UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ |

Preliminary Proxy Statement |

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

Definitive Proxy Statement |

| x |

Definitive Additional Materials |

| ¨ |

Soliciting Material under §240.14a-12 |

Tesla, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ¨ |

Fee paid previously with preliminary materials |

| ¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

On May 21, 2024, Tesla, Inc. updated its website, www.VoteTesla.com.

A copy of the updated materials, other than those previously filed, is below.

On May 21, 2024, Tesla delivered the following letter to stockholders.

| Dear Fellow Stockholder,

We need your vote ahead of this year’s Annual Stockholders’ Meeting on two critical proposals to protect

your investment in Tesla.

The belief that ingenuity and hard work can transform great risk into great reward is a fundamental

American principle. Disinterested stockholders overwhelmingly approved the 2018 CEO Performance

Award over six years ago.

The award did what it was designed to do. Elon delivered the type of growth that most thought was

impossible, and he has created tremendous value for you, the owners of the Company. But the Delaware

Court ignored the will of stockholders and overturned your vote.

In line with the recommendation of the independent Special Committee, we believe redomesticating in

Texas will best position us to fulfill our mission and deliver value to you. We strongly believe that the

Texas legal regime is the regime of the future – one that accommodates our unmatched pace of innovation

and our existence as a mission-driven company. It not only further facilitates our mission, but also

advances corporate democracy and stockholder rights – two principles that are at the heart of Tesla’s and

America’s values.

These two proposals are critical for our future growth. Your fellow stockholders have spoken out about the

importance of this vote. Vote now to ensure your voice is heard and to protect the current and future value

of your investment.

Vote FOR Proposal Three

Redomesticating Tesla in

the State of Texas

Vote FOR Proposal Four

Sincerely,

Robyn M. Denholm

Chair of the Board Learn more at VoteTesla.com

Your Vote Is Essential

Ratification of the 2018 CEO

Performance Award |

| Vote FOR Tesla Proposals 3 and 4

Proposal Four

Ratification of the 2018 CEO Performance Award

Since 2018, Elon

has delivered for

stockholders and the

American Economy ~1,100% total shareholder return

since March 20182

$15B profit turned around

from a $2.2B loss1 ~$987M

the overall impact from Giga

Texas to Texas’s gross state

product in 2022 alone3

Top 4 of the ‘most American’

cars are Teslas4

An American Growth Story

Elon hit every “jaw-dropping” target in the innovative and ambitious 2018 Award, leading to

staggering growth. We have seen what the leadership of an incentivized Elon can do to drive

innovation and create value. Protect that same value creation for the future.

And in America, a deal should be a deal.

Despite having a signed contract in place, Elon has not been compensated for any of his work

for Tesla over the past six years, even though he led Tesla to significant growth and stockholder

value. That strikes us – and the many stockholders from whom we have already heard – as

fundamentally unfair and inconsistent with the will of the stockholders who voted for it.

As we embark on our next phase of growth, Elon’s

leadership is more important than ever. |

| Proposal Three

Redomesticating Tesla in the State of Texas

“Elon Musk shows what America

produces... he’s taking on… all these people

who have all this stuff and he’s got an idea.

And he’s winning. That’s America.”

Warren Buffett 5

Vote Now April 14, 20225

Elon Musk…shows what America produces. Elon is taking on

General Motors and Ford and Toyota – all these people who

have all this stuff. And he’s got an idea. And he’s winning.

That’s America. You can’t dream it up. It’s astounding.”

Warren

Buffett

Texas Is Our Home

Texas is already our business home and our largest manufacturing facility, Gigafactory

Texas, is located in the state. Remaining incorporated in Delaware – where the corporate

law is increasingly causing uncertainty and instability for our stockholders – doesn’t

support us anymore. We need you to help us make Texas our legal home as well.

Tesla should be incorporated in the legal regime of the future, one that allows a

mission-driven company to thrive in pursuing big bets on the future while

respecting stockholders’ decisions. Texas is where Tesla belongs.

With the appropriate legal home, we can focus on what matters to our

stockholders – executing on our mission and driving value for you. |

| Voting Your Shares Is Quick and Easy

Don’t wait – vote NOW. Whether or not you attend the Annual Meeting, please

vote FOR Proposal Three: Redomesticating Tesla from Delaware to Texas and

Proposal Four: Ratifying the 2018 CEO Performance Award.

If you need help voting your shares or have any questions, please

contact our proxy solicitor, Innisfree M&A Incorporated.

Stockholders

+1 (877) 800-5182 (U.S. and Canada) OR +1 (412) 232-3651 (all other countries)

Banks and Brokers

+1 (212) 750-5833 (collect)

1 Refers to 2017 and 2023 net loss/net income, as disclosed on form 10-K, respectively. 2023 net income included a one-time non-cash tax benefit of $5.93 billion for the release of valuation allowance on certain

deferred tax assets.

2 As measured from March 2018 through year-end 2023.

3 Per Tesla Giga Texas Update to Travis County Commissioners Court; October 3, 2023.

4 Kelley Blue Book, ‘Report: Tesla Makes the ‘Most American’ Cars,’ April 2, 2024 (https://www.kbb.com/car-news/report-tesla-makes-the-most-american-cars/)

5 Warren Buffet public interview with Charlie Rose, April 14, 2022 (https://charlierose.com/videos/31221)

Additional Information and Where to Find It

Tesla, Inc. (“Tesla”) has filed with the Securities and Exchange Commission (the “SEC”) a definitive proxy statement on Schedule 14A with respect to its solicitation of proxies for Tesla’s 2024 annual meeting (the

“Definitive Proxy Statement”). The Definitive Proxy Statement contains important information about the matters to be voted on at the 2024 annual meeting. STOCKHOLDERS OF TESLA ARE URGED TO READ THESE

MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT TESLA HAS FILED OR WILL FILE WITH THE SEC BECAUSE THEY CONTAIN OR WILL

CONTAIN IMPORTANT INFORMATION ABOUT TESLA AND THE MATTERS TO BE VOTED ON AT THE 2024 ANNUAL MEETING. Stockholders are able to obtain free copies of these documents and other documents

filed with the SEC by Tesla through the website maintained by the SEC at www.sec.gov. In addition, stockholders are able to obtain free copies of these documents from Tesla by contacting Tesla’s Investor Relations

by e-mail at ir@tesla.com, or by going to Tesla’s Investor Relations page on its website at ir.tesla.com

Participants in the Solicitation

The directors and executive officers of Tesla may be deemed to be participants in the solicitation of proxies from the stockholders of Tesla in connection with 2024 annual meeting. Information regarding the interests

of participants in the solicitation of proxies in respect of the 2024 annual meeting is included in the Definitive Proxy Statement.

Forward-Looking Statements

Certain statements in this document are forward-looking statements that are subject to risks and uncertainties. These forward-looking statements are based on management’s current expectations. Various

important factors could cause actual results to differ materially, including the risks identified in our SEC filings. Tesla disclaims any obligation to update any forward-looking statement contained in this document.

Tesla © 2024

Vote Online

Locate your control number on your

proxy materials, visit the website

listed and follow the instructions. If

you have received proxy materials by

e-mail, you can simply click the link

and follow the instructions.

Vote by Phone

Registered stockholders can locate

the number on your proxy materials,

dial the number indicated and follow

the prompts.

Vote by QR Code

If your proxy materials include a

QR code, scan the QR code using

your mobile device and follow the

instructions.

Vote by Mail

Mark, sign and date the proxy card

and return it in the pre-paid envelope

provided. |

On May 20, 2024, Elon Musk posted the following on X. Included herein

are stills and a transcript of the video in the post.

Transcript of video in post:

Andrew Ross Sorkin: We want to talk about stocks and the markets with

you, but do you have a view about this. This guy is going to get nothing, but he only gets money, he only gets paid, if he raises the

company’s market value by $50 billion increments and at the same time has revenue and adjusted EBITDA numbers. If he doesn’t

get either, he gets nada.

Ray Dalio: So, I don’t know the particulars of the deal, but

if it’s just as you’re telling me I think it’s fabulous. Also, I mean, the man is Tesla. It’s his dream, he’s

built the dream. And so, when we start to think about who is going to be the other person…

Joe Kernen: Is there anything illusory about the dream, because there

all people like [unintelligible] that says without all the subsidies it’s worth zero. It’s at infinity times EBITDA right

now…

Kernen: But if the company is worth zero, then he gets zero…

Dalio: There are so many companies that are like that, the question

is what the future holds, right? We don’t know what the future holds, so it’s your choice, you don’t have to invest

in it. Don’t invest in it, short it, you do whatever you want to do. Ok the question is, what is his incentives? So, I mean all

the critiquing about that, you know, don’t short it.

Becky Quick: We don’t do either…

Dalio: But I’m just saying, um, I think it ties him together.

It’s the dream, you either buy into the dream and you have the right, or…

Quick: But Ray the idea of saying that your compensation is tied to

market capitalization, those are factors that are out of your control because markets can be completely irrational, to one side or the

other.

Sorkin: But you also have to hit the operating numbers…

Dalio: That’s his risk as much as everybody else, but isn’t

it partners with the people…

Quick: I would think hitting your operating numbers and if you want

to tie it to stock performance maybe that’s different than tying it to market capitalization.

Sorkin: The stock performance is the market capitalization.

Quick: No it’s not, there are other factors that affect market

capitalization.

Dalio: Everything can’t be precise, you can tie it to earnings,

but then market capitalization makes a big difference. But they’re partners, if you’re a shareholder you’re a market

cap person, so that ties it to that. Whether you do that or not I think is a secondary consideration relative to the notion that he’s

on the line for the timeline.

Quick: Would it incentive you to do things for short term rather than

long term?

Dalio: I don’t think that’s him. But you have to make a

choice whether that’s him or not. The character, you have to decide where that’s coming from.

Quick: That’s true. That’s been the case with this company

all along. It’s all about Elon Musk and what you think of him.

Sorkin: The shareholders get to vote. And I would also say, as I said

before, even once the shares vest, if he actually hits all the things, he then has to hold the shares for 5 years. I’ll say it again

[anchors speaking over each other] these are $50 billion increments and he gets nothing if he gets $49 billion in market capitalization,

plus he has to hit the operating numbers.

Quick: Just, we talk all the time about how markets can be irrational.

So you can not get rewarded for good performance, you can be rewarded for questionable performance.

Kernen – And there’s no claw backs –

Sorkin: The claw back is he has to own it for five years if it goes

to zero.

Quick: Doesn’t matter, you still get 1% and even if it goes and

loses half its value you still own 1% of the company at that point, it’s not a claw back.

Sorkin: This is a much preferential – by the way, you have to

think about how would you, if you’re the compensation committee of Tesla, how would you want to incentivize him? Do you want to

pay him –

Quick : You’re never going to be able somebody [unintelligible]

–

Sorkin: He’s the purest guy in the game.

Kernen: And you’re convinced that he’s the Steve Jobs of

the auto industry, obviously. Have you ever heard the term that past performance is no guarantee, he gets ten years because he’s

Elon Musk? What if he sucks five years from now?

Sorkin: He gets ten years of what, he gets ten years of getting paid

nothing and they can fire him tomorrow.

Kernen: I understand but it’s a ten-year employment contract?

Quick: If they can fire him tomorrow –

Sorkin: They can fire him tomorrow.

Kernen: If he doesn’t hit his numbers.

Sorkin: This is –

Kernen: You think this is skin in the game?

Sorkin: This is the ultimate ski—I don’t think, I think

this is the best deal that shareholders could ever have. What kind - I’ve never heard of an executive compensation plan like this.

Most of the time we’re sitting here talking about how people are getting paid when the stock is going down and they’re getting

this and getting that, this guy is getting zero. By the way, this guy can create $99 billion of [unintelligible] and get nothing.

Kernen: How about this, I love when commodity close down funds, they

close down when they lose money because they don’t get their 10% or whatever it is anymore. Can he leave in two years if it’s

obvious we’re not going higher in market cap?

Sorkin: He could leave.

Kernen: Then he can leave?

Sorkin: Sure.

Kernen: OK, then you’re not even locking him in?

Sorkin: But you can’t lock anyone in, how else would you lock

him in?

Kernen: I don’t know, it just seems gimmicky, and it’s

too radical.

Sorkin: Hey Jim, weigh in on the Elon Musk compensation plan. It’s

an all or nothing plan, you like it or not, we’ve had a debate going for the last couple hours here.

Jim Cramer: I didn’t like it, I loved it. I loved it. Because

you know what, if he makes that much money for people, I would double what he gets. And I wish that everyone would take that, I know there

was discussion. I thought that was a great piece, holy cow. What it really did present to you was, here’s a man of conviction and

I’ve been neutral on the stock because who knows, but Andrew that was a fabulous article and it told me a blueprint about what to

do with CEOs, it’s the Musk plan.

Sorkin: Ok, Jim thank you. Appreciate very much.

Cramer: Fabulous article.

Sorkin: Overnight, Elon Musk, he’s the subject of the column,

telling me has agreed to stay on as CEO of Tesla for the next decade. There had been a lot of speculation that he’d be stepping

down in the next two to three years. He had said that once the completion of the Model S, or the Model 3 rather, was up and running that

he might not stay at the company as the CEO. But, Tesla is now announcing a radical new compensation plan, it could be perhaps the most

radical compensation plan in history.

Musk’s compensation is gonna be tied directly to the company’s

performance. The executive will receive no guaranteed compensation of any kind at all. He gets no salary, cash bonus, equity. He only

gets equity that vests over time, but only if he reaches these hurdle rates which are, dare I say, crazy. So right now the company is

worth $59 billion, they run at $50 billion increments, so if he gets the company to $100 billion –

Quick: Are you just talking market capitalization, it’s not based

on revenue, not based on the number of, production?

Sorkin: There’s going to be two metrics at each step. So, the

first step is he has to get the company to $100 billion and reach these operational and adjusted EBITDA and revenue number. If he doesn’t

get either of them, he gets nothing.

Quick: That’s kind of a weird way to break it down based on market

cap.

Sorkin: If he gets to $150 and has to hit the operational numbers [unintelligible]

–

Quick: But I mean the market can be irrational, so you can’t

control that.

Sorkin: At each $50 billion number, he collects 1% of the company.

If, somehow, magically, he would get the company to $650 billion, which is literally what the plan calls for if you can believe this,

he would collect the equivalent of about $55 billion in compensation. Otherwise, he gets absolutely nothing, zero.

Quick: OK, what if he gets it to $650 Billion and then it immediately

collapses to $500 billion, is it just hitting that market capitalization milestone that matters, is it keeping it there for a certain

time, is it hitting [unintelligible]…

Sorkin: Here’s where it gets even more interesting, the shares

vest. But then he has to hold the shares for five years. At each breakpoint.

Quick: He’ll still get it, right. Even if - market capitalization

is the weirdest thing [unintelligible].

Sorkin: It’s impossible to game because even if you were to get

the company and the market cap to $100 billion, you then have to by the way hit the operational numbers on top of it. You have to get

both, and then you have to hold the shares for five years. So, if you’re trying to do something temporary to –

Quick: To try and get the stock price up [unintelligible]

Sorkin: You can’t.

[Unintelligible - anchors talking over each other]

Sorkin: The shares would be worthless.

Quick: Right.

Kernen: It would affect decisions on buybacks, issuing stock and floats,

and all kinds of…

Quick: Market cap is just a bizarre –

Sorkin: So interestingly, the last compensation plan that they had

started in 2012, it was similar in some ways to this, it had a market cap component, and then it had all sorts of –

Quick: I’ve never heard of another company tying [unintelligible]

capitalization.

Sorkin: Nobody’s ever done it. But he literally gets nothing.

And the other thing that’s interesting is, if he gets to let’s say $99 billion, he gets nothing. If you get to the next, if

you get to $149 billion, you get nothing. But it is truly eat what you kill, skin in the game.

Melissa Lee: We’ve gotta talk about your column today in DealBook,

and Tesla’s new compensation plan for its CEO Elon Musk, this is radical one can say, and you can’t say Elon Musk doesn’t

have skin in the game at this point.

Sorkin: This is the ultimate skin in the game, this is an executive

comp program on steroids, and I would argue is about as shareholder friendly as you’d get. By the way, had a debate on the set with

Joe and Becky, who thought maybe you could game the system, I think it’s very hard to game a system where effectively you only get

paid in 50 - effectively there’s $50 billion increments in terms of market cap that he has to create, and at the same time, that’s

paired with certain metrics on the operational side and adjusted EBIDTA number and revenue number, he has to hit both of those numbers

at every – or he doesn’t get paid at all. So, if he creates $99 billion, if the market cap gets to $99 billion it doesn’t

get to $100, he doesn’t get anything. If he gets to $100 billion and doesn’t hit the operational numbers, he gets nothing.

And this continues on and on and on. If in fact he gets to – he believes one day this company is a trillion-dollar company, if he

gets there or to the highest number on the list which is $650 billion in market cap, he’ll end up a very happy man at $55 billion

worth of stock, but at the same time, I would imagine shareholders would be pretty happy too. By the way in all cases, even once the shares

vest and he gets them, he then has to hold it for another five years, which is a feature that you just don’t see in many compensation

plans.

Lee: Yeah, you’ve got to wonder if any other CEOs would be bold

enough to adopt any similar compensation plans, I mean already, Elon Musk was getting paid the absolute minimum under California law,

which I think is $37,000 –

Sorkin: Yup.

Lee: A check that he doesn’t cash, it’s like sitting in

some Tesla bank account still just collecting interest for the company.

Sorkin: Literally, he’s been doing this all for free and by the

way, I asked him, I said what do you need this money, what do you need money for, because he always says he’s not incentivized by

money, and his answer is he said look, I want to help humanity pursue this multiplanetary system. He wants all of us to live on Mars.

He said that requires a certain amount of capital. So, for his sake if it works, it may go towards that, in which case, maybe it will

go towards all of us.

Lee: Andrew thank you. Andrew Ross Sorkin in Davos, Switzerland.

Sorkin: Thank you.

Additional Information and Where to Find It

Tesla, Inc. (“Tesla”) has filed

with the Securities and Exchange Commission (the “SEC”) a definitive proxy statement on Schedule 14A with

respect to its solicitation of proxies for Tesla’s 2024 annual meeting (the “Definitive Proxy Statement”).

The Definitive Proxy Statement contains important information about the matters to be voted on at the 2024 annual meeting. STOCKHOLDERS

OF TESLA ARE URGED TO READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT TESLA

HAS FILED OR WILL FILE WITH THE SEC BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT TESLA AND THE MATTERS TO BE VOTED

ON AT THE 2024 ANNUAL MEETING. Stockholders are able to obtain free copies of these documents and other documents filed with the SEC by

Tesla through the website maintained by the SEC at www.sec.gov. In addition, stockholders are able to obtain free copies of these documents

from Tesla by contacting Tesla’s Investor Relations by e-mail at ir@tesla.com, or by going to Tesla’s Investor Relations page

on its website at ir.tesla.com.

Participants in the Solicitation

The directors and executive officers of Tesla

may be deemed to be participants in the solicitation of proxies from the stockholders of Tesla in connection with 2024 annual meeting.

Information regarding the interests of participants in the solicitation of proxies in respect of the 2024 annual meeting is included in

the Definitive Proxy Statement.

Forward-Looking Statements

This communication contains forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995 reflecting Tesla’s current expectations that involve

risks and uncertainties. These forward-looking statements include, but are not limited to, statements concerning its goals, commitments,

strategies and mission, its plans and expectations regarding the proposed redomestication of Tesla from Delaware to Texas (the “Texas

Redomestication”) and the ratification of Tesla’s 2018 CEO pay package (the “Ratification”), expectations

regarding the future of litigation in Texas, including the expectations and timing related to the Texas business court, expectations regarding

the continued CEO innovation and incentivization under the Ratification, potential benefits, implications, risks or costs or tax effects,

costs savings or other related implications associated with the Texas Redomestication or the Ratification, expectations about stockholder

intentions, views and reactions, the avoidance of uncertainty regarding CEO compensation through the Ratification, the ability to avoid

future judicial or other criticism through the Ratification, its future financial position, expected cost or charge reductions, its executive

compensation program, expectations regarding demand and acceptance for its technologies, growth opportunities and trends in the markets

in which we operate, prospects and plans and objectives of management. The words “anticipates,” “believes,” “continues,”

“could,” “design,” “drive,” “estimates,” “expects,” “future,”

“goals,” “intends,” “likely,” “may,” “plans,” “potential,” “seek,”

“sets,” “shall,” “spearheads,” “spurring,” “should,” “will,” “would,”

and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these

identifying words. Tesla may not actually achieve the plans, intentions or expectations disclosed in its forward-looking statements and

you should not place undue reliance on Tesla’s forward-looking statements. Actual results or events could differ materially from

the plans, intentions and expectations disclosed in the forward-looking statements that we make. These forward-looking statements involve

risks and uncertainties that could cause Tesla’s actual results to differ materially from those in the forward-looking statements,

including, without limitation, risks related to the Texas Redomestication and the Ratification and the risks set forth in Part I, Item

1A, “Risk Factors” of the Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and that are otherwise described

or updated from time to time in Tesla’s other filings with the SEC. The discussion of such risks is not an indication that any such

risks have occurred at the time of this filing. Tesla disclaims any obligation to update any forward-looking statement contained in this

document.

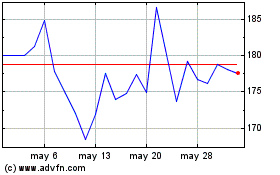

Tesla (NASDAQ:TSLA)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Tesla (NASDAQ:TSLA)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024