Earnings Call to be held 7:30 am CT on

Thursday, August 8, 2024

Texas Pacific Land Corporation (NYSE: TPL) (the “Company” or

“TPL”) today announced its financial and operating results for the

second quarter of 2024.

Second Quarter 2024 Highlights

- Water Service and Operations segment achieved record

performance for the following:

- Water sales revenue of $40.7 million

- Produced water royalties revenue of $25.3 million

- Total segment revenues of $68.3 million

- Total segment net income of $34.5 million

- Announced a target cash and cash equivalents balance of

approximately $700 million. Above this targeted level, TPL will

seek to deploy the majority of its free cash flow towards share

repurchases and dividends. In conjunction with this announcement,

the Company declared a special cash dividend of $10.00 per share,

which was paid on July 15, 2024

- Consolidated net income of $114.6 million, or $4.98 per share

(diluted)

- Consolidated revenues of $172.3 million

- Adjusted EBITDA(1) of $153.2 million

- Free cash flow (1) of $116.0 million

- Royalty production of 24.9 thousand barrels of oil equivalent

(“Boe”) per day

- $6.3 million of common stock repurchases

- Quarterly cash dividend of $1.17 per share paid on June 17,

2024

- As of June 30, 2024, TPL’s royalty acreage had an estimated 6.3

net well permits, 9.5 net drilled but uncompleted wells, 4.0 net

completed wells, and 73.3 net producing wells. Net producing wells

added during the quarter had an average lateral length of

approximately 10,366 ft.

Six Months Ended June 30, 2024 Highlights

- The Company announced the development of a new energy-efficient

method of produced water desalination and treatment. The Company

has successfully conducted a technology pilot and is progressing

towards the construction of a larger test facility with an initial

capacity of 10,000 barrels of produced water per day.

- Three-for-one stock split effective March 26, 2024

- Consolidated net income of $229.0 million, or $9.95 per share

(diluted)

- Consolidated revenues of $346.5 million, including record water

segment revenues of $131.0 million

- Adjusted EBITDA(1) of $305.3 million

- Free cash flow (1) of $230.5 million

- Royalty production of 24.9 thousand Boe per day

- $16.6 million of common stock repurchases

- $53.8 million of total cash dividends paid through June 30,

2024

(1) Reconciliations of Non-GAAP measures are provided in the

tables below.

“This quarter’s strong results highlight the meaningful

contribution derived from investments we have made in the water

business since its inception in 2017,” said Tyler Glover, Chief

Executive Officer of the Company. “The substantial investment into

hiring personnel and developing targeted infrastructure over

several years was a pivotal moment in the Company’s history,

purposefully positioning TPL to be at the forefront of the Permian

Basin’s emergence as a world-class resource. This most recent

quarter represents corporate records for each of water sales and

produced water royalties revenues, which is a testament to the

water segment’s continued success and relevance to TPL overall. The

Permian Basin, with its enormous size and excellent resource

quality, provides TPL a long growth runway, and we remain focused

on extracting maximum value where we can leverage our superb

people, technology, and asset footprint.”

Financial Results for the Second Quarter of 2024 -

Sequential

The Company reported net income of $114.6 million for the second

quarter of 2024 compared to net income of $114.4 million for the

first quarter of 2024.

Total revenues for the second quarter of 2024 were $172.3

million compared to $174.1 million for the first quarter of 2024.

The slight decrease in revenues is primarily due to a decrease of

$4.1 million in easements and other surface-related income and a

$2.3 million decrease in oil and gas royalty revenue compared to

the first quarter of 2024. While the Company’s share of production

was 24.9 thousand Boe per day for the second quarter of 2024 versus

24.8 thousand Boe per day for the first quarter of 2024, the

average realized price decreased 3% to $41.44 per Boe in the second

quarter of 2024 compared to $42.71 per Boe in the first quarter of

2024. These decreases in revenue were partially offset by increases

of $3.5 million in water sales and $2.3 million in produced water

royalties over the same period. The growth in water sales is

principally due to an increase of 16.5% in water sales volumes for

the second quarter of 2024 compared to the first quarter of 2024.

Our revenue streams are directly impacted by commodity prices and

development and operating decisions made by our customers.

Total operating expenses were $39.1 million for the second

quarter of 2024 compared to $38.1 million for the first quarter of

2024. The change in operating expenses is principally related to an

increase in water service-related expenses over the same time

period.

Financial Results for the Second Quarter of 2024 - Year Over

Year

Total revenues for the six months ended June 30, 2024 were

$346.5 million compared to $307.0 million for the same period of

2023. All revenue streams, except land sales, increased for the six

months ended June 30, 2024 with the $18.4 million increase in water

sales being the biggest contributor. The growth in water sales is

principally due to an increase of 25.5% in water sales volumes.

Additionally, oil and gas royalty revenue increased $10.4 million

primarily due to higher production volumes for the six months ended

June 30, 2024 compared to the same period of 2023. Oil and gas

royalty revenue for the six months ended June 30, 2023 included an

$8.7 million settlement with an operator with respect to unpaid oil

and gas royalties for older production periods. Excluding the

impact of the $8.7 million settlement on 2023 revenues, oil and gas

royalty revenue for the six months ended June 30, 2024 increased

$19.1 million over the six months ended June 30, 2023. The

Company’s share of production was 24.9 thousand Boe per day for the

six months ended June 30, 2024 versus 22.9 thousand Boe per day for

the same period of 2023. The average realized price was $42.07 per

Boe for the six months ended June 30, 2024 versus $41.08 per Boe

for the same period of 2023. TPL’s revenue streams are directly

impacted by commodity prices and development and operating

decisions made by our customers.

Total operating expenses were $77.2 million for the six months

ended June 30, 2024 compared to $81.7 million for the same period

of 2023. The change in operating expenses is principally related to

a decrease in legal and professional fees for the six months ended

June 30, 2024 compared to the same period of 2023, partially offset

by higher water service-related expenses due to the 25.5% increase

in water sales volumes.

Special Cash Dividend Declared

On June 13, 2024, the Company’s Board of Directors (the “Board”)

declared a special cash dividend of $10.00 per share which was paid

on July 15, 2024 to stockholders of record at the close of business

on July 1, 2024.

Quarterly Dividend Declared

On August 6, 2024, the Company's Board declared a quarterly cash

dividend of $1.17 per share, payable on September 17, 2024 to

stockholders of record at the close of business on September 3,

2024.

Conference Call and Webcast Information

The Company will hold a conference call on Thursday, August 8,

2024 at 7:30 a.m. Central Time to discuss second quarter results. A

live webcast of the conference call will be available on the

Investors section of the Company’s website at

http://www.TexasPacific.com. To listen to the live broadcast, go to

the site at least 15 minutes prior to the scheduled start time in

order to register and install any necessary audio software.

The conference call can also be accessed by dialing

1-877-407-4018 or 1-201-689-8471. The telephone replay can be

accessed by dialing 1-844-512-2921 or 1-412-317-6671 and providing

the conference ID# 13745173. The telephone replay will be available

starting shortly after the call through August 22, 2024.

About Texas Pacific Land Corporation

Texas Pacific Land Corporation is one of the largest landowners

in the State of Texas with approximately 869,000 acres of land,

with the majority of its ownership concentrated in the Permian

Basin. The Company is not an oil and gas producer, but its surface

and royalty ownership provide revenue opportunities throughout the

life cycle of a well. These revenue opportunities include fixed fee

payments for use of our land, revenue for sales of materials

(caliche) used in the construction of infrastructure, providing

sourced water and/or treated produced water, revenue from our oil

and gas royalty interests, and revenues related to saltwater

disposal on our land. The Company also generates revenue from

pipeline, power line and utility easements, commercial leases and

temporary permits related to a variety of land uses including

midstream infrastructure projects and hydrocarbon processing

facilities.

Visit TPL at http://www.TexasPacific.com.

Cautionary Statement Regarding Forward-Looking

Statements

This news release may contain forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, that are based on TPL’s beliefs, as well as assumptions

made by, and information currently available to, TPL, and therefore

involve risks and uncertainties that are difficult to predict.

Generally, future or conditional verbs such as “will,” “would,”

“should,” “could,” or “may” and the words “believe,” “anticipate,”

“continue,” “intend,” “expect” and similar expressions identify

forward-looking statements. Forward-looking statements include, but

are not limited to, references to strategies, plans, objectives,

expectations, intentions, assumptions, future operations and

prospects and other statements that are not historical facts. You

should not place undue reliance on forward-looking statements.

Although TPL believes that plans, intentions and expectations

reflected in or suggested by any forward-looking statements made

herein are reasonable, TPL may be unable to achieve such plans,

intentions or expectations and actual results, and performance or

achievements may vary materially and adversely from those envisaged

in this news release due to a number of factors including, but not

limited to: the initiation or outcome of potential litigation; and

any changes in general economic and/or industry specific

conditions. These risks, as well as other risks associated with TPL

are also more fully discussed in our Annual Report on Form 10-K and

our Quarterly Reports on Form 10-Q. You can access TPL’s filings

with the Securities and Exchange Commission (“SEC”) through the

SEC's website at http://www.sec.gov and TPL strongly encourages you

to do so. Except as required by applicable law, TPL undertakes no

obligation to update any forward-looking statements or other

statements herein for revisions or changes after this communication

is made.

FINANCIAL AND OPERATIONAL

RESULTS

(unaudited)

Three Months Ended

Six Months Ended

June 30,

2024

March 31,

2024

June 30,

2024

June 30,

2023(2)

Company’s share of production

volumes(1):

Oil (MBbls)

967

990

1,958

1,792

Natural gas (MMcf)

3,851

3,806

7,658

7,088

NGL (MBbls)

661

633

1,294

1,177

Equivalents (MBoe)

2,270

2,258

4,528

4,151

Equivalents per day (MBoe/d)

24.9

24.8

24.9

22.9

Oil and gas royalty revenue (in

thousands):

Oil royalties

$

74,747

$

72,614

$

147,361

$

127,077

Natural gas royalties

2,367

7,062

9,429

14,731

NGL royalties

12,699

12,444

25,143

21,069

Total oil and gas royalties

$

89,813

$

92,120

$

181,933

$

162,877

Realized prices (1):

Oil ($/Bbl)

$

80.93

$

76.77

$

78.82

$

74.24

Natural gas ($/Mcf)

$

0.66

$

2.01

$

1.33

$

2.25

NGL ($/Bbl)

$

20.78

$

21.24

$

21.00

$

19.34

Equivalents ($/Boe)

$

41.44

$

42.71

$

42.07

$

41.08

_________________________

(1)

Term

Definition

Bbl

One stock tank barrel of 42 U.S.

gallons liquid volume used herein in reference to crude oil,

condensate or NGLs.

MBbls

One thousand barrels of crude

oil, condensate or NGLs.

MBoe

One thousand Boe.

MBoe/d

One thousand Boe per day.

Mcf

One thousand cubic feet of

natural gas.

MMcf

One million cubic feet of natural

gas.

NGL

Natural gas liquids. Hydrocarbons

found in natural gas that may be extracted as liquefied petroleum

gas and natural gasoline.

(2)

The metrics and dollars provided

for the six months ended June 30, 2023 exclude the impact of an

$8.7 million settlement with an operator with respect to unpaid oil

and gas royalties.

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME

(in thousands, except share and

per share amounts) (unaudited)

Three Months Ended

Six Months Ended

June 30,

2024

March 31,

2024

June 30,

2024

June 30,

2023

Revenues:

Oil and gas royalties

$

89,813

$

92,120

$

181,933

$

171,542

Water sales

40,650

37,126

77,776

59,377

Produced water royalties

25,301

23,006

48,307

40,975

Easements and other surface-related

income

16,570

20,646

37,216

33,677

Land sales

—

1,244

1,244

1,400

Total revenues

172,334

174,142

346,476

306,971

Expenses:

Salaries and related employee expenses

12,771

12,461

25,232

21,189

Water service-related expenses

14,824

10,212

25,036

15,943

General and administrative expenses

3,673

4,924

8,597

6,879

Legal and professional fees

2,307

4,057

6,364

26,782

Ad valorem and other taxes

1,444

2,357

3,801

3,644

Land sales expenses

—

250

250

5

Depreciation, depletion and

amortization

4,093

3,840

7,933

7,297

Total operating expenses

39,112

38,101

77,213

81,739

Operating income

133,222

136,041

269,263

225,232

Other income, net

13,220

9,943

23,163

12,260

Income before income taxes

146,442

145,984

292,426

237,492

Income tax expense

31,853

31,567

63,420

50,531

Net income

$

114,589

$

114,417

$

229,006

$

186,961

Net income per share of common stock

(1)

Basic

$

4.99

$

4.97

$

9.96

$

8.10

Diluted

$

4.98

$

4.97

$

9.95

$

8.10

Weighted average number of shares of

common stock outstanding (1)

Basic

22,987,971

23,003,001

22,995,486

23,068,056

Diluted

23,013,793

23,020,249

23,018,313

23,083,643

_________________________

(1)

All share and share price amounts

reflect the three-for-one stock split effected on March 26,

2024.

SEGMENT OPERATING

RESULTS

(dollars in thousands)

(unaudited)

Three Months Ended

June 30,

2024

March 31,

2024

Revenues:

Land and resource management:

Oil and gas royalties

$

89,813

52

%

$

92,120

53

%

Easements and other surface-related

income

14,219

8

%

18,121

10

%

Land sales

—

—

%

1,244

1

%

Total land and resource management

revenue

104,032

60

%

111,485

64

%

Water services and operations:

Water sales

40,650

24

%

37,126

21

%

Produced water royalties

25,301

15

%

23,006

13

%

Easements and other surface-related

income

2,351

1

%

2,525

2

%

Total water services and operations

revenue

68,302

40

%

62,657

36

%

Total consolidated revenues

$

172,334

100

%

$

174,142

100

%

Net income:

Land and resource management

$

80,129

70

%

$

80,971

71

%

Water services and operations

34,460

30

%

33,446

29

%

Total consolidated net income

$

114,589

100

%

$

114,417

100

%

Six Months Ended

June 30,

2024

June 30,

2023

Revenues:

Land and resource management:

Oil and gas royalties

$

181,933

53

%

$

171,542

56

%

Easements and other surface-related

income

32,340

9

%

32,401

11

%

Land sales

1,244

—

%

1,400

—

%

Total land and resource management

revenue

215,517

62

%

205,343

67

%

Water services and operations:

Water sales

77,776

22

%

59,377

20

%

Produced water royalties

48,307

14

%

40,975

13

%

Easements and other surface-related

income

4,876

2

%

1,276

—

%

Total water services and operations

revenue

130,959

38

%

101,628

33

%

Total consolidated revenues

$

346,476

100

%

$

306,971

100

%

Net income:

Land and resource management

$

161,100

70

%

$

134,976

72

%

Water services and operations

67,906

30

%

51,985

28

%

Total consolidated net income

$

229,006

100

%

$

186,961

100

%

NON-GAAP PERFORMANCE MEASURES AND

DEFINITIONS

In addition to amounts presented in accordance with generally

accepted accounting principles in the United States of America

(“GAAP”), we also present certain supplemental non-GAAP performance

measurements. These measurements are not to be considered more

relevant or accurate than the measurements presented in accordance

with GAAP. In compliance with the requirements of the SEC, our

non-GAAP measurements are reconciled to net income, the most

directly comparable GAAP performance measure. For all non-GAAP

measurements, neither the SEC nor any other regulatory body has

passed judgment on these non-GAAP measurements.

EBITDA, Adjusted EBITDA and Free Cash Flow

EBITDA is a non-GAAP financial measurement of earnings before

interest expense, taxes, depreciation, depletion and amortization.

Its purpose is to highlight earnings without finance, taxes, and

depreciation, depletion and amortization expense, and its use is

limited to specialized analysis. We calculate Adjusted EBITDA as

EBITDA plus employee share-based compensation. Its purpose is to

highlight earnings without non-cash activity such as share-based

compensation and other non-recurring or unusual items, if

applicable. We calculate Free Cash Flow as Adjusted EBITDA less

current income tax expense and capital expenditures. Its purpose is

to provide an additional measure of operating performance. We have

presented EBITDA, Adjusted EBITDA and Free Cash Flow because we

believe that these metrics are useful supplements to net income in

analyzing the Company’s operating performance. Our definitions of

Adjusted EBITDA and Free Cash Flow may differ from computations of

similarly titled measures of other companies.

The following table presents a reconciliation of net income to

EBITDA, Adjusted EBITDA and Free Cash Flow for the three months

ended June 30, 2024 and March 31, 2024 and for the six months ended

June 30, 2024 and June 30, 2023 (in thousands):

Three Months Ended

Six Months Ended

June 30,

2024

March 31,

2024

June 30,

2024

June 30,

2023

Net income

$

114,589

$

114,417

$

229,006

$

186,961

Add:

Income tax expense

31,853

31,567

63,420

50,531

Depreciation, depletion and

amortization

4,093

3,840

7,933

7,297

EBITDA

150,535

149,824

300,359

244,789

Add:

Employee share-based compensation

2,700

2,220

4,920

4,715

Adjusted EBITDA

153,235

152,044

305,279

249,504

Less:

Current income tax expense

(30,766

)

(31,898

)

(62,664

)

(51,204

)

Capital expenditures

(6,499

)

(5,662

)

(12,161

)

(5,144

)

Free Cash Flow

$

115,970

$

114,484

$

230,454

$

193,156

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240807669797/en/

Investor Relations IR@TexasPacific.com

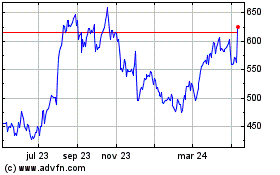

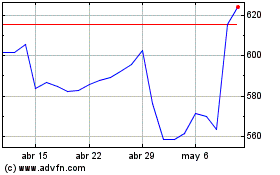

Texas Pacific Land (NYSE:TPL)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Texas Pacific Land (NYSE:TPL)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024