TeraWulf Inc. Announces Closing of $500 Million 2.75% Convertible Senior Notes Offering

25 Octubre 2024 - 3:01PM

TeraWulf Inc. (Nasdaq: WULF) (“TeraWulf” or the “Company”), a

leading owner and operator of vertically integrated,

next-generation digital infrastructure powered by predominantly

zero-carbon energy, today completed its previously announced

offering of 2.75% Convertible Senior Notes due 2030 (the

“Convertible Notes”) in a private placement to persons reasonably

believed to be qualified institutional buyers pursuant to Rule 144A

under the Securities Act of 1933, as amended (the “Securities

Act”). The aggregate principal amount of notes sold in the offering

was $500 million, which includes $75 million aggregate principal

amount of notes issued pursuant to an option to purchase additional

notes granted to the initial purchasers.

In conjunction with the issuance of the Convertible Notes, the

Company entered into capped call transactions with a cap price of

$12.80 (representing a premium of 100% over the last reported sale

price) and repurchased $115 million of the Company’s common

stock.

The table below illustrates the potential net dilution

expectations from the overall transaction.

The net proceeds from the sale of the Convertible Notes were

approximately $487.1 million after deducting the initial

purchasers’ discounts and commissions and estimated offering

expenses payable by the Company. The Company expects to use $60

million of the net proceeds to pay the cost of the capped call

transactions, $115 million to repurchase shares of its common stock

and the remainder for general corporate purposes, which may include

working capital, strategic acquisitions, expansion of data center

infrastructure to support high-performance computing activities and

expansion of existing assets.

Forward-Looking Statements This press release

contains forward-looking statements within the meaning of the “safe

harbor” provisions of the Private Securities Litigation Reform Act

of 1995, as amended. Such forward-looking statements include

statements concerning anticipated future events and expectations

that are not historical facts. All statements, other than

statements of historical fact, are statements that could be deemed

forward-looking statements. In addition, forward-looking statements

are typically identified by words such as “plan,” “believe,”

“goal,” “target,” “aim,” “expect,” “anticipate,” “intend,”

“outlook,” “estimate,” “forecast,” “project,” “continue,” “could,”

“may,” “might,” “possible,” “potential,” “predict,” “should,”

“would” and other similar words and expressions, although the

absence of these words or expressions does not mean that a

statement is not forward-looking. Forward-looking statements are

based on the current expectations and beliefs of TeraWulf’s

management and are inherently subject to a number of factors,

risks, uncertainties and assumptions and their potential effects.

There can be no assurance that future developments will be those

that have been anticipated. Actual results may vary materially from

those expressed or implied by forward-looking statements based on a

number of factors, risks, uncertainties and assumptions, including,

among others: (1) conditions in the cryptocurrency mining industry,

including fluctuation in the market pricing of bitcoin and other

cryptocurrencies, and the economics of cryptocurrency mining,

including as to variables or factors affecting the cost, efficiency

and profitability of cryptocurrency mining; (2) competition among

the various providers of cryptocurrency mining services; (3)

changes in applicable laws, regulations and/or permits affecting

TeraWulf’s operations or the industries in which it operates,

including regulation regarding power generation, cryptocurrency

usage and/or cryptocurrency mining, and/or regulation regarding

safety, health, environmental and other matters, which could

require significant expenditures; (4) the ability to implement

certain business objectives and to timely and cost-effectively

execute integrated projects; (5) failure to obtain adequate

financing on a timely basis and/or on acceptable terms with regard

to growth strategies or operations; (6) loss of public confidence

in bitcoin or other cryptocurrencies and the potential for

cryptocurrency market manipulation; (7) adverse geopolitical or

economic conditions, including a high inflationary environment; (8)

the potential of cybercrime, money-laundering, malware infections

and phishing and/or loss and interference as a result of equipment

malfunction or break-down, physical disaster, data security breach,

computer malfunction or sabotage (and the costs associated with any

of the foregoing); (9) the availability, delivery schedule and cost

of equipment necessary to maintain and grow the business and

operations of TeraWulf, including mining equipment and

infrastructure equipment meeting the technical or other

specifications required to achieve its growth strategy; (10)

employment workforce factors, including the loss of key employees;

(11) litigation relating to TeraWulf and/or its business; and (12)

other risks and uncertainties detailed from time to time in the

Company’s filings with the Securities and Exchange Commission

(“SEC”). Potential investors, stockholders and other readers are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date on which they were

made. TeraWulf does not assume any obligation to publicly update

any forward-looking statement after it was made, whether as a

result of new information, future events or otherwise, except as

required by law or regulation. Investors are referred to the full

discussion of risks and uncertainties associated with

forward-looking statements and the discussion of risk factors

contained in the Company’s filings with the SEC, which are

available at www.sec.gov.

Investors:Investors@terawulf.com

Media:media@terawulf.com

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/6dc9f0ea-cb8a-4910-9e05-daa4d5422db6

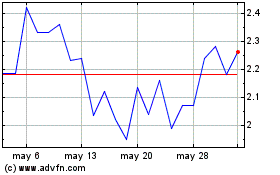

TeraWulf (NASDAQ:WULF)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

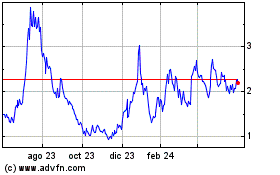

TeraWulf (NASDAQ:WULF)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024