| May 13, 2024 |

Registration Statement Nos. 333-270004 and 333-270004-01; Rule 424(b)(3) |

JPMorgan Chase Financial Company LLC

Structured Investments

$609,372,790†

Alerian MLP Index®* ETNs due January 28,

2044

*with payment at maturity or upon early repurchase or

redemption based on the VWAP level of the Index and with coupons based on cash distributions on the components of the Index

Fully and Unconditionally Guaranteed by JPMorgan Chase & Co.

| · | The return on the notes is linked to the performance of the Alerian MLP Index®, which we refer to as the Index, as

measured by its VWAP level, and to cash distributions on its components: |

| · | The notes may pay a variable quarterly coupon based on cash distributions on the components of the Index, subject to the deduction

of an investor fee of 0.85% per annum that accrues each day. If cash distributions on the components of the Index are less than the investor

fee accrued, the shortfall will be carried forward and offset against future coupon payments. You are not guaranteed any coupon payments. |

| · | The payment on the notes at maturity or upon early repurchase or redemption is based on the VWAP level of the Index over a five-day

Measurement Period, together with any coupon payment, subject to the deduction of any remaining investor fee shortfall. The VWAP level

reflects the volume-weighted average prices of the components of the Index. You may lose some or all of your initial investment at

maturity or upon early repurchase or redemption. |

| · | The Index measures the composite performance of energy-oriented Master Limited Partnerships (“MLPs") that earn the

majority of their cash flows from qualified activities involving energy commodities using a capped, float-adjusted, capitalization-weighted

methodology. MLPs are limited partnerships primarily engaged in the exploration, marketing, mining, processing, production, refining,

storage or transportation of any mineral or natural resource. |

| · | On any business day on or after July 26, 2024, we may, in our sole discretion, redeem the notes, in whole or in part. |

| · | On a weekly basis, you may request that we repurchase a minimum of 50,000 notes if you comply with the required procedures. Any payment

upon early repurchase will also be subject to the deduction of a repurchase fee of 0.125%. |

| · | The notes are unsecured and unsubordinated obligations of JPMorgan Chase Financial Company LLC, which we refer to as JPMorgan Financial,

the payment of which is fully and unconditionally guaranteed by JPMorgan Chase & Co. Any payment on the notes is subject

to the credit risk of JPMorgan Financial, as issuer of the notes, and the credit risk of JPMorgan Chase & Co., as guarantor

of the notes. |

| · | The notes are listed on NYSE Arca, Inc., which we refer to as NYSE Arca, under the ticker symbol “AMJB.” No assurance

can be given as to the continued listing for the term of the notes, or the liquidity or trading market for the notes. We are not required

to maintain a listing on NYSE Arca or any other exchange. |

| · | The Intraday Intrinsic Note Value is published every 15 seconds on the Bloomberg Professional® service (“Bloomberg”)

under the ticker symbol “AMJBIV” and on Bloomberg.com under the ticker symbol “AMJBIV:IND.” See “Understanding

the Value of the Notes” and “Bloomberg Ticker Symbols” in this pricing supplement. |

| · | The purpose of this amendment no. 1 to the pricing supplement is to reflect the issuance on May 13, 2024 of additional notes with

an aggregate principal amount of $505,372,790 pursuant to a registration statement on Form S-4 (Registration Nos. 333-276554 and 333-276554-01)

and an amended and restated prospectus dated April 15, 2024 (the “Exchange Offer”). $104,000,000 aggregate principal

amount of notes were originally issued on January 30, 2024, which we refer to as the “original notes.” The additional

notes issued pursuant to the Exchange Offer constitute a further issuance of, and are consolidated with and form a single tranche with,

the original notes. The additional notes issued pursuant to the Exchange Offer have the same CUSIP as the original notes and will trade

interchangeably with the original notes. References to the “notes” collectively refer to such additional notes pursuant to

the Exchange Offer and the original notes. Upon the issuance of such additional notes, the aggregate principal amount of the outstanding

notes of this tranche is $609,372,790. |

Investing in the notes involves a number of risks. See

“Risk Factors” beginning on page PS-2 of the accompanying prospectus supplement, “Risk Factors” beginning on page

PS-4 of the accompanying product supplement and “Selected Risk Considerations” beginning on page PS-9 of this pricing supplement.

The notes may not be suitable for all investors and should

be used only by investors with the sophistication and knowledge necessary to understand the risks inherent in the Index and investments

in MLPs generally. Investors should consult with their broker or financial advisor when making an investment decision and to evaluate

their investment in the notes.

Neither the Securities and Exchange Commission (the “SEC”)

nor any state securities commission has approved or disapproved of the notes or passed upon the accuracy or the adequacy of this pricing

supplement or the accompanying product supplement, prospectus supplement and prospectus. Any representation to the contrary is a criminal

offense.

None of the notes were sold on the Inception Date. As of

May 13, 2024, we have sold or delivered approximately $535,402,790 aggregate principal amount of notes, including $505,372,790 principal

amount of notes delivered pursuant to the Exchange Offer. The remainder of the notes and any additional notes may be offered and sold

from time to time, at our sole discretion, through J.P. Morgan Securities LLC, which we refer to as JPMS, at market prices prevailing

at the time of sale, at prices related to market prices or at negotiated prices that may vary from the Intraday Intrinsic Note Value.

However, we are under no obligation to issue additional notes or sell any notes or additional notes at any time. If we limit, restrict

or stop sales of the notes or any additional notes, or if we subsequently resume sales of the notes or any additional notes, the liquidity

and trading price of the notes in the secondary market could be materially and adversely affected. We will receive proceeds equal to 100%

of the offering price of any remaining or additional notes that are sold. See “Supplemental Plan of Distribution” in this

pricing supplement.

JPMS will not receive selling commissions in connection with

sales of the notes. JPMS will be entitled to receive the aggregate profits generated from the deduction of the investor fee to cover license

fees and other costs related to the notes and as projected profits for managing our hedge and a structuring fee for developing the notes.

See “Supplemental Plan of Distribution” in this pricing supplement.

The notes are not bank deposits, are not insured by the

Federal Deposit Insurance Corporation or any other governmental agency and are not obligations of, or guaranteed by, a bank.

† $104,000,000 aggregate principal amount

of notes were issued on January 30, 2024, and $505,372,790 aggregate principal amount of notes were registered on Registration Statement

Nos. 333-276554 and 333-276554-01 and issued on May 13, 2024 pursuant to the Exchange Offer.

Amendment no. 1 to pricing supplement dated January 26,

2024 to product supplement no. 7-I dated December 19, 2023 and the prospectus supplement and prospectus, each dated April 13, 2023

Key Terms

Issuer: JPMorgan

Chase Financial Company LLC, an indirect, wholly owned finance subsidiary of JPMorgan Chase & Co.

Guarantor:

JPMorgan Chase & Co.

Principal Amount*:

$26.00 per note, which is equal to the Initial VWAP Level divided by ten, rounded to the nearest cent

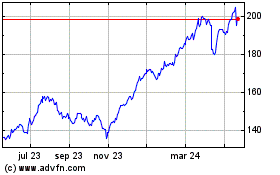

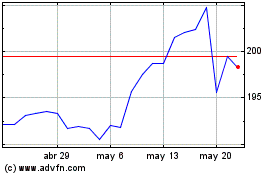

Index:

The return on the notes is linked to the performance of the Alerian MLP Index® (Bloomberg ticker: AMZ), which we refer

to as the Index, as measured by its VWAP level, and to cash distributions on its components. See “— Terms Relating to Closing

Intrinsic Note Value — VWAP Level” below.

The Index measures the composite performance

of energy-oriented Master Limited Partnerships, or MLPs, that earn the majority of their cash flows from qualified activities involving

energy commodities (the “Index Components”) using a capped, float-adjusted, capitalization-weighted

methodology. The Index is calculated and maintained by VettaFi LLC (“VettaFi”).

Coupon Payments:

For each note you hold on a Coupon Record Date,

you will receive on the immediately following Coupon

Payment Date an amount in cash equal to the Coupon

Amount, if any, as of the immediately preceding Coupon Valuation Date.

Coupon Amount*:

The Coupon Amount as of any Coupon Valuation

Date will equal:

| · | the Reference Distribution Amount with respect to that Coupon

Valuation Date, minus |

| · | the Accrued Investor Fee with respect to that Coupon Valuation

Date, |

provided that the Coupon Amount will not

be less than $0.

If the Reference Distribution Amount

on a Coupon Valuation Date is less than the Accrued Investor Fee on that Coupon Valuation Date, an amount equal to the excess of the Accrued

Investor Fee over the Reference Distribution Amount (the “Investor Fee Shortfall”)

will be included in the Accrued Investor Fee with respect to the next Coupon Valuation Date.

The Accrued Investor Fee will reduce each

Coupon Amount. In addition, no Coupon Payment will be payable with respect to a Coupon Valuation Date if the Reference Distribution Amount

is less than the Accrued Investor Fee, even if the Reference Distribution Amount is positive. You are not guaranteed any Coupon Payments.

Payment at Maturity:

For each note, unless earlier repurchased or

redeemed, you will receive at maturity a cash payment equal to the Closing Intrinsic Note Value determined over the Measurement Period

with respect to the Final Valuation Date. If that amount is less than or equal to zero, the payment at maturity will be $0.

Issuer Redemption:

On any Business Day on or after July 26, 2024,

we may, in our sole discretion, redeem the notes, in whole or in part. If we exercise our right to redeem your notes prior to maturity,

for each note that is redeemed, you will

receive on the Redemption Settlement Date a cash payment equal to the Closing Intrinsic Note

Value determined over the Measurement Period with respect to the Redemption Valuation Date. If that amount is less than or equal to zero,

the payment upon early redemption will be $0.

Weekly Repurchase:

On a weekly

basis, you may request that we repurchase a minimum of 50,000* notes if you comply with the required procedures, subject to a repurchase

fee of 0.125%. For each note that is repurchased, you will receive on the relevant Repurchase Date a cash payment equal to the Closing

Intrinsic Note Value determined over the Measurement Period with respect to the Repurchase Valuation Date minus the Repurchase

Fee Amount with respect to the Repurchase Valuation Date.

If the amount calculated above is less than or

equal to zero, the payment upon early repurchase will be $0.

_____________

You may lose some or all of your initial

investment at maturity or upon early repurchase or redemption. The aggregate payments on your notes will be less than your initial investment

if any Coupon Payments (which reflect the negative effect of the Accrued Investor Fee) are insufficient to offset any decrease in the

VWAP level of the Index and the negative effect of any Investor Fee Shortfall (and, in the case of early repurchase, the Repurchase Fee

Amount).

Terms Relating

to Closing Intrinsic Note Value

Closing Intrinsic Note Value*:

As of any date of determination, an amount per

note equal to:

| · | the Principal Amount, multiplied by the Index Ratio

as of that date, plus |

| · | the Coupon Amount as of that date, calculated

as if that date were a Coupon Valuation Date (the “Stub

Coupon Amount”), minus |

| · | any Investor Fee Shortfall determined in calculating that

Stub Coupon Amount. |

In addition, if the Coupon Ex-Date

with respect to the Coupon Amount as of the immediately preceding Coupon Valuation Date has not yet occurred, the Closing Intrinsic Note

Value will also include that Coupon Amount (an “Unpaid Coupon Amount”).

For purposes of determining the Closing Intrinsic

Note Value over any Measurement Period, the Index Ratio is determined based on the arithmetic average of the VWAP Levels over that Measurement

Period, and the date of determination for purposes of determining the Coupon Amount, any Investor Fee Shortfall and any Unpaid Coupon

Amount is the final day of that Measurement Period.

The Closing Intrinsic Note Value is not the

closing price or any other trading price of the notes in the secondary market and is not intended as a price or quotation, or as an offer

or solicitation for the purchase or sale of your notes or as a recommendation to transact in the notes at the stated price. The trading

price of the notes at any time may vary significantly from the Closing Intrinsic Note Value due to, among other things, imbalances of

supply and demand (including as a result of any decision of ours

| PS-1 | Structured Investments

Alerian MLP Index® ETNs

|  |

to issue, stop issuing or resume issuing additional

notes), lack of liquidity, transaction costs, credit considerations and bid-offer spreads.

If the Reference Distribution Amount used

to calculate the Stub Coupon Amount on any Index Business Day is less than the Accrued Investor Fee used to calculate that Stub Coupon

Amount, the resulting Investor Fee Shortfall will be deducted in calculating the Closing Intrinsic Note Value on that Index Business Day.

Accordingly, the payment at maturity or upon early repurchase or redemption will be reduced by the amount of any Investor Fee Shortfall

reflected in the relevant Closing Intrinsic Note Value.

Index Ratio:

As of any date of determination, the Index Ratio

is equal to:

VWAP

Level

Initial VWAP Level

provided that, solely for purposes

of determining the Closing Intrinsic Note Value in connection with any payment at maturity or upon early repurchase or redemption,

the Index Ratio determined over the relevant Measurement Period is equal to:

Final

VWAP Level

Initial VWAP Level

Initial VWAP Level:

The arithmetic average of the VWAP Levels determined

over a period of five Index Business Days ending on the Inception Date, which was 260.0267

Final VWAP Level:

With respect to a Measurement Period, the arithmetic

average of the VWAP Levels on the five Index Business Days in that Measurement Period, as calculated by the Note Calculation Agent

Measurement Period**:

With respect to the Final Valuation Date or any

Repurchase Valuation Date or Redemption Valuation Date, the five Index Business Days starting from and including the Final Valuation Date

or that Repurchase Valuation Date or Redemption Valuation Date, as applicable (or, if that day is not an Index Business Day, the five

Index Business Days immediately following that day)

VWAP Level:

On any Index Business Day, as calculated by the

VWAP Calculation Agent, the sum of the products for each Index Component of:

| · | the VWAP of that Index Component as of that day; and |

| · | the Index Units of that Index Component as of that day, divided

by the Index Divisor as of that day |

The calculation of the VWAP Level may be modified

in circumstances described under “General Terms of Notes — Postponement of an Averaging Date” and “General Terms

of Notes — Discontinuation of an Index; Alteration of Method of Calculation” in the accompanying product supplement.

The official closing level of the Index may

vary significantly from the VWAP Level.

VWAP:

With respect to each Index Component, as of any

date of determination, the volume-weighted average price of one share of that Index Component as determined by the VWAP Calculation Agent

based on the Primary Exchange for that Index Component

Index Units:

With respect to each Index Component, as of any

date of determination, the number of units of that Index Component included in the Index for purposes of the calculation of the official

level of the Index by the Index Calculation Agent. For more information about Index Units, see “The Alerian MLP Index®

— Units Outstanding” in the accompanying product supplement.

Index Divisor:

As of any date of determination, the divisor

used in the calculation of the official level of the Index by the Index Calculation Agent. For more information about the Index Divisor,

see “The Alerian MLP Index® — Index Calculation” in the accompanying product supplement.

Inception Date:

January 26, 2024

Initial Issue

Date: January 30, 2024

Final Valuation

Date: January 20, 2044

Maturity Date**:

January 28, 2044

Terms Relating

to Coupon Payments

Accrued Investor Fee*:

The Accrued Investor Fee accrues at a rate of

0.85% per annum each day. In addition, the Accrued Investor Fee carries forward any shortfall if the Reference Distribution Amount

determined in connection with any Coupon Payment is less than the Accrued Investor Fee at that time.

With respect to each Coupon Valuation Date, the

Accrued Investor Fee is an amount equal to:

| · | the Periodic Investor Fee with respect to that Coupon Valuation

Date, plus |

| · | the Investor Fee Shortfall, if any, as of the immediately

preceding Coupon Valuation Date, if any. |

Periodic Investor Fee*:

With respect to each Coupon Valuation Date, an

amount equal to the product of:

| · | the investor fee of 0.85% per annum; |

| · | the Principal Amount multiplied by the Index Ratio

as of the immediately preceding Index Business Day that is not a Disrupted Day for any Index Component; and |

| · | the day count fraction, calculated using a 30/360 day count

convention as described under “General Terms of Notes — Day Count Fraction” in the accompanying product supplement. |

Reference Distribution Amount*:

With respect to each Coupon Valuation Date, an

amount equal to the sum of the gross cash distributions that a Reference Holder would have been entitled to receive in respect of each

Index Component held by that Reference Holder on the “record date” with respect to that Index Component, for those cash distributions

whose “ex-dividend date” occurs during the Coupon Accrual Period for that Coupon Valuation Date.

| PS-2 | Structured Investments

Alerian MLP Index® ETNs

|  |

Notwithstanding the foregoing, with respect to

cash distributions for an Index Component that are scheduled to be paid prior to the applicable Coupon Ex-Date, if the issuer of that

Index Component fails to pay the distribution to holders of that Index Component by the scheduled payment date for that distribution,

that distribution will be assumed to be zero for the purposes of calculating the applicable Reference Distribution Amount.

Reference Holder*:

As of any date of determination, a hypothetical

holder of a number of shares of each Index Component equal to:

| · | the Index Units of that Index Component as of that date, divided by |

| · | the Index Divisor as of that date multiplied by 10, |

provided that solely for purposes of

determining the Reference Distribution Amount included in any Stub Coupon Amount payable at maturity or upon early repurchase or redemption,

the Reference Holder will be deemed to hold four-fifths, three-fifths, two-fifths and one-fifth of the shares of each Index Component

it would otherwise hold on the second, third, fourth and fifth Index Business Days, respectively, in the relevant Measurement Period.

Coupon Accrual Period:

With respect to each Coupon Valuation Date, the

period from but excluding the immediately preceding Coupon Valuation Date (or, in the case of the first Coupon Valuation Date, from but

excluding November 15, 2023) to and including that Coupon Valuation Date

Coupon Valuation Date:

The first Index Business Day occurring on or

after the 15th of February, May, August and November of each calendar year during the term of the notes, beginning on February

15, 2024

Coupon Ex-Date:

With respect to a Coupon Amount, the first Exchange

Business Day on which the notes trade without the right to receive that Coupon Amount. Under current NYSE Arca practice, the Coupon Ex-Date

will generally be the first Exchange Business Day immediately preceding the applicable Coupon Record Date; however, beginning May 28,

2024, under NYSE Arca practice, the Coupon Ex-Date is expected to generally be the applicable Coupon Record Date. For purposes of this

paragraph, “Exchange Business Day” means any day on which the primary exchange or market for trading of the notes is scheduled

to be open for trading.

Coupon Record Date:

The 9th Index Business Day following each Coupon

Valuation Date

Coupon Payment Date:

The 15th Index Business Day following each Coupon

Valuation Date.

Terms Relating

to Issuer Redemption

Early Redemption:

On any Business Day on or after July 26, 2024,

we may, in our sole discretion, redeem the notes, in whole or in part. If we exercise our right to redeem your notes, we will deliver

an irrevocable redemption notice (the “Redemption Notice”) to The Depository Trust

Company (“DTC”) (the holder of the master note evidencing the

notes) at least five

Business Days prior to the Redemption Valuation Date specified in the Redemption Notice. If fewer than all the notes are to be redeemed,

we will specify in the Redemption Notice the principal amount of notes to be redeemed, and the Trustee will select the notes to be redeemed

pro rata, by lot or in such manner as it deems appropriate and fair.

Payment upon Early Redemption:

If we exercise our right to redeem your notes

prior to maturity, for each note selected for redemption by the Trustee, you will receive on the Redemption Settlement Date a cash payment

equal to the Closing Intrinsic Note Value determined over the Measurement Period with respect to the Redemption Valuation Date. If that

amount is less than or equal to zero, the payment upon early redemption will be $0.

Redemption Valuation Date:

The date specified as the Redemption Valuation

Date in the Redemption Notice

Redemption Settlement Date:

Unless otherwise specified in the Redemption

Notice, the day that follows the final day in the Measurement Period with respect to the Redemption Valuation Date by a number of Business

Days corresponding to the standard settlement cycle, which is currently two Business Days and which is expected to be one Business Day

beginning May 28, 2024. In no event will the Redemption Notice specify a Redemption Settlement Date that follows the final day in the

Measurement Period by more than five Business Days.

Terms Relating

to Weekly Repurchase Right

Early Repurchase:

On a weekly basis, you may request that we repurchase

a minimum of 50,000* notes if you comply with the procedures described under “— Repurchase Procedures” below and unless

we have delivered a Redemption Notice to DTC to redeem all of the outstanding notes. We may from time to time, in our sole discretion,

reduce the minimum number of notes required for an early repurchase on a consistent basis for all holders of the notes, but we are under

no obligation to do so.

Payment upon Early Repurchase:

Subject to your compliance with the required

procedures, for each note that is repurchased, you will receive on the relevant Repurchase Date a cash payment equal to the Closing Intrinsic

Note Value determined over the Measurement Period with respect to the Repurchase Valuation Date minus the Repurchase Fee Amount

with respect to the Repurchase Valuation Date. If that amount is less than or equal to zero, the payment upon early redemption will be

$0.

Repurchase Fee Amount:

With respect to any Repurchase Valuation Date,

an amount per note in cash equal to 0.125% of the Closing Intrinsic Note Value with respect to that Repurchase Valuation Date (but excluding

any Unpaid Coupon Amount included in that Closing Intrinsic Note Value)

Repurchase Valuation Date:

The last Index Business Day of each week, generally

Friday

Repurchase Date:

Unless otherwise specified in the Issuer’s

acknowledgement, the day that follows the final day in

| PS-3 | Structured Investments

Alerian MLP Index® ETNs

|  |

the Measurement Period with respect to the Repurchase

Valuation Date by a number of Business Days corresponding to the standard settlement cycle, which is currently two Business Days and which

is expected to be one Business Day beginning May 28, 2024. In no event will the Issuer’s acknowledgement specify a Repurchase Date

that follows the final day in the Measurement Period by more than five Business Days.

Repurchase Notice:

A repurchase notice in the form attached to this

pricing supplement as Annex A

Repurchase Procedures:

In order to request that we repurchase your notes,

you must instruct your broker or other person through which you hold your notes to take the following steps:

| · | send a completed Repurchase Notice to us via email at ETN_Repurchase@jpmorgan.com

by no later than 4:00 p.m., New York City time, on the Business Day immediately preceding the applicable

Repurchase Valuation Date; |

| · | instruct your DTC custodian to book a delivery versus payment

trade with respect to your notes on the final day in the Measurement Period with respect to the relevant Repurchase Valuation Date at

a price equal to the amount payable upon early repurchase of the notes; and |

| · | cause your DTC custodian to deliver the trade as booked for

settlement via DTC at or prior to 10:00 a.m., New York City time, on the relevant Repurchase Date. |

Different brokerage firms may have different

deadlines for accepting instructions from their customers. Accordingly, you should consult the brokerage firm through which you own your

interest in the notes in respect of those deadlines.

Once delivered, a Repurchase Notice may not be

revoked. If we do not receive your Repurchase Notice by the deadline, your Repurchase Notice will not be effective. The Issuer or its

affiliate must acknowledge receipt of the Repurchase Notice on the same Business Day for it to be effective, which acknowledgment will

be deemed to evidence its acceptance of your repurchase request. The Note Calculation Agent will, in its sole discretion, resolve any

questions that may arise as to the

validity of a Repurchase Notice and the timing of receipt of a Repurchase Notice.

Questions about repurchase procedures should

be directed to ETN_Repurchase@jpmorgan.com.

Additional Terms

Business Day:

Any day other than a day on which the banking

institutions in the City of New York are authorized or required by law, regulation or executive order to close or a day on which transactions

in dollars are not conducted

Index Business Day:

Any day on which the Primary Exchange and the

Related Exchange with respect to each Index Component are scheduled to be open for trading

Primary Exchange:

With respect to each Index Component, the primary

exchange or market of trading of that Index Component

Related Exchange:

With respect to each Index Component, each exchange

or quotation system where trading has a material effect (as determined by the Note Calculation Agent) on the overall market for futures

or options contracts relating to that Index Component

Disrupted Day:

With respect to an Index Component, a day on

which the Primary Exchange or any Related Exchange with respect to that Index Component fails to open for trading during its regular trading

session or on which a market disruption event (as described in the accompanying product supplement) with respect to that Index Component

has occurred or is continuing, and, in each case, the occurrence of which is determined by the Note Calculation Agent to have a material

effect on the VWAP Level

Index Sponsor:

VettaFi

Index Calculation

Agent: VettaFi

VWAP Calculation

Agent: Solactive AG

Note Calculation

Agent: J.P. Morgan Securities LLC (“JPMS”)

Published ETN

Value Calculation Agent: Solactive AG

Trustee:

Deutsche Bank Trust Company Americas

* Subject to adjustment in the event of a split

or reverse split of the notes as described under “Split or Reverse Split of the Notes” in the accompanying product supplement

** Subject to postponement in the event of a

market disruption event and as described under “General Terms of Notes — Postponement of an Averaging Date” and “General

Terms of Notes — Postponement of a Payment Date” in the accompanying product supplement

| PS-4 | Structured Investments

Alerian MLP Index® ETNs

|  |

What Is the

Alerian MLP Index®?

The return on the notes is linked to the performance

of the Alerian MLP Index®, which we refer to as the Index, as measured by its VWAP Level, and to cash distributions on

its components. The VWAP Level reflects the volume-weighted average prices of the components of the Index.

The Index measures the composite performance of MLPs

that earn the majority of their cash flows from qualified activities involving energy commodities, which are referred to as Index Components,

using a capped, float-adjusted, capitalization-weighted methodology. Qualified activities include compression,

gathering and processing, liquefaction, marketing, pipeline transportation, rail terminating and storage of energy commodities.

How Are Payments

on the Notes Determined, and What Fees Are Incurred by Investors in the Notes?

The notes may pay a variable quarterly coupon based

on cash distributions on the Index Components over the relevant quarterly period, which we refer to as the Reference Distribution Amount,

minus an Accrued Investor Fee. The Accrued Investor Fee accrues at a rate of 0.85% per annum each day. If the Reference Distribution

Amount determined in connection with any Coupon Payment is less than the Accrued Investor Fee at that time, such shortfall, which we refer

to as an Investor Fee Shortfall, will be carried forward. The Accrued Investor Fee is incurred by all investors in the notes and is deducted

in connection with each Coupon Payment.

At maturity or upon early repurchase or redemption,

the notes provide for a cash payment based on the Closing Intrinsic Note Value calculated using the average VWAP Level over a five-day

Measurement Period minus, in the case of an early repurchase, a Repurchase Fee Amount of 0.125% of that Closing Intrinsic Note

Value (but excluding any Unpaid Coupon Amount). The Repurchase Fee Amount is borne by investors in the notes who submit notes for repurchase

prior to maturity. In addition, the Stub Coupon Amount and any Unpaid Coupon Amount will be added, and any Investor Fee Shortfall will

be deducted in calculating the Closing Intrinsic Note Value and each Intraday Intrinsic Note Value on that Index Business Day. Accordingly,

the payment at maturity or upon early repurchase or redemption will be reduced by the amount of any Investor Fee Shortfall reflected in

the relevant Closing Intrinsic Note Value.

Coupon Payments and the Accrued Investor Fee

For each note you hold on a Coupon Record Date, you

will receive on the immediately following Coupon Payment Date an amount in cash equal to the Coupon Amount, if any, as of the immediately

preceding Coupon Valuation Date. Coupon Payments on the notes will be payable quarterly in arrears on the fifteenth Index Business Day

following each Coupon Valuation Date.

The Coupon Amount as of any Coupon Valuation Date will

equal:

| · | the Reference Distribution Amount with respect to that Coupon

Valuation Date, minus |

| · | the Accrued Investor Fee with respect to that Coupon Valuation

Date, |

provided that the Coupon Amount will not be

less than $0.

The Accrued Investor Fee accrues on a daily basis at

a rate of 0.85% per annum, applied to the Principal Amount, as adjusted to reflect the performance of the Index from the Initial VWAP

Level to the VWAP Level on the Index Business Day immediately preceding the relevant Coupon Valuation Date. On any Index Business Day,

the VWAP Level reflects the weighted VWAPs of the Index Components, where the VWAP of each Index Component is the volume-weighted average

price of one share of that Index Component as determined by the VWAP Calculation Agent based on the Primary Exchange for that Index Component.

All else being equal, if the VWAP Level increases, the amount of the Accrued Investor Fee will increase, and, if the VWAP Level decreases,

the amount of the Accrued Investor Fee will decrease.

In addition, if the Reference Distribution Amount on

a Coupon Valuation Date is less than the Accrued Investor Fee on that Coupon Valuation Date, an amount equal to the excess of the Accrued

Investor Fee over the Reference Distribution Amount, which we refer to as the Investor Fee Shortfall, will be included in the Accrued

Investor Fee with respect to the next Coupon Valuation Date.

The Accrued Investor Fee will reduce each Coupon

Amount. In addition, no Coupon Payment will be payable with respect to a Coupon Valuation Date if the Reference Distribution Amount is

less than the Accrued Investor Fee, even if that Reference Distribution Amount is positive. You are not guaranteed any Coupon Payments.

For information about the precise mechanics used to

determine the Reference Distribution Amount and the Accrued Investor Fee, see “Key Terms — Terms Relating to Coupon Payments”

above.

Payment at Maturity or upon Early Redemption or

Repurchase

Payment at maturity. For each note, unless earlier

repurchased or redeemed, you will receive at maturity a cash payment equal to the Closing Intrinsic Note Value determined over the Measurement

Period with respect to the Final Valuation Date. If that amount is less than or equal to zero, the payment at maturity will be $0.

Payment upon early redemption. On any Business

Day on or after July 26, 2024, we may, in our sole discretion, redeem the notes, in whole or in part. If we exercise our right to redeem

your notes prior to maturity, for each note that is redeemed, you will receive on the Redemption Settlement Date a cash payment equal

to the Closing Intrinsic Note Value determined over the Measurement Period with respect to the Redemption Valuation Date. If that amount

is less than or equal to zero, the payment upon early redemption will be $0.

| PS-5 | Structured Investments

Alerian MLP Index® ETNs

|  |

Payment upon early repurchase. On a weekly basis,

you may request that we repurchase a minimum of 50,000 notes if you comply with the required procedures, subject to a repurchase fee of

0.125%. For each note that is repurchased, you will receive on the relevant Repurchase Date a cash payment equal to the Closing Intrinsic

Note Value determined over the Measurement Period with respect to the Repurchase Valuation Date minus the Repurchase Fee Amount

with respect to the Repurchase Valuation Date. If that amount is less than or equal to zero, the payment upon early repurchase will be

$0.

The Repurchase Fee Amount with respect to any Repurchase

Valuation Date is equal to 0.125% of the Closing Intrinsic Note Value with respect to that date (but excluding any Unpaid Coupon Amount

included in that Closing Intrinsic Note Value). Accordingly, the Repurchase Fee Amount will vary based on the performance of the VWAP

Level, the Stub Coupon Amount and any Investor Fee Shortfall with respect to the Stub Coupon Amount.

Closing Intrinsic Note Value. As of any date

of determination, the Closing Intrinsic Note Value is an amount per note equal to:

| · | the Principal Amount, multiplied by the Index Ratio

as of that date, plus |

| · | the Coupon Amount as of that date, calculated as if that date

were a Coupon Valuation Date, which we refer to as the Stub Coupon Amount, minus |

| · | any Investor Fee Shortfall determined in calculating that

Stub Coupon Amount. |

In addition, if the Coupon Ex-Date with respect to

the Coupon Amount as of the immediately preceding Coupon Valuation Date has not yet occurred, the Closing Intrinsic Note Value will also

include that Coupon Amount, which we refer to as an Unpaid Coupon Amount.

For purposes of determining the Closing Intrinsic Note

Value in connection with any payment at maturity or upon early repurchase or redemption, the Index Ratio as of the final day of the relevant

Measurement Period reflects the performance of the Index from the Initial VWAP Level to the arithmetic average of the VWAP Levels on the

five Index Business Days in that Measurement Period, which we refer to as the Final VWAP Level.

_____________

You may lose some or all of your initial investment

at maturity or upon early repurchase or redemption. The aggregate payments on your notes will be less than your initial investment if

any Coupon Payments (which reflect the negative effect of the Accrued Investor Fee) are insufficient to offset any decrease in the VWAP

Level and the negative effect of any Investor Fee Shortfall (and, in the case of early repurchase, the Repurchase Fee Amount).

Timing of Payment upon Early Repurchase

Because the payment upon early repurchase is based

on the average VWAP Level over a five-day Measurement Period that begins after the deadline for submitting a Repurchase Notice, you will

not know the payment upon early repurchase amount you will receive at the time you elect to request that we repurchase your notes. For

example, if you request that we repurchase your notes in connection with the Repurchase Valuation Date occurring on Friday, May 17, 2024,

the following timeline will apply:

| Thursday, May 16, 2024 |

A Repurchase Notice must be received by 4:00 p.m. New York City time, and the Issuer or its affiliate must acknowledge receipt. |

Friday, May 17, 2024* –

Thursday, May 23, 2024* |

The amount payable upon early repurchase is determined, based in part, on the average VWAP Level over a five-Index Business Day Measurement Period. |

| Tuesday, May 28, 2024* |

The payment upon early repurchase is made on the second** Business Day following the last Index Business Day in the Measurement Period, assuming that the Issuer’s acknowledgement does not specify a different Repurchase Date. |

* Subject to postponement in the event of a market

disruption event and as described under “General Terms of Notes — Postponement of an Averaging Date” and “General

Terms of Notes — Postponement of a Payment Date” in the accompanying product supplement.

** Beginning May 28, 2024, the standard settlement

cycle will be shortened such that the payment upon early repurchase would be made on the first Business Day following the last Index Business

Day in the Measurement Period, assuming that the Issuer’s acknowledgement does not specify a different Repurchase Date.

Understanding

the Value of the Notes

The initial offering price was determined on the Inception

Date. The initial offering price, the Closing Intrinsic Note Value and the Intraday Intrinsic Note Value are not the same as the trading

price, which is the price at which you may be able to sell your notes in the secondary market, if one exists. An explanation of each of

those values is set forth below:

Initial Offering Price to the Public

The initial offering price to the public is equal to

the Principal Amount of the notes. The initial offering price reflects the value of the notes only on the Inception Date.

Closing Intrinsic Note Value / Daily Closing Intrinsic

Note Value

The Closing Intrinsic Note Value is calculated and

published on each Index Business Day and is meant to approximate the intrinsic value of the notes at the close on that day, but the published

value is not the same as the Closing Intrinsic Note Value

| PS-6 | Structured Investments

Alerian MLP Index® ETNs

|  |

used to calculate any payment at maturity or upon early

repurchase or redemption. We refer to the published value as the Daily Closing Intrinsic Note Value.

The Closing Intrinsic Note Value on any date of determination

reflects the Principal Amount of the notes, as adjusted by the Index Ratio on that date, plus the Stub Coupon Amount on that date,

minus any Investor Fee Shortfall with respect to that Stub Coupon Amount. In addition, if the Coupon Ex-Date with respect to the

Coupon Amount as of the immediately preceding Coupon Valuation Date has not yet occurred, the Closing Intrinsic Note Value will also include

any Unpaid Coupon Amount.

The Index Ratio for the Daily Closing Intrinsic Note

Value reflects the VWAP Level on that Index Business Day as compared to the Initial VWAP Level. However, the payment at maturity or upon

early repurchase or redemption will be determined based on the Closing Intrinsic Note Value calculated using an Index Ratio that reflects

the average VWAP Level over a five-day Measurement Period as compared to the Initial VWAP Level (subject to a repurchase fee of 0.125%

in the case of an early repurchase).

The Closing Intrinsic Note Value is not the closing

price or any other trading price of the notes in the secondary market and is not intended as a price or quotation, or as an offer or solicitation

for the purchase or sale of your notes or as a recommendation to transact in the notes at the stated price. The trading price of the notes

at any time may vary significantly from the Closing Intrinsic Note Value due to, among other things, imbalances of supply and demand (including

as a result of any decision of ours to issue, stop issuing or resume issuing additional notes), lack of liquidity, transaction costs,

credit considerations and bid-offer spreads.

Intraday Intrinsic Note Value

The Intraday Intrinsic Note Value is calculated and

published by NYSE Arca every 15 seconds during NYSE Arca’s Core Trading Session, which is currently from 9:30 a.m. to 4:00 p.m.,

New York City time, on each Index Business Day and is meant to approximate the intrinsic value of the notes at that time. Accordingly,

the Intraday Intrinsic Note Value at any time reflects the Principal Amount of the notes, as adjusted by the cumulative performance of

the Index (calculated using the level of the Index at that time rather than the VWAP Level) from the Initial VWAP Level, plus the

Stub Coupon Amount on that Index Business Day, minus any Investor Fee Shortfall with respect to that Stub Coupon Amount. In addition,

if the Coupon Ex-Date with respect to the Coupon Amount as of the immediately preceding Coupon Valuation Date has not yet occurred, the

Intraday Intrinsic Note Value will also include any Unpaid Coupon Amount. Because the Intraday Intrinsic Note Value is calculated every

15 seconds, the level of the Index (which is also calculated every 15 seconds) is used instead of the VWAP Level (which is calculated

only once each day following the close).

The Intraday Intrinsic Note Value is not the closing

price or any other trading price of the notes in the secondary market and is not intended as a price or quotation, or as an offer or solicitation

for the purchase or sale of your notes or as a recommendation to transact in the notes at the stated price. No payments on the notes will

be based on the Intraday Intrinsic Note Value. The trading price of the notes at any time may vary significantly from the Intraday Intrinsic

Note Value at that time due to, among other things, imbalances of supply and demand (including as a result of any decision of ours to

issue, stop issuing or resume issuing additional notes), lack of liquidity, transaction costs, credit considerations and bid-offer spreads.

A premium or discount over the Intraday Intrinsic Note Value can also arise in the trading price as a result of mismatches of trading

hours between the notes and the components included in the Index underlying the notes, actions (or failure to take action) by the index

sponsor and NYSE Arca and technical or human errors by service providers, market participants and others.

Trading Price

The market value of the notes at any given time, which

we refer to as the Trading Price, is the price at which you may be able to sell your notes in the secondary market, if one exists. The

Trading Price of the notes at any time may vary significantly from the Intraday Intrinsic Note Value or the Closing Intrinsic Note Value

due to, among other things, imbalances of supply and demand (including as a result of any decision of ours to issue, stop issuing or resume

issuing additional notes), lack of liquidity, transaction costs, credit considerations, bid-offer spreads, mismatches of trading hours

between the notes and the components included in the Index underlying the notes, actions (or failure to take action) by the index sponsor

and NYSE Arca and technical or human errors by service providers, market participants and others. These and other factors may cause the

notes to trade at a premium or discount, which may be significant, in relation to the Intraday Intrinsic Note Value or the Closing Intrinsic

Note Value. Investors can compare the trading price, if any, of the notes against the Intraday Intrinsic Note Value to determine whether

the notes are trading in the secondary market at a premium or a discount to the intrinsic value of the notes at any given time.

If you pay a premium for the notes above the Closing

Intrinsic Note Value and the Intraday Intrinsic Note Value, you could incur significant losses if you sell your notes at a time when the

premium is no longer present in the market. In addition, the payment on the notes at maturity or upon early repurchase or redemption will

be determined based on the Closing Intrinsic Note Value calculated using the average VWAP Level over a five-day Measurement Period, which

may vary significantly from the trading price of the notes and will not reflect any premium. Furthermore, if you sell your notes in the

market at a time when the notes are trading at a discount below the Closing Intrinsic Note Value and the Intraday Intrinsic Note Value,

you will receive less than the Closing Intrinsic Note Value and the Intraday Intrinsic Note Value.

| PS-7 | Structured Investments

Alerian MLP Index® ETNs

|  |

Bloomberg

Ticker Symbols

The Bloomberg ticker symbols under which information

relating to the Index can be located are set forth below. The publication of the Intraday Intrinsic Note Value on the Bloomberg website

below will be subject to a delay of at least 15 minutes, and the publication of the other information below may also occasionally be subject

to delay or postponement.

| Intraday Index Level: |

AMZ |

|

| Closing Index Level: |

AMZ |

|

| VWAP Level: |

AMZVWAP |

|

The Bloomberg ticker symbols and Bloomberg websites

under which information relating to the notes can be located are set forth below. The publication of this information may occasionally

be subject to delay or postponement. The information on the Bloomberg websites set forth below is not incorporated by reference into this

pricing supplement and should not be considered part of this pricing supplement. The Published ETN Value Calculation Agent is responsible

for calculating the Daily Closing Intrinsic Note Value, the Intraday Intrinsic Note Value and the Interim Coupon or Shortfall Amount for

purposes of publication.

| Daily Closing Intrinsic Note Value*: |

AMJBVWAP |

www.bloomberg.com/quote/AMJBVWAP:IND |

| Intraday Intrinsic Note Value: |

AMJBIV |

www.bloomberg.com/quote/AMJBIV:IND |

| Trading Price of the Notes: |

AMJB |

www.bloomberg.com/quote/AMJB:US |

| Interim Coupon or Shortfall Amount**: |

AMJBEU |

www.bloomberg.com/quote/AMJBEU:IND |

* The Daily Closing Intrinsic Note Value on any date

of determination is the Closing Intrinsic Note Value on that date calculated using the VWAP Level on that date. However, the payment at

maturity or upon early repurchase or redemption will be determined based on the Closing Intrinsic Note Value calculated using the average

VWAP Level over a five-day Measurement Period.

** The Interim Coupon or Shortfall Amount on any day

represents the adjustment made in the calculation of the Closing Intrinsic Note Value as of that day to reflect the Stub Coupon Amount,

any Investor Fee Shortfall with respect to the Stub Coupon Amount and any Unpaid Coupon Amount. Accordingly, as of any date of determination,

the Interim Coupon or Shortfall Amount is equal to the Coupon Amount as of that date, calculated as if that date were a Coupon Valuation

Date, minus any Investor Fee Shortfall with respect to that Stub Coupon Amount. In addition, if the Coupon Ex-Date with respect

to the Coupon Amount as of the immediately preceding Coupon Valuation Date has not yet occurred, the Interim Coupon or Shortfall Amount

will also include any Unpaid Coupon Amount. The Interim Coupon or Shortfall Amount will be negative if the cash distributions on the

Index Components over the relevant period are insufficient to offset the Accrued Investor Fee. While the Interim Coupon or Shortfall Amount

is calculated and published in connection with each Index Business Day, the Coupon Amount will be calculated and paid quarterly.

Reopening

Issuances

In our sole discretion, and without providing you notice

or obtaining your consent, we may decide to issue and sell additional notes from time to time. These further issuances, if any, will be

consolidated to form a single sub-series with the originally issued notes, will have the same CUSIP number and will trade interchangeably

with the notes immediately upon settlement.

However, we are under no obligation to issue or sell

additional notes at any time, and if we do sell additional notes, we may limit or restrict those sales, and we may stop and subsequently

resume selling additional notes at any time. If we limit, restrict or stop sales of such additional notes, or if we subsequently resume

sales of such additional notes, the liquidity and trading price of the notes in the secondary market could be materially and adversely

affected. Unless we indicate otherwise, if we suspend selling additional notes, we reserve the right to resume selling additional notes

at any time, which might result in the reduction or elimination of any premium in the trading price. If you pay a premium for the notes

above the Closing Intrinsic Note Value and the Intraday Intrinsic Note Value, you could incur significant losses if you sell your notes

at a time when the premium is no longer present in the market.

A suspension of additional issuances of the notes could

result in a significant reduction in the number of outstanding notes if investors subsequently exercise their right to have the notes

repurchased by us. Accordingly, the number of outstanding notes, and their liquidity, could vary substantially over the term of the notes.

For more information on such additional offerings,

see “General Terms of Notes — Reopening Issuances” in the accompanying product supplement.

| PS-8 | Structured Investments

Alerian MLP Index® ETNs

|  |

Selected Risk

Considerations

An investment in the notes involves significant risks.

These risks are explained in more detail in the “Risk Factors” section of the accompanying product supplement.

Risks Relating to the Notes Generally

| · | YOUR INVESTMENT IN THE NOTES MAY RESULT

IN A LOSS — |

You may lose

some or all of your initial investment at maturity or upon early repurchase or redemption. The aggregate payments on your notes will be

less than your initial investment if any Coupon Payments (which reflect the negative effect of the Accrued Investor Fee) are insufficient

to offset any decrease in the VWAP Level and the negative effect of any Investor Fee Shortfall (and,

in the case of early repurchase, the Repurchase Fee Amount).

| · | YOU ARE NOT GUARANTEED ANY COUPON PAYMENTS

— |

No Coupon Payment will be payable with respect

to a Coupon Valuation Date if the Reference Distribution Amount is less than the Accrued Investor Fee, even if that Reference Distribution

Amount is positive. The Reference Distribution Amount reflects cash distributions on the Index Components over a relevant quarterly period.

The Accrued Investor Fee accrues at a rate of 0.85% per annum each day. If the Reference Distribution Amount on the previous Coupon Valuation

Date is less than the Accrued Investor Fee on that Coupon Valuation Date, any Investor Fee Shortfall will also be included in the Accrued

Investor Fee.

In addition, the Coupon Amount as of any Coupon

Valuation Date will reflect only the excess of the Reference Distribution Amount over the Accrued Investor Fee with respect to that Coupon

Valuation Date. Any reduction in or elimination of the cash distributions of one or more Index Component will similarly reduce the Reference

Distribution Amount and the amount of the relevant Coupon Payment, if any.

| · | THE ACCRUED INVESTOR FEE AND THE REPURCHASE

FEE AMOUNT WILL REDUCE AMOUNTS PAYABLE ON THE NOTES — |

Each Coupon Amount reflects the deduction of

an Accrued Investor Fee, which will reduce each Coupon Amount, if any. The actual amount of the deduction will be determined on the relevant

Coupon Valuation Date and will depend on the VWAP Level as of the immediately preceding Index Business Day that is not a Disrupted Day

for any Index Component and any Investor Fee Shortfall carried over from the immediately preceding Coupon Valuation Date.

In addition, if the Reference Distribution Amount

used to calculate the Stub Coupon Amount on any Index Business Day (other than an actual Coupon Valuation Date) is less than the Accrued

Investor Fee used to calculate that Stub Coupon Amount, an amount equal to the difference between the Accrued Investor Fee and the Reference

Distribution Amount, which is the Investor Fee Shortfall, will be deducted in calculating the Closing Intrinsic Note Value and each Intraday

Intrinsic Note Value on that Index Business Day. Accordingly, the payment at maturity or upon early repurchase or redemption will be reduced

by the amount of any Investor Fee Shortfall reflected in the relevant Closing Intrinsic Note Value.

Furthermore, a Repurchase Fee Amount of 0.125%

of the Closing Intrinsic Note Value as of the final day of the relevant Measurement Period (but excluding any Unpaid Coupon Amount included

in that Closing Intrinsic Note Value) is deducted in determining the amount payable upon early repurchase. As a result, the Repurchase

Fee Amount will reduce the amount payable upon early repurchase.

| · | CREDIT RISKS OF JPMORGAN FINANCIAL AND JPMORGAN CHASE & CO. — |

Investors are dependent on our and JPMorgan

Chase & Co.’s ability to pay all amounts due on the notes. Any actual or potential change in our or JPMorgan Chase & Co.’s

creditworthiness or credit spreads, as determined by the market for taking that credit risk, is likely to adversely affect the value of

the notes. If we and JPMorgan Chase & Co. were to default on our payment obligations, you may not receive any amounts owed

to you under the notes and you could lose your entire investment.

| · | AS A FINANCE SUBSIDIARY, JPMORGAN FINANCIAL HAS NO INDEPENDENT OPERATIONS AND HAS LIMITED ASSETS —

|

As a finance subsidiary of JPMorgan Chase & Co.,

we have no independent operations beyond the issuance and administration of our securities. Aside from the initial capital contribution

from JPMorgan Chase & Co., substantially all of our assets relate to obligations of our affiliates to make payments under

loans made by us or other intercompany agreements. As a result, we are dependent upon payments from our affiliates to meet our obligations

under the notes. If these affiliates do not make payments to us and we fail to make payments on the notes, you may have to seek payment

under the related guarantee by JPMorgan Chase & Co., and that guarantee will rank pari passu with all other unsecured

and unsubordinated obligations of JPMorgan Chase & Co.

| · | THE EARLY REDEMPTION FEATURE MAY FORCE A POTENTIAL EARLY EXIT — |

If we elect to redeem your notes early, the

term of the notes may be reduced to as short as approximately six months and you may lose some or all of your initial investment upon

early redemption. You will not receive any further payments, including any Coupon Payments, after the applicable Redemption Settlement

Date. There is no guarantee that you would be able to reinvest the proceeds from an investment in the notes at a comparable return for

a similar level of risk.

| PS-9 | Structured Investments

Alerian MLP Index® ETNs

|  |

| · | THE PAYMENT ON THE NOTES IS LINKED TO THE

VWAP LEVELS, NOT TO THE CLOSING LEVELS OF THE INDEX — |

The payment at maturity or upon early repurchase

or redemption is linked to the performance of the Final VWAP Level with respect to the relevant Measurement Period, as compared to the

Initial VWAP Level. The Initial VWAP Level is the arithmetic average of the VWAP Levels determined over a period of five Index Business

Days ending on the Inception Date, and each Final VWAP Level is the arithmetic average of the VWAP Levels over five consecutive Index

Business Days. Although the VWAP Level is intended to track the performance of the Index, the calculation of the VWAP Level is different

from the calculation of the official closing level of the Index, and the VWAP Level will not necessarily correlate with the performance

of the official closing level of the Index. The official closing level of the Index may vary significantly from the VWAP Level. Therefore,

the payment at maturity or upon early repurchase or redemption may be different from, and may be significantly less than, the payment

you would receive if that payment were determined by reference to the official closing level of the Index.

| · | A TRADING MARKET MAY NOT DEVELOP, AND THE

NOTES MAY NOT CONTINUE TO BE LISTED OVER THEIR TERM — |

Although the notes are listed on NYSE Arca,

no assurance can be given as to the continued listing for the term of the notes, or the liquidity or trading market for the notes. There

can be no assurance that a secondary market for the notes will develop. We are not required to maintain a listing on NYSE Arca or any

other exchange.

| · | THE TRADING PRICE OF THE NOTES IN ANY SECONDARY MARKET MAY DIFFER SIGNIFICANTLY FROM THE CLOSING INTRINSIC NOTE VALUE AND INTRADAY

INTRINSIC NOTE VALUE — |

The Closing Intrinsic Note Value is published

on each Index Business Day and is meant to approximate the intrinsic value of the notes at the close on that day, and the Intraday Intrinsic

Note Value is calculated every 15 seconds on each Index Business Day and is meant to approximate the intrinsic value of the notes at that

time. See “Understanding the Value of the Notes” above in this pricing supplement. In contrast,

the trading price of the notes at any time is the price at which you may be able to sell your notes in the secondary market at that time,

if one exists.

The trading price

of the notes at any time may vary significantly from the Closing Intrinsic Note Value and the Intraday Intrinsic Note Value at that time

due to, among other things, imbalances of supply and demand (including as a result of any decision of ours to issue, stop issuing or resume

issuing additional notes), lack of liquidity, transaction costs, credit considerations and bid-offer spreads. A premium or discount

over the Intraday Intrinsic Note Value can also arise in the trading price as a result of mismatches of trading hours between the notes

and the components included in the Index underlying the notes, actions (or failure to take action) by the index sponsor and NYSE Arca

and technical or human errors by service providers, market participants and others. If you pay a premium

for the notes above the Closing Intrinsic Note Value and the Intraday Intrinsic Note Value, you could incur significant losses if you

sell your notes at a time when the premium is no longer present in the market.

In addition, the payment on the notes at maturity

or upon early repurchase or redemption will be determined based on the Closing Intrinsic Note Value calculated using the average VWAP

Level over a five-day Measurement Period, which may vary significantly from the trading price of the notes and will not reflect any premium.

Furthermore, if you sell your notes in the market at a time when the notes are trading at a discount below the Closing Intrinsic Note

Value and the Intraday Intrinsic Note Value, you will receive less than the Closing Intrinsic Note Value and the Intraday Intrinsic Note

Value.

| · | THE LIQUIDITY OF THE MARKET FOR THE NOTES

MAY VARY MATERIALLY OVER TIME, INCLUDING AS A RESULT OF ANY DECISION OF OURS TO ISSUE, STOP ISSUING OR RESUME ISSUING ADDITIONAL NOTES

— |

In our sole discretion, and without providing

you notice or obtaining your consent, we may decide to issue and sell additional notes from time to time. However, we are under no obligation

to issue or sell additional notes at any time, and if we do sell additional notes, we may limit or restrict those sales, and we may stop

and subsequently resume selling additional notes at any time. If we limit, restrict or stop sales of such additional notes, or if we subsequently

resume sales of such additional notes, the liquidity and trading price of the notes in the secondary market could be materially and adversely

affected. Unless we indicate otherwise, if we suspend selling additional notes, we reserve the right to resume selling additional notes

at any time, which might result in the reduction or elimination of any premium in the trading price. See “— The trading price

of the notes in any secondary market may differ significantly from the Closing Intrinsic Note Value and Intraday Intrinsic Note Value”

above.

In addition, affiliates of ours may engage in

limited purchase and resale transactions in the notes, although they are not required to do so. The number of notes outstanding or held

by persons other than our affiliates could be further reduced at any time due to early repurchase of the notes or due to our or our affiliates’

purchases of notes in the secondary market. A suspension of additional issuances of the notes could result in a significant reduction

in the number of outstanding notes if investors subsequently exercise their right to have the notes repurchased by us.

Accordingly, the number of outstanding notes,

and their liquidity, could vary substantially over the term of the notes. There may not be sufficient liquidity to enable you to sell

your notes readily, and you may suffer substantial losses and/or sell your notes at prices substantially less than the Closing Intrinsic

Note Value and the Intraday Intrinsic Note Value, including being unable to sell them at all or only for a price of zero in the secondary

market. In addition, any election by holders to request that we repurchase the notes will be subject to the restrictive conditions and

procedures described in this pricing supplement, including the condition that you may request repurchase of at least 50,000 notes at any

one time and that you may only exercise your right to require us to repurchase the notes once per week. If the total number of outstanding

notes is close to or below 50,000, you may not be able to purchase enough notes to meet the minimum size requirement in order to exercise

your early repurchase right. The unavailability of the repurchase right can result in the

| PS-10 | Structured Investments

Alerian MLP Index® ETNs

|  |

notes trading in the secondary market at a discount

below the Closing Intrinsic Note Value and the Intraday Intrinsic Note Value.

| · | THERE ARE RESTRICTIONS ON THE MINIMUM NUMBER

OF NOTES YOU MAY REQUEST THAT WE REPURCHASE AND THE DATES ON WHICH YOU MAY EXERCISE YOUR RIGHT TO HAVE US REPURCHASE YOUR NOTES —

|

If you elect to exercise your right to have

us repurchase your notes, you must request that we repurchase at least 50,000 notes on the applicable Repurchase Date. If you own fewer

than 50,000 notes, you will not be able to have us repurchase your notes. Your request that we repurchase your notes is valid only if

we receive your Repurchase Notice by no later than 4:00 p.m., New York City time, on the Business Day immediately preceding the applicable

Repurchase Valuation Date (generally Thursday). Once delivered, a Repurchase Notice may not be revoked. If we do not receive your Repurchase

Notice by the deadline, your Repurchase Notice will not be effective, and we will not repurchase your notes on the corresponding Repurchase

Date. In addition, because of the timing requirements of the Repurchase Notice and the five-Index Business Day Measurement Period, settlement

of the repurchase will be prolonged when compared to a sale and settlement in the secondary market.

| · | YOU WILL NOT KNOW THE PAYMENT UPON EARLY

REPURCHASE OR THE REPURCHASE DATE AT THE TIME YOU ELECT TO REQUEST THAT WE REPURCHASE YOUR NOTES — |

You will not know the amount payable upon early

repurchase or the Repurchase Date at the time you elect to request that we repurchase your notes. Your notice must be received by us no

later than 4:00 p.m., New York City time, on the Business Day immediately preceding the applicable Repurchase Valuation Date. The Issuer’s

acknowledgement may specify a Repurchase Date that follows the final day in the Measurement Period by up to five Business Days. In addition,

the amount payable upon early repurchase will not be determined until the final day of the Measurement Period with respect to the Repurchase

Valuation Date, which is the fifth Index Business Day from the Repurchase Valuation Date, subject to postponement in the event of a market

disruption event and as described under “General Terms of Notes — Postponement of an Averaging Date” in the accompanying

product supplement. As a result, you will be exposed to market risk in the event the market fluctuates after we receive your request.

| · | NO DISTRIBUTIONS OR VOTING RIGHTS — |

As a holder of the notes, you will not have

voting rights or rights to receive cash distributions or other rights that direct holders of the Index Components would have.

| · | THE U.S. FEDERAL TAX CONSEQUENCES OF AN

INVESTMENT IN THE NOTES ARE UNCLEAR — |

There is no direct legal authority as to the

proper U.S. federal income tax treatment of the notes, and we do not intend to request a ruling from the Internal Revenue Service (the

“IRS”) regarding the notes. The IRS might not accept, and a court might not uphold, the treatment of the notes as “open

transactions” that are not debt instruments, as described in “Tax Treatment” in this document and in “Material

U.S. Federal Income Tax Consequences” in the accompanying product supplement. If the IRS were successful in asserting an alternative

treatment for the notes, the timing and character of any income or loss on the notes could be materially affected. For example, the IRS

could seek to treat you as the beneficial owner of the underlying MLPs for U.S. federal income tax purposes. In that event, you would

be required to recognize your allocable share of the taxable income earned by the underlying MLPs that are treated as partnerships for

U.S. federal income tax purposes, which in a particular taxable year could differ significantly from (and could be significantly greater

than) the amount of cash payments you receive on the notes in that year. In addition, among other potentially adverse consequences, a

Non-U.S. Holder treated as a beneficial owner of those underlying MLPs would be treated as engaged in a U.S. trade or business, would

be required to file tax returns in the jurisdiction in which those MLPs operate and generally would be subject to 15% withholding on amounts

deemed realized upon rebalancings of the Index and the sale or disposition of a note (including upon early repurchase or redemption at

maturity), which withholdings would generally be creditable against its U.S. federal income tax, provided it properly filed the required

tax return(s). Alternatively, the IRS could seek to treat the notes as “contingent payment debt instruments.” In this event,

a U.S. Holder will be required to accrue into income original issue discount on your notes, with the result that your taxable income in

any year could differ significantly from (and could be significantly higher than) the Coupon Amounts (if any) you receive in that year.

In addition, any gain recognized at maturity, upon early repurchase or redemption or upon a sale or exchange of your notes generally will

be treated as interest income, and if you recognize a loss above certain thresholds, you might be required to file a disclosure statement

with the IRS.

Even if the notes are treated as open transactions

that are not debt instruments, the notes could be treated as “constructive ownership transactions” within the meaning of Section

1260 of the Internal Revenue Code of 1986, as amended (the “Code”). Due to the lack of governing authority, our special tax

counsel is unable to opine as to whether the constructive ownership rules apply to the notes. If applicable, the constructive ownership

rules would recharacterize any gain recognized in respect of the notes that would otherwise be long-term capital gain and that is in excess

of the “net underlying long-term capital gain” (as defined in Code Section 1260) as ordinary income, and impose a notional

interest charge as if that income had accrued for tax purposes at a constant yield over your holding period for the notes. The “net

underlying long-term capital gain” is presumed to be zero unless you provide clear and convincing evidence to the contrary. You

will be responsible for obtaining information necessary to determine the “net underlying long-term capital gain” with respect

to the notes; we are not required, and do not intend, to supply you with such information. Accordingly, you should consult your tax advisers

regarding the potential application of the constructive ownership rules.

In addition, in 2007 Treasury and the IRS

released a notice requesting comments on the U.S. federal income tax treatment of “prepaid forward contracts” and similar

instruments, which may include the notes. The notice focuses in

| PS-11 | Structured Investments

Alerian MLP Index® ETNs

|  |

particular on whether to require investors

in these instruments to accrue income over the term of their investment. It also asks for comments on a number of related topics, including

the character of income or loss with respect to these instruments; the relevance of factors such as the exchange-traded status of the

instruments and the nature of the underlying property to which the instruments are linked; and whether these instruments are or should

be subject to the “constructive ownership” regime. While the notice requests comments on appropriate transition rules and

effective dates, any Treasury regulations or other guidance promulgated after consideration of these issues could materially and adversely

affect the tax consequences of an investment in the notes, possibly with retroactive effect. You should review carefully the section entitled

“Material U.S. Federal Income Tax Consequences” in the accompanying product supplement and consult your tax adviser regarding

the U.S. federal income tax consequences of an investment in the notes, including possible alternative treatments and the issues presented

by this notice.

Subject to discussion in the next paragraph,

we generally expect that Coupon Amounts paid to Non-U.S. Holders will be withheld upon at a rate of 30%, subject to the possible reduction

or elimination of that rate under the “other income” or similar provision of an applicable income tax treaty. Coupon Amounts

that are treated as “effectively connected” with the conduct of a trade or business in the United States should not be subject

to this withholding tax. However, in order to avoid withholding on “effectively connected” Coupon Amounts, you will likely

be required to provide a properly completed IRS Form W-8ECI. Any “effectively connected income” from your notes, including

also any gain from the sale or settlement of your notes that is or is treated as effectively connected with your conduct of a United States

trade or business, will be subject to U.S. federal income tax, and will require you to file U.S. federal income tax returns, in each case

in the same manner as if you were a U.S. Holder. In particular, if you own or are treated as owning more than 5% of the notes, you could

be treated as owning a “United States real property interest” within the meaning of Code Section 897, in which case any gain

from the sale or settlement of your notes would be deemed to be “effectively connected income,” with the consequences described

above.

Code Section 871(m) and Treasury regulations

promulgated thereunder (“Section 871(m)”) generally imposes a 30% withholding tax (or a lower rate under the dividend provision

of an applicable income tax treaty) on certain “dividend equivalents” paid or deemed paid with respect to derivatives linked

to U.S. stocks or indices that include U.S. stocks under certain circumstances, even in cases where the derivatives do not provide for

payments explicitly linked to dividends. In general, this withholding regime applies to derivatives that substantially replicate the economic

performance of one or more underlying U.S. stocks, as determined when the derivative is issued, based on one of two tests set forth in

the regulations. Moreover, the applicable Treasury regulations generally require a “look through” of certain partnerships

(“Covered Partnerships”) that own stock of U.S. corporations. It would be prudent to assume that many of the Index Components

that are treated as partnerships for U.S. federal income tax purposes are Covered Partnerships. Accordingly, the applicable Treasury regulations

can deem non-U.S. investors to be receiving dividend equivalents in respect of Index Components that are treated as corporations for U.S.

federal income tax purposes and in respect of underlying U.S. stocks owned by Index Components that are Covered Partnerships, even if

no payments on the notes are directly traceable to any dividends on those underlying stocks. Withholding in the latter instance would

be based on the amount of dividends paid on underlying U.S. stocks owned by those Covered Partnerships during your ownership period. The

aggregate amounts actually paid on those underlying U.S. stocks during the applicable quarter may not be known until the following year,

if at all. Based on certain factual determinations made by us, we currently believe that an estimate of the dividend equivalent amounts

that are attributable to underlying U.S. stocks owned by Index Components that are Covered Partnerships is 0.1157% of the Principal Amount