Northern Trust and EDS Selected by Cornerstone FTM for Research Management and Portfolio Construction Capabilities

07 Mayo 2024 - 9:10AM

Business Wire

Asset manager demand for advanced front-office

support propels growth of Investment Data Science business at

Northern Trust

Northern Trust (Nasdaq: NTRS) announced today that Cornerstone

FTM, a financial technology focused investment fund, has selected

Northern Trust and its strategic partner, Equity Data Science

(EDS), for Research Management System (RMS) and Portfolio

Construction solutions. Cornerstone will also leverage Northern

Trust custody and hedge fund administration services, and data

visualization and ingestion capabilities from EDS.

This new collaboration highlights the continued growth momentum

of Northern Trust’s Investment Data Science (IDS) product suite, of

which EDS is a key partner. In the last 12 months, IDS has more

than doubled the number of clients that utilize its services.

“The solutions available through Northern Trust and EDS support

our critical processes and decision-making from front to back

office,” said Jean-Jacques Louis, CIO & Co-Founder of

Cornerstone FTM. “We are impressed with their advanced capabilities

that will automate our investment process, allowing us to scale and

make better investment decisions. We look forward to capitalizing

on these data aggregation, ingestion and visualization tools to

improve our investment process.”

RMS and Portfolio Construction are data-driven tools that allow

for quicker, more informed investment decisions backed by

actionable insights. Using the tools, investment teams are better

equipped to analyze and measure the success of their inputs and

decisions.

Paul Fahey, Head of Investment Data Science at Northern Trust

Asset Servicing, said: “this appointment by Cornerstone, FTM is

further evidence of the value of our data science toolset, which

helps our clients drive high quality outcomes so they can invest

more effectively in their core activities. We look forward to

building on our momentum in the future.”

As Northern Trust continues to expand its solutions and reach,

it remains committed to delivering its Whole Office strategy.

Moving beyond middle and back-office capabilities, Northern Trust

Asset Servicing can offer services and benefits to all parts of an

asset manager’s business, including direct support for portfolio

managers’ daily investment processes.

About Cornerstone FTM

Cornerstone Financial Technology Management is a fundamental

long/short equity manager seeking private equity-like, risk

adjusted returns by investing in publicly traded equities within

financial technology and related space. Founded by Robert Greifeld

and Jean-Jacques Louis, Cornerstone FTM leverages a deep expertise

in financial technology space powered by a custom-built, cutting

edge, technology driven investment platform to drive stock

selection. The Founders have used similar strategically focused and

cash flow-oriented methodology over several decades to execute on

and manage over 50 private acquisitions and numerous equity and

direct capital investments as executives in prior funds and

businesses. Over the years, our commitment to data-driven,

systematic, rigorous due diligence and fundamental analyses has

consistently yielded exceptional results both in the public and

private markets, as well as the operation of large businesses.

About Equity Data Science

Equity Data Science (EDS) is an investment process management

(IPM) solutions provider that empowers many of the world's leading

hedge funds and asset managers through greater insights and

productivity for decision-making. Trusted since 2012, it harnesses

proprietary and third-party data and research on a modern platform

configured to the unique investment visions of clients. The EDS

platform supports idea generation, research management, portfolio

construction and analytics, risk management, performance

attribution and ESG.

About Northern Trust

Northern Trust Corporation (Nasdaq: NTRS) is a leading provider

of wealth management, asset servicing, asset management and banking

to corporations, institutions, affluent families and individuals.

Founded in Chicago in 1889, Northern Trust has a global presence

with offices in 24 U.S. states and Washington, D.C., and across 22

locations in Canada, Europe, the Middle East and the Asia-Pacific

region. As of March 31, 2024, Northern Trust had assets under

custody/administration of US$16.5 trillion, and assets under

management of US$1.5 trillion. For more than 130 years, Northern

Trust has earned distinction as an industry leader for exceptional

service, financial expertise, integrity and innovation. Visit us on

northerntrust.com. Follow us on X (formerly Twitter) @NorthernTrust

or Northern Trust Corporation on LinkedIn.

Northern Trust Corporation, Head Office: 50 South La Salle

Street, Chicago, Illinois 60603 U.S.A., incorporated with limited

liability in the U.S. Global legal and regulatory information can

be found at https://www.northerntrust.com/terms-and-conditions.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240507292964/en/

Media Contacts Europe, Middle East,

Africa & Asia-Pacific:

Camilla Greene +44 (0) 20 7982 2176 Camilla_Greene@ntrs.com

Simon Ansell + 44 (0) 20 7982 1016 Simon_Ansell@ntrs.com

US & Canada:

John O’Connell +1 312 444 2388 John_O'Connell@ntrs.com

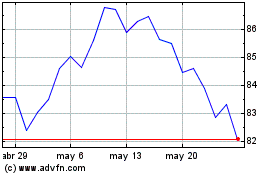

Northern (NASDAQ:NTRS)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Northern (NASDAQ:NTRS)

Gráfica de Acción Histórica

De May 2023 a May 2024