non-votes” will be treated as shares that are present for purposes of determining the presence of a quorum. An

“abstention” occurs when a stockholder sends in a proxy with explicit instructions to decline to vote regarding a particular

matter. A broker non-vote occurs when a broker or other nominee who holds shares for another person does not vote on a particular

proposal because that holder does not have the discretionary voting power for the proposal and has not received voting instructions from

the beneficial owner of the shares; as a result, the broker or other nominee is unable to vote those uninstructed shares. Abstentions

and broker non-votes, while included for quorum purposes, will not be counted as votes “cast” for or against any proposal.

The following table summarizes

the votes required for passage of each proposal and the effect of abstentions and uninstructed shares held by brokers. Please

note that brokers may not vote your shares on the election of directors or any other non-routine matters if you have not given

your broker specific instructions as to how to vote. Please be sure to give specific voting instructions to your broker so that your vote

can be counted.

Proposal

Number |

|

Description |

|

Votes

Required for Approval |

|

Abstentions |

|

Uninstructed Shares |

| 1 |

|

Election of Directors |

|

Nominees receiving highest number of votes FOR |

|

Not voted |

|

Not voted |

| 2 |

|

Increase in the number of shares of authorized common stock |

|

Majority of votes cast |

|

Not voted |

|

Discretionary vote – brokers may vote |

| 3 |

|

Reverse Stock Split |

|

Majority of votes cast |

|

Not voted |

|

Discretionary vote – brokers may vote |

| 4 |

|

Amendment to our 2021 Equity Incentive Plan |

|

Majority of votes cast |

|

Not voted |

|

Not voted |

| 5 |

|

Ratification of Independent Registered Public Accounting Firm |

|

Majority of votes cast |

|

Not voted |

|

Discretionary vote – brokers may vote |

Recommendation of Board of Directors

Unless you instruct otherwise

on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board

of Directors. Specifically, the Board’s recommendations are as follows:

| ● | FOR the election of the Class III director

nominee to serve a three-year term expiring at the 2027 annual meeting of stockholders and until such director’s successor is duly

elected and qualified; |

| ● | FOR the increase in the authorized common stock; |

| ● | FOR the reverse stock split; |

| |

● |

FOR the amendment to our 2021 Equity Incentive Plan to amend the automatic increase “evergreen” clause within the 2021 Plan to increase the number of shares available under the 2021 Plan in future years; and |

| ● | FOR the ratification of the selection of Marcum

LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2024. |

The proxy holders will vote

as recommended by the Board with respect to any other matter that properly comes before the Annual Meeting, including any postponements

or adjournments thereof. If the Board on any such matter gives no recommendation, the proxy holders will vote in their own discretion.

Revocation of Proxies

After you have submitted

your proxy, you may change your vote at any time before the proxy is exercised by filing with the Secretary of Cyngn either a notice of

revocation or a duly executed proxy bearing a later date. The powers of the proxy holders will be suspended if you attend the Annual Meeting

in person and request to recast your vote. Attendance at the Annual Meeting will not, by itself, revoke a previously granted proxy.

Householding

The SEC has adopted rules

that permit companies and intermediaries, such as brokers, to satisfy the delivery requirements for proxy statements with respect to two

or more security holders sharing the same address by delivering a single copy of a notice and, if applicable, a proxy statement, to those

security holders.

A single copy of the Notice

and, if applicable, this Proxy Statement will be delivered to multiple stockholders sharing an address unless contrary instructions have

been received from these stockholders. Once you have received notice from your broker, or from us, that they will be “householding”

communications to your address, “householding” will continue until you are notified otherwise or until you revoke your consent.

If, at any time, you no longer wish to participate in “householding” and would prefer to receive a separate Notice and Proxy

Statement, please notify your broker and also notify us by sending your written request to: Cyngn Inc., 1015 O’Brien Dr., Menlo

Park, CA 94025, Attention: Investor Relations or by calling Investor Relations at (650) 924-5905.

A stockholder who currently

receives multiple copies of the Notice or Proxy Statement at its address and would like to request “householding” should also

contact its broker and notify us using the contact information above.

Voting Procedures and Tabulation of Votes

Our inspector of election

will tabulate votes cast by proxy or in person at the Annual Meeting. We will also report the results in a current report on Form 8-K filed

with the Securities and Exchange Commission (“SEC”) within four business days of the Annual Meeting.

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

The Board is currently comprised

of five members, three non-employee directors (Ms. Macleod, Ms. Cunningham and Mr. McDonnell) and two employee directors (Mr. Tal,

our CEO, and Mr. Alvarez, our CFO). The Board is divided into three classes of directors, each serving a staggered three-year term.

At each annual meeting of stockholders, a class of directors is elected for a three-year term to succeed the class whose term is then

expiring.

The Board has unanimously

determined that Ms. Macleod, Ms. Cunningham and Mr. McDonnell are “independent” directors, as such term is defined in

the Nasdaq Stock Market Rules (the “Stock Market Rules”).

The definition of “independent

director” included in the Stock Market Rules includes a series of objective tests, such as that the director is not an employee

of the Company, has not engaged in various types of specified business dealings with the Company, and does not have an affiliation with

an organization that has had specified business dealings with the Company. Consistent with the Company’s corporate governance principles,

the Board’s determination of independence is made in accordance with the Stock Market Rules, as the Board has not adopted supplemental

independence standards. As required by the Stock Market Rules, the Board also has made a subjective determination with respect to each

director that such director has no material relationship with the Company (either directly or as a partner, stockholder or officer of

an organization that has a relationship with the Company), even if the director otherwise satisfies the objective independence tests included

in the definition of an “independent director” included in the Stock Market Rules.

To facilitate this determination,

annually each director completes a questionnaire that provides information about relationships that might affect the determination of

independence. Management provides the Nominating and Corporate Governance Committee and the Board with relevant facts and circumstances

of any relationship bearing on the independence of a director or nominee that is outside the categories permitted under the director independence

guidelines.

The following table sets

forth the names, ages as of the date of this proxy statement, and certain other information for each of the nominees for director at the

Annual Meeting, and for each of the continuing members of the Board. Full biographical for our director nominees and continuing directors

information is below.

| Name |

|

Class |

|

Age |

|

Position |

|

Director

Since |

|

Current

Term Expires |

|

Expiration of

Term for Which Nominated |

|

Independent |

|

Audit

Committee |

|

Compensation

Committee |

|

Nominating

and Corporate Governance Committee |

| Directors with Terms expiring at the Annual Meeting/Nominees |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Colleen Cunningham |

|

III |

|

61 |

|

Director |

|

2021 |

|

2024 |

|

— |

|

X |

|

X |

|

X |

|

X |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Continuing Directors |

|

|

|

|

|

|

|

|

| Lior Tal |

|

I |

|

50 |

|

Chief Executive Officer and Director |

|

2016 |

|

2025 |

|

— |

|

— |

|

— |

|

— |

|

— |

| Donald Alvarez |

|

I |

|

59 |

|

Chief Financial Officer |

|

2022 |

|

2025 |

|

— |

|

— |

|

— |

|

— |

|

— |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Karen Macleod |

|

II |

|

60 |

|

Director |

|

2021 |

|

2026 |

|

2026 |

|

X |

|

X |

|

X |

|

X |

| James McDonnell |

|

II |

|

69 |

|

Director |

|

2021 |

|

20236 |

|

2026 |

|

X |

|

X |

|

X |

|

X |

Nominees for Director

Colleen Cunningham

Ms. Cunningham has served

as a member of the Board since September 2021. Ms. Cunningham has served as a board member and the treasurer of Northstar Pet

Rescue since 2017. From 2012 to 2018, Ms. Cunningham was the senior vice president and corporate controller of Zoetis, Inc. Prior to that,

Ms. Cunningham was the global managing director of Resources Connection, Inc. from 2007 to 2012. From 2003 to 2007, Ms. Cunningham

was the president and chief executive officer of Financial Executives International. From 2001 to 2003, Ms. Cunningham was the chief financial

officer of Havas Advertising, North America. Ms. Cunningham was chief accountant at AT&T, Inc. from 1999 to 2001. Prior to that, Ms.

Cunningham was a division manager of accounting policy and external reporting for AT&T, Inc. from 1995 to 1999. Ms. Cunningham was

the assistant controller of AT&T Capital Corporation from 1988 to 1995. From 1984 to 1988, Ms. Cunningham was a senior auditor at

Touche Ross/Coopers & Lybrand. Ms. Cunningham has also served on various committees. From 2015 to 2018, Ms. Cunningham served

as a member of the US Chamber of Commerce Financial Reporting Committee. From 2012 to 2018, Ms. Cunningham served as a member of the FEI

Committee on Corporate Reporting. From 2007 to 2012, Ms. Cunningham served as a member of the International Issues Conference Committee

of AICPA. From 2005 to 2009, Ms. Cunningham served as a board member and the chair of the Ethics Resource Center Finance Committee.

From 2005 to 2018, Ms. Cunningham served as a member of the advisory board to the accounting department of Pennsylvania State University.

From 2003 to 2007, Ms. Cunningham served as a member of both the International Accounting Standards Board Standing Advisory Committee

and the Financial Accounting Standards Board Advisory Committee. Ms. Cunningham holds a B.A. in economics from Rutgers University and

an M.B.A. in management from New York University’s Stern School of Business.

Ms. Cunningham’s prior

management experience and expertise in corporate reporting, governance and accounting issues qualify her to serve on the Board.

Continuing Directors

Lior Tal (Chief Executive Officer

and Chairman of the Board of Directors)

Mr. Tal has served as

the Company’s Chief Executive Officer and a Director since October 2016. From June 2016 to October 2016, Mr. Tal

served as the Company’s Chief Operating Officer. Prior to joining the Company, Mr. Tal was the director of international growth

and partnerships at Facebook where he worked from April 2011 to June 2016. Mr. Tal co-founded Snaptu (acquired by

Facebook) in September 2007 and was the vice president of business development until May 2011. During his time at Snaptu, Mr. Tal

helped grow the user base from launch to tens of millions of users. Prior to co-founding Snaptu, Mr. Tal was a partner at Barzam,

Tal, Lerer Attorneys at law & Patent attorneys from March 2004 to August 2007. Mr. Tal has also held leadership

roles at Actimize (acquired by NICE), DiskSites (acquired by EMC), and Odigo (acquired by Comverse). Mr. Tal holds a law degree from

Tel Aviv University.

Mr. Tal holds an LLB

in law and a BA in Business Management from Reichman University. Mr. Tal’s executive and technology industry experience qualify

him to serve on the Board.

Donald Alvarez (Chief Financial

Officer and Director)

Mr. Alvarez has served

as the Company’s Chief Financial Officer since June 2021 and a Director since August 2022. Prior to joining the Company,

Mr. Alvarez was the vice president of finance of the International Council of Shopping Centers from 2017 to August 2020. During

his time at the International Council of Shopping Centers, Mr. Alvarez helped improve internal controls, increase productivity and

reduce cost. From 2015 to 2017, Mr. Alvarez was vice president of finance of QuVa Pharma, Inc. (“QuVa”), where he helped

create an accounting and finance department. From 2011 to 2014, Mr. Alvarez was the national managing partner, COO and CFO of Tatum,

a Randstand Company (“Tatum”). During his time with Tatum, Mr. Alvarez oversaw a business turnaround that significantly

improved Tatum’s financial performance. Mr. Alvarez has held several other senior financial and operational roles in both private

and public companies, including CFO of Broadband Discovery Systems, Inc., CFO of Fatbrain.com, CFO of Shop.com, and Regional Managing

Director of Resources Global Professionals. Mr. Alvarez began his career in the audit and assurance practice of Deloitte where he

spent seven (7) years. Mr. Alvarez holds a BS in Business Administration from California State University, East Bay.

Mr. Alvarez’s

financial expertise and significant audit and reporting knowledge qualify him to serve on the Board.

Karen Macleod (Director)

Ms. Macleod has served as

a member of the Board since July 2021. Ms. Macleod was the Founder and CEO of The Arete Group, LLC from 2015 to 2021. Ms. Macleod

was the president of Tatum, Randstand Holdings NV Company from 2011 to 2014. Ms. Macleod was the president of Resources Connection, Inc.

North America from 2004 to 2009 and previously served in other capacities after joining the company in 1996. From 1985 to 1994, Ms. Macleod

was a senior manager at Deloitte. Ms. Macleod additionally has served on the board of directors of Track Group Inc. (OTCQX — TRCK)

since 2016 and currently chairs the Audit Committee. She also has served on the board of the Lakeland Hills YMCA since 2020 and currently

serves on the Executive Committee and as Chair of the Finance Committee. Ms. Macleod served as a member of the board of directors and

a member of the audit committee of the FWA of New York from 2018 to 2021. From 1998 to 2009, Ms. Macleod served on the board of directors

of RGP (NASDAQ — RGP). From 2006 to 2013, Ms. Macleod served on the board of directors of Overland Solutions. Ms. Macleod

holds a B.A. in Business Economics from University of California, Santa Barbara.

Ms. Macleod prior board experience

and particularly her role serving on audit committees qualify her to serve on the Board.

James McDonnell (Director)

Mr. McDonnell has served

as a member of the Board since September 2021. Mr. McDonnell was Senior Vice President of Sales and Marketing for Vispero, from

2017 to 2022. Mr. McDonnell was VP of sales at Honeywell from 2013 to 2017. Mr. McDonnell served on the board of Asetek from 2014

to 2019. Mr. McDonnell was SVP Sales & Marketing at Intermec from 2010 to 2013. Prior to this, Mr. McDonnell was an

SVP and served in many executive sales and marketing roles at Hewlett-Packard from 1983 to 2009. Mr. McDonnell began his career

at the General Electric Company from 1977 to 1983. Mr. McDonnell has a BS degree in Electrical engineering from Villanova University.

Mr. McDonnell’s

prior experiences in sales & marketing leadership within various technology companies and his experience in industrial markets

qualify him to serve on the Board.

Family Relationships

There are no family relationships

among our executive officers and directors.

Involvement in Certain Legal Proceedings

None of our directors or executive

officers has been involved in any legal proceeding in the past ten (10) years that would require disclosure under Item 401(f) of

Regulation S-K.

Board Leadership Structure

The Board believes it is

important to retain flexibility in allocating the responsibilities of the CEO and Chairman of the Board in any way that is in the best

interests of our Company based on the circumstances existing at a particular point in time. Accordingly, we do not have a strict policy

on whether these roles should be served independently or jointly. Currently, our CEO, Mr. Tal, also serves as our Chairman of the

Board.

Mr. McDonnell serves

as our Lead Independent Director.

The Board’s Role in Risk Oversight

The Board as a whole actively

oversees management of the Company’s risks and looks to its audit committee, as well as senior management, to support the Board’s

oversight role. The Company’s Audit Committee assists with oversight of financial risks. The full Board regularly receives information

through committee reports and from members of senior management on areas of material risk to the Company, including operational, financial,

legal and regulatory, technical and strategic risks.

Meetings and Committees of the Board of

Directors

Our business, property and

affairs are managed under the direction of the Board. The Board provides management oversight, helps guide the Company on strategic planning

and approves the Company’s operating budgets. Our independent directors meet regularly in executive sessions. Members of the Board

are kept informed of our business through discussions with our Chief Executive Officer and other officers and employees, by reviewing

materials provided to them, by visiting our offices and by participating in meetings of the Board and its committees.

The Board holds regularly

scheduled quarterly meetings. In addition to the quarterly meetings, typically there is at least one other regularly scheduled meeting

and other communication each year. The Board met formally eight times in fiscal year 2023, each director attended 100% of all Board meetings

held during such director’s tenure on the Board. Our audit committee met four times during fiscal year 2023, with each member attending

100% of the committee meetings.

Board Committees

The Board has established

an Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee.

Each of the above-referenced committees

operates pursuant to a formal written charter. The charters for these committees, which have been adopted by the Board, contain a detailed

description of the respective committee’s duties and responsibilities and are available on our website at https://www.cyngn.com/

under the “Investor Relations — Governance” tab.

Below is a description of

each committee of the Board. Each of the committees has authority to engage legal counsel or other experts or consultants as it deems

appropriate to carry out its responsibilities. The Board has determined that each member of the Audit Committee, Compensation Committee

and Nominating and Corporate Governance Committee meet the independence requirements under the NASDAQ’s current listing standards

and each member is free of any relationship that would interfere with his individual exercise of independent judgment.

The Audit Committee

The Audit Committee has the

responsibility for, among other things, (i) selecting, retaining and overseeing our independent registered public accounting firm,

(ii) obtaining and reviewing a report by independent auditors that describe the accounting firm’s internal quality control,

and any materials issues or relationships that may impact the auditors, (iii) reviewing and discussing with the independent auditors

standards and responsibilities, strategy, scope and timing of audits, any significant risks, and results, (iv) ensuring the integrity

of the Company’s financial statements, (v) reviewing and discussing with the Company’s independent auditors any other

matters required to be discussed by PCAOB Auditing Standard No. 1301, (vi) reviewing, approving and overseeing any transaction between

the Company and any related person and any other potential conflict of interest situations, (vii) reviewing, approving and overseeing

related party transactions, and (viii) establishing and overseeing procedures for the receipt, retention and treatment of complaints

received by the Company regarding accounting, internal accounting controls or auditing matters and the confidential, anonymous submission

by Company employees of concerns regarding questionable accounting or auditing matters.

The Audit Committee is comprised

of three directors appointed by the Board. Each of the committee members who served during 2023, Ms. Macleod, Ms. Cunningham and Mr. McDonnell,

satisfied the independence and financial management expertise requirements the Stock Market Rules.

The Board has determined

that Ms. Cunningham is an “audit committee financial expert” within the meaning of Section 407 of the Sarbanes-Oxley Act of 2002

and Item 407(d)(5) of Regulation S-K. For a description of Ms. Cunningham’s relevant experience, please see

her biographical information contained in section titled “Board of Directors and Corporate Governance” of this proxy statement.

Report of Audit Committee

Review of Fiscal Year 2023 Consolidated

Financial Statements

In connection with its review

of our Fiscal Year 2023 Consolidated Financial Statements, the Audit Committee has:

| (1) | reviewed and discussed the audited consolidated financial

statements with management; |

| (2) | discussed with Marcum LLP, our independent registered public

accounting firm, the matters required to be discussed by Public Company Accounting Oversight Board Auditing Standard No. 1301, Communications

with Audit Committees; and |

| (3) | received from Marcum LLP, the written disclosures and letter

required by applicable requirements of the Public Company Accounting Oversight Board and discussed with Marcum LLP their independence. |

Based upon the review and

discussions described above, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements

for fiscal year ended December 31, 2023 be included in the Company’s Annual Report on Form 10-K for the fiscal year

ended December 31, 2023.

By the Audit Committee of the Board of Directors:

Colleen Cunningham, Chair

Karen Macleod

James McDonnell

The material in this report

is not deemed to be “soliciting material,” or to be “filed” with the Securities and Exchange Commission and is

not to be incorporated by reference in any of our filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934,

as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filings.

The Compensation Committee

The Compensation Committee

is comprised of members who are “Non-Employee Directors” within the meaning of Rule 16b-3 under the Securities

Exchange Act of 1934, as amended (the “Exchange Act”) and “outside directors” within the meaning

of Section 162(m) of the Code. They are also “independent” directors within the meaning of Nasdaq Rule 5605(b)(1).

The Compensation Committee has the responsibility for, among other things, (i) reviewing and approving the chief executive officer’s

compensation based on an evaluation in light of corporate goals and objectives, (ii) reviewing and recommending to the Board the

compensation of all other executive officers, (iii) reviewing and recommending to the Board incentive compensation plans and equity

plans, (iv) reviewing and discussing with management the Company’s Compensation Discussion and Analysis and related information

to be included in the annual report on Form 10-K and proxy statements, and (v) reviewing and recommending to the Board

for approval procedures relating to Say on Pay Votes.

Ms. Macleod serves as Chair

of the Compensation Committee and is joined by Ms. Cunningham and Mr. McDonnell.

Nominating and Corporate Governance Committee

The Nominating and Corporate

Governance Committee is comprised of entirely “independent” directors within the meaning of Nasdaq Rule 5605(b)(1). The

Nominating and Corporate Governance Committee has the responsibility relating to assisting the Board in, among other things, (i) identifying

and screening individuals qualified to become members of our board of directors, consistent with criteria approved by our board of directors,

(ii) recommending to the Board the approval of nominees for director, (ii) developing and recommending to our board of directors

a set of corporate governance guidelines, and (iv) overseeing the evaluation of our board of director.

Mr. McDonnell currently

serves as the Chair of the Nominating and Corporate Governance Committee and is joined on the committee by Ms. Macleod and Ms. Cunningham.

The Chair and members of

each committee of the Board are summarized in the table below:

| Name |

|

Audit

Committee |

|

Compensation

Committee |

|

Nominating

and Corporate Governance Committee |

| Karen Macleod – (Independent) |

|

Member |

|

Chair |

|

Member |

| Colleen Cunningham – (Independent) |

|

Chair |

|

Member |

|

Member |

| James McDonnell – (Independent) |

|

Member |

|

Member |

|

Chair |

Consideration of Director Nominees

We seek directors with the

highest standards of ethics and integrity, sound business judgment, and the willingness to make a strong commitment to the Company and

its success. The Nominating and Corporate Governance Committee works with the Board on an annual basis to determine the appropriate and

desirable mix of characteristics, skills, expertise, and experience for the full Board and each committee, taking into account both existing

directors and all nominees for election as directors, as well as any diversity considerations and the membership criteria applied by the

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee and the Board, which do not have a formal

diversity policy, consider diversity in a broad sense when evaluating board composition and nominations; and they seek to include directors

with a diversity of experience, professions, viewpoints, skills, and backgrounds that will enable them to make significant contributions

to the Board and the Company, both as individuals and as part of a group of directors. The Board evaluates each individual in the context

of the full Board, with the objective of recommending a group that can best contribute to the success of the business and represent stockholder

interests through the exercise of sound judgment. In determining whether to recommend a director for re-election, the Nominating and Corporate

Governance Committee also considers the director’s attendance at meetings and participation in and contributions to the activities

of the Board and its committees.

The Nominating and Corporate

Governance Committee will consider director candidates recommended by stockholders, and its process for considering such recommendations

is no different than its process for screening and evaluating candidates suggested by directors, management of the Company, or third parties.

When considering director

candidates, the Nominating and Corporate Governance Committee will evaluate multiple factors in assessing their qualification. A candidate

must have extensive and relevant leadership experience including an understanding of the complex challenges of enterprise leadership.

An appropriate candidate will have gained appropriate experience and education in some or all of the key areas below.

| ● | Relevant Sector Experience. Director

candidates will have gained their leadership experience in sectors directly relevant to the Company’s business and/or served as

the Chief Executive Officer, Chief Operating Officer or other major operating or staff officer of a public corporation, with a background

in marketing, finance and/or business operations. |

| ● | Corporate Governance Experience. Director

candidates should have sufficient applicable experience to understand fully the legal and other responsibilities of an independent director

of a U.S.-based public company. |

| ● | Education. Generally, it is

desirable that a Board candidate should hold an undergraduate degree from a respected college or university and in relevant fields of

study. |

When further considering

director candidates, personal attributes and characteristics will be considered. Specifically, these should include the following:

| ● | Personal. Director candidates

should be of the highest moral and ethical character. Candidates must exhibit independence, objectivity and be capable of serving as

representatives of the stockholders. The candidates should have demonstrated a personal commitment to areas aligned with the Company’s

public interest commitments, such as education, the environment and welfare of the communities in which we operate. |

| ● | Individual Characteristics. Director

candidates should have the personal qualities to be able to make a substantial active contribution to Board deliberations. These qualities

include intelligence, self-assuredness, a high ethical standard, inter-personal skills, independence, courage, a willingness to

ask the difficult question, communication skills and commitment. In considering candidates for election to the board of directors, the

Board should constantly be striving to achieve the diversity of the communities in which the Company operates. |

| ● | Availability. Director candidates

must be willing to commit, as well as have, sufficient time available to discharge the duties of Board membership. Generally, therefore,

the candidate should not have more than three other corporate board memberships. |

| ● | Compatibility. The Board candidate

should be able to develop a good working relationship with other Board members and contribute to the Board’s working relationship

with the senior management of the Company. |

Board Diversity

Each year, our nominating

and corporate governance committee will review, with the Board, the appropriate characteristics, skills and experience required for the

board of directors as a whole and its individual members. In evaluating the suitability of individual candidates, our nominating and corporate

governance committee will consider factors including, without limitation, an individual’s character, integrity, judgment, potential

conflicts of interest, other commitments and diversity. While we have no formal policy regarding board diversity for our board of directors

as a whole nor for each individual member, the nominating and corporate governance committee does consider such factors as gender, race,

ethnicity, experience and area of expertise, as well as other individual attributes that contribute to the total diversity of viewpoints

and experience represented on the board of directors.

On August 6, 2021, the

Securities and Exchange Commission (“SEC”) approved The Nasdaq Stock Market LLC’s (“Nasdaq”) proposal to

adopt listing rules for Nasdaq-listed companies related to board diversity. The new Rule 5605(f) (Diverse Board Representation)

requires Nasdaq-listed companies, subject to certain exceptions, (1) to have at least one director who self-identifies as

a female, and (2) to have at least one director who self-identifies as Black or African American, Hispanic or Latinx, Asian,

Native American or Alaska Native, Native Hawaiian or Pacific Islander, two or more races or ethnicities, or as LGBTQ+, or (3) to

explain why the reporting company does not have at least two directors on its board who self-identify in the categories listed above.

In addition, Rule 5606 (Board Diversity Disclosure) requires each Nasdaq-listed company, again subject to certain exceptions,

to provide statistical information about such company’s board of directors, in a proposed uniform format, related to each director’s

self-identified gender, race, and self-identification as LGBTQ+.

The Company believes that

it is presently in compliance with the diversity requirements imposed by the Nasdaq listing rules.

Board Diversity Matrix for Cyngn Inc. (as

of May , 2024)

| Total Number of Directors: | |

| 5 | | |

| | | |

| | | |

| | |

| | |

| Female | | |

| Male | | |

| Non-Binary | | |

| Did Not

Disclose

Gender | |

| Part I: Gender Identity | |

| | | |

| | | |

| | | |

| | |

| Directors | |

| 2 | | |

| 3 | | |

| — | | |

| — | |

| African American or Black | |

| — | | |

| — | | |

| — | | |

| — | |

| Alaskan Native or Native American | |

| — | | |

| — | | |

| — | | |

| — | |

| Asian | |

| — | | |

| — | | |

| — | | |

| — | |

| Hispanic or Latinx | |

| — | | |

| 1 | | |

| — | | |

| — | |

| Native Hawaiian or Pacific Islander | |

| — | | |

| — | | |

| — | | |

| — | |

| White | |

| 2 | | |

| 2 | | |

| — | | |

| — | |

| Two or More Races or Ethnicities | |

| — | | |

| — | | |

| — | | |

| — | |

| LGBTQ+ | |

| — | | |

| 1 | | |

| — | | |

| — | |

| Did Not Disclose Demographic Background | |

| — | | |

| — | | |

| — | | |

| — | |

Information Regarding Stockholder Communication

with the Board of Directors; Attendance of Board Members at the Annual Meeting

Stockholders may contact

an individual director, the Board as a group, or a specified Board committee or group, at the following address: Corporate Secretary,

Cyngn Inc., 1015 O’Brien Dr., Menlo Park, CA 94025, Attn: Board of Directors. Our Secretary will process communications before

forwarding them to the addressee. Directors generally will not be forwarded stockholder communications that are primarily commercial in

nature, relate to improper or irrelevant topics, or request general information about the Company.

We do not require Board members

to attend our Annual Meeting of Stockholders.

Statement on Corporate Governance

We regularly monitor developments

in the area of corporate governance by reviewing federal laws affecting corporate governance, as well as rules adopted by the SEC and

Nasdaq. In response to those developments, we review our processes and procedures and implement corporate governance practices which we

believe are in the best interests of the Company and its stockholders. The Board has approved a set of corporate governance guidelines

to promote the functioning of the Board and its Committees and to set forth a common set of expectations as to how the Board should perform

its functions. Our Corporate Governance Guidelines are posted on the Company’s website under “Investor Relations — Corporate

Governance.” On an annual basis, each director and executive officer is obligated to complete a Director and Officer Questionnaire

which requires disclosure of any transactions with the Company in which the director or executive officer, or any member of his or her

immediate family, has a direct or indirect material interest.

The Board has adopted a written

code of business conduct and ethics, applicable to each employee, including our Chief Executive Officer, Chief Operating Officer and Chief

Financial Officer. The code also applies to our agents and representatives, sales representatives and consultants. The code of business

conduct and ethics is posted on our website at www.cyngn.com. If we make certain amendments to or waivers of our code of ethics,

we intend to satisfy the SEC disclosure requirements by promptly posting the amendment or waiver on our website.

Policies and Procedures for Approval of

Related Party Transactions

We may encounter business

arrangements or transactions with businesses and other organizations in which one of our directors or executive officers, significant

stockholders or their immediate families is a participant and the amount exceeds $120,000. We refer to these transactions as related party

transactions. Related party transactions have the potential to create actual or perceived conflicts of interest between Cyngn and its

directors, officers and significant stockholders or their immediate family members. Our audit committee is charged with the responsibility

to review, approve and oversee related party transactions.

PROPOSAL 1

ELECTION OF DIRECTORS

The Board is currently composed

of five members. In accordance with our amended and restated certificate of incorporation, the Board is divided into three staggered classes

of directors. At the Annual Meeting, one Class III director will be elected for a three-year term. Each director’s term

continues until the election and qualification of their successor, or such director’s earlier death, resignation, or removal. The

Nominating and Corporate Governance Committee and the Board seek, and the Board is comprised of, individuals whose characteristics, skills,

expertise, and experience complement those of other Board members.

Nominees

Our Nominating and Corporate

Governance Committee has recommended, and the Board has approved Colleen Cunningham as a nominee for election as a Class III director

at the Annual Meeting. If elected, Ms. Cunningham will serve as a Class III director until our 2027 annual meeting of stockholders

or until a successor is duly elected and qualified, or until her earlier resignation or removal. We have no reason to believe that the

nominee is unable or will decline to serve as a director if elected. For information concerning the nominees, please see the section titled

“Board of Directors and Corporate Governance.”

Unless otherwise indicated

by the stockholder, the accompanying proxy will be voted for the election of Ms. Cunningham. Although the Company knows of no reason why

the nominee could not serve as a director, if the nominee shall be unable to serve, the accompanying proxy will be voted for a substitute

nominee.

Required Vote and Recommendation of the

Board of Directors

Directors are elected by

a plurality of the votes present in person or represented by proxy and entitled to vote at the Annual Meeting. Shares represented by executed

proxies will be voted, if authority to do so is not withheld, “FOR” the election of Ms. Cunningham.

Vote Required

As there is only one director

nominee, Ms. Cunningham will be elected as a Class III director at the Annual Meeting if she receives at least one “FOR” vote.

You may vote either FOR the nominee, or WITHHOLD your vote from the nominee. Votes that are withheld will not be included in the vote

tally for the election of directors. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in

street name for the election of directors. As a result, any shares not voted by a beneficial owner will be treated as a broker non-vote.

Such broker non-votes will have no effect on the results of this vote.

THE BOARD RECOMMENDS A

VOTE FOR THE ELECTION OF THE NOMINEE NAMED ABOVE AS DIRECTOR, AND PROXIES SOLICITED BY THE BOARD WILL BE VOTED IN FAVOR THEREOF UNLESS

A STOCKHOLDER HAS INDICATED OTHERWISE ON THE PROXY.

PROPOSAL 2

INCREASE IN THE NUMBER OF SHARES OF AUTHORIZED

COMMON STOCK

Introduction

Our Certificate of Incorporation,

as amended and restated, currently authorizes the issuance of up to 200,000,000 shares of common shares and 10,000,000 shares

of preferred stock. The Board has approved an amendment to increase the number of authorized shares of common stock from 200,000,000 to

400,000,000 shares.

The proposed form of Certificate

of Amendment to the Fifth Amended and Restated Certificate of Incorporation to effect the increase in our authorized common stock is attached

as Appendix A to this Proxy Statement.

Following the increase in

authorized shares as contemplated in the Certificate of Amendment to the Fifth Amended and Restated Certificate of Incorporation (the

“Certificate of Amendment”), 400,000,000 shares of common stock and 10,000,000 shares of preferred stock will be authorized.

There will be no changes to the issued and outstanding shares of common stock or preferred stock as a result of the amendment.

Reasons for the Increase Certificate of

Amendment

The Board has determined

that the increase in our authorized shares of common stock is in the best interests of the Company and unanimously recommends approval

by the stockholders. The Board believes that the availability of additional authorized shares of common stock is required for several

reasons including, but not limited to, the additional flexibility to issue common stock for a variety of general corporate purposes as

the Board may determine to be desirable including, without limitation, future financings, investment opportunities, acquisitions, or other

distributions and stock splits (including splits effected through the declaration of stock dividends).

As of the Record Date 141,542,715

shares of our common stock were outstanding out of the 200,000,000 shares that we are authorized to issue.

Our working capital requirements

are significant and may require us to raise additional capital through additional equity financings in the future. If we issue additional

shares of common stock or other securities convertible into shares of our common stock in the future, it could dilute the voting rights

of existing stockholders and could also dilute earnings per share and book value per share of existing stockholders. The increase in authorized

number of common stock could also discourage or hinder efforts by other parties to obtain control of the Company, thereby having an anti-takeover effect.

The increase in authorized number of common stock is not being proposed in response to any known threat to acquire control of the Company.

Current Plans, Proposals or Arrangements

to Issue Shares of Common Stock

As of the Record Date, the

Company had:

| ● | 16,951,317 shares of common stock issuable upon the

exercise of outstanding stock options with a weighted-average exercise price of $1.02 per share; |

| ● | 264,915shares of common stock issuable upon vesting of restricted

stock unit awards with a weighted-average exercise price of $0 per share; |

| ● | 8,497,216shares of common stock reserved for future issuance

under our 2021 Equity Incentive Plan; and |

| ● | 7,236,776 shares of common stock issuable upon exercise

of warrants to purchase common stock with a weighted-average exercise price of $2.82per share. |

Other than as set forth above,

the Company has no current plans, proposals or arrangements, written or oral, to issue any of the additional authorized shares of common

stock that would become available as a result of the filing of the Certificate of Incorporation, as amended and restated.

In addition, following the

approval and filing of the amendment, the Company may explore additional financing opportunities or strategic transactions that would

require the issuance of additional shares of common stock, but no such plans are currently in existence and the Company has not begun

any negotiations with any party related thereto. If we issue additional shares, the ownership interest of holders of our capital stock

will be diluted.

Effects of the Increase in Authorized Common

Stock

Following the filing of the

Certificate of Amendment with the Secretary of State of the State of Delaware, we will have the authority to issue up to an additional

200,000,000 shares of common stock. These shares may be issued without stockholder approval at any time, in the sole discretion of

the Board. The authorized and unissued shares may be issued for cash or for any other purpose that is deemed in the best interests of

the Company.

The increase in our authorized

common stock could have a number of effects on the Company’s stockholders depending upon the exact nature and circumstances of any

actual issuances of authorized but unissued shares. If we issue additional shares of common stock or other securities convertible into

shares of our common stock in the future, it could dilute the voting rights of existing stockholders and could also dilute earnings per

share and book value per share of existing stockholders. The increase in authorized number of common stock could also discourage or hinder

efforts by other parties to obtain control of the Company, thereby having an anti-takeover effect. The increase in authorized number

of common stock is not being proposed in response to any known threat to acquire control of the Company.

The increase in our authorized

common stock will not change the number of shares of common stock issued and outstanding, nor will it have any immediate dilutive effect

or change the rights of current holders of our common stock.

Advantages and Disadvantages of Increasing

Authorized Common Stock

There are certain advantages

and disadvantages of increasing the Company’s authorized common stock.

The advantages include:

| ● | The ability to raise capital by issuing capital stock under

future financing transactions, if any. |

| ● | Having shares of common stock available to pursue business

expansion opportunities, if any. |

The disadvantages include:

| ● | In the event that additional shares of common stock are issued,

dilution to the existing stockholders, including a decrease in our net income per share in future periods. This could cause the market

price of our stock to decline. |

| ● | The issuance of authorized but unissued stock could be used

to deter a potential takeover of the Company that may otherwise be beneficial to stockholders by diluting the shares held by a potential

suitor or issuing shares to a stockholder that will vote in accordance with the desires of the Board, at that time. A takeover may be

beneficial to independent stockholders because, among other reasons, a potential suitor may offer such stockholders a premium for their

shares of stock compared to the then-existing market price. The Company does not have any plans or proposals to adopt provisions

or enter into agreements that may have material anti-takeover consequences. |

Procedure for Implementing the Amendment

The increase in our authorized

common stock will become effective upon the filing of the Certificate of Amendment or such later time as specified in the filing with

the Secretary of State of the State of Delaware. The form of the Certificate of Amendment is attached hereto as Appendix A. The

exact timing of the filing of the Certificate of Amendment will be determined by the Board based on its evaluation as to when such action

will be the most advantageous to the Company and our stockholders.

Interests of Officers and Directors in this

Proposal

Our officers and directors

do not have any substantial interest, direct or indirect, in this proposal.

Reservation of Right to Abandon Amendment

to Increase Authorized Shares of Common Stock

The Board reserves the

right to abandon the amendment of the Certificate of Incorporation to increase the number of authorized shares of our common stock from

200,000,000 shares to 400,000,000 shares without further action by our stockholders at any time before the effectiveness of the filing

with the Secretary of State of the State of Delaware of the Certificate of Amendment, even if the authority to amend the Certificate of

Incorporation to increase the number of authorized shares of our common stock from 200,000,000 shares to 400,000,000 shares has been approved

by our stockholders at the Annual Meeting. For example, if the Reverse Stock Split is implemented, the Board may choose to abandon the

amendment of the Certificate of Incorporation to increase the number of authorized shares of our common stock, since the Reverse Stock

Split would effectively increase the number of authorized shares available for future issuance.

Votes Required

Approval of an amendment

to our Certificate of Incorporation to increase our authorized shares of common stock requires the affirmative vote of the majority

of the votes cast at the meeting. Abstentions will have the effect of a vote against this proposal.

Voting Recommendation

The Board unanimously recommends

a vote “FOR” Proposal 2.

PROPOSAL 3

AUTHORIZATION OF REVERSE STOCK SPLIT

The Board has approved an amendment

to our Certificate of Incorporation to combine the outstanding shares of our common stock into a lesser number of outstanding shares (a

“Reverse Stock Split”).

If approved by our stockholders,

this proposal would permit (but not require) the Board to effect a Reverse Stock Split of the outstanding shares of our common stock within

one (1) year of the date the proposal is approved by stockholders, at a specific ratio within a range of one-for-five (1-for-5) to a maximum

of a one-for-one hundred (1-for-100) split, with the specific ratio to be fixed within this range by the Board in its sole discretion

without further stockholder approval. We believe that enabling the Board to fix the specific ratio of the Reverse Stock Split within the

stated range will provide us with the flexibility to implement it in a manner designed to maximize the anticipated benefits for our stockholders.

In fixing the ratio, the Board

may consider, among other things, factors such as: the initial and continued listing requirements of the Nasdaq Capital Market; the number

of shares of our common stock outstanding; potential financing opportunities; and prevailing general market and economic conditions.

The Reverse Stock Split, if approved

by our stockholders, would become effective upon the filing of the amendment to our Certificate of Incorporation with the Secretary of

State of the State of Delaware, or at the later time set forth in the amendment. The exact timing of the amendment will be determined

by the Board based on its evaluation as to when such action will be the most advantageous to our Company and our stockholders. In addition,

the Board reserves the right, notwithstanding stockholder approval and without further action by the stockholders, to abandon the amendment

and the Reverse Stock Split if, at any time prior to the effectiveness of the filing of the amendment with the Secretary of State of the

State of Delaware, the Board, in its sole discretion, determines that it is no longer in our best interest and the best interests of our

stockholders to proceed.

The proposed form of amendment

to our certificate of incorporation to effect the Reverse Stock Split is attached as Appendix B to this Proxy Statement.

Any amendment to our certificate of incorporation to effect the Reverse Stock Split will include the Reverse Stock Split ratio fixed by

the Board, within the range approved by our stockholders.

Reasons for the Reverse Stock Split

The Company’s primary reasons

for approving and recommending the Reverse Stock Split is to increase the per share price and bid price of our common stock to regain

compliance with the continued listing requirements of Nasdaq.

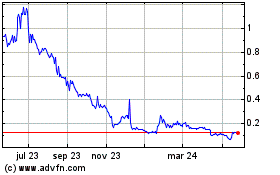

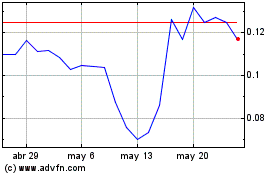

On August 24, 2023, we received

a written notice from Nasdaq notifying the Company that it was not in compliance with Nasdaq Listing Rule 5550(a)(2), which requires listed

companies to maintain a minimum bid price of $1.00 per share (the “Bid Price Requirement”). Under Nasdaq Listing Rule 5810(c)(3)(A),

the Company was granted a period of 180 calendar days, or until February 20, 2024, to regain compliance with the Bid Price Requirement.

On February 21, 2024, we were granted an additional 180-day period from the Nasdaq Stock Market Listing Qualifications Staff, through

August 19, 2024, to regain compliance with the $1.00 minimum bid price requirement for continued listing on the Nasdaq Capital Market.

To demonstrate compliance with this requirement, the closing bid price of our common stock will need to be at least $1.00 per share for

a minimum of 10 consecutive business days before August 19, 2024.

Reducing the number of outstanding

shares of common stock should, absent other factors, generally increase the per share market price of the common stock. Although the intent

of the Reverse Stock Split is to increase the price of the common stock, there can be no assurance, however, that even if the Reverse

Stock Split is effected, that the Company’s bid price of the Company’s common stock will be sufficient, over time, for the

Company to regain or maintain compliance with the Nasdaq minimum bid price requirement.

Additionally, the Company believes

the Reverse Stock Split will make its common stock more attractive to a broader range of investors, as it believes that the current market

price of the common stock may prevent certain institutional investors, professional investors and other members of the investing public

from purchasing stock. Many brokerage houses and institutional investors have internal policies and practices that either prohibit them

from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. Furthermore,

some of those policies and practices may function to make the processing of trades in low-priced stocks economically unattractive to brokers.

Moreover, because brokers’ commissions on low-priced stocks generally represent a higher percentage of the stock price than commissions

on higher-priced stocks, the current average price per share of common stock can result in individual stockholders paying transaction

costs representing a higher percentage of their total share value than would be the case if the share price were higher. The Company believes

that the Reverse Stock Split will make our common stock a more attractive and cost effective investment for many investors, which in turn

would enhance the liquidity of the holders of our common stock.

Reducing the number of outstanding

shares of our common stock through the Reverse Stock Split is intended, absent other factors, to increase the per share market price of

our common stock. However, other factors, such as our financial results, market conditions and the market perception of our business may

adversely affect the market price of our common stock. As a result, there can be no assurance that the Reverse Stock Split, if completed,

will result in the intended benefits described above, that the market price of our common stock will increase following the Reverse Stock

Split, that as a result of the Reverse Stock Split we will be able to meet or maintain a bid price over the minimum Bid Price Requirement

of Nasdaq or that the market price of our common stock will not decrease in the future. Additionally, we cannot assure you that the market

price per share of our common stock after the Reverse Stock Split will increase in proportion to the reduction in the number of shares

of our common stock outstanding before the Reverse Stock Split. Accordingly, the total market capitalization of our common stock after

the Reverse Stock Split may be lower than the total market capitalization before the Reverse Stock Split.

The Board believes that the Reverse

Stock Split will result in a more appropriate and effective structure for the Company and the resultant trading price would be more appealing

to a wider range of investors.

In evaluating whether to seek

stockholder approval for the Reverse Stock Split, the Board took into consideration negative factors associated with reverse stock splits.

These factors include: the negative perception of reverse stock splits that investors, analysts and other stock market participants may

hold; the fact that the stock prices of some companies that have effected reverse stock splits have subsequently declined, sometimes significantly,

following their reverse stock splits; the possible adverse effect on liquidity that a reduced number of outstanding shares could cause;

and the costs associated with implementing a reverse stock split.

Even if our stockholders approve

the Reverse Stock Split, the Board reserves the right not to effect the Reverse Stock Split if in the Board’s opinion it would not

be in the best interests of the Company or our stockholders to effect such Reverse Stock Split.

Potential Effects of the Proposed Amendment

If our stockholders approve the

Reverse Stock Split and the Board effects it, the number of shares of common stock issued and outstanding will be reduced, depending upon

the ratio determined by the Board. The Reverse Stock Split will affect all holders of our common stock uniformly and will not affect any

stockholder’s percentage ownership interest in the Company, except that as described below in “Fractional Shares,” record

holders of common stock otherwise entitled to a fractional share as a result of the Reverse Stock Split because they hold a number of

shares not evenly divisible by the Reverse Stock Split ratio will automatically be entitled to receive an additional fraction of a share

of common stock to round up to the next whole share. In addition, the Reverse Stock Split will not affect any stockholder’s proportionate

voting power (subject to the treatment of fractional shares).

The Reverse Stock Split will

not change the terms of the common stock. Additionally, the Reverse Stock Split will have no effect on the number of common stock that

we are authorized to issue. After the Reverse Stock Split, the shares of common stock will have the same voting rights and rights to dividends

and distributions and will be identical in all other respects to the common stock now authorized. The common stock will remain fully paid

and non-assessable.

After the effective time of the

Reverse Stock Split, we will continue to be subject to the periodic reporting and other requirements of the Exchange Act.

Registered “Book-Entry” Holders of

Common Stock

Our registered holders of common

stock hold some or all of their shares electronically in book-entry form with the transfer agent. These stockholders do not have stock

certificates evidencing their ownership of the common stock. They are, however, provided with statements reflecting the number of shares

registered in their accounts.

Stockholders who hold shares

electronically in book-entry form with the transfer agent will not need to take action to receive evidence of their shares of post-Reverse

Stock Split common stock.

Holders of Certificated Shares of Common Stock

Stockholders holding shares of

our common stock in certificated form will be sent a transmittal letter by the transfer agent after the effective time of the Reverse

Stock Split. The letter of transmittal will contain instructions on how a stockholder should surrender his, her or its certificate(s)

representing shares of our common stock (the “Old Certificates”) to the transfer agent. Unless a stockholder specifically

requests a new paper certificate or holds restricted shares, upon the stockholder’s surrender of all of the stockholder’s

Old Certificates to the transfer agent, together with a properly completed and executed letter of transmittal, the transfer agent will

register the appropriate number of shares of post-Reverse Stock Split common stock electronically in book-entry form and provide the stockholder

with a statement reflecting the number of shares registered in the stockholder’s account. No stockholder will be required to pay

a transfer or other fee to exchange his, her or its Old Certificates. Until surrendered, we will deem outstanding Old Certificates held

by stockholders to be cancelled and only to represent the number of shares of post-Reverse Stock Split common stock to which these stockholders

are entitled. Any Old Certificates submitted for exchange, whether because of a sale, transfer or other disposition of stock, will automatically

be exchanged for appropriate number of shares of post-Reverse Stock Split common stock. If an Old Certificate has a restrictive legend

on its reverse side, a new certificate will be issued with the same restrictive legend on its reverse side.

STOCKHOLDERS SHOULD NOT DESTROY

ANY STOCK CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY STOCK CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

Fractional Shares

We will not issue fractional

shares in connection with the Reverse Stock Split. Instead, stockholders who otherwise would be entitled to receive fractional shares

because they hold a number of shares not evenly divisible by the Reverse Stock Split ratio will automatically be entitled to receive an

additional fraction of a share of common stock to round up to the next whole share. In any event, cash will not be paid for fractional

shares.

Effect of the Reverse Stock Split on Outstanding

Stock Options and Warrants

Based upon the Reverse Stock

Split ratio, proportionate adjustments are generally required to be made to the per share exercise price and the number of shares issuable

upon the exercise of all outstanding options and warrants. This would result in approximately the same aggregate price being required