Doman Building Materials Group Ltd. (“Doman” or the “Company”)

(TSX:DBM) is pleased to announce that it has acquired South

Carolina-based CM Tucker Lumber Companies, LLC (“Tucker Lumber”).

The Company acquired the assets of Tucker Lumber for a base

purchase price of approximately US$255 million in cash (the

“Transaction”)3. Tucker Lumber is being acquired on a cash-free and

debt-free basis, and the Transaction is being funded from the

Company’s existing cash on hand and revolving credit facilities.

Founded in 1920, Tucker Lumber is headquartered

in Pageland, South Carolina, employing 425 personnel across three

locations. The Pageland facility is vertically integrated,

comprising a specialty sawmill, dry kilns, treating plants,

remanufacturing operations and distribution facilities. Treating

plants located in Henderson, North Carolina and Rock Hill, South

Carolina provide added capacity and capabilities to quickly service

Eastern U.S. markets. Tucker Lumber offers a comprehensive variety

of products, including treated lumber and plywood, decking, deck

posts, balusters, spindles, handrails, step stringers, step treads,

fence panels, fence pickets, round fence posts and split rail

fencing.

Tucker Lumber’s operations are highly

complementary to the Company’s existing U.S. Central and West Coast

operations without overlap. The Transaction will facilitate the

Company’s growth and geographic coverage, will be immediately

accretive and will expand the Company’s product suite to include

new offerings.

“We are very excited with the addition of Tucker

Lumber to the Doman Group of companies. The Transaction is a great

complement to our existing U.S. operations while further advancing

our growth strategy, developing a leadership position and expanding

our footprint into ten previously unserved States,” said Amar

Doman, Chairman and CEO. “We continue our disciplined approach in

tracking and executing on accretive growth opportunities, further

strengthening our financial performance, and enhancing shareholder

value based on a fundamentally sound and sustainable growth plan.

With this Transaction, our US footprint now extends from

coast-to-coast plus Hawaii, and we proudly operate 37 treating

plants across our system. We look forward to working with David,

Paul, Mark and Andrew Tucker along with the entire Tucker Lumber

team in this significant new development for our organization.

Additionally, I’d like to acknowledge and thank our banking

partners, Wells Fargo, CIBC, RBC and TD for their important role in

this transaction. Their long-standing support continues to be an

integral component of our growth and success.”

Transaction Highlights

- Diversified and Complementary

Operations. The Transaction facilitates the Company’s ongoing

United States expansion by entering the important Eastern U.S.

region - a large, robust and active market. Previously unserved

states include South Carolina, North Carolina, Florida, Georgia,

Virginia, West Virginia, Delaware, Maryland, New York and

Pennsylvania. The Company immediately obtains a significant market

position in this region with a diversified and loyal customer base

from its current U.S. locations.

- Continued Wood Treatment Expansion.

Tucker Lumber adds approximately 800 million board feet of treating

capacity and builds on Doman’s position as one of the largest

pressure-treated lumber producers in North America with over three

billion board feet of approximate annual capacity.

- Financially Attractive. The

acquisition of Tucker is expected to increase the Company’s sales

in the United States by approximately 40%, and the purchase price

is consistent with the Company’s traditional targeted EBITDA

multiples range for acquisitions. The Transaction is expected to be

immediately accretive to the Company’s annual earnings and free

cash flow per share and is expected to lead to further expansion of

EBITDA margins.

- Skilled Operational Leadership

Team. Tucker Lumber is an exceptionally-run, family-owned business

that has a strong legacy in its key markets and strong

relationships with its customer and suppliers. Tucker Lumber has a

committed and strong management team. Key management is inclusive

of highly experienced, key Tucker family operators who will remain

in place, further adding to the Company’s bench strength.

- Synergy Potential. The Company

expects to realize scale-based synergies from this well-run

business. Opportunities for additional operational and margin

synergies are expected to be realized over time, including

purchasing benefits on pressure-treated inputs, shared best

practises and utilization of the Company's established purchasing,

sales and distribution channels and access to the Company’s

infrastructure and resources.

The Transaction was completed on October 1,

2024, and is not subject to any further regulatory or shareholder

approvals or consents.

Advisors and Counsel

The Company was advised by a team including

Dorsey & Whitney LLP, Goodmans LLP and Bernard LLP.

About Doman Building Materials Group

Ltd.

Founded in 1989, Doman is headquartered in

Vancouver, British Columbia, and trades on the Toronto

Stock Exchange under the symbol DBM.

As Canada’s only fully integrated national

distributor in the building materials and related products sector,

Doman operates several distinct divisions with multiple

treating plants, planing and specialty facilities and distribution

centres coast-to-coast in all major cities across Canada and

coast-to-coast across the United States.

Strategically located across Canada,

Doman Building Materials Canada operates

distribution centres coast-to-coast, and Doman Treated Wood

Canada operates multiple treating plants near major

cities. In the United States; headquartered in Dallas, Texas,

Doman Lumber operates 21

treating plants, two specialty planing mills and five specialty

sawmills located in nine states, distributing, producing and

treating lumber, fencing and building material servicing the

central U.S.; Doman Tucker Lumber operates three

treating plants, specialty sawmilling operations and a captive

trucking fleet serving the U.S. east coast; Doman Building

Materials USA and Doman Treated Wood

USA serve the U.S. west coast with multiple locations in

California and Oregon; and in the state of Hawaii the

Honsador Building Products Group services 15

locations across all the islands. The Company’s Canadian

operations also include ownership and management of private

timberlands and forest licenses, and agricultural post-peeling and

pressure treating through its Doman Timber

operations.

For additional information on Doman Building Materials Group

Ltd., please refer to the Company’s filings on SEDAR+ and the

Company’s website www.domanbm.com

For further information regarding Doman please

contact:

Ali MahdaviInvestor Relations416-962-3300

ali.mahdavi@domanbm.com

Certain statements in this press release may

constitute “forward-looking” statements. When used in this press

release, forward-looking statements often but not always, can be

identified by the use of forward-looking words such as, including

but not limited to, “may”, “will”, “intend”, “should”, “expect”,

“believe”, “outlook”, “predict”, “remain”, “anticipate”,

“estimate”, “potential”, “continue”, “plan”, “could”, “might”,

“project”, “targeting” or the inverse or negative of these terms or

other similar terminology. Forward-looking information includes,

without limitation, statements regarding the anticipated financial

and operational benefits of the Transaction as well as potential

synergies between the Company and Tucker Lumber. These statements

are based on management’s current expectations regarding future

events and operating performance, and on information currently

available to management, speak only as of the date hereof and are

subject to risks including those described in the Company’s current

Annual Information Form dated March 28, 2024 (“AIF”) and the

Company’s public filings on the Canadian Securities Administrators’

website at www.sedarplus.com (“SEDAR”) and as updated from time to

time, and would include, but are not limited to, dependence on

market economic conditions, risks related to the impact of

geopolitical conflicts, local, national, and international health

concerns, including but not limited to COVID-19 or other viruses,

epidemics or pandemics, sales and margin risk, acquisition and

integration risks and operational risks related thereto,

competition, information system risks, technology risks,

cybersecurity risks, availability of supply of products, interest

rate risks, inflation risks, risks associated with the introduction

of new product lines, product design risk, product liability risk,

modern slavery and supply chain risks, environmental risks, climate

change risks, volatility of commodity prices, inventory risks,

customer and vendor risks, contract performance risk, availability

of credit, credit risks, performance bond risk, currency risks,

insurance risks, tax risks, risks of legislative or regulatory

changes, international trade and tariff risks, operational and

safety risks, resource industry risks, resource extraction risks,

risks relating to remote operations, forestry management and

silviculture, fire and natural disaster risks, key executive risk

and litigation risks. These risks and uncertainties may cause

actual results to differ materially from those contained in the

statements. Such statements reflect management’s current views and

are based on certain assumptions. Some of the key assumptions

include, but are not limited to, assumptions regarding the

performance of the Canadian and the United States (“US”) economies,

the impact of COVID-19, other viruses, epidemics, pandemics or

health risks, interest rates, exchange rates, inflation, capital

and loan availability, commodity pricing, the Canadian and the US

housing and building materials markets; international trade

matters; post-acquisition operation of a business; the amount of

the Company’s cash flow from operations; tax laws; laws and

regulations relating to the protection of the environment,

including the impacts of climate change, and natural resources; and

the extent of the Company’s future acquisitions and capital

spending requirements or planning in respect thereto, including but

not limited to the performance of any such business and its

operation; availability or more limited availability of access to

equity and debt capital markets to fund, at acceptable costs, the

Company’s future growth plans, the implementation and success of

the integration of acquisitions, the ability of the Company to

refinance its debts as they mature; the direct and indirect effect

of the US housing market and economy; exchange rate fluctuations

between the Canadian and US dollar; retention of key personnel; the

Company’s ability to sustain its level of sales and earnings

margins; the Company’s ability to grow its business long-term and

to manage its growth; the Company’s management information systems

upon which it is dependent are not impaired, ransomed or

unavailable; the Company’s insurance is sufficient to cover losses

that may occur as a result of its operations as well as the general

level of economic activity, in Canada and the US, and abroad,

discretionary spending and unemployment levels; the effect of

general economic conditions; market demand for the Company’s

products, and prices for such products; the effect of forestry,

land use, environmental and other governmental regulations; and the

risk of losses from fires, floods and other natural disasters and

unemployment levels. They are, by necessity, only estimates of

future developments and actual developments may differ materially

from these statements due to a number of known and unknown factors.

Investors are cautioned not to place undue reliance on these

forward-looking statements.

In addition, there are numerous risks associated

with an investment in the Company’s common shares and senior

unsecured notes, some which are also further described in in the

periodic and other reports filed by Doman with Canadian securities

commissions and available on SEDAR including in the “Risk Factors”

section of Doman’s AIF.

Neither Doman nor any of its associates or

directors, officers, partners, affiliates, or advisers, provides

any representation, assurance or guarantee that the occurrence of

the events expressed or implied in any forward-looking statements

in these communications will actually occur. Except as required by

applicable securities laws and legal or regulatory obligations,

Doman is not under any obligation, and expressly disclaims any

intention or obligation, to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise._____

1 In the discussion, reference is made to

EBITDA, which represents earnings from continuing operations before

interest, including amortization of deferred financing costs,

provision for income taxes, depreciation, and amortization. This is

not a generally accepted earnings measure under IFRS and does not

have a standardized meaning under IFRS, and therefore the measure

as calculated by Doman may not be comparable to similarly titled

measures reported by other companies. EBITDA is presented as we

believe it is a useful indicator of a company’s ability to meet

debt service and capital expenditure requirements and because we

interpret trends in EBITDA as an indicator of relative operating

performance. EBITDA should not be considered by an investor as an

alternative to net earnings or cash flows as determined in

accordance with IFRS. For a reconciliation of EBITDA to the most

directly comparable measures calculated in accordance with IFRS

refer to “Reconciliation of Net Earnings to Earnings before

Interest, Tax, Depreciation and Amortization (EBITDA) and Adjusted

EBITDA” in our Q2 2024 Management Discussion and Analysis.

2 In the discussion, reference is made to Free

Cash Flow of the Company. This is a non-IFRS measure generally used

by Canadian companies as an indicator of financial performance. The

measure as calculated by the Company might not be comparable to

similarly-titled measures reported by other companies. Management

believes that this measure provides investors with an indication of

the cash available for distribution to shareholders of the Company.

We define free cash flow as cash flow from operating activities

excluding changes in non-cash working capital, and after interest

on outstanding debt instruments, maintenance of business capital

expenditures and funds received from other assets.

3 The base purchase price is exclusive of

inventory, which value is subject to post-closing determination and

payment in the ordinary course of business in accordance with the

terms of the Transaction agreement. Additional earn-out

consideration may be payable related to each of the years 2025 to

2029, contingent upon achieving certain earnings performance

targets, which payments are not individually material.

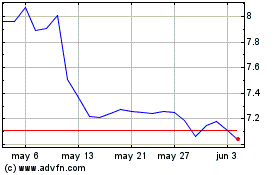

Doman Building Materials (TSX:DBM)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Doman Building Materials (TSX:DBM)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024