false

0000022701

0000022701

2024-08-28

2024-08-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

United

States

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (date of earliest event reported): August

28, 2024

Pineapple Energy Inc.

| |

(Exact

name of Registrant as Specified in its Charter) |

|

Minnesota

| |

(State Or Other Jurisdiction

Of Incorporation) |

|

| 001-31588 |

|

41-0957999 |

| (Commission

File Number) |

|

(I.R.S.

Employer Identification No.) |

10900

Red Circle Drive

Minnetonka,

MN

|

|

55343 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

(952) 996-1674

| |

Registrant’s Telephone

Number, Including Area Code |

|

Securities

registered pursuant to Section 12(b) of the Act

| Title

of Each Class |

Trading

Symbol |

Name

of each exchange on which registered |

| Common

Stock, par value, $.05 per share |

PEGY |

The

Nasdaq Stock Market, LLC |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

| |

☐ |

Written communications pursuant to Rule 425

under the Securities Act |

| |

☐ |

Soliciting material pursuant to Rule 14a-12

under the Exchange Act |

| |

☐ |

Pre-commencement communications pursuant to

Rule 14d-2(b) under the Exchange Act |

| |

☐ |

Pre-commencement communications pursuant to

Rule 13e-4(c) under the Exchange Act |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR

§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Effective August 28, 2024, Andrew Childs was appointed as Chief Financial Officer (“CFO”) of Pineapple Energy Inc., (the “Company”).

Andrew Childs, age 45, has extensive financial executive experience at both private and public institutions. Prior to joining the Company, from 2022 to present, Mr. Childs served as CFO of Conduit Capital Partners providing strategic input into EPC public companies alongside dealing with climate and sustainable institutional equity and debt funds. From 2016 - 2020, Mr. Childs served as CFO to The Conduit, a Delaware company, and prior to this as SVP of North America for Soho House overseeing gross revenues of $350 million, having spent several years in this position from 2012-2015. Prior to 2019, Mr. Childs held key financial positions as CFO of Cinema Lab, a sustainable platform that regenerates high street real estate, including having spent ten years in C-Suite level positions in various financial and operational capacities. Mr. Childs holds a bachelor’s degree in business economics from the University of Portsmouth.

Mr. Childs will receive an annual base salary of $250,000 (“Base Salary”), subject to annual adjustments as determined by the Board of Directors (“Board”). Mr. Childs will also be eligible for an annual bonus of up to 40% of his Base Salary as determined at the sole discretion of the Board in consultation with the Compensation Committee. In addition, Mr. Childs is eligible to participate in the Company’s standard benefit plans and programs.

As noted above in Mr. Childs biography, Mr. Childs previously held the position of CFO of Conduit Capital, which is a debtholder in our Company. Mr. Childs no longer holds a position with Conduit Capital and is not a member of our board of directors and, therefore, will not have any voting power of or control of either entity. If, and to the extent, any future transactions require related party transaction disclosures under applicable rules, then we will provide all such required disclosures related thereto, as well as in our future quarterly and annual reports.

A copy of Mr. Childs offer letter effective August 28, 2024, is annexed hereto as Exhibit 10.1.

| Item 9.01. | Financial Statements and Exhibits. |

SIGNATUREs

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

PINEAPPLE ENERGY INC. |

| |

|

| |

By: |

/s/ James Brennan |

| |

|

James Brennan

Chief Operating Officer |

| |

|

|

| Date: September 4, 2024 |

|

|

8-28-2024

Dear Andrew (“Andy”) Childs,

It

is our pleasure to offer you the position of Interim CFO (Chief Financial Officer) and Corporate Secretary with Pineapple Energy,

Inc. (the “Company”). Your work location will be the SUNation Office located at 171 Remington

Blvd. Ronkonkoma, NY 11779. This position will report to Scott Maskin, Interim CEO.

Start Date for Hire: 8-28-2024

You will devote your

full business time and best efforts to the performance of your job and perform such duties as are assigned to you by the Company.

Compensation: Your total compensation will

consist of a weekly salary payable on the Company’s regular paydays. All compensation is less

tax and withholding required by law as well as those deductions authorized by you.

Annual Salary = $250,000.00

Bonus Potential = Up to 40% of your base salary.

Employee Bonus Program: The Company Employee Bonus

Program is discretionary based on goals established by the Company’s Board of Directors and

may be changed from time to time. Any bonus payable shall be paid as a lump sum by March 15 of the calendar year following the year for

which the bonus was calculated. Employee must be employed by the Company on the date of the payment of any bonus to earn any bonus

under the Company’s Employee Bonus Program.

Initial goal for 50% of the total annual bonus is as follows:

| 1. | Successful PIPE exchange into new vanilla preferred shares |

| 2. | $5M Equity Raise to shore up the balance sheet and remove the “going concern” auditors statement in our financial

statements |

| 3. | $35M Debt/Equity Raise to acquire 1-2 companies and clean up the debt schedule |

Benefits:

You will be eligible to participate in employee benefits and Paid Time Off programs (PTO) provided

by the Company to its employees generally, subject to the terms, conditions and eligibility requirements

of the applicable plans and policies as modified by the Company from time to time. PTO is

paid at your base rate of compensation in effect at the time that you take the PTO. PTO is accrued based on years of service. Your

hire year PTO is accrued at 1.846 hours per week with a maximum of 12 days for the year. You will

be eligible for Holiday Pay on the 8 Holidays designated by the company. Based on your date of hire, you may be eligible for 2

floating holidays after 90 days of employment. Your first year PTO will be prorated according to

your hire date, and you will be eligible after 30 days

10900 Red Circle Drive • Minnetonka, MN • 1-800-268-5130

• 952-996-1674 • www.pineappleenergy.com

except for NYSSL (NY Sick and

Safe Leave). If additional time off is needed, with approval of your supervisor you may be able to take additional unpaid time off. Working

remotely, a benefit offered sparingly to key employees, will not require the use of PTO days. The

entire PTO policy is available in the employee handbook.

Medical/Dental/Vision/Life/Accident/STD/LTD/HSA/CI/

insurance is available following 30 days of employment.

401K:

You will automatically be enrolled at 6% Pre-Tax contribution at 90 Days and must sign in to the 401K website to change your contribution

or opt out. The Company matches .50/$1 up to a total of 3%.

Mind/Body/Wellness:

The Company will reimburse you up to $35/month for activities with a wellness benefit. Some examples include: gym membership, yoga

or painting classes, craft or athletic equipment or registration fees to compete in athletic events.

Eligible at 90 Days.

Our offer is contingent upon each of the

following:

First and foremost, this offer

is conditioned on your not being subject to any agreement or understanding that would hinder the full and complete performance of your

duties as an employee of our Company.

The Immigration Reform and Control

Act of 1986 requires all US employers to verify all prospective employees’ identity and authority

to work in the United States. For this verification, you will need to complete an I-9 Employment Eligibility form and provide the

required documentation within the time required by law.

Conditions: Employee will have access to,

extremely sensitive confidential, proprietary and trade secret information relating to the Company,

its employees, and its customers. As a result, Employee’s continued employment with the Company are strictly conditioned on Employee

agreeing to the confidentiality provisions and postemployment restrictions.

In consideration of the foregoing, and other good

and valuable consideration, the receipt and sufficiency of which are acknowledged by the Company

and Employee, the parties agree as follows:

1.

Employment Duties: No Conflict; Contingency. The Company hereby agrees to continue to employ Employee

pursuant to the terms and conditions of this Agreement and Employee accepts such employment.

Employee agrees to perform the duties consistent with his position and other duties as may

be requested by the Company from time to time. Employee will perform his duties with a high level of

professionalism and integrity. Employment pursuant to this Agreement is subject to all Company policies in effect throughout Employee’s

employment. During the term of Employee’s employment with the Company, Employee will

not render or perform services for any other corporation, firm, entity or person that are

inconsistent with the provisions of this Agreement except as expressly permitted by the Company in writing.

2.

Employment at Will. Employee’s employment with the Company is at-will and continues until terminated

by the Company or Employee for any reason.

3. Termination. Employee’s employment with the Company may be terminated at any time upon sixty (60) days’ written notice by (a) the Company to Employee

in person or by certified mail to Employee’s address on record at the Company, or (b) Employee

to the then-current Chair of the Board in person or by certified mail to the Company.

2

| (a) Upon termination of Employee’s employment with the Company, Employee shall be entitled to receive: |

| (i) | Base Salary owed through the Termination Date, |

| (ii) | reimbursement of reasonable expenses incurred as of the Termination Date. |

Such

amounts shall be paid within fourteen (14) days of the Termination Date. Employee acknowledges and agrees that said payments, as applicable,

shall be in full satisfaction of any amount due to Employee by the Company, and Employee shall not

be entitled to any further payment, severance, benefits continuation, damages, or any additional compensation whatsoever.

(b)

Termination by the Company for Cause - If the Employee’s employment is terminated by the Company

for Cause, termination will be immediate. For purposes of this Agreement, “Cause” means:

| (i) | gross negligence or gross neglect of duties; |

(ii)

commission of any felony, or a gross misdemeanor involving moral turpitude that in the

reasonable determination of the Board is materially and demonstrably injurious to the Company or that impairs Employee’s ability

to substantially perform Employee’s duties with the Company or any of its affiliates;

(iii)

fraud, disloyalty, dishonesty or willful violation of any law or a willful violation

of a Company policy that, after warning, remains a continuing violation, committed in connection

with the Employee’s employment;

(iv)

conduct that, in the judgment of the Board, results in damage to the Company’s

business, property, reputation, or goodwill, including allegations of sexual harassment or discrimination;

| (v) breach of or inability to perform Employee’s obligations under this Agreement other than by reason of disability or death; or |

| (vi) | failure to follow a directive of the Board |

4.

Proprietary Information. During the course of employment with the Company Employee will Have

access to the Company’s proprietary and trade secret information. Maintaining the confidentiality

of such information is important to the Company’s competitive position in the industry and

ultimately to the Company’s ability to achieve financial success and provide employment opportunities. Employee will not discuss

the business affairs and operations of the Company with anyone outside of the Company except when required in the normal course of business.

To the extent Employee has access to proprietary and/or trade secret information, he is responsible for the security of that

information. Extreme care must be exercised to insure that such information is safeguarded to protect the Company, its suppliers, clients,

and employees.

5.

Confidential Information. Employee recognizes and acknowledges that Employee will have access to certain

information of the Company and that such information is confidential and constitutes valuable, special and unique property of the Company.

Employee shall not at any time, either during or after termination of employment, directly or indirectly

disclose to others, use, copy or permit to be copied, except as directed by law or in accordance

with Employee’s duties for or on behalf of the Company, its successors, assigns or nominees, any Confidential Information

of the Company (regardless of whether developed by the Employee), without the prior written consent

of the Company. The term “Confidential Information” means any secret or non-public information or know-how relating to the

Company and its business, and shall include but not be limited to information relating to the Company’s

3

plans, customers, costs, prices, personnel, business

relationships, uses and applications of products and services, results of investigations, studies owned or used by the Company, and all

products, processes, compositions, computer programs, and servicing, marketing or operational methods and techniques at any

time used, developed, investigated, made or sold by the Company, before or during the term of Employee’s

employment with the Company, that are not readily available to the public or that are maintained

as confidential by the Company. Employee shall maintain in confidence any Confidential

Information of third parties, received as a result of the Employee’s employment, in accordance with the Company’s obligations

to such third parties and the policies established by the Company.

Consistent with

state and federal law, nothing in this Agreement is intended to limit Employee’s right to discuss the terms, wages, and working

conditions of his employment; or prohibits Employee from reporting possible violations of

law to a government agency or attorney, including information about trade secrets in a document

filed in a lawsuit if the disclosure is made in confidence, good faith, solely for the purpose of reporting or investigating a suspected

violation of law and is done only as permitted by law.

6.

Conflict of Interests. The Company expects all employees to conduct business according to the highest

ethical standards of conduct. Employee is expected to devote his best efforts to the interests and business of the Company. Business

dealings that create, or appear to create, a conflict between the interests of the Company and Employee are prohibited. The Company recognizes

the right of employees to engage in activities outside of their employment that are of a private

nature and unrelated to the Company’s business. However, Employee must disclose any possible conflicts so that the Company

may assess and prevent potential conflicts of interest from arising. A potential or actual conflict

of interest may occur when an employee is in a position to influence a business decision that may result in personal gain

to the employee, a family member, or personal acquaintance. It is not possible to specify every action

that might create a conflict of interest. Any question regarding whether an action or proposed course of conduct could create, or appear

to create, a conflict of interest should immediately be presented to the Board Chair or the

Human Resources Department for review.

By accepting this offer, you

understand and acknowledge that this letter sets forth all the elements of our employment offer, and that it supersedes all prior agreements

and understandings between you and our Company regarding this offer. You further understand and agree that this letter does not create

a contract of employment or obligation on our Company or any other person to employ you or to continue

your employment for any period of time, and you acknowledge that your employment will be at-will

and that either you or our Company may terminate your employment at any time, for any reason, with or without cause.

7. Remote Work: It is understood that Andy will work remotely from his home office in NJ and be at the Company office 3 days

every other week. There may be some occasional business travel that will interrupt this normal cadence.

Miscellaneous Item:

It is understood that Andy has

exiting engagements with Cinema Lab, a hotel in Puerto Rico and Conduit Capital. None of these will

be worked on in company time and be wound down in due course or require termination if position

moves from interim CFO to CFO.

4

| |

|

|

| Andrew Childs |

|

Scott Maskin, CEO |

5

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

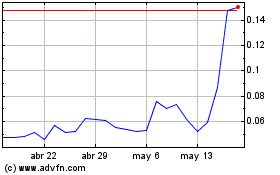

Pineapple Energy (NASDAQ:PEGY)

Gráfica de Acción Histórica

De Sep 2024 a Oct 2024

Pineapple Energy (NASDAQ:PEGY)

Gráfica de Acción Histórica

De Oct 2023 a Oct 2024