UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange

Act of 1934

For the month of

May, 2024

Commission File Number

1-15106

PETRÓLEO BRASILEIRO

S.A. – PETROBRAS

(Exact name of registrant

as specified in its charter)

Brazilian Petroleum

Corporation – PETROBRAS

(Translation of Registrant's

name into English)

Avenida Henrique Valadares, 28 – 19th floor

20241-030 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark

whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form

40-F _______

Indicate by check mark

whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

|

Financial Information

Jan-Mar/2024

—

|

B3: PETR3 (ON) | PETR4 (PN)

NYSE: PBR (ON) | PBRA (PN)

www.petrobras.com.br/ir

petroinvest@petrobras.com.br

+ 55 21 3224-1510

Disclaimer

This presentation

contains some financial indicators that are not recognized by GAAP or the IFRS. The indicators presented herein do not have standardized

meanings and may not be comparable to indicators with a similar description used by others. We provide these indicators because we use

them as measures of company performance and liquidity; they should not be considered in isolation or as a substitute for other financial

metrics that have been disclosed in accordance with IFRS. See definitions of EBITDA, LTM EBITDA, Adjusted EBITDA, LTM Adjusted EBITDA,

Adjusted Cash and Cash Equivalents, Net Debt, Gross Debt, Free Cash Flow, and Leverage in the Glossary and their reconciliations in the

sections Liquidity and Capital Resources, Reconciliation of LTM Adjusted EBITDA, Gross Debt/LTM Adjusted EBITDA and Net Debt/LTM Adjusted

EBITDA Metrics and Consolidated Debt.

TABLE OF CONTENTS

| CONSOLIDATED RESULTS |

|

| Key Financial Information |

4 |

| Sales Revenues |

4 |

| Cost of Sales |

5 |

| Income (Expenses) |

5 |

| Net finance (expense) income |

6 |

| Income tax expenses |

7 |

| Net Income attributable to shareholders of Petrobras |

7 |

| |

|

| CAPITAL EXPENDITURES (CAPEX) |

8 |

| |

|

| LIQUIDITY AND CAPITAL RESOURCES |

9 |

| |

|

| CONSOLIDATED DEBT |

10 |

|

RECONCILIATION OF EBITDA, ADJUSTED EBITDA, LTM EBITDA,

LTM ADJUSTED EBITDA, GROSS DEBT/ LTM ADJUSTED EBITDA AND NET DEBT/LTM ADJUSTED EBITDA METRICS |

|

| EBITDA, Adjusted EBITDA and Net cash provided by operating activities – OCF |

11 |

| LTM EBITDA, LTM Adjusted EBITDA |

12 |

| Adjusted Cash and Cash Equivalents, Gross Debt, Net Debt, Net Cash provided by Operating Activities (LTM OCF), LTM Adjusted EBITDA, Gross Debt Net of Cash and Cash Equivalents/LTM OCF, Gross Debt/LTM Adjusted EBITDA and Net Debt/LTM Adjusted EBITDA Metrics |

13 |

| |

|

| RESULTS BY OPERATING BUSINESS SEGMENTS |

|

| Exploration and Production (E&P) |

14 |

| Refining, Transportation and Marketing |

15 |

| Gas and Low Carbon Energies |

16 |

| |

|

| GLOSSARY |

17 |

CONSOLIDATED RESULTS

The main functional currency of the Petrobras Group is the Brazilian

real, which is the functional currency of the parent company and its Brazilian subsidiaries. As the presentation currency of the Petrobras

Group is the U.S. dollar, the results of operations in Brazilian reais are translated into U.S. dollars using the average exchange rates

prevailing during the period (average exchange rate of R$/US$ 4.95 in Jan-Mar/2024 compared to R$/US$ 5.19 in Jan-Mar/2023).

Key Financial Information

| US$ million |

Jan-Mar/2024 |

Jan-Mar/2023 |

Change

(%) |

| Sales revenues |

23,768 |

26,771 |

(11.2) |

| Cost of Sales |

(11,511) |

(12,658) |

(9.1) |

| Gross profit |

12,257 |

14,113 |

(13.2) |

| Income (expenses) |

(3,273) |

(2,560) |

27.9 |

| Consolidated net income attributable to the shareholders of Petrobras |

4,782 |

7,341 |

(34.9) |

| Net cash provided by operating activities |

9,386 |

10,347 |

(9.3) |

| Adjusted EBITDA |

12,127 |

13,956 |

(13.1) |

| Average Brent crude (US$/bbl) * |

83.24 |

81.27 |

2.4 |

| Average Domestic basic oil products price (US$/bbl) |

96.13 |

109.53 |

(12.2) |

|

* Source: Refinitiv.

|

|

|

|

| |

|

|

|

|

|

| US$ million |

03.31.2024 |

12.31.2023 |

Change

(%) |

| Gross Debt |

61,838 |

62,600 |

(1.2) |

| Net Debt |

43,646 |

44,698 |

(2.4) |

| Gross Debt/LTM Adjusted EBITDA ratio |

1.22 |

1.19 |

2.5 |

| Net Debt/LTM Adjusted EBITDA ratio |

0.86 |

0.85 |

1.2 |

Sales Revenues

| US$ million |

Jan-Mar/2024 |

Jan-Mar/2023 |

Change

(%) |

| Diesel |

7,076 |

8,305 |

(14.8) |

| Gasoline |

3,205 |

3,694 |

(13.2) |

| Liquefied petroleum gas (LPG) |

758 |

929 |

(18.4) |

| Jet fuel |

1,184 |

1,406 |

(15.8) |

| Naphtha |

427 |

478 |

(10.7) |

| Fuel oil (including bunker fuel) |

344 |

286 |

20.3 |

| Other oil products |

1,019 |

1,084 |

(6.0) |

| Subtotal Oil Products |

14,013 |

16,182 |

(13.4) |

| Natural gas |

1,322 |

1,526 |

(13.4) |

| Crude oil |

1,229 |

1,350 |

(9.0) |

| Renewables and nitrogen products |

31 |

21 |

47.6 |

| Breakage |

140 |

220 |

(36.4) |

| Electricity |

128 |

110 |

16.4 |

| Services, agency and others |

247 |

244 |

1.2 |

| Total domestic market |

17,110 |

19,653 |

(12.9) |

| Exports |

6,398 |

6,741 |

(5.1) |

| Crude oil |

4,911 |

5,547 |

(11.5) |

| Fuel oil (including bunker fuel) |

1,322 |

1,034 |

27.9 |

| Other oil products and other products |

165 |

160 |

3.1 |

| Sales abroad * |

260 |

377 |

(31.0) |

| Total foreign market |

6,658 |

7,118 |

(6.5) |

| Sales revenues |

23,768 |

26,771 |

(11.2) |

|

* Sales revenues from operations outside

of Brazil, including trading and excluding exports.

|

|

|

|

Sales revenues were US$ 23,768 million for

the period Jan-Mar/2024, a 11.2% decrease (US$ 3,003 million) when compared to US$ 26,771 million for the period Jan-Mar/2023, mainly

due to:

| (i) | a US$ 2,169 million decrease

in domestic market oil products revenues, of which US$ 1,711 million relates to a decrease in average domestic basic oil products prices

following the reduction in average international prices for diesel and gasoline, and US$ 458 million relates to a decrease in sales volumes; |

| (ii) | a US$ 636 million decrease in exported

crude oil revenues, of which US$ 628 million relates to a decrease in sales volumes, and US$ 8 million relates to a decrease in the average

price of crude oil exports due to the devaluation of international prices when exports were carried out in 2024; |

| (iii) | a US$ 121 million decrease in domestic

market crude oil revenues, composed of a US$ 209 million decrease which relates to a decrease in sales volumes, partially offset by a

US$ 88 million increase which relates to an increase in average crude oil prices in domestic market following the appreciation of average

Brent crude prices; and |

| (iv) | a US$ 288 million increase in exported

fuel oil revenues, of which US$ 259 million relates to an increase in sales volumes, and US$ 30 million relates to an increase in average

prices. |

Cost of Sales

| US$ million |

Jan-Mar/2024 |

Jan-Mar/2023 |

Change

(%) |

| Raw material, products for resale, materials and third-party services * |

(5,391) |

(7,095) |

(24.0) |

| Depreciation, depletion and amortization |

(2,649) |

(2,396) |

10.6 |

| Production taxes |

(3,030) |

(2,783) |

8.9 |

| Employee compensation |

(441) |

(384) |

14.8 |

| Total |

(11,511) |

(12,658) |

(9.1) |

* It includes short-term leases and inventory turnover.

Cost of sales was US$ 11,511 million for the

period Jan-Mar/2024, a 9.1% decrease (US$ 1,147 million) when compared to US$ 12,658 million for the period Jan-Mar/2023, mainly due to

lower costs with raw material and products for resale with emphasis on lower acquisition costs for imported crude oil and oil products.

Income (Expenses)

| US$ million |

Jan-Mar/2024 |

Jan-Mar/2023 |

Change

(%) |

| Selling expenses |

(1,333) |

(1,221) |

9.2 |

| General and administrative expenses |

(447) |

(357) |

25.2 |

| Exploration costs |

(135) |

(157) |

(14.0) |

| Research and development expenses |

(183) |

(154) |

18.8 |

| Other taxes |

(140) |

(200) |

(30.0) |

| Impairment of assets |

9 |

(3) |

- |

| Other income and expenses, net |

(1,044) |

(468) |

123.1 |

| Total |

(3,273) |

(2,560) |

27.9 |

Selling expenses were US$ 1,333 million for

the period Jan-Mar/2024, a 9.2% increase (US$ 112 million) compared to US$ 1,221 million for the period Jan-Mar/2023, mainly due

to higher logistical expenses related to natural gas transportation, partially offset by lower volumes of crude oil exports.

General and administrative expenses were US$

447 million for the period Jan-Mar/2024, a 25.2% increase (US$ 90 million) compared to US$ 357 million for the period Jan-Mar/2023,

mainly due to higher salary expenses due to the hiring of new employees and to inflationary effects over the salaries of other employees.

Other taxes were US$ 140 million for the period

Jan-Mar/2024, a 30.0% decrease (US$ 60 million) compared to US$ 200 million for the period Jan-Mar/2023, mainly due to

a 9.2% extraordinary taxation over exports of crude oil in 2023, pursuant to Provisional Measure No. 1,163/2023. This extraordinary taxation

was temporary and only applicable for the period March to June 2023.

Other income and expenses, net was a US$ 1,044

million expense in Jan-Mar/2024, a 123.1% increase (US$ 576 million) compared to US$ 468 million for the period Jan-Mar/2023, mainly due

to lower gains from asset divestments (US$ 162 million of income in Jan-Mar/2024 compared to a US$ 496 million income in Jan-Mar/2023).

Net finance (expense) income

| US$ million |

Jan-Mar/2024 |

Jan-Mar/2023 |

Change

(%) |

| Finance income |

552 |

465 |

18.7 |

| Income from investments and marketable securities (Government Bonds) |

432 |

333 |

29.7 |

| Other finance income |

120 |

132 |

(9.1) |

| Finance expenses |

(1,072) |

(844) |

27.0 |

| Interest on finance debt |

(554) |

(541) |

2.4 |

| Unwinding of discount on lease liability |

(547) |

(358) |

52.8 |

| Capitalized borrowing costs |

376 |

271 |

38.7 |

| Unwinding of discount on the provision for decommissioning costs |

(272) |

(212) |

28.3 |

| Other finance expenses |

(75) |

(4) |

1,775.0 |

| Foreign exchange gains (losses) and indexation charges |

(1,419) |

(243) |

484.0 |

| Foreign exchange gains (losses) |

(881) |

797 |

- |

| Reclassification of hedge accounting to the Statement of Income |

(697) |

(1,154) |

(39.6) |

|

Indexation to the Selic interest rate of anticipated dividends

and dividends

payable |

(70) |

(32) |

118.8 |

| Recoverable taxes inflation indexation income |

49 |

64 |

(23.4) |

| Other foreign exchange gains and indexation charges, net |

180 |

82 |

119.5 |

| Total |

(1,939) |

(622) |

211.7 |

Net finance (expense) income was an expense of US$ 1,939 million

for the period Jan-Mar/2024, an increase of US$ 1,317 million compared to an expense of US$ 622 million for the period Jan-Mar/2023, mainly

due to:

| · | a foreign exchange loss of US$ 881 million in Jan-Mar/2024,

as compared to a US$ 797 million gain in Jan-Mar/2023 reflecting a 3.2% depreciation of the real/US$ exchange rate in Jan-Mar/2024 (03/31/2024:

R$ 5.00/US$, 12/31/2023: R$ 4.84/US$) compared to a 2.6% appreciation in Jan-Mar/2023 (03/31/2023: R$ 5.08/US$, 12/31/2022: R$ 5.22/US$),

which applied to a higher average net liability exposure to the US$ during Jan-Mar/2024 than in Jan-Mar/2023. |

Income tax expenses

Income tax was an expense of US$ 2,147 million in Jan-Mar/2024, compared

to an expense of US$ 3,596 million in Jan-Mar/2023. The decrease was mainly due to lower net income before income taxes (US$ 6,952 million

of income in Jan-Mar/2024 compared to a US$ 10,966 million income in Jan-Mar/2023), resulting in nominal income taxes computed based on

Brazilian statutory corporate tax rates (34%) of US$ 2,363 million in Jan-Mar/2024 compared to a US$ 3,729 million in Jan-Mar/2023.

Net Income attributable to shareholders of Petrobras

Net income attributable to shareholders of Petrobras was US$

4,782 million for the period Jan-Mar/2024, a US$ 2,559 million decrease compared to a net income attributable to shareholders of

Petrobras of US$ 7,341 million for the period Jan-Mar/2023, as explained above, mainly due to lower gross profit (US$ 12,257 million in

Jan-Mar/2024 compared to US$ 14,113 million in Jan-Mar/2023), higher expenses (US$ 3,273 million of expenses in Jan-Mar/2024 compared

to US$ 2,560 million of expenses in Jan-Mar/2023), higher net finance expenses (US$ 1,939 million of expenses in Jan-Mar/2024 compared

to US$ 622 million of expenses in Jan-Mar/2023) partially offset by lower income tax expenses (US$ 2,147 million of expenses in Jan-Mar/2024

compared to US$ 3,596 million of expenses in Jan-Mar/2023).

CAPITAL

EXPENDITURES (CAPEX)

| CAPEX (US$ million) |

Jan-Mar/2024 |

Jan-Mar/2023 |

Change (%) |

| Exploration and Production |

2,472 |

2,040 |

21.2 |

| Refining, Transportation and Marketing |

362 |

342 |

5.8 |

| Gas and Low Carbon Energies |

108 |

33 |

227.3 |

| Corporate and Other businesses |

101 |

67 |

50.7 |

| Total |

3,043 |

2,482 |

22.6 |

In line with our Strategic Plan, our Capital Expenditures

were primarily directed toward investment projects which Management believes are most profitable, relating to oil and gas production.

In Jan-Mar/2024, Capital Expenditures in the E&P segment

totaled US$ 2,472 million, representing 81.2% of the CAPEX of the Company, a 21.2% increase when compared to US$ 2,040 million

in Jan-Mar/2023, mainly due to the development of large projects that are expected to sustain the production curve over the next few years.

CAPEX in Jan-Mar/2024 were mainly concentrated on: (i) the development of production in the pre-salt layer of the Santos Basin (US$ 1.3

billion), mainly on Buzios and Mero fields; (ii) the Campos Basin pre- and post-salt projects (US$ 0.6 billion), mainly on Jubarte, Marlim

and Raia Manta and Pintada fields; and (iii) exploratory investments (US$ 0.2 billion).

LIQUIDITY

AND CAPITAL RESOURCES

| US$ million |

Jan-Mar/2024 |

Jan-Mar/2023 |

| Adjusted Cash and Cash Equivalents at the beginning of the period |

17,902 |

12,283 |

| Government bonds, bank deposit certificates and time deposits with maturities of more than three months at the beginning of the period |

(5,175) |

(4,287) |

| Cash and cash equivalents at the beginning of the period |

12,727 |

7,996 |

| Net cash provided by operating activities |

9,386 |

10,347 |

| Acquisition of PP&E and intangibles assets |

(2,838) |

(2,423) |

| Acquisition of equity interests |

(1) |

(8) |

| Proceeds from disposal of assets – (Divestments) |

569 |

1,855 |

| Financial compensation from co-participation agreement |

397 |

391 |

| Dividends received |

24 |

11 |

| Divestment (Investment) in marketable securities |

(1,475) |

(930) |

| Net cash provided by (used in) investing activities |

(3,324) |

(1,104) |

| (=) Net cash provided by operating and investing activities |

6,062 |

9,243 |

| Proceeds from finance debt |

2 |

51 |

| Repayments of finance debt |

(1,601) |

(1,320) |

| Net change in finance debt |

(1,599) |

(1,269) |

| Repayment of lease liability |

(1,918) |

(1,389) |

| Dividends paid to shareholders of Petrobras |

(3,455) |

(4,192) |

| Dividends paid to non-controlling interest |

(57) |

(48) |

| Share repurchase program |

(232) |

0 |

| Changes in non-controlling interest |

93 |

(75) |

| Net cash used in financing activities |

(7,168) |

(6,973) |

| Effect of exchange rate changes on cash and cash equivalents |

(74) |

24 |

| Cash and cash equivalents at the end of the period |

11,547 |

10,290 |

| Government bonds, bank deposit certificates and time deposits with maturities of more than three months at the end of the period |

6,645 |

5,471 |

| Adjusted Cash and Cash Equivalents at the end of the period |

18,192 |

15,761 |

| |

|

|

| Reconciliation of Free Cash Flow |

|

|

| Net cash provided by operating activities |

9,386 |

10,347 |

| Acquisition of PP&E and intangible assets |

(2,838) |

(2,423) |

| Acquisition of equity interests |

(1) |

(8) |

| Free Cash Flow * |

6,547 |

7,916 |

*Free Cash Flow (FCF) is in accordance with the new Shareholder Remuneration

Policy (“Policy”), approved in July 2023, which is the result of the equation: FCF = net cash provided by operating activities

less the sum of acquisition of PP&E and intangible assets and acquisition of equity interests. For comparative purposes, the amount

of Jan-Mar/2023 has been adjusted in accordance with the new Policy.

As of March 31, 2024, the balance of Cash and cash equivalents

was US$ 11,547 million and Adjusted Cash and Cash Equivalents totaled US$ 18,192 million.

The three-month period ended March 31, 2024 had net cash provided

by operating activities of US$ 9,386 million and positive Free Cash Flow of US$ 6,547 million. This level of cash generation, together

with proceeds from disposal of assets (divestments) of US$ 569 million, financial compensation from co-participation agreements of

US$ 397 million, dividends received of US$ 24 million and proceeds from finance debt of US$ 2 million, were allocated to: (a) debt

prepayments and payments of principal and interest due in the period of US$ 1,601 million; (b) repayment of lease liability of US$ 1,918

million; (c) dividends paid to shareholders of Petrobras of US$ 3,455 million; (d) share repurchase program of US$ 232 million; and (e)

acquisition of PP&E and intangibles assets of US$ 2,838 million.

In the three-month period ended, the Company repaid

several finance debts, in the amount of US$ 1,601 million.

CONSOLIDATED

DEBT

| Debt (US$ million) |

03.31.2024 |

12.31.2023 |

Change (%) |

| Capital Markets |

16,719 |

17,514 |

(4.5) |

| Banking Market |

8,502 |

8,565 |

(0.7) |

| Development banks |

664 |

698 |

(4.9) |

| Export Credit Agencies |

1,705 |

1,870 |

(8.8) |

| Others |

148 |

154 |

(3.9) |

| Finance debt |

27,738 |

28,801 |

(3.7) |

| Lease liability |

34,100 |

33,799 |

0.9 |

| Gross Debt |

61,838 |

62,600 |

(1.2) |

| Adjusted Cash and Cash Equivalents |

18,192 |

17,902 |

1.6 |

| Net Debt |

43,646 |

44,698 |

(2.4) |

| Leverage: Net Debt/(Net Debt + Shareholders' Equity) |

35% |

36% |

(2.8) |

| Average interest rate (% p.a.) |

6.5 |

6.4 |

1.6 |

| Weighted average maturity of outstanding debt (years) |

11.30 |

11.38 |

(0.7) |

As of March 31, 2024, the Company has maintained

its liability management strategy to improve the debt profile and to adapt to the maturity terms of the Company’s long-term investments.

Gross Debt decreased 1.2% (US$ 762 million) to US$ 61,838

million as of March 31, 2024 from US$ 62,600 million as of December 31, 2023, mainly due to lower finance debt (with a US$ 1,063

million decrease in the period), partially offset by the higher lease liabilities in the period (a US$ 301 million increase). Gross Debt

was maintained in the range between US$ 50,000 million and US$ 65,000 million target defined in the 2024-2028 Strategic Plan, mainly due

to debt prepayments and scheduled repayments.

As of March 31, 2024, Net Debt decreased by 2.4% (US$ 1,052

million), reaching US$ 43,646 million, compared to US$ 44,698 million as of December 31, 2023.

RECONCILIATION

OF EBITDA, ADJUSTED EBITDA, LTM EBITDA, LTM ADJUSTED EBITDA, GROSS DEBT/LTM ADJUSTED EBITDA AND NET DEBT/LTM ADJUSTED EBITDA METRICS

LTM Adjusted EBITDA reflects the sum of the last twelve months

of Adjusted EBITDA, which is computed by using the EBITDA (net income before net finance (expense) income, income taxes, depreciation,

depletion and amortization) adjusted by items not considered part of the Company’s primary business, which include results in equity-accounted

investments, results on disposal and write-offs of assets, impairment and results from co-participation agreements in bid areas.

LTM Adjusted EBITDA represents an alternative to the Company's operating

cash generation. This measure is used to calculate the metrics Gross Debt/LTM Adjusted EBITDA and Net Debt/LTM Adjusted EBITDA, to support

management’s assessment of liquidity and leverage.

EBITDA, Adjusted EBITDA and Net cash provided

by operating activities – OCF

| US$ million |

Jan-Mar/2024 |

Jan-Mar/2023 |

Change (%) |

| Net income |

4,805 |

7,370 |

(34.8) |

| Net finance (expense) income |

1,939 |

622 |

211.7 |

| Income taxes |

2,147 |

3,596 |

(40.3) |

| Depreciation, depletion and amortization |

3,362 |

2,924 |

15.0 |

| EBITDA |

12,253 |

14,512 |

(15.6) |

| Results in equity-accounted investments |

93 |

(35) |

- |

| Impairment of assets (reversals) |

(9) |

3 |

- |

| Results on disposal/write-offs of assets |

(162) |

(496) |

(67.3) |

| Results from co-participation agreements in bid areas |

(48) |

(28) |

71.4 |

| Adjusted EBITDA |

12,127 |

13,956 |

(13.1) |

| Allowance for credit loss on trade and other receivables |

30 |

24 |

25.0 |

| Trade and other receivables |

604 |

412 |

46.6 |

| Inventories |

(627) |

989 |

- |

| Trade payables |

407 |

(478) |

- |

| Taxes payable |

(3,143) |

(4,497) |

(30.1) |

| Others |

(12) |

(59) |

(79.7) |

| Net cash provided by operating activities – OCF |

9,386 |

10,347 |

(9.3) |

LTM EBITDA, LTM Adjusted EBITDA, LTM Net

cash provided by operating activities – OCF

| |

US$ million |

| |

Last twelve months (LTM) at |

|

|

|

|

| |

03.31.2024 |

12.31.2023 |

Apr-Jun/2023 |

Jul-Sep/2023 |

Oct-Dec/2023 |

Jan-Mar/2024 |

| Net income |

22,430 |

24,995 |

5,859 |

5,484 |

6,282 |

4,805 |

| Net finance (expense) income |

3,650 |

2,333 |

21 |

1,985 |

(295) |

1,939 |

| Income taxes |

8,952 |

10,401 |

2,576 |

2,263 |

1,966 |

2,147 |

| Depreciation, depletion and amortization |

13,718 |

13,280 |

3,249 |

3,475 |

3,632 |

3,362 |

| EBITDA |

48,750 |

51,009 |

11,705 |

13,207 |

11,585 |

12,253 |

| Results in equity-accounted investments |

432 |

304 |

22 |

248 |

69 |

93 |

| Impairment of assets (reversals) |

2,668 |

2,680 |

401 |

78 |

2,198 |

(9) |

| Results on disposal/write-offs of assets |

(962) |

(1,295) |

(692) |

37 |

(145) |

(162) |

| Results from co-participation agreements in bid areas |

(304) |

(284) |

0 |

(19) |

(237) |

(48) |

| Adjusted EBITDA |

50,584 |

52,414 |

11,436 |

13,551 |

13,470 |

12,127 |

| Allowance for credit loss on trade and other receivables |

46 |

40 |

10 |

15 |

(9) |

30 |

| Trade and other receivables |

280 |

88 |

763 |

(588) |

(499) |

604 |

| Inventories |

(52) |

1,564 |

91 |

52 |

432 |

(627) |

| Trade payables |

(69) |

(954) |

187 |

(726) |

63 |

407 |

| Taxes payable |

(9,109) |

(10,463) |

(2,769) |

(819) |

(2,378) |

(3,143) |

| Others |

571 |

523 |

(76) |

69 |

590 |

(12) |

| Net cash provided by operating activities -OCF |

42,251 |

43,212 |

9,642 |

11,554 |

11,669 |

9,386 |

Adjusted Cash and Cash Equivalents, Gross

Debt, Net Debt, Net Cash provided by Operating Activities (LTM OCF), LTM Adjusted EBITDA, Gross Debt Net of Cash and Cash Equivalents/LTM

OCF, Gross Debt/LTM Adjusted EBITDA and Net Debt/LTM Adjusted EBITDA Metrics

The Gross Debt/LTM Adjusted EBITDA ratio and Net

Debt/LTM Adjusted EBITDA metrics are important metrics that support our management in assessing the liquidity and leverage of Petrobras

Group. These ratios are important measures for management to assess the Company’s ability to pay off its debt, mainly because our

Strategic Plan 2024-2028 defines US$ 65 billion as a maximum level for our Gross Debt.

The following table presents the reconciliation

for those metrics to the most directly comparable measure derived from IFRS captions, which is in this case the Gross Debt Net of Cash

and Cash Equivalents/Net Cash provided by operating activities ratio:

| |

US$ million |

| |

|

|

| |

03.31.2024 |

12.31.2023 |

| Cash and cash equivalents |

11,547 |

12,727 |

| Government bonds, bank deposit certificates and time deposits (maturity of more than three months) |

6,645 |

5,175 |

| Adjusted Cash and Cash equivalents |

18,192 |

17,902 |

| Finance debt |

27,738 |

28,801 |

| Lease liability |

34,100 |

33,799 |

| Current and non-current debt - Gross Debt |

61,838 |

62,600 |

| Net Debt |

43,646 |

44,698 |

| Net cash provided by operating activities - LTM OCF |

42,251 |

43,212 |

| Allowance for credit loss on trade and other receivables |

(46) |

(40) |

| Trade and other receivables |

(280) |

(88) |

| Inventories |

52 |

(1,564) |

| Trade payables |

69 |

954 |

| Taxes payable |

9,109 |

10,463 |

| Others |

(571) |

(523) |

| LTM Adjusted EBITDA |

50,584 |

52,414 |

| Gross Debt net of cash and cash equivalents/LTM OCF ratio |

1.19 |

1.15 |

| Gross Debt/LTM Adjusted EBITDA ratio |

1.22 |

1.19 |

| Net Debt/LTM Adjusted EBITDA ratio |

0.86 |

0.85 |

| |

|

|

|

RESULTS BY OPERATING BUSINESS

SEGMENTS

Exploration and Production (E&P)

Financial information

| US$ million |

Jan-Mar/2024 |

Jan-Mar/2023 |

Change (%) |

| Sales revenues |

16,077 |

15,730 |

2.2 |

| Gross profit |

9,463 |

9,351 |

1.2 |

| Income (Expenses) |

(630) |

(123) |

412.2 |

| Operating income |

8,833 |

9,228 |

(4.3) |

| Net income attributable to the shareholders of Petrobras |

5,846 |

6,108 |

(4.3) |

| Average Brent crude (US$/bbl) |

83.24 |

81.27 |

2.4 |

| Production taxes – Brazil |

2,981 |

2,784 |

7.1 |

| Royalties |

1,871 |

1,610 |

16.2 |

| Special Participation |

1,101 |

1,162 |

(5.2) |

| Retention of areas |

9 |

12 |

(25.0) |

[1]

In the period Jan-Mar/2024, gross profit for

the E&P segment was US$9,463 million, an increase of 1.2% in relation to the period Jan-Mar/2023, due to higher sales revenues, which

reflect mainly increase production, in addition to higher Brent prices.

Operating income was US$ 8,833 million in the

Jan-Mar/2024 period, a decrease of 4.3% compared to the Jan-Mar/2023 period, mainly due to higher expenses with maintenance stoppages,

as well as to lower revenue with a reduced number of assets sold.

In the period Jan-Mar/2024, the increase in

production taxes was caused primarily by the higher in Brent prices, in relation to the Jan-Mar/2023 period.

Operational information

| Production in thousand barrels of oil equivalent per day (mboed) |

Jan-Mar/2024 |

Jan-Mar/2023 |

Change (%) |

| Crude oil, NGL and natural gas – Brazil |

2,742 |

2,640 |

3.9 |

| Crude oil and NGL (mbbl/d) |

2,236 |

2,141 |

4.4 |

| Natural gas (mboed) |

506 |

499 |

1.4 |

| Crude oil, NGL and natural gas – Abroad |

34 |

36 |

(5.6) |

| Total (mboed) |

2,776 |

2,676 |

3.7 |

Production of crude oil, NGL and natural gas

was 2,776 mboed in the period Jan-Mar/2024, representing an increase of 3.7% compared to Jan-Mar/2023, mainly due to the ramp up of platforms

Almirante Barroso (Búzios field), P-71 (Itapu field), FPSO Anna Nery (Marlim field), FPSO Anita Garibaldi (Marlim, Voador and Espadim

fields) and FPSO Sepetiba (Mero field), in addition to the start of production of new wells in the Campos and Santos Basins.

Refining, Transportation and Marketing

Financial information

| US$ million |

Jan-Mar/2024 |

Jan-Mar/2023 |

Change (%) |

| Sales revenues |

22,190 |

24,842 |

(10.7) |

| Gross profit |

2,207 |

2,974 |

(25.8) |

| Income (Expenses) |

(836) |

(1,178) |

(29.0) |

| Operating income |

1,371 |

1,796 |

(23.7) |

| Net income attributable to the shareholders of Petrobras |

775 |

1,199 |

(35.4) |

| Average refining cost (US$ / barrel) – Brazil |

2.63 |

2.12 |

24.1 |

| Average domestic basic oil products price (US$/bbl) |

96.13 |

109.53 |

(12.2) |

In the period Jan-Mar/2024, Refining, Transportation and

Marketing gross profit was US$ 767 million lower than in the period Jan-Mar/2023 mainly due to a decrease in international margins, especially

diesel, and lower volume of sales in domestic market, mainly diesel and gasoline.

The operating income for the period Jan-Mar/2024 reflects

lower gross profit partially offset by a decrease of expenses, mainly expenses with compensation for the termination of a vessel charter

agreement that occurred in Jan-Mar/2023.

The average refining cost in the period Jan-Mar/2024 was

US$ 2.63/bbl, 24.1% higher than in the period Jan-Mar/2023, due to inflationary effects on personnel and service costs and to an increased

scope of maintenance and revitalization activities in our refineries.

Operational information

| Thousand barrels per day (mbbl/d) |

Jan-Mar/2024 |

Jan-Mar/2023 |

Change (%) |

| Total production volume |

1,753 |

1,652 |

6.1 |

| Domestic sales volume |

1,648 |

1,697 |

(2.9) |

| Reference feedstock |

1,813 |

1,851 |

(2.1) |

| Refining plants utilization factor (%) |

92 |

85 |

8.2 |

| Processed feedstock (excluding NGL) |

1,628 |

1,527 |

6.6 |

| Processed feedstock |

1,676 |

1,573 |

6.5 |

| Domestic crude oil as % of total |

91 |

90 |

1.1 |

Domestic sales in the period Jan-Mar/2024 were

1,648 mbbl/d, a decrease of 2.9% compared to Jan-Mar/2023.

Gasoline sales volume decreased 6.8% in Jan-Mar/2024

compared to Jan-Mar/2023 mainly due to the higher competitiveness in price compared to hydrous ethanol. Diesel decreased 3.4% between

periods because of the higher imports from third parties and the increase in biodiesel content.

Total production of oil products for the period

Jan-Mar/2024 was 1,753 mbbl/d, 6.1% higher than Jan-Mar/2023. The production in the previous year was affected by two relevant turnarounds

at RPBC and REFAP, in comparison to relatively smaller turnarounds at REPAR and REPLAN this year.

Processed feedstock for the period Jan-Mar/2024

was 1,676 mbbl/d, 6.5% more than Jan-Mar/2023.

Gas and Low Carbon Energies

Financial information

| US$ million |

Jan-Mar/2024 |

Jan-Mar/2023 |

Change (%) |

| Sales revenues |

2,422 |

2,854 |

(15.1) |

| Gross profit |

1,245 |

1,387 |

(10.2) |

| Income (expenses) |

(889) |

(779) |

14.1 |

| Operating income (loss) |

356 |

608 |

(41.4) |

| Net income (loss) attributable to the shareholders of Petrobras |

242 |

388 |

(37.6) |

| Average natural gas sales price – Brazil (US$/bbl) |

67.88 |

73.27 |

(7.4) |

In Jan-Mar/2024, the sales revenues reduction in relation

to Jan-Mar/2023 was due to the lower volume of natural gas sold to the thermoelectric and non-thermoelectric markets, as well as reduction

of thermoelectric generation and the lower average natural gas sales price.

In addition, the lower operating income in Jan-Mar/2024

compared to Jan-Mar/2023 is mainly due to an increase in selling expenses, relating to the natural gas transportation, as there was a

reduction in the compensation received from transport companies when third parties use their pipelines, due to a reduction in transported

volumes.

Operational information

| |

Jan-Mar/2024 |

Jan-Mar/2023 |

Change (%) |

| Sale of Thermal Availability at Auction (ACR)- Average MW |

1,186 |

1,655 |

(28.3) |

| Sale of electricity - average MW |

442 |

562 |

(21.4) |

| National gas delivered - million m³/day |

30 |

32 |

(6.3) |

| Regasification of liquefied natural gas - million m³/day |

3 |

- |

- |

| Import of natural gas from Bolivia - million m³/day |

15 |

19 |

(21.1) |

| Natural gas sales and for internal consumption - million m³/day |

48 |

50 |

(4.0) |

In Jan-Mar/2024, electricity sales by Petrobras

decreased 21.4% compared to Jan-Mar/2023, due to the high level of hydroelectric plants’ reservoirs in Brazil and consequently lower

demand in the thermoelectric market. In this scenario, power generation was used mainly to supply Petrobras' internal energy demand, as

well as for one-off opportunities to export to Argentina.

There was also a reduction in the volume of

thermal availability at auctions (ACR), due to the expiration of contracts.

The supply of national gas decreased in Jan-Mar/2024

due to planned maintenance on the Mexilhão Plataform and UTGCA gas processing unit whose impact was offset by an increase in gas

imports.

GLOSSARY

ACL - Ambiente de Contratação Livre

(Free contracting market) in the electricity system.

ACR - Ambiente de Contratação Regulada

(Regulated contracting market) in the electricity system.

Adjusted Cash and Cash Equivalents - Sum of cash and

cash equivalents, government bonds, bank deposit certificates and time deposits with maturities of more than 3 months from the date of

acquisition, considering the expected realization of those financial investments in the short-term. This measure is not defined under

the International Financial Reporting Standards – IFRS and should not be considered in isolation or as a substitute for cash and

cash equivalents computed in accordance with IFRS. It may not be comparable to adjusted cash and cash equivalents of other companies.

However, management believes that it is an appropriate supplemental measure to assess our liquidity and supports leverage management and

uses this measure in the calculation of Net Debt.

Adjusted EBITDA Net income plus net finance (expense)

income; income taxes; depreciation, depletion and amortization; results in equity-accounted investments; impairment; results on disposal/write-offs

of assets; and results from co-participation agreements in bid areas. Adjusted EBITDA is not a measure defined by IFRS and it is possible

that it may not be comparable to similar measures reported by other companies. However, management believes that it is an appropriate

supplemental measure to assess our liquidity and supports leverage management.

ANP - Brazilian National Petroleum, Natural Gas and Biofuels

Agency.

Average Domestic basic oil products price (US$/bbl) -

represents Petrobras' domestic sales revenues per unit of basic oil products, which are: diesel, gasoline, LPG, jet fuel, naphtha and

fuel oil.

Capital Expenditures – Capital

expenditures based on the cost assumptions and financial methodology adopted in our Strategic Plan, which include acquisition of PP&E

and intangible assets, acquisition of equity interests, as well as other items that do not necessarily qualify as cash flows used in investing

activities, comprising geological and geophysical expenses, research and development expenses, pre-operating charges, purchase of property,

plant and equipment on credit and borrowing costs directly attributable to works in progress.

CTA – Cumulative translation adjustment –

The cumulative amount of exchange variation arising on translation of foreign operations that is recognized in Shareholders’ Equity

and will be transferred to profit or loss on the disposal of the investment.

EBITDA - net income before net finance (expense) income, income

taxes, depreciation, depletion and amortization. EBITDA is not a measure defined by IFRS and it is possible that it may not be comparable

to similar measures reported by other companies. However, management believes that it is an appropriate supplemental measure to assess

our liquidity and supports leverage management.

Effect of average cost in the Cost of Sales

– In view of the average inventory term of 60 days, the crude oil and oil products international prices movement, as well as foreign

exchange effect over imports, production taxes and other factors that impact costs, do not entirely influence the cost of sales in the

current period, having their total effects only in the following period.

|

|

Free Cash Flow - Net cash provided by operating

activities less the sum of acquisition of PP&E and intangibles assets and acquisition of equity interests. Free cash flow is not defined

under the IFRS and should not be considered in isolation or as a substitute for cash and cash equivalents calculated in accordance with

IFRS. It may not be comparable to free cash flow of other companies. However, management believes that it is an appropriate supplemental

measure to assess our liquidity and supports leverage management.

Gross Debt – Sum of current and non-current

finance debt and lease liability, this measure is not defined under the IFRS.

Leverage – Ratio between the Net Debt and the sum

of Net Debt and Shareholders’ Equity. Leverage is not a measure defined in the IFRS and it is possible that it may not be comparable

to similar measures reported by other companies, however management believes that it is an appropriate supplemental measure to assess

our liquidity.

Lifting Cost - Crude oil and natural gas lifting cost

indicator, which considers expenditures occurred in the period.

LTM EBITDA –EBITDA for the last twelve months.

LTM Adjusted EBITDA – Adjusted EBITDA for the last

twelve months.

OCF - Net Cash provided by (used in) operating activities

(operating cash flow)

Operating income (loss) - Net income (loss) before finance

(expense) income, results in equity-accounted investments and income taxes.

Net Debt – Gross Debt less Adjusted Cash and Cash

Equivalents. Net Debt is not a measure defined in the IFRS and should not be considered in isolation or as a substitute for total long-term

debt calculated in accordance with IFRS. Our calculation of Net Debt may not be comparable to the calculation of Net Debt by other companies.

Management believes that Net Debt is an appropriate supplemental measure that helps investors assess our liquidity and supports leverage

management.

Results by Business Segment – The information

by the company's business segment is prepared based on available financial information that is directly attributable to the segment or

that can be allocated on a reasonable basis, being presented by business activities used by the Executive Board to make resource allocation

decisions and performance evaluation.

When calculating segmented results, transactions with third

parties, including jointly controlled and associated companies, and transfers between business segments are considered. Transactions between

business segments are valued at internal transfer prices calculated based on methodologies that take into account market parameters, and

these transactions are eliminated, outside the business segments, for the purpose of reconciling the segmented information with the consolidated

financial statements of the company.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: May 28, 2024

PETRÓLEO BRASILEIRO S.A–PETROBRAS

By: /s/ Carlos Alberto Rechelo Neto

______________________________

Carlos Alberto Rechelo Neto

Chief Financial Officer and Investor Relations

Officer

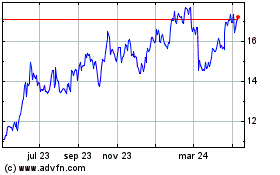

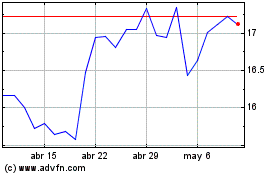

Petroleo Brasileiro ADR (NYSE:PBR)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Petroleo Brasileiro ADR (NYSE:PBR)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024